👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the banking sector’s half-year results and highlights from the Quarterly Economic Review Report.First off, enjoy a dose of our weekly business news in memes.

This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Fuel up the convenient way with your Co-op Bank ATM card. No need to carry cash at the pump; just tap, pay and go. Make your trips smoother, faster, and cashless at NO extra cost.

Click below to see available card discounts.

Equity Group’s Profit Up 8%

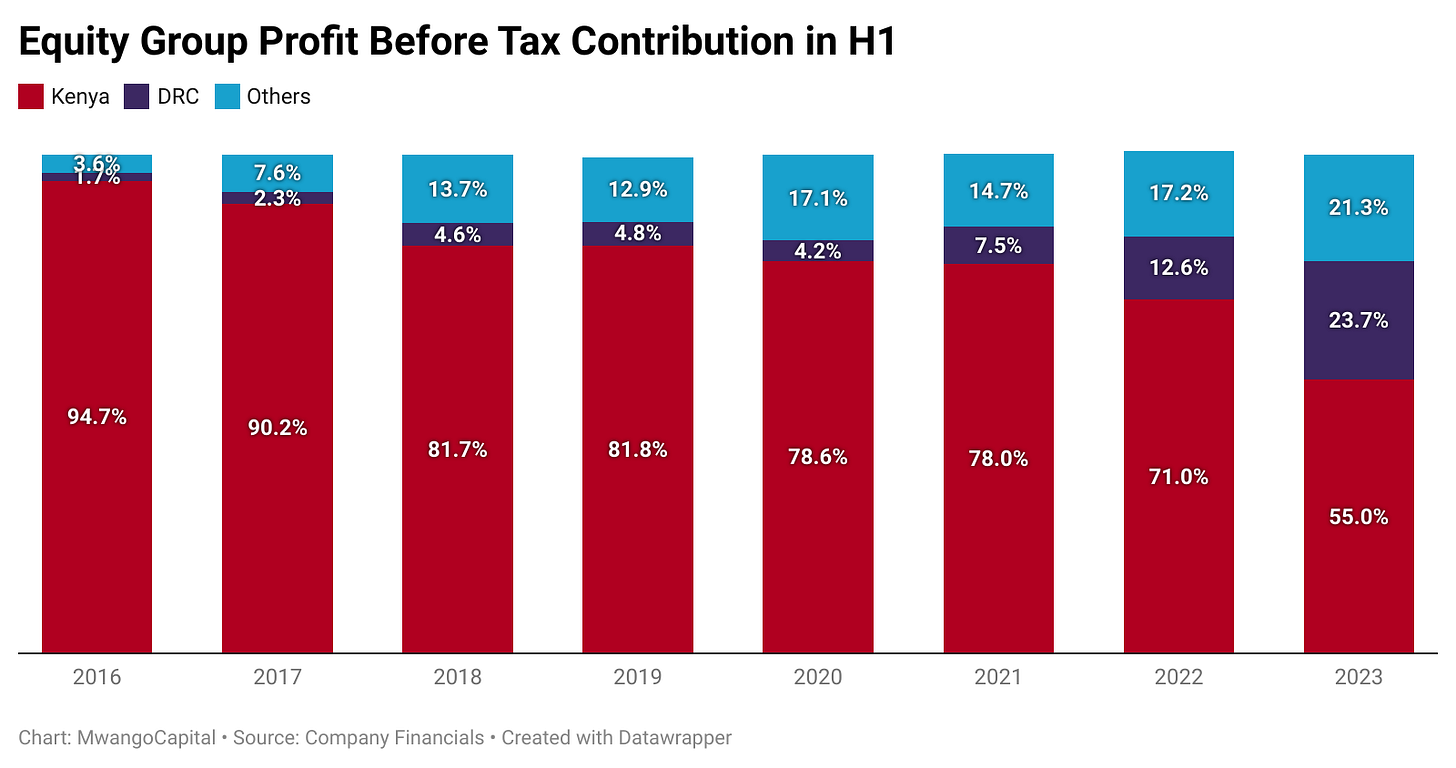

Equity Group Holdings announced its H1 2023 results on August 15, 2023, recording 7.8% growth in Group profitability to KES 26.3B as EPS closed at KES 6.75 (+7.3% y/y). Profitability for the Kenyan subsidiary closed at KES 15.6B, down 12.6%.

