👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Co-operative Bank of Kenya Q3 2023 Results, IMF-Kenya staff-level agreement and QBER Q1 FY 23/24 highlights.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Introduce your child to savings and responsible money management with Coop Bank’s Jumbo Junior Account.

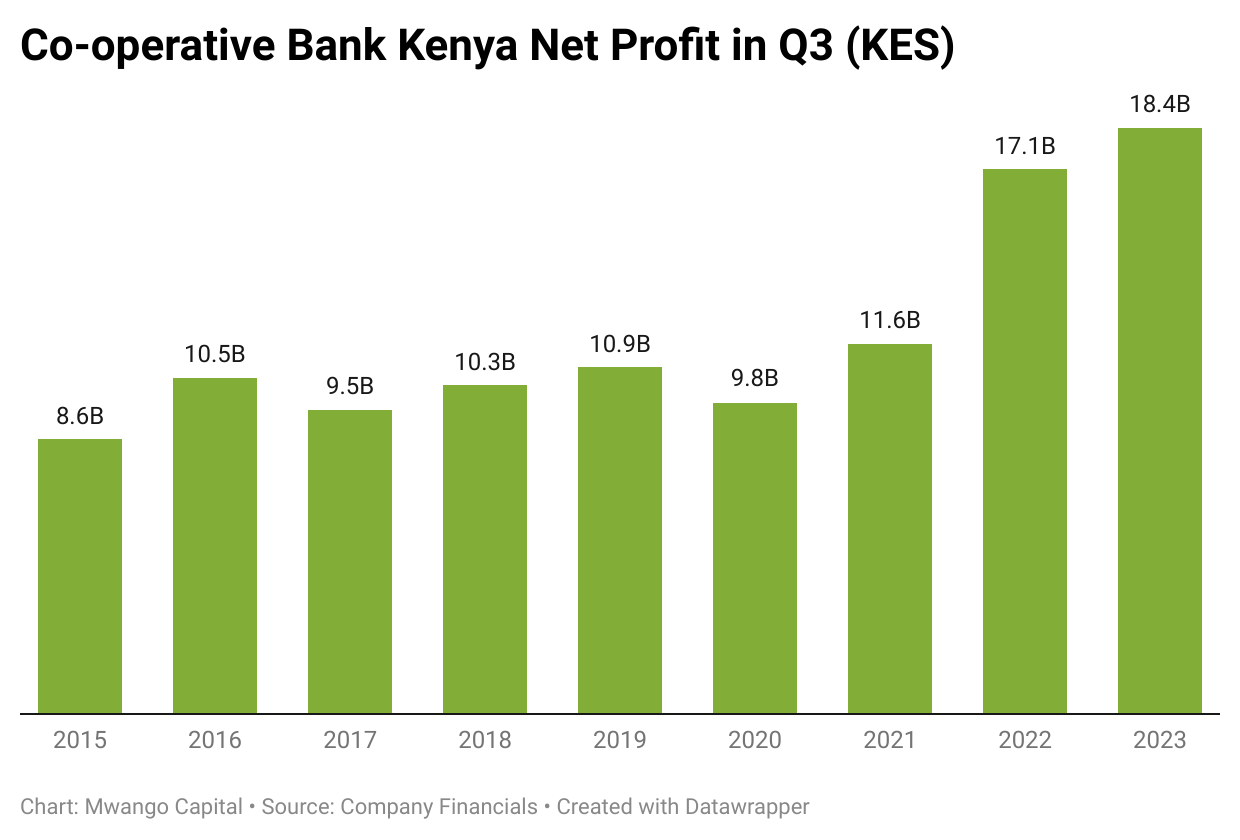

Co-op’s Net Profit Grows 8%

Co-operative Group released its Q3 2023 on 16th November 2023, becoming the first bank to release earnings in the Q3 bank earnings season. Net profit grew by 7.6% year-on-year to reach KES 18.4B [H1 2022: +47.1%]. EPS was up 8.2% to KES 3.15.

Balance Sheet Decomposition: The Group’s loan book grew by 12.8% to KES 378.1B, while Kenya government securities holdings were up marginally by 1.5% to KES 185B. Customer deposits closed at KES 432.8B, up 0.2% year-on-year, albeit down 6.7% [KES 31B] quarter-on-quarter.

Lacklustre Earnings: Interest income from loans and advances edged higher by 14.3% to KES 31.8B, while that from government securities was up 8.1% to KES 16.8B. Group operating income closed at KES 53.4B, up 2.3%, with net interest income and non-interest income growing marginally at 2.5% and 2.1%, respectively. Interest expenses grew at 41.3% to KES 16.5B, as compared to a 12.9% growth in interest income to KES 49.4B.

