👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Safaricom PLC’s H1 2024 results and Kenya’s redemption of its USD 2B Eurobond.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Introduce your child to the world of savings and responsible money management with Coop Bank’s Jumbo Junior Account.

Safaricom H1 2024 Results

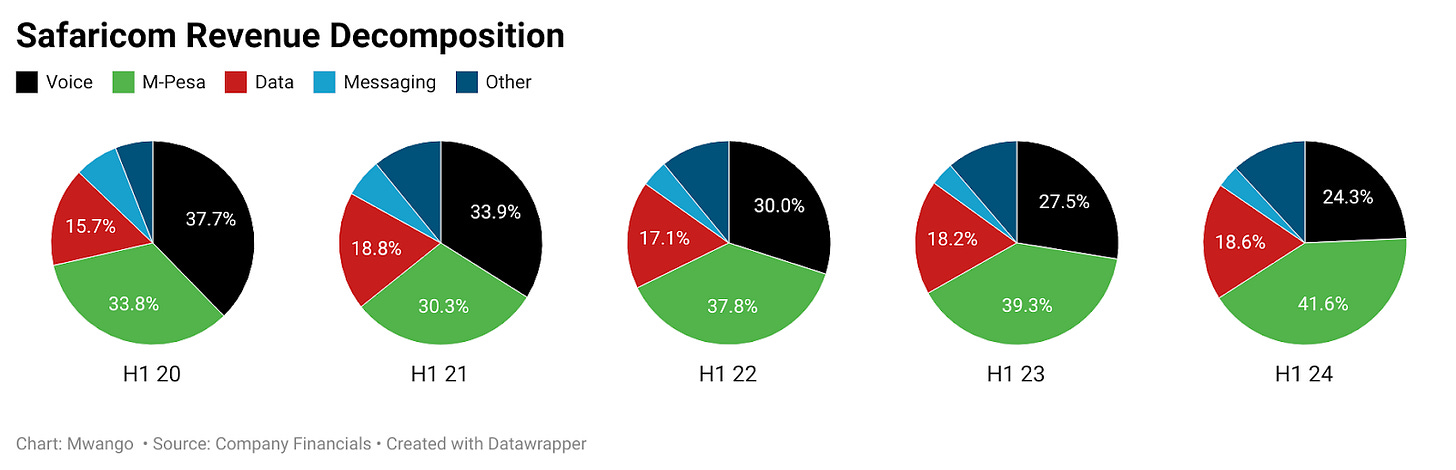

M-PESA, Mobile Data Grow Double Digits: Group service revenue grew by 9.9% year-on-year to KES 159.1B (+9.3% when adjusted for Mobile Termination Rate impact), mainly driven by M-PESA and mobile data revenue streams, which rose by 16.5% and 12.5% to reach KES 66.2B and KES 29.6B, respectively. M-PESA and mobile data now account for 41.6% and 24.3% of the service revenue pie from 39.3% and 27.5% respectively the prior year. Voice revenues fell for the second consecutive half-year period, declining by 3.0% to KES 38.7B, while messaging revenues grew for the first time since H1 19, up 6.0% to KES 5.8B.

M-PESA Anchors Earnings: M-PESA contributed to 41.6% and 40.2% of service and gross revenues, with 1-month active customers and Lipa Na M-PESA tills growing by 3.1% and 22.3% to 32.13M and 658.4K, respectively. In the revenue mix, personal payments earned KES 43B (65%), up 13.5%, while business payments earned KES 17.6B, up 40.2%. Transaction value and volume stood at KES 18.3T and 12.9B, up 1.1% and 34.7%, out of which KES 10.1T and 5.6B transactions were chargeable, up 64.3% and 45.4%, respectively.

