Gov't Sets KES 3.38T Revenue Target

This is a 10.6% increase from the projected KES 3.06T in FY 2024/25

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the 2025 Budget Policy Statement, Kenyan banks cutting lending rates, and results of the reopened IFB1/2022/14 and IFB1/2023/17 auction.The 2025 Budget Policy Statement

Each year, the National Treasury must table the Budget Policy Statement (BPS) in Parliament by February 15. Once presented, the BPS is referred to each Departmental Committee for review based on their mandates. Below are key highlights of the 2025 BPS.

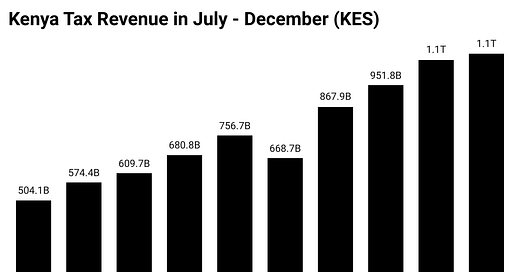

Revenue: The government aims to collect KES 3.38T in revenue for FY 2025/26, reflecting a 10.6% increase from the projected KES 3.06T in FY 2024/25. Ordinary revenue is expected to reach KES 2.835T (14.7% of GDP), up from the projected KES 2.576T (14.8% of GDP) in FY 2024/25. This growth is supported by ongoing tax policy and revenue administration reforms aimed at expanding the tax base and improving compliance.

As of December 2024, ordinary revenue grew by 6.3% to KES 1.15T, against a target of KES 1.257T, resulting in a shortfall of KES 93B. To address this, the government is focusing on broadening the tax base, reducing tax expenditures, improving compliance, leveraging technology, and increasing non-tax revenue from public services.

Expenditure: Total expenditure is projected to rise by 7.3% to KES 4.26T (22.1% of GDP) in FY 2025/26, up from KES 3.97T (22.8% of GDP) in FY 2024/25. The FY 2025/26 expenditure comprises KES 3.096T (16.1% of GDP) in recurrent expenditure, KES 725.1B (3.8% of GDP) in development expenditure, KES 436.7B in transfers to county governments, and KES 5.0B allocated to the Contingency Fund.

Public Debt & Fiscal Deficit: The projected fiscal deficit, including grants, is estimated at KES 831.0B (4.3% of GDP) in FY 2025/26, down from KES 862.7B (4.9% of GDP) in FY 2024/25. This deficit will be financed through KES 146.8B (0.8% of GDP) in net external financing and KES 684.2B (3.6% of GDP) in net domestic financing. The government will continue monitoring macroeconomic conditions before accessing international capital markets through sovereign bond issuances and liability management operations. Additionally, it will explore alternative financing options such as green and climate change financing, should economic conditions improve. To further diversify funding sources, the government may issue Panda, Samurai, and diaspora bonds.

Economic Growth: Economic growth is projected at 4.6% in 2024 and 5.3% in 2025, driven by strong performance in the services sector, manufacturing recovery, high agricultural productivity, and improved exports.

Funding for Counties: The 2025 BPS proposes increasing the equitable share allocation to counties from KES 387.4B to KES 405.1B, marking a KES 17.6B increase. The total proposed funding for counties in FY 2025/26, combining the equitable share, conditional grants, and in-kind support from national programs, is KES 474.8B, up from KES 429.4B in the current fiscal year.

Numbers Don’t Lie: Arvocap Funds’ Performance Speaks for Itself!

This week’s newsletter is brought to you by Arvocap Asset Managers.

You work hard for your money, but is your money working hard for you? Check out the numbers and see why thousands of investors are choosing Arvocap for financial security and growth.

Over the past eight months, Arvocap Funds have consistently delivered strong returns, and consistent growth reinforcing our commitment to growing your wealth securely and efficiently.

But we’re not stopping there! Our projected 12-month returns indicate even greater financial potential, making this the perfect time to invest. Whether you’re saving for a dream home, securing your child’s future, or building long-term wealth, Arvocap is here to make every shilling count.

Invest Today.

Banks Cut Lending Rates

Kenyan banks are cutting lending rates following pressure from the Central Bank of Kenya (CBK), which has warned of fines for non-compliance. The regulator is enforcing rate adjustments to ease credit costs and stimulate borrowing. Below is a summary of the key changes across major banks:

Equity Bank: Announced a 300 basis points reduction in interest rates on all Kenya Shilling-denominated loans, effective February 13 for new loans and March 1 for existing ones. This brings the Equity Bank Reference Rate (EBRR) down to 14.39%.

KCB Bank: Reduced its base lending rate by 100 basis points to 14.6%, down from 15.6%. The new rate takes effect from February 10, 2024.

