👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover we cover Amsons' bid to acquire 100% of Bamburi Cement PLC, Kenya downgrade by Moody’s, and Kenya’s FY 2023/2024 tax revenue collections.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Amsons' Mega Move on Bamburi

USD 180M: Amsons Group, a prominent Tanzanian conglomerate in manufacturing and energy, has launched a bid to acquire up to 100% of Kenya's Bamburi Cement PLC. The bid, valued at USD 180M (KES 23.6B), represents one of East Africa's largest takeover deals. Before the announcement on 10th July 2024, Bamburi was trading at KES 45.00 per share on the Nairobi Securities Exchange (NSE). Amsons' offer of KES 65 per share reflects a 40% premium. In the last trading session, Bamburi's share price closed at KES 61.50, marking a 36.7% increase since the bid announcement. The stock closed the week as the top gainer, up 37.89%, with a market capitalization of KES 22.3 billion.

Established in 2006, Amsons Group has a diverse portfolio, including cement manufacturing, oil and petroleum products, flour milling, concrete plants, and transportation across several African countries. The acquisition of Bamburi Cement is being pursued through Amsons Industries (K) Ltd, a Kenya-registered investment holding company.

Juicy Valuation: At the bid announcement, Bamburi Cement's market capitalization at the Nairobi Securities Exchange (NSE) was KES 16.3 billion. Amsons' bid of KES 23.2 billion valued Bamburi at 1.4 times its market cap. As of the end of FY 2023, Bamburi had a net debt of KES 1.2 billion, resulting in an enterprise value (EV) of KES 17.5 billion. This EV was 32.5% lower than Amsons' offer price. Last week, Bamburi’s market capitalization increased to KES 22.3 billion, raising its EV to KES 23.5 billion, which is slightly above Amsons’ offer. This new valuation indicates that the bid is fair and provides a good premium to Bamburi shareholders.-

What Next? As per the offer notice, Amsons has received irrevocable commitments from major Bamburi shareholders including Fincem Holding Limited and Kencem Holding Limited, who hold a combined 58.6% of Bamburi’s shares. The transaction is subject to approval from the Capital Markets Authority (CMA). Further, the offeror (Fincem and Kencem) has agreed to a breakup fee of USD 5.3M (KES 685.6M), equal to 3% of the value of the bid for 100% shares of Bamburi, if the offer is not completed by 28th November 2025. Should Amsons achieve acceptances of 75% or more of the offer shares, it will evaluate the efficacy of Bamburi remaining listed and may apply for delisting from the NSE subject to CMA approval.

Find the Notice of Intention by Amsons Industries (K) Ltd here.

Kenya’s Moody Blues

Down the Grade: Moody's Ratings has downgraded Kenya's local and foreign-currency long-term issuer ratings, as well as its foreign-currency senior unsecured debt ratings, to Caa1 from B3, maintaining a negative outlook. This downgrade reflects a shift from "high credit risk" to "very high credit risk." In contrast, Moody's ratings for Tanzania and Uganda stand at B1 (Positive Outlook) and B3 (Stable Outlook), issued in March and May 2024, respectively.

Key factors influencing this decision include Kenya’s limited capacity to introduce and implement new tax measures, exacerbated by the withdrawal of the Finance Bill 2024, which aimed to generate KES 346.7 billion in revenue for FY 2024/2025. Additionally, Moody's has expressed skepticism regarding the government's proposed reactionary measures, particularly the feasibility of implementing extensive public expenditure reductions, which are deemed challenging under the current economic conditions.

"Multilateral lenders and rating agencies seem to only recognize raising revenues as a viable consolidation strategy, expressing skepticism towards substantial government expenditure cuts. Their doubts appear warranted, as the withdrawal of the Finance Bill 2024 has left a KES 224.7B deficit, given that only KES 122B was cut in supplementary budget I. Cognizant of the country's constrained fiscal space, I believe there are significant opportunities for expenditure reductions — if the government is truly committed."

Standard Investment Bank Research Analyst, Stellar Swakei

“We do not expect Kenya’s government to have the political capacity to introduce measures that would meaningfully raise revenue in the foreseeable future. Instead, the government has begun work on a supplementary budget for fiscal 2025 which will reduce spending by KES177 billion, or 1% of fiscal 2025 GDP, while increasing the fiscal deficit to 4.6% of GDP, from an original target of 3.3% of GDP. We now expect a slower pace of fiscal consolidation with debt affordability remaining weaker for longer.

