👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the issuance of KENINT 2031 Eurobond, BAT Kenya PLC full year 2023 results, and February/March 2024 pump prices.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Get access to proper healthcare and prioritize your family's well-being through Co-op Bancassurance Intermediary.

9.75% Coupon at 10.375% Yield

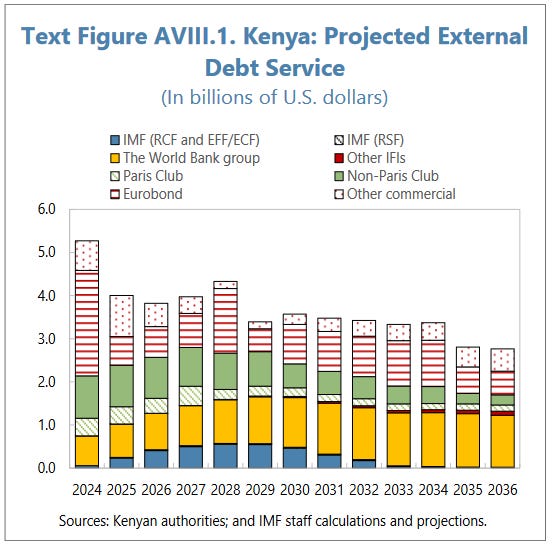

The Debt Dance: Kenya's Eurobond issuance outperformed market expectations by drawing $5 billion in orders, with the nation securing $1.5 billion at a yield of 10.375% for seven-year debt. This yield, the highest among African issuers this year, underscores Kenya's position in the global financial market and its strategy to refinance maturing securities and extend debt maturity amidst a $5.2 billion foreign debt repayment challenge. In comparison, Benin and Ivory Coast entered the market with lower yields, at 8.375% for a 14-year bond and 8.5% respectively, showcasing diverse fiscal health and investor confidence across the continent. The bond will be redeemed in equal installments on February 16, 2029, February 16, 2030, and February 16, 2031, and has a weighted average life of the bond is 6 years. Kenya's issuance, aimed at addressing its immediate financial needs, offered a coupon rate of 9.75% with semi-annual payments and is structured to finance the repurchase of outstanding securities.

“In the credit market, the merits of the KENINT transaction are not clear-cut…This transaction will be expensive for the government. Pricing new USD bonds at these levels could still be seen as a negative signal by credit investors. Ghana issued at 10.75% in 2015 (with a 40% World Bank guarantee) before defaulting in December 2022, and Egypt’s 10.875% sukuk issuance in February 2023 contributed to a sell-off in the complex. Kenya’s situation may be different given significant IMF support for the sovereign and the easing of immediate pressure from the June 2024 maturity. However, the negative medium-term signaling effect will need to be carefully managed by the authorities.”

“The high subscription of the Eurobond is an indication of the investor confidence in the Kenyan economic management and our debt management strategy. This is a confidence boost to us because it shows the rest of the world believes Kenya is good for business and we have been out of the market for a long time. We tried in 2021, we couldn’t go, but now the market is open. As a result of this, the issue around uncertainty on the exchange rate has been addressed.”

Permanent Secretary to the National Treasury, Dr. Chris Kiptoo

Happy Fund Managers: Kenya's decision to proactively manage its debt maturities through Eurobond reissuance, despite the higher costs, has been well-received by fund managers who see the value in preserving foreign currency reserves over depleting them for June's bond repayments. This strategy, coupled with Kenya's potential to secure additional concessional funding, may effectively balance the high yield costs, ensuring sustainability.

“Fund managers said last week they were happy Kenya is being proactive about its upcoming maturity, even at a high cost, rather than sitting and waiting for it without attempting any liability management. This will allow it to preserve foreign currency reserves, rather than use them up in June repaying bondholders.”

KENINT 2024 Tender Offer Results: The offer to buy back a portion of the KENINT 2024 Eurobond falling due in June 2024 received valid tenders totaling USD 1.48B, exceeding the USD 1.4B Maximum Tender Amount initially set by the government as per the Tender Offer Memorandum. The government increased the maximum acceptance to USD 1.443B, and the accepted Notes are to be purchased at $1,000 per $1,000 principal, plus accrued interest payment. The settlement date for the accepted Notes is 21st February 2024. The accepted Notes are to be cancelled with the Notes not tendered or accepted to stay outstanding. The government is set to pursue other liability management operations for the outstanding USD 0.6B of the KENINT 2024 Eurobond.

