👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover KCB Group's FY 2024 results, Sanlam's profit turnaround, and CBK's proposed bank licensing fees.KCB Group FY 2024 Results

PAT Up 66%: KCB Group Plc recorded an impressive 66.1% year-on-year (y/y) growth in profit after tax to KES 60.1B, driven by a 26.9% surge in the total interest income to KES 213.4B. Non-interest income also grew 16.6% y/y to KES 67.5B, supported by a 61.7% jump in foreign exchange trading income to KES 17.5B. The Group’s net interest margin (NIM) rose to 7.6%, reflecting improved pricing on loans and investments in high-yielding government securities. Customer deposits fell by 18% to KES 1.4T, driven by the appreciation of the Kenyan Shilling, the bank ceding market share of the government-to-government deal (G2G), and the de-consolidation of the assets of the National Bank of Kenya (NBK).

Dividend Yield at 7.12%: Despite strong earnings growth, KCB declared a final dividend of KES 1.50 per share, bringing the total payout to KES 3.00 for the year. This translates to a 16% payout ratio, below its 2019 peak of KES 3.50 per share. With the current share price at KES 42.15, the dividend yield stands at 7.12%, falling short of investor expectations. The decision, intended to preserve capital for expansion, sparked a sharp sell-off, with KCB’s share price plunging 20.6% to KES 35.00 on Thursday, a day after the results were released.

NPLs Rise to 19.2%: KCB’s loan book shrank by 9.6% y/y to KES 990.4B, primarily due to the reclassification of NBK balances to other assets and liabilities in line with IFRS 5, pending the conclusion of its divestiture, as well as the impact of a stronger shilling. Meanwhile, the Group’s non-performing loan (NPL) ratio climbed to 19.2%, with KCB Kenya at 21.8% and NBK at a concerning 33.7%. Rising defaults in real estate, agriculture, and construction sectors remain a key challenge.

Subsidiaries Performance: KCB’s regional subsidiaries remained a key growth driver, contributing 30.3% of total PAT. The National Bank of Kenya bounced back to a profit of KES 1.05B from a loss of KES 3.3B in 2023.

This week’s newsletter is brought to you by:

Two of our top-performing funds have delivered exceptional returns in just 9 months!

Arvocap Almasi Fixed Income Accumulation Fund (KES): 20.3% return

Arvocap Multi-Asset Strategy Fund (USD): 15.84% return

Looking for stable, consistent returns? The Arvocap Almasi Fixed Income Accumulation Fund is your best bet! Invest in government bonds, treasury bills, and corporate bonds—perfect for building wealth safely over time.

Want to tap into the global economy? The Arvocap Multi-Asset Strategy Fund gives you access to AI, technology, gold, oil, and more—a smart hedge against currency risks with impressive dollar-denominated returns.

Get Started Now!

📲 Visit www.arvocap.com or download the Arvocap Investment App on the Play Store & App Store.

📞 Call us: 0701 300 200 / 0701 300 700

Sanlam Returns to Profit

Sanlam Kenya posted a KES 1.05B net profit for the year ended December 2024, marking its first profit since 2019 and a sharp recovery from the KES 126.6M net loss in 2023. The turnaround was driven by a fivefold increase in investment income to KES 5.27B, up from KES 1.06B. Despite this, the insurer’s core insurance service result declined slightly to KES 643.5M from KES 686.1M.

No Dividend: Sanlam’s board did not recommend a dividend for the 11th consecutive year, opting instead to focus on liquidity and debt reduction. The company plans to raise KES 3.25B through a rights issue to repay a Stanbic Bank Kenya loan and reduce finance costs, which rose to KES 734.8M from KES 604.61M. Sanlam's strong performance saw it close the week as the top gainer, surging 15.0% to KES 8.12, bringing its year-to-date gains to 64.04%.

CBK Proposed Licensing Fees

The Central Bank of Kenya (CBK) has announced proposed amendments to the Banking (Fees) Regulations, shifting from a branch-based licensing fee structure to a Gross Annual Revenue (GAR)-based model. Under this new framework, banks will pay licensing fees calculated as a percentage of their Gross Annual Revenue, phased in gradually over a three-year period. Specifically, fees will start at 0.6 percent in December 2025, rise to 0.8 percent in 2026, and reach a final rate of 1.0 percent from December 2027 onwards.

The GAR methodology takes into account various revenue streams such as interest income, fees, commissions, dividends, and foreign exchange trading income, reflecting a more holistic view of a bank’s financial performance. This change aims to modernize the fee structure, align with international regulatory practices, and accurately reflect the growing complexity and scale of Kenya's banking sector, which has experienced significant growth in assets, deposits, and profitability since the last fee revision in 1990.