Loan Book v Gov’t Securities: The Group’s loan book grew 25.6% to KES 817.2B compared to government securities holdings which increased 17.6% to KES 278.5B. Growth of government securities holdings is however higher at the Kenyan subsidiary level at 19.2% compared to the loan book which only grew 10%.

“We see interest income growing quite fast at 27% because the Group has sustained lending at 26%. And that's why one would ask ‘How does a bank grow loans at 26% to earn 27% during such difficult times?’ It is simply because people require an umbrella when it is raining. You never take an umbrella away from people when it's raining. So we want to support businesses, we want to support communities, we want to support entrepreneurs, so as to wade through this difficult and challenging time.”

Equity Group CEO, Dr. James Mwangi

Deposits Bolster Balance Sheet: The bank boasts KES 1.2T customer deposits against KES 817.2B Group loan book translating to a 69.5% loan-to-deposit ratio from 67.0% the prior year. The Group’s balance sheet stands at KES 1.6T (+23.3% y/y).

NFI Growing Faster Than NII: Group FX trading income, which grew 68%, propelled non-funded income (NFI) to KES 36.5B (+41.2%) compared to net interest income (NII) which grew 16.5% to KES 46.4B. Interest expense grew 54.3% compared to the 27.0% growth of interest income, indicative of the existing high interest rate environment.

Concerning Asset Quality: Group non-performing loans grew 59.8% to KES 97.5B as provisions grew 73.6% to KES 7.1B. The Group’s NPL ratio stands at 9.8% against the June 2023 industry average of 14.5%. Of concern is the Kenya subsidiary NPL ratio which stands at 11.2%, 330 basis points off the industry average.

Subsidiaries: Equity BCDC reported KES 23.7B in revenue, up 80%. Excluding Equity Bank Kenya, Equity BCDC recorded the largest absolute PBT at KES 8.9B, up 130%, to account for 52.7% of the Group’s PBT. Notably, Equity BCDC returned KES 6.2B in net income to be the second most profitable subsidiary in the Group. The South Sudan subsidiary reported the highest growth in PBT and net profit across the banking subsidiaries at 269% and 222% to KES 1.7B and KES 1.2B, respectively.

“Almost 50% of the entire balance sheet of the Group is now outside the Kenya banking subsidiary, which would likely be called the mother of the Group. So the expansion has worked very well and this has really placed the Group very well given that the subsidiaries are in the top 3 financial service providers in the countries they operate in. All 5 of the subsidiaries out of 6 are systemic and are in the top 3. And that again shows the capability of the Group to support regional trade.”

Equity Group CEO, Dr. James Mwangi

Find our analysis here and the full results here.

