👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover FY 2024/25 budget proposals and medium-term budget, pump prices for the December/January 2024 period, and an outlook on what to expect in 2024.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay For E-Citizen services conveniently with Co-op Bank.

Kenya’s FY 2024/2025 Budget

During the week, the National Treasury held public hearings from the 13th to the 15th of December on the FY 2024/25 Budget Proposals and Medium-Term Budget. Among the key speakers were the Treasury Cabinet Secretary and Permanent Secretary. Here is a rundown of the key highlights.

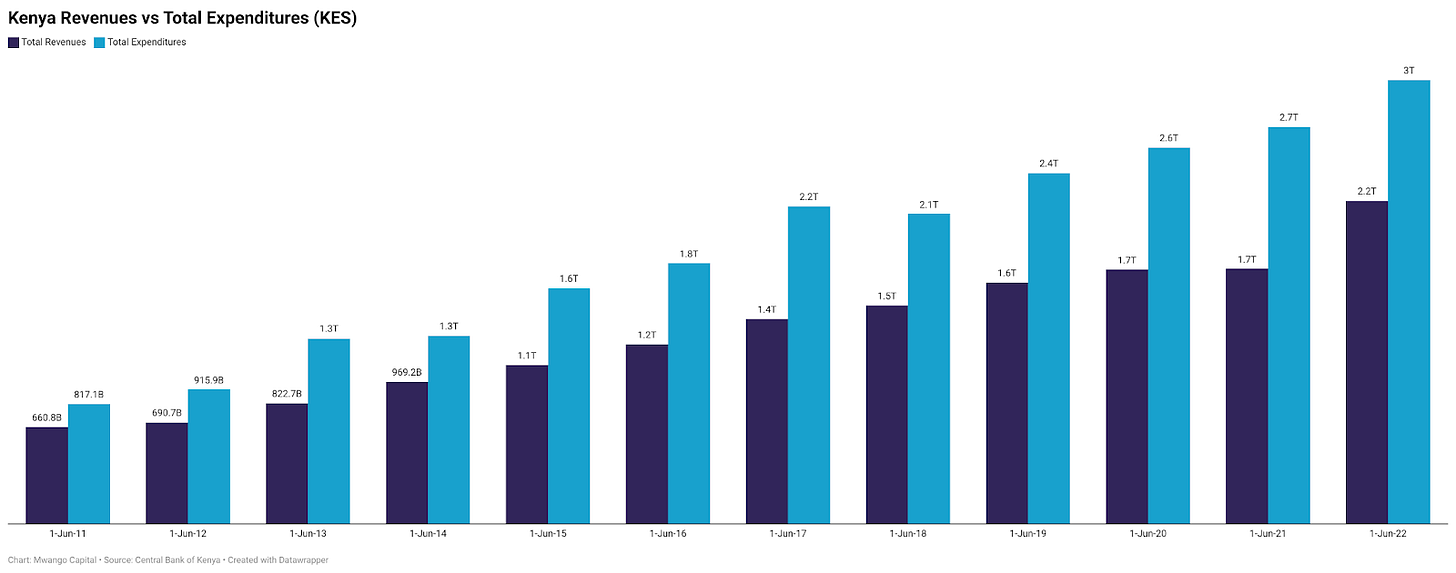

Revenues and Expenditure: Total revenues, excluding appropriations-in-aid, are expected to be at KES 3.4T, equivalent to 19.1% of GDP, while ordinary revenues are estimated at KES 2.96T, or 16.4% of GDP. Gross expenditure has been projected to be KES 4.2T, equivalent to 23.3% of GDP. Recurrent and development expenditure has been estimated at KES 2.9T and KES 881.3B, equivalent to 16% and 4.9% of GDP, respectively.

Fiscal Deficit: The deficit is expected to be in the sub 4.0% region, settling at 3.9% of GDP in FY 2024/2025 from 5.5% in FY 2023/24. The net financing earmarked to be raised domestically and externally has been estimated at KES 377.4B and KES 326.2B, equivalent to 2.1% and 1.8% of GDP, respectively.

Zero-Based Budgeting: The National Treasury has requested ministries, departments, and agencies to submit financial requirements through a costing tool that ensures zero-based budgeting. Unlike traditional budgeting, zero-based budgeting involves the creation of budget vote heads from scratch without referring to previous actual spending levels, and the move is aimed at containing public spending.

Pending Bills: The gross amount of funds owed to suppliers, merchants, and contractors by the national and county governments between June 2005 and June 2022 amounts to KES 640B, and the Pending Bills Verification Committee approved by the cabinet is currently auditing the bills as part of steps in the lead up to the resolution and the eventual settlement.