In addition to implementing the new GAR framework, CBK proposes simplifying administrative processes by discontinuing all existing application fees under the Banking Act, except those related to representative offices. Representative offices will continue to incur an application fee of KES. 5,000 and an annual renewal fee of KES. 20,000. CBK invites stakeholders and the public to provide comments on the proposed changes by March 31, 2025, aiming to align Kenya’s banking regulatory practices with international standards.

Markets Wrap

NSE Weekly Recap: Week 11 (7-14 Mar 2025):

Sanlam Kenya (+15.0%) climbed to KES 8.12, leading the gainers, while Centum (-21.9%) dropped to KES 12.15, making it the worst performer.

Markets struggled—NASI (-3.12%) at 129.5, NSE 20 (-4.33%) at 2,236.7, NSE 10 (-3.52%) at 1,334.5, and NSE 25 (-3.13%) at 3,529.5.

Equity turnover declined 19.2% to KES 2.01B, while bond turnover rose 1.4% to KES 57.05B.

Foreign investors were net sellers, offloading KES 79.9M, accounting for 27.82% of total turnover.

Investors now focus on Absa’s FY results (19 March) and Equity Group’s FY results (25 March).

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 149.2%, down from 210.7% the previous week. Investors placed bids totaling KES 35.8B, out of which KES 26.9B was accepted, reflecting a 75% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 0.48, 3.60, and 2.31 basis points to 8.918%, 9.115%, and 10.474%, respectively.

Treasury Bonds: The Central Bank of Kenya (CBK) successfully raised KES 35.2B from the reopened 25-year bond (FXD1/2018/25), surpassing its KES 25B target due to strong investor demand. The bond auction saw an oversubscription of KES 47B, reflecting a sustained appetite for long-term securities amid falling interest rates. Investors secured the bond at a discount, paying KES 100.37 per KES 100 unit, factoring in accrued interest. The bond offers a 13.4% coupon rate with an implied yield of 13.8%. Of the funds raised, KES 27.6B will go toward redemptions, while KES 7.5B represents fresh borrowing for the government.

