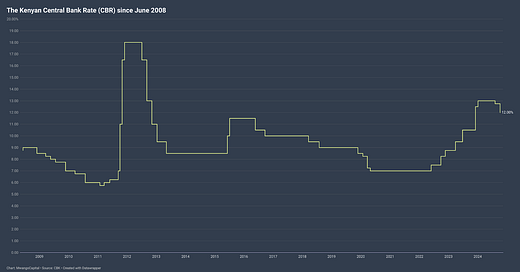

CBK Slashes Rate to 12%

Cites easing inflationary pressures and a stable macroeconomic environment

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the MPC's 75bps rate cut, the integration of Paybills with the tax system, and KETRACO's KES 95.7B deal with Adani Energy.Kenya’s Rate Cut

75 Bps Cut: In its October 2024 sitting, Kenya's Monetary Policy Committee (MPC) lowered the Central Bank Rate (CBR) to 12.00% citing easing inflationary pressures and a stable macroeconomic environment. The decision follows a marked decline in overall inflation, buoyed by improved food supply from recent harvests, lower fuel prices, and a stable exchange rate. Non-food non-fuel (NFNF) inflation has also moderated. The MPC highlighted concerns over reduced credit to the private sector and slower economic growth in the second quarter of 2024, reinforcing the need for more accommodative monetary policy:

“Following the Fed's jumbo rate cut last month and the disinflation outturn in Kenya, the rate cut did not come as a surprise. The 75bps cut was driven by the need to stoke the private sector credit demand, even as core inflation remains subdued. We do expect a lagged transmission channel of the policy rate to the real sector, but one "quick win" should be an ease in the domestic rates (for T-Bills and T-bonds). Real policy rate (CBR - inflation) on an ex-post basis was 9.0% prior to the policy cut, higher than in most African economies and the policy signaling of the rate cut is to trim this positive premium, and to nudge rates lower. The path to a normalization of market rates should be gradual though, in my view.”

IC Group Economist, Churchill Ogutu

Asset Quality: The CBK Governor emphasised that the rate cut is aimed at encouraging banks to lower their lending rates, which should help reduce non-performing loans (NPLs) and stimulate borrowing from the private sector. He noted that credit to the private sector has slowed considerably, which could negatively impact economic performance. By lowering interest rates, the CBK hopes to incentivize borrowers and improve loan repayment conditions, ultimately reducing NPLs.

“The whole idea really of this sharp reduction in the CBR rate is to encourage the banks to lower their lending rates so that we can also reduce the NPLs and also encourage borrowing by the private sector from the banks.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

On the IMF Review: The CBK Governor also provided an update on the pending seventh and eighth reviews under the International Monetary Fund (IMF) program, noting significant progress in negotiations. He confirmed that the fiscal framework, including a 4.3% deficit target, has been agreed upon with the IMF. The governor expressed optimism that the disbursement, which is crucial for Kenya's reserve buildup, would be completed before the end of the year. This disbursement is part of Kenya's plan to accumulate $1.9 billion in foreign reserves for 2024. This is what various analyst think of the reviews:

"The combination of the 7th and 8th review of Kenya's ECF/EFF was to be expected, after the abandonment of the finance bill. It is common for the IMF to fold a review into the following review when program performance goes off track as it makes it easier to keep up planned disbursement during the program period. That is not to say that coming IMF program reviews won’t be challenging with fiscal policy targets likely to remain the main challenge.”

REDD Intelligence Senior Credit Research Analyst, Mark Bohlund

“On the IMF Programme and the combination of the 7th and 8th Reviews, I think that was expected given the sunset date of the whole programme which is just 5 months out now. The question is whether Kenya can adhere to the 4.3% fiscal deficit target as indicated by the Governor because Supplementary Budget I 2024/25 has already maxed that out with Kes 769.0 billion deficit. It means the wiggle room for Supplementary Budget II, if any, is really wafer thin despite the fact that we saw considerable unfunded requests under Supplementary Budget I such as the KES 102.0 billion under the State Department for Medical Services & Kes 29.5 billion under the Teachers Service Commission.”