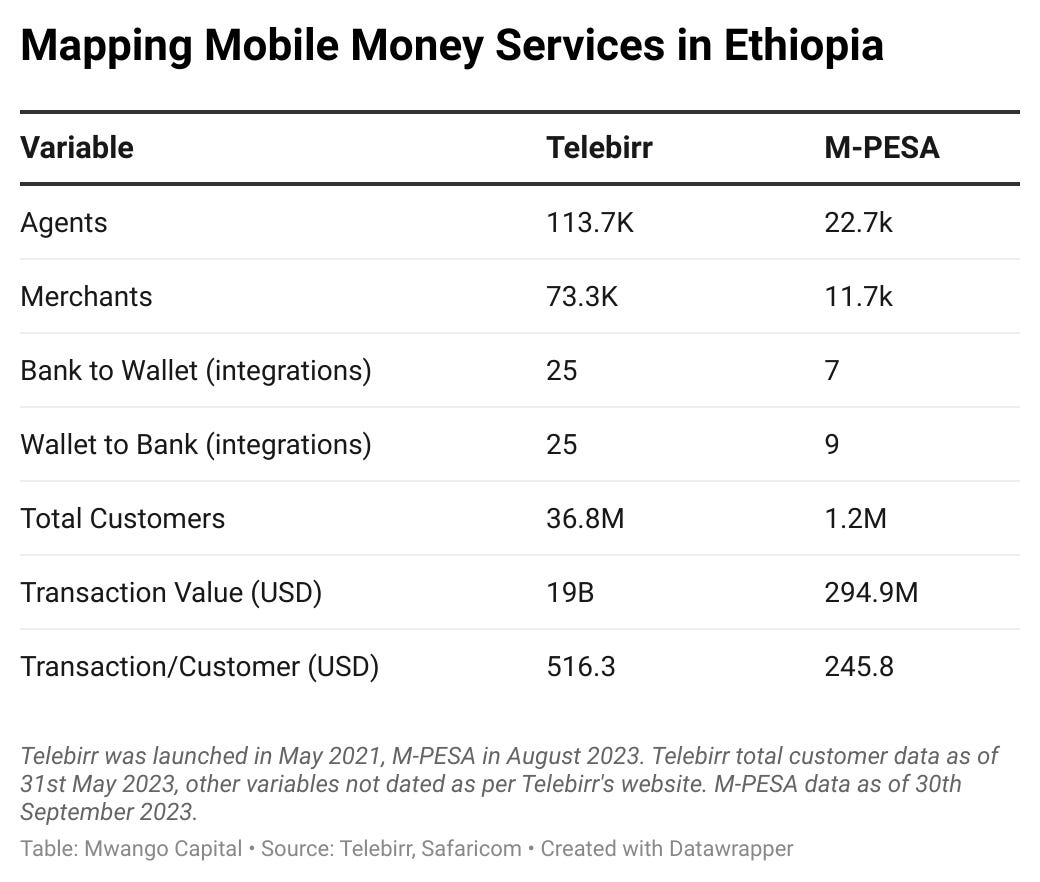

Ethiopia Operations: In the operating period, Safaricom launched mobile financial services in Ethiopia on 15th August 2023. Since its launch, M-PESA in Ethiopia has onboarded 22.7K agents and 11.7K merchants, and has integrated 7 banks with Bank to M-PESA and 9 banks with M-PESA to Bank. Safaricom Ethiopia targets to break even on an EBITDA basis by FY 2026. So far, the gross funding by shareholders in Safaricom Ethiopia since inception totals USD 1.6B, out of which Safaricom PLC has funded USD 833M (51.6%).

“Looking at M-PESA in Ethiopia, since switching on M-PESA in mid-August, we've registered just over 1.2M customers. M-PESA strategy revolves around four or five key pillars. Establishing a widespread agent, adding the merchant ecosystem, delivering a superior customer experience, enabling digital payments and integrated solutions, supporting e-commerce and remittances, and finally, offering digital financial services.”

Safaricom Ethiopia CEO, Win Vanhelleputte

Rising CapEx: Capital Expenditure (CapEx) for Kenya totalled KES 24.4B, with radio access and IT accounting for the bulk at 37.5% and 23.6%, or KES 9.15B and KES 5.76B in absolute terms, respectively. In Ethiopia, CapEx was KES 17.4B, with radio access accounting for the largest share at 60.3% or KES 10.5B as Safaricom Ethiopia sets up critical radio and network infrastructure to increase coverage. In sum, Group CapEx was KES 41.9B, up 11.7% [H1 2023: +64.3%].

Impact of Macros on Earnings: The macroeconomic conditions relating to interest rates, currency movements, and inflation impacted operations in Kenya and Ethiopia, and the Group undertook various actions in this respect. In Kenya, the weakening of the shilling occasioned the retirement of dollar-denominated debt to cut exposure to FX-related losses. Here is the CFO, Dilip Pal, expounding on this:

“Now, moving to the balance sheet, a bit on the debt and the finance cost, we have seen our finance cost increasing due to rising interest rates. We closed our debt position at KES 89.8B and our net debt position was KES 74.9B. We have taken measures to reduce our foreign currency exposure due to the depreciating currency by reducing our foreign currency exposure. You will recall that in FY 2022, we took a USD 400M bridge facility to finance our Ethiopia license investment. In FY 2023, 30% of that was converted to a local dollar facility, about 120M. And I am happy to note that we managed to pay off the entire dollar denominated loan, which is actually helping us reduce our exposure in foreign currency.”

