StanChart’s Dividend up 31.8%

Final DPS of KES 23.00, in addition to the KES 6.00 interim dividend, declared

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Standard Chartered Bank Kenya FY 2023 results, March/April pump prices, and Carbacid H1 2024 results.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Whether it's restocking shelves with pharmaceuticals for your chemist, replenishing agricultural supplies for your agrochemical shop, or acquiring tools and equipment for your hardware store, their tailored financing solutions can help you get the cash you need.

StanChart Kenya FY 2023 Results

Standard Chartered reported its FY 2023 results last week, recording a 32% year-on-year growth in net interest income to KES 29.3B, to account for 70.3% of total operating income. Profit after tax grew by 14.74% to KES 13.8B, and per-share earnings totaled KES 36.17, up 14.9%. The Board of Directors declared a final dividend per share of KES 23.00, which in addition to the KES 6.00 interim dividend in the year, brings the total dividend to KES 29.00.

Pivot Towards Lending: The loan book expanded by 17.0%, the highest growth since 17.27% in FY 2012, to close FY 2023 at KES 163.2B to account for 38.04% of total assets [FY 2022: 36.57%]. The growth in lending was under the backdrop of an 8% decline in government securities holdings to KES 108.5B [2022: KES 125.5B].

NPL Ratio at 9.7%: Gross Non-Performing Loans (NPLs) fell by 23.7% to KES 17.2B, equivalent to 10.55% of the loan book [FY 2022: 16.19%]. Net NPLs increased by 9.3% to KES 3.2B, representing 1.95% of loans [FY 2022: 2.09%]. The NPL ratio closed the year at 9.7% from 14.3% in FY 2022. Notably, loan loss provisions were KES 3.4B, up 154.4% to an equivalent of 8.10% of total operating income [FY 2022: 3.91%].

Deposits’ Double-digit Growth: Customer deposits edged higher by 22.9% to KES 342.9B, equivalent to 79.93% of the asset base. Current and Savings Accounts (CASA) Deposits crossed the KES 300B mark to close the year at KES 331.2B in FY 2023, representing a growth of KES 87.1B.

Profitability and Dividends: Pre-tax profits were up 15% y/y to KES 19.6B, and the net result for the year amounted to KES 13.8B, representing a 14.7% y/y growth. Earnings Per Share (EPS) grew by 14.9% y/y to KES 36.17 while Dividends Per Share were up 31.8% to KES 29.00 translating to a payout ratio of 80.1%.