USD/KES Rate Volatility: The recent surge in the Kenyan shilling's value against the US Dollar was on the back of various developments in the week. Firstly, concerns regarding a potential Eurobond default were damped given the repayment efforts undertaken in the week including the issuance of the KENINT 2031 Eurobond whose proceeds were directed towards buying back USD 1.4443B of the KENINT 2024 Eurobond. Additionally, substantial foreign interest in the IFB/2024/8.5 infrastructure bond issuance exerted downward pressure on the shilling. Market dynamics were further exacerbated by panic-driven selling and herd mentality, contributing to heightened volatility.

Nevertheless, market participants anticipate a stabilization period as the market adjusts to these shifts. The strengthened shilling has the potential to mitigate import and fuel expenses while also easing the burden of foreign debt, underscoring the intricate interplay between financial instruments and market sentiment in shaping currency valuations. As of the end of last week, the Kenya shilling exchanged at 144 units to the dollar, an appreciation of more than 7.26% this year and 9.0% month-to-date.

“Expectedly, the infrastructure bond elicited considerable foreign investor appetite, leading to the shilling rally, especially on the back of the sovereign’s successful Eurobond issuance that beat back quite convincingly earlier difficult risk concerns.”

Chairman of Kenya Bankers Association and NCBA Group CEO, John Gachora

Kenya’s Public Debt: As of the end of December 2023, Kenya’s stock of domestic debt stood at KES 5.1T, while that of external debt amounted to KES 6.089T (USD 38.92B). As of that point, the Kenyan shilling exchanged for 156.84 units to the dollar and is currently exchanging for 145.75 units - a 7.26% appreciation.

Find the Tender Offer Results here and a link to an X Spaces we had last week on Kenya’s Eurobond Issuance and Buyback.

BAT FY 2023 Results

In the fiscal year ended 31st December 2023, gross sales including taxes fell by 2.36% year-on-year to reach KES 41.2B on account of lower domestic sales. Net revenues declined 6.7% to KES 25.6B, the first decline recorded since FY 2017 when they dipped by 5.93%. Operating profit declined by 19.79% to reach KES 7.93B.

Macros Impact: The operating period was characterised by elevated interest rates, currency depreciation, reduced consumer spending, and tax increases leading to margins contracted. Relative to FY 2022, the operating margin fell by 5.10% to 31.0%, while the net margin edged lower by 3.40% to 21.8%. Taxes were up 5% in the year to KES 19.4B.

Dividend Slashed: The net profit for the year fell by 19.2% to reach KES 5.6B. Per Share Earnings declined 19.21% to KES 55.68 [FY 2022: KES 57] while the final dividend was slashed by 13.46% to KES 45 [FY 2022: KES 52], bringing the total FY 2023 dividend to KES 50. While the dividend has reduced in absolute terms, the dividend payout ratio was up by 7.10% to 89.8% in FY 2023. The firm's dividend yield stands at 11.9% as of last week’s closing stock price.

Share Price Reaction: The stock price closed the week at KES 419 from KES 425 before results release, representing a decline of 1.4% year-to-date and a decline of 5.84% over the last one year.

Links to the results and analysis.

February/March Pump Prices

Pump Prices Slashed: For the February/March pumping cycle, the Energy and Petroleum Regulatory Authority (EPRA) has slashed the prices of super petrol, diesel, and kerosene by KES 1 to KES 206.36, KES 195.47 and KES 193.23 per litre, respectively. For diesel, this is the second consecutive month the price has remained sub-KES 200 per litre, while for Kerosene, it is the 3rd consecutive month, and for super petrol, the price is yet to return to sub-KES 2022.

Subsidized Diesel: The price of Diesel was cross-subsidized with that of Super Petrol - with the Petroleum Development Levy Fund set to fund the subsidy - marking the 6th consecutive pumping cycle in which EPRA has intervened in pump price stabilization. Notably, under taxes and levies, the Petroleum Regulatory Levy for Super Petrol, Diesel and Kerosene was up 3X to KES 0.75 per litre from KES 0.25 in the January/February pumping cycle.

“The Price of Diesel has been cross-subsidized with that of Super Petrol while Kerosene has been fully subsidized. Oil Marketing Companies (OMCs) will be compensated for the under-recovery of costs from the Petroleum Development Levy (PDL) Fund.”

Find the full press release here.