Nation Media Group Business Journalist, Julians Amboko

“The CBK also clarified the continuation of the 8th review, even as the 7th review is yet to be completed. To be sure, that has been the case. The IMF programme is coming to an end next March, with the 9th review being the final review. The 8th review was slated to be completed by next month, so even with the protracted 7th review, it still makes sense for the IMF to start discussions around the 8th review, with a possible combined 7th/8th disbursement. Hardly surprising, and case in point is Egypt's current programme that commenced in Dec 2022. The first and second reviews were delayed in 2023 but were combined and completed in March this year. For Kenya's case, my sense is that the biggest drag on the completion of the remaining reviews should be the structural benchmarks that entail political will. Evidently, there have been concerns about the fiscal targets (revenue, primary balance, and social spending), but those ones are the lesser evils; the targets that have really derailed are the structural benchmarks, case in point, KQ restructuring options, lack of railguards re petroleum development pt levy, and those are the problematic ones. For the current IMF programme to come to a completion, we need to see political capital.”

IC Group Economist, Churchill Ogutu

Forex Reserves: The CBK Governor stated that Kenya's foreign exchange reserves have increased significantly, attributed to inflows from various sources such as remittances and exports, particularly agricultural exports like tea. He confirmed that the Central Bank has been intervening in the foreign exchange market to moderate fluctuations and build reserves, but not to affect the overall direction of the exchange rate. This intervention is part of their strategy to strengthen Kenya’s forex buffer, which had previously relied on external loans. By the end of the year, the CBK expects the gross usable reserves to reach $8.6 billion

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Integrating Paybill with Tax System

Paybill Integration: This past week, Moses Kuria, Senior Advisor, Council of Economic Advisors, outlined Kenya’s ambitious tax modernization agenda driven by the need to expand its revenue base and reduce domestic borrowing. The government is taking steps to transform its tax system and incorporate digitization as a key element of economic management. A key initiative within this plan is integrating Kenya Revenue Authority (KRA) systems with mobile payment platforms, leveraging the country’s well-established digital infrastructure. Kenya’s mobile money ecosystem, particularly M-Pesa, is widely recognized as one of the most advanced in the world, and the government seeks to tap into this resource to streamline tax compliance. This integration of Paybill services with KRA’s tax systems reflects a bold move to make it nearly impossible for businesses to evade taxes. By ensuring that all mobile payment transactions are linked to KRA’s real-time systems, the government aims to capture taxable transactions that might otherwise go unreported, thus broadening the tax base.

“We've agreed with the Commissioner General that all paybills will also be virtual ETRs for purposes of KRA. This means that by Christmas 2024, every business using Paybill services will be connected to KRA systems for real-time tax collection. The aim is to make tax evasion virtually impossible by capturing all mobile payment transactions and ensuring that they are properly taxed. This integration will significantly reduce tax leakage and broaden the tax base, especially within the informal sector.”

Council of Economic Advisors Senior Advisor, Moses Kuria

Data Transparency for Tax Compliance: In parallel, the government is addressing concerns related to data protection, particularly as it pertains to tax enforcement. The administration has made it clear that privacy concerns will not hinder the pursuit of tax compliance. This firm stance signals the government’s intent to amend the legal framework to ensure that data sharing and transparency are mandatory for all entities holding relevant data. By mandating data sharing, Kenya aims to prevent businesses from exploiting privacy laws to avoid tax obligations.

“Even hiding behind data protection and data privacy cannot save you. The government is taking steps to amend the legal framework to ensure data sharing for tax purposes is mandatory. We understand the importance of data protection, but when it comes to tax compliance, we cannot allow privacy laws to be exploited as a shield for tax evasion. Every entity holding relevant data will be required to share it, ensuring full transparency and accountability in our revenue collection system.”

Council of Economic Advisors Senior Advisor, Moses Kuria

Markets Wrap

NSE: In Week 41 of 2024, Orchards led the market, rising 32.88% to KES 44.05, while Express was the worst performer, dropping 9.74% to KES 3.15. The NSE 20 went up by 1.9% to 1,806.6 points, the NSE 25 gained 1.8% to 3,001.4 points, and the NASI index advanced by 1.7% to 110.1 points, while the NSE 10 edged up by 1.8% to 1,168.7 points. Equity turnover decreased by 11.4% to KES 895.6M, while bond turnover declined to KES 15.35B from KES 28.88B the previous week.