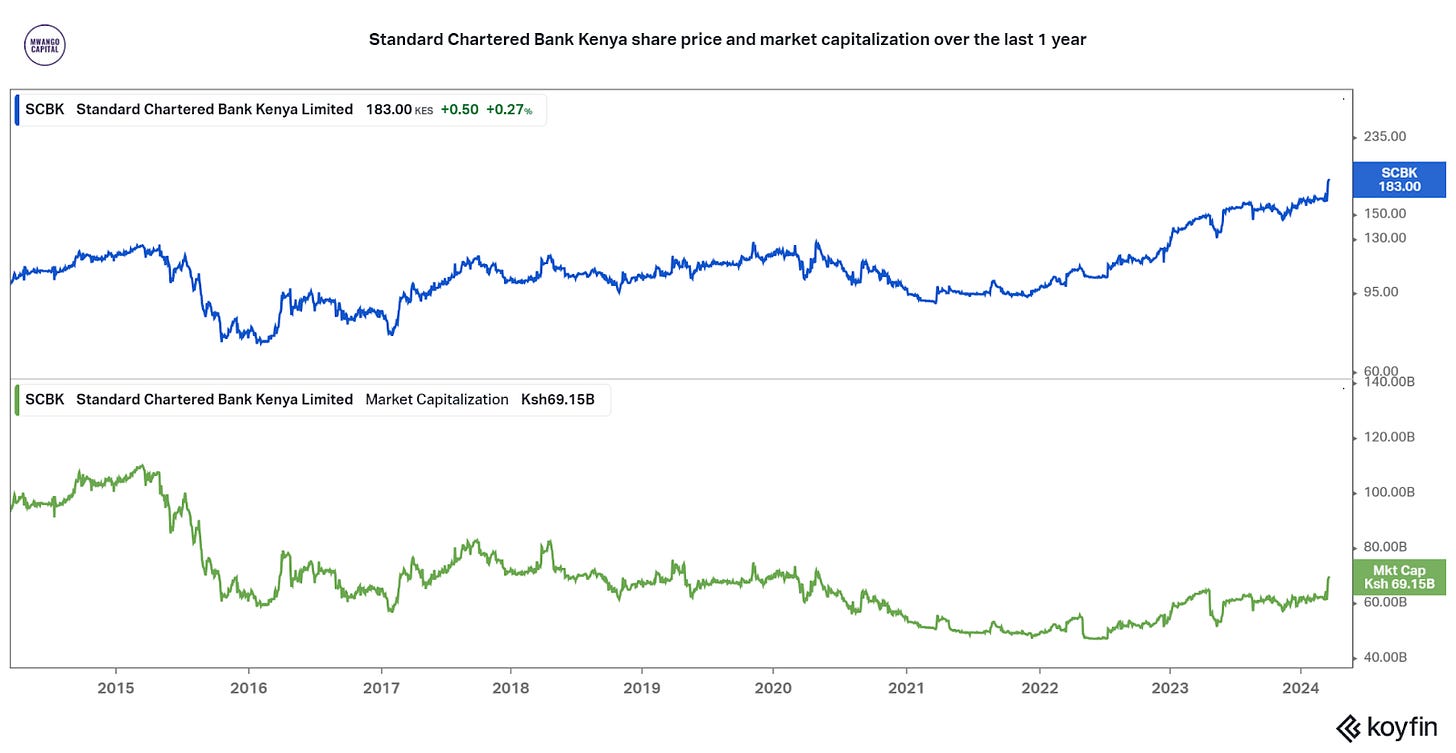

Share Price Reaction: On the back of the results released on 12th March, the share price at the Nairobi Securities Exchange appreciated by 5.7% in the following trading day action to close at KES 180.25. As of market close last week, the share price was KES 183.00, up 12.9% year-to-date, and up 25.6% over the last 1 year.

Across the Banking Sector: Absa Bank Kenya’s share price touched a multi-year high of KES 14 in last week’s trading, representing a year-to-date gain of 19.5%, and an appreciation of 10.7% over the last 1 year. This happened as the bank remains set to release FY 2023 results on 18th March.

Equity Group has been ranked the 2nd strongest brand globally as brand value in 2023 grew by USD 22M to reach USD 450M (KES 64B) from USD 428M in 2022.

Coming Up: We expect earnings from Absa Bank Kenya on 18th March 2024 and KCB Group on 20th March 2024.

Find the results, our analysis, and an X thread with key charts.

Mar/Apr Pump Prices Back to Sub-200

Pump Prices Slashed: The Energy and Petroleum Regulatory Authority (EPRA) has cut the prices for super petrol, diesel, and kerosene for the March/April 2024 pumping cycle by KES 7.21, KES 5.09, and KES 4.49 to KES 199.15, KES 190.38, and KES 188.74 respectively, bringing the prices back to below the KES 200 mark. Notably, no cross-subsidies have been implemented in the pumping cycle after 6 consecutive months of price stabilization by EPRA.

