👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Equity Group Holdings and Co-operative Bank Q3 2024 results and Kenya’s Q3 2024 unit trust performance.Provisions Cut Lifts Equity’s Earnings

EPS Up 13.6%: Equity Group’s EPS increased by 13.6% year-on-year to KES 10.41, fueled by a 33.2% cut in loan loss provisions to KES 12.7B and strategic repayment of costly debt. The Group's operating income grew 8.7% to KES 141.7B, driven by a 13.3% rise in interest income and a significant 61.4% jump in other operating income.

Regional subsidiaries played a key role in this performance, contributing KES 18.4B in net income. Equity Bank Kenya, the Group's largest subsidiary, faced challenges with net interest income falling 3.9% to KES 42.1B, impacted by higher funding costs. Profit after tax went up 13.1% to reach KES 40.9B from KES 36.2B posted in the same period last year.

Subsidiaries Drive Growth: The Group's regional subsidiaries and life insurance arm showed robust growth, with the latter recording an 181% year-on-year increase in profit before tax to KES 1.1B. Equity Bank Tanzania Ltd. (EBTL) saw a 14% increase in profit to KES 0.8B, while Equity Bank Rwanda Limited (EBRL) recorded a 36% rise to KES 3.8B.

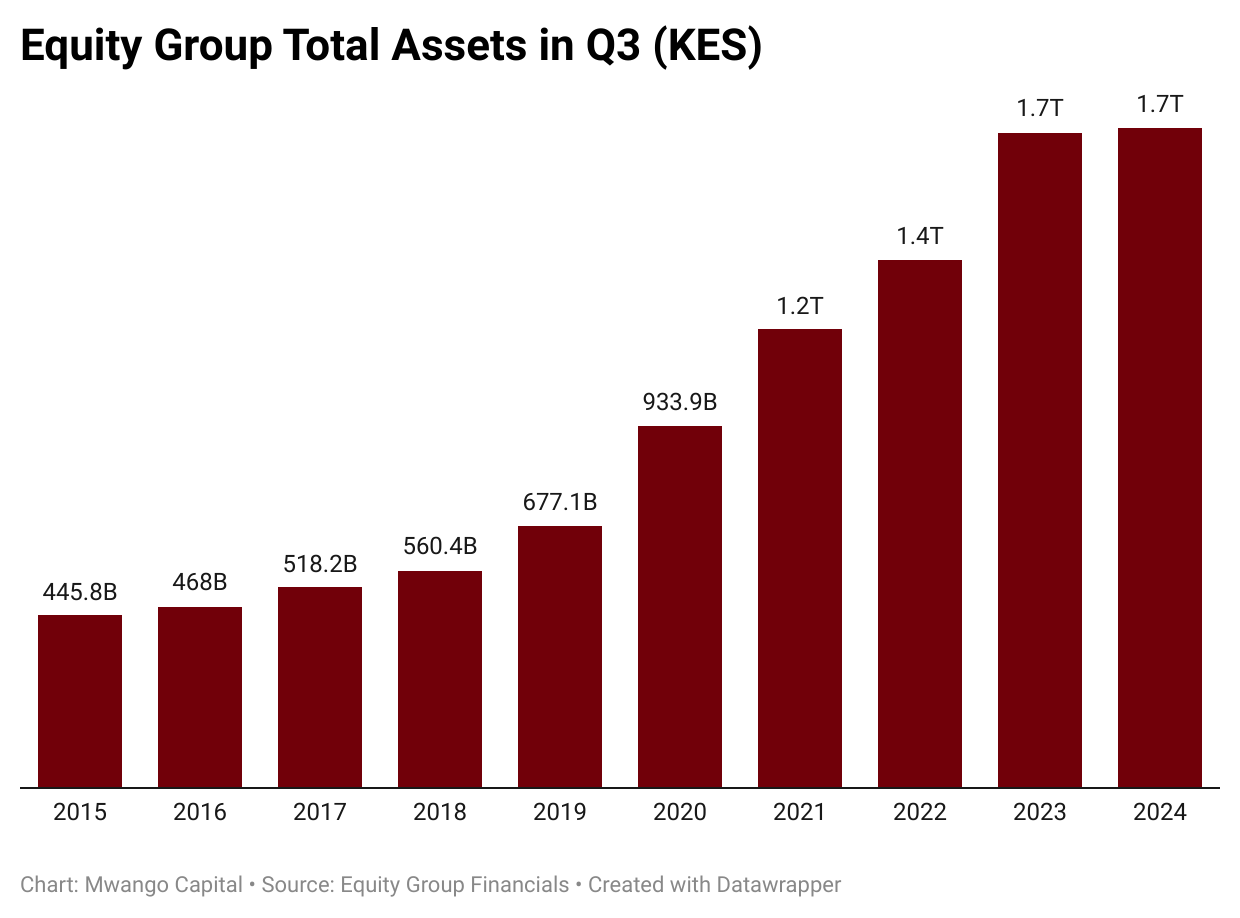

Equity Bank Uganda Limited’s (EBUL) earnings dropped by 14% to KES 2.4B, alongside Equity Bank South Sudan, which saw a 61% decline to KES 0.6B. Equity BCDC maintained its profit at KES 11.4B. The regional businesses also contributed 48% of the Group’s total assets, which stood at KES 1.7T as of September 30, 2024.

13.4% NPL Ratio: The Group's non-performing loan (NPL) ratio increased to 13.4% from 12.2% a year earlier, largely due to the contracting loan book. While gross non-performing loan levels remained relatively stable at KES 125.3B (+0.7% year-on-year), operating expenses before impairments surged 19.1%, elevating the cost-to-income ratio to 55.1% from 50.2% in the third quarter of 2023.

Despite subdued private sector credit demand and a 5.4% contraction in the loan book to KES 800.1B, the Group's liquidity improved to 55.0%, creating flexibility to scale lending when demand rebounds. The Group's investment in government securities increased by 5% year-on-year to KES 468.1B. Management highlighted risk-based pricing and higher yields on loans and government securities as key factors supporting interest income.

