Proposed Title: EPRA’s H1 2023/24 Energy Report

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover EPRA’s report for July - December 2023 (H1 2023/2024), fuel prices for the April/May 2024 pumping cycle, Cemtech Clinker Plant launch, and MansaX’s Q1 2024 Performance.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Whether it's restocking shelves with pharmaceuticals for your chemist, replenishing agricultural supplies for your agrochemical shop, or acquiring tools and equipment for your hardware store, their tailored financing solutions can help you get the cash you need.

Kenya’s Energy Sector in H1 2023/2024

Last week, the Energy and Petroleum Regulatory Authority (EPRA) released its report covering the period from July to December 2023 (H1 2023/24). Here are the key takeaways:

Electric Mobility: In H1 2023/24, 2,694 new Electric Vehicles (EVs) were registered to bring the total EV count in Kenya to 3,753. EVs now make up 1.6% of all vehicles registered in 2023, inching the country closer to the 2025 goal of 5%. Notably, in April 2023, EPRA introduced a special tariff for e-mobility aiming to pave the way for sustainable transportation. Energy consumption in this sector soared by 160% from July to December 2023, hitting 75.729K kWh.

Solar Power: Between July and December 2023, EPPRA approved 11 applications for PPAs for captive solar energy projects with a combined capacity of 6.502 MW, with Isuzu East Africa being one of the companies approved under this segment.

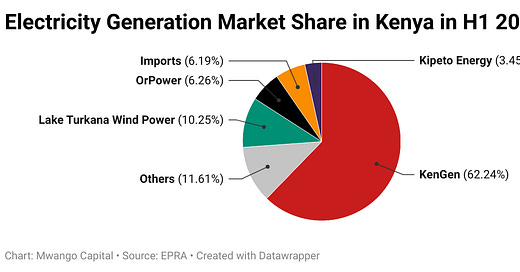

Electricity Generation: Kenya's electricity generation in H1 2023/2024 saw KenGen remain dominant with a 64.24% market share. Lake Turkana Wind Power (LTWP) was a notable contributor at 10.25%, while imports saw a significant rise, jumping from 4.49% in June to 6.19% by December.

Own-Source Power Generation: Own-source power generation in Kenya rose 60% year-on-year in the period under review to reach 449.5MW as consumers sought cheaper electricity alternatives to Kenya Power.

Connected Customers: In the period under review, a total of 253.48K new customers were connected to bring the total number of connected customers to 9.5M.

System Losses: The total system losses, both technical and commercial, totalled 23.2% exceeding the 18.5% benchmark set by EPRA.

