Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.

Our newsletter this week is brought to you by:

Mwango Capital. Mwango Capital provides A+ quality analysis and research on the East African capital markets. Follow us on Twitter, join us on Telegram, check out our website. If you would want to sponsor our weekly newsletter and Twitter Spaces, contact us via email at hello@mwangocapital.com.

This week, we cover the delayed Economic Survey 2021. We also take a look at the results of Kenya’s Infrastructure Bond.

Economic Survey 2021

Late release: Statistics agency Kenya National Bureau of Statistics (KNBS) released Kenya’s annual economic survey this week. Typically, the report is released in late April or early May.

“In 2021 there are two main factors that affected the production of the report...COVID-19 and late submission of data at some stages. Revision of national accounts was second reason for late release”Treasury CS Ukur Yatani

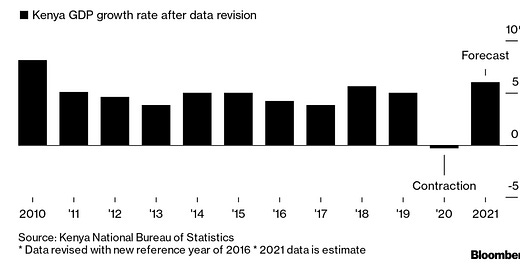

GDP: The economy contracted by 0.3% in 2020, a first in nearly three decades, compared to a 5% growth in 2019. A strong rebound is expected in 2021.

Significantly, the GDP was rebased for the first time since 2014. The nominal GDP grew by ~Kshs 520B to Kshs 10.26T.

Explainer: Rebasing is aimed at recalibrating how the country’s Gross Domestic Product (GDP), or the size of the national cake, is computed. Besides adding or subtracting new economic activities by using a new base year as the reference period for calculating GDP, rebasing also involves adopting new compilation methods as well as new or improved data. [Source: The Standard]

“The revised and rebased national accounts has resulted in an increase in the size of GDP, increase in per-capita income, change in the production structure and revised GDP growth rates among other changes”- Kenya National Bureau of Statistics Director-General Macdonald Obudho

Winners and losers: Construction and ICT sectors registered impressive growth while Tourism was hard hit.

Construction recorded 11.8% growth in 2020 [2019: 5.6%] supported by 21.3% increase in cement consumption to 7.4m tonnes.

ICT sector grew 4.8% supported by increase in mobile money transactions and the use of ICT to facilitate out of school learning.

Agriculture, forestry and fishing grew 4.6% in 2020.

Tourism earnings declined 43.9% to Ksh 91.7B in 2020.

Education recorded a 10.7% drop.

Job losses: Total employment dropped to 17.4m in 2020 from 18.1m jobs in 2019, translating to 737,000 jobs lost. Find our full coverage of the survey here.

Strong Appetite for Kenya’s Infrastructure Bond

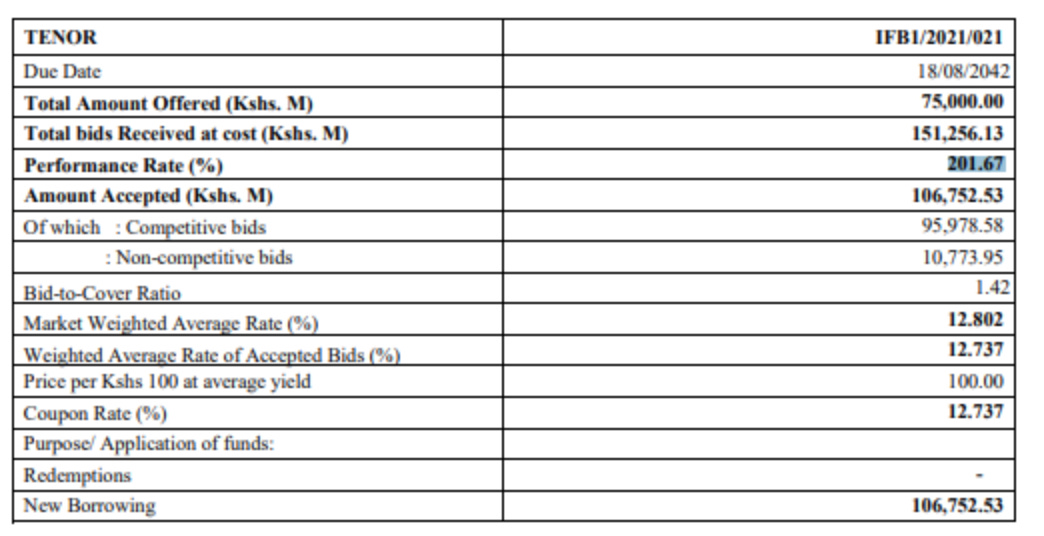

201% oversubscription: Kshs 106B was accepted by Kenya’s Treasury from an initially sought Kshs 75B amount. The Coupon rate for this bond is 12.74%