“What has really worked is the restructuring of our balance sheet. The Sh130 billion of foreign-denominated loans that we have paid were very expensive. These loans were previously priced at an average of 3.2% and they had come to 11%. So they were about four times more expensive and this was affecting our topline, where interest expense was growing twice as fast as interest income. The second thing was to focus on productivity. We told ourselves that if we could not control anything else because of macroeconomics, there is one thing that was within our control as staff. The staff increased their productivity significantly and that has brought out efficiency. Our non-performing loans (NPLs) had also peaked and so we no longer needed to build more provisions this quarter. So, lower provisioning and lower cost of risk from 3.5% to 2.2%, made a huge difference.”

Equity Group CEO, James Mwangi

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Co-op’s Expensive Deposits

EPS grows 4.4%: Co-op Bank's Q3 2024 results show a 4.4% year-over-year increase in EPS to KES 3.27, driven by a 12.3% rise in net interest income (NII) to KES 36.9B and an 8.2% increase in non-interest revenue (NIR) to KES 22.3B. The growth in interest income was largely driven by a 24.6 % increase from Co-operative Bank Kenya Limited, the bank’s key subsidiary.

However, total interest expense surged 50.6% to KES 24.9B, primarily due to an 18.7% increase in the deposit book to KES 513.9B. Despite this, net income rose 4.4% to KES 19.21B, with return on average equity declining to 21.3% and return on average assets to 3.6%.

Revenue Growth: Co-op Bank saw a strong 23.7% rise in interest income from loans to KES 39.4B, despite a modest 0.9% growth in its loan book. This was achieved through a mix of strategic lending and risk-based pricing, which helped offset the relatively stagnant loan book growth. Additionally, the bank capitalized on favorable yields from government securities, with income from these investments climbing 17.8% year-on-year to KES 19.8B. The group’s total investment in government securities increased by 14.3% to KES 211.6B.

Notably, foreign exchange trading income surged by an impressive 51.3% to KES 3.7B. Fees and commission income, though, grew more slowly at 1.7% to KES 17.9B, reflecting the muted demand for certain banking products.

Asset Quality: Asset quality showed signs of strain, with gross non-performing loans (NPLs) increasing by 13.1% to KES 70B. This led to a rise in the gross NPL ratio to 16.7%, up from 14.9% in the previous year. Co-operative Bank Kenya reported a 16.1% increase in gross NPLs, reaching KES 65.7B. In response, the bank raised its loan loss provisions by 32.5% year-on-year to KES 5.6B. Operating expenses before impairments grew by 9.3%, reaching KES 27.1B, driven by higher staff and rental costs associated with the expansion of its branch network.