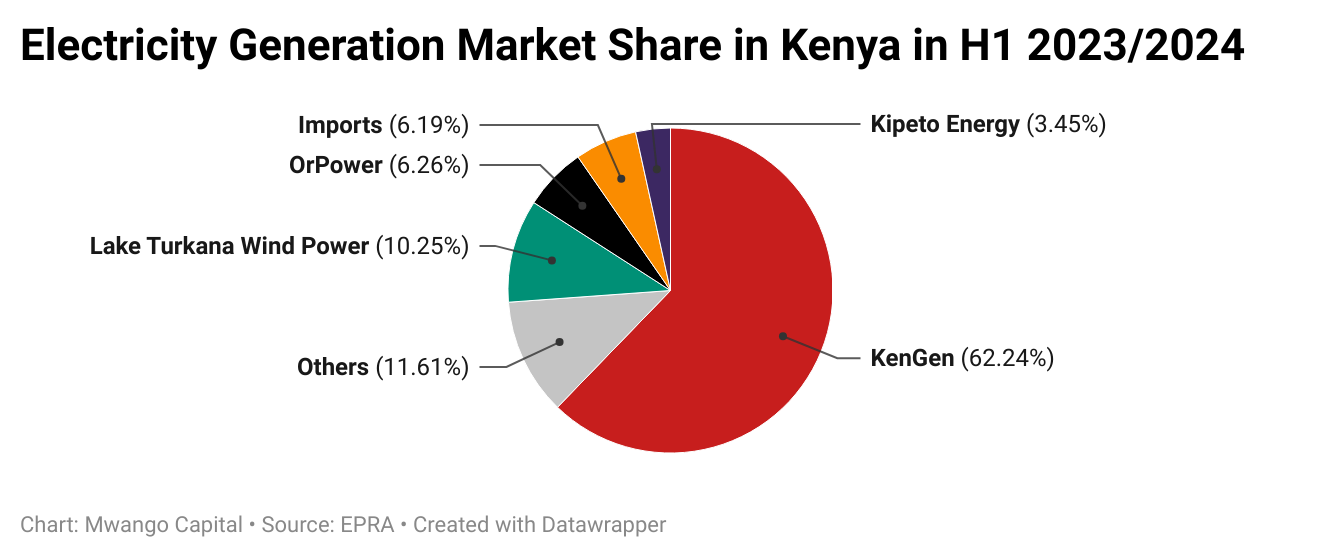

OMCs Market Share: Among Oil Marketing Companies, Vivo Energy had the largest market share at 22.07%, followed by Total Energies and Rubis Energy at 14.88% and 14.05% respectively.

LPG: Demand for Liquefied Petroleum Gas (LPG) edged higher by 8% to 360.594 Metric Tonnes (MT) in 2023 [2022: 333.830 MT]. The Authority undertook 840 inspections on wholesale and retail sites which recorded a compliance level of 51.96%. The compliance encompassed 54 bulk LPG road tankers which recorded a compliance level of 82.07% and 18 LPG storage and filling plants with a compliance level of 65.3%.

