👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the recently adjusted fuel prices and subsidies, Equity acquiring Spire Bank assets, and highlights from president Ruto's inauguration speech.First off, enjoy our weekly business news in memes brought to you by Mwango Capital:

Ruto Transition

Kenya’s Fifth President: On Tuesday last week, Dr William Samoei Ruto was sworn into office as Kenya’s fifth president. Below are key highlights from his inauguration speech.

Health and Insurance: President Ruto has pointed out that contributions to the National Health Insurance Fund (NHIF) will be graduated and based on income levels. In a function that brought together legislators allied to the Kenya Kwanza Alliance last week, the President pledged to elaborate on his administration’s Universal Health Care Plan.

“We will be taking you through our Universal Health Coverage plan so that you also understand what we need to do so that we can actualize the commitment we made to the people of Kenya on matters to do with Universal Health Coverage. How are we going to make it 300 Shillings for the lowest category and how are we going to graduate it so that instead of being a fixed amount, people contribute in accordance with their incomes.”

President of Kenya, William Samoei Ruto

Cost of Credit: The incoming leadership intends to reform the credit score system to provide borrowers with an opportunity to manage their creditworthiness. The headway achieved here will help accelerate the adoption and use of risk-based lending among banks.

Diaspora Focus: He pledged to elevate diaspora issues at a ministry level and set up a mechanism for public participation by the diaspora.

Institutional Financial Independence: The National Treasury has designated the Inspector General of Police as the accounting officer of the National Police Service. Previously, the mandate was within the Office of the President. President Ruto has also pledged to scale up the Judiciary’s allocation by an additional KES 3B annually for the next 5 years.

Good to Know: Ruto is taking over the Presidency at a time when public finances are in a dire state. According to the latest disclosures by the National Treasury, the government’s opening balance for September 2022 is KES 93.7M. The opening balances for July and June were KES 70.9M and KES 616.55M, respectively - the lowest figures recorded since July 2018.

Access a copy of his inauguration speech here.

Fuel Prices and Subsidies

EPRA Price Reviews: The Energy and Petroleum Regulatory Authority (EPRA) released pump prices for the September/October cycle in which subsidies on diesel and kerosene were retained but lifted on super petrol. For the coming month, motorists will pay KES 179.3, KES 165, and KES 147.94 per litre of super petrol, diesel, and kerosene, respectively.

Unsustainable Subsidy: In his inauguration speech, President William Ruto pointed out that the interventions in place to combat the costs of transport were not sustainable.

“On fuel subsidy alone, the taxpayers have spent a total of Ksh144 billion, a whooping Ksh 60 billion in the last 4 months. If the subsidy continues to the end of the financial year, it will cost the taxpayer Ksh 280 billion, equivalent to the entire national government development budget.”

President of Kenya, William Samoei Ruto

IMF Demands: In the third review under the Extended Arrangement under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) that saw Kenya unlock a $235.6M funding line, one of IMF’s requests was for the completion of a review of the fuel pricing mechanism geared towards progressive elimination of the fuel subsidy within H1 FY 2022/23.

“The authorities intend to continue gradually realigning domestic to global fuel prices in FY2022/23 so as to eliminate the fuel subsidy by October 2022. Domestic fuel prices should be gradually realigned to global levels to eliminate fuel subsidies in H1 FY2022/23 while avoiding abrupt moves which could have socially destabilizing effects.”

The removal of the petrol subsidy is an indication that the government will follow through on its agreement with the IMF. After petrol, the removal of subsidies on diesel and kerosene is next. The National Treasury is set to save an estimated KES 9.49B from the partial withdrawal of the subsidies.

Agricultural Subsidies: For the short rain season, Ruto’s government is planning to make available to farmers 1.4M bags of fertilizer at KES 3.5K for a 50kg bag down from KES 6.5K. The production of maize, Kenya’s staple food, is projected to be below 30M bags this year against the normal production of 40M bags. In August, the unga subsidy cost the government KES 7B. By subsidizing the cost of fertilizer, Ruto’s administration is shifting from consumption subsidy interventions toward production subsidy interventions.

