👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover KCB's acquisition of TMB Bank, the US-Africa Summit, and Fitch's downgrade of Kenya's long-term foreign-currency issuer default rating.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

KCB Completes TMB Acquisition

Transaction: KCB Group has completed the acquisition of an 85% stake in Trust Merchant Bank (TMB) SA in DRC after receiving requisite approvals from relevant authorities in Kenya, the DRC, and the COMESA Competition Commission. The acquisition brings the bank’s regional footprint to 8 countries including a representative office in Ethiopia founded in 2015.

“We have found a partner with a proven and trusted history of serving and supporting customers, businesses, and communities. Combining our common legacies and our complementary footprints will strengthen our ability to serve our communities and regional customers and provide solutions that make a difference in people’s lives.”

KCB Group CEO, Paul Russo

Consideration: In a joint announcement on the transaction in August, KCB said it would pay a cash consideration for the shares determined based on the net asset value of TMB at the completion of the transaction, and using a price to book (P/B) multiple of 1.49, 2.3X KCB’s current P/B measure of 0.6. In contrast, Equity Group’s acquisition of BCDC was at a P/B ratio of 0.8.

Minority Buy-Out: According to resolutions by KCB Group shareholders in September’s Extraordinary General Meeting on the acquisition proposal, existing shareholders will continue to hold to their joint 15% stake post-transaction for not more than 2 years after which KCB will increase its stake to 100%.

“Under the terms of the transaction, KCB will acquire 85% of the shares in TMB while the existing shareholders will continue to hold the balance for a period of not less than 2 years after which KCB will have the right to acquire their shares.”

TMB DRC Positioning: TMB currently has US$1.7B (KES 209.1B) in gross assets, equivalent to 57.1% of StanChart Kenya's asset base as of Q3 2022. TMB’s branch network in the DRC spans 109 branches and operates a representative office in Belgium. TMB's market share in DRC by total assets stands at 11% and has an 18-year operational history [KCB Group: 45 years].

Impact: The transaction brings KCB’s asset base to KES 1.5T, the largest across East and Central Africa.

US-Africa Leaders’ Summit

Another Summit: In the United States, under the auspices of the 3-day U.S.-Africa Leaders Summit that ran from December 13 to December 15, President William Samoei Ruto secured various commitments and partnerships on an array of matters. Below is a rundown of Kenya-related deliberations.

KQ Restructuring: A discussion between the President and Peter Carter, the Executive Vice President - External Affairs at Delta Airlines, focused on partnerships towards increasing the competitiveness and attractiveness of both airlines. Ruto further discussed the entry of the national carrier to Djibouti with President Ismail Oguelleh. The Kenya Kwanza administration is keen on revitalising the airline whose gross losses total KES 146.1B in the last 9 years.

Visa Partnership: Deliberations between Ruto and Visa CEO Alfred Kelly might see the multinational payments processing firm play a role around Hustler Fund access. Separately, during the US-Africa Business Forum, Visa pledged to invest $1B in Africa by 2027.

"Today, an estimated 500M people in Africa are without access to formal financial services, less than 50% of the adult population made or received digital payments in Africa & more than 40M merchants do not accept digital payments."