Co-op’s Loan Book Up 11%

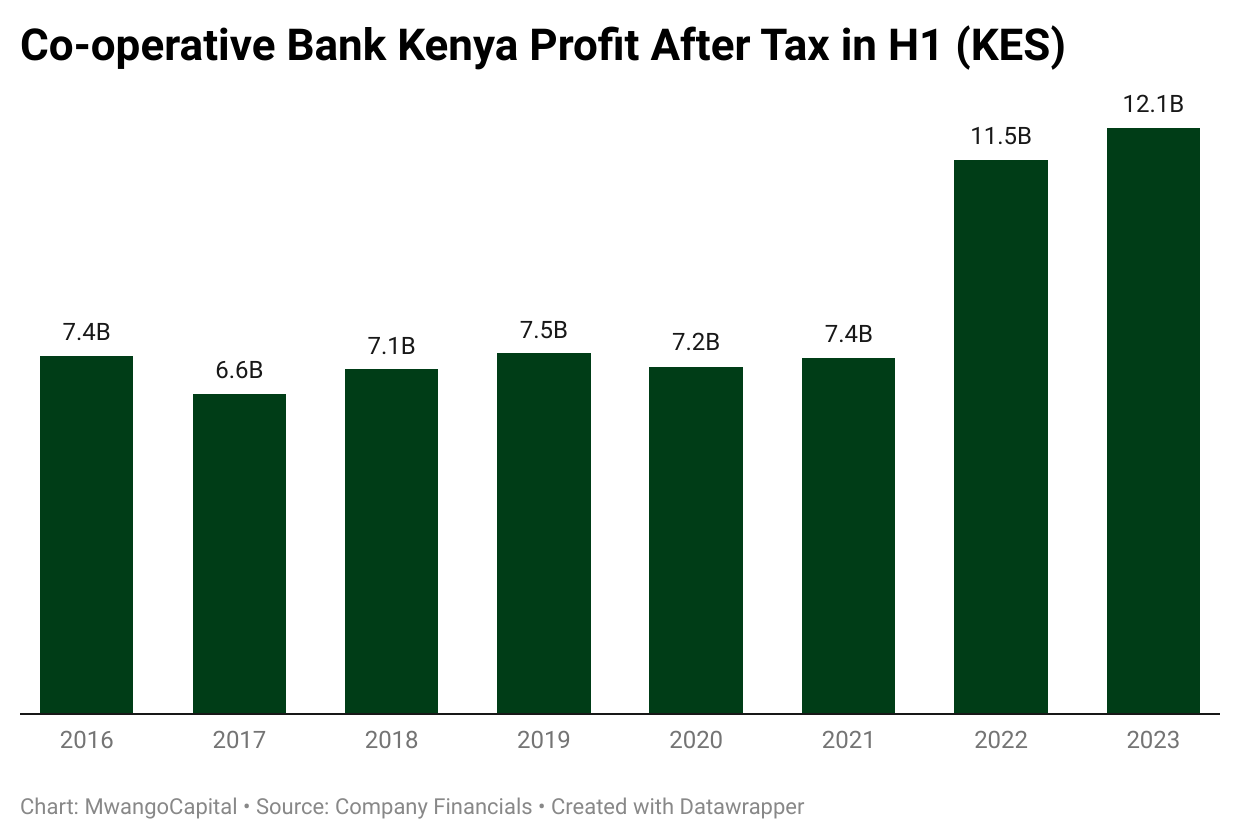

Co-operative Group announced its H1 2023 results on August 17, 2023, recording a 5.9% growth in Group profitability to KES 12.1B as EPS closed at KES 2.08 (+6.7% y/y). Profitability for the Kenyan subsidiary closed at KES 10.9B, up 4.9%.

Balance Sheet: The Group’s loan book grew 10.7% to KES 365.4B compared to Kenya government securities holdings which were up marginally by 2.9% to KES 188.5B. Customer deposits stand at KES 463.9B (+9.7%) translating to 78.8% loan to deposit, unchanged from the prior year.

Income Remains Subdued: Group total operating income ticked up 3.0% to KES 35.4B as both net interest income and non-funded income recorded single-digit growth, up only 2.3% and 4.0% respectively. Interest expense grew significantly by 38.9% to KES 10.4B compared to interest income which grew 12.0% to KES 32.0B.

Bucking the Trend: While loan loss provisions for Stanbic Holdings and Equity Group Holdings are up 98.0% and 73.6% respectively in H1 2023, Co-operative is bucking the trend, cutting its provisions by 14.4% to KES 2.9B. FX trading income remains a sweet spot for Stanbic and Equity, growing 44.4% and 68.0% respectively, while Co-operative’s declined by 10%.