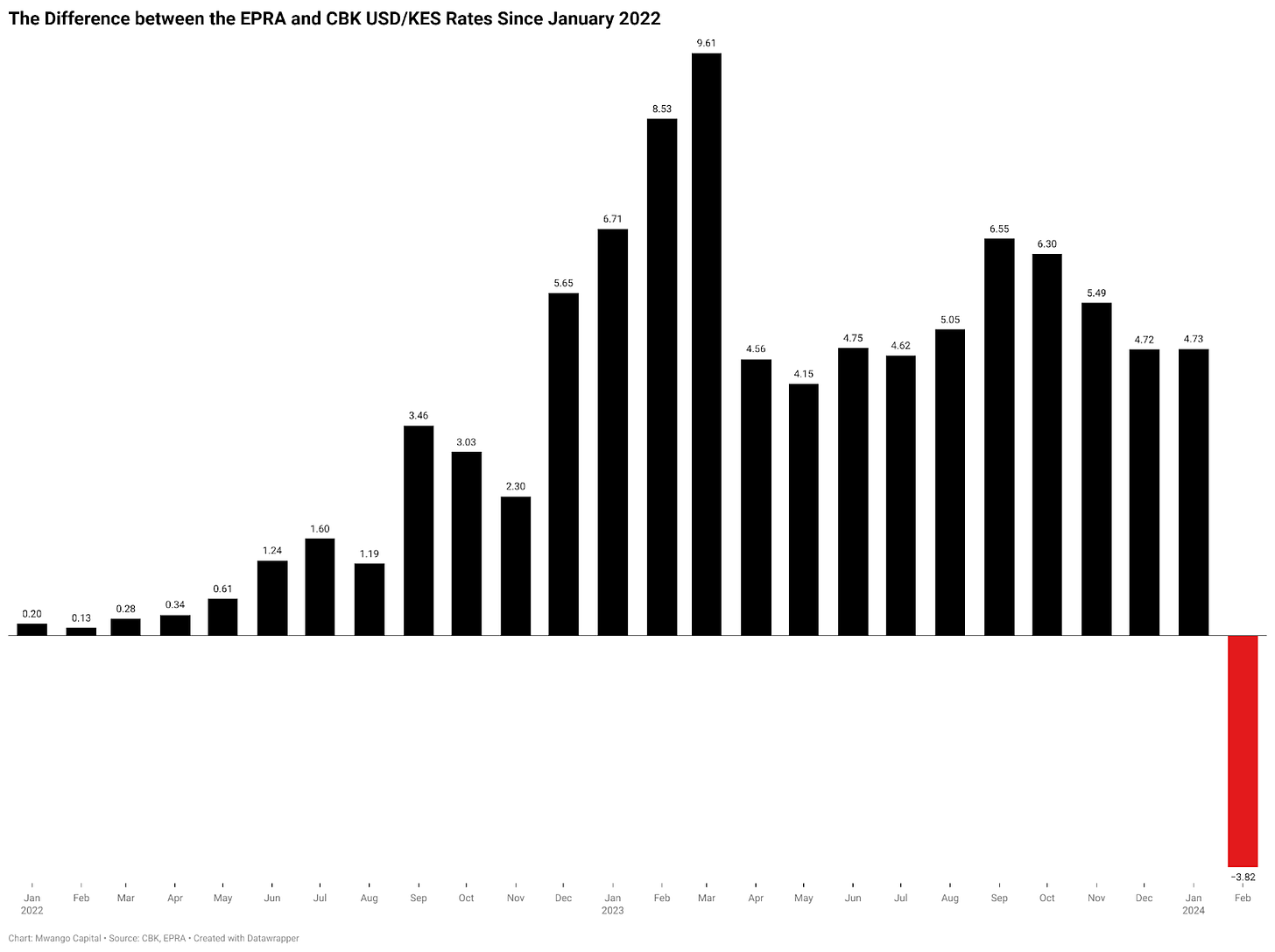

EPRA’s USDKES Rate Trend: In February 2024, EPRA’s USDKES exchange rate was 148.02, marking a significant decline of 9.97% from 164.42 in January. Notably, at 148.02, this marks the first time the rate has gone below the sub-150 mark since August 2023. There was also a notable decline in the price of Murban crude oil, whose print stood at USD 77.68 per barrel in February 2024, down 6.77% month-on-month, marking the first time it has been recorded at sub-80 since August 2023.

Find the full press release here.

Markets Wrap

NSE: In Week 11 of 2024, KCB Group was the top-performing stock, up 15.9% to close at KES 24.0. Eveready was the worst-performing stock, down 8.4% to close at KES 1.20. The NSE 20 gained 5.2% to close at 1,637.7 points, the NSE 25 rose by 7.0% to close at 2,702.3 points, and the NASI index edged higher by 7.3%, crossing the 100 points mark to close at 101.8 points. Equity turnover was up 256.1% to KES 2.7B from KES 770.3M in the prior week while bond turnover closed the week at KES 33.7B compared to the prior week’s KES 35.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.6976%, 16.8900%, and 16.9889% respectively. The total amount on offer was KES 24B with the CBK accepting KES 19.8B of the KES 22.4B bids received, to bring the aggregate performance rate to 93.47%. The 91-day and 364-day instruments recorded 351.40% and 47.75% performance rates, respectively.

