👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover rising energy costs, trade shock, and debt markets.First off, enjoy our weekly business news in memes:

Fuel Prices Up

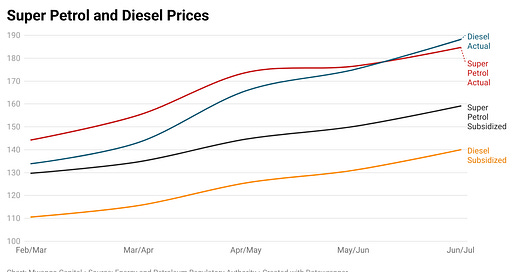

EPRA this week adjusted June/July pump prices for super petrol, diesel, and kerosene upwards by Kshs 9 each to Kshs 159.12, Kshs 140.00, and Kshs 127.94 per litre respectively. Were it not for the fuel subsidy, the products would have retailed at Kshs 184.68, Kshs 188.19, and Kshs 170.37.

Unsustainable Subsidy: In a press release this week on fuel prices, the National Treasury pointed out that the cost of the fuel subsidy could eventually surpass its budgetary allocation; thus potentially escalating the public debt to unsustainable levels.

“The cost of the fuel subsidy could eventually surpass its allocation in the national budget, thus potentially escalating public debt to unsustainable levels and disrupting the Government’s plans to reduce the rate of debt accumulation. For this reason, a gradual adjustment in domestic fuel prices will be necessary in order to progressively eliminate the need for the fuel subsidy, possibly within the next financial year.”

National Treasury & Planning Cabinet Secretary, Ukur Yatani

OMCs Push: Oil Marketing Companies are pushing for further increases in fuel prices to compensate them in the wake of a parallel exchange rate system. The marketers have pointed out that EPRA’s compensation is based on CBK official exchange rates which are lower than the rates at which oil marketers buy dollars from banks.

“If I am buying the dollar at Kshs 118 and am getting compensated at the rate of Kshs 115, then that is a loss of Kshs 3 on the dollar exchange alone. Are you going to negotiate with the banks on the dollar rates or you are focused on getting enough dollars to make payments for your shipments?”

Chief Executive Officer of a local oil firm

NOCK Quota Opposed: A section of OMCs has raised concern over the government’s plan to allocate the National Oil Company of Kenya a 30% import quota of fuel products. The marketers have said that the move will impact the fuel supply chain and may precipitate unnecessary shortages.

Tariff Cut Delayed: Kenyans might have to wait for the next regime to unlock the second phase of a 15% cut to electricity bills as the incumbent government is yet to open negotiations with independent power producers (IPPs). The Energy Ministry has further pointed out that the second cut will target low-income households.

KRA Biggest Beneficiary: The surge in pump prices has set up the taxman as the biggest recipient of the price gains as taxes and levies account for the biggest component of the pump prices. In the latest review, out of a litre of super petrol and diesel, KRA’s share stands at 39.52% and 36.89% respectively.

Debt Markets

Laikipia Bond Approved: This week, the Senate approved the National Treasury's request to underwrite Laikipia’s Kshs 1.16B infrastructure bond. With both Cabinet and Parliamentary approvals in, Laikipia is set to float the 7-year bond at the NSE whose proceeds will be invested in at least 16 projects.

Kshs 25B Tap Sale: In what will be the last act of borrowing from the domestic markets in the 2021/22 fiscal year through Treasury bonds, the Central Bank of Kenya is seeking Kshs 25B through a tap sale. The vehicles that will be reopened are FXD1/2022/03 and FXD1/2022/15.