Coming Up: We expect results from Standard Chartered Bank Kenya, KCB Group, Diamond Trust Bank Kenya, Absa Bank Kenya and NCBA Group.

Find our analysis here and full results here.

QBER Q4 2022/2023 Highlights

In the week, the National Treasury released the Quarterly Economic and Budgetary Review for the quarter ending 30th June 2023. Here are some of the key takeaways from the report:

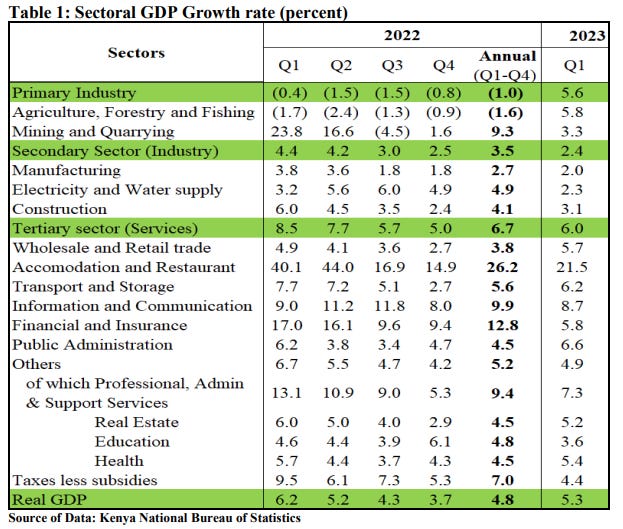

Economic Growth: In 2022, the Kenyan economy grew by 4.8% in 2022, down from 7.6% in 2021, due to lacklustre agricultural productivity. The Accommodation and Restaurant sector recorded the highest growth at 26.2%, while Agriculture, Forestry and Fishing contracted the most at -1.6%.

Balance of Payments: The current account deficit improved to USD 4.6B, equivalent to 4.6% of GDP [June 2022: USD 5.8B or 5.1% of GDP]. The capital account, which tracks net investment flows into the country, recorded a USD 28.1M growth to a USD 189.7M surplus.

