Centum's Sidian Exit Falls Through

Centum's Share Purchase Agreement with Access Bank stands terminated

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the agreement termination of Centum’s exit from Sidian Bank, the insurance sector's Q3 2022 performance, and Sasini's FY 2022 results.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

Centum’s Sidian Exit Terminated

Recap: In June 2022, Centum Investment Plc entered into a binding agreement with Access Bank Kenya to sell its 83.4% stake in the Tier III lender for a KES 4.3B consideration.

Agreement Terminated: The investment firm this week said it failed to reach an agreement with Access Bank as at the long stop date of the transaction. Centum has opted not to pursue an extension of the Share Purchase Agreement (SPA) and will retain its stake in Sidian.

“The Long Stop Date has passed without all conditions being fulfilled or waived, despite the support and guidance by the Central Bank of Kenya. Further, Centum has not been able to reach acceptable terms with Access Bank Kenya PLC for a further extension of the Share Purchase Agreement and has opted not to pursue an extension of the same. The Share Purchase Agreement has therefore lapsed in accordance with its terms, and it stands terminated.”

Centum Investment Plc CEO, James Mworia

Pain Points: Mworia has cited new variables into 2023, including the depreciating shilling and the introduction of risk-based pricing models in the banking sector that will most likely pivot bank earnings as key trade-offs in consideration. This is what he had to say about the circumstances around the SPA:

When we had agreed to the deal, Kenya shilling to USD was 114. We are now at 124 and a number of other currencies have also depreciated. Inflation was 5%, and we are now at 9%. And then if you look at the banking side, in 2021, we had not adopted risk-based pricing models et cetera. So the question is are you exchanging an appreciating asset for a possibly highly depreciating asset? Because in an inflationary environment, inflation can wipe out the real purchasing power of the consideration.”

Centum Investment Plc CEO, James Mworia

More Acquisitions: Access Bank has said it will pursue more acquisitions despite the failed Sidian acquisition. In 2020, Access Bank acquired Transnational Bank for a deal valued at over KES 1.5B.

“The bank remains committed to growing its franchise in a safe and sound manner in Kenya and the broader East African Community (EAC) and will continue to explore a variety of organic and inorganic opportunities to grow its market share therein.”

Planned Deleveraging: A total amount of $10M that was to be booked in realized gains from the Sidian exit was to be applied towards the retirement of some $15M liabilities to mitigate forex exposure. In the current context going forward, banking operations at Sidian will be counted among dollar-generating lines for purposes of retiring USD debt.

Buyback Programme: The firm will have an Extraordinary General Meeting on February 3, 2023, to deliberate on the share buyback programme. Centum intends to repurchase 66.5M or 10% of issued capital at a range of KES 0.5 - 9.03 per share. The total cash on its balance sheet as of H1 2023 was KES 761M.

Find our entire conversation on the Sidian deal with Centum CEO, James Mworia, below:

Insurance Sector Q3 2022 Report

Long-Term Insurance Business

Gross Premium Income rose 12.3% year-over-year to KES 103.5B. The Deposit Administration class recorded the highest change - at 26.9% to reach KES 37.6B, accounting for 36.3% of gross premium income.

Total assets expanded 15.3% to KES 633.4B with Shareholders' Equity accounting for 11.2% of total assets.

Britam Life Assurance had the highest market share at 21.1%, followed by ICEA Lion Life Assurance and Jubilee Insurance Company at 14.5% and 13.1%, respectively.

Total investments edged higher by 15% to reach KES 586.7B [2021: 510.2B]. Government securities accounted for 77.8% or KES 456.6B of investments.

General Insurance Business

Gross Premiums rose 10.7% to KES 134.4B [2021: 121.4B]. The Motor Private class accounted for the largest share of premiums at 15% or KES 20.3B [2021: KES 18.2B] and the Fire Industrial class recorded the highest change at 30.9% to KES 15.1B [2021: KES 11.5B].