Secondary trading: Trading of the bond in multiples of Kshs 50,000 will begin on Tuesday, 14th September, 2021

Source: CBK

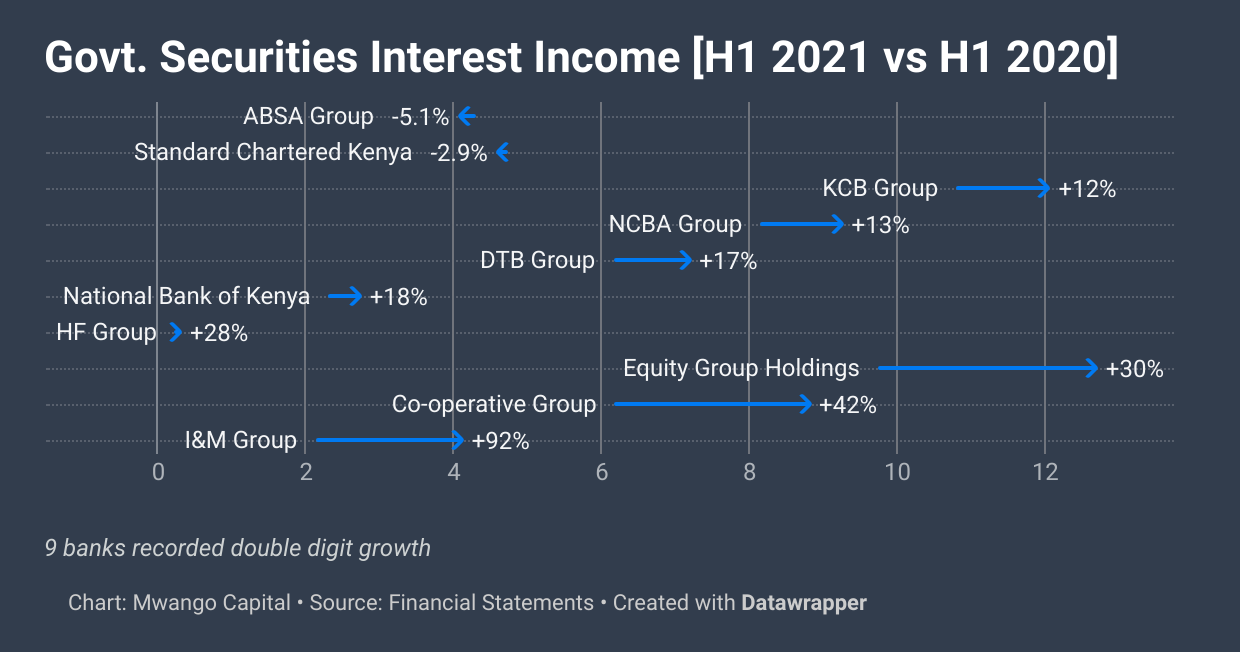

Public sector credit demand is likely to continue growing as private sector credit demand remains subdued in the current business environment.

Banks will continue to profit off this growth in public sector credit demand. Nine banks reported positive growth in government securities interest income in H1 2021 numbers.

Major Milestones

M-PESA Africa:

