👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Co-operative Bank Q1 2025 results, TPS Eastern Africa FY 2024 results, and the completion of I&M share allotment to EAGH.Co-op’s Q1 2024 Results

Co-operative Bank reported a 5.3% year-on-year increase in net profit to KES 6.9B for Q1 2025, with pre-tax profit rising 6.8% to KES 9.6B. Growth was supported by a 21.7% jump in net interest income to KES 14.2B, driven by improved returns on both customer lending and government securities. Interest income from loans rose 12.2% to KES 13.9B, while returns from government securities increased 12.8% to KES 7.1B.

The loan book remained broadly flat, expanding by just 1.7% to KES 384.6B. Investment in government securities rose 19.9% to KES 242.1B, reflecting a continued shift towards lower-risk assets. Customer deposits grew 9.0% to KES 525.2B, while interest expenses rose by a modest 3.3% to KES 7.3B. This helped support margins despite a 16.5% increase in operating expenses to KES 9.6B, largely driven by higher staff costs (+10.4%) and other operating costs (+28.5%).

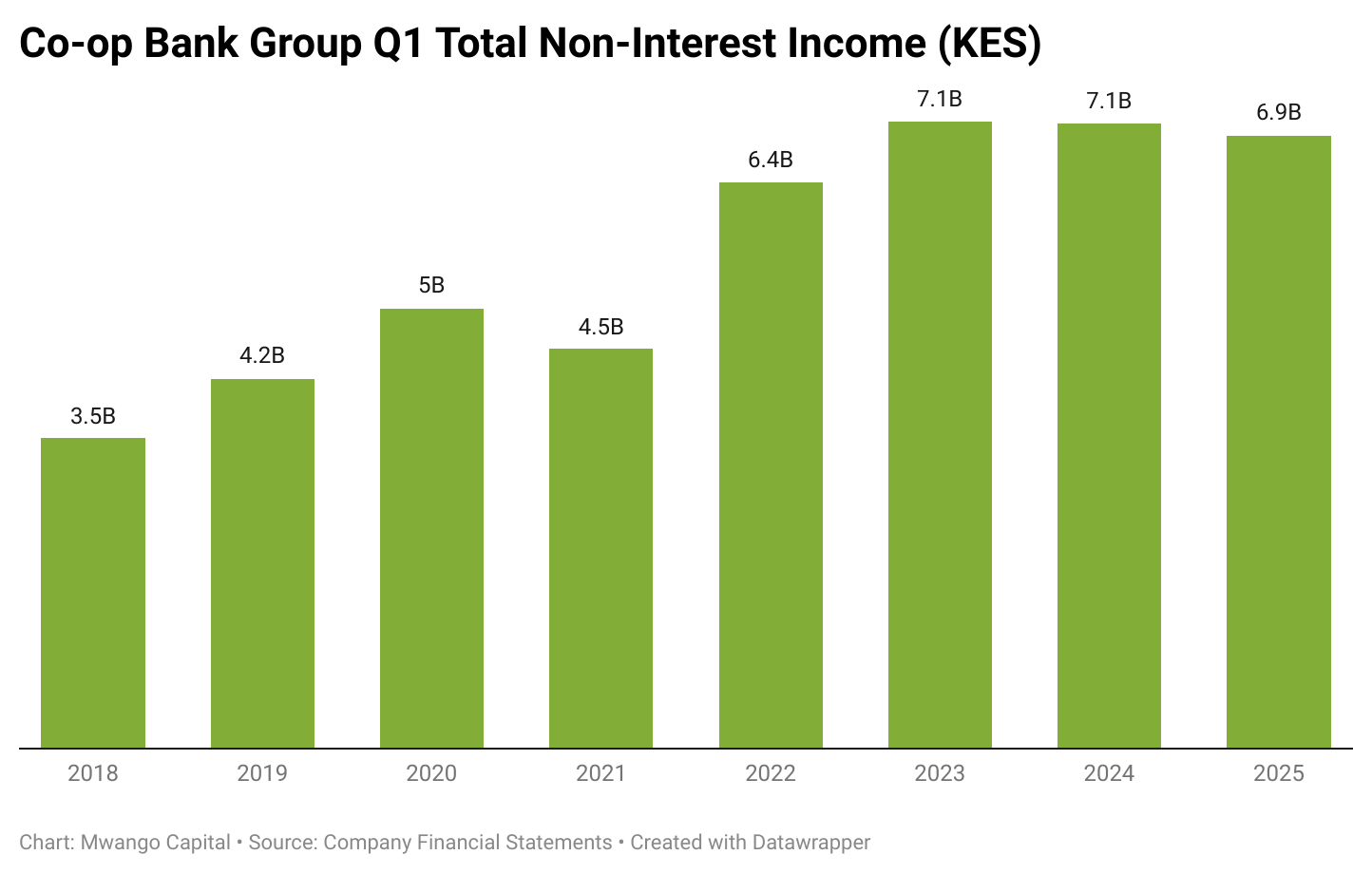

Non-Interest Income Slips on FX: Group non-interest revenue declined 1.9% to KES 6.9B, driven by a 44.6% drop in foreign exchange trading income to KES 800.6M following reduced volatility in currency markets. Commissions on loans and advances fell 4.4% to KES 2.8B, while other fees and commissions rose 19.2% to KES 3.1B. Other income increased 81.1% to KES 316.0M.

Asset Quality: Co-operative Bank’s gross non-performing loans rose by 11.4% to KES 74.1B in Q1 2025, while loan loss provisions increased by 32.6% to KES 2.1B. This compares to an industry-wide NPL ratio of 17.2% as of February. Net non-performing loans fell by 3.6% to KES 26.5B, pointing to improved provisioning coverage during the period.

Find our analysis of the results here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

TPS Eastern Africa (Serena Hotels) FY 2024 Results

FX Gains Lift Earnings: TPS Eastern Africa (Serena Hotels) reported a 5.2% increase in revenue to KES 10.2B for the full year ended December 2024. EBITDA declined 3.2% to KES 2.4B, with operating cash flow down 21.5% to KES 1.76B, amid elevated operating costs and inflationary pressures.