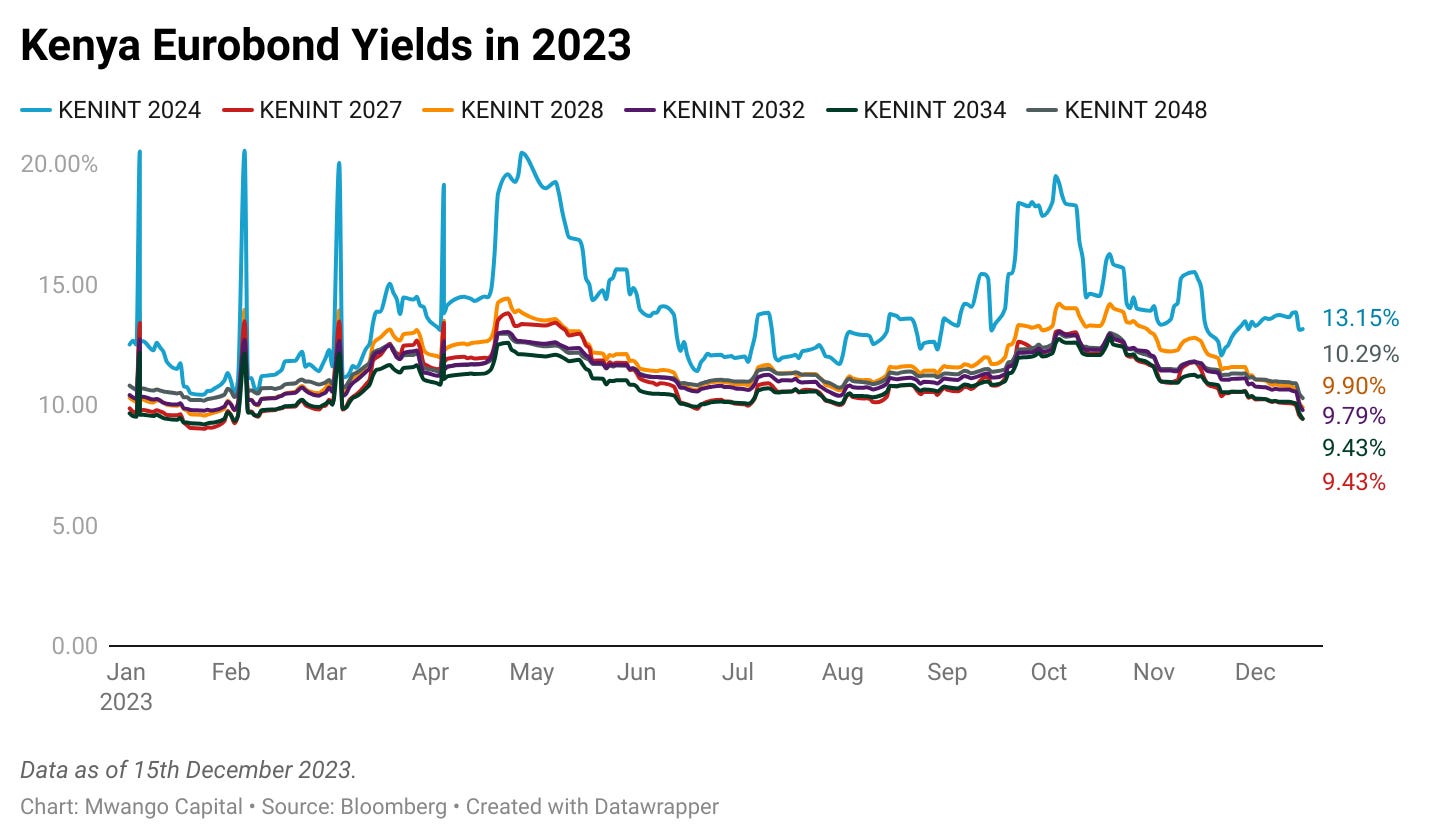

Lurking Risks: The cabinet secretary for the national treasury Prof. Njuguna Ndung’u cited risks to the fiscal space and financing of the budget on account of tightening liquidity conditions. This cements his earlier position when he pointed out that Kenya was going to stay out of the international capital markets in FY 2023/2024 on account of higher interest rates.

Find the document here.

