👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover TransCentury’s receivership and Kenya’s FY 2023/2024 budget.First off, enjoy a dose of our weekly business news in memes.

This week’s newsletter is brought to you by:

Co-operative Bank of Kenya. Co-operative Bank of Kenya is providing reduced-interest mortgages of 9.9% on a reducing-balance basis, enabling you to borrow up to Kes 8 million to buy or build a home in any part of Kenya.

End of the Road

Bye-Bye: Equity Bank Kenya has placed TranscCentury PLC in receivership with East African Cables being put in administration. They will both be run by PricewaterhouseCoopers as the bank seeks to recover some of the loans it pumped into the two companies.

Delayed Books: It has been clear for a while that the two companies have been having issues. For instance, Transcentury’s H1 2022 financial books were released in May this year. The company seems to have failed to agree with Equity Bank and other lenders to restructure loans worth KES 5.2B. In its FY 22 report, East Africa Cables noted that it had commenced engagements with the lenders to restructure the debt.

Failed Rights Issue: Earlier this year, TransCentury had a KES 2.06B rights issue which recorded a subscription rate of 40%. This is the lowest subscription rate recorded in a rights issue at the NSE in data dating back to 2008. Kuramo Capital was a major player here. Also, Shaka Kariuki, the Co-CEO of Kuramo Capital and the board chair of Transcentury was appointed the Chair of the Competition Authority earlier this year.

This is what Sunil Sanger, Managing Director at Orion Advisory Services, had to say about the development:

"Transcentury (TCL) and its subsidiary EA Cables have been running on negative net worth since 2017. TCL has been over 12 months late in declaring its results for the last few years. The writing has been on the wall for some time now. It is surprising that the companies continue to be listed on the NSE, and indeed that TCL was permitted to have a rights issue under these circumstances."

Pain Ahead as Budget is Read

Debut Budget: The Treasury Secretary, Prof Njuguna Ndung’u, last week presented the government's maiden budget. For FY 23/24, the total revenues, including Appropriations in Aid, are projected at KES 2.9T with expenditures projected at KES 3.7T. This brings the fiscal deficit to KES 718B (4.4% of GDP). KES 586.5B (81.7%) of debt will be sourced domestically while KES 131.5B is set to be sourced externally.

“The fiscal consolidation plan targets to gradually reduce the fiscal deficit including grants from 6.2% of GDP in the FY 2021/22 to 5.8% of GDP in the FY 2022/23 to 4.4% of GDP in the FY 2023/24 and further to 3.6% in the FY 2026/27.”

Cabinet Secretary to the National Treasury, Njuguna Ndung’u

Revenue-Expenditure Breakdown: The budget will be targeting a gross revenue of KES 2.9T in FY 2023/2024 with an ordinary revenue target of KES 2.6T (89.7% of the total revenue target and 15.8% of GDP). Gross expenditure for the fiscal year has been set at KES 3.7T (22.6% of GDP). Recurrent expenditures account for the largest share at KES 2.5T while the outlays for development spending and Equitable Share to Counties are at KES 713.3B and KES 385.4B, respectively.

Key Proposals: Some of the new proposals with major implications include:

Reduction of excise duty rate on imported fish,

Zero rating of LPG,

Removal of VAT on exported services,

Increase in VAT of petroleum products from 8% to 16%,

Increase of turnover tax from 1% to 3% (upper threshold from KES 50M to KES 25M).

Across East Africa: Regionally, excluding Kenya, Tanzania presented the largest budget at $19.3B (TSHS 44.38T), followed by Uganda at $13.9B (USHS 52.7B) budget. Rwanda’s budget was the lowest in absolute terms at $4.4B (RWf 5.03T). In terms of growth from FY 2022/2023 budgets, Uganda’s budget expanded the most at 9.6%, Tanzania’s at 7%, and Kenya’s and Rwanda’s at 6% and 5.6%, respectively. On an average basis, the budgets expanded by 7.2%.

You can find a copy of Kenya’s budget here.

Markets Wrap

NSE: In Week 24 of 2023, Uchumi was the top-performing stock on the Nairobi Securities Exchange, unchanged from last week, appreciating by 15% to KES 0.23. Eveready PLC was the worst-performing stock, falling 17.3% to KES 1.34. The NSE 20 index fell by 1.8% to 1,564.7 points while the NSE 25 index was down by 3.8% to 2,634.7 points. The NSE All Share Index (NASI) depreciated by 5.2% to close above 100.4 points. Equity turnover was up 169.1% to KES 1.7B while bonds turnover fell by 46.4% to KES 3.9B.