The Group is taking steps to address the impact of rising interest rates which have impacted finance costs.

“We, however, must deal with the challenge of managing the rising interest rates, which has led to an increase of 48.5% in our finance cost. We have already started taking some deliberate steps on this with the recent Sustainability Linked Loan of KES 15B. The rates for this loan will be linked to our sustainability targets and will be therefore below market rates.”

In Ethiopia, hyperinflation occasioned a KES 13B monetary gain on the balance sheet, which when adjusted for restated expenses totalling KES 5.3B on the income statement, results in a KES 7.7B net monetary gain.

“That leads to a gain of KES 7.7B. What I did not mention is that when you calculate our dividend, which is payable to our shareholders, we exclude the impact of that. We also put something excluding hyperinflation net impact, because that's not necessarily available for shareholders. KES 7.7B is the net impact in the income statement, and we do not calculate that as an available reserve for payment of dividend.”

Profitability: At the Group level, pre-tax profits were down marginally by 2.7% to KES 46.9B - a softer decline compared to the 11.8% drop recorded in H1 23. On a net basis, income declined by 10.1% to reach KES 27.2B, marking the first time net income has gone sub-KES 30B since H1 17. Noteworthy, the Group absorbed a KES 22.1B loss in the period from Safaricom Ethiopia operations.

Revised Guidance: Safaricom Kenya EBIT is now projected at KES 129B - KES 132B, revised upwards from KES 117B - KES 120B initially while the CapEx projection is KES 45B - KES 48B, from KES 42B - KES 45B initially. For Safaricom Ethiopia, initial guidance remains unchanged with EBIT projected at (KES 42B - KES 39B) and CapEx at KES 40B - KES 45B. At the Group level, EBIT and CapEx guidance is at KES 87B - KES 93B and KES KES 85B - KES 93B, revised from KES 75B - KES 81B and KES 82B - KES 90B, respectively.

