Govt's Privatisation Drive

President Ruto commits to list 5-10 mature public enterprises in the next 12 months

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Ruto’s privatisation drive, Airtel's mobile money unit split, and KNBS' Q2 2022 GDP Report.First off, enjoy our weekly business news in memes brought to you by Junior Achievement Kenya:

Ruto’s Privatisation Drive

On the Agenda: Last week, President William Samoei Ruto visited the Nairobi Securities Exchange where he highlighted the role of the capital markets in his economic transformation agenda. He said that the government will list between 5 and10 mature public enterprises in the next 12 months.

“I have said and made a commitment and I have asked the Ministry concerned that between 5 and 10 public enterprises that are mature should be listed in the next 12 months. I expect that the private sector will work with the capital markets so that we can have companies on the private sector listing on the Nairobi Stock Exchange.”

President of Kenya, William Samoei Ruto

Domestic Dollar-Denominated Bond: The government is looking to float a local dollar-denominated bond on the Nairobi Securities Exchange. If the plan sails through, it will be the first of its kind in the country. Other countries that have issued such an instrument include Ghana and Egypt.

“To affirm this resolve, my administration will revitalize the capital markets by embarking on the privatisation of state-owned enterprises where divestiture is long overdue and strategic as well as the introduction of such innovative products as a domestic dollar-denominated bond”

President of Kenya, William Samoei Ruto

Privatization Law Changes: President Ruto has said that his government will be amending or repealing the Privatization Law to lessen the requirements around the privatisation process. The President is targeting to privatize between 5-10 companies. Between 1990 and 2002, President Daniel Moi’s administration privatized 8 companies while President Mwai Kibaki oversaw the privatisation of 6 companies between 2003 and 2008.

“In order for us to do this, the government is embarking on the review of the existing privatization law with a view to repealing it or replacing it with a legal and less inhibiting and more facilitative policy framework to steer rapid privatisation processes. “

President of Kenya, William Samoei Ruto

Retail Investor Protection: The President has pointed out that his government is working on ways to protect investors in the market. He said his administration is set to direct efforts to improve the Investor Compensation Fund, the entity responsible for the compensation of investors who suffer pecuniary loss resulting from the failure of a licensed stockbroker or dealer to meet their contractual obligations.

“Even as we seek to strengthen and deepen the capital markets, we are cognizant of the need to protect and promote the small investors. I have instructed the capital markets authority and other relevant departments to work on developing a framework that places investor protection including the enhancement of the Investor Compensation Fund, Investor Education and strict enforcement of compliance by market intermediaries at the centre of reenergized capital markets.”

President of Kenya, William Samoei Ruto.

Airtel Completes Split

Mobile Money Unit Spinoff: Last week, the Central Bank of Kenya announced the successful separation of Airtel’s mobile money unit from the telecommunications business. As a result, Airtel Money Kenya Limited will operate as a pure-play mobile money firm, while Airtel Networks Kenya Limited will run point on telecommunications. The efforts to split Airtel started in 2019.

NCBA to Follow Suit: Kenya’s third-largest bank by assets NCBA Group is set to spin out its financial technology business into a standalone company with its own Chief Executive Officer (CEO) and Board of Directors. Parts of the business to be hived off include M-Shwari - a savings and loan service that enables M-PESA customers to save and access loans and Fuliza - an overdraft facility.

“What we are now discussing is how we package our business as a fintech so that it can get the right valuation. I understand from what I have seen in some write-ups that people don’t know the details of Fuliza and M-Shwari but we can package it in a way where we can report on all these details.”

NCBA Group CEO, John Gachora

Safaricom Split: On Safaricom splitting M-PESA, the CBK Governor Dr Patrick Njoroge earlier noted that efforts were underway and results will be visible from January 2023.

“I would want you to ask me that question in January next year. So if you just be patient, ask the question next time I see you before the end of the year, but definitely by January.”

CBK Governor, Dr Patrick Njoroge

Q2 2022 GDP Report

The Kenya National Bureau of Statistics released statistics for Q2 2022 and below are the key highlights:

Economic Expansion: Kenya’s Gross Domestic Product (GDP) expanded by 5.2% during Q2 2022 compared to 11% growth in Q2 2021.

Sectoral Performance: The accommodation and food services sector grew the most in Q2 2022 - by 22% compared to 90.1% in Q2 2021. The Agriculture, Forestry and Fishing Industry sector grew the least, contracting by 2.1% compared to a contraction of 0.5% in Q2 2021.

Electricity Generation: The total electricity generated increased by 5.1% in Q2 2022 to 3,126.7M KWh compared to 2,975.8MWh generated in Q2 2021. The largest contributor to the production mix in Q2 2022 was geothermal, at 46.6%, followed by Hydro at 24.9%.