“…that means that the fiscal adjustment that the government is planning is gonna be more heavily focused on expenditure cuts and the reason why we are doubtful of that is because if you look at spending and what’s happened over the past 2 or 3 years, we’ve seen development spending cut significantly already…For a country at Kenya’s stage of development, without an improvement in the efficiency of public investment decision making, we don’t think development spending is the area which can be cut on a sustained basis, meaning that you can reduce it for 1 year, for 2 years, but at some point needs to increase and the same goes with operating and maintenance expenses.”

VP, Senior Credit Officer, Moody’s Investors Service

What to Do? Goldman Sachs analysts Bojos Morule and Andrew Matheny highlighted Kenya's political uncertainty and social unrest following the withdrawal of the Finance Bill, 2024 which has now limited the capacity to increase revenues through taxes, the government will be forced to rely on borrowing to cover the fiscal gap, leading to Moody’s downgrade of Kenya's credit rating to Caa1 from B3.

“The government's decision to accommodate larger fiscal deficits rather than attempt to cut spending by an equal amount as the canceled tax measures reflects the constraints to such large expenditure cuts in a short period of time. More than half of government spending in fiscal 2025 falls under Consolidated Fund Services, the category of spending that includes statutory obligations and allocations that are generally non-discretionary. This will leave a large share of spending cuts to fall on operations and maintenance and the development budget”

IMF on Kenya's Fiscal Fix: The IMF last week highlighted Kenya's fiscal challenges, noting a decade-long decline in its tax-to-GDP ratio and a dramatic increase in public debt service. With debt consuming a substantial portion of revenues, the IMF stressed the urgent need for Kenya to boost revenue mobilization to meet its financial obligations and development needs:

"Kenya's tax-to-GDP ratio has been declining for almost a decade since its peak of 15.4% in FY 14/15 & remains lower than that of its regional peers. Over the same period, public debt service to revenue ratio has increased markedly from about 35 to about 60% of revenues. With a significant share of revenues going toward debt service, Kenya needs to mobilize more revenues to meet the country's needs."

Spokesperson of the International Monetary Fund, Julie Kozack.

Here’s an X Space we had last week on Breaking Down Kenya’s Debt Situation in light of the ratings downgrade.

Supplementary I Budget is Here

Lean and Mean: The National Treasury has submitted the Supplementary Estimates I for FY 2024/2025, the Programme-Based Budget (PBB), and the Memorandum on the Supplementary Estimates to Parliament. The Estimates seek to align budget estimates with the revised Fiscal Framework and actualize expenditure cuts and have been transmitted to the National Assembly's Budget & Appropriations Committee (BAC) for consideration. The BAC will conduct public participation on the same and report back to the House by July 24th, 2024. Kenyans have until 22nd July 2024 to submit their memoranda for the revised estimates.

Key Observations: Last week, we noted that President Ruto's plan to address the withdrawal of the Finance Bill 2024 included cutting spending by KES 177B and increasing borrowing by KES 169.7B. The supplementary Budget 1 comes with significant cuts of KES 121.8 B in total, with KES 34.1B from recurrent expenditure and KES 122.4B from development expenditure.

Key reductions include significant cuts to both development and recurrent expenditures, with specific sectors such as the Executive Office, education, health, agriculture, and energy facing notable budget slashes. Notably, the budget is appreciably quite meticulous in detail. Here are some key items we noted:

Total revenues are revised downwards from 18.5% to 17.5% of GDP.

Total expenditure and net lending are revised downwards from 22.1% to 21.4% of GDP.

Grants are projected at 0.3% of GDP.

The overall fiscal deficit is revised upwards from 3.3% to 3.6% of GDP.

Net foreign financing is revised upwards from 1.8% to 2.0% of GDP.

Net domestic financing is revised upwards from 1.5% to 1.6% of GDP.

Ministerial expenditure has decreased by 6.6%, with recurrent expenditure down by 2.1% and development expenditure down by 16.4%.

The overall ministerial budget has decreased by KES 56.4B, a 6.6% reduction.

The supplementary estimates adhere to fiscal principles, including allocating a minimum of 30% of the national budget to development expenditure.

Find the notification of the Supplementary Estimates No. 1 FY 24/25 here, the Supplementary Estimates I FY 24/25 here, the Development Supplementary Estimates I here, and the Recurrent Supplementary Estimates I here.

“Nearly all ministries and state departments faced budget cuts, except for the State Department for Cooperatives and the State Department for Economic Planning, while the National Intelligence Service's allocation remained unchanged. Interestingly, the county equitable share saw a KES 10.8bn increase, and CFS expenditure rose by KES 23.8bn. The rationale for the increase in county budgets is unclear, as they were already allocated the funds approved under the county equitable share schedule. For CFS, the additions likely cover the extra interest expenses that the country is expected to incur from higher borrowings due to the increased deficit.”