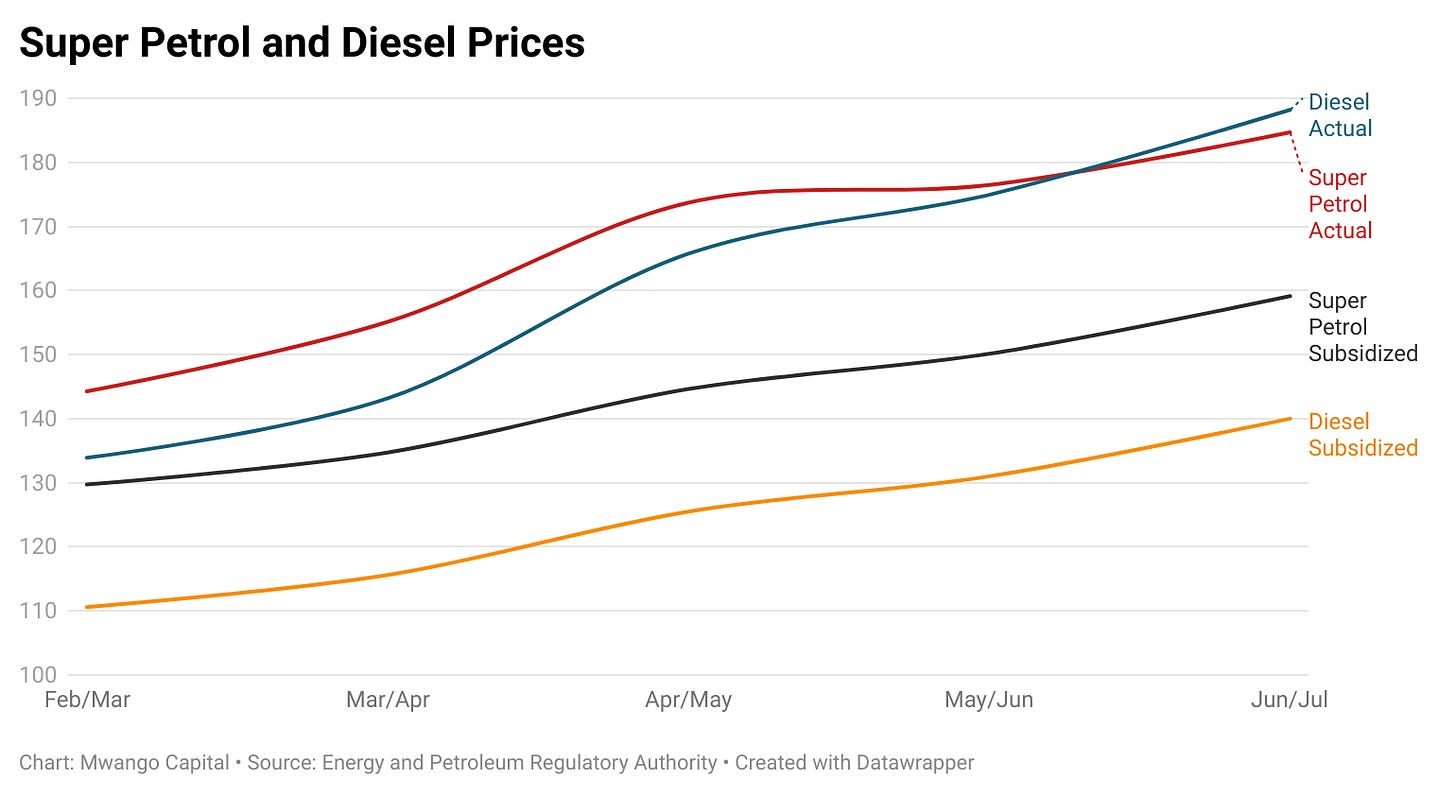

Treasury Bills: In the gilts market, average interest rates for 91-day, 182-day, and 364-day instruments came in at 7.925%, 9.096%, and 9.961% respectively. The rate on the 364-day paper is at its highest since the auction on January 3 2019 when it stood at 10.01%.

Rising Rates: Because of the government’s heavy borrowing, the interest rate on the 91-day paper has risen, forcing banks to increase interest rates on wholesale deposits to keep up, lest depositors lend to the government directly. Banks have passed on the costs to customers to protect their spreads as evidenced by the 12.2% 27-month high average lending rate registered in April 2022.

Take-Away: There is a broad increase in interest rates in the current environment. The deposit rate has more room for upward upside given that it is over 70 basis points below what the government is offering through the 91-day paper.

Eurobonds: Nigeria, Ghana, and Kenya will stay out of Eurobond markets on surging borrowing costs in international debt markets. Ghana has already gone the loan syndication route, having secured a $1B pledge from various international lenders. Kenya has also canceled its $1B Eurobond issuance and will instead borrow from a syndicate of banks.