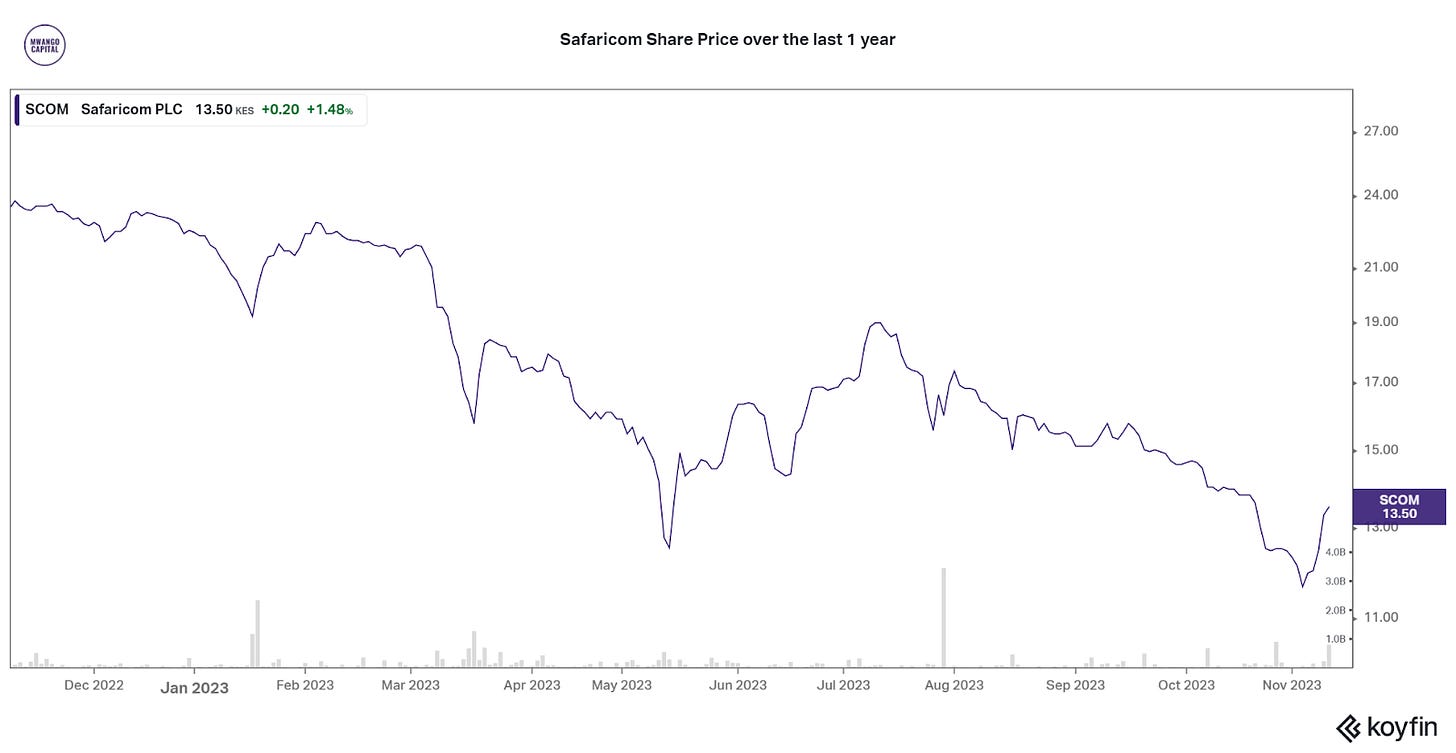

Market Reaction: The NSE reacted positively to the results, with the stock gaining 10.4% in trading on the results announcement day to close at KES 13.75. As of the close of the week ended 10th November 2023, the share price closed at KES 13.50, up 15.9% week-on-week, down 60.2% year-to-date, and down 57.6% over the last 1 year.

Here are the links to the press release, results booklet, and results presentation. In the week, Nairobi Business Ventures PLC also reported its earnings for the half-year period ending 30th September 2023.

Find a summary of the results here.

Kenya’s USD 2B Eurobond Redemption

USD 300M Payment: President William Ruto in his maiden State of the Nation address in Parliament, announced Kenya will in December 2023 settle USD 300M (KES 45B) of the USD 2B KENINT 2024 eurobond debt set to mature in June 2024. The President’s remarks cemented those of his economic adviser who earlier in the week, remarked in an economic forum that the 2024 Eurobond is fully funded.

“Our efforts to stabilise the situation have yielded such progress that next month, in December, we will be able to settle the first USD 300M instalment of the USD 2B Eurobond debt that falls due next year. I can now state with confidence that we will and shall pay the debt that has become a source of much concern to citizens, markets and partners.”

President of Kenya, William Ruto

“The thing which is looming largest and rightly so is the 2024 Eurobond. Markets are closed and it's the biggest bond maturing in emerging markets in Africa and in frontier markets. As of now, the 2024 Eurobond is fully funded. The refinancing is fully funded. We know the markets are closed. There's an IMF mission in town. The IMF has facilities. It can augment our program as of now, up to USD 650M, that they've agreed to do. They can also give us access to something called an exceptional window, in the event. So we have access to the entire IMF balance sheet.”

“We will probably be doing either some early sort of redemption or buyback or something like that by the end of the year. So it should improve the chances of being able to go to the market if the markets are open. I hope that settles that question once and for all.”

Dr. David Ndii, Chairperson of the Presidential Council of Economic Advisors

Fitch Ratings: In the week, Fitch Ratings released a note on Kenya pointing out that deploying FX reserves to redeem the Eurobond could reduce import cover and contribute to a rating downgrade depending on the size of the drawdown and the structure of external financing sources. Kenya’s stock of FX reserves closed the week at USD 6.853B, equivalent to 3.68 months of import cover.

Kenya’s Public Debt: As of 31st August 2023, Kenya’s total domestic debt stood at KES 4.9T, while total external debt amounted to KES 5.6T, bringing the total public and publicly guaranteed debt to KES 10.5T (USD 38.61B).

Across Africa: In 2024, including Kenya, African emerging and low-income countries will see over USD 16B of bullet payments coming due. Whether there will be debt defaults or debt restructuring by some of these countries on account of liquidity challenges remains to be seen.

“If we talk about liquidity too long, we get into insolvency and then we get into debt, and then everybody says there is a debt problem. But really it begins with the short-term liquidity problem that can be solved. 2024 is going to be very important for a lot of emerging and low-income countries because we do have over USD 16B of bullet payments coming due and the decision whether it is going to be a liquidity event or it is going to be a debt default problem is going to be quite important.”

Liquidity and Sustainability Facility Board Chairperson, Vera Songwe

Markets Wrap

NSE: In Week 45 of 2023, Safaricom was the top-performing stock, up 15.8% to close at KES 13.50. Standard Group was the worst-performing stock, down 19.5% to close at KES 5.54. The NSE 20 index fell by 1.6% to close at 1,420.1 points, the NSE 25 increased by 0.2% to close at 2,312.1 points, and the NASI index increased by 3.7% to close at 89.0 points. Equity turnover increased to KES 1.6B from KES 622.8M the prior week while bond turnover closed the week at KES 9.6B compared to the prior week’s KES 0.88B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.1863%, 15.2714%, and 15.4391% respectively. The total amount on offer was KES 24B with the CBK accepting KES 23.71B of the KES 24.67B bids received, to bring the aggregate performance rate to 102.82%. The 91-day and 364-day instruments recorded 562.00% and 9.14% performance rates, respectively.