Treasury Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 11.64%, 11.649%, and 11.734% respectively. The total amount on offer was KES 24B with the CBK accepting KES 10.6B of the KES 22.6B bids received, to bring the aggregate performance rate to 94.2%. The 91-day and 364-day instruments recorded 454.86% and 17.46% performance rates, respectively.

Exceptional IFB: With the government seemingly broke and likely not to hit the domestic borrowing targets, last Wednesday’s Infrastructure Bond auction presented the perfect opportunity for redemption. The 7-year IFB1/2023/007 bond, which sought to raise KES 60B, got a massive 367.5% performance rate. The total bids came in at KES 220.5B with the government accepting a massive KES 212.4B. The weighted average rate of accepted bids was 15.837%. Two days later, the National Treasury issued a rare press release stating they had, as of 16th June 2023, hit KES 419.5B in domestic borrowing in FY 22/23 against a target of Kshs. 425.11B.

Eurobonds: Last week, the yields fell on a week-on-week basis across the 6 outstanding papers.

KENINT 2024 yield fell the most - by 203.4 basis points to 12.062% while KENINT 2048 fell the least, by 25.5 bps to 10.884%. On aggregate, yields were down 80.73 bps week-on-week.

All yields were up on a Year-To-Date (YTD) basis, with the exception of KENINT 2024, which fell by 54.1 bps. KENINT 2034 led gains, appreciating by 34.1 bps to 9.996%, while at the lower end, KENINT appreciated by 6%. The average increase was 10.75 bps.

KENINT 2034 led price gains week-on-week, rising by 3.3% to 76.175, while KENINT 2024’s price was up the least at 2.1% to 95.208. On a YTD basis, KENINT 2024 and KENINT 2027 prices rose by 2.1% and 3.0% respectively to 95.208 and 90.377, while the other instruments recorded an average decline of 0.9%.

Market Gleanings

🗳️ | Buyback the Eurobond? | Kenya’s external debt service will almost double from KES 242.1B to KES 475.6B in the FY 2023/24 driven by the redemption of the $2.0 billion Eurobond. The National Treasury is already seeking a lead manager to advise the Government on liability management options toward the resolution of the Eurobond 2024. Treasury PS Chris Kiptoo has stated that 6 lead arrangers (out of 16 selected) have been issued with Request for Proposal (RFP). One of the options Kenya has in dealing with the maturing $2B bond next year includes a potential buyback of a part of the bond:

“I wish to assure Kenyans and investors that our fiscal position remains strong and the Government remains committed to meet all maturing obligations, as and when they fall due, including the maturing Eurobond.”

Treasury CS, Prof. Njuguna Ndung’u

“We have many options. At this point, we don’t have a position.”