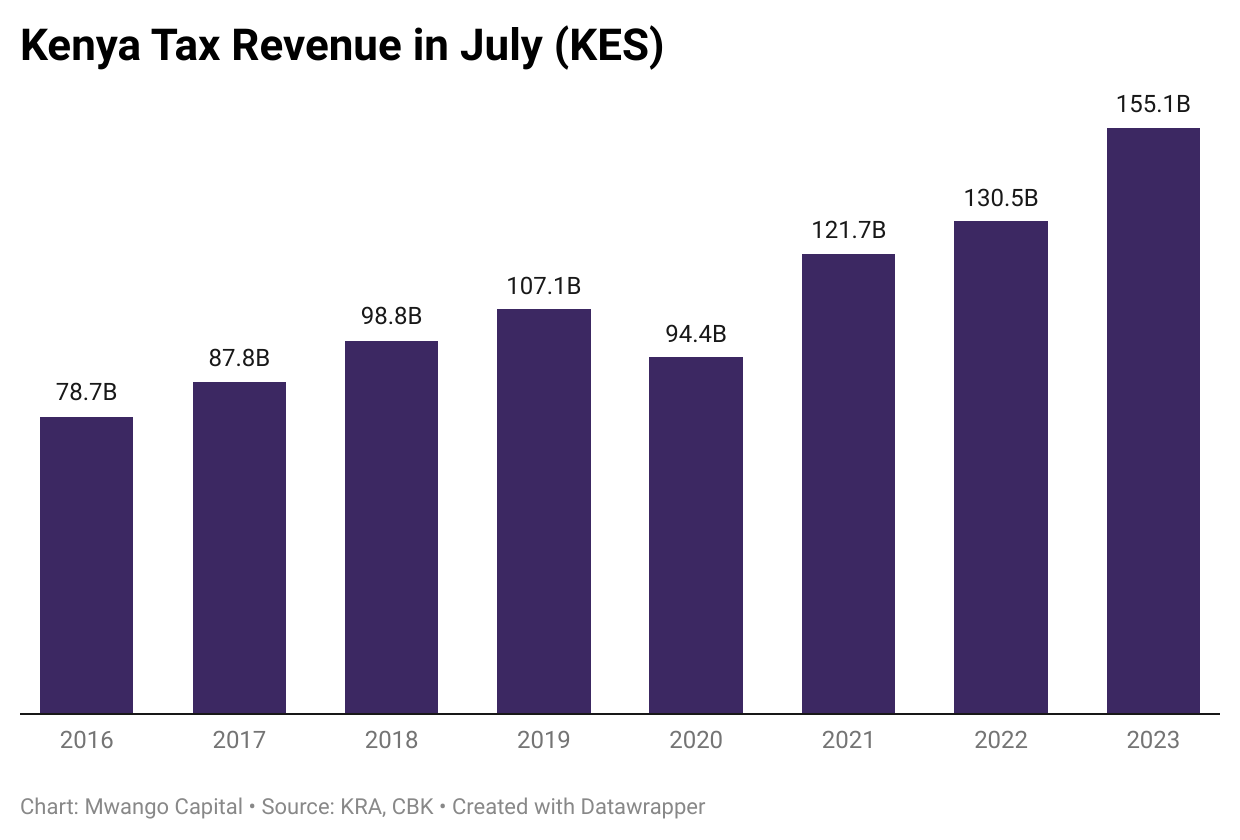

Revenue and Expenditure: Total revenue collection as at 30th June 2023 was KES 2.36T, up 7.3%. Ordinary revenue was KES 2.04T accounting for 86.5% of total revenue, up from 87.2% in Q4 2021/2022. The aggregate expenditure and lending was KES 3.22T, out of which KES 2.2B or 69.8% was recurrent expenditure [Q4 2021/2022: 68.9%].

Pending Bills: As at 30th June 2023, the gross outstanding national government pending bills were KES 567.5B. State corporations accounted for the bulk at 78.2% or KES 443.6B, while Ministries, Departments and Agencies (MDAs) accounted for KES 123.9B or 21.8%. In aggregate, the pending bills were equivalent to 4.2% of GDP.