Old Mutual General Insurance had the largest market share by Gross Premium Income at 9.0% [2021: 8.7%]. 7 insurers jointly controlled 51.4% of total Gross Premium Income [2021: 47.9%].

Claims incurred rose 10.8% to KES 56.8B [2021: KES 51.3B], equivalent to 42.3% of gross premiums [2021: 42.3%]. Class-wise, Paid claims were highest in Medical at KES 23.7B [2021: KES 18.8B], or 44.5% of total claims paid [2021: 40%].

General Insurers cut their gross underwriting loss by 45.2% to KES 2.3B [2021: KES 4.1B]. Losses were highest in the Motor Private class at KES 2.9B [2021: KES 4.8B], followed by Motor Commercial at KES 1.8B [2021: 2.5B]. The Workmen’s Compensation class recorded the highest profit at KES 2.5B [2021: KES 1.7B].

Industry Fiscal Position

Total assets of the insurance industry rose 9.8% to KES 918B [2021: KES 836.1B]. Shareholder’s Funds increased by 4% to KES 178.45B or 19.4% of total assets [2021: KES 171.6B or 20.5%].

Investments in income-generating assets rose 12.5% to KES 805.42B [2021: KES 715.9B]. 71.5% of the industry’s investment portfolio was deployed in government securities while 3.3% was allocated to equities.

Energy Sector Statistics FY 2021/22

The Energy and Petroleum Regulatory Authority (EPRA) released statistics for the financial year ended June 30 2022. Below are the key highlights:

Installed Capacity: Maximum power generation capacity rose 3.4% year-over-year to 3,074.34MW [2020/21: 2,972MW]. Geothermal accounted for the largest source, at 30.87%, or 949.12MW, while biomass was the least at 0.07% or 2MW.

Peak Electricity Demand: Peak demand edged higher by 3.2% to 2,056.67MW [2021: 1,993.63 MW]. The highest load on the electricity grid was recorded on June 14, 2022.

Electrical Energy: Total electrical energy delivered to the grid rose 4.55% to 12,652.74 GWh [2021: 12,101.17 GWh]. At 4,953.15 GWh (39.15%) Geothermal was the largest source [2021: 5,033.69 GWh] while Biogas was the smallest source at 0.38 GWh [0.33 GWh].

System Losses: The cumulative system losses recorded in the period were 22.43% against the 19.9% benchmark set by EPRA.

Connected Customers: New customers connected to the grid rose by 8.6% to 8.9M [2020/21: 8.2M].

Renewable Energy: The total installed capacity was 2,481.69 MW (78.55% of the overall installed capacity). Geothermal accounted for the largest source at 949.13MW or 38.2% and solar the least at 170 MW.

Petroleum: Retail pumps consumed 3,937.8K Metric Tonnes (MT) (75.8% of the total fuel consumption in the country). The marine sector excluding Naval Forces had the least consumption at 2.1 MT.

OMCs Market Share: Among Oil Marketing Companies, Vivo Energy had the largest market share at 23.83%, followed by Total Energies and Rubis Energy at 17.3% and 10%, respectively.

Coal: Licensed captive coal generation plants had a total capacity of 58.5 MW. Cemtech Ltd accounted for the largest capacity at 30 MW or 51.3% of total capacity.

LPG: Demand for Liquefied Petroleum Gas rose 13.9% to 373.865 MT in 2021 [2020: 320.909K MT]. The total number of bulk LPG storage facilities increased to 120 [2012: 8], distributed across 25 counties with a combined storage capacity of 34K Tonnes.

Access the entire report here.

FY 2023/24 Medium-Term Budget

Below are key highlights from the public hearings on the proposed FY 2023/24 and Medium Term Budget which ran from January 11 to January 13 this week.

Macroeconomic Outlook: The National Treasury projects economic growth of 5.5% in 2022 and 6.1% in 2023 on the back of broad-based public sector growth, including recoveries in agriculture and public sector consolidation.

