👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the Finance Bill 2024, Q1 2024 results from Equity Group and the Co-operative Bank of Kenya, and an update from the Retirement Benefits Authority.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Finance Bill 2024

The Finance Bill, 2024, through which the National Treasury aims to raise KES 323B in revenue for FY 2024/25, was released last week, and on the 13th of May, it underwent the First Reading in the National Assembly. Currently undergoing debate and analysis in the public domain, the National Assembly is inviting public input, and the public has up to 1700H, 28th May 2024, to submit comments. Find a sample template here for the submission of comments.

Here are some of the key highlights from the Bill:

Motor Vehicle Circulation Tax: Among the most contentious proposals in the Finance Bill 2024 is the proposed tax on motor vehicles, which has been set at the rate of 2.5% of the vehicle's value, with the minimum tax set at KES 5K and the maximum capped at KES 100K. The determination of the tax will be based on the make, model, engine capacity, and year of manufacture of the vehicle, with the proposed effective date being 1st July 2024. The Association of Kenya Insurers has put out a statement, urging the National Assembly to discard the proposed motor circulation tax given the burden it portends for motorists in the country.

“The imposition will notably increase the cost of motor insurance. Currently, the average comprehensive insurance premium rate stands at 5%, and with the additional 2.5%, the total premium rate surges to 7.5%. With motor vehicle insurance being compulsory in Kenya, we anticipate a major shift towards third-party motor insurance if this tax is implemented. Consequently, motorists will face higher risks, as they will essentially only be covered for third-party liabilities, leaving their own vehicles unprotected in the event of accidents.”

The Association of Kenya Insurers Executive Director, Tom Gichuhi

VAT-Related Changes: At the top level, the Bill proposed reducing entities' registration threshold to KES 5M from KES 8M. Financial services such as credit/debit card issuance and forex transactions will attract Value Added Tax (VAT) at the standard rate of 16%. Resultantly, the Kenya Bankers Association (KBA) on 17th May released a statement on the proposed standard rating of VAT on banking services, urging Parliament to reconsider the proposal.

“The increased cost of banking to customers will hamper financial inclusion efforts, particularly affecting low-income individuals and small businesses. Coupled with Excise Duty, taxation on financial services would reach 40% from the current 15% (excise Duty only), significantly impacting affordability and accessibility.”

Kenya Bankers Association Chief Executive Officer, Raimond Molenje

“A curious introduction of both Tobin Tax and Robinhood Tax through the scrapping of VAT exemptions for banking transactions. It will make basic banking expensive, raise [the] cost of credit, and drive people to the black market. Kenya has been a leading light in financial inclusion globally. An unnecessary tax on banking transactions will make us uncompetitive. Large FX transactions will be offshored.“

Kenya Bankers Association Chairman and NCBA Group Chief Executive Officer, John Gachora

Other VAT-related changes include the proposal to delete the VAT exemption for betting, gaming, and lottery services and put in place a standard VAT rate of 16%. The Bill further proposes VAT exemptions on certain goods and services in tourism, manufacturing, and construction sectors be removed, aiming to standardize the tax structure across various sectors.

Excise Duty Changes: The Bill proposes to raise excise duty for telephone and internet data services, money transfer services by cellular phone service providers, and fees charged for money transfer services from 15% to 20%. Another proposal seeks to extend the excise duty related to adverts on alcoholic beverages, betting, gaming, lotteries, and prize competitions at a rate of 15% to include advertisements on the internet and social media.

The Bill further proposes to amend the contentious provision of the Finance Act 2023 mandating 24-hour excise duty remittance on alcoholic beverages by proposing to extend the period to 5 working days. Further, the Bill also contains a proposal to slap a 25% excise duty on vegetable oils, which the Edible Oils Manufacturers Association has pointed out could result in an unprecedented price surge for consumers.

“The Edible Oil Sub Sector of Kenya Association of Manufacturers urgently alerts policymakers and the public to the severe consequences of the proposed 25% excise duty on vegetable oils included in the Finance Bill 2024. If implemented, this excise duty will trigger an unprecedented surge in the price of cooking oil, a staple in Kenyan households. The cost of this essential commodity is projected to skyrocket by 80%, rendering it unaffordable for millions of Kenyans.”

Tax Procedures Act: The Bill proposes to increase the timeframe for objection decision from 60 to 90 days. Further, there is a proposal to exclude weekends and public holidays from the computation of tax-related deadlines. Integration with KRA's system may become mandatory for certain taxpayers to enhance real-time document submission and compliance monitoring.