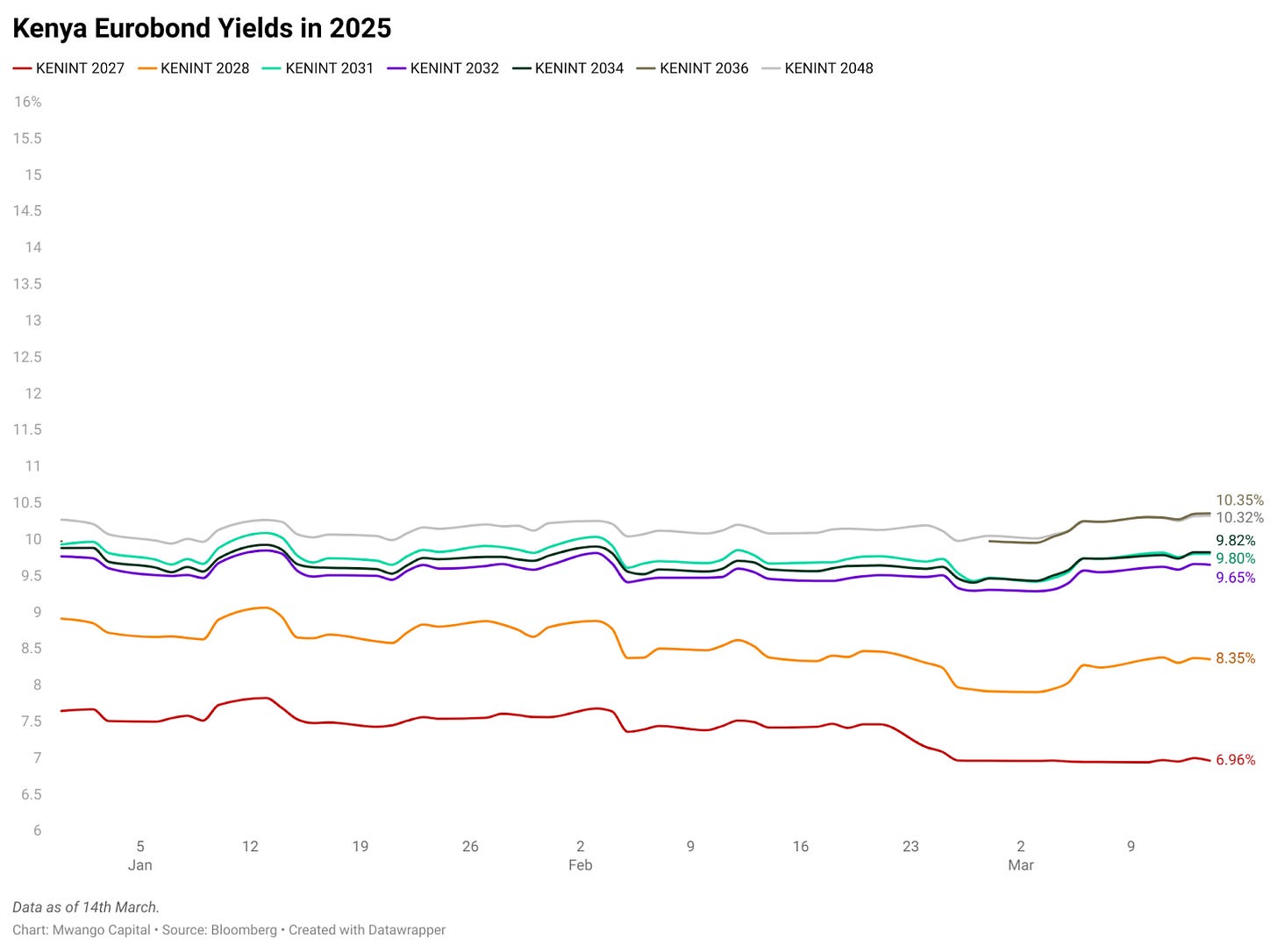

Eurobonds: Last week, yields on six of Kenya’s seven outstanding Eurobonds increased, led by the KENINT 2028 bond, which rose 32.80 basis points to 8.239%. The KENINT 2034 bond followed, climbing 27.0 basis points to 9.731%, while the KENINT 2027 bond declined 1.70 basis points to 6.943%. On average, Eurobond yields increased 22.07 basis points week-on-week.

Market Gleanings

⛽| Mar/Apr Fuel Cycle | The Energy and Petroleum Regulatory Authority (EPRA) announced that fuel prices will remain unchanged for the third consecutive cycle from March 15 to April 14, 2025, with Super Petrol at KES 176.58, Diesel at KES 167.06, and Kerosene at KES 151.39 per liter.

⚡| Kenya Power Cuts Ormat’s Debt | Kenya Power has paid USD 20M to US-based Ormat Technology in January and February 2025, reducing its outstanding USD 38.3M debt for electricity supply to USD 18.3M. Ormat, which operates the 150 MW Olkaria III geothermal plant through its subsidiary OrPower 4, sells electricity to Kenya Power under a contract expiring between 2033 and 2036. In 2024, Kenya Power accounted for 13% (USD 90.73M) of Ormat’s USD 702.3M global electricity revenue.

✔️| Alterra and Phatisa Acquire Java House | African private equity firms Alterra Capital Partners and Phatisa have acquired 100% of Java House Africa from investor Actis for an undisclosed amount. Java House, which operates nearly 100 outlets across Kenya, Uganda, and Rwanda, owns brands such as Java House, Java Express, 360 Degrees Pizza, Planet Yoghurt, and Kukito. Alterra has invested USD 1.9B in 20 companies across Africa, while Phatisa focuses on food and agribusiness investments with over USD 140M in capital.

🔺| Ola Energy Announces Restructuring | OLA Energy has announced a restructuring plan to improve its profitability and market position in Kenya over the next five years. The company cited rising operational costs as a key challenge, prompting measures to boost sales and cut expenses. As part of the restructuring, OLA Energy will implement a redundancy program, stating that it is struggling to sustain its current fixed costs.

🚙| Silver Box Acquires Mobius Motors | Silver Box, a Middle East-based investment firm, has acquired Mobius Motors Kenya. The company plans to restart production of the Mobius 3 by July 2025 and introduce a new SUV model by December 2025. Mobius has also reopened its service centers. The company cited financial investment and market expansion as key priorities following the acquisition.

✔️| CMA Confirms Genghis Capital Status | The Capital Markets Authority (CMA) has clarified that Genghis Capital Limited is not under statutory management but has been directed to resolve outstanding contractual obligations with a third party. The regulator also reassured investors that the Genghis Unit Trust Scheme operates under Collective Investment Schemes Regulations 2023, ensuring that client assets remain held by a custodian in segregated accounts, separate from the firm's own funds.

🚌| KCB Bank to Finance 150 Buses | KCB Bank Kenya is financing 150 new buses for County Bus Service (CBS) SACCO to improve public transport in Nairobi. This is part of its KES 8B agreement with the Matatu Owners Association in 2024, which includes KES 5B in asset financing to help SACCOs upgrade and modernize their fleets.

💼| Leadership Changes |

NMG: Nation Media Group (NMG) has appointed Geoffrey Odundo as Group Managing Director and CEO, effective April 7, 2025. Odundo, former CEO of the Nairobi Securities Exchange (2015-2024), was most recently the Group Executive Advisor at CPF Group.

Bamburi Cement: Salem Balleith, a Tanzanian national, has been appointed to the Board of Directors of Bamburi Cement effective March 12, 2025.

Old Mutual Holdings: The company announced the appointment of Matthew Brinckmann as Executive Director, effective March 8, 2025, pending regulatory approval.