👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s FY 2024/2025 budget, the 7th review of the IMF-Kenya program, and Kenya’s privatization drive.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenya’s FY 2024/2025 Budget

Last week, on the 13th of June, Kenya’s Cabinet Secretary to the National Treasury Njuguna Ndung’u, just like other East Africa Finance Ministers, delivered the budget speech in Parliament, outlining the government's fiscal outlay for the upcoming 2024/2025 financial year.

KES 3.992T: The total budget for FY 2024/2025 is at KES 4.767T, and when adjusted for debt redemptions to the size of KES 843.28B, the budget stands at KES 3.992T. The budget for FY 23/24 was KES 3.90T, which means the FY 24/25 budget exceeds that of FY 23/24 by KES 92B. Notably, the FY 24/25 budget is equivalent to 22.1% of Kenya’s KES 15.1T GDP.

Expenditure and Revenue Outlay: Total expenditure for the fiscal year is projected at KES 3.992T with recurrent spending standing at KES 2.84T, development spending at KES 774B, and the equitable share for counties at KES 401B. The total revenue for the fiscal year has been projected at KES 3.343T [18.5% of GDP] with ordinary revenue at KES 2.917T, Appropriations-In-Aid (AIA) at KES 426.0B, and grants at KES 51.8B.

Fiscal Deficit: The fiscal deficit for FY 2024/2025 has been projected at KES 597B which will be financed by KES 263.2B in domestic borrowing and KES 333.8B in external borrowing. The deficit as a percentage of GDP is projected at 3.3% in FY 2024/2025, a reduction of 240 basis points (bps) from the estimated 5.7% in FY 2023/2024.

Core Capital Proposal: In his budget statement, the CS for the National Treasury pointed out to progressive adjustment of the banking sector’s minimum core capital requirements to KES 10B from the current KES 1B. Should the minimum capital requirements be adjusted, analysis of data shows only 15 of 39 registered banks in Kenya would meet that threshold as of the end of FY 2023, leaving those below the threshold to either raise capital, merge, or close.

Kenya’s Fiscal Update: As of 31st May 2024, tax revenue collections for May 2024 were up 9.5% year-on-year to KES 183.1B. For the period from July 2023 to May 2024, revenues were up 10.8% year-on-year to reach KES 1.93T.

Find the budget statement and the Mwananchi Guide here.

Kenya’s Privatization Drive

Cabinet Sanctions Divestiture: Kenya's Cabinet this week gave the green light to the proposed divestiture of the state's shareholding in 6 listed firms. The shares will be disposed of through the Nairobi Securities Exchange (NSE) as part of broader institutional reforms aimed at enhancing the management and governance of state corporations. The move is part of a broader initiative to privatize shares in state-owned companies, with plans announced last November to privatize 35 state firms.

Stakes for Sale: The companies and the respective government shareholdings to be disposed of are as follows:

Find the entire despatch from the cabinet here.