Digital Superhighway: Operators of digital platforms or those monetizing digital content will face a 20% tax for non-residents and 5% for residents. Further, there is a provision that proposes a shift from a Digital Service Tax (DST) to a Significant Economic Presence Tax at 30% for certain non-residents.

Export and Investment Promotion Levy: The bill seeks to reduce the Export and Investment Promotion Levy from 17.5% to a maximum of 3% on various items. The levy now also applies to vodka, cooking stoves, milk & cream of a fat content by weight exceeding 1% but less than 6%.

Taxing Infrastructure Bonds: The Bill proposes taxing interest income from Infrastructure Bonds (IFBs). Under the proposed changes, previously issued IFBs will not be eligible for taxation, but newly issued IFBs are set to be subject to a 5% Withholding Tax (WHT).

Find a thread with more on the Finance Bill, 2024, here.

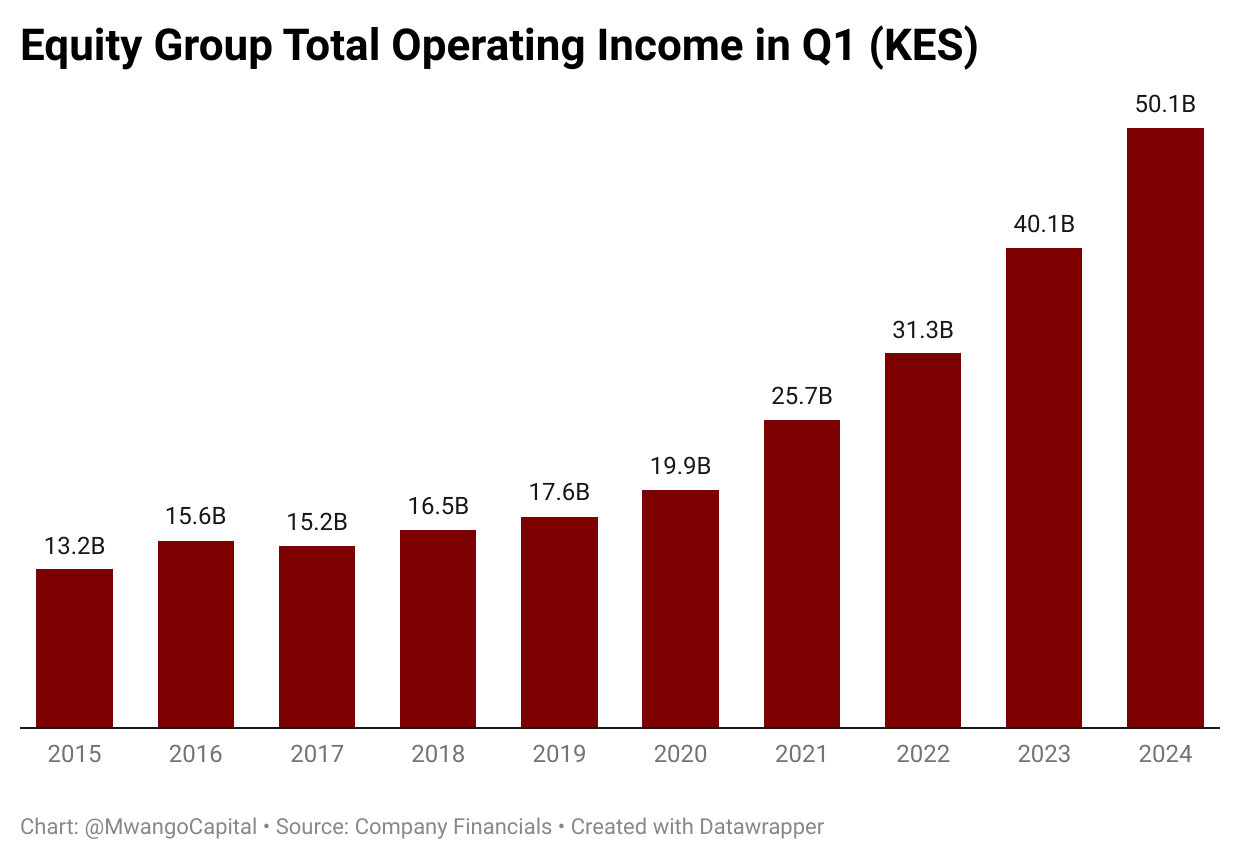

Equity’s Q1 2024 Earnings

Equity Group became the second major listed lender to release its set of Q1 2024 results, Net Interest Income was up 28.4% to KES 27.8B, with non-interest income grew by 20.9% to reach KES 22.2B. Total operating income for the quarter totaled KES 50.1B, up 24.9% year-on-year, and the Group reported KES 20.4B in profit before tax, up 20.9% year-on-year.

