👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover BAT FY 2022 results, Longhorn HY 2023 results, and the Quarterly Economic and Budgetary Review for H1 FY 2022/2023.Our newsletter this week is brought to you by:

Branch Microfinance Bank. Branch Microfinance Bank was founded in 2015 by Daniel Jung and Matt Flannery and has operations in India, Nigeria, Kenya, and Tanzania. It has disbursed over $600M to 5M borrowers with its app being downloaded over 21M times.

First off, enjoy a dose of our weekly business news in memes brought to you by Branch Microfinance Bank:

BAT Kenya Reports 2022 Results

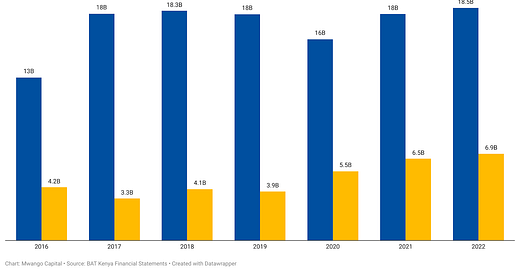

Excise Duties Impact: Just like EABL, BAT’s revenues in 2022 were impacted by the frequent and steep increases in excise tax rates which totalled 21.3% for the year (+5% in November 2021, +10% in July 2022, +6.3% in November 2022). Overall, gross sales including indirect taxes grew 5.5% YoY to KES 42.2B, while net revenue excluding excise duty and VAT was up 7.7% to KES 27.4B. BAT attributes the growth in revenue to growth in export sales volumes and a pricing benefit on domestic and export sales. Net profit grew by 6.3% to KES 6.9B.

“The steep and frequent increases in excise rates, totalling 21.3%, cumulative over a 12-month period, further compounded the pressure on consumer purchasing pricing power. Taxes in the form of excise duty, VAT, Pay As You Earn (PAYE) and corporation tax increased by 3% to KShs 18.5 billion, reflecting higher excise duty rates and profitability.”

Dividends Rising: The Board of Directors proposed a final dividend of KES 52 per share to bring the total dividend for FY 2022 to KES 57 per share. This translates to a dividend yield of 12.8%, around the rate at which the government is borrowing from the public through Treasury Bonds.

“Our Dividend Policy has been to pay at least a minimum of 80% of our profit to our shareholders. And this is something that we have done for an extended period of time. When we look at the profile of our investors who tend to be long-term institutional investors forming the bulk of those who hold our shares, we believe that beyond the capital gains that are made by the appreciation of the share, part of the reason they make the investment in the share is because of the strong dividend policy we have.”