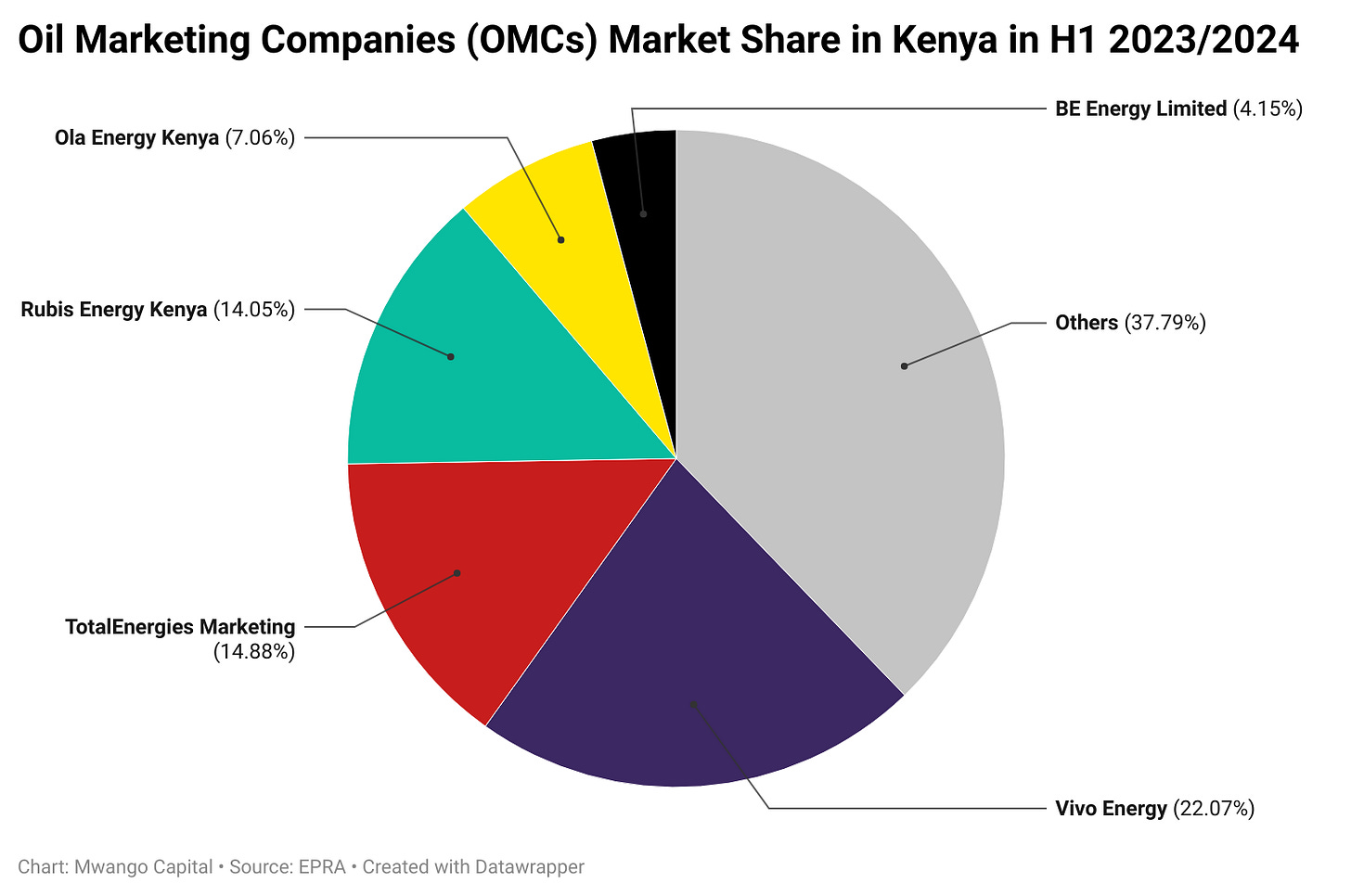

April/May Pump Prices: EPRA has reduced the prices for super petrol, diesel, and kerosene for the April/May 2024 pumping cycle by KES 5.31, KES 10.00, and KES 18.68 to KES 193.84, KES 180.38, and KES 170.06, per litre, respectively.