Mapping the Asset Base: Total assets were up 9.64% year-on-year to reach KES 1.7T. The loan book expanded at a marginal 3.0% [Q1 2023: +21.3%, Q1 2022: 27.8%] to reach KES 779.2B, equivalent to 46.2% of the asset base as compared to 49.19% in Q1 2023. The deposit base was up 11.3% to reach KES 1.2T, to account for 73.3% of the balance sheet [Q1 2023: 72.26%]. The group ramped up its holdings of investment securities by 20.6% to KES 473.23B, equivalent to 28.1% of the balance sheet [Q1 2023: 25.5%].

At the Kenya level, loans to customers fell by 6.1% to reach KES 421.6B, against a 7.9% growth in customer deposits to KES 587.5B, to bring the loan-to-deposit ratio to 71.8% as compared to 82.5% in Q1 2023. Investments in securities totaled KES 348.9B, up 10.1% to account for 36.3% of the asset base as compared to 35.1% in Q1 2023.

At both the Kenya and Group level, the real growth in allocation was mostly recorded in investment securities. On the loan book, something notable is that 30% of the Group’s loan book was denominated in US Dollars in Q1, and the 16% appreciation of the Kenya Shilling against the US Dollar in the quarter reduced the USD equivalent of the Group’s loan book, hence the lacklustre 3.0% growth in loans recorded.

Surging Stock of NPLs: The stock of gross Non-Performing Loans (NPLs) closed the quarter at KES 120.4B, up 50%, accounting for 15.45% of the loan book, up from 10.62% in Q1 2023. Net NPLs also surged considerably, growing by 64.9% to reach KES 50.2B, equivalent to 6.45% of the loan book. The stocks of NPLs in proportion to the loan books were last recorded in the COVID-impacted operating periods of 2019 and 2020. Regarding the overall asset quality, the NPL ratio closed the quarter at 13.2%, against a 2024 guidance of 9% - 11%, with the NPL coverage ratio declining significantly to 68.6% in Q1 2024 as compared to 87.5% in Q1 2023.

“Interest rates have peaked. Remember early last year, we said interest rates had peaked, and truly they had peaked, but they have remained at elevated levels. We believe that NPLs will remain elevated for quite some time because of the trailing effect. We know in the region, the effect of flooding will affect NPLs that’s why we believe they will remain. But we will see from Q4, we will see that starting to come down. In between, we will experience recoveries that might start influencing the trend and causing declines in NPLs.”

Equity Group Chief Executive Officer, James Mwangi

KES 20B Q1 PBT Milestone: The contribution of Net Interest Income and Non-Funded Income (NFI) to gross Group operating income stood at 56:44, compared to 54:46 in Q1 2023. Across non-interest income, the FX Trading Income line was the only item that recorded a decline, down by 25.6% to KES 3.8B, to account for 17.3% of non-interest income [Q1 2023: 28.1%]. Q1 Pre-tax profits crossed the KES 20B mark for the first time to reach KES 20.4B, up 20.9%.

Regional Subsidiaries: Out of the KES 26.0B in Profit Before Tax (PBT) before provisions, regional subsidiaries contributed KES 15.0B, or 63%, with Equity BCDC contributing the largest amount across the subsidiaries at KES 7.6B or 28% - which is not far off from the KES 8.8B or 37% contributed by Equity Bank Kenya Limited (EBKL). PBT post provisions totaled KES 20.4B, with the subsidiaries contributing KES 11.4B or 63%. On a net basis, the Group’s profit was KES 16B, with a 62:38 split across subsidiaries and EBKL. Equity BCDC recorded 24.9% in Return on Average Equity (RoAE), Kenya 21.0%, and the Group 29.1%.

Find our analysis here, the investor booklet here, the results here, the investor briefing here, and our thread with charts here.