“The unga subsidy, for one month the taxpayer was asked to give 7 Billion Shillings. If we had spent 7 Billion Shillings on fertilizer, it would be a very different ballgame. We are intervening on fertilizer for the short rains, 1.4 Million bags. We are intervening for tea fertilizer, that’s another 1.7 Million bags for KTDA. It is costing us less than the subsidy of unga that is for one month and yet the subsidy we are providing is going to reach close to half a million farmers. That’s the difference.”

President of Kenya, William Samoei Ruto

Equity to Acquire Spire Assets

Scoop: Equity Bank, a subsidiary of Equity Group, has entered into an Assets and Liabilities Purchase Agreement with Spire Bank for the purchase of certain assets and liabilities. The transaction will see Equity take on Spire Bank’s 20K existing depositors with a total deposit of KES 1.322B and ~3,700 loan customers with a net loan book of KES 945M.

“We feel honoured to extend a hand of partnership to teachers with whom we have had a long and strong relationship. With the 20,000 teachers we will be inheriting from Spire bank, Equity will become home to over 100,000 teachers spread throughout the country and accessing our services through our branches, agent network, and digital banking channels. Currently, Equity processes a total monthly remittance of Kshs 1.8 billion in teachers’ salaries. 43,000 teachers have borrowed loans valued at Kshs 33 billion with a monthly repayment of Kshs.800 million.”

Equity Group CEO, James Mwangi

Transaction Details: The initial cash consideration is about KES 468M, even though the final amount paid will vary to reflect changes in Spire Bank’s deposits and loan book up to the date of completion of the transaction.

“The estimated cash consideration specified in the Agreement is KES 468 million although the final amount paid will vary to take into account changes in Spire Bank’s customer deposits and loan book up to the completion date.”

Spire Bank Financials: In the year to June 2022, the loan book shrank by 25% to KES 1.7B. Deposits fell by 63% to reach KES 1.938B from KES 5.176B in June 2021. The bank recovered from a KES 2.3B negative equity position to post KES 9.55M in book value in June 2022. Gross Non-Performing Loans (NPLs) exceeded the performing loan book by KES 896M. On its income statement, the net loss narrowed by 21% to KES 403.03M.

Stumbling Block?: Last week, a board member at Spire Bank resigned, leaving the Board without the necessary quorum of 5 required to ratify the deal. Spire Bank’s Board has had a high turnover with two of its members resigning this year.

Impact: The acquisition saves Spire Bank from collapse after failed recapitalization attempts and relieves Mwalimu Sacco’s books of a bad bank. Post-transaction, Spire Bank will cease to provide banking services.

Find our write-up on the transaction here.

In other banking news:

NCBA ESG Moves: Kenya’s third-largest bank by assets, NCBA, is planning to venture into carbon credit banking and the financing green conversion of buildings. The green building venture will see the bank extend loans to clients to either retrofit or design buildings that emphasize energy and water-saving. In August, NCBA injected an initial KES 2B - ~0.8% of its loan book - into asset finance for electric vehicles.

Credit Bank Sells Stake: The shareholders of Credit Bank are selling a 20% stake in the lender to ShoreCap III, a multinational Private Equity fund managed by US-based Equator Capital Partners. Credit Bank has 16 branches country-wide and a KES 25.97B asset base as of December 2021. In December 2016, Equator Capital Partners invested KES 600M through its ShoreCap II Fund into Jamii Bora Bank for an equity stake of 15% at a 1.3X price-to-book valuation. In 2020, The Co-operative Bank acquired 90% of the issued share capital of Jamii Bora Bank at KES 1B.