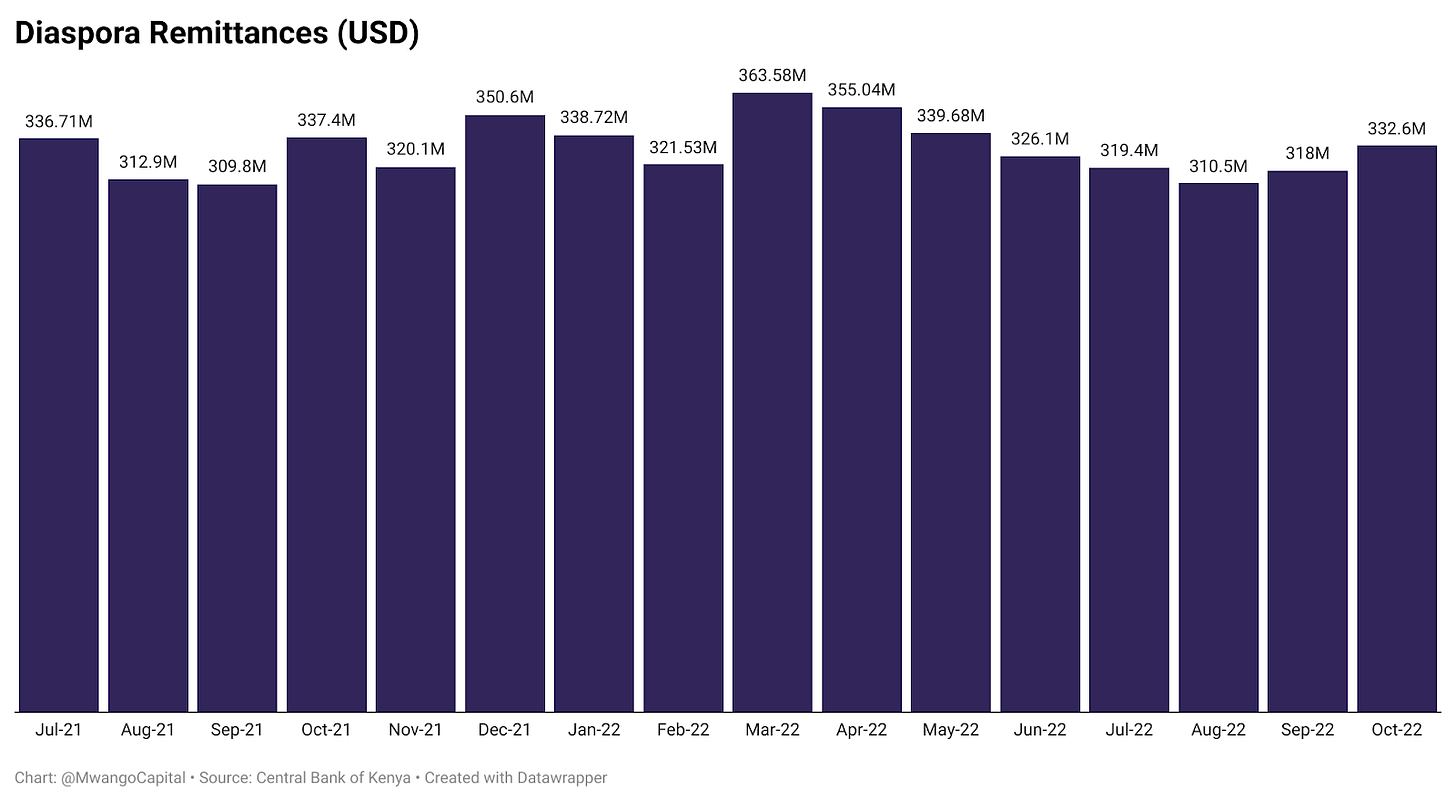

Remittances: Ruto highlighted the growing importance of diaspora remittances to Kenya. Among the leading sources of foreign exchange in Kenya, the World Bank projects remittances to grow at an average of 5.5% in 2023. In broader plans, US President Joe Biden issued an Executive Officer establishing a New Diaspora Council - the President’s Advisory Council on African Diaspora Engagement in the United States (PAC-ADE).

Fitch Downgrades Kenya

‘B+’ to ‘B’: New York-headquartered Fitch Ratings downgraded Kenya’s Long-Term Foreign-Currency Issuer Default Rating to ‘B’ from ‘B+’; with a stable outlook. Below are highlights of key indicators behind the downgrade from the rating action commentary.

Twin Deficits: The fiscal deficit narrowed to 6.2% of GDP in fiscal 2021/22 [2020/21: 8.2%], and Fitch expects the metric to reach 6.1% of GDP in fiscal 2022/23, above the forecast ‘B’ median. In terms of net trade flows, the analysts forecast Kenya’s current account deficit to be 5.9% of GDP in 2022 and to remain at those levels in 2023 and 2024.

Forex Reserves: Fitch expects Kenya’s twin deficits to result in sustained pressure on international reserves which stood at $7.2B at the end of November 2022 [2021: $9.5B]. The forecast puts them at $7.4B at the end-2023 [2021: $9.5B], equivalent to 3 months of current external payments [2021: 4.8 months].

Currency Depreciation: Exchange rate flexibility has helped absorb some of the external funding pressure. Foreign-currency liquidity has tightened, resulting in increased external interest servicing in local currency terms. As at the acquisition of Eurobond KENINT 2024 debt in 2013/14, the local unit exchanged at an average of 90 units to the dollar [Currently: 123.02].

Debt-to-Revenue: Kenya’s debt-to-revenue ratio stood at 385% in fiscal 2021/22, which is above the agency’s ‘B’ median of 282%. Interest payments are forecast to account for 29.5% of revenue in fiscal 2022/23, close to 3X the ‘B’ median forecast of 10.8%.

Increased External Debt Service: As of October 2022, Kenya’s pile of public and publicly guaranteed external debt stood at US$35.93B/KES 4.4T, accounting for 49.8% of Kenya’s total public debt. External debt service is expected to rise to 24.8% of current external receipts in 2024, up from 16.6% in 2023 on account of the maturity of a US$2B Eurobond (KENINT 2024) in June 2024.