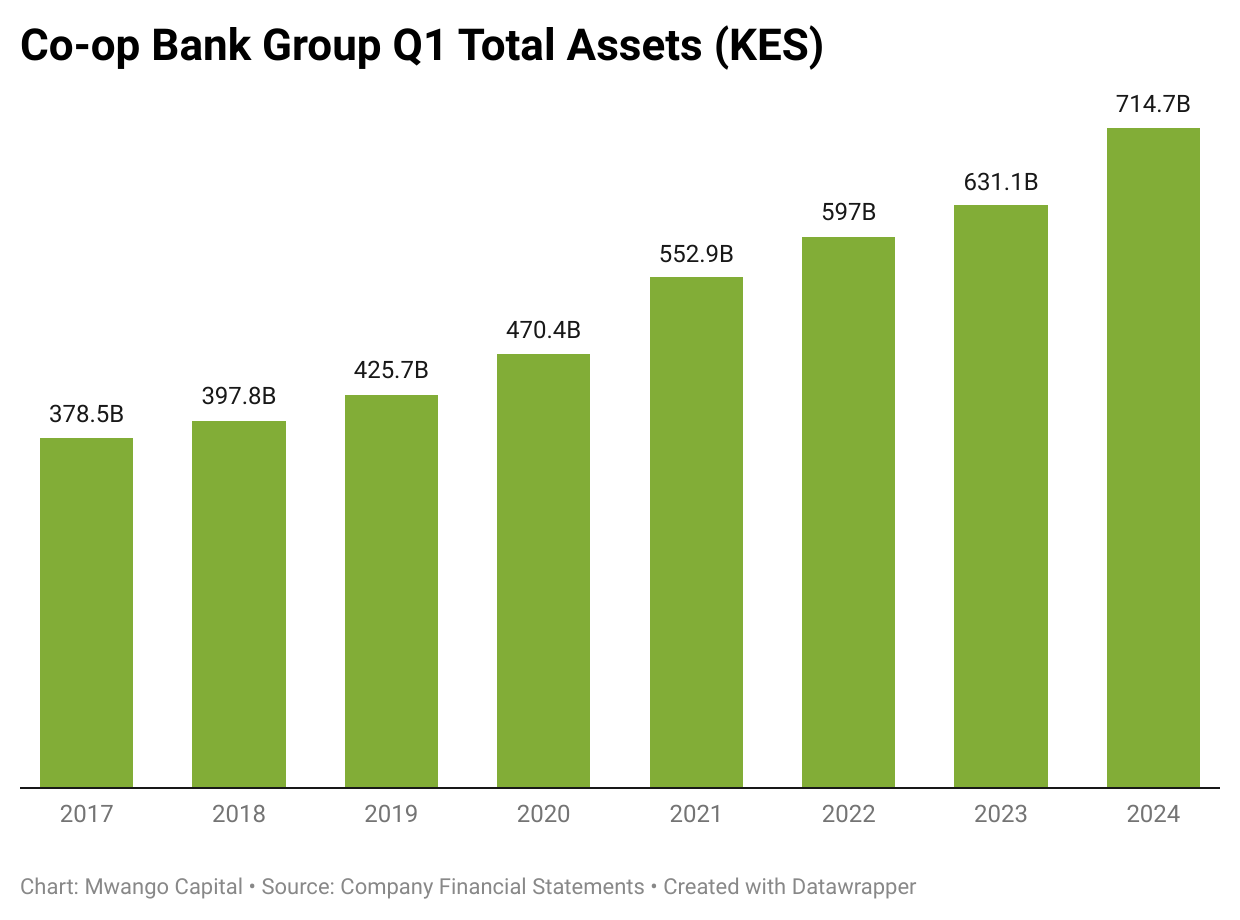

Co-op’s Q1 2024 Results

The Co-operative Bank of Kenya last week released its set of Q1 2024 results, becoming the 3rd major listed bank to do so. The asset base notably crossed the KES 700B mark, and pre-tax profits amounted to KES 9B, up 10.6% year-on-year. Net profit for the period under review closed at KES 6.6B, while Per Share Earnings were KES 1.12, up 7.7% in both cases.

Assets Cross KES 700B: Total assets grew by 13.3% year-on-year to breach the KES 700B mark to reach KES 714.7B. Across individual asset groupings, loans and advances closed the quarter at KES 378.1B, up 5.0% to account for 52.91% of the asset base as compared to 57.06% in Q1 2023. Holdings of government securities amounted to KES 201.9B, up from KES 181B, representing a growth of 11.5%. The securities holdings were equivalent to 28.25% as compared to 28.69% in Q1 2023.