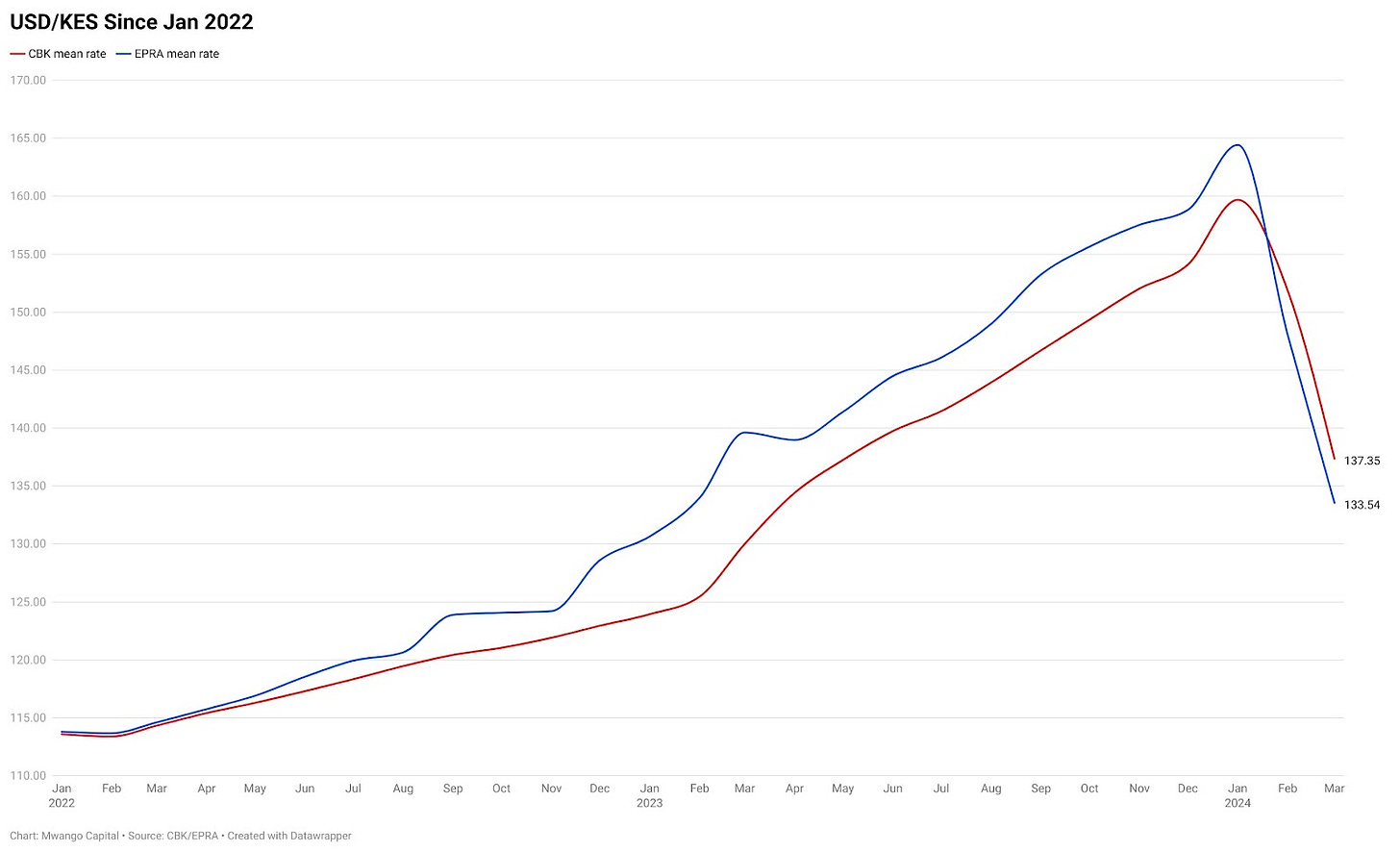

No cross-subsidies have been implemented in the April/May pumping cycle, unchanged from March/April. In March 2024, EPRA’s USDKES exchange rate was 133.54 (a level last recorded in February 2023), marking an appreciation of 9.8% from 148.02 in February 2024. Comparatively, the average exchange rate by the Central Bank of Kenya (CBK) for March 2024 was 137.35, representing an appreciation of 9.5% from February 2024.

Find EPRA’s H1 2023/24 report here and the April/May fuel prices press release here.

Deals, Mergers, and Acquisitions

Cemtech Limited Clinker Plant: President William Ruto last week commissioned the KES 45B Cemtech Limited Clinker Plant in Sebit, West Pokot County. According to the President, the plant is set to create jobs and expand opportunities for people and entrepreneurs in the region.

Kenya - Rwanda Northern Corridor: Kenya and Rwanda have embarked on boosting cooperation through enhanced transport services along the Northern Corridor. The initiative is meant to strengthen trade and streamline the movement of goods and people through improved connectivity.

EU - Kenya EPA: The Parliament's Departmental Committee on Trade, Industry, and Cooperatives is inviting the public to submit comments on the Economic Partnership Agreement (EPA) between Kenya and the European Union. The agreement aims to secure long-term market access for exports, foster economic growth and development, promote regional integration, and facilitate the gradual integration of East African Community (EAC) Partner States into the global economy. Kenyans are invited to submit memoranda on the Agreement by 16th April 2024.

Markets Wrap

NSE: In Week 15 of 2024, TransCentury was the top-performing stock, up 13.8% to close at KES 0.66. Car General was the worst-performing stock, down 10.0% to close at KES 26.10. The NSE 20 was down 1.3% to close at 1,724.9 points, the NSE 25 was down 2.3% to close at 2,932.5 points, and the NASI index decreased by 2.4%, to close at 110.6 points. Equity turnover was down 42.4% to KES 1.4B from KES 2.4B in the prior week while bond turnover closed the week at KES 17.5B compared to the prior week’s KES 10.5B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.7330%, 16.8684%, and 16.5310% respectively. The total amount on offer was KES 24B with the CBK accepting KES 45.7B of the KES 46.3B bids received, to bring the aggregate performance rate to 192.78%. The 91-day and 364-day instruments recorded 410.43% and 192.86% performance rates, respectively.