Treasury Bills and Bonds: Treasury Bills were oversubscribed for the second consecutive week recording an overall subscription rate of 304.3% from 224.8% the prior week. A total of KES 31.2 worth of KES 73.0 bids received was accepted, translating to an acceptance rate of 42.7% from 54.2% the previous week. Yields across the three tenors dropped by 69.6 bps, 40.5 bps, and 39.1 bps respectively, with the 91-day paper closing below 15.0% for the first time since October 2023.

In the October 2024 Treasury Bond auction of the re-opening of FXD1/2016/10 and FXD1/2022/10, the Central Bank of Kenya received bids worth KES 50.9B against KES 30.0B offered, translating to an overall subscription rate of 169.9%. KES 31.3B was accepted, translating to an acceptance rate of 61.4%. The weighted average rate of accepted bids for the FXD1/2016/10 and FXD1/2022/10 closed at 17.0%.

Eurobonds: In the week, yields rose across five outstanding papers on a week-on-week basis, with KENINT 2034 seeing the largest increase, up by 8.50 bps to 9.645%, followed by KENINT 2032, which rose by 8.30 bps to 9.709%. KENINT 2027 was the only paper to record a decline, down 7.50 bps to 7.901%. The average week-on-week change was 4.1 bps.

Market Gleanings

🔴| Gachagua’s Impeachment | The National Assembly last week voted to impeach Deputy President Rigathi Gachagua, accusing him of self-enrichment and promoting ethnic divisions. The impeachment motion passed with 281 lawmakers voting in favor with 44 MPs voting against and one abstaining, surpassing the two-thirds requirement. The next step is for the Senate to hear the proposed removal from office on October 16th and 17th, 2024.

🤝| KETRACO Signs Deal with Adani | Kenya has inked a KES 95.68B agreement with Adani Energy Solutions to develop key power transmission lines and substations, a move aimed at tackling the persistent power outages. The deal, signed with the Kenya Electricity Transmission Company (KETRACO), will see Adani finance, build, and manage the infrastructure for 30 years, after which the assets will be transferred to KETRACO.

🏥| Extension of Medical Insurance for Civil Servants | The government has extended the Comprehensive Medical Insurance Scheme for Civil Servants (CMIS) until November 21, 2024, following concerns from public sector unions over the transition from NHIF to the Social Health Authority (SHA). The Ministry of Public Service stated that the extension, agreed upon with SHA, aims to ensure seamless service delivery and a smooth transition.

☕| Reserve Tea Price Suspension for Kenyan Tea | The East African Tea Trade Association (EATTA) has announced the suspension of minimum reserve prices for Kenyan tea, a policy introduced in 2022 to stabilize the market and support prices. This decision was made following consultations with stakeholders and directed by the Minister of Agriculture. The suspension takes effect immediately.

📶| Ethio Telecom to List | Ethio Telecom is poised to be the first firm to list on Ethiopia's nascent stock exchange with a 10% stake up for sale this week, marking a pivotal moment in the country’s economic liberalization efforts. This partial privatization is a strategic move under Prime Minister Abiy Ahmed’s agenda to attract foreign capital and revitalize state-owned enterprises. The listing serves as a valuation test ahead of a broader 45% divestment planned for the telecom giant.

🇺🇬| Uganda's Central Bank Cuts Interest Rates | Uganda’s central bank reduced its key lending rate by 25 basis points for the second consecutive time, bringing it down to 9.75%. The decision comes as inflation eased to 3.0% year-on-year in September, below the bank’s 5% target. The country's shilling has strengthened by 3% against the dollar this year, bolstered by strong coffee exports and a stable exchange rate.

💼| Appointments |

Absa Bank Kenya: The Board of Directors of Absa Bank Kenya PLC has appointed Standard Group CEO Marion Gathoga-Mwangi as an Independent Non-Executive Director, effective October 2, 2024. She has also served as a Non-Executive Director at British American Tobacco Kenya PLC and BOC Kenya PLC.

CAK: David Kibet Kemei has been appointed as the Director General of the Competition Authority of Kenya (CAK), effective October 7, 2024. His appointment follows a thorough recruitment process, including joint vetting and approval by Parliament. Kemei replaces Adano Rioba, who served in an acting capacity since the end of Wang’ombe Kariuki’s term.

BOC Kenya: BOC Kenya PLC has announced the appointment of Mr. Kiplagat Kiprotich as the company's new Finance Director, effective 9th October 2024. Before joining BOC Kenya, he held key financial positions at Britannia Foods Ltd and Almasi Bottlers.