However, net profit jumped 188% to KES 1.32B, driven largely by a non-cash unrealised foreign exchange gain of KES 833M following the appreciation of the Kenya shilling against the US dollar. This compares to a loss of KES 1.03B in 2023 on the group’s US dollar-denominated liabilities. EPS rose 218% to KES 4.54, while cash and equivalents declined 12.2% to KES 695.9M. Total assets fell slightly to KES 20.19B (-1.5%).

Dividend Reinstated After Five Years: The board has recommended a final dividend of KES 0.35 per share for FY 2024, marking the first payout since 2018. The results were published two weeks past the regulatory deadline, following an audit review by KPMG Kenya that required restatements of prior-year accounts. The adjustments mainly related to lease accounting under IFRS 16.

Despite the delay, the Group noted that all subsidiaries reported positive EBITDA and that US dollar revenues remain adequate to meet upcoming foreign currency obligations.

Find our analysis of the results here.

Takeaways from Banks’ FY 2024 Reports

NCBA Group:

Regional income rose to KES 9B in FY24, up 157% since FY20. Regional units now contribute 14% of group income, nearly 1 in every 7 shillings earned

Profit after tax increased fivefold over five years, from KES 4.6B in 2020 to KES 21.9B in 2024

Non-performing loan (NPL) ratio improved from 15.8% in 2021 to 11.2% in 2024.

Cost-to-income ratio rose from 42.0% to 51.3% over the same period

Return on equity (ROE) increased from 6.6% in 2020 to 21.7% in 2024, peaking at 24.1% in 2023

Stanbic Bank: In January 2025, the Bank of South Sudan requested that Stanbic convert its South Sudan branch into a fully locally incorporated subsidiary. Talks on implementation are ongoing.

DTB Group: Finance Director Alkarim Jiwa increased his stake to 474,000 shares in 2024, up from 76,260 in 2023, raising his ownership to 0.2%

Markets Wrap

NSE Weekly Recap: Week 20 (9–16 May 2025)

Top Gainer: Sanlam Kenya +26.9% to KES 7.46

Top Loser: TPS Serena –6.5% to KES 14.30

NASI: +5.8% to 134.3

Market Capitalisation: KES 2.11T (+5.9%)

Equity Turnover: KES 3.25B (+81.4%)

Bond Turnover: KES 44.2B (+23.7%)

Foreign Participation: 40.3% of total turnover

Net Foreign Inflow: KES 246.1M

Treasury Bills: Treasury bills were oversubscribed last week, with a subscription rate of 179.69%, down from 219.45% the previous week. Investors submitted bids totaling KES 43.1B, and the Central Bank of Kenya (CBK) accepted KES 37.4B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 1.20, 1.80, and 0.76 basis points to 8.3699%, 8.5831%, and 10.002%, respectively.