Crispin Achola, BAT Kenya MD

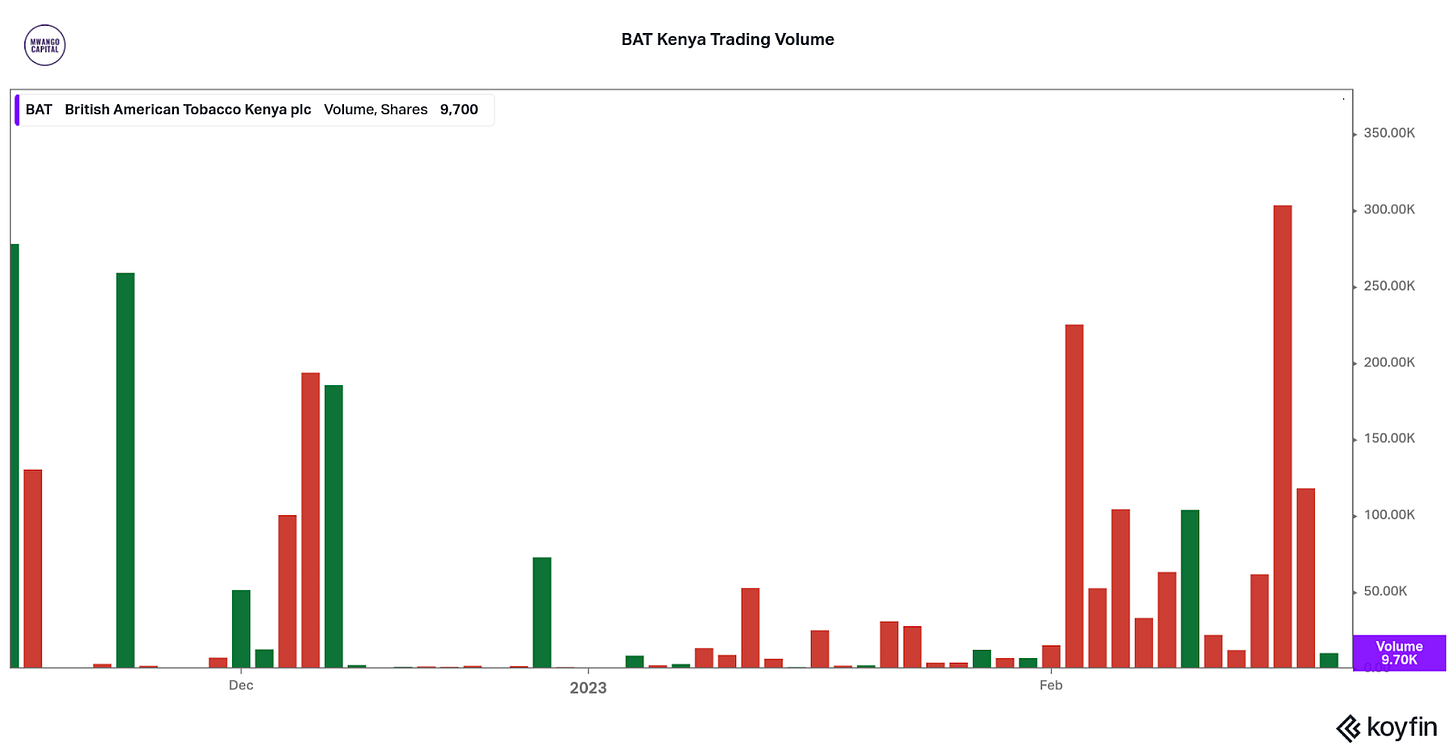

Stock Activity: In last week’s trading action, total foreign sales of BAT stock stood at 219.9M shares while foreign buys were 17.9M shares. On the last day of trading of the week, the number of foreign sales of BAT stock was 1.5M with nil foreign buys. The share price closed at KES 479.75, up 7.8% week-on-week.

Longhorn H2 2023 Loss

Low Spending: Total sales were depressed in the 6 months ended 31st December 2022 falling 46.2% year-on-year to KES 516.9M. This was a result of lower government business and the reorganization of school terms in the academic calendar occasioned by the COVID pandemic, leading to lower expenditure on books.

“Across the various markets, we have seen a slowdown in economic growth and heightened inflationary pressures. Further, with the increased number of school terms in the last few calendar years, consumer spending power on books was depressed as parents and schools prioritized fees and uniforms.”

Back to Losses: Longhorn recorded a loss amounting to KES 98.3M for the operating period compared to a profit of KES 15.1M in 2021. In 2020, the net loss was KES 145.3M, bringing the average loss for the 3 operating periods to KES 211.7M. Longhorn has attributed the loss position in 2022 to lower revenues recorded in the operating period.

Stock is Down 25%: Over the last year, Longhorn's share price fell 25% to KES 3 as of the market close last week. On a year-to-date basis, the share is mostly flat at KES 3. In last week’s trading, the 35.5K shares of the stock were sold on Friday as at market close. The last time this much of the stock was sold was in November 2022.