7th Reviews of IMF-Kenya Program

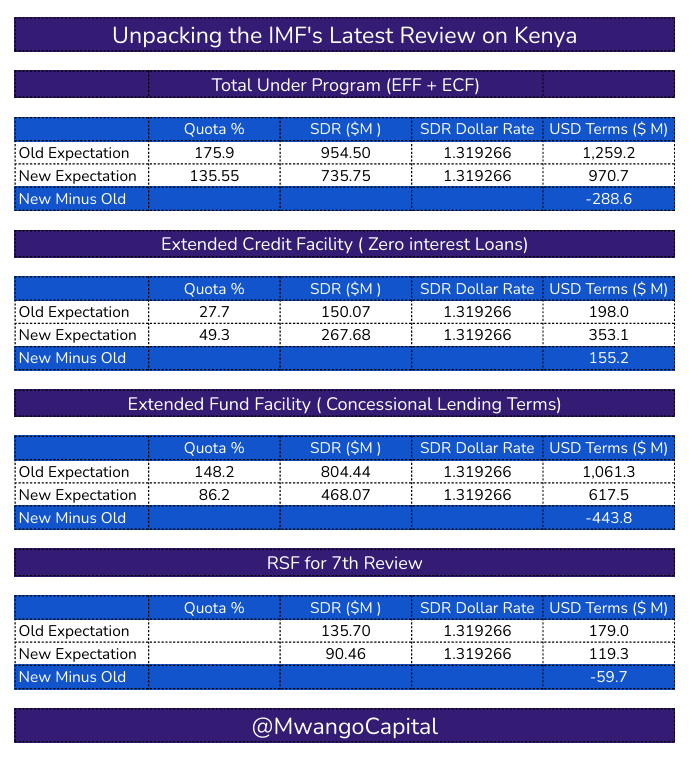

The International Monetary Fund (IMF) last week reached a staff-level agreement with Kenyan authorities covering the 7th review of the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements and the 2nd review under the Resilience and Sustainability Facility (RSF). Under the current reviews, the Funs has revised its allocations and terms for Kenya, reflecting the country's fiscal and macro status, economic reforms, and climate adaptation efforts. In a detailed and complex statement, the IMF outlined significant changes to the financial support mechanisms under the ECF, the EFF, and the RSF. Here are the key highlights of the IMF's adjustments:

Highlights: The total expected funding under the ECF and EFF has been reduced from USD 1.3B to USD 971M. Under the ECF, the IMF has increased the expected funding by USD 155M, bringing the total to USD 353M. Conversely, the expected funding under the EFF, which provides loans on concessional terms (with interest), has been reduced by USD 444M. Under the current review, the expected funding under the RSF, aimed at climate arrangements, has been reduced from an anticipated USD 179M to USD 120M, a reduction of approximately USD 60M.

Off Exceptional Access Window: Notably, Kenya has been removed from the IMF's exceptional access window following the successful USD 1.5B KENINT 2031 Eurobond issuance and the simultaneous partial refinancing of its USD 2B KENINT 2024 Eurobond in February 2024. The KENINT 2024 Eurobond falls due on 24th June with USD 556.97M outstanding. This shift marks a significant change in Kenya's financial positioning and its ability to manage external debt.

“In this review, the IMF announced a reduction of its overall financing commitment to Kenya from USD 4.4B to USD 3.6B, bringing its borrowing within “normal limits” as well as shifting some lending towards more concessional financing under the ECF. This decision was made in light of the decline in Kenya’s financing needs following its eurobond issuance.”

Goldman Sachs’ analysts, Bojosi Morule and Andrew Matheny

Current Disbursements and Future Access: To date, under the current program with the IMF, Kenya has received total disbursements amounting to Special Drawing Rights (SDR) 2.7B (USD 3.6B), equivalent to 464.4% of Kenya’s IMF quota. This adjustment leaves an additional 135.6% of the quota available for future disbursements, ensuring Kenya remains within the IMF's normal access limit of 600% cumulative disbursement.

Implications for Kenya's Economic Strategy: The IMF's revised funding terms highlight a balanced approach to supporting Kenya's economic reforms while addressing climate change challenges. The increased ECF funding demonstrates a commitment to providing zero-interest loans to stabilize the economy, whereas the reduction in EFF and RSF funding suggests a cautious stance on concessional lending and climate finance.

The absence of an immediate post-review drawdown for the 7th review indicates that Kenya may not receive immediate funding following this assessment. This move could encourage Kenyan authorities to expedite their economic and structural reforms to meet the IMF's expectations for future disbursements.

Find the entire statement here.

Markets Wrap

NSE: In Week 24 of 2024, Eveready was the top-performing stock, up 22.2% to close at KES 1.43. EA Portland was the worst-performing stock, down 15.7% to close at KES 6.44. The NSE 20 was down 1.0% to close at 1,744.3 points, the NSE 25 fell by 1.2% to close at 2,948.2 points, while the NASI index declined by 0.8%, to close at 113.7 points. Equity turnover went down by 37.2% to close at KES 1.1B from KES 1.8B in the prior week while bond turnover closed the week at KES 21.7B compared to the prior week’s KES 21.9B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9719%, 16.6997%, and 16.7538% respectively. The total amount on offer was KES 24B with the CBK accepting KES 21.2B of the KES 22.7B bids received, to bring the aggregate performance rate to 94.66%. The 91-day and 364-day instruments recorded 257.15% and 25.02% performance rates, respectively.

Treasury Bonds: In the T-bonds market, the total bids received in the reopened sale of FXD1/2023/05 and FXD1/2024/010 treasury bonds were KES 41.5B out of a target amount of KES 30B, bringing the performance rate to 138.53%. The CBK accepted KES 30.17B in bids bringing the acceptance rate to 72.6%.

Eurobonds: In the week, the yields were up across the 7 outstanding papers.