Markets Wrap

NSE: In Week 6 of 2024, TransCentury was the top-performing stock, up 8.9% to close at KES 0.49. Sasini was the worst-performing stock, down 8.9% to close at KES 20.0. The NSE 20 gained 0.3% to close at 1,516.5 points, the NSE 25 rose by 0.3% to close at 2,415.5, and the NASI index decreased by 1.1% to close at 91.2 points. Equity turnover rose by 19.6% to KES 1B from KES 839.45M the prior week while bond turnover closed the week at KES 22.4B compared to the prior week’s KES 22.7B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.5539%, 16.7155%, and 16.9188% respectively. The total amount on offer was KES 24B with the CBK accepting KES 39.7B of the KES 42.7B bids received, to bring the aggregate performance rate to 177.79%. The 91-day and 364-day instruments recorded 654.07% and 52.78% performance rates, respectively.

Treasury Bonds: The IFB/2024/8.5 Infrastructure Bond received bids totaling KES 288.7B out of an offer amount of KES 70B - bringing the performance rate to a whopping 412.4%. The CBK accepted KES 240.9B - with the market weighted average rate for the bond standing at 18.62% and the coupon at 18.46%. Out of the KES 240.9B accepted, KES 70.49B was earmarked for redemptions and KES 170.46B was new borrowing.

KMRC Amortizes its MTN: Kenya Mortgage Refinance Company (KMRC) last week announced that the 2nd Principal Repayment and 4th Interest Payment for its Fixed Rate Medium Term Note (MTN) Programme, Tranche 1 (ISIN KE7000007760), is due on March 1, 2024. The bond, which was issued on March 4, 2022, will have its interest paid at a fixed rate of 12.5%. A partial redemption will be made as per the Pricing Supplement to the bondholders registered as of the close of business on 15th February 2024.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2024 fell the most week-on-week, down by 91.80 bps to 8.916% while KENINT 2034 fell the least, down by 15.50 basis points to 10.368%. The average week-on-week change stood at -56.40 bps.

KENINT 2034 rose the most on a year-to-date (YTD) basis, appreciating by 27.90 bps while KENINT 2024 rose the least at -361.40 bps.

Prices rose across the board week-on-week, with KENINT 2028 rising the most at 2.9% to 93.314. Year-to-date, KENINT 2048 fell the most, depreciating by 2.1% to 81.371, while KENINT 2028 appreciated the most at 2.1% ro 96.122, followed by KENINT 2024 at 1.9% to 99.291.

Markets Gleanings

🏛️ | FY 2024/2025 Budget Policy Statement | Last week, the government released the draft Budget Policy Statement for 2024/2025. Here are a few key takeaways:

Budgetary allocations: In the 2023 Budget Policy Statement (BPS) the total budget for 2024 is projected at KES 4.14T with the allocation across National Government, Consolidated Fund Services, and County Governments standing at KES 2.5T, KES 1.2T, and KES 391B respectively.

Economic Expansion: The economy grew 5.6% in the first three quarters of 2023. It’s projected to expand by 5.5% in 2023 and 2024, up from 4.8% in 2022. This growth is driven by the services sectors, a rebound in agriculture, and government initiatives.

Revenue and Expenditure: Ordinary revenue is projected to increase by 12.3% to KES 2.95T or 16.4% of GDP in FY 2024/2025 [FY 2023/24: KES 2.6T]. The government’s expenditure as a share of GDP is projected to decrease from 24.2% in FY 2023/24 to 23.2% in FY 2024/25, with the overall expenditure and net lending expected to rise from KES 3.9T to KES 4.2T.

Fiscal Deficit: According to the 2024 Budget Policy Statement, the implementation of reforms on revenue and expenditure is anticipated to reduce the fiscal deficit, including grants, from KES 785B ( 4.9% of GDP) in the fiscal year 2023/24 to KES 771B ( 3.1% of GDP) in the fiscal year 2027/28.

Pending Bills: As of 17th April 2023, Counties had settled KES 23.96B of the KES 48.13B eligible bills verified as of December 2021. The gross amount of pending bills rendered ineligible due to lack of documentation stood at KES 108.05B as of December 2021.

Public Debt: As of September 2023, the total public and publicly guaranteed debt stock stood at a gross Ksh 10.58T, which is equivalent to 65.6% of the Gross Domestic Product (GDP). This figure indicates that the government has exceeded the legal borrowing limit of KES 10.0T by KES 585.1B, as outlined in Section 50 (2) of the Public Finance Management (PFM) Act, 2012.