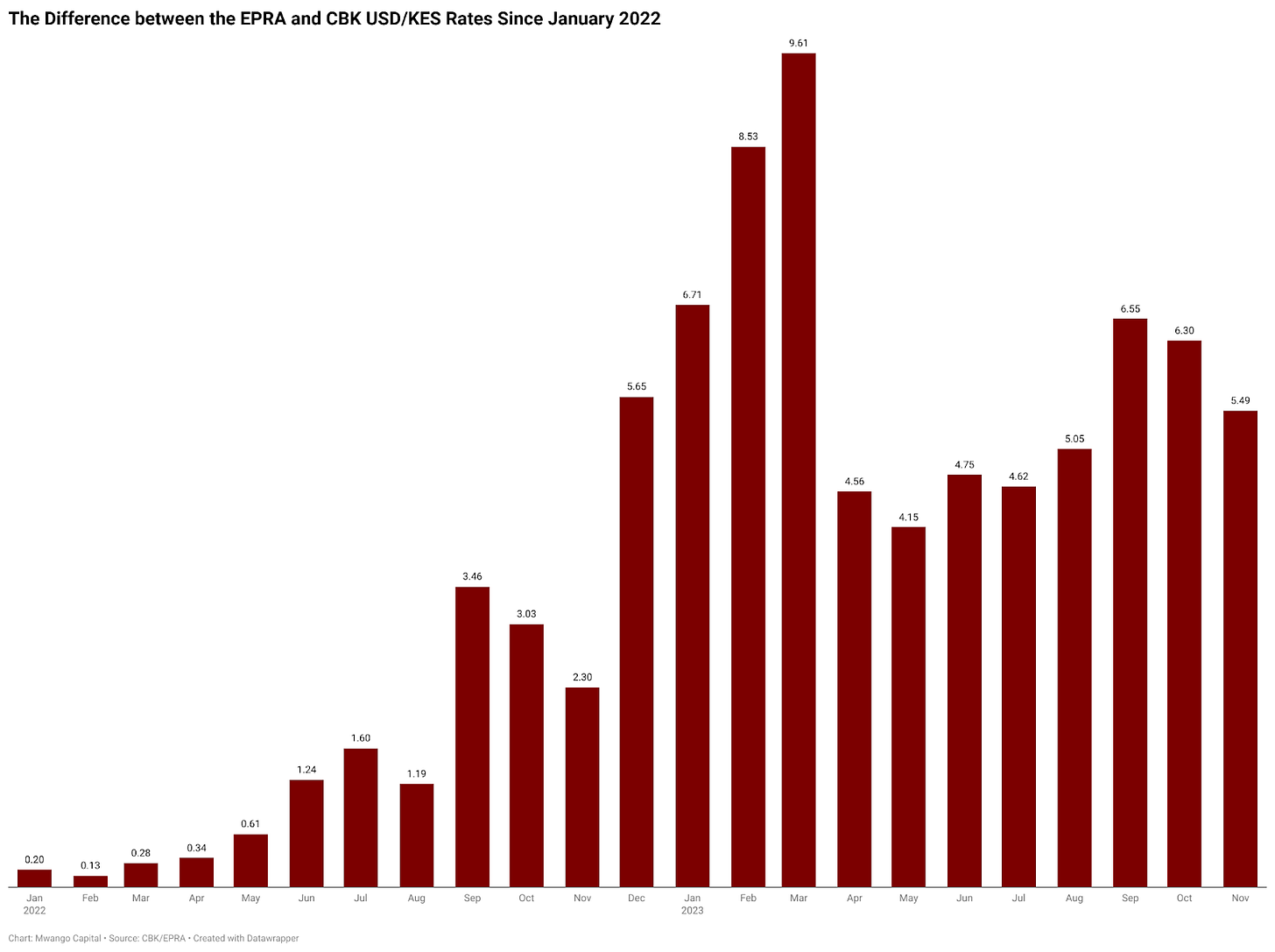

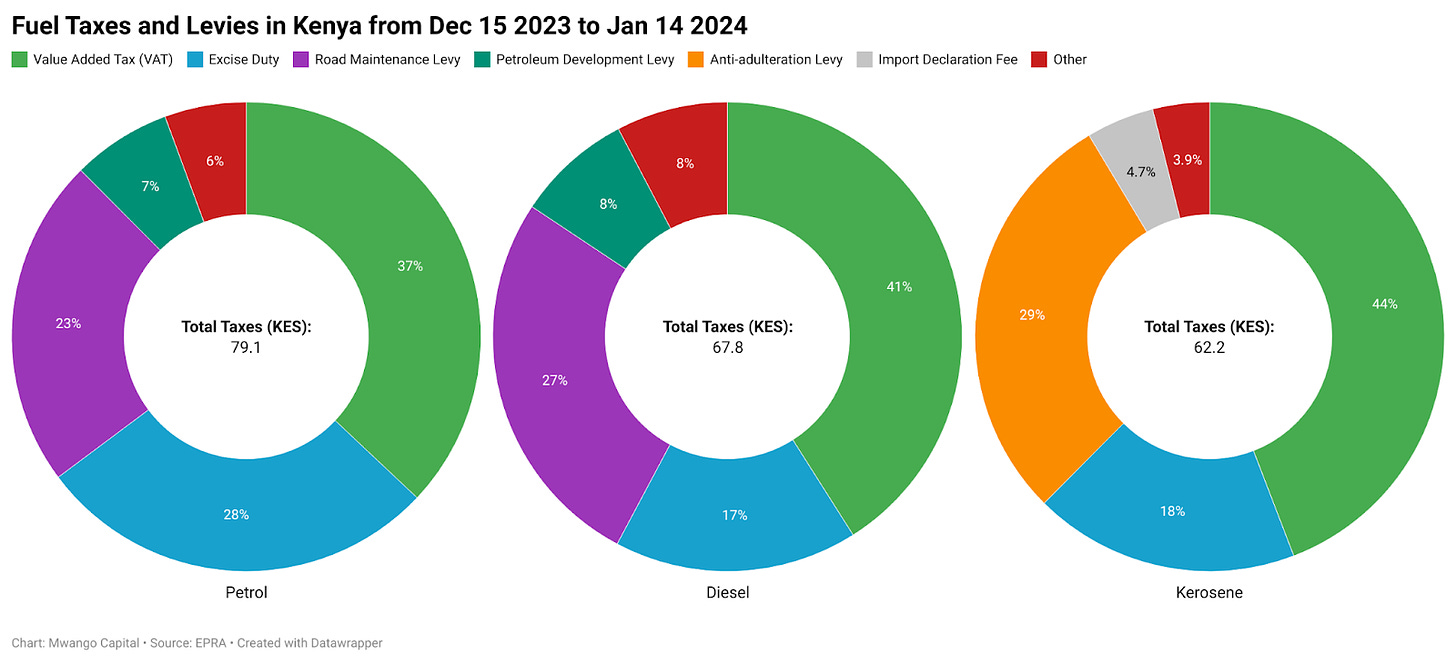

Kenya’s Fuel Prices Edge Lower

Dec-Jan Pump Prices: For the December-January 2024 pumping cycle, the Energy and Petroleum Regulatory Authority (EPRA) has reduced the price of super petrol, diesel, and kerosene by KES 5.00, KES 2.00 and KES 4.01 to KES 212.36, KES 201.47 and KES 199.05 per litre. S&P Global Platts prices for the products edged lower by 1.55%, 5.14%, and 2.59% with landed costs falling by 16.1%, 5.43%, and 6.63% in November 2023, respectively. The difference between the mean EPRA USDKES rate and the mean CBK rate was KES 5.49, falling for the second consecutive time from September 2023.

Subsidized Diesel: In the Dec/Jan pumping cycle, the price of diesel has been cross-subsidized with that of petrol, adding to the interventions the government has carried out to anchor fuel prices - similar to those implemented in the August/September 2024, September/October 2024, October/November 2024 and November/December 2024 pumping cycles to cushion consumers.

“The price of diesel has been cross-subsidized with that of super petrol and in order to further cushion the economy, the Government has opted to stabilise the resultant diesel price. The government through the National Treasury has identified resources within the current resource envelope to compensate Oil Marketing Companies.”

You can find the full press release here.

2024 Outlook

KENINT 2024 Redemption: The KENINT 2024 Eurobond will be maturing in June 2024, and the government has been lining up several options for redeeming the debt. By the end of December, the government is expected to buy back part (USD 300M) of the Eurobond. This will be among the top items of focus for Kenya - and the indications point that the debt will be redeemed by finances obtained from syndication by multilateral institutions and bilateral arrangements.

“The elephant in the room undoubtedly is the settlement of KENINT 2024, but all indications are that this will be a non-event. The authorities have managed to secure additional concessional financing to maintain FX reserves at current levels, post-payment of the Eurobond; partial buyback notwithstanding. That said, the path to a return to market access may prove uncertain into 2024 for potential new issuance, and as such, GoK will continue relying on short-tenor domestic borrowing.”