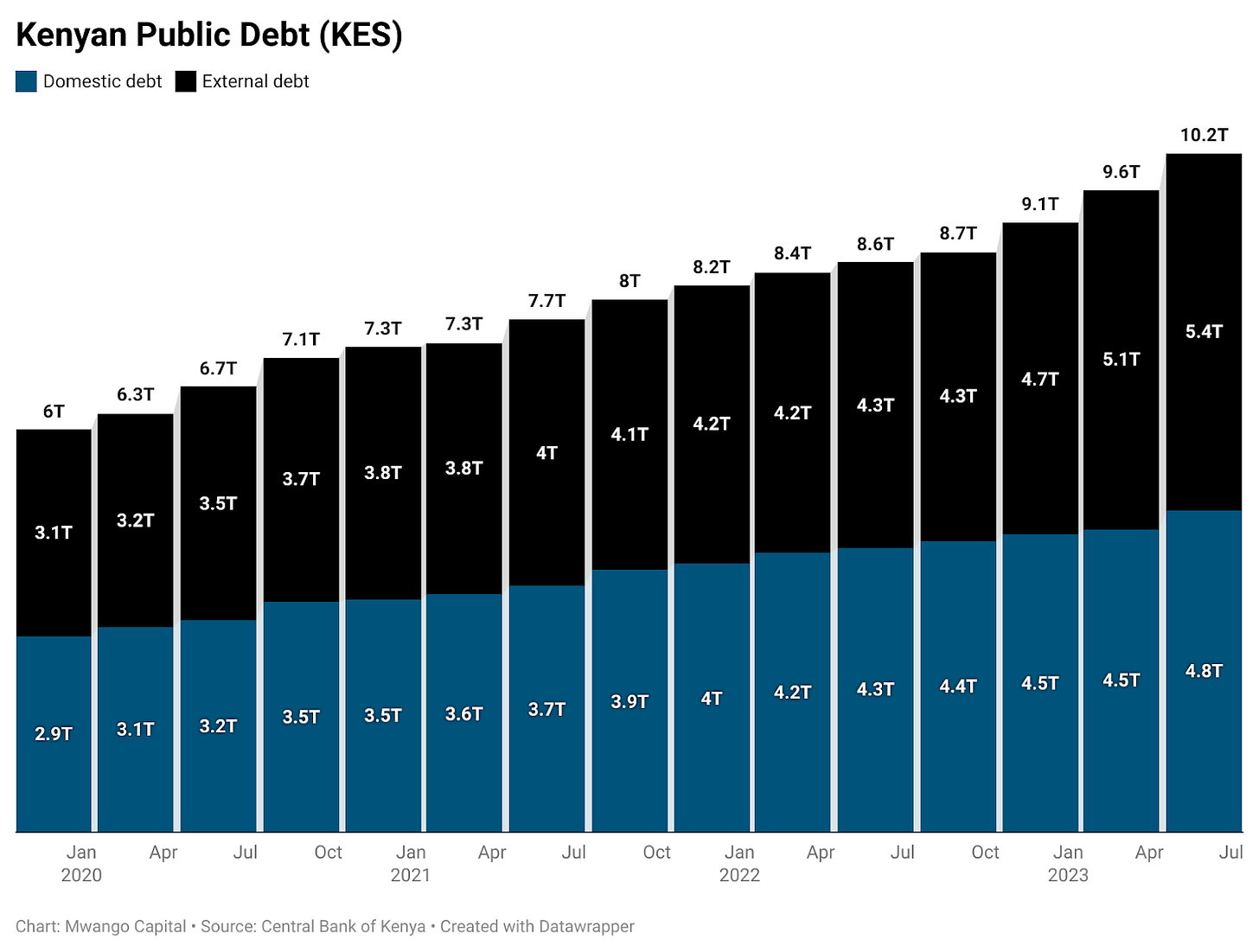

Public Debt: Domestic debt grew by 11.6% to KES 4.8T, while external debt edged higher by 24.6% to KES 5.4T or 52.6% of gross debt [2022: 49.8%, 2021: 52%]. In sum, gross public debt crossed the KES 10T mark to reach KES 10.2T, up 18.1% or KES 1.56T in absolute terms.

Debt Service: In FY 2022/2023, the government paid KES 12.3B in guaranteed debt owed to Kenya Airways, consisting of KES 10.6B in principal and KES 1.7B in interest. The aggregate external debt service payments to external lenders amounted to KES 391.6B, out of which 60.6% or KES 237.4B was principal and KES 154.2B or 39.4% in interest. 41.4% of the total external debt service was to commercial creditors [bilateral: 39%, multilateral:19.6%].

Find the entire report here.