Trade Shocks

Regional Trade Wars: Kenyan authorities have reintroduced a levy of Kshs 72 per tray of eggs from Uganda setting the stage for another round of trade wars. On the Kenya-Tanzania border at the Namanga Border Post, over 400 trucks with stocks of grain for Kenyan millers are stuck following Tanzania's new policy requiring grain traders to get an export permit before shipping maize into Kenya.

Khat Exports to Somalia: Things could change regarding Kenya’s access to the Somalia market for khat after its closure in 2020 following a political fallout that led to the loss of business worth more than 50 tonnes of Kenyan khat valued at over Kshs 20M daily. The recent change of leadership could result in a respite in the trade of the commodity between the two countries.

Pakistan Mulls Tea Import Cuts: Exports of tea are facing an uncertain future after the largest buyer, Pakistan, asked its citizens to downsize consumption of the beverage in a bid to reduce import bills amidst an economic crisis. Traders are speculating that Pakistan’s government could institute a cap on tea imports.

Russia Tea Exports Fall: The Tea Board of Kenya has said that earnings from exports of tea to Russia declined by Kshs 598M in March as volumes fell 74% to 686,072 KGs from 2.6M KGs exported in a similar period in the previous year.

Banking Round-Up

KCB v English Point Marina: In court documents, KCB Group has accused the directors of English Point Marina of diverting funds earned from the sale of apartments at the luxurious hotel to other ends other than offsetting the Kshs 5.2B accumulated loan. The firm’s directors have also been barred by a judge from accessing 15 bank accounts at DTB pending the hearing of an application by KCB.

UBA Bank - Uchumi: UBA Bank has dropped its bid to auction Uchumi’s land on Langata road over a Kshs 172M debt. The move was informed by government plans to compulsorily acquire the land - a transaction that will see the bank get the first claim on the proceeds by virtue of the property's status as security in the lender’s books.

New NBK Leadership: Following the appointment of Paul Russo as the CEO of KCB Group, the board of National Bank of Kenya has appointed an insider - Finance Director Mr. Peter Kioko - as the Acting Managing Director effective June 10, 2022.

FX Deposits Up: Foreign currency deposits were up 3.9% Year-over-Year to Kshs 811B in March 2022, an all-time high. Buyers have been accumulating the US currency on the weakening local unit and in fear of a shortage of the currency in the market.

“The 2.9 percent month-on-month jump could be attributed to foreign exchange valuation, with the dollar strengthening against the shilling by one percent on average in April. Also, the balance has been an organic growth in foreign currency deposits by locals against the backdrop of risk-off sentiment not just locally, but globally.”

IC Asset Managers Economist, Churchill Ogutu

What Else Happened This Week

KenGen’s New Plant: KenGen this week commissioned Olkaria 1 Unit 6; adding 83 MW to the national grid. The operationalization of the plant effectively increases the share of installed geothermal capacity to 42%. [Business Daily]

KRA Shuts Down Keroche: Despite initial tax agreements, the taxman took enforcement action on May 15 and closed down Keroche Breweries due to an ongoing tax dispute. Elsewhere, for the 2021/22 financial year, KRA is expecting to beat its tax collection target by Kshs 140B. [Capital FM]

Limuru Tea Stake Sale: Billionaire businessman Joe Wanjui who owns a 25.48% stake in Limuru Tea, has gone to court seeking to block British multinational Unilever from selling its 52% majority stake in Limuru Tea to a private equity fund as part of a Kshs 596.7 ($5.1B) global deal. [Business Daily]

Not So EAC: In the first act of the new EAC structure - a joint military deployment to DRC to combat terrorism - DRC has requested the exclusion of Rwandan troops. The two countries are in a spat over alleged Rwandan backing of the M23 rebel group in Congo. [The East African]

