👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover World Bank’s Kenya Economic Update, proposed changes in the tax laws, and more profit warnings.Please help us improve our service delivery to you by filling out the survey in the link below.

World Bank’s Kenya Economic Update

GDP Growth: Kenya's GDP growth in 2024 has slowed, with the economy expanding by 5.0% in Q1 and 4.6% in Q2, down from the 5.6% growth recorded for the full year 2023. These figures align with the pre-pandemic average of 4.6% (2011–2019) and the World Bank's potential growth estimate of 4.7%, a downward revision from the 5% forecast in June. Economic activity was hampered by severe floods in April, which affected urban livelihoods, and mid-year protests subdued business sentiment. While agriculture showed resilience with a 4.8% growth in Q2, this marked a decline from the 6.5% growth in 2023, as the cyclical rebound following the drought faded. Services also decelerated to 5.5% in Q2, from 7.0% in 2023, partly due to reduced tourist arrivals.

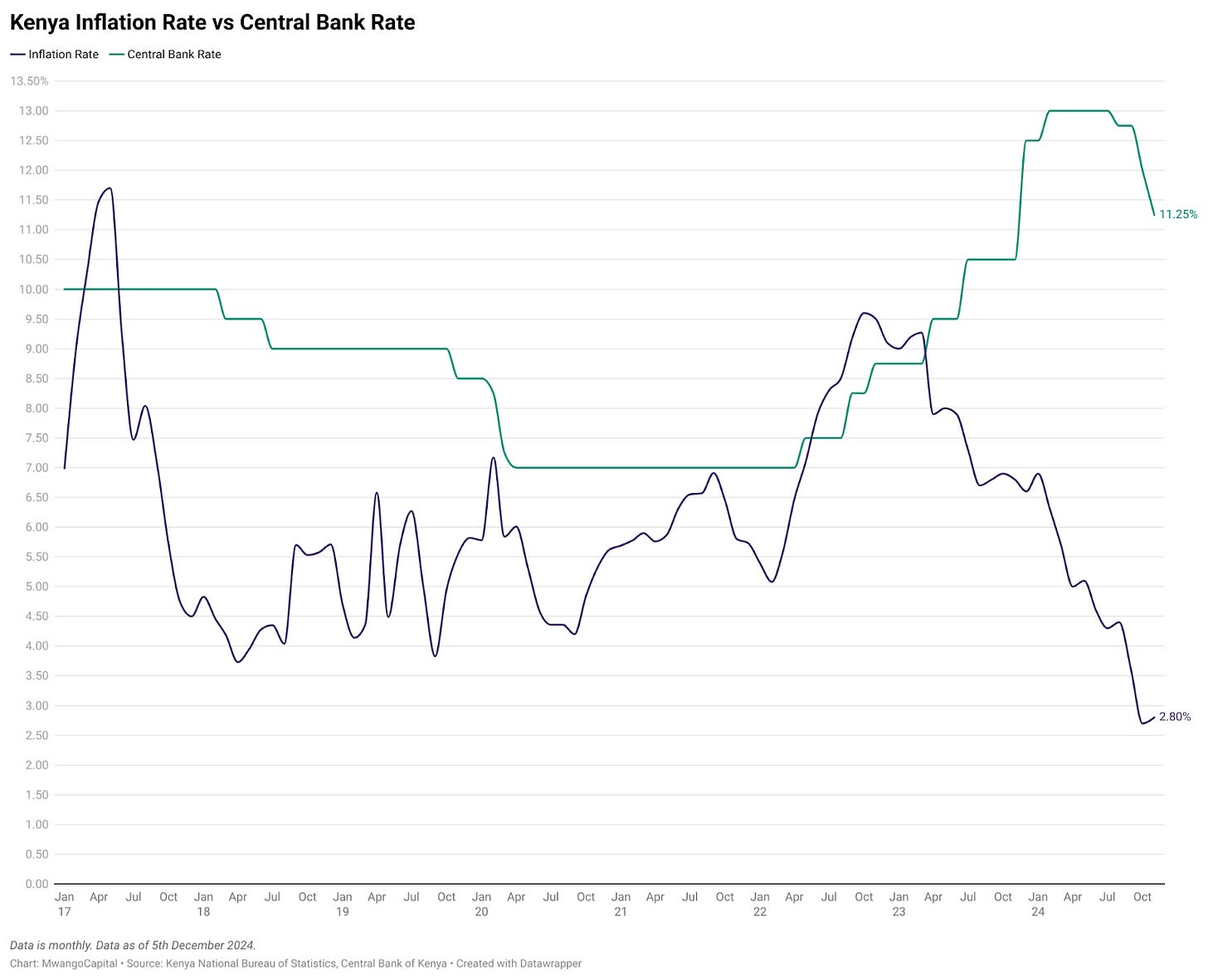

Inflation and Monetary Policy: Kenya achieved significant progress in controlling inflation, which dropped from 6.9% in January to 2.8% by November 2024, well below the Central Bank of Kenya's (CBK) target midpoint of 5%. This success was driven by declining food prices and energy costs, alongside a stable Kenyan shilling. To sustain these gains, the CBK reduced the Central Bank Rate (CBR) from 13.0% in August to 11.25% by December. However, private sector credit growth slowed dramatically to 1.3% in August 2024, down from 12.6% a year earlier, as high interest rates and government borrowing constrained credit availability, particularly in sectors like construction and manufacturing.

Public Finance and Revenue Collection: Fiscal consolidation remains a critical challenge, with Kenya's fiscal deficit narrowing to 5.2% of GDP in FY2023/24, above the target of 4.7%. At 16.9% of GDP, total revenue improved slightly from 16.7% in FY2022/23 but fell short of projections due to underperforming revenue sources. Rising debt service costs, equivalent to 5.3% of GDP, consumed a large share of revenues, limiting funds for social and development programs. Domestic borrowing accounted for 51.1% of total public debt, reflecting increased reliance on local markets as external debt obligations declined following the Kenyan shilling's appreciation. Pending bills remained a concern, amounting to KES 528.4B in September 2024, equivalent to 2.9% of GDP.