Capital Markets: The Nairobi Securities Exchange (NSE) 20 Share Index fell by 16.2% from 1,928 points in June 2021 to 1,613 points in June 2022.

Financial Services: The cost of borrowing from commercial banks increased to 12.27% at end of June 2022 from a rate of 12.02% in June 2021. The savings rate decreased from 2.55% in June 2021 to stand at 2.50% in June 2022.

Foreign Debt; The stock of external public and publicly guaranteed debt rose 7.3% year-over-year to KES 4.29T in June 2022 from KES 3.99T in June 2021. Multilateral sources were the leading source of debt, accounting for 48.8% of the external debt pile as of the end of June 2022.

International Merchandise Trade: Volume of trade grew 35.5% year-over-year to KES 886.5B in 2022 from KES 663.9B in 2021. The total value of exports grew 27.3% year-over-year to KES 228.4B, while imports rose 35.8% to KES 658.1B.

You can access the reports here and here.

Diageo Ups EABL Stake

Diageo Kenya Tender Offer: Diageo Kenya, a wholly owned subsidiary of Diageo PLC, has announced its intention to acquire up to 118,394,897 ordinary shares (14.97% of the ordinary share capital) () in East Africa Breweries Limited (EABL) by a means of a tender offer to all other EABL shareholders. The price payable for each ordinary share tendered in the Proposed Tender Offer is KES 192 - 39% above EABL’s Thursday closing price.

New Ownership Structure: Currently, Diageo Kenya holds 395,608,434 EABL Ordinary Shares, representing 50.03% of the issued share capital of EABL, making the firm the largest shareholder of EABL. A full acceptance of the Tender Offer will result in Diageo Kenya holding 514,003,331 ordinary shares in EABL, representing 65% of the issued share capital of EABL.

Stock Market Reaction: At the Nairobi Securities Exchange, EABL stock last week closed at KES 171, an increase of 23.2% from yesterday’s close. EABL last traded at these levels in September 2021. The KES 171 share price is 11% below the KES 192 Per Share Diageo offer price.

Debt Markets

T-bills: In the Treasury bills market, market-weighted average interest rates for the 91-Days, 182-Days and 364-Days papers were 9.058%, 9.656% and 9.910%, respectively. The performance rate stood at 253.8%, 139.46% and 39.19%, against an acceptance rate of 253.75%, 129.45%, and 39.18%, respectively.

What Else Happened This Week

📉 Kenya Imports Down 20%: Steel and Iron imports dropped 20% year-over-year to 225,126 Metric Tonnes in Q2 2022 from 282,132 Metric Tonnes recorded in Q2 2021 amid price increases occasioned by the fallout of the Russia -Ukraine fallout.

💰 Govt’s KES 3T Tax Target: In a bid to fund the country’s development budget, Kenya’s government is banking on the Kenya Revenue Authority to raise KES 3T in taxes for the financial year ending June 2023. In the first two months of the current fiscal year, KRA has collected KES 280.2B, compared to KES 247.8B in 2021.