Eurobonds: In the week, yields rose across the 7 outstanding papers.

KENINT 2024 rose the most, up by 45.60 basis points (bps) to 7.067% while KENINT 2048 rose the least, appreciating by 7.70 bps to 9.886%. The average week-on-week change stood at 15.7 bps.

All papers except for KENINT 2034 had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 546.30 bps while KENINT 2034 rose by 4.90 bps.

Prices fell across the board week-on-week, with KENINT 2034 falling the most by 0.9% to 80.521. YTD, KENINT 2027 rose the most at 3.4% to 97.344, while KENINT 2034 rose the least at 0.1%.

Market Gleanings

📊| MansaX’s Q1 Performance | The KES fund returned 5.6% after-fees, with the Assets Under Management (AUM) expanding by 21.5% quarter-on-quarter to KES 23.7B. On the other hand, the USD fund returned 3.5% after fees with the AUM growing by 45.2% quarter-on-quarter to USD 29.9M. The top holding in both funds by far is Eurobonds, with 11% of the KES fund in Eurobonds and 12.9% of the USD fund invested in Eurobonds.

📄| Liberty’sZero Return | Liberty Kenya Holdings last week announced a ZERO (0%) return for their pooled guaranteed pension portfolio in 2023

“The low investment performance reported under this portfolio is predominantly due to the low returns from the investment market, particularly the equities market, which delivered a negative 28% return & the Treasury bonds market, due to fair value losses resulting from a rapid rise in yields at the primary auctions in 2023.”