Eurobonds: In the week, yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper whose yield fell, down by 2.70 bps to 7.191% while KENINT 2032 rose the most, appreciating by 24.10 basis points to 9.513%. The average week-on-week change stood at 17.10 bps.

KENINT 2024 fell the most on a year-to-date (YTD) basis, depreciating by 533.90 bps while KENINT 2034 rose the most at 16.80 bps.

Prices rose across the board week-on-week, with KENINT 2048 rising the most at 2.8% to 84.258 while KENINT 2024 stayed flat at 99.888, while other papers recorded a depreciation led by KENINT 2034 at 1.5%. Year-to-date, KENINT 2027 rose the most at 2.7% to 96.708, while KENINT 2034 fell the most at 0.8% to 79.780.

Market Gleanings

📈 | Carbacid HY 2024 Net Profit Up 18% | For the 6 months ended 31 January 2024, Carbacid Investments turnover grew by 26% y/y to reach KES 1.1B on account of new liquid carbon dioxide markets in the operating period. Net profit rose by 18% to KES 485.7M, bringing the net margin to 44.9% [HY 2023: 48.1%], while Earnings Per Share amounted to KES 1.90, up 17.3%. The Board of Directors did not recommend an interim dividend and, instead, a final dividend is to be considered.

🗲 | Ormat - Kenya Power | As at the end of December 2023, the amount overdue from Kenya Power in Kenya to Ormat Technologies was USD 62.8M of which USD 32.2M was paid in Jan and Feb 2024. In the year, Kenya Power accounted for 13.2% of Ormat's revenues, down 120 bps from FY 2022.

📉 | KES Strengthening Run | As of the end of trading last week, the Kenya Shilling exchanged for 134.00 units to the US Dollar, a level last seen in April 2023, representing an appreciation of 14.4% year-to-date and a depreciation of 3.6% over the last one year. The strengthening of the Kenya Shilling saw the currency become the best performer globally last week.

🤝| Deals, Mergers, and Acquisitions | The Competition Authority of Kenya has approved the acquisition of select assets from Style Industries by Hair Manufacturing Kenya Limited on condition Hair Manufacturing retains ~70% of Style's employees under employment terms no less favorable than their current ones for 12 months post-transaction completion. Separately, the Government of Kenya is inviting Expressions of Interest (EOIs) from potential investors to acquire its entire shareholding in KWAL and 43.77% of KHEAL. The deadline for submissions of the EOIs is 5th April 2024.

💲| Diaspora Remittances | Kenya received USD 385.9M in diaspora remittances in February 2024, an increase of 24.8% from the same month last year. The remittances were down 6.4% month-on-month from USD 412.4M in January 2024. In the last 12 months to February 2024, the cumulative inflows were USD 4.330B, up 7.5% from USD 4.026B in the corresponding period in 2023.

💸| Tax Revenue in February 2024 | Kenya’s tax revenue collections for February 2024 rose by 19.9% year-on-year to KES 157.6B, while the cumulative tax revenue collections for July 2023 to February 2024 grew by 11.2% year-on-year to KES 1.37T.

💰 | Airtel Money IPO | Airtel Africa plc is considering an Initial Public Offering (IPO) for its mobile money unit Airtel Money that could value it at USD 4B+, and the listing could happen as soon as this year. Airtel Money operates in 14 markets and its transaction value as of H1 FY 2024 was USD 56B.

🖥️ | Data Centers Taking Root in Africa | Airtel Africa, which has operations in 14 countries in Africa, last week officially broke ground on its first data centre in Lagos, Nigeria. The Nxtra by Airtel data centre will deliver 38 megawatts of total power and is expected to be live by Q1 2026. The facility will be the first of five hyperscale data centres to be developed by Airtel Africa on the continent, which, when combined, these data centres will offer 180-MW capacity, distributed across 13 major data centres and over 48 edge data centres.