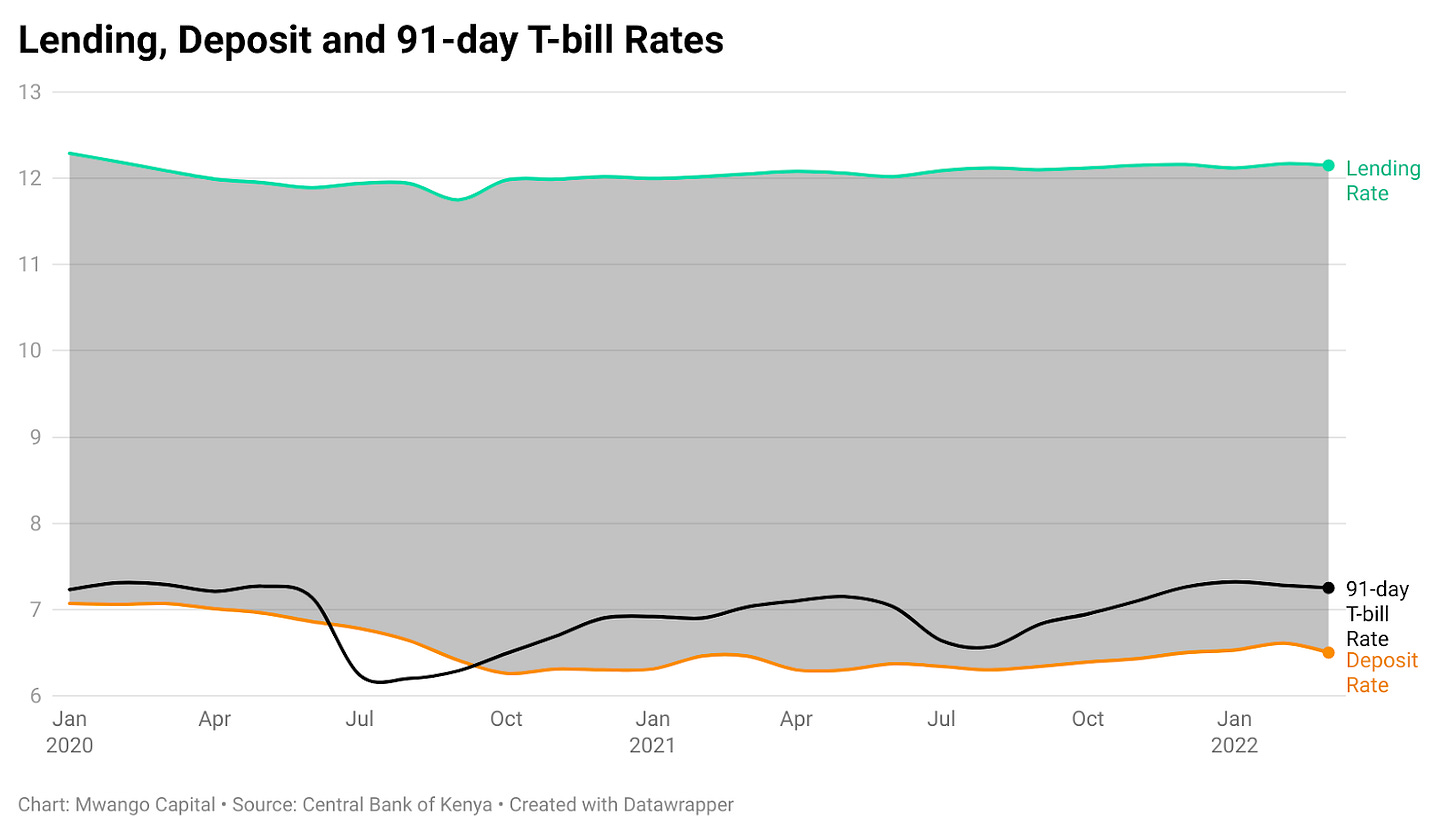

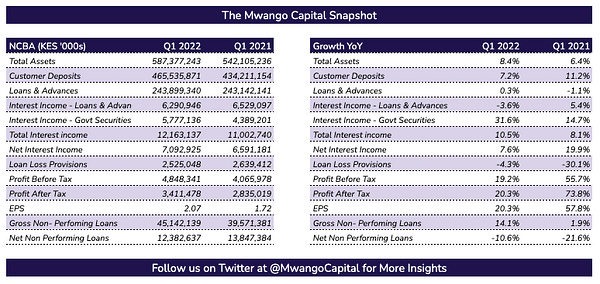

Don’t miss! Our analysis of banks’ performance in Q1 2022:

Interest Rates Watch

United States: The Federal Reserve delivered another hike of 75 basis points during the week - its biggest since 1994; bringing the Fed funds rate target to 1.5% - 1.75%.

Botswana: The Monetary Policy Committee of the Bank of Botswana raised the Monetary Policy Rate by 50 basis points to 2.15% from 1.65% to contain inflation.