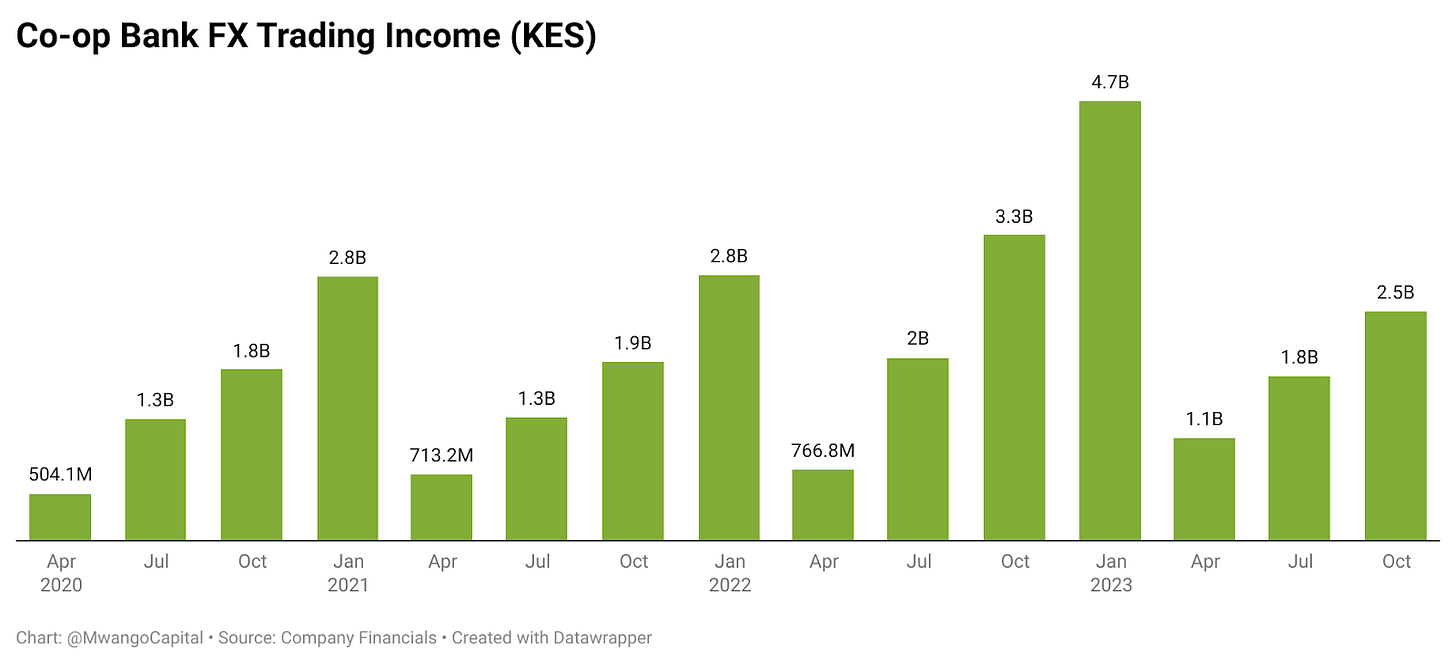

FX Trading Income: Foreign exchange trading income in the period under review closed at KES 2.5B, 25% lower relative to Q3 2022. In the last two quarters, FX trading income growth has been weakening, partly as a result of improving conditions in the FX market on account of new measures introduced to alleviate access to FX.

Coming Up: This week, we expect results from Equity Group and KCB Group on 20th November 2023 and 22nd November 2023 respectively.

Find our analysis here and full results here.