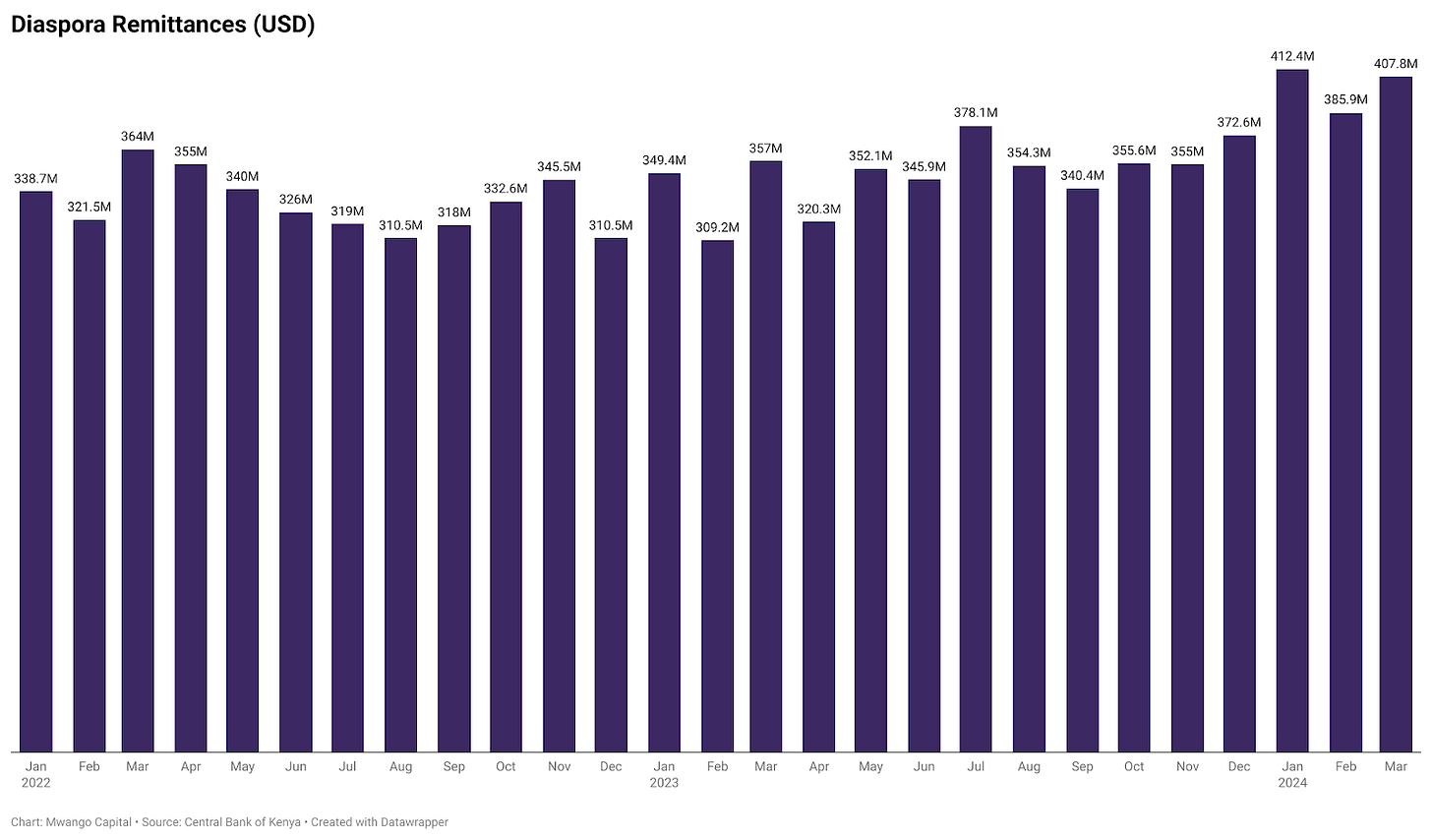

💲| Diaspora Remittances | Kenya received USD 407.8M in diaspora remittances in March 2024, up 14.2% year-on-year. On a month-on-month basis, the remittances grew by 5.7% from USD 385.9M in February 2024. In the 12 months to March 2024, the cumulative inflows were USD 4.38B, up 9.0% from USD 4.02B in the corresponding period in 2023.

🚚| Simba’s New Truck Model | Last week, Simba Corporation expanded its offerings with the launch of the Ashok Leyland ECOMET Truck. This 7-tonne truck enters the competitive light-duty truck segment and coincides with the opening of a new dealership in Thika Town. Priced at KES 4.5M, the ECOMET offers versatility by transforming into a 29 or 33-seater bus. This caters to both cargo and passenger transportation needs, positioning Simba Corporation as a comprehensive transport solutions provider for the Kenyan market.