Recurrent Expenditure: The government aims to reduce recurrent spending by cutting down on non-priority expenditures. Expenditures as a share of GDP are expected to fall from 23.3% in FY 2022/23 to 22.4% in FY 2023/24 and further to 21.7% in FY 2025/26.

Sasini FY 2022

Revenue: Gross sales edged higher by 36.3% to KES 7.3B [2021: 5.4B]. Net profit rose 103.8% to KES 1.2B, bringing the Net Profit Margin to 16.4% [2021: 10.6%].

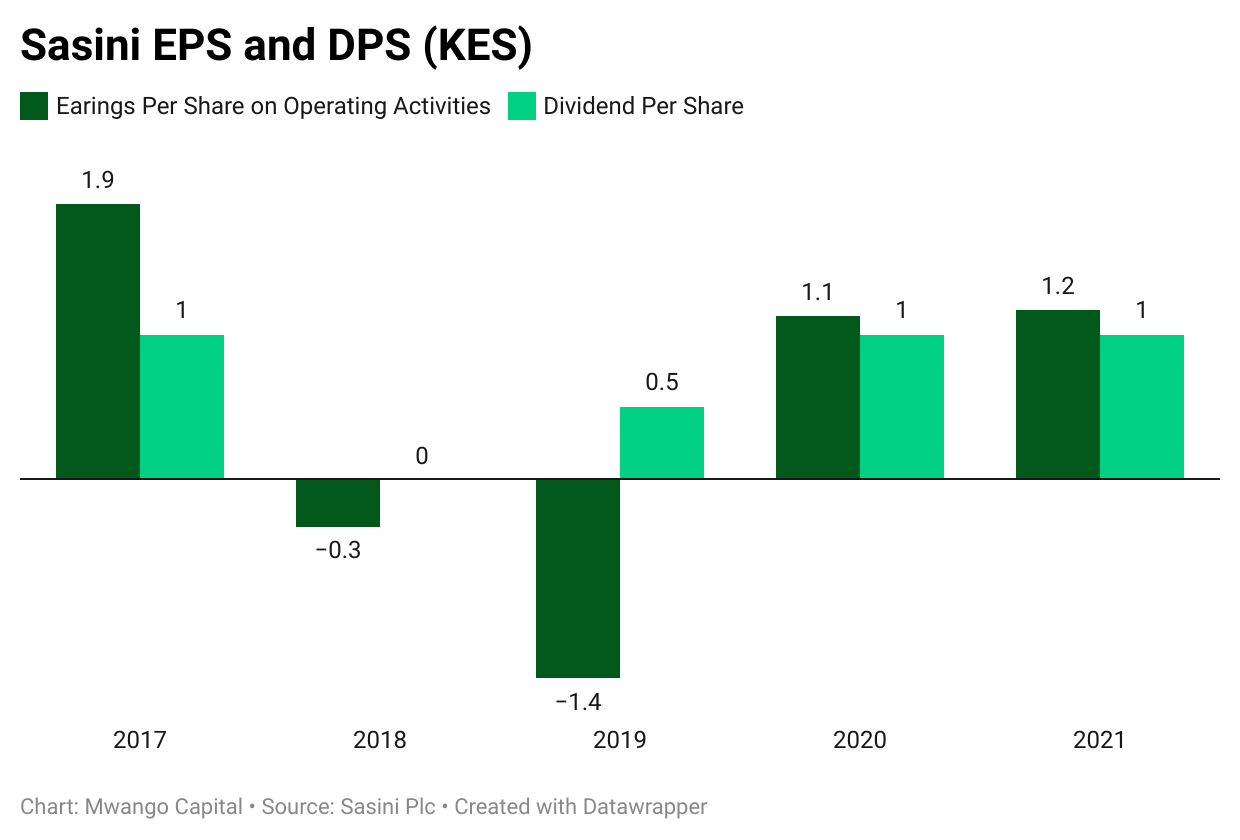

Earnings: Earnings Per Share were up 105.6% to KES 5.12 [2021: KES 2.49]. The firm paid an interim dividend amounting to KES 228.05M, or KES 1 Per Share in the year [2021: KES 0.5] but however skipped a final dividend [2021: KES 0.5].