NCBA: Lowered its Kenya Shillings Base Lending Rate from 16.91% to 15.34% per annum. The new rate takes effect from February 16, 2025.

Co-op Bank: Reduced its base lending rate by 2 percentage points, from 16.5% to 14.5%. The final rate will include a margin of 0% to 4%, depending on the customer’s credit profile. The new rates take effect immediately.

Absa: Lowered its Absa Base Rate by 300 basis points to 13.5% per annum. Additionally, its Risk-Based Pricing base rate was reduced by 100 basis points, effective immediately for new loans and from March 13, 2025, for existing loans.

I&M Bank: Announced a 2.00% reduction in Kenya Shillings lending interest rates, effective March 1, 2025. This follows a 0.75% cut in Q4 2024, bringing the total rate reduction to 2.75% in recent months.

DTB Bank: Reduced lending rates by 0.5% effective January 1, 2025, followed by an additional 0.37% cut effective February 15, 2025.

Markets Wrap

NSE This Week:

EA Portland Cement (+17.9%) surged to KES 35.90, while Uchumi (-21.1%) plunged to KES 0.30, leading gains and losses.

Markets edged higher—NASI (+1.18%) at 131.1, NSE 20 (+1.29%) at 2,222.7, NSE 10 (+1.06%) at 1,354.7, and NSE 25 (+1.34%) at 3,555.8.

Equity turnover fell 30.3% to KES 1.90B, while bond turnover declined 20.3% to KES 31.00B.

Foreign investors remained net sellers, offloading KES 957.3M, contributing 56.61% of total turnover.

Eyes now on EABL’s dividend (21 Feb) and KPLC’s interim dividend (28 Feb).

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 184.4%, down from 296.6% the previous week. Investors placed bids totaling KES 44.3B, out of which KES 25.1B was accepted, reflecting a 56.8% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 14.6, 10.9, and 16.4 basis points to 8.97%, 9.41%, and 10.59%, respectively.