IMF - Kenya Agreement

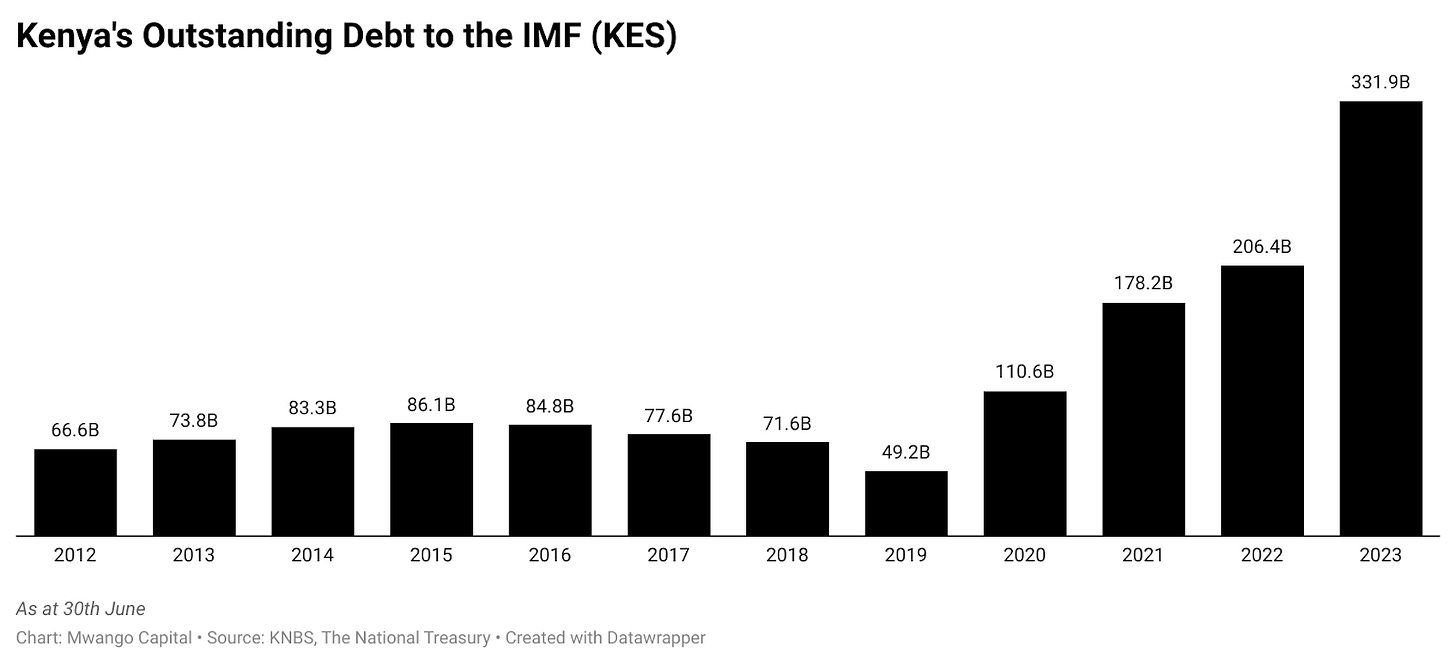

Highlights: The International Monetary Fund (IMF) and Kenyan authorities last week reached a staff-level agreement, concluding the sixth reviews and augmentation of Kenya’s Extended Credit Facility (ECF) and Extended Fund Facility (EFF) arrangements amounting to 130.3% of the quota [~USD 938M]. The agreement is subject to approval in January 2024.

USD 682.3M Immediate Access: Approval by IMF’s Executive Board will see Kenya have immediate access to USD 682.3M out of which USD 622.3M has been sourced from the augmentation of access under the ECF/EFF, and USD 60M from the first review of the Resilience Sustainability Facility. The disbursements will bring the gross IMF disbursements under the ECF/EFF and RSF arrangements in the current programme to USD 2.68B out of a total commitment of USD 4.43B.

Market Access in Eurobond Redemption: The IMF has pointed out that market access to international bond markets remains uncertain as the redemption of the KENINT 2024 Eurobond nears:

“Despite continued commitment to the implementation of the IMF-supported economic program which is broadly on track, uncertainty looms over Kenya’s effective access to international bond markets. This uncertainty is exerting substantial pressure on liquidity, primarily due to the sizeable Eurobond maturing in 2024. Against this backdrop, the authorities are actively mobilizing additional financing from their development partners, the IMF, and commercial sources while concurrently intensifying their efforts to enhance macroeconomic policies and implement structural reforms.”

Head of IMF Mission to Kenya, Haimanot Teferra

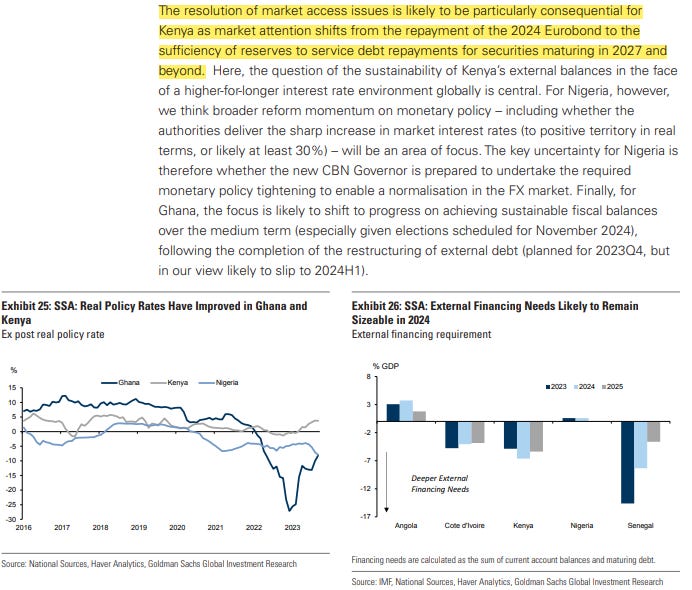

A Goldman Sachs note last week tied Kenya’s challenges in accessing the international capital markets to the redemption of external debt post the 2024 Eurobond:

You can find a link to the entire press release to the IMF-Kenya Staff-Level Agreement here.