National Treasury PS, Chris Kiptoo

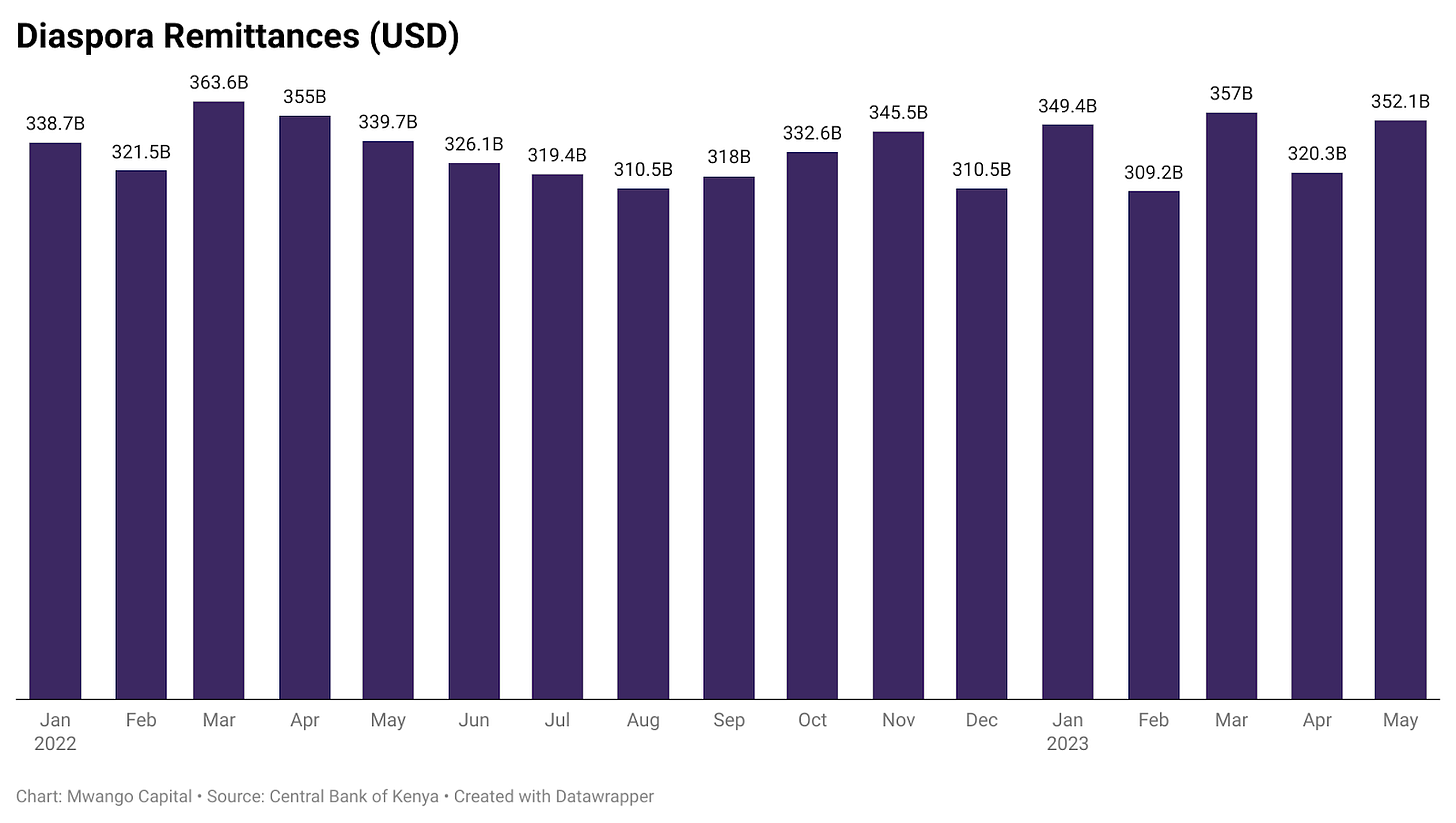

🗳️ | Diaspora Remittances | In May 2023, remittances totalled $ 352.1M, up 3.7% year-on-year. On a month-on-month basis, the remittances increased by 9.9% with the cumulative 12-month remittances to the month ending May 2023 reaching $3.997B.

⛽ | June/July Pump Prices | EPRA has reduced the prices of super petrol and diesel by KES 1.12 and KES 0.66, to KES 182.04 and KES 167.28 per litre, respectively. The price of kerosene increased by KES 0.35 to KES 161.48 per litre. The mean monthly exchange rate of the USD-KES as quoted by EPRA stood at KES 141.39 in May from KES 138.96 in April. As of March 2023, murban crude oil prices were down 12.5% in the year while the mean exchange rate as quoted by EPRA depreciated by 8.2% over the same period.

💰 | Hustler Fund Update | As of 15th June 2023, KES 30.8B had been disbursed through the Hustler Fund, with the total number of borrowers standing at 16.07M. Of these, repeat borrowers stood at 7.1M. The aggregate number of transactions done over the platform stood at 43.5M. Mandatory savings in the Fund stood at KES 1.5B while voluntary savings totalled KES 17M.

🗳️ | State of The Coffers | As at 31st May 2023, actual tax revenue stood at KES 1.74T, while non-tax revenue stood at KES 71.1B against revised estimates of KES 2.1T and KES 83.7B, respectively. Domestic borrowing stood at KES 464.7B (52.4%) out of a KES 886.5B target. External loans and grants stood at KES 311.8B (59.9%), against a target of KES 520.6B. The National Treasury this week released an update on borrowing numbers in the country:

“The FY 2022/23 actual net domestic cumulative borrowing as of 16th June 2023 stood at Kshs. 419.46 billion against a target of Kshs. 425.11 billion (98.7% performance). The total external disbursements amount to Kshs 504.37 billion against a target of Kshs. 599.34 billion. Therefore, the Net Foreign Financing stood at Kshs. 267.69 billion against a target of Kshs. 362.76 billion.”

The Public Debt Management Office, The National Treasury, and Planning

🗳️ | Mic Drop | Last Saturday was the last day in the office for the 9th Governor of the Central Bank of Kenya Dr. Patrick Njoroge. It was also the last day in office for CBK Board Chair Mohammed Nyaoga. The incoming Governor is Dr. Kamau Thugge though no appointment has been made for a new Chair yet:

“This is not a goodbye as I leave CBK, this is a thank you. Thank you for believing in our vision of the financial sector and pursuing it with courage and vigour. Thank you for your patience. But most of all, thank you for your encouragement and friendship.”

Outgoing CBK Governor, Dr. Patrick Njoroge