👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Safaricom HY 23 results, South Africa president Ramaphosa's visit to Kenya, and IMF and Kenya's staff-level agreement.First off, enjoy our weekly business news in memes brought to you by the Jubilee Live Free Race:

Safaricom HY 23 Results

Highlights: Service revenue was up 4.6% year-over-year to reach KES 144.88B. Gross revenue for the period was up 4.8% to KES 153.4B. Earnings Before Interest Taxes and Depreciation (EBITDA) grew 3.1% to KES 80.1B.

M-PESA Revenue Up 8%: M-PESA revenue was up 8.7% to KES 56.86B, accounting for 39.3% of service revenue and 37.1% of total revenue. Notably, the 8.7% increase was lacklustre compared to the 45.8% recorded in HY 22. Part of the inference as to the slower growth of M-PESA revenue is the situation around Covid-19 and attendant restrictions in HY 23 compared to HY 22.

Safaricom Ethiopia: Launched on October 6, the Ethiopia unit is currently operating in 16 cities covering a population of 8.5M people, equivalent to 7.5% of Ethiopia’s total population. Safaricom Ethiopia is targeting a population coverage of 25% by April 2023. It currently has 930K customers and expects the number to reach 1M next week. In terms of growth, Safaricom expects its Ethiopia unit to grow to Safaricom Kenya's current size in half the period, ie in 12 years.

"Safaricom Ethiopia penetration to get to 25 cities by end of March. Safaricom projects to cover 25% of the Ethiopian population by then. We believe the Ethiopian business would grow to the size Safaricom is today, in half the time (12 years). We should see significant Topline growth from next year."

Safaricom PLC Chief Executive Officer, Peter Ndegwa

CapEx: The total capital expenditure for Safaricom Kenya was KES 18B while that of Safaricom Ethiopia was KES 19.5B, bringing the total CapEx for the period to KES 39.5B, equivalent to 25.7% of gross revenue for the period under review.

Profitability: Earnings Before Interest and Taxation (EBIT) fell 11.5% to KES 51.3B with Profit Before Tax declining 11.8% to KES 48.3B. At the Group level, Safaricom recorded KES 33.5B in net profit, a 9.6% decrease. The coming into force of the Mobile Tariffs Regulations (MTRs) 2 months ago slashed KES 470M from the HY 23 results with the impact projected at KES 3B for FY 23.

"The MTR regulations effected 2 months ago slashed KES 470M from Safaricom Half Year results. On an annualised basis, we expect a KES 3B impact on our business by the end of the year."

Safaricom PLC Chief Executive Officer, Peter Ndegwa

FY 23 Guidance: For the full year, Safaricom Kenya sees its CapEx ranging between KES 40B - 43B and EBIT at a range of between KES 112B -115B. For the Ethiopia unit, Safaricom expects to spend between KES 60B - 65B in CapEx and expects KES 22B - 25B in EBIT. On a consolidated basis, the projections for CapEx are between KES 100B - 108B while those for EBIT are in the range of KES 87B - 93B.

SA’s Ramaphosa Visits

Highlights: Last week, South Africa’s President Cyril Ramaphosa visited Kenya on a two-day state visit. Bilateral exchanges between the Kenyan and South African delegations saw various agreements reached between the two countries, including a solution to the long-standing issues around entry requirements to Africa’s second-largest economy. Below are some of the aspects that were realized from the exchanges:

Visa Requirements: The two countries have reached an agreement that will see Kenyans holding ordinary passports enter South Africa visa-free for up to 90 days per calendar year effective January 1, 2023.

Signed MOU: Kenya and South Africa signed 3 Memoranda of Understanding (MOUs) and 1 agreement of cooperation of correctional sciences, housing and human settlement, cooperation between Kenya School of Government and the National School of Governments from South Africa and an agreement on audio-visual co-production.

KQ - SAA: The two leaders agreed to advance discussions on plans to combine the assets of South Africa Airways (SAA) and Kenya Airways to form a pan-African airline. The code-sharing deal will see each airline sell under its code while travellers will combine flight segments and baggage on a single ticket.

Trade: The Heads of State of Kenya and South Africa said they would deal with non-tariff barriers including licensing bureaucracy, regulation restrictions and sanctions to allow for the opening up of business in sectors like industries, agricultural produce export and logistics.

“President Ramaphosa and I have agreed to develop a sustainable mechanism to identify, monitor and resolve non-trade barriers that limit trade potential between our two countries,”

President of Kenya, William Samoei Ruto

According to data from the Kenya National Bureau of Statistics, Kenya exported goods worth KES 3.9B to South Africa in 2021, or 1.3% of total exports to African countries against imports valued at KES 44.1B equivalent to 19.1% of imports from African countries, bringing Kenya’s trade deficit with South Africa to KES 40.1B.

Kenya Goodies from Cop27

The Rundown: The 2022 United Nations Climate Change Conference is underway in Sharm El-Sheikh in Egypt and is expected to run through November 18. The conference kicked off on November 6 with various global leaders addressing the current situation around climate change and mitigation measures.