Treasury Bonds: In the 6.5-year Treasury Bond IFB1/2023/6.5 with KES 50B on offer, CBK accepted KES 67B of the KES 88.9B bids submitted, settling a coupon rate of 17.93%. KES 67B of the accepted bids is slated for new borrowing.

Eurobonds: In the week, yields rose across the 6 outstanding papers.

KENINT 2024 rose the most week-on-week, up by 205.8 bps to 15.390% while KENINT 2034 rose the least, appreciating by 20.10 basis points to 11.180%. The average week-on-week change stood at 175.70 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 278.7 bps while KENINT 2048 rose the least at 88.7 bps to 11.711%.

Prices fell across the board week-on-week, with KENINT 2028 falling the most at 2.4% to 82.497. KENINT 2024 depreciated the least at 1.0% to 96.185. Year-to-date, KENINT 2024 was the only price that rose, appreciating by 2.9%. The largest price losses YTD were 8.7% for KENINT 2034 to 70.732. The average price change week-on-week and YTD was -4.8% and -1.6%, respectively.

Market Gleanings

⚠️ | Sasini Profit Warning | Sasini PLC, an agricultural company, has issued a profit warning for the financial year ended September 30, 2023. The company expects its net earnings to be 25% lower than the reported earnings for the year ended September 30, 2022. The company attributes the decline in profits to high production costs, severe drought, lower-than-expected coffee prices, and the effects of the global recession on the macadamia business.

📄 | Airtel Uganda IPO Results | Airtel Uganda this week announced the results of its Initial Public Offering (IPO) which raised UGX 211.4B. The IPO was subscribed at a rate of 54.45%, with 4,355,902,835 shares allocated to successful applicants. NSSF Uganda was the largest investor in the IPO, acquiring 10.55% of the total shares outstanding. Following the IPO, professional investors will hold 10.55% of the total shares outstanding of Airtel Uganda, with retail investors holding 0.34%. The issued shares of Airtel Uganda were listed on the Main Investment Market Segment of the Uganda Securities Exchange on November 7, 2023.

🛠️| CIC Group Restructuring | CIC Insurance Group is offering an early retirement package to its employees as part of a restructuring effort. The early retirement package is available to all CIC Insurance Group PLC employees, General Insurance Limited, CIC Life Assurance Company Ltd., and CIC Asset Management Ltd. The company has not disclosed the details of the severance package, but employees can access more information on the company's intranet, Jumuika.

🧾| Tax Revenue in October | In October 2023, total tax revenue collections grew by 19.4% year-on-year to reach KES 170.5B. From July to October 2023, the collections amounted to KES 684.7B, up 12.6%.

🔚 | BII’s Exit in I&M Group | I&M Group PLC has announced that British International Investment has agreed to sell its shares in the company, amounting to approximately 10.13% of I&M’s issued share capital, to East Africa Growth Holding. East Africa Growth Holding is an investment vehicle established by Africinvest Fund IV LLC, Africinvest IV Netherlands CV, and Africinvest Financial Inclusion Vehicle LLC. The proposed transaction is subject to customary regulatory approvals in Kenya and other countries where I&M has operating subsidiaries.

🤝 | Tatu City - Guangdong Partnership | Tatu City, Kenya’s first operational Special Economic Zone(SEZ), signed a trade deal with China’s Guangdong province to promote bilateral trade and investment. The agreement establishes links between Guangdong’s business community and Tatu City, providing a platform for Chinese companies to enter the African market. Guangdong ranks second in exports and first in imports from Kenya, with the new trade deal expected to attract even more investment.

💰 | BasiGo Gets USD 1.5M Grant | The United States Agency for International Development (USAID) has awarded BasiGo a USD 1.5M grant to support its pilot program in Kigali, Rwanda. Together, USAID and BasiGo aim to scale the Electric Bus fleet in Kigali to 200 buses by 2025. BasiGo will also provide all charging and maintenance services for the electric buses through their all-inclusive Pay-As-You-Drive model.

🛢️ | Tanzania-Uganda Gas Pipeline | Tanzania and Uganda signed a bilateral agreement on November 9 to construct a natural gas pipeline that will transport natural gas from Tanzania’s southern regions to Uganda. The two countries will work together on a feasibility study to assess the project’s design, gas demand, pipeline size and other factors. Tanzania has discovered large quantities of natural gas, approximately 57.54 trillion cubic feet with the government continuing to explore new sources.