Results Wrap

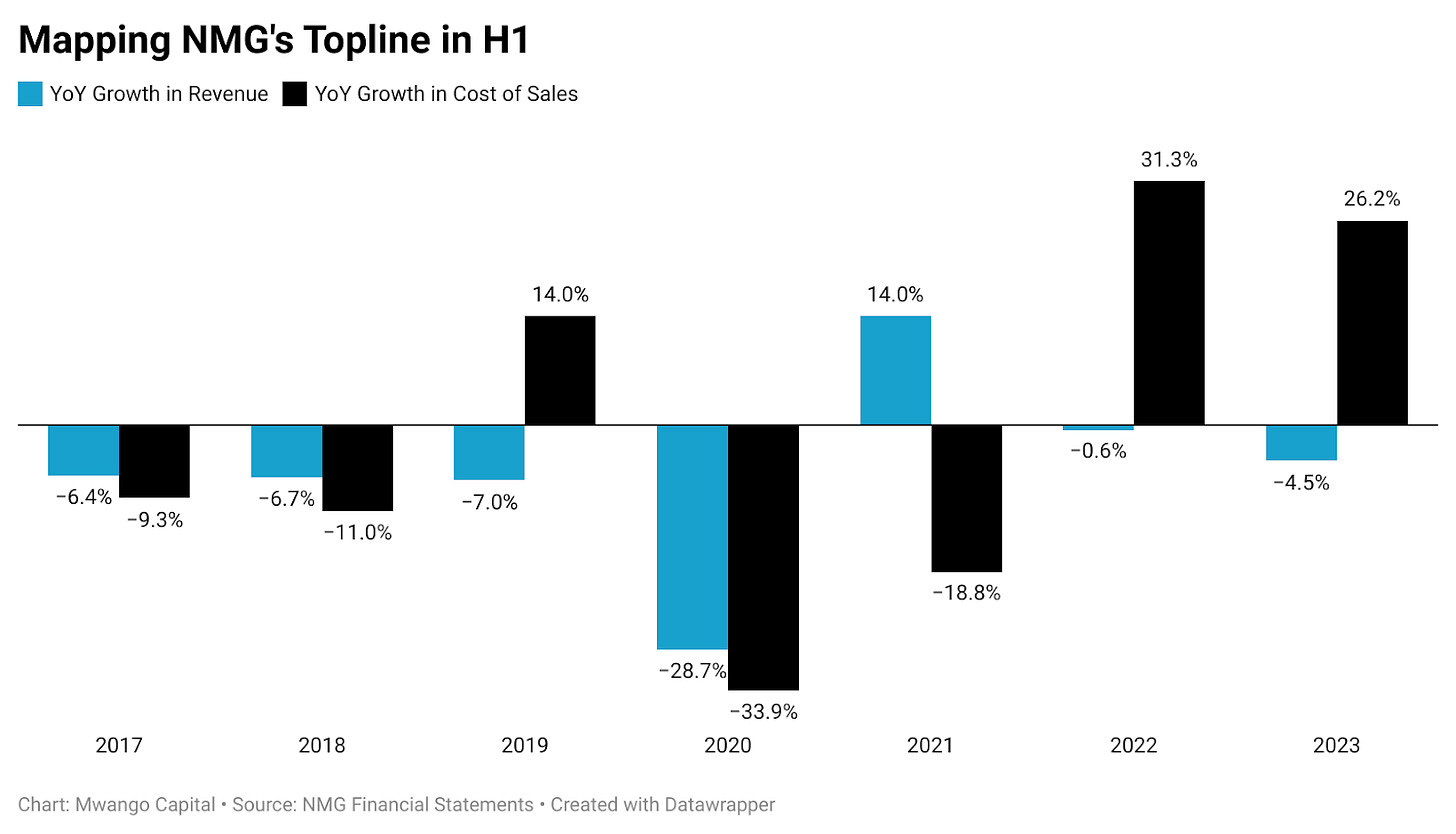

Rising Costs Hurt NMG: Turnover fell by 4.5% year-on-year to KES 3.5B on the back of challenging macro, weak consumer spending and rising prices. Up 26.2%, the growth in the cost of sales outpaced turnover growth to reach KES 862.2M - equal to 24.4% of turnover [2022: 18.5%]. As a result, gross profit fell by 11.5% to KES 2.7B or a 75.6% gross margin [2022: 81.6%]. Noteworthy, cash from investing activities was up 4X to KES 1B - an amount equivalent to more than a third of turnover. Net income declined by a whopping 98.8% to KES 2.9M, and the EPS was KES 0.0 [2022: KES 1.3]. The Board of Directors did not recommend payment of an interim dividend [2022: Nil].