Treasury Bonds: The CBK’s re-opened 20-year bond FXD1/2012/020 received KES 54.39B in bids against KES 30B offered, with KES 43.52B accepted at an average yield of 13.65%. Proceeds will cover KES 14.23B in redemptions and raise KES 29.29B in new borrowing.

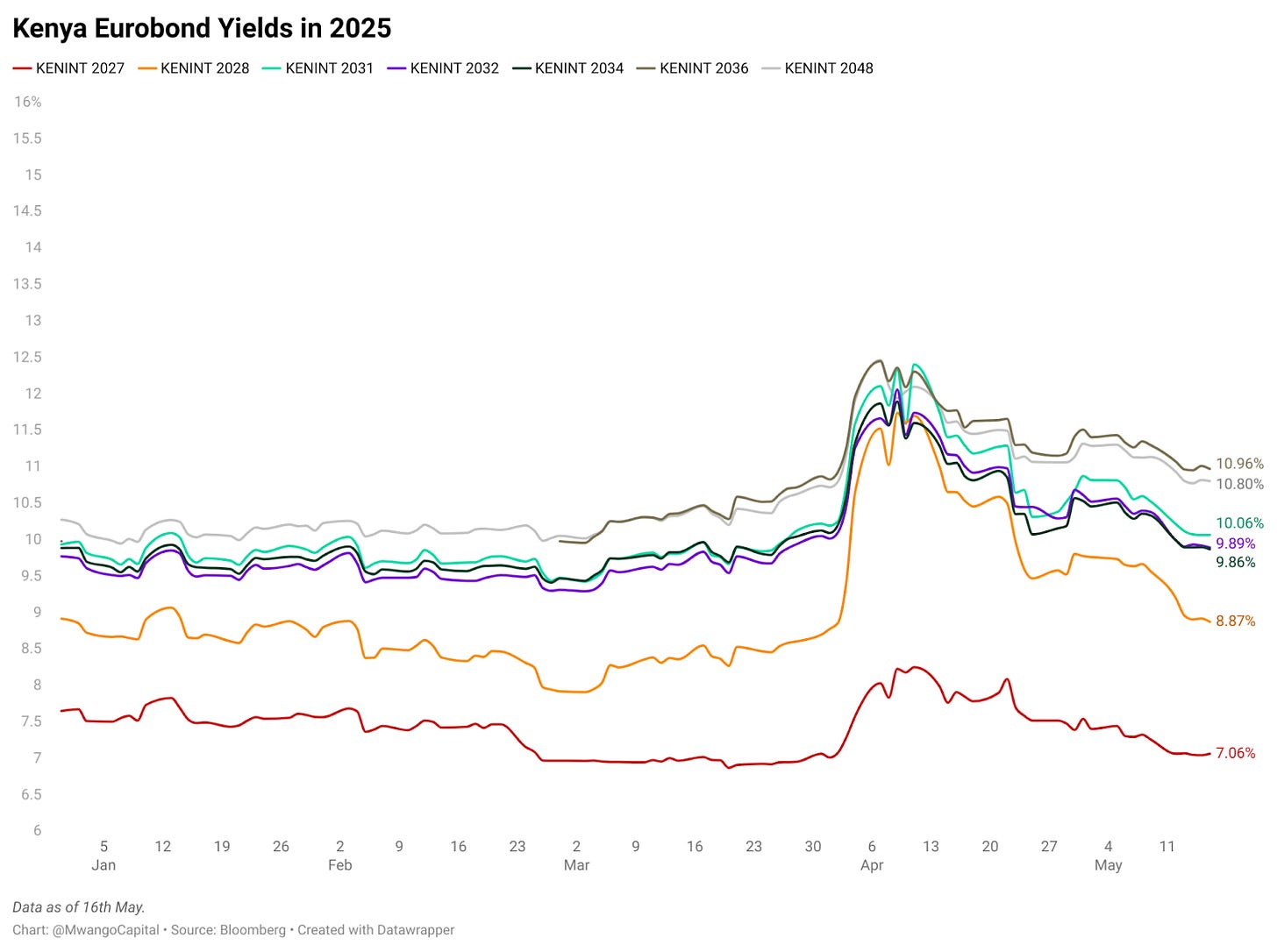

Eurobonds: Last week, yields on Kenya’s seven outstanding Eurobonds declined, led by the KENINT 2028 bond, which dropped by 69.40 basis points to 8.865%. The KENINT 2032 bond followed, falling 48.70 basis points to 9.885%. On average, Eurobond yields declined by 42.21 basis points week-on-week.

Market Gleanings

⛽| May/June Fuel Cycle | EPRA has announced that fuel prices will remain unchanged from May 15 to June 14, 2025. Petrol will continue retailing at KES 174.63 per litre, diesel at KES 164.86, and kerosene at KES 148.99.

✔️| Standard Group Gets Rights Issue Nod | The Capital Markets Authority (CMA) has approved Standard Group PLC’s plan to raise KES 1.5B through a rights issue, allowing the company to issue discounted shares to existing shareholders. The funds are intended to help reduce debt and improve the company’s financial position amid a shift toward digital operations. Shareholders approved the proposal in September 2024. CMA noted that the company met the necessary disclosure requirements under capital markets regulations.

🤝| I&M Completes Share Allotment to EAGH | I&M Group PLC has completed the allotment of 86.5 million new ordinary shares to East Africa Growth Holding (EAGH), following shareholder approval at a General Meeting held on 10 December 2024. The shares have been listed on the Nairobi Securities Exchange in line with the Subscription Agreement. The new shares, priced at KES 48.42 each, represent about 4.97% of the Group’s expanded share capital. This follows EAGH’s earlier acquisition of a 10.13% stake in I&M from British International Investment in early 2024. With the latest transaction, EAGH’s total stake in I&M Group now stands at 14.6%.