Interest Expenses Dent Interest Income: Interest income from loans and advances grew by 24.2% to reach KES 12.4B, while that from government securities closed at KES 6.2B, representing a growth of 21.4%. In sum, interest income was KES 19.4B, up 24.7%. Interest expenses surged by a whopping 60.1% to KES 7.7B, with the interest on customer deposits alone growing by 61.9% to reach KES 6.4B, equivalent to 51.3% of interest income from loans and advances [Q1 2023: 39.4%]. NII edged higher by 8.62% to KES 11.7B.

Across NFI, the Group bucked the trend in FX Trading Income to post a 30.8% growth to KES 1.4B. However, fees and commissions on loans and advances dropped by 14.7% to KES 2.9B, and overall, NFI fell by a marginal 0.3% to KES 7.1B. Operating income for the quarter was KES 18.8B, up 5.1%, with the contribution mix from NII and NFI standing at 62:38 as compared to 60:40 in Q1 2023.

Profitability: PBT grew by 10.6% to reach KES 9B, equivalent to 48.0% of operating income [Q1 2023: 45.6%], and the net result for the year was KES 6.6B, up 7.7%, accounting for 35.0% of operating income [Q1 2023: 34.2%, Q1 2022: 34.8%, Q1 2021:24.1%, Q1 2020: 11.9%].

Find our analysis here, the results here, and a thread with charts here.

RBA’s 2023 Industry Brief

Overall Asset Growth: The Retirement Benefits Authority (RBA) has released the retirement benefits industry report for the year ended December 2023 in the week. The report for December 2023 reveals a modest increase in overall assets under management (AUM), rising by 1.28% from KES. 1,703.69B in June 2023 to KES 1,725.44B by the end of the year. This represents a year-on-year growth of 9.47% from KES 1,576.22B in December 2022.

Performance of Equities: On the year-on-year performance, quoted and unquoted equities recorded the highest negative growth of 32.56% and 27.16%. There was significant positive growth in fixed deposits, offshore investments, private equity, and cash and demand deposits. The significant growth in offshore investment is attributable to the exchange rate movement where the shilling had considerably lost value against the dollar hence making offshore investments more attractive.

Assets Held by Fund Managers: In the period ending December 2023, a total of 1,041 scheme reports were submitted by 19 fund managers and 17 approved issuers. The total fund value was KES 1,600.28B, marking a 0.1% increase in total assets under management from KES 1598.68B in June 2023. This represented an 8.68% increase from KES 1,472.47B in December 2022. The top five fund managers in Kenya managed 90% of the industry's assets, totaling KES 1.1T.

Assets Held by NSSF: In December 2023, the total investments held by NSSF rose by 6.4% to reach KES 328.11B, up from KES 308.26B in December 2022. The assets managed internally by NSSF amounted to KES 80.25B. However, the externally managed funds decreased 5.3% over the period, dropping from KES 261.65B in June 2023 to KES 247.86B in December 2023.

Find the entire brief here.

Markets Wrap

NSE: In Week 20 of 2024, Standard Group was the top-performing stock, up 9.8%% to close at KES 6.26. TP Serena was the worst-performing stock, down 8.3% to close at KES 1375. The NSE 20 was up 2.7% to close at 1,705.0 points, the NSE 25 increased by 3.6% to close at 2,893.3 points, with the NASI index increased by 3.8%, to close at 110.5 points. Equity turnover was down 22.5% to KES 881.44M from KES 1.1B in the prior week while bond turnover closed the week at KES 30.5B compared to the prior week’s KES 25.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9370%, 16.5176%, and 16.5295% respectively. The total amount on offer was KES 24B with the CBK accepting KES 46B of the KES 46.7B bids received, to bring the aggregate performance rate to 194.75%. The 91-day and 364-day instruments recorded 325.35% and 156.83% performance rates, respectively.

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper whose yield rose week-on-week, up 294.70 bps to 9.749% while KENINT 2034 fell the most, down by 20.00 bps to 9.131%. KENINT 2031 fell the least, down by 3.80 bps to 9.338% The average week-on-week change stood at 33.80bps.

Yields on all papers declined on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 278.10 bps while KENINT 2034 fell the least at 20.60 bps.