Kenyan Quarterly Economic Update

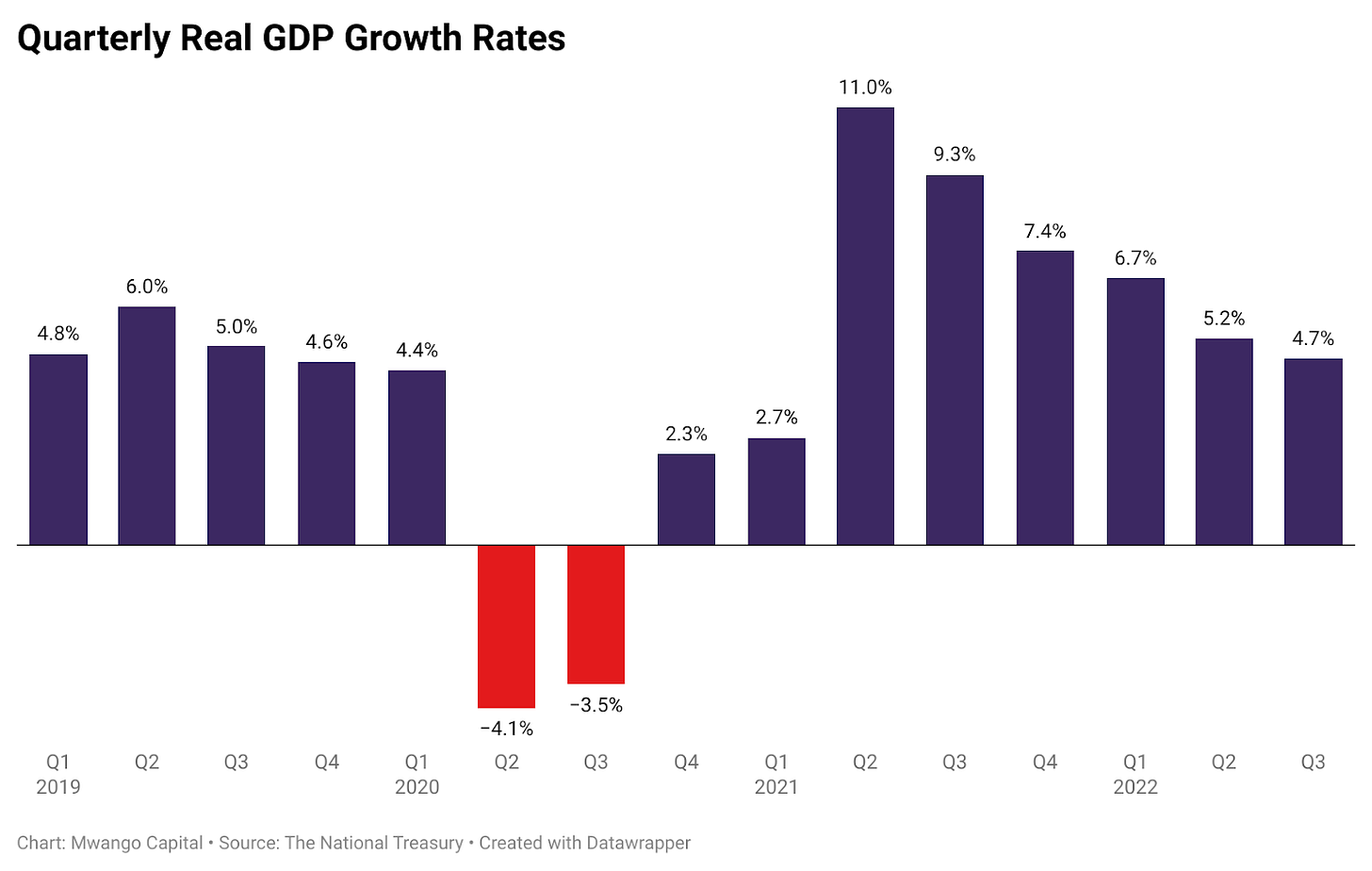

Economic Growth: The Kenyan economy grew at 6.7%, 5.2%, and 4.7% in the first three quarters of 2022 compared to 4.4%, -4.1%, and -3.5% in 2021. Q3 2022 growth was supported mainly by the services sectors including accommodation and food service activities, trade, professional, administrative, and support services sectors. The growth in these sectors is in line with the recovery from the impact of Covid as compared to 2021.

Revenue Mapping: As of the end of December 2022, the total ordinary revenue collection in FY 2022/23 was KES 985B against a target of KES 1.0281T, KES 43.2B or 4.2% below the target. Across all ordinary revenue categories, only VAT on Imports, Import Declaration Fees and Other Revenue recorded above target performance, exceeding the target by KES 4.1B, KES 10.4B and KES 5.3B, respectively. The gross revenue including Appropriations-In-Aid stood at KES 1.147T against a target of KES 1.1582T.

Expenditure Outlay: The gross expenditure and net lending as of 31st December 2022 was KES 1.4688T against a KES 1.4489T target, bringing the over-expenditure to KES 19.9B. Recurrent expenditure stood at KES 1.096T, exceeding the target by 11.6%, and a growth of 13.8% year-on-year compared to the same period in FY 2021/2022.

Pending Bills: The total outstanding national government pending bills as at 31st December 2022 amounted to KES 481B. At the devolved level, a special audit by the Office of the Auditor General put eligible bills at KES 48.1B as at 30 June 2022, with another KES 108.1B in ineligible bills for payment due to lack of documentation. As at 21st December 2022, counties had settled KES 22.9B or 47.6% of eligible pending bills, leaving an outstanding balance of KES 25.1B. With regards to the ineligible bills, only KES 1.8B was paid out, leaving a KES 106.2B balance.

Division of Revenue: The National Government has been allocated KES 2.1779T or 84.7%, while the devolved units have been allocated KES 385.4B or 15% of the KES 2.5712T ordinary revenue projection in FY 2023/24.

Public Debt: Domestic interest payments rose by 15.8% to KES 251.6B - equivalent to 25.5% of ordinary revenue collected in the period as compared to KES 217.3B or 24.1% of ordinary revenue in FY 2021/22. Foreign Interest payments rose by 16.9% to KES 67B [FY 2021/22: KES 57.3B]. As at 31st December 2022, the total gross public and publicly guaranteed debt was KES 9.1T, up 11.4%.

You can access the entire document here.