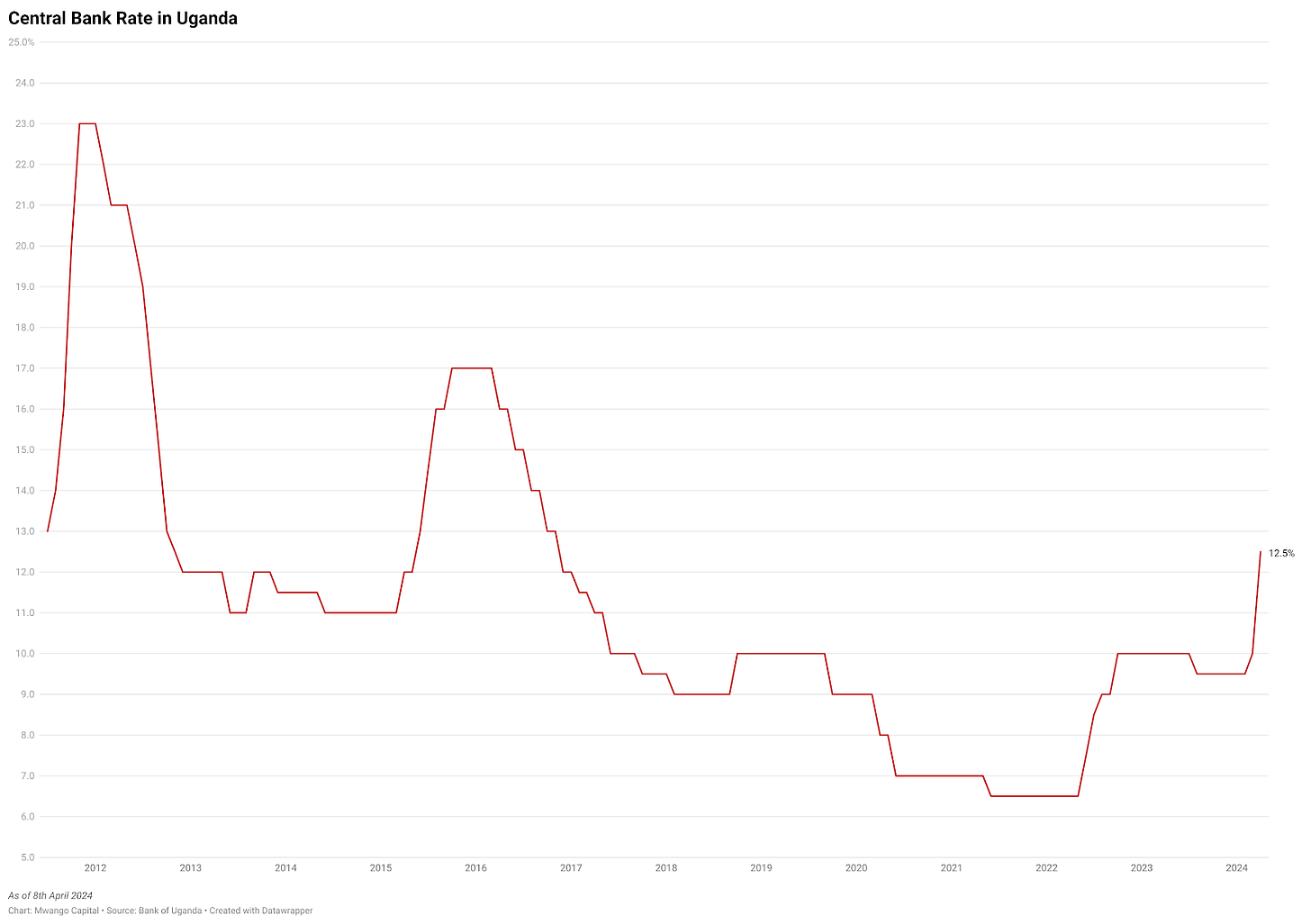

📈| Bank of Uganda Hikes CBR | The Bank of Uganda (BoU) last week raised its Central Bank Rate (CBR) to 10.25% to combat potential inflation and interest rate increases while stabilizing the foreign exchange rate. This tighter policy may lead to higher lending rates (currently at ~18.1%) and slower economic growth. Despite a slight decrease in headline inflation to 3.3%, the BoU remained concerned about future inflation reaching 5.5-6.0% within a year. The Ugandan economy is expected to grow by 6.0% in FY 2023/2024 with projections of 5.5-6.5% growth in subsequent years.

💸| IMF - Côte d’Ivoire Agreement | The International Monetary Fund (IMF) last week reached a staff agreement on the review of 2 lending programs, paving the way for the disbursement of USD 574M. This comes under the USD 3.5B Extended Fund Facility (EFF) & Extended Credit Facility (ECF) arrangements and the USD 1.3B Resilience & Sustainability Facility (RSF) arrangement.

🇳🇬| Nigeria Takes on FX Crisis | Last week, Nigeria's Central Bank offered the sale of USD 10K to FX bureaus at the rate of 1,101 Naira per USD. The FX Bureaus were directed to sell the dollars at not more than a 1.5% spread above the purchase price. Separately, Nigeria is set to receive $1.05B from oil-backed syndicated loans by end-May to help revive its economy and boost the supply of hard currency on the FX market. The funds form part of a $3.3B prepayment facility arranged by Afreximbank to be repaid using crude cargoes.