All prices gained week-on-week, except KENINT 2024, which fell by 0.3% to 99.714. KENINT 2034 recorded the highest gains at 1.0% to 81.706, while KENINT 2031 had the lowest gains at 0.2% to 101.998. YTD, KENINT 2028 rose the most at 4.3% to 95.720, while KENINT 2034 rose the least, at 1.5% to 81.706.

Market Gleanings

📄| CIC Reports FY 23 Results | CIC Insurance Group last week announced its 2023 full-year results. Total assets increased by 15.6% to KES 50.3B, while insurance revenue surged by 22.5% to KES 25.4B. Profit after tax increased by a whopping 817% reaching KES 1.4B with the earnings per share rising to KES 0.57 from KES 0.06 in 2022. The Board of Directors recommended a first and final dividend of KES 0.13 per share.

At its virtual Annual General Meeting (AGM) slated for the 7th of June 2024, the Group will seek a mandate from shareholders to establish new subsidiaries including CIC Microinsurance, CIC Pharmacy, and CIC Asset Management in Uganda.

🏦| Across Banking | KCB Group and Proparco have entered into a partnership, signing a USD 95M credit line to fund climate-related investment projects and support women entrepreneurs in Kenya. Meanwhile, DIB Bank Kenya posted its first-ever profit in Q1 2024, with a profit after tax of KES 6.3M, a turnaround from a loss of KES 124.6M in Q1 2023.

Across the region, NMB Bank became the first Tanzanian bank to list a corporate bond on the London Stock Exchange. Currently, the bank has two issuances totaling USD 105M in the international market, including the Jasiri bond on the Luxembourg Stock Exchange and the Jamii bond on the London Stock Exchange.