💰| Burn Secures USD 5M | BURN Manufacturing has secured USD 5M from EDFI Management Company via the EU-funded ElectriFI initiative to expand distribution of its ECOA Induction Cooker in Kenya. The funding is expected to support adoption among over 100,000 households, offering an alternative to charcoal, wood, and LPG. The cooker features mobile-enabled Pay-As-You-Cook (PAYC) technology, aimed at making electric cooking accessible through small installment payments.

🔴| Ogilvy Africa Ends 15-Year Partnership with Airtel | WPP Scangroup has announced that its subsidiary Ogilvy Africa has ended its nearly 15-year partnership with Airtel Africa. While details of the separation remain confidential, the company acknowledged the long-standing collaboration. Airtel Africa has since appointed Publicis Groupe Africa as its integrated marketing partner across 12 markets.

⚡| Umeme Extends Dispute Talks | Umeme has extended its good faith negotiations with the Government of Uganda until 20 May 2025, following the expiry of the initial 30-day period on 10 May. The discussions focus on the Buy Out Amount under the Concession Agreement. If no agreement is reached, the matter will proceed to arbitration in London. The Uganda Securities Exchange has directed the company to publish its financial statements by 31 May 2025, regardless of the negotiations' outcome. Meanwhile, the Nairobi Securities Exchange has extended the suspension of trading in Umeme Ltd shares by 30 days to 12 June 2025.

💰| Equity Group and AGF USD 500M Guarantee Facility | Equity Group Holdings and the African Guarantee Fund (AGF) have signed a USD 500M guarantee facility to support increased lending to micro, small, and medium enterprises (MSMEs) across Kenya, Uganda, Rwanda, Tanzania, and the DRC. The facility is intended to unlock up to USD 1B in loans, with a focus on women-owned, youth-led, and green businesses.

💰| EIB and Family Bank Sign EUR 100M SME Lending Deal | The European Investment Bank’s development arm, EIB Global, and Kenya’s Family Bank have signed a EUR 100M financing agreement to expand lending to small and medium-sized enterprises (SMEs) and mid-sized firms in Kenya. EIB will provide EUR 50M, matched by Family Bank, with at least half of the funds earmarked for women-owned or led businesses, and 30% targeting youth entrepreneurs.