IC Asset Managers Economist, Churchill Ogutu

Privatization Drive: The government was set to list a few mature State Owned Enterprises (SOEs) this year but did not follow through, and in 2024, among the key things to look out for include new listings at the bourse and the government’s broad agenda of privatization of SOEs.

Regulation: Among key pieces of legislation with an impact on the economy include the Affordable Housing Bill - which seeks to cure the unconstitutionality of the Affordable Housing Levy. Further, new measures on eTIMS also kick in, which will have ramifications on how corporates, SMEs, and individuals do business. We have a podcast that breaks down the entire subject here.

Here is what IC Asset Managers economist Churchill Ogutu has to say on the outlook:

“I was surprised by the jumbo rate hike at the start of this month. With the inflation outlook expected to show some ebbing, I still hold the view that the KES angle that dominated the MPC discourse is a red herring. Without beating the bush, I think the rate hike was to assuage the IMF, before the Jan 2024 disbursement, inflation having breached the target levels in the review period (2Q 2023). With inflation expected to moderate next year, and the start of the cutting cycle, CBK should also have legroom for rate cuts in 2024.”

“On the fiscal, still struggling to get some coherent stance from the government of the day. 2023 is coming to an end, and we are yet to get hold of the fourth Medium Term Plan (2023 - 2027). I may be too pedantic, but a MT Plan should be the yardstick of articulating the government's broad-based plans, over and above the campaign manifestos. As it is, there are lots of stuff thrown at the wall with the hope that a majority will stick. But there has not been a dearth of docs/reports to keep us going. For one, I think the tax plans - National Tax policy and Medium Term Revenue strategy will give the broad thrust around taxation. However, I think the docs/reports need to be harmonized as the sense I have is that some clauses are contradicting each other, rather than complimenting.”

“In the real sector, I see inflation coming lower to mid-target levels. Largely food inflation has cooled, with a calming effect on the headline inflation. I think this will continue, unless there is a protracted El Nino effect, but I would be more concerned should it disrupt the bread-basket regions. Overall, real GDP growth should be supported at c. 5.8% levels in the year, bolstered by the agricultural sector.”

“On the external side, adjustment of the KES should be complete by 2024. We have seen some reforms around FX interbank restoration that suggests to me that further KES weakness may not be warranted. Despite the adjustment on the domestic unit, current account balance has remained sticky; if not an admission of demand compression. Net foreign assets held by the overall banking sector suggests that commercial banks can weather some short-term pain, but we still think that a converging level for KES should see meaningful flows to Kenya.”

Markets Wrap

NSE: In Week 50 of 2023, Unga Group was the top-performing stock, up 9.5% to close at KES 16.75. Sanlam was the worst-performing stock, down 15.9% to close at KES 6.14. All indices were red, with the NSE 20, NSE 25, NSE 10, and NASI falling by 1.4%, 1.9%, 2.0%, and 2.1% to close at 1,491.9, 2,375.7, 907.4 and 92.0 points, respectively. Equity turnover edged lower by 64.0% to KES 487.66M from KES 1.4B in the prior week while bond turnover closed the week at KES 21T compared to the prior week’s KES 12.2T.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.7706%, 15.9219%, and 15.8340% respectively. The total amount on offer was KES 24B with the CBK accepting KES 17.1B of the KES 17.3B bids received, to bring the aggregate performance rate to 72.26%. The 91-day and 364-day instruments recorded 344.79% and 6.29% performance rates, respectively.

Treasury Bonds: In its January 2024 Treasury Bond sale, the Central Bank of Kenya (CBK) is seeking to raise KES 35B via the new issuance of FXD1/2024/03 and the re-opening of FXD1/2023/05. The period of sale runs from 14th December 2023 to 10th January 2024.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2028 fell the most week-on-week, down by 92.50 bps to 9.899% while KENINT 2024 fell the least, depreciating by 58.00 basis points to 13.152%. The average week-on-week change stood at -28.50 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 54.90 bps while KENINT 2028 rose the least at -64.00 bps.

Prices rose across the board week-on-week, with KENINT 2048 rising the most at 6.2% to 81.923. Year-to-date, KENINT 2048 rose the most, appreciating by 5.2%, while KENINT 2034 rose the least at 3.1% to 79.882.