Barclays To Offer Private Banking: After the lender exited its remaining 7.4% stake in South Africa’s Absa Group for $620M last month, the bank is expanding private-banking services in Africa targeting the continent’s $3T high net-worth market.

Debt Markets

Treasury Bills Report: In the short-term debt markets, the Central Bank of Kenya (CBK) accepted KES 17.368B out of an offer of KES 24B, an acceptance rate of 72.4%. Yields on the 91 Days, 182 Days, and 364 Days papers were 8.950%, 9.615%, and 9.913%, respectively, compared to, 8.910%, 9.559%, and 9.915% in the previous auction.

Bond Market Report: In the Treasury Bond market, the CBK received KES 46.1B in bids, out of which, it accepted KES 39B from a KES 50B target. The vehicles were reopened FXD1/2022/10 and FXD1/2022/15. The performance rate of FXD1/2022/10 was 57.03%, the highest recorded on a reopened instrument since May. In a pre-auction note, AIB AXYS analysts had expectations of improved subscription rates.

“We expect an oversubscription largely on account of improved liquidity in the money markets coupled with the passing of the cloud of uncertainty following the conclusion of the election petitions and subsequent swearing-in. Additionally, improved liquidity in the last few weeks, as observed in two weeks of T-Bill oversubscription, is likely to drive higher subscription rates.”