KES 3.6T Secured Investments: Out of the conference, Kenya has secured investments upwards of KES 3.6T ($30B), equivalent to 27.3% of Kenya's Gross Domestic Product (GDP) as of December 2021.

“We are leaving Egypt with investments upwards of $30 billion, as you have seen we have signed off agreements with the UK, with private sector developers and we are leaving here with firm agreements on the exploitation of geothermal resources, wind, solar resources and shortly we will be on the highway on getting Kenya where we want her to be.”

President of Kenya, William Samoei Ruto

KES 500B UK-Kenya Projects: On the sidelines of Cop27, President Ruto and Rishi Sunak - the Prime Minister of the United Kingdom (UK), agreed to progress new British investment projects worth nearly KES 500B/£3.5B to support Kenya's leadership on climate change. The project with the largest outlay is the KES 425B/£880M Grand High Falls Dam - a Public Private Partnership (PPP) on Tana River that will generate 1,000MW of hydroelectric power - equivalent to 27.2% of Kenya's hydroelectric generation in 2021, and irrigate 400K hectares of farmland - equivalent to 7% of Kenya's arable land.

IMF, Kenya Agreement

US $433M Facility: The International Monetary Fund (IMF) staff and Kenyan authorities have reached a staff-level agreement on economic policies to conclude the fourth review of the 38-month Extended Fund Facility (EFF)/Extended Credit Facility (ECF) arrangements. The agreement is set to unlock US$433M or KES 52.7B in financing upon completion of review by IMF Management and Executive Board.

Notable Progress: The IMF noted the decline of Kenya’s overall fiscal deficit on a cash basis from 8.2% of GDP in FY 2020/21 to 6.2% of GDP in FY 2021/22, and highlighted the country’s efforts to remove fuel subsidies in line with the Fund’s policy advice in the third reviews of the EFF/ECF arrangement.

Deferred Obligations: The IMF has pointed out that the National Treasury deferred obligations amounting to nearly KES 90B ($744M) to the current financial year FY 2022/23 after it cancelled plans to float a $1.1B (KES 133B) Eurobond in FY 2021/22 on high-interest costs.

“However, a constrained borrowing environment meant that planned external commercial financing did not materialize. The lack of funds contributed to 0.7% of GDP in unpaid obligations that were carried over to FY2022/23.”

Debt Markets

Infrastructure Bridge Bond: In last week's inaugural cabinet meeting, the executive resolved to consider the Road Infrastructure Financing Plan for FY 2022/23 to FY 2025/26 to support the upgrade of the ongoing construction of roads to bitumen standards. The plan also addresses the outstanding pending bills owed to contractors in the road sector. A framework was approved to settle all outstanding pending bills owed to government contractors amounting to KES 92B through a bridge bond.