QEBR Q1 FY 23/24

In the week, the National Treasury released the Quarterly Economic and Budgetary Review for the quarter ending 30th September 2023. Here are some key takeaways from the report:

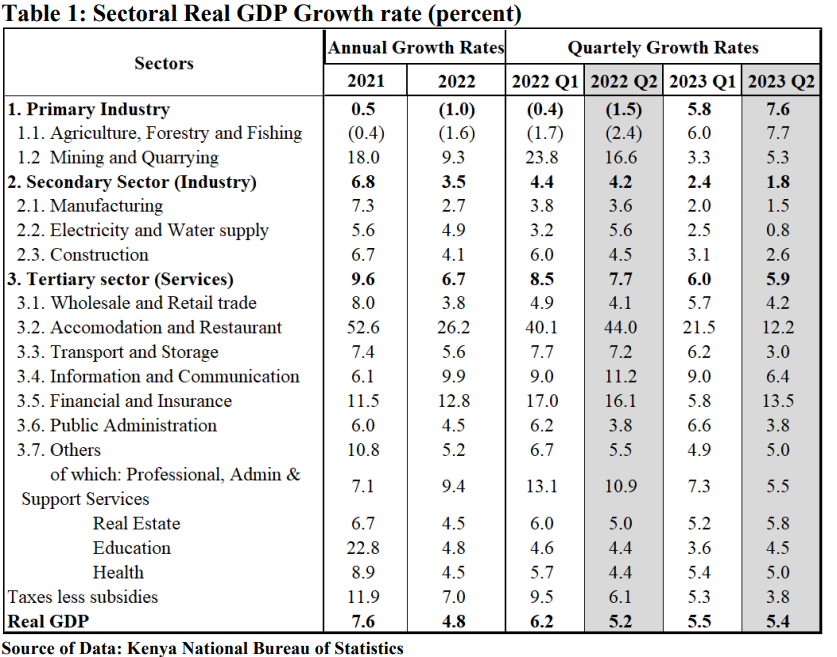

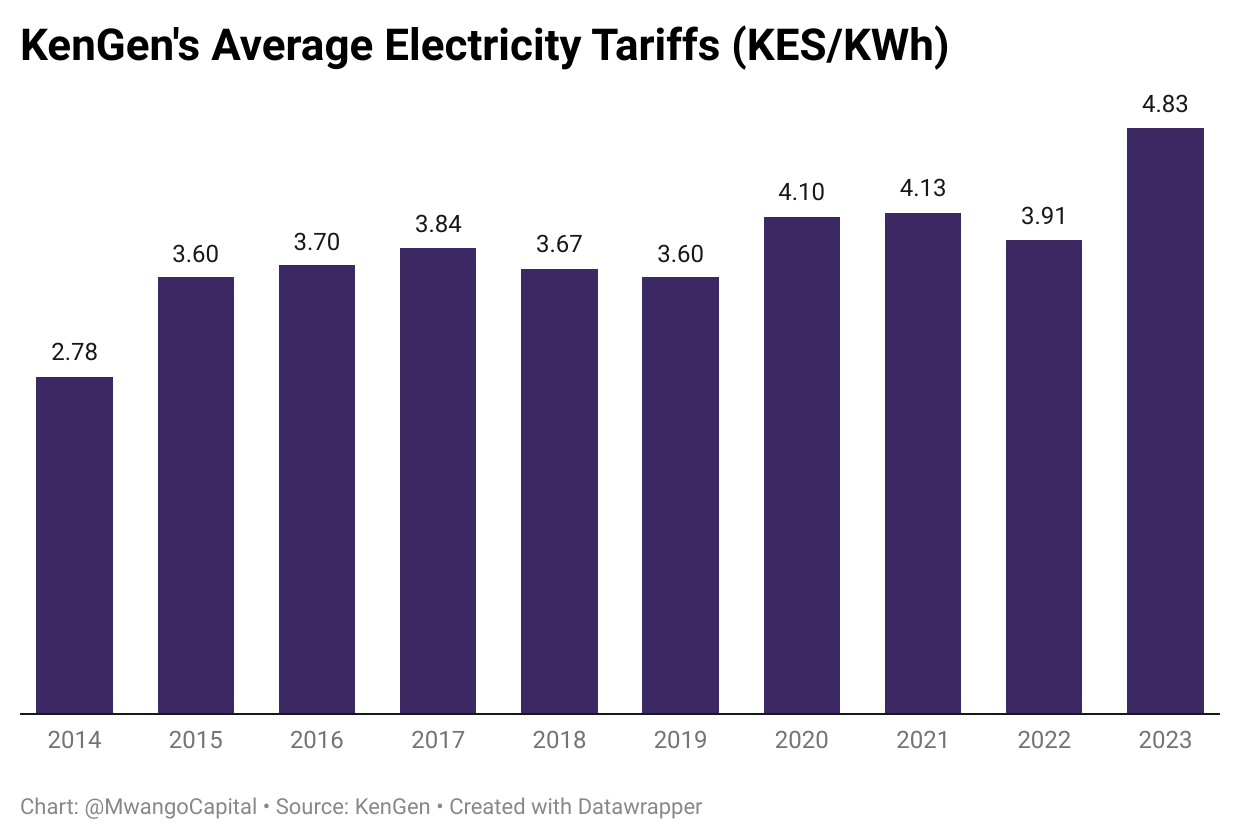

Economic Growth: The Kenyan economy grew by 5.4% in the second quarter of 2023 compared to a growth of 5.2% in the second quarter of 2022, due to a rebound in agricultural activities. The Financial and Insurance sub-sector recorded the highest growth at 13.5%, while the Electricity and Water sub-sector grew the slowest at 0.8%.

Balance of Payments: The current account deficit improved to USD 4.2B, equivalent to 4.1% of GDP [September 2022: USD 5.9B [5.3% of GDP]]. The capital account, which tracks net investment flows into the country, recorded a USD 12.6M growth to a USD 144.1M surplus.

Revenue and Expenditure: Total revenue collection as of 30th September 2023 was KES 629.6B, up 10.5%. Ordinary revenue was KES 536.7B, accounting for 85.2% of total revenue, similar to Q4 2022/2023. The aggregate expenditure and lending was KES 804.2B, of which 75.4% [KES 606.5B] was recurrent expenditure [Q4 2022/2023: 74.3%].

Pending Bills: As of 30th September 2023, the gross outstanding national government pending bills were KES 630.6B. State corporations accounted for the bulk at 73.9% [KES 509.4B], while Ministries, Departments and Agencies (MDAs) accounted for KES 121.2B [26.1%].