You can find the entire statement here.

📄 | SACCOs FY 2023 Results | Last week, more Saccos reported their FY 2023 results:

Kenya National Police DT SACCO: In the financial year ending 31 December 2023, the Kenya National Police DT SACCO reported a net profit of KES 2.5B, marking a 12.9% increase year-on-year. The SACCO offered an interest rate of 11% on member deposits and a dividend rate of 17% on member share capital.

Nation Deposit-Taking SACCO: In the 2023 fiscal year, Nation Deposit-Taking SACCO, recorded a surplus of KES 116.8M, a 3.8% increase from the previous year. The SACCO also enhanced its returns to members, raising the interest rate on deposits to 11% from 9.5% in 2022, and increasing the dividend on share capital to 20% from 18% in 2022.

💼 | Standard Group’s Auditor Change | Last week, The Standard Group PLC announced a change in its auditors. Grant Thornton LLP will assume the role of the company’s External Auditor from January 31, 2024, succeeding PwC Kenya.

📜 | Retirements Benefits Regulation Amendments | Last week, the Retirements Benefits Authority and the Institute of Certified Public Accountants of Kenya (ICPAK) held a joint meeting to discuss amendments to retirement benefits regulations. The key takeaways include:

Retirement Benefits Schemes will continue to prepare financial statements per International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS), specifically in compliance with IAS 26.

Amendments to the provisions relating to the determination of net interest to be declared and credited to members focus on disclosure requirements by trustees to Members

The net return declared and credited to members’ accounts should exclude unrealized gains and losses from changes in the fair value of debt instruments (bonds) held by the scheme at the close of the financial year.

The report by trustees to members shall include a memorandum detailing the basis of the determination of the net return.

🍺 | Diageo One Roll Out | Kenya Breweries Limited (KBL) is scaling up the rollout of a new technology platform, Diageo One, that will enable retailers to place orders online for products from their distributors. The platform has been on trial for the last year and is now being scaled wider for more distributors and retailers across the country to use.

✔️ | Sanctioned Privatizations | Last week, the Cabinet approved the proposed privatization of the Development Bank of Kenya (DBK) which has fully transitioned into a deposit-taking commercial bank regulated by the Central Bank of Kenya. The Cabinet also sanctioned divestitures in non-strategic commercial state-owned enterprises including Kenya Safari Lodges and Hotels Limited, Golf Hotel Limited, Sunset Hotel Limited, Mt. Elgon Lodge Limited, and Kabarnet Hotel Limited.

🛠️ | VAT Return Filling Simplified | The Kenya Revenue Authority has updated its notice on the simplification of VAT return filling. Pre-filled VAT returns with KRA’s available tax information will now start in February 2024. This change aims to ensure all input VAT claims are supported by valid electronic tax invoices issued through TIMS/eTIMS. Claims not validated through these systems or against existing customs import declarations will be disallowed.

🚌 | Roam Buses Secures Funding | Kenyan electric mobility firm, Roam, has secured USD 24M in a Series A funding round led by Equator Africa. This funding is expected to boost Roam’s mission to revolutionize transportation in Africa with its electric motorcycles and buses. Roam’s unique offering includes battery ownership for riders, reducing costs, and enabling longer distances.

💵 | Tanzania OMCs Face Dollar Shortages | In Tanzania, Oil Marketing Companies (OMCs) are grappling with significant dollar challenges. The Energy and Water Utilities Regulatory Authority (EWURA) used a forex rate of 2,574 for the Cap Price publication on February 7, 2024, which is considerably lower than the market rate OMCs are encountering.

🇿🇲 | Zambia Raises Interest Rates | The Bank of Zambia raised its key interest rate by 1.5% to 12.5% to combat rising inflation driven by a weakening currency and high food prices. Inflation rose to an average of 12.9% in Q4 2023, up from 11.0% in Q3, and further increased to 13.2% in January 2024. The MPC’s current forecast shows inflation moving further away from the 6-8% target band.

🇳🇬 | Nigeria’s inflation | Nigeria’s inflation rate hit a near 28-year high of 29.9% in January 2024, exceeding expectations and putting pressure on the Central Bank to raise interest rates at its February meeting. The annual inflation rate rose to 29.9% last month, a jump from 28.9% in December, as reported by the National Bureau of Statistics.