Weekly Capital Markets Wrap

The NSE: In Week 7 of 2023, Flame Tree was the top gainer, up 19%, while Unga was the top loser, down 16%. The NSE 20 and NSE 25 indices appreciated by a marginal 0.5% and 0.2% to 1,680.5 and 3,190.1 points, respectively while the NSE All Share Index fell 0.2% to 128.0 points. Equity turnover was down 4.6% to KES 1.3B while bonds turnover was down by 28.9% to KES 13.2B.

T-bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.623%, 10.079%, and 10.638% respectively. The total amount on offer was KES 24B with the CBK accepting KES 44.7B of the received bids. The acceptance rate was 186.3%.

T-Bonds: Across the tap sale on FXD1/2017/010 and FXD1/2023/010 treasury bonds, total bids received at face value were KES 8.9B and KES 3.6B. The CBK accepted bids totalling KES 8.6B and KES 3.6B bringing the weighted average rate of accepted bids to 13.875% and 14.151%, respectively. On aggregate, the performance and acceptance rates were 124.6% and 122%, respectively.

Eurobonds: Last week, the yields edged higher week-on-week across all 6 outstanding papers.

KENINT 2024 recorded the largest gain, increasing by 62.7 basis points (bps) week-on-week to 11.818%.

All instruments except KENINT 2024 were up on a Year-To-Date basis. KENINT 2024 was down by 78.5bps while KENINT 2034 was up the most, rising by 29.5 bps to 9.95%.

KENINT 2024 led price gains year-to-date, rising 1.6% to 94.018. On a week-on-week basis, prices fell across the board led by KENINT 2037 and KENINT 2032 at -1.3%.

Market Gleanings

🧾| Safaricom Ethiopia Update | Safaricom provided a business update on Ethiopia as part of its inaugural Investor Day Forum. As of February 2023, Safaricom Ethiopia had network penetration to 10% of the population, 847 network sites across 25 cities had been installed, 28K retailers, 103 distributor shops, and 5K acquisition agents had been onboarded and customer gross adds crossed the 2M mark.

💵| New Eurobond? | According to Kenya’s Director of Debt Management, who spoke to Reuters, the country may opt to issue a Eurobond with a different tenor to manage next year’s maturity of the $2b, 10-Year Bond [KENINT 2024].

"We may not want to see such huge maturities in the future. It poses a risk. $2 billion is significant."

Director of Debt Management, Haron Sirima

🏦| NBK Updates | National Bank of Kenya, a subsidiary of KCB Group, has appointed George Otieno Odhiambo as Managing Director, taking over from Finance & Strategy Director Peter Kioko who has been holding the position in an acting capacity since June 2022. In other news, a Kenyan court allowed former Taita Taveta MP Basil Criticos to seize NBK’s cash and bonds held at the CBK after NBK failed to pay him KES 2.57B as ordered. This was after NBK was found guilty of unfairly confiscating his 15,000-acre sisal farm over a KES 20M loan.

💰| Kenyan Saccos | The Cabinet Secretary for Co-operatives & MSMEs, Simon Chelugui, has made a proposal to institute inter-Sacco lending that should kick off in August this year. Meanwhile, more Saccos reported their 2022 results:

Kenya National Police DT SACCO: Net Interest Income grew by 7% to KES 4.2B. Total assets expanded by 11.1% to KES 48.9B. The interest on member deposits was 11% [2021: 10.8%], while the dividend rate on members’ share capital was 17% [2021: 17%].

Egerton University SACCO: The Net Surplus After Tax grew by 59.9% to KES 22.9B. The interest on member deposits was 5% [2021: 3%], while the dividend rate on members’ share capital was 10%.

Safaricom SACCO: Net Interest Income grew by 22.6% to KES 227.2M. Total assets expanded by 16.7% to KES 2.6B. The interest on member deposits was 9% [2021: 8%], while the dividend rate on members’ share capital was 14% [2021: 13%].

🦈| Shark Tank Appearance | Kenyan Margaret Nyamumbo, founder of Kahawa 1893, was on Shark Tank this past week seeking to raise $350k for a 5% equity stake in her company. Kahawa 1893 focuses on delivering quality coffee to customers while paying their farmers well and allowing the final customer to tip the farmers too. She left with a deal of $350k for an 8% stake in the company, valuing her business at $4.4M.

🛍 | Ghana and Nigeria | In January 2023, inflation in Ghana eased to 53.6% even as it ticked up to 21.82% in Nigeria in January. Nigeria is headed to the general elections this Saturday and Ghana is facing tough times ahead as it is close to defaulting as the grace period on a $40.6M coupon bond. Meanwhile, Nigeria has delayed a plan to outlaw some old high-value banknotes to April 10th this year.