Proposed Changes In The Tax Laws (Amendment) Act, 2024

Income Tax Changes – Business Related

Income Tax Changes – Paye (Employee Related)

VAT Changes

Miscellaneous Fees & Levies Act Changes

Excise Duty Changes

Markets Wrap

NSE This Week: In Week 50 of 2024, Kenya Power led the top gainers, rising by 17.2% to close at KES 4.15, while Bamburi Cement was the worst performer, dropping 13.9% to close at KES 48.65. The NSE 20 rose by 2.7% to 1,880.3 points, while the NSE 25, NSE 10, and NASI indices gained by 3.4%, 3.9%, and 3.4%, closing at 3,244.9, 1,252.0, and 119.1 points, respectively. Equity turnover rose by 3.6%, totaling KES 1.98B, while bond turnover fell to KES 25.0B, up from KES 38.0B the previous week.

Treasury Bills and Bonds: Treasury bills were undersubscribed in the week with an overall subscription rate of 69.17%, down from 176.3% the previous week. Investors placed bids worth KES 16.6B, out of which KES 16.5B was accepted, resulting in an acceptance rate of 99.9%. Yields on the three treasury bill tenors continued to decline, dropping by 42.53 basis points, 54.7 basis points, and 21.01 basis points, closing at 10.03%,10.00%, and 11.76% for the 91-day, 182-day, 364-day bills.

The re-opened 10-year Treasury bond FXD1/2024/10 attracted bids worth KES 53.6B against a target of KES 20.0B, resulting in a 268.1% oversubscription. The accepted average rate for the bond closed at 14.685%, marking a decline from the 15.855% rate recorded in the November 2024 auction.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds increased across the board, with the KENINT 2027 recording the sharpest increase of 60.20 basis points to 7.744%, followed by the KENINT 2028, which rose by 24.00 basis points to 8.370%. The average week-on-week yield increase was 19.75 basis points.

Market Gleanings

🔺| Profit Warnings |

Express Kenya PLC has announced a profit warning, projecting earnings for the financial year ending December 31, 2024, to decline by at least 25% compared to the previous year. The company attributes this to adverse economic challenges, including reduced demand for warehousing services and lower economic activity, which have significantly impacted its operational efficiency and bottom line.