Unit Trust Assets Hit KES 300B

During the week, the Capital Market Authority released its Q3 2024 collective investment schemes (CIS) report highlighting the sector’s performance during the quarter. Below are the key highlights:

AUM: During the quarter ended September 2024, Kenya’s unit trust assets under management (AUM) grew to KES 316.4B, a 24.5% increase from KES 254.1B in June 2024. Money market funds are the most popular, accounting for 62.2% of assets managed at KES 316.4B from KES 254B in June 2024.

Market Share: CIC, the largest unit trust fund manager with 22.2% market share, hit the KES 70B AUM mark during the quarter. CIC, Sanlam, and NCBA control 47.8% of the industry’s market share from 54.2% in June 2024.

Asset Allocation: The bulk of Kenya’s unit trust assets is invested in government securities and fixed deposits, at 41.4% and 31.1% in September 2024, respectively, from 39.2% and 33.4% in June 2024. Offshore investments now account for 6.2% of total assets in September 2024 from 0.2% in June 2024, following the conversion of Mansa X funds to Mansa X Special CIS funds, which have a total of KES 19.0B of offshore investments.

Investors: The number of investors in collective investment schemes grew marginally to KES 1.3M in September 2024 from KES 1.2M in June 2024.

Markets Wrap

NSE This Week: In Week 46 of 2024, EA Portland led the top gainers, rising by 21.4% to close at KES 42.75, while Scangroup was the worst performer, dropping 15.6% to close at KES 2.22. The NSE 20 increased by 0.1% to 1,930.2 points, while the NSE 25 rose by 0.2% to 3,195.3 points. The NSE 10 index also gained 0.1%, closing at 1,238.1 points. However, the NASI index declined by 0.5%, ending at 115.0 points. Equity turnover fell by 68.1%, totaling KES 702.1B, while bond turnover decreased to KES 23.4B from KES 26.2B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed in the week, with an overall subscription rate of 398.1%, down from 409.8% the previous week. Investors placed bids worth KES 95.5B, out of which KES 43B was accepted, resulting in an acceptance rate of 45.0%, lower than the previous week’s 54.6%. Yields on the three treasury bill tenors continued to decline, dropping by 65.9 basis points, 78.1 basis points, and 54.9 basis points, closing at 12.79% for the 91-day, 13.06% for the 182-day, and 13.89% for the 364-day bills.

In the primary market, the Central Bank of Kenya released auction results for the 10-Year Re-Opened FXD1/2024/010 bond. Investors placed bids totaling KES 55.58B, surpassing the offer of KES 20B. Out of the total bids, KES 30.52 B was accepted. The market-weighted average rate for the accepted bids was 16.1127%.

Eurobonds: Last week, yields increased across all six outstanding papers on a week-on-week basis. The KENINT 2031 saw the largest rise, up by 29.8 basis points to 10.03%, followed closely by the KENINT 2028, which increased by 26.2 basis points to 9.07%. Overall, the average week-on-week yield change was an increase of 23.6 basis points.

Market Gleanings

📉| Laffer Curve? | Kenya's Treasury recorded a revenue shortfall of KES 5.63B in fuel levies for the fiscal year ending June 2024, as declining fuel consumption due to a sluggish economy impacted collections. The Road Maintenance Levy Fund (RMLF) and Petroleum Development Levy (PDL) suffered a combined decline, with RMLF receipts falling 5.78% to KES 66.07B and PDL down 6.09% to KES 24.34B. The drop is attributed to reduced demand for diesel and petrol, exacerbated by the recent VAT hike on fuel to 16%, which muted consumer benefits from softening global oil prices. As the government struggles to balance revenue generation and price stabilization, it raised the RMLF levy by 39% while drawing KES 47.26B from exchequer funds to sustain fuel subsidies, underscoring the challenges of managing fiscal policy amid economic constraints and fluctuating global energy markets.