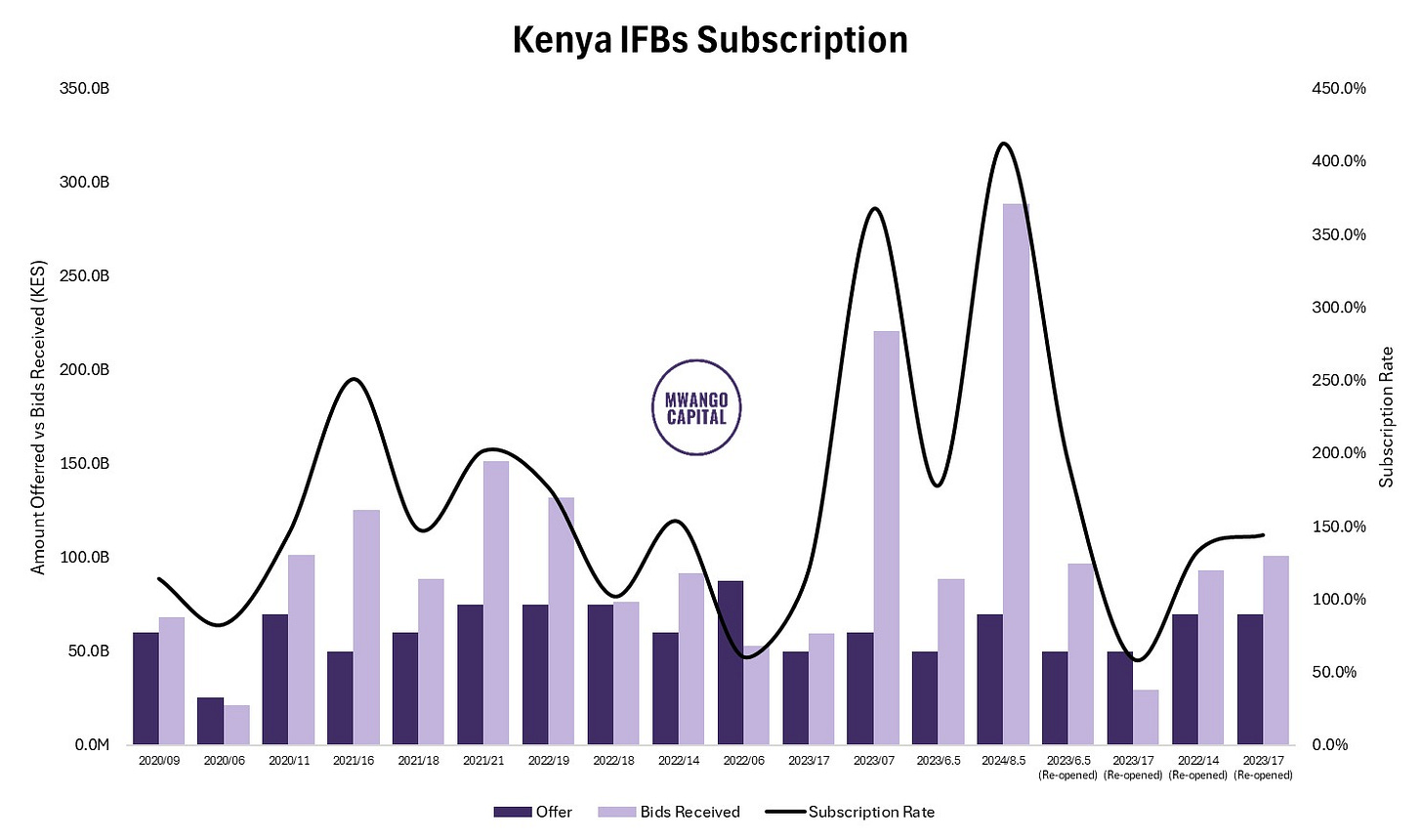

Treasury Bonds: The reopened Treasury bonds IFB1/2022/014 and IFB1/2023/017 were oversubscribed at 277%, attracting KES 193.9B in bids against the KES 70B on offer. The government accepted KES 130.8B, translating to a 67.5% acceptance rate. The weighted average yield for accepted bids was 13.978% for IFB1/2022/014 and 14.281% for IFB1/2023/017.

Eurobonds: Last week, yields on Kenya’s five outstanding Eurobonds declined, led by the KENINT 2028 bond, which dropped 12.30 basis points to 8.376%. The KENINT 2048 bond followed, falling 3.80 basis points to 10.078%, while KENINT 2031 remained unchanged at 9.585%. Overall, Eurobond yields decreased by an average of 3.83 basis points week-on-week.