TotalEnergies Marketing Kenya also issued a profit warning for the year ending 31st December 2024, projecting a more than 25% decline in net profits compared to 2023 due to higher finance costs driven by elevated interest rates. The firm cited the impact of prolonged high interest rates and a challenging business environment, which have significantly increased finance costs and eroded net earning

⛽| Dec/Jan Fuel Cycle | EPRA has reduced fuel prices for the December-January cycle. Super Petrol now costs KES 176.29 per litre, down by KES 4.37, while Diesel is priced at KES 165.06 per litre and Kerosene at KES 148.39 per litre, both reduced by KES 3.00.

✈️| KQ Adds Gatwick to London Routes | Kenya Airways (KQ) has announced a new direct route from Nairobi's Jomo Kenyatta International Airport (JKIA) to London’s Gatwick Airport (LGW), starting July 2, 2025. This addition will bring the airline's London frequency to 10 weekly flights, complementing its existing operations to Heathrow Airport (LHR). The new Gatwick flights will operate three times a week—on Wednesday, Friday, and Sunday—departing Nairobi at night.

💰| KRA Hits KES 1T Mark | The Kenya Revenue Authority (KRA) collected KES 1.005T in the first five months of the 2024/25 financial year, reflecting a 4.3% growth from KES 963.7B in the same period last year. Customs revenue grew by 5.9% to KES 359.57B, driven by a modest 1% increase in imports, while domestic taxes rose by 3.5% to KES 643.79B.

✔️| Sanlam Kenya Shareholders Approve Rights Issue | Sanlam Kenya shareholders have approved a KES 3.25B rights issue during an Extra-Ordinary General Meeting held on Wednesday. The rights issue will be structured to achieve the target amount, enabling the insurer to recapitalize its balance sheet by making an early repayment of an existing loan facility from Stanbic Bank Kenya. Additionally, part of the proceeds will be allocated as working capital, providing management with the resources and flexibility needed to drive growth and profitability. Shareholders also authorized the board to execute the rights issue and to allot up to 1 billion ordinary shares with a nominal value of KES 5 each to current shareholders.

💵| Kenya Secures KES 140.7B in PPP Investments Since 2013 | Since adopting the public-private partnership (PPP) model in 2013, Kenya has attracted a cumulative KES 140.7B in investment for various infrastructure projects. This includes the KES 88B Nairobi Expressway, completed in 2020, which marked the country's first double-decker highway. The PPP model allows the government to undertake large projects without relying on Exchequer funds or incurring additional debt.

🏦| Access Bank to Acquire Bidvest Bank | Access Bank has agreed to acquire a 100% stake in South Africa’s Bidvest Bank for R2.8 billion ($158 million). Proceeds from the sale will repay Bidvest’s debt. The acquisition supports Access Bank's 2027 goal to become one of Africa's largest lenders. In Kenya, Access Bank is set to acquire NBK from KCB, expected to close in Q1 2025.

💰| Nigeria Secures USD 2.2B | Nigeria has secured USD 2.2B from lenders led by the African Development Bank (AfDB) to fund the transformative Special Agro-Industrial Processing Zones (SAPZ) Phase II project. The funds were mobilized during the Africa Investment Forum, marking the largest amount raised for SAPZ initiatives across the 12 African countries covered by the program.

💼| Key Appointments |

WPP Scangroup: Ms. Miriam Kaggwa has been appointed Chief Operating Officer, effective 1st January 2025, after previously serving as Chief Financial Officer. Mr. Sanjeev Panwar has been named Chief Financial Officer, having previously served as Group Finance Director.

Unga Group: Mr. Alan McKittrick has been appointed as an alternate director to Mr. Jinaro Kibet, effective December 5, 2024. Mr. McKittrick retired from his principal director position during the Company’s Annual General Meeting held on the same day.

Integrated Payment Services Limited: The company has announced new board appointments, including Paul Russo, Group Managing Director of KCB Group Limited; Abdi Mohamed, Managing Director of Absa Bank Kenya PLC; Anthony Mburu, CEO of Kingdom Bank Limited; and Jubril Adeniji, Managing Director of Guaranty Trust Bank Limited.

KBA: The Kenya Bankers Association has appointed Mr. Raimond Molenje as its CEO, effective 1st December 2024. Mr. Molenje, who joined KBA in 2018, has been serving as the Acting CEO and previously held the role of Director of Legal, Human Resources, and Policy Advocacy.