Find an analysis of the results here.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.425%, 9.859%, and 10.434% respectively. The total amount on offer was KES 24B with the CBK accepting all the KES 26.1B received bids. The performance and acceptance rates were 108.88% and 108.8%, respectively.

T-bonds: Across the re-opened FXD1/2020/005 and FXD1/2022/015 bonds, total bids received at cost were KES 27.6B and KES 14B. The CBK accepted KES 24.4B and KES 7.2B bringing the weighted average rate of accepted bids to 12.9% and 14.3%, respectively. On aggregate, the performance and acceptance rates were 83.3% and 63.1%, respectively.

Eurobonds: Last week, yields were down across all outstanding papers, and

KENINT 2024 recorded the largest drop, falling 81.4 basis points Year-To-Date and 85.4bps week-on-week to 11.789%.

KENINT 2032 fell the least Year-To-Date, by 23.1 bps to 9.424%; while week-on-week, KENINT 2048 fell the least; by 14.4 bps to 10.539%.

KENINT 2048 led price gains Year-To-Date, rising 2.6% to 79.906, while week-on-week; KENINT 2032’s price rose the most, by 1.9% to 87.715.

What Else Happened This Week

🧾 Actis Selling Java: Three years after assuming management rights on Abraaj Private Equity IV and Abraaj Africa Fund III, Actis is disposing of its entire stake in Kenya’s biggest coffee chain Java House. an entity that was part of the 14 portfolio companies acquired in the July 2019 transaction.

⛽ Jan/Feb Fuel Cycle: EPRA last week adjusted the prices for Super Petrol, Diesel and Kerosene downwards by 6.2%, 11.1% and 4.1%, respectively for the January/February cycle. The price of diesel has been cross-subsidised with that of Petrol, while a subsidy of KES 25.13 per litre has been maintained for kerosene.

💰 Hustler Fund Updates: As of January 12 1800H, the total disbursement stood at KES 14.2B with the amount repaid being KES 6.4B. The average loan size was KES 589.5 and the share of repeat customers amongst opted-in customers was 28.8% across 24.1M gross transactions.

💵 $4B Remittances: Diaspora remittances increased 1.9% year-over-year to $357.3M in December 2022 [2021: $350.6M]. On a month-on-month basis, they edged up 3.4% from $345.4M in November. 2022 saw the remittances cross $4B to $4.028B, up 8.3% year-over-year [2021: $3.718B].

🦠 Uganda Ebola-Free: Last week, Uganda declared an official end to its Ebola outbreak. Widespread testing did not detect new cases in more than 42 days, double the 21 days it takes for the virus to incubate between exposure and infection. Over the course of the outbreak, 162 total cases were reported, out of which 142 or 87.7% were confirmed by lab tests. 39% or 55 people with confirmed infections died.

📈 Ghana Inflation Spikes: Consumer inflation in Africa's largest gold producer Ghana reached 51.4% in December [November: 50.3%] - the highest level in 22 years since April 2001. At 82.3%, prices rose the most in the housing, water, electricity, gas and other fuels category year-on-year.

Interest Rate Watch

🇰🇪 Kenya: Banks are adopting risk-based pricing models in a move that heralds higher interest rates for borrowers.

“Kenya, where interest rates are going up, credit is becoming expensive at the expense of credit growth. The net effect is that the credit growth will be at best very soft. When the macros change and we see CBK through its Monetary Policy Committee (MPC) start reducing the Central Bank Rate (CBR), then the interest rates in the market will start coming down and consequently, credit will start again picking up.”

Kenya Bankers Association CEO, Habil Olaka

🇦🇴 Angola: Africa’s second-largest oil producer will give the direction of its monetary policy on January 20th in the coming week. Currently, the key interest rate is 19.5% and inflation stood at 13.86% as of December 2022.