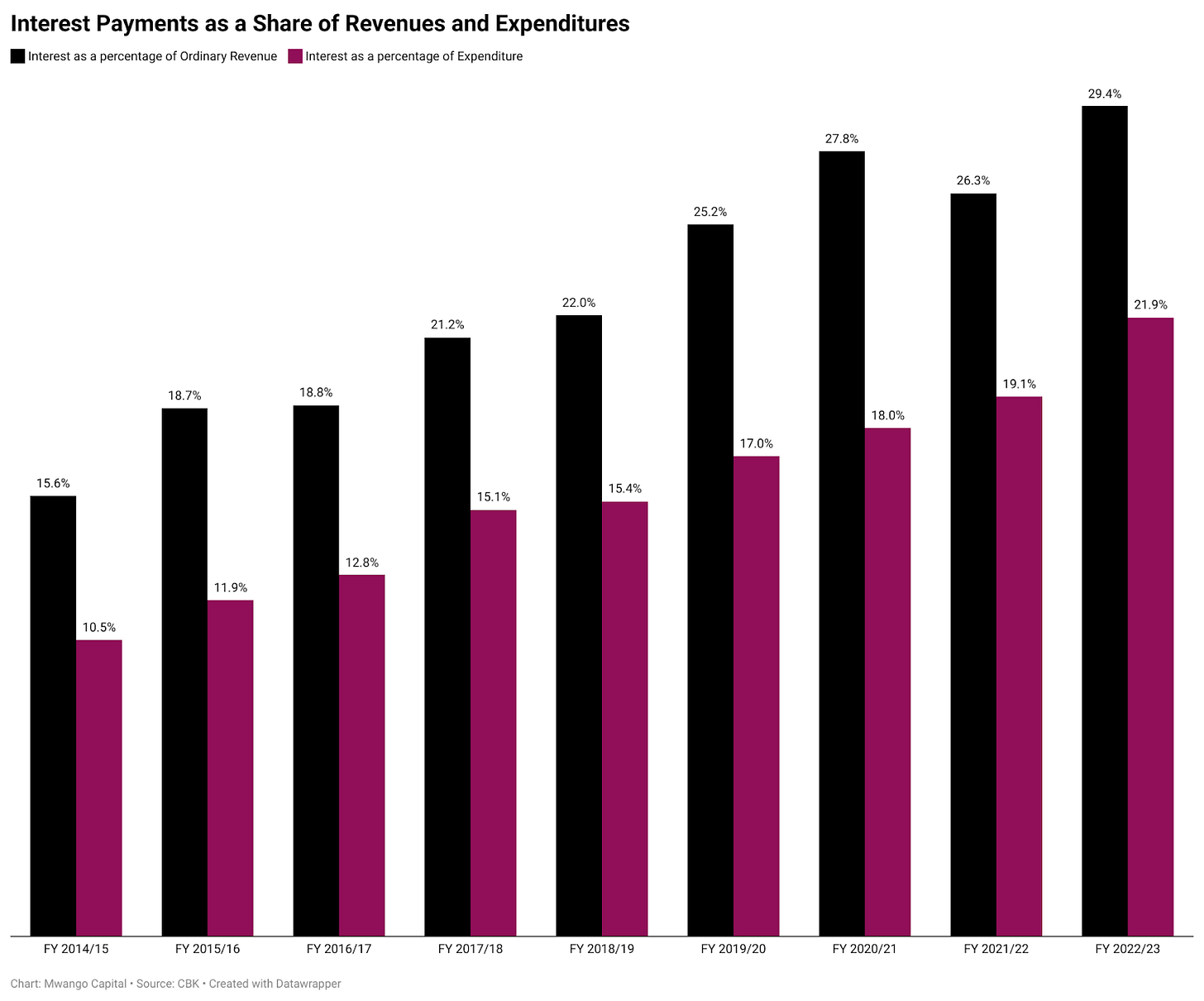

Public Debt: Domestic debt grew by 11.1% to KES 4.9T, while external debt edged higher by 30.8% to KES 5.6T to account for 55.7% of gross debt [2022: 51.9%, 2021: 54.5%]. In sum, gross public debt increased to KES 10.6T, up 20.8%.

Debt Service: During the quarter ending September 2023, the government paid KES 2.7B in guaranteed debt owed to Kenya Airways, consisting of KES 2.4B in principal and KES 0.4B in interest. The aggregate external debt service payments to external lenders amounted to KES 152.1B, of which, KES 89.4B [58.8%] was principal and KES 62.7B in interest. 28.5% of the total external debt service was to commercial creditors [bilateral: 55.4%, multilateral: 16.2%].

You can find a link to the report here.

Markets Wrap

NSE: In Week 46 of 2023, Bamburi was the top-performing stock, up 28.4% to close at KES 28.90. NBV was the worst-performing stock, down 16.6% to close at KES 2.42. The NSE 20 index increased by 3.7% to close at 1,472.1 points, the NSE 25 increased by 2.4% to close at 2,367.1 points, and the NASI index increased by 1.8% to close at 90.6 points. Equity turnover increased to KES 2.3B from KES 1.6B the prior week while bond turnover closed the week at KES 26.97B compared to the prior week’s KES 9.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.3632%, 15.4281%, and 15.6385% respectively. The total amount on offer was KES 24B with the CBK accepting KES 23.71B of the KES 45.34B bids received, to bring the aggregate performance rate to 208.32%. The 91-day and 364-day instruments recorded 942.71% and 28.91% performance rates, respectively.