💰| Another Rights Issue at the NSE | Sanlam Kenya has unveiled plans for a KES 3.25B rights issue, with the capital raised intended to reduce its long-term debt burden and bolster financial flexibility. The insurer aims to use the funds to streamline its debt profile, ultimately lowering interest expenses, which are currently a significant cost. Additionally, the increased financial flexibility is expected to empower management to drive Sanlam's growth strategy, supporting both operational needs and the pursuit of new business opportunities. This rights issue, pending shareholder and Capital Markets Authority approval, is part of Sanlam's commitment to achieving a more sustainable balance sheet and enhancing shareholder value over the long term.

📈| Foreign Stake Rises in KCB | In Q3 2024, foreign investors increased their holdings in KCB Group by purchasing an additional 16.87M shares, equivalent to about KES 664M. This raised their stake to 11.38%, up from 10.86% in Q2 2024. As of 30 September 2024, KCB Group’s shareholder composition included 62.55% held by local institutional investors, amounting to 1.37B shares, and 26.07% held by local individual investors, with 837.87M shares. The National Treasury of Kenya remained a major shareholder with a 19.76% stake (635M shares), while the National Social Security Fund (NSSF) held 10.01% (321.7M shares), both maintaining their positions as the only shareholders with over 5% ownership.

⛽| Nov/Dec Pump Prices Unchanged | The Energy and Petroleum Regulatory Authority (EPRA) has maintained the retail prices of Super Petrol, Diesel, and Kerosene at KES 180.66, KES 168.06, and KES 151.39 respectively, for the period 15th November to 14th December 2024. These prices are inclusive of the 16% VAT as per the Finance Act 2023 and the Tax Laws (Amendment) Act 2020. Additionally, the road maintenance levy remains at KES 25 per litre.

✅| COMESA Clears Amsons to Acquire Bamburi | The COMESA Competition Commission has cleared AMSONS Group’s proposal to acquire a 100% stake in Bamburi Cement Plc for KES 23B, stating that the deal will not harm competition within the Common Market for Eastern and Southern Africa (COMESA).In October, Bamburi Cement issued a circular detailing two competing offers for its 100% acquisition: AMSONS Industries at KES 65 per share and Savannah Clinker at KES 76.55 per share. Shareholders have until December 5th, 2024, to decide.

💪| CBK Assures the Public of Banking Stability | The Central Bank of Kenya (CBK) issued a warning last week about malicious actors spreading false information regarding changes in the banking system. In an official statement, CBK reassured Kenyans that the banking sector remains stable, resilient, and adequately capitalized, urging customers to continue transacting as usual. The bank clarified that it has not made any announcements regarding changes to the sector's operations and advised the public to disregard any unofficial information.

🏦| IMF Roundup |

DRC: The International Monetary Fund (IMF) has reached a staff-level agreement with the Democratic Republic of Congo (DRC) on a new 3-year economic and financial program under the Extended Credit Facility (ECF) for about USD 1.77B, and a climate-focused program under the Resilience and Sustainability Facility (RSF) for about USD 1.1B. The agreement is subject to approval by IMF management and the Executive Board, with consideration tentatively scheduled for mid-January 2025.

Morocco: Last week, the IMF Executive Board completed the second review of Morocco’s Resilience and Sustainability Facility (RSF) arrangement, approving an immediate disbursement of USD 415M. This brings the total disbursement under the program to USD 747M.

Zambia: The Zambian authorities and the IMF team have reached a staff-level agreement on the economic policies and reforms needed to conclude the fourth review of Zambia’s 38-month Extended Credit Facility (ECF) arrangement. Subject to IMF management approval and Executive Board consideration, the agreement will allow Zambia to access about USD 185.5M in financing upon completion of the review.

💰| Nigeria Seeks USD 5B Facility from Saudi Arabia | Nigeria is seeking a USD 5B trade facility from Saudi Arabia to support its economic reform program. President Bola Tinubu discussed the proposal with Crown Prince Mohammed bin Salman in Riyadh during the joint Arab-Islamic Summit. The two leaders explored areas of potential cooperation, particularly in oil and gas, agriculture, infrastructure, and the establishment of the Saudi-Nigeria Business Council.

🇹🇿| Tanzania Secures Funding | Tanzania has secured funding from Standard Chartered, Sinosure, and AfDB for the Uvinza-Musongati SGR section, linking Tanzania and Burundi. The 2,561km railway aims to enhance regional trade and connectivity across East Africa.