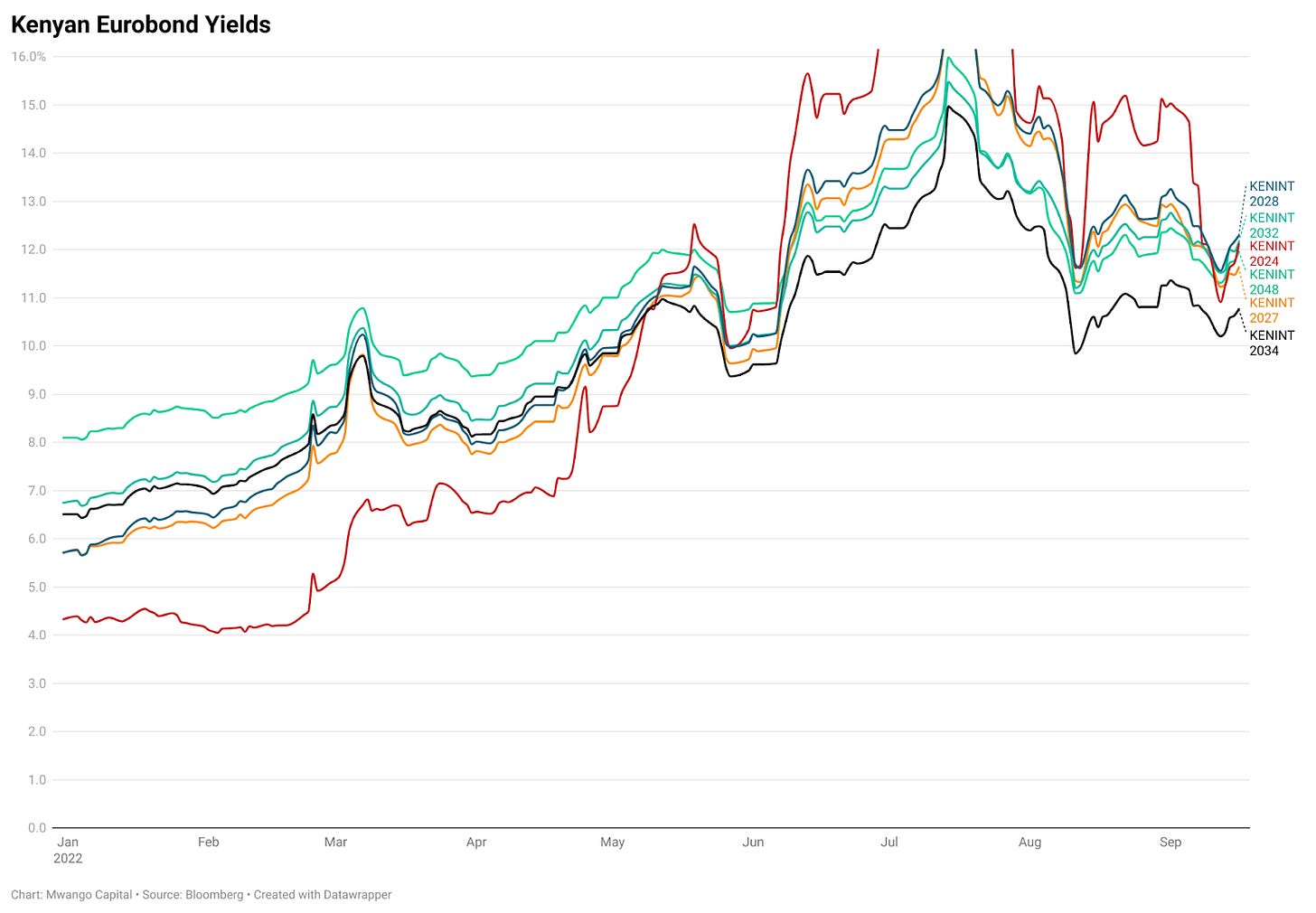

Eurobond Market Report: Below are notes from IC Asset Managers Economist Churchill Ogutu on last week’s market action:

The week started on a sound footing with KENINTs closing Monday's sessions at levels last seen in late May/early June. This wasn't to be replicated in the remainder of the week; thanks to a disappointing US CPI Aug print on Tuesday that invited some risk-off sentiment across major asset classes.

Although the short-end KENINTs (2024 and 2027) closed the week with marginal gains, the belly through the back-end (2028 through 2048) closed weaker w-o-w due to the global risk-off sentiment.

What Else Happened This Week

🤝 Merger: Hillcrest International Schools entered into a binding agreement on Sep 14th, 2022 for the sale of assets & business to Braeburn Schools. The transaction is to be concluded by Dec 31st, 2022 subject to approvals from the Competition Authority of Kenya.

📉 Remittances Fall: In August 2022, diaspora remittances declined by 0.8% to reach $310.5M compared to $315.9M posted in August 2021. On a month-on-month basis, the remittances fell 2.8%. In the 12 months to August 2022, remittances totalled $3.992B, an increase of 14.7% compared to $3.481B posted in the same period in 2021.

📈 Rising Electricity Prices: EPRA increased the fuel cost component of the power bill by 46.6%, the highest in over five years. The fuel cost charge (FCC) will now be KES 6.79 per kilowatt-hour (kWh) of electricity up from KES 4.63 in September 2022.

⚒️ KenGen starts Djibouti Wells: The Kenya Electricity Generating Company has started drilling three geothermal wells in Djibouti under a KES 700M contract on behalf of the Djiboutian Office of Geothermal Energy Development.

📉 LPG Consumption Falls: The consumption of liquid petroleum gas dropped in H1 2022 on high prices arising from the impact of the Russia-Ukraine conflict. In the 6 months to June this year, Kenyans bought 123,150 Tonnes of cooking gas, down 34.8% compared to 188,150 Tonnes in H1 2021.

🚀 Meme Stock: Kenya Power was the best-performing stock at the NSE this week. It rose by 23.13% this week to close the week at KES 1.97 on a volume of 26.8M shares valued at KES 51.6M. The firm is currently looking for a headhunter to lead the hiring of a substantive Managing Director and two other senior executive positions that have been held in an acting capacity for over a year.

Interest Rate Watch

🇿🇦 South Africa: The Monetary Policy Committee (MPC) of the South African Reserve Bank is set to have its sitting on September 22, when it will announce its interest rate decision. In its last meeting, it raised the key interest rate by 75 basis points to 5.50%. Inflation in July stood at 7.8%, a 13-year high.