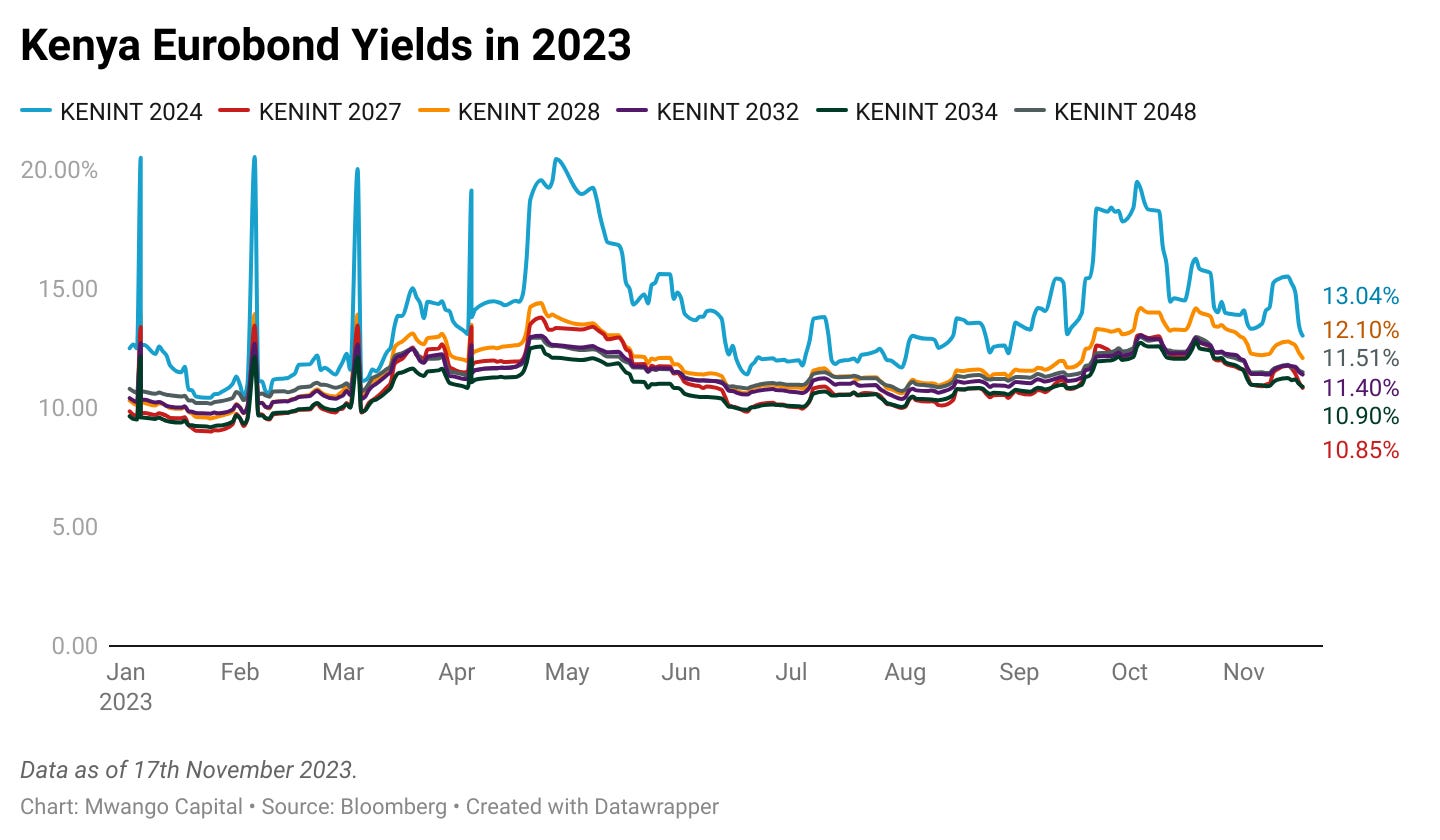

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2024 fell the most week-on-week, down by 234.8 bps to 13.042% while KENINT 2048 fell the least, depreciating by 20.30 basis points to 11.508%. The average week-on-week change stood at -74.05 bps.

KENINT 2028 rose the most on a year-to-date (YTD) basis, appreciating by 178.9 bps while KENINT 2024 rose the least at 43.9 bps.

Prices rose across the board week-on-week, with KENINT 2027 rising the most at 2.4% to 89.032. KENINT 2024 appreciated the least at 1.5% to 96.578. Year-to-date, KENINT 2024 was the only price that rose, appreciating by 4.4%. The largest price losses YTD were 6.9% for KENINT 2034 to 72.142. The average price change week-on-week and YTD was -0.03% and 0.02%, respectively.

Market Gleanings

🛠️| CIC Restructuring | CIC Insurance Group, along with its Kenyan subsidiaries, this week announced that it had embarked on a strategic restructuring initiative to streamline its organisational structure. The restructuring includes a Voluntary Early Retirement/Exit Programme affecting approximately 75 staff, which is 10% of the total workforce. In H1 2023, CIC Group recorded a 153% increase in profit before tax to KES 1.2B.

📃| Bamburi Sells Hima Shares | Bamburi Cement PLC announced a proposed sale of its 70% stake in Hima Cement Limited, owned by Him Cem Holdings Limited, a subsidiary of Bamburi. The share purchase agreement will see Sarrai Group Limited and Rwimi Holdings Limited acquire 100% of the issued share capital of Hima Cement for a value of USD 120M. Upon completion, Hima Cement will cease to be a member of the Bamburi Group and will become a member of the Sarrai Group.

💸| Diaspora Remittances | In October 2023, diaspora remittances stood at USD 355.6M, up 6.9% year-on-year. The remittances are up 4.5% on a month-on-month basis. The cumulative inflows for the 12 months to October 2023 totalled USD 4.165B, up 4.2% year-on-year.