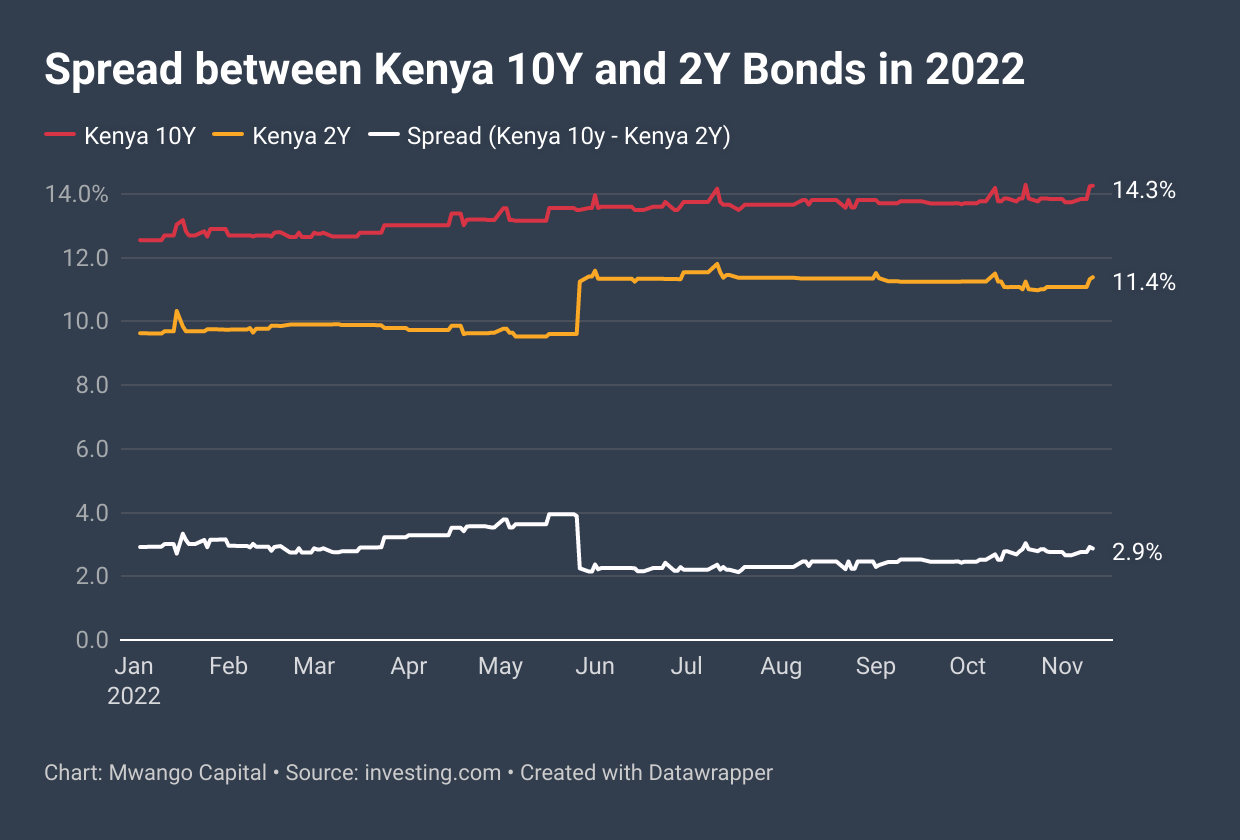

Lower Gov’t Borrowing Rates? President Ruto asked the Treasury to reconsider its borrowing calculus, asking officials to seek debt in the local markets capped at an interest rate of 10%. The President pointed out that the current borrowing rates are high. In last week’s long-term public borrowing, the interest rate on the Infrastructure Bond stood at 14%.

“I have also given instructions to the Ministry of Finance that yes we will go to the market and if we find that in the market we cannot find money at 10%, we will go back and relook at other sources. It's not possible for us to borrow at beyond 10%. Anything 12%, the last borrowing that we did was at 14%. That is unacceptable. That’s the trajectory we are going. I don’t know whether it is good news for you, I don’t know whether it is bad news but that’s where we are going.”

President of Kenya, William Samoei Ruto

T-bills: In the short-term debt markets, the yields on the 91-Days, 182-Days and 364-Days paper were 9.173%, 9.796%, and 10.186%, respectively. Out of the KES 24B total offer across the 3 securities, the Central Bank of Kenya (CBK) accepted KES 38.3B, bringing the performance rate to 159.7%. The acceptance rate was high in the 91-Days paper at 466.2% and lowest in the 364-Days paper at 86.8%. The yields are up by a total of 21.6 basis points (bps) from last week’s auction.

153% Performance Rate: The performance rate of the infrastructure bond IFB1/2022/014 was 153.1% with the CBK receiving KES 91.8B in bids against a KES 60B offer. The CBK accepted KES 75.8B to bring the acceptance rate to 125.9%. The weighted average rate of accepted bids was 13.9%. The performance rate was the second highest in the domestic government bond market in 2022 since the auction for infrastructure bond IFB1/2022/019 in February 2022 which had a 176.3% performance rate. This highlights investor appetite for infrastructure bonds due to their tax-free status.

Eurobond Market: IC Asset Managers Economist, Churchill Ogutu had a few notes to share on the market action last week:

KENINTs post the best weekly performance since election week (week ending August 8); Prices edged up an average of 11.5% week-on-week while yields declined an average of 235.8 bps.

Global factors: US elections at the start of the week and a better-than-expected Oct US CPI lifted sentiment across asset classes.

Idiosyncratic: IMF 4th review staff-level agreement announced at the start of the week.

What Else Happened This Week

🔙 KQ Pilots Back to Work: Earlier last week, a ruling in the Employment and Labour Relations Court issued a ruling requiring the aviators to resume work, bringing the four-day strike to an end. The pilots resumed duty on Wednesday, November 9 at 0600 HRS EAT. Earlier, the national carrier put the estimated daily losses from the strike at KES 300M, bringing the total loss to KES 1.2B excluding other auxiliary costs. Notably, the court barred the airline from pursuing any disciplinary action against KALPA members.

🛫 Exclusive Cargo Airport: Kenya's Cabinet Secretary for Trade and Industry Moses Kuria last week announced plans to create an airport dedicated to cargo on idle East Africa Portland Cement (EAPCF) idle land.

"We can't export our flowers, we can't export our avocados, we can't export our vegetables because we do not have enough flights for cargo from this country and we are discussing with a number of partners to use the idle land we have within East Africa Portland Cement to develop Kenya's first exclusive cargo airport right here. It will be done."

Cabinet Secretary for Trade and Industry, Moses Kuria

🧾 Hustler Fund Regulations: The National Treasury last week published draft regulations for the KES 50B Financial Inclusion Fund, popularly known as the Hustler Fund. The document is open for public input before it can progress to the next stage. The government is set to roll out the Fund starting December 1.

💰 IFC Investments: The International Finance Corporation (IFC) has availed $100M (KES 12.2B) Working Capital Solutions to Diamond Trust Bank Kenya( DTB) with a maturity timeframe of 24 months and renewable once for up to 36 months. Separately, the IFC will also be assisting with advisory services to the State Department of Urbanisation and the National Housing Corporation (NHC) to develop affordable houses.