KENINT 2024 rose the most, up 534 bps to 15.15%, followed by KENINT 2032 at 38.2 bps to 9.91%. KENINT 2027 rose the least, up 27.9 bps to 8.42%. The average week-on-week change stood at 104.8bps

Except for KENINT 2027 and KENINT 2028 which shed 60.5 bps and 29 bps to 9.40% and 9.98%, respectively, yields on the remaining papers rose on a year-to-date (YTD) basis, with KENINT 2024 rising the most by 262.4 bps followed by KENINT 2034 at 63.10 bps to 9.97%.

All prices fell week-on-week, except KENINT 2024, which was flat at 99.854. KENINT 2048 fell the most at 3.10% to 80.573, followed by KENINT 2034 at 2.20% to 77.655. KENINT 2027 fell the least at 0.70% to 96.364. YTD, KENINT 2024 rose the most at 2.5%, followed by KENINT 2027. KENINT 2034 price fell the most YTD, down 3.50% to 77.655.

Market Gleanings

📰| NMG Share Buyback | Nation Media Group PLC ( NMG), last week completed a share buyback, acquiring 10% of its issued and paid-up share capital. The buyback offer opened on July 3, 2023, and closed on June 12, 2024. The company set out to acquire a maximum of 19,029,516 ordinary shares, representing approximately 10% of the company’s issued share capital adjusted for treasury shares. By the closing date, the company had successfully acquired all 19,029,516 ordinary shares, achieving a 100% success rate.

📃| Directline Assurance | The Insurance Regulatory Authority (IRA) in Kenya last week addressed concerns regarding the operations of Directline Assurance Company Limited. The IRA clarified that the company continues to operate fully, as licensed and approved by the Authority, despite recent communications suggesting otherwise. The alleged transfer of the insurer’s assets to a third party was declared null and void.

☕| State Waives Coffee Debt | The Cabinet last week approved a debt waiver for coffee farmers, sanctioning the write-off of debts amounting to KES 6.8B. To facilitate this, coffee cooperatives, SACCOs, and other creditors are required to submit details of indebted farmers to the Ministry for Cooperatives for verification and payment processing, with fraudulent claims to be handled legally.

⛽| Kenya’s June/July Pump Prices | EPRA has reduced the prices for super petrol, diesel, and kerosene for the June/July 2024 pumping cycle by KES 3.00, KES 6.08, and KES 5.71 to KES 189.84, KES 173.1, and KES 163.05, per litre, respectively.

🗠| MTN Uganda Share Offer | MTN Uganda, a subsidiary of South Africa’s MTN Group, concluded a successful secondary market offer for the purchase of shares, which saw an oversubscription of approximately 100%. The offer, conducted from May 27 to June 10, 2024, involved the sale of 1.57 billion ordinary shares held by MTN International (Mauritius) Limited, representing a 7.03% stake in the company.

📄| Access Bank Acquires ABC Tanzania | Access Bank, a Nigerian lender, has acquired African Banking Corporation (Tanzania) Limited (BancABC Tanzania), a move that bolsters its presence in East Africa. The acquisition will combine BancABC Tanzania's activities with Standard Chartered Bank Tanzania’s operations to form a new entity, Access Bank Tanzania.

📡| Ethio Telecom Share Sale | Ethiopia has shifted its focus to local investors, halting the sale of shares in state-owned Ethio Telecom to foreign companies to prioritize domestic retail investors. Initially, the government aimed to sell 45% of Ethio Telecom to foreign investors. Ethiopia now plans to sell a 10% stake to retail investors and will consider resuming foreign sales after Ethio Telecom lists on the Ethiopian Securities Exchange in October.

🥂| Diageo Restructures Nigeria Business | Diageo is transforming its business model in Nigeria by selling its 58.02% shareholding in Guinness Nigeria PLC to Tolaram, a specialist manufacturing, marketing, and distribution conglomerate with a 50-year presence in Nigeria. The shares will be sold for 81.60 NGN per share, representing a 63% premium to the 30-day volume-weighted average share price.

💰| $2.2B Nigeria Package | The World Bank last week approved a package of USD 2.25B for Nigeria, aimed at bolstering the country’s economy and supporting the most vulnerable sectors. The initiative is designed to provide immediate financial and technical assistance to Nigeria, aiding in economic stabilization.

🔴| BlackRock's ETF Liquidation | The Board of Directors of BlackRock's iShares has approved the closure and liquidation of the iShares Frontier and Select EM ETF (FM) due to persistent liquidity challenges in certain frontier markets, including delays or limits on repatriation of local currency. The last trading date is expected around March 31, 2025.