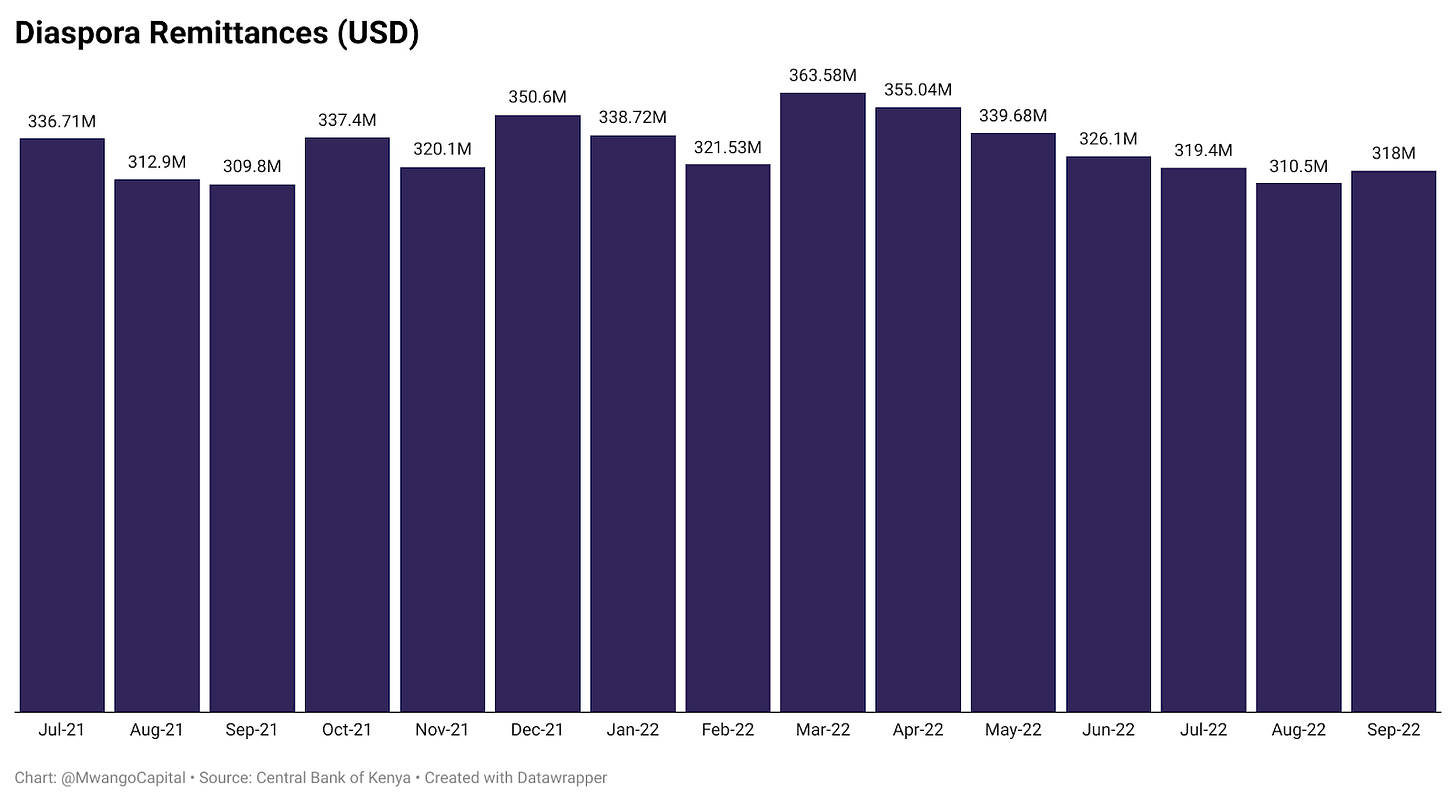

💵 Remittances Up 2.6%: In September 2022, diaspora remittances rose 2.6% Year-over-Year to reach $318M compared to $309.8M posted in September 2021. On a month-on-month basis, the remittances edged up 2.4%. In the 12 months to September 2022, remittances totalled $4.001B compared to $3.53B posted in the same period in 2021.

👨💼 Absa Gets Interim CEO: Absa Bank Kenya, Kenya’s sixth largest lender by assets (KES 445.2B), has appointed Yusuf Omari as interim CEO and MD effective 1 November 2022 following the upcoming exit of Jeremy Awori on 31 October 2022. Yusuf is currently the bank’s CFO and has held the position since 2009. Jeremy is heading to Ecobank Group which has an asset base of KES 3.27T.

📈 LPG Prices Up: The average retail price of a 13-Kilogram Liquefied Petroleum Gas (LPG) has risen by KES 824 or 34% year-over-year to reach KES 3,218.22 in June 2022 from KES 2,394 registered in July 2021. This is despite the halving of Value Added Tax to 8% by the government. Earlier this month, President Ruto, while on an official visit trip to Tanzania, agreed with his Tanzanian counterpart Samia Suluhu to revive an agreement that will allow Tanzania to export gas into Kenya.

🎒 GSK to Exit Kenya: Pharmaceutical multinational GlaxoSmithKline (G 0.00%↑ SK) is set to exit Kenya amid below-budget sales and will instead shift to a distributor-led model. The Kenya exit leaves GSK’s Africa footprint in Algeria, Egypt, Morocco, Nigeria, Tunisia and South Africa. Other global manufacturers that have stopped production in Kenya include Reckitt-Benckiser (maker of Dettol), Cadbury, and Colgate-Palmolive.

⚔️ Treasury Defends Kenya’s Fiscal Position: Earlier last week, reports indicated that Chinese banks had fined Kenya KES 1.312B in the year ended June 2022 for loan defaults on repayment of loans provided to build the Standard Gauge Railway (SGR). The National Treasury, in a press release, said Kenya’s financial position is sound and robust and pointed out Kenya has not defaulted on the settlement of its debt service obligations.

Interest Rate Watch

Rising Rates Affecting Emerging Markets: Last week, Kenya’s Central Bank Governor Dr Patrick Njoroge highlighted that increasing interest rates in developed markets have had significant spillovers to emerging markets whose repercussions might have spillback effects and worsen the current global economic situation.

“The spillovers to emerging markets have been significant and if the advanced economies don’t deal with it – meaning, don’t consider the repercussions to their actions – there’ll be significant spillbacks to them, which will obviously be very expensive for the world and for advanced economies as if we’re not in a bad place already.”

Central Bank of Kenya Governor, Dr Patrick Njoroge