Standard Investment Bank Research Analyst, Stellar Swakei

KRA’s FY 23/24 Provisional Numbers

2023/24 Revenue Collections: Kenya Revenue Authority (KRA) released provisional numbers on tax collections for FY 23/24 which showed that tax revenue collections in the 2023/2024 financial year were KES 2.4T, up 11.1% year-on-year, equivalent to 15.9% of Kenya’s GDP. Across categories, domestic taxes recorded the highest performance at KES 1.611T, representing a growth of 14.4% and 96.1% achievement of the target.

Performance by categories:

Domestic Taxes: +14.4% to KES 1.611T (96.1% target achieved)

Customs Revenue: +4.9% to KES 791.4B (94.6% target achieved)

Domestic VAT: +15.3% to KES 314.2B

Capital Gains Tax: +49.5% to KES 8.3B (108.7% target achieved)

Corporation Tax: +4.9% to KES 278.2B (93.4% target achieved)

Pay As You Earn (P.A.Y.E): +9.7% to KES 543.2B

Domestic Excise: +8.1% to KES 73.6B

Other notable items:

By June 2024, 280,663 VAT-registered taxpayers had joined the Electronic Tax Invoice Management System (eTIMS), helping the KRA collect KES 314.2B, or 13.1% of the 2023/2024 fiscal year's total revenue.

Taxes collected from betting and gaming companies were KES 24.3B, up 26.2% YoY, buoyed by the integration of systems between the firms and the KRA for real-time tax collection.

Debt collection initiatives targeted at non-compliant taxpayers yielded a collection of KES 103.4B.

The tax amnesty programme that started running on 1st September 2023 and ended on the 30th of June 2024 realized collections totaling KES 23.9B with 2.6M taxpayers granted amnesty.

Next week we get the numbers from the Treasury on collections in FY 23/24.

Markets Wrap

NSE: In Week 28 of 2024, Bamburi led the market, rising 37.9% to KES 61.5, while Express was the worst performer, dropping 10.0%% to KES 2.88. The NSE 20 rose by 2.2% to 1659.8 points while both the NSE 25 and NASI indices rose by 1.9% and 0.9%, closing at 2,908.9 and 110.0 points, respectively. Equity turnover rose by 15.4% to KES 1.1B, while bond turnover surged to KES 46.7B from KES 35B the previous week.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.99%, 16.82%, and 16.87% respectively. The total amount on offer was KES 24B with the CBK accepting KES 30.25B of the KES 32.9B bids received, to bring the aggregate performance rate to 137.3%. The 91-day and 364-day instruments recorded 364.7% and 82.97% performance rates, respectively.

The Central Bank of Kenya has announced the results of the tap sale of the FXD1/2023/002 treasury bond, investors submitted KES 487.5M out of the KES 20B on offer, resulting in a performance rate of 2.44%. The Central Bank of Kenya accepted KES 485.48M.