Markets Gleanings

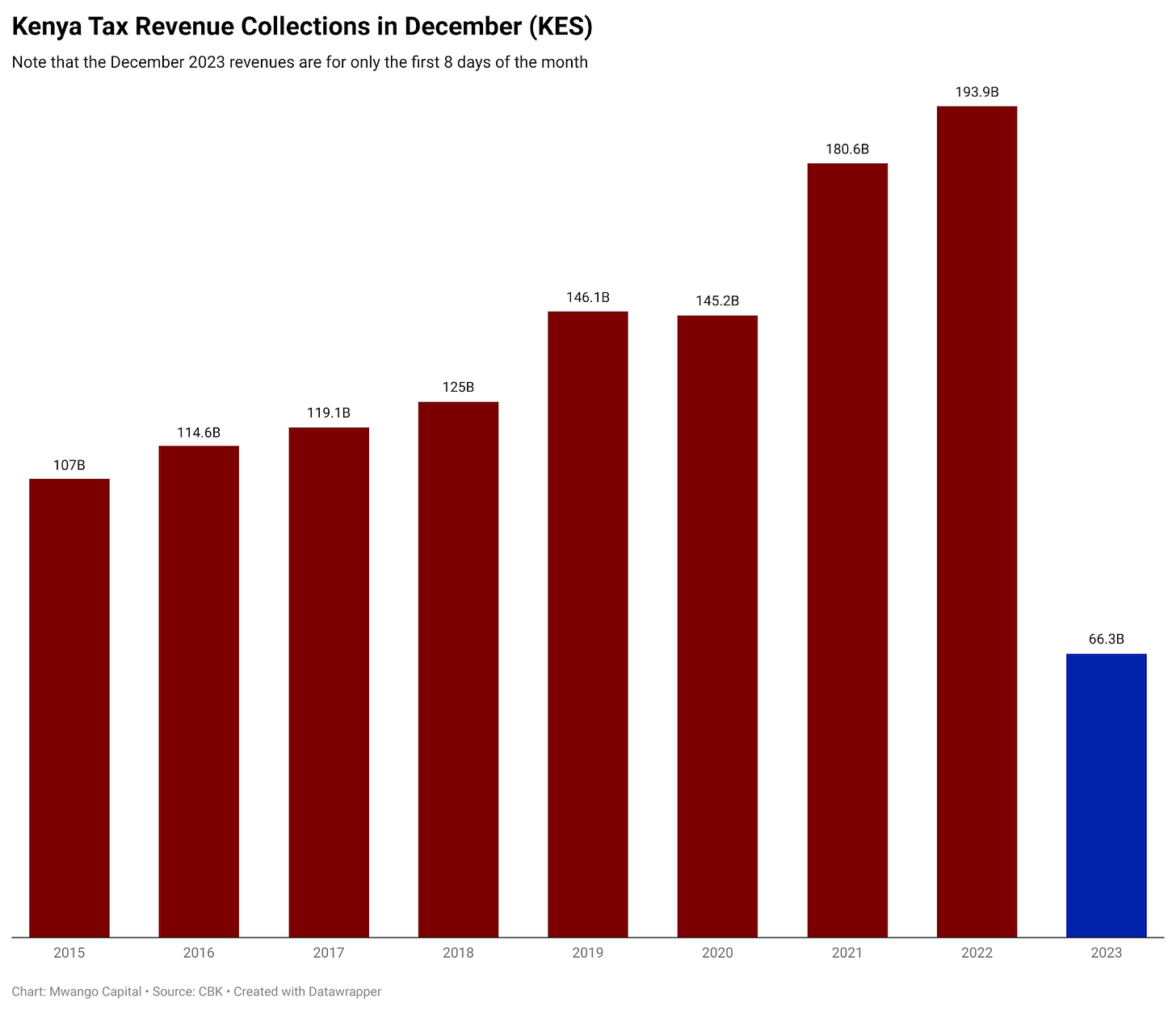

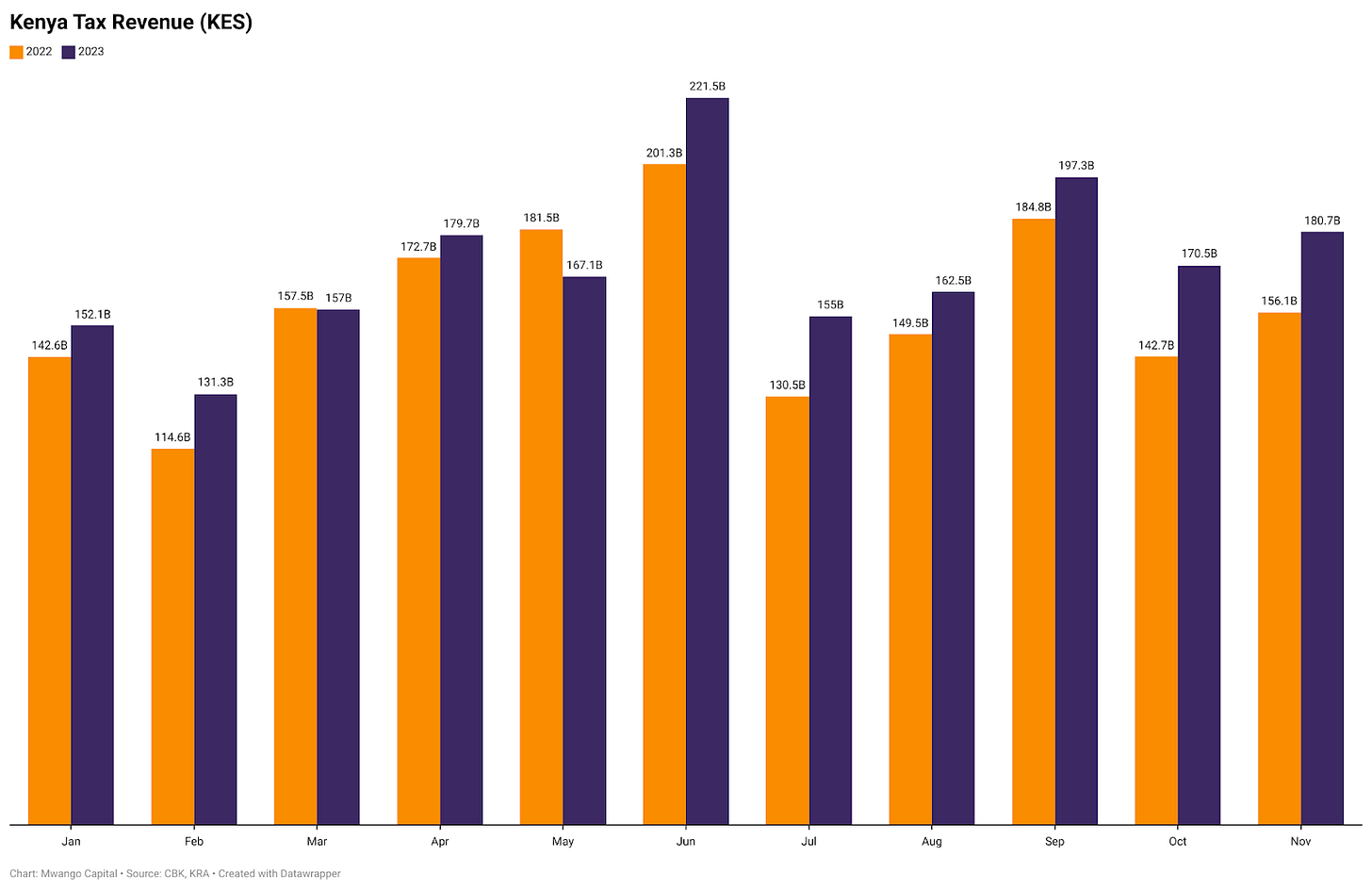

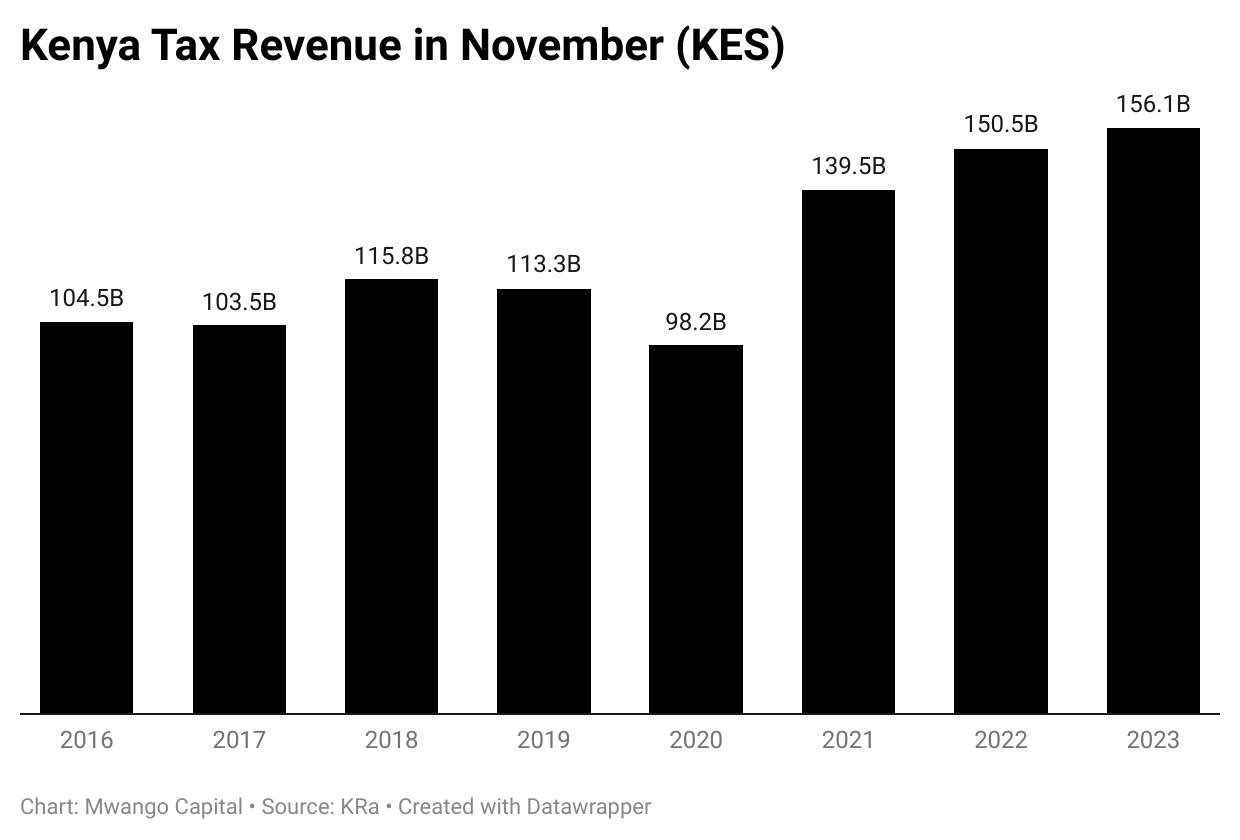

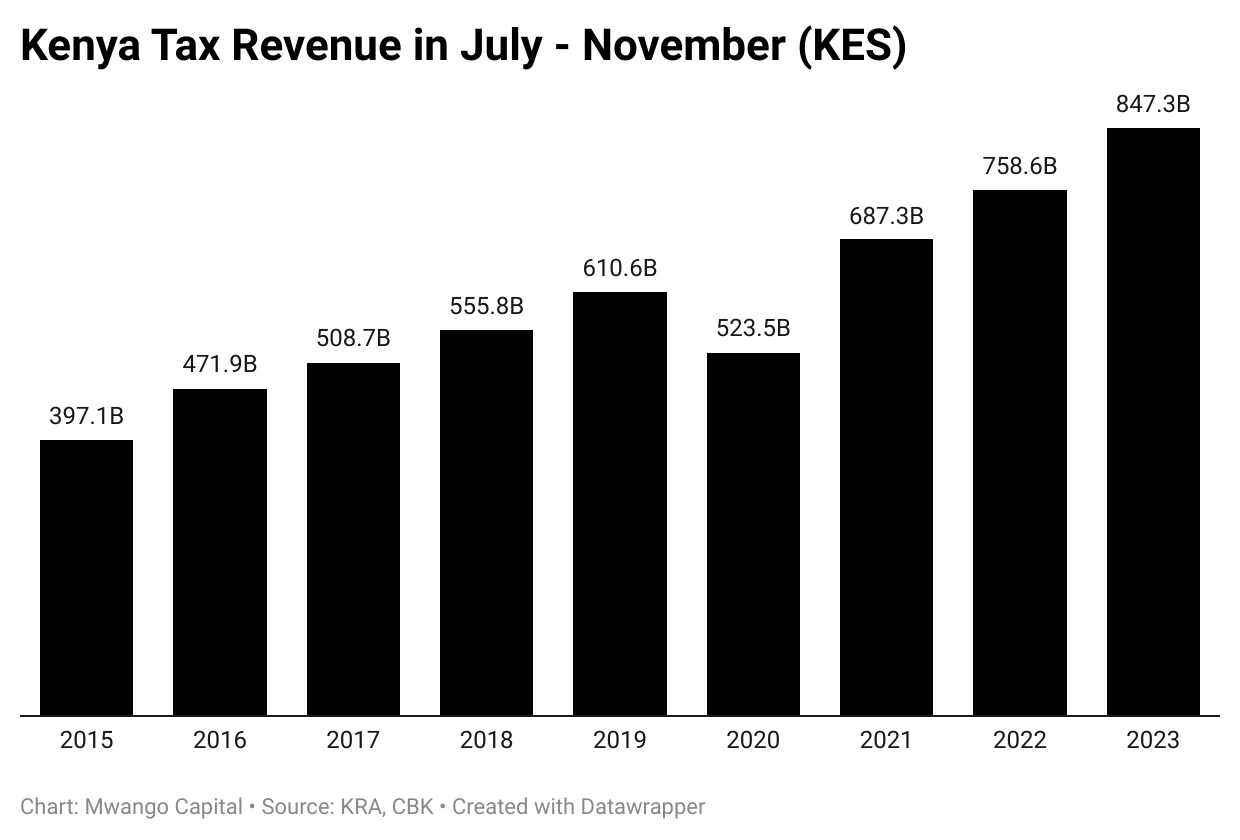

🧾| Kenya Tax Revenue Update | Tax revenue collections for November 2023 were KES 180.74B, up 15.8% year-on-year, while for July - November, they totaled KES 847.3B, up 