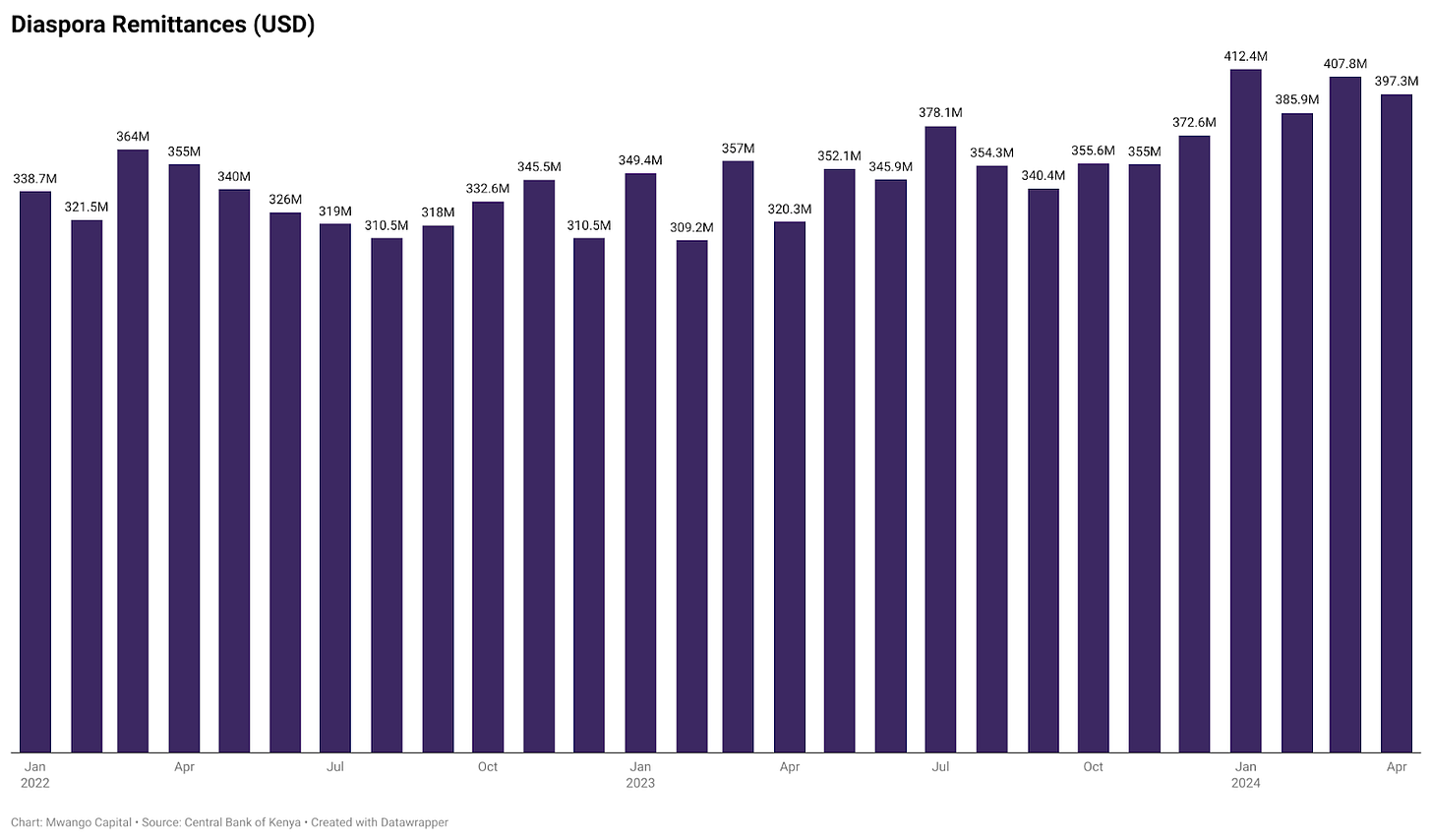

💰| Diaspora Remittances | Kenya received USD 397.3M in diaspora remittances in April 2024, up 24% year-on-year. On a month-on-month basis, the remittances went down by 2.57% from USD 407.8M in March 2024. For the 12 months to April 2024, the cumulative remittances totaled USD 4.457B, up 11.8% year on year.

⛽| May/June 2024 Pump Prices | The Energy and Petroleum Regulatory Authority (EPRA) this week cut the Prices for super petrol, diesel, and Kerosene for the May/June 2024 cycle by KES 1.00, KES 1.20 and KES 1.30 to KES 192.84, 179.18 and KES 168.76 respectively.

Separately, Kenya and Uganda have agreed to extend the oil pipeline from Eldoret in Kenya to Kampala in Uganda, a move that will allow Uganda to import refined petroleum products directly through Nairobi.

🗲| Ormat-Kenya Power | As of 31st Mar 2024, the amount overdue from Kenya Power to Ormat Technologies was USD 40.0M of which USD 12.4M/31% was paid in Apr 2024. In terms of revenue contribution, Kenya Power contributed to 12.2% of Ormat's revenues in Q1 24, [Q1 23: 14.5%].

🔴| Betsafe Exits Kenya | Betsafe has exited the Kenyan market amid increased taxation, joining other firms like Betin in ceasing operations. Effective May 14, the closure, attributed to excessive taxes including a 15% tax on gross gaming revenue, 30% corporate tax, 16% income tax, and annual licensing fees, left employees jobless.

Separately, data from Uganda's National Lotteries and Gambling Regulatory Board indicates that betting companies paid out at least USHS 3T (USD 787.6M) to winning tickets in the 10 months to April, signaling the growth of gaming and betting as an income earner.

📡| Deep Sea Fibre Cuts | Last week, the Communication Authority of Kenya reported that the restoration of internet services following deep sea fibre cuts is underway. However, the backlog of internet traffic may take some time to clear. The authority also appreciated efforts by mobile operators to restore the internet using additional undersea cables.

💲| IMF-Tanzania Agreement | The IMF and Tanzanian authorities have reached a staff-level agreement on a reform program to address climate change challenges supported by the Resilience and Sustainability Facility (RSF) and completed the third review under the Extended Credit Facility (ECF). The IMF mission held meetings in Dodoma and Dar es Salaam, resulting in an agreement to make available SDR 113.3M [~USD 150M], bringing total IMF support to SDR 455.5M [~USD 604.2M]. Additionally, Tanzania requested access to RSF funds amounting to SDR 596.7M [~USD 789.6M].

Separately, the Fund approved a new method for countries to use their reserve assets, known as Special Drawing Rights (SDRs), to fund multilateral development banks for climate resilience and poverty reduction initiatives. This allows countries to acquire hybrid capital instruments from lenders like the Inter-American Development Bank and the African Development Bank.

📈| Nigeria’s Inflation Rises | In April 2024, Nigeria's headline inflation rate rose to 33.69%, a 0.49% increase from March's 33.20%, according to the Nigeria Bureau of Statistics. This rate is 11.47% higher year-on-year compared to April 2023's 22.22%. Core inflation, which excludes farm produce and energy costs, rose to 26.8% from 25.9% and food price growth was up 40.5% from 40% in March.