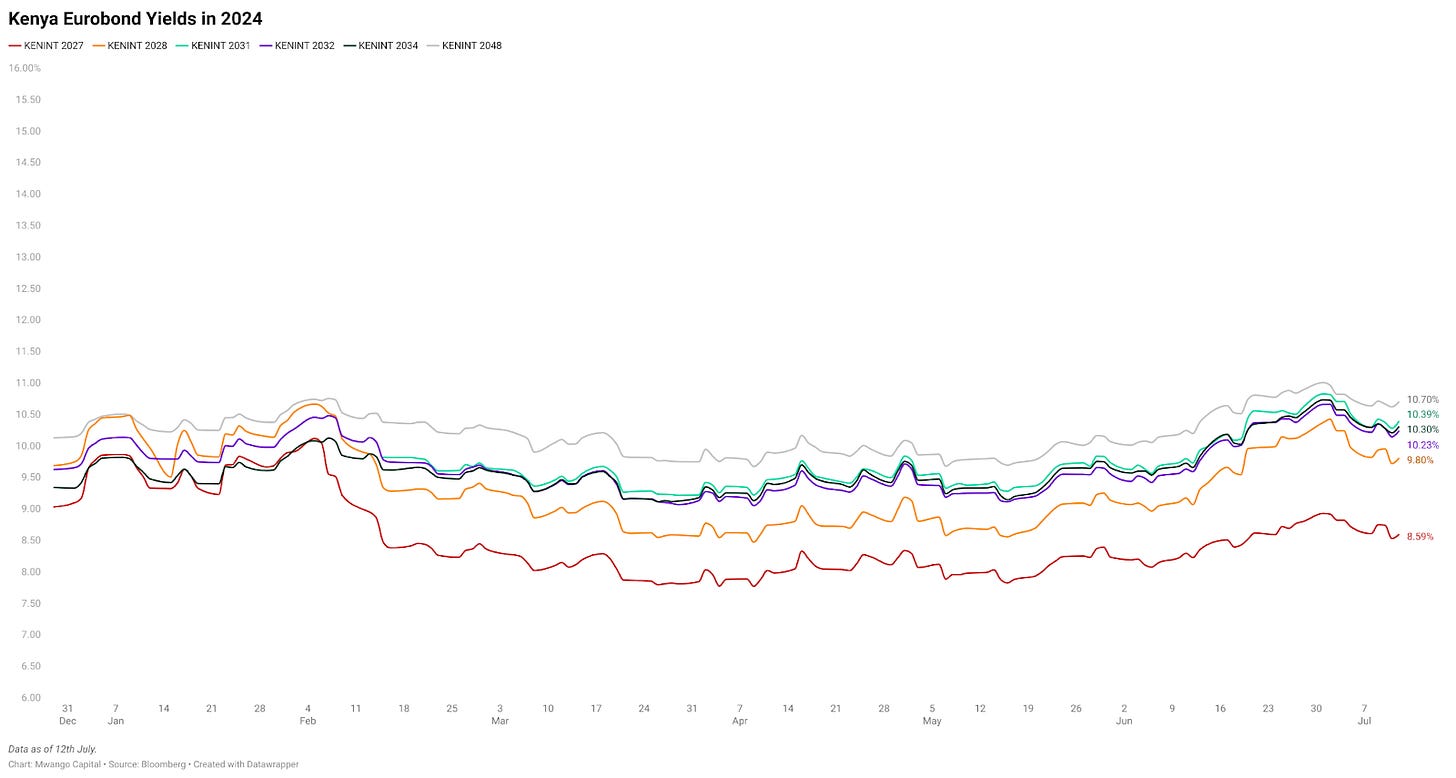

Eurobonds: In the week, yields were down week-on-week across the 5 outstanding papers with KENINT 2028 falling the most, down 17.30 bps to 9.799%, followed by KENINT 2034 at 14.80 bps to 14.80%. KENINT 2048 fell the least, down 5.20 bps to 10.696%. The average week-on-week change stood at -12.43bps.

Market Gleanings

⚖️| SHIF Declared Null and Void | The implementation of the Social Health Insurance Fund (SHIF) has been halted after a three-judge panel declared its rollout null and void. The SHIF was intended to replace the National Health Insurance Fund (NHIF) starting October 1, 2024. The court ruled that the entire Social Health Insurance Fund Act 2023, Digital Health Act 2023, and Primary Health Act 2023 were unconstitutional.

🏛️| ILAM Fahari REIT Joins NSE’s USP | ILAM Fahari Real Estate Investment Trust (I-REIT) has successfully been listed on the Unquoted Securities Platform (USP) of the Nairobi Securities Exchange (NSE). This follows a comprehensive restructuring that involved converting from the unrestricted ILAM Fahari Income Real Estate Investment Trust (IFIR) into a restricted I-REIT.

🗠| Stanbic Kenya June 2024 PMI | In June 2024, Kenyan business activity experienced a sharp decline, with the Stanbic Bank Kenya PMI falling to 47.2 from 51.8 in May, indicating the steepest deterioration in seven months. Economic challenges, including the cost-of-living crisis and protests against the Finance Bill 2024, negatively impacted sales, leading to the fastest drop in new business intakes since November last year.

🪙| Uganda Gold Purchases | Uganda's Central Bank has started purchasing locally-produced gold to bolster its foreign reserves and address emerging challenges in international financial markets. This initiative aims to accumulate foreign currency reserves, which stood at USD 3.5B as of April 30, covering 3.2 months of imports, down from 3.4 months the previous year.

📡| Ethio Telecom FY 2023/2024 Results | In FY 2023/2024, Ethio Telecom reported revenues of ETB 93.7B, a 22% year-on-year increase. Net profit rose by 21% to ETB 21.79B. The company's mobile money service, Telebirr, reached 47.5M subscribers, up 38.6% year-on-year, while total subscribers grew by 9% to 78.3M.

💸| Nala Raises USD 40M Funding | UK-based remittance fintech Nala has secured USD 40M in a Series A funding round led by Acrew Capital. Founder and CEO Benjamin Fernandes announced that the funds will be used to expand Nala’s consumer business beyond Africa and to develop its B2B payments platform, Rafiki, aimed at creating a robust payment infrastructure for Africa.