11.7% from FY 2022/2023. The performance was buoyed by a 42.5% growth in oil taxes to KES 27.9B on account of increased oil volumes and increase in VAT on petroleum products to 16% from 8%. For the first 8 days of December 2023, the collections were KES 66.3B, equivalent to 34% of December 2022 tax revenues.

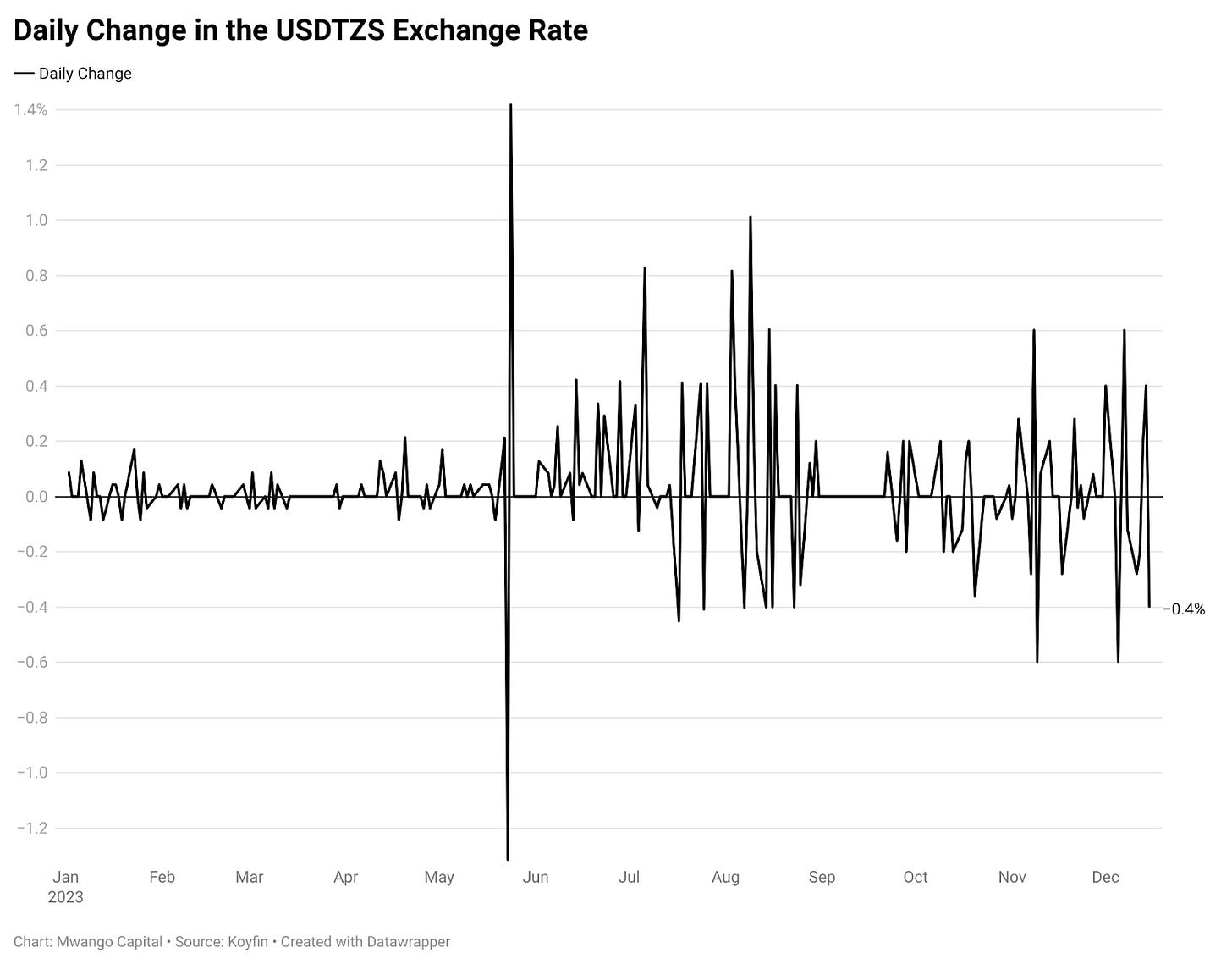

💰 | NMB’s Sustainability Bond | NMB Bank PLC’s dual-tranche green bond has raised TSHS 400B - the largest sustainability bond in East Africa. The TSHS tranche of the bond recorded a subscription rate of 284%, while the USD tranche was 730%, with the amounts raised at TSHS 212.92B and USD 73M out of initial targets of TSHS 75B and USD 10M, respectively.