Market Gleanings

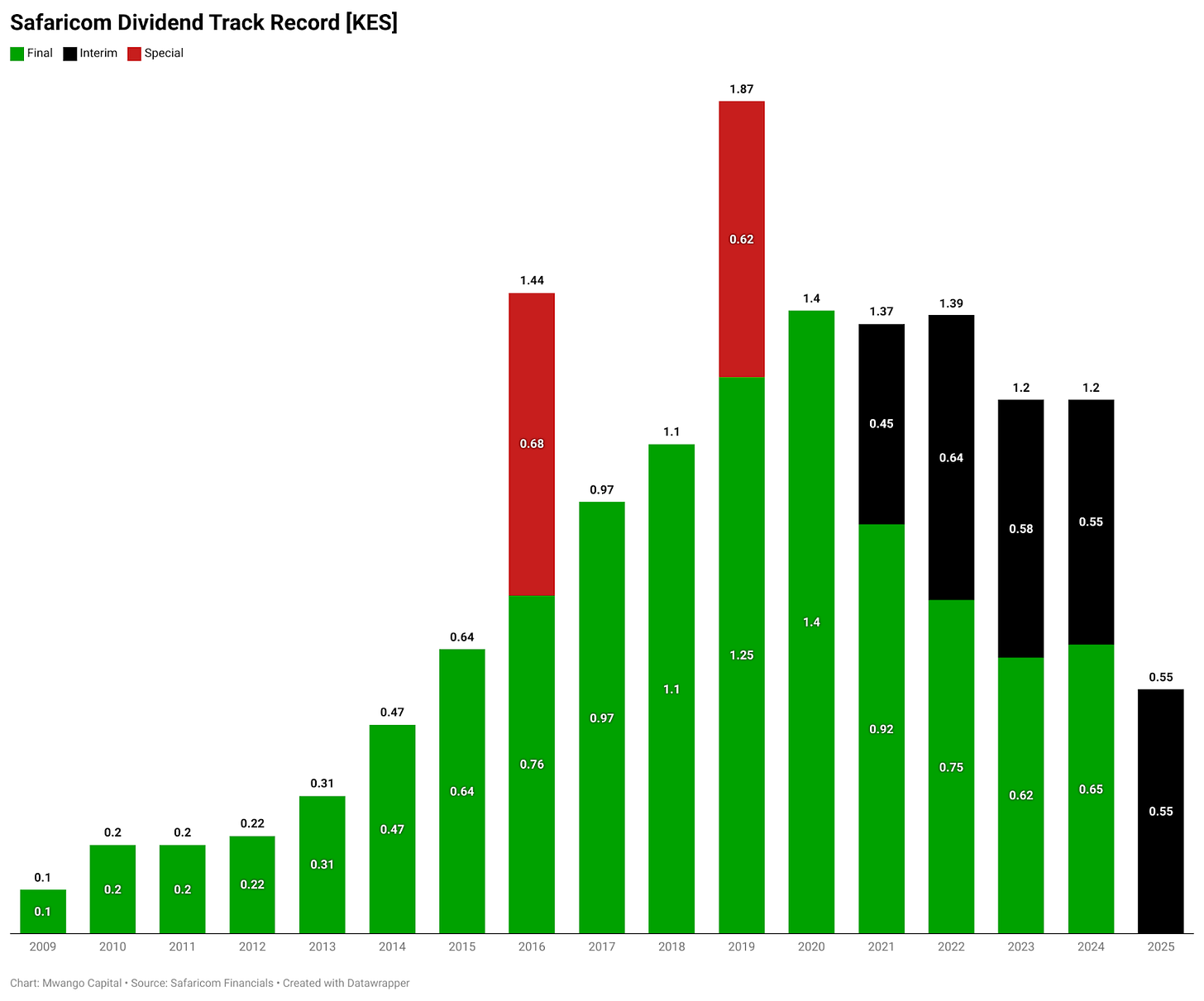

💰| Safaricom’s KES 0.55 Interim Dividend | Safaricom will maintain its interim dividend at KES 0.55 per share, totalling KES 22.04B, despite a drop in half-year profits. The company posted a KES 28.1B net profit for the six months to September 2024 and will pay the dividend by March 31, 2025, to shareholders registered by March 3, 2025.

⛽| Feb/Mar Fuel Cycle | EPRA has announced that fuel prices will remain unchanged from February 15 to March 14, 2025. Petrol will continue retailing at KES 176.58 per litre, diesel at KES 167.06, and kerosene at KES 151.39.

✔️| MSCI Adds Two Kenyan Firms | Morgan Stanley Capital International (MSCI) has added Standard Chartered Bank Kenya to its Frontier Markets Index and HF Group to its Frontier Markets Small Cap Index in its latest review. The changes, set to take effect after February 28, 2025, bring the total number of Kenyan firms in MSCI’s indices to six in the Frontier Markets Index and eight in the Small Cap Index.

📄| Cabinet Approves KES 199.9B in Supplementary Budget | The Cabinet has approved the second supplementary budget for the 2024/25 fiscal year, raising total expenditure beyond KES 4T from the current KES 3.88T. The additional KES 199.9B includes KES 125.1B for recurrent spending and KES 74.8B for development, targeting government projects, personnel costs, budget realignments, and revenue adjustments.

🚘| Govt Eyes New Taxes for All Cars | The government plans to reintroduce taxes on insurance premiums and carbon emissions, aiming to boost funding for road construction and maintenance. This move, outlined in the National Tolling Policy published last week, revives proposals that were shelved last year following public protests against the Finance Bill 2024. The policy also suggests raising the fuel levy, introducing road tolls, and implementing a "polluter pays" principle to address declining fuel tax revenues as more motorists shift to fuel-efficient and electric vehicles.

🤝| Metal Cans & Closures to Acquire Nampak Kenya Assets | Metal Cans & Closures Kenya has received unconditional approval from the Competition Authority of Kenya (CAK) to acquire Nampak Kenya’s assets, including plant, machinery, properties, and inventory. Metal Cans specializes in manufacturing fabricated metal containers for industries such as paint, chemicals, seeds, and coffee. Nampak Kenya, which is set to shut down, is controlled by Nampak, a Johannesburg Stock Exchange-listed South African firm.

📄| Kenya Police Sacco FY 2024 Results | Kenya National Police DT SACCO posted financial results for 2024, with net interest income rising 9% to KES 5.4B, while profit grew 1.6% to KES 2.5B. Total assets increased 10.3% to KES 59.8B. The SACCO maintained an 11% interest on member deposits and a 17% dividend on share capital, unchanged from 2023.

🏦| AU Launches Credit Rating Agency | The African Union has established the African Credit Rating Agency to challenge perceived bias in global credit ratings, which a study estimates costs the continent USD 75B in lost opportunities. Speaking at the launch in Addis Ababa, Kenyan President William Ruto criticized global agencies for using flawed models that exaggerate risks and inflate borrowing costs. An upgrade of just one notch could unlock USD 15.5B in financing for Africa.

🇨🇫| CAR Launches Meme Coin | The Central African Republic (CAR) has introduced CAR Meme, its second cryptocurrency, to attract investment and boost its USD 3B economy. President Faustin-Archange Touadéra aims to leverage blockchain for development, following the 2022 adoption of Bitcoin as legal tender. The memecoin, launched on the Solana blockchain, has seen high volatility, dropping nearly 90% since its launch.

🇳🇬| Nigeria Approves USD 36.4B Budget | Nigerian lawmakers have approved a USD 36.4B budget for 2025, a 9% increase from the initial proposal. The revised plan follows higher revenue projections, with federal tax collections expected to reach ₦25.2T. The budget includes USD 200M for healthcare and sets ambitious targets, including 4.6% GDP growth and 15% inflation by 2025.