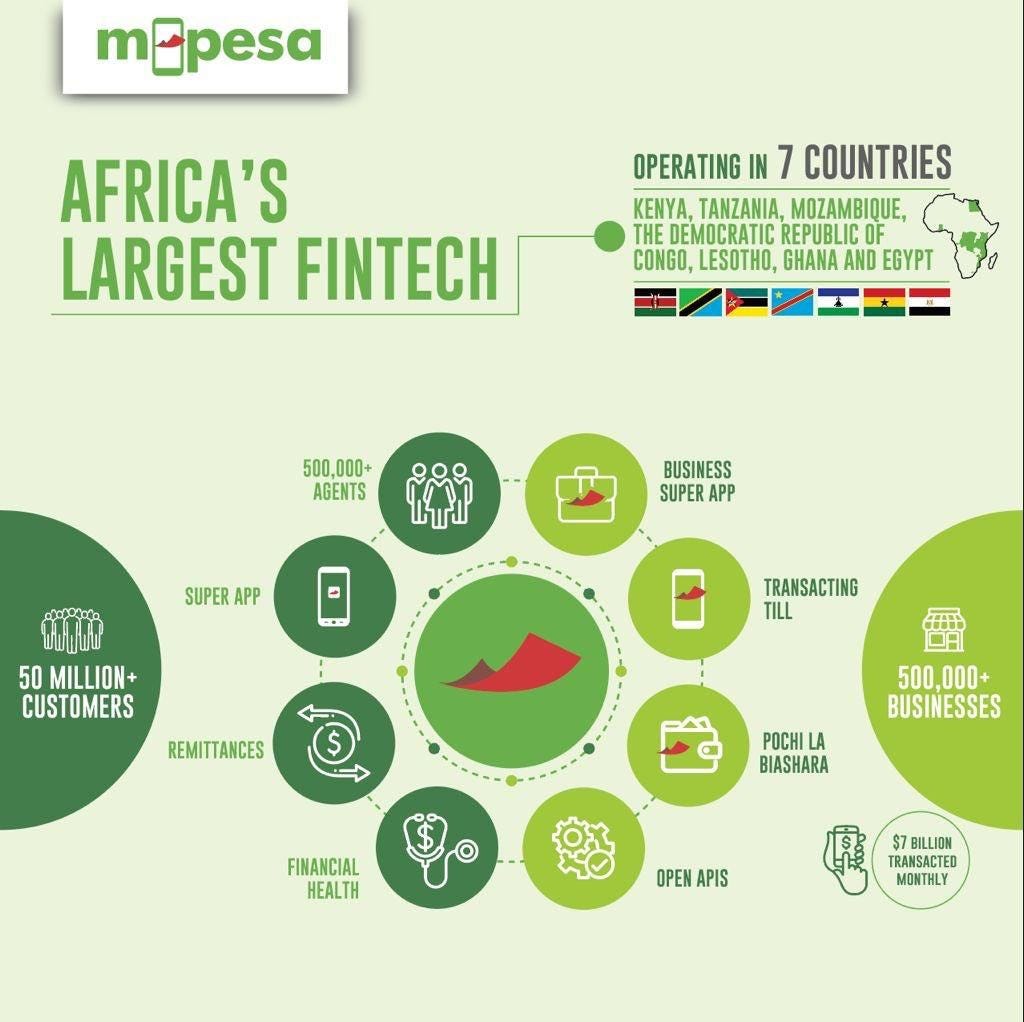

50 million and counting: The leading mobile money service celebrated 50 million monthly active customers this week. M-PESA is today available in Kenya, Tanzania, Mozambique, DRC, Lesotho, Ghana, and Egypt.

Safaricom and Vodacom acquired the M-Pesa brand and platform from UK parent firm Vodafone Plc to form the joint venture, M-Pesa Africa.

In Case You Missed it:

There is a very interesting piece on M-Pesa by London-based analyst Marc Rubinstein titled M-Pesa and the African Fintech Revolution

Safaricom launched their first ever advert for Ethiopia that is filled with menacing intent:

Nation Africa:

The digital platform celebrated its one-year anniversary this week. The platform has more than 350,000 subscribers as of August this year.

Source: NMG H1 report

Digital transformation: Nation Media Group launched Nation.Africa to shift from the legacy model of dependence on advertising and print sales for revenue growth. The platform is aimed towards reader revenue by delivering content digitally.

Markets this Week

In East Africa, Kenya recorded a 0.37% rise in the Nairobi Securities Exchange All Share Index, closing the week at 180.14, up from last week’s 179.47. Tanzania’s DSE ASI was down 0.19% to close at 1,974.65 from last week’s 1,978.46, while Uganda’s USE ASI recorded a 1.32% drop to close at 1,510.75.

Across Africa: Zimbabwe’s ZSE ASI recorded the highest increase in returns this week, up 3.31% to close at 6,878.97.

What Else Happened This Week?

Aviation Updates:

Kenya Airports Authority is facing financial woes and has requested a cash bailout from the Treasury. The agency is also risking an auction following Kshs 37B debt.

British Airways resumed Nairobi-London flights after nearly five months [Business Daily]

Low-cost carrier Jambojet made its inaugural flight to Goma, DRC [Reuters]

Scangroup: The publication of half-year 2021 results will be delayed by a month. Special business at the AGM slated for 30th September 2021 will involve the creation of a merger reserve account to absorb past and future impairments on the share value of subsidiaries [Scangroup]

NSE Board Changes: Check here for the executive appointments that happened this week.

End of an era: Long serving KTDA CEO Lerionka Tiampati resigned before expiry of his contract [KTDA]

Offshore investments: Sterling Capital has partnered with EGM Securities to offer its clients access to offshore investments [Sterling Capital]

M&A: Nigeria’s Autochek acquired Cheki Kenya and Uganda from ROAM Africa [TechCrunch]

Telcos exit in Uganda: UK-based Africell Group will end operations in Uganda by 7th October 2021 after struggling to expand against South Africa’s MTN Group [Telecom.com]

More Ethiopian ventures: Kenya’s Halton Pharmacy, a subsidiary of mPharma opened a branch at Sarbet in Addis Ababa [Capital FM Business]

If you enjoyed our newsletter, please share it with your friends