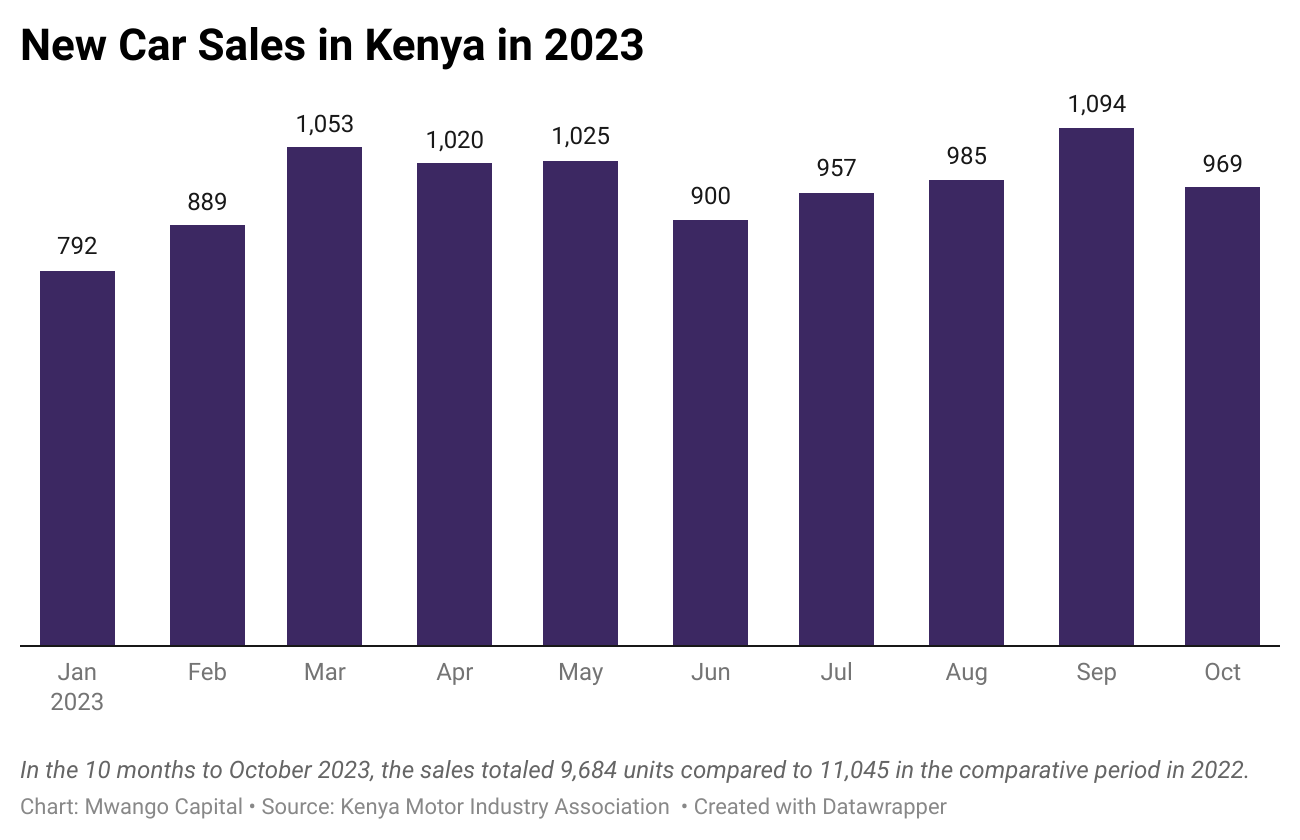

🚗 | Car Sales in Kenya | New car sales in Kenya in the 10 months to October 2023 totaled 9,684 units, down 12.3% y/y compared to 11,045 in the comparative period in 2022. For October 2023, the sales were 969 units, down 11.4% month-on-month. Data further indicates that the value of vehicle imports for the 10 months through September 2023 was USD 680M (KES 102 B), down 17.58% or USD 145M from 2022.

⚡ | Mitigating Blackouts in Kenya | The cabinet last week resolved to implement measures aimed at bolstering the resilience of Kenya’s grid and curbing nationwide power outages that have recently increased in frequency. As part of the measures, the Bomet-Narok line will be built with KES 400M from the African Development Bank, and a KES1.2B KenGen solar power project at the Seven Forks Dam will be constructed to provide a safeguard against power failure.

💳 | Kenya is Visa Free | During Jamhuri Day celebrations last week, President William Samoei Ruto announced that effective 1st January 2024, Kenya will be visa free. Visitors will instead be required to pay USD 30 KES 4,590) for an Electronic Travel Authorisation (ETA) to get into Kenya, and should they overstay it, a fine of USD 100 (KES 15,300) will be incurred.

🛤️ | Burundi - Tanzania SGR | The Board of Directors of the African Development Bank Group approved USD 696.41M in funding for phase II of the Tanzania-Burundi-DRC Standard Gauge Railway (SGR). The funding has been earmarked for the construction of 651 KM on the Tanzania-Burundi railway. Separately, the 1,443KM East African Crude Oil Pipeline (EACOP) project set to facilitate pumping of oil from Uganda through Tanzania officially entered its construction phase with the arrival of the first 100KM of pipes at the Dar es Salaam port.

💰 | IMF’s Arrangements | The IMF’s executive board has completed the second review of Tanzania’s Extended Credit Facility (ECF) arrangement, greenlighting immediate disbursement of USD 150.5M for budget support. The completion of the second review brings the total access under the current arrangement to USD 455.3M, out of USD 1.0464B approved in July 2022. Separately, the IMF Executive Board has granted Rwanda a new 14-month credit facility of USD 268.05M, with USD 138.84M accessible immediately. The agreement falls under the fund’s Stand-by Credit Facility (SCF) & Resilience and Sustainability Facility (RSF).

🤝 | Somalia Gets Debt Relief | Somalia is set to receive USD 4.5B in debt relief from its international creditors under the IMF’s Heavily Indebted Poor Countries which would see the country’s debt as a percentage of GDP fall by 10X to 6% from 65%. The relief will see Somalia rejoin the global financial system after a 3-decade hiatus.