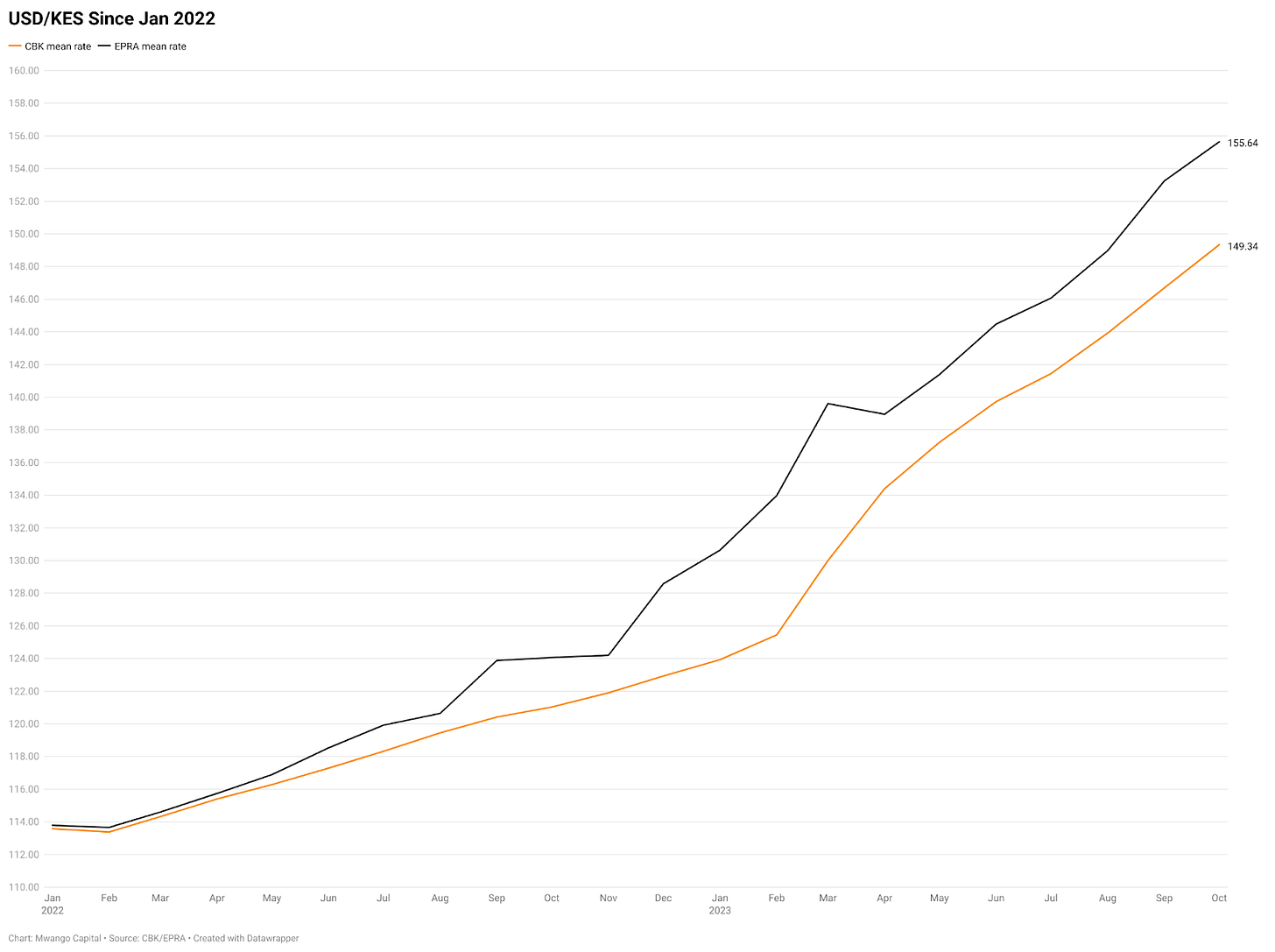

🛢️| Nov/Dec Fuel Prices | In the week, EPRA announced new fuel prices for the November/December pumping cycle, with the prices of petrol, diesel, and kerosene set at KES 217.36, 203.47, and 203.06. Excluding subsidies, the retail prices would have stood at KES 229.37, 223.29, and 206.70, respectively. According to EPRA, in October, the USDKES exchange rate averaged 155.64 units, while the price of Murban crude oil was USD 87.28/barrel, up by 1.6% and 8.0%, respectively.

💼| CSquared Fundraising | CSquared Link Holdings, a Pan-African technology company, has secured an equity investment of KES 3.8B from CPIDF, the International Finance Corporation (IFC), and the International Development Association’s (IDA) Private Sector Window Blended Finance Facility. The funding will be used to expand the company’s carrier-neutral, open-access broadband infrastructure across Africa.

🔴| Ethiopia’s Third Telecom License | Ethiopia’s bid to sell a third wireless license encountered challenges, with no bids received due to concerns about the ongoing conflict in the country. The sale process is expected to be paused, according to sources.