You can find the full commentary here.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.356%, 9.821%, and 10.229% compared to 9.327%, 9.796%, and 10.245% in the previous auction, respectively. The total amount on offer was KES 24B with the CBK accepting KES 17.4B of the KES 29.2B bids received. The performance and acceptance rates were 121.75% and 72.6%, respectively.

IFB Tap Sale: The CBK has announced a tap sale on Fixed Treasury Bond IFB1/2022/006, running between December 14 to December 22. A gross amount of KES 20B is on offer and the bond’s coupon rate is 13.215% with an adjusted average price of KES 100.741 per KES 100.

KES 50B Re-opened Bonds: The CBK has reopened FXD1/2020/005 and FXD1/2022/015, seeking liquidity up to KES 50B across the instruments with a tenor of 2.4 years and 14.3 years, respectively. The coupon rates stand at 11.667% and 13.942%, respectively, with the sale expected to run from December 14 and close in January 2023.

Eurobond Market: Yields on KENINT 2024 rose 70.8 basis points (bps) week-on-week to 12.849% - the highest point in 37 days, while KENINT 2048 rose the least, at 13.8 bps to 10.686%. Yields were up across all papers to bring the average increase to 348 bps. Price action was red across the board, with the KENINT 2034 falling the highest - by 190 bps week-on-week to 78.833% and KENINT 2024 the least, by 90 bps to 92.022%.

What Else Happened This Week

⛽ Dec/Jan Pump Prices: According to EPRA, fuel prices are set to remain unchanged for the period from December 14 2022 to January 14, 2023. The regulator has maintained its super petrol-diesel cross-subsidy instituted in the previous cycle.

⚠️ Crown Paint’s Profit Warning: The paint manufacturer expects net earnings for the 2022 fiscal year to reduce by more than 25% compared to fiscal 2021 earnings. The firm has attributed the expected drop in profit to the increased cost of raw materials, volatility in foreign exchange rates, and economic slowdown.

💰 Hustler Fund Update: As of December 15, the end of the first 14 days, the total value of loans disbursed grossed KES 8.4B. Borrowers totalled 14.7M, with repayments reaching KES 1.7B, a 20.2% repayment rate. The average loan ticket size was KES 571, with savings totalling KES 423M.

🔻 Safaricom Cuts Costs: Following the CBK’s reintroduction of fees on bank-to-wallet transactions, Safaricom has reduced its bank-to-M-PESA and M-PESA-to-bank charges by an average of 61% and 47%, respectively. Transactions below KES 100 will remain zero-rated and the new tariffs will take effect on January 1, 2023. The aggregate amount of zero-rated transactions from FY 21 to HY 23 grosses KES 16.2T.

🛑 Uganda Ends Power Concessions: Uganda will not renew the concession agreements of Eskom Ltd and Umeme Ltd when they come to their natural end in 2023 and 2025, respectively. Eskom has a 20-year concession from March 1 2003 managing the 180MW and 200MW Kira Hydropower Plants, respectively. Umeme's electricity distribution concession took effect on March 1, 2005.

🤝 IMF-Ghana Agreement: The IMF and Ghana - Africa's largest gold producer, reached a staff-level agreement on economic policies and reforms to be supported by a new 3-year arrangement under the Extended Credit Facility (ECF) totalling SDR2.2B/US$3B.

⚽ Argentina Wins World Cup: Lionel Messi’s team edged France 4-2 on penalties after a 3-3 tie in over 120 minutes of play. The La Selección bagged their 3rd trophy after previous victories in 1978 and 1986. Separately, on Jamhuri Day, Ruto outlined plans for Kenyan football, including Under-19 inter-county competitions, a bid to host the African Cup of Nations 2027 alongside other EAC Nations, and propagation of Harambee Stars to the World Stage in 2030.

Interest Rate Watch

🇲🇺 Mauritius: Last week, the Monetary Policy Committee (MPC) of the Bank of Mauritius raised the Key Repo Rate by 50 bps to 4.5%. The MPC pointed out the need to anchor inflation expectations as it seeks to normalize and bring inflation in 2023 down to 6%. In November, inflation in Africa’s only country with a Hindu majority, or 48.5% of religions, stood at 12.1%, a 16-year high. The recent action by the MPC brings the total hike to date in 2022 to 250 bps.

🇺🇸 United States: In its last MPC meeting of 2022, the Federal Reserve delivered a 50 bps hike to 4.25% - 4.5% - the highest level since 2007 during the Global Financial Crisis. It was the 7th consecutive hike in 2022 as the US combats inflation. The Fed expects interest rates to reach 5.1% in 2023, 4.1% in 2022, and 3.1% in 2025.