“Group profitability was adversely impacted by increased direct costs attributable to the drastic rise in the cost of imported raw materials, particularly newsprint, and the depreciation of the Kenya Shilling against the US Dollar. The resultant incremental direct costs of KES 179M were absorbed by the Group.”

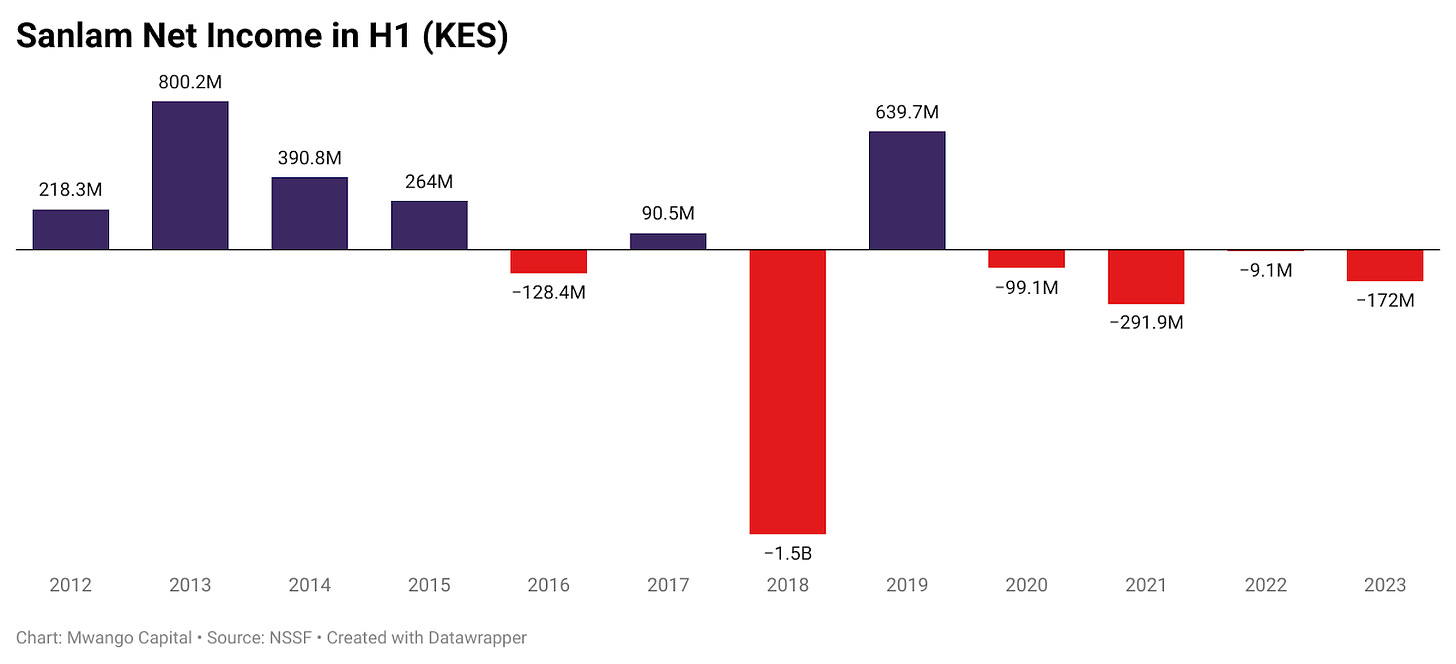

Sanlam H1 Loss Widens: Net revenue for the operating period fell by 15.7% to reach KES 309.9M as compared to KES 367.7M in 2022 on account of KES 181M losses incurred from insurance investment. Other income totalled KES 48.4M on a net basis, down 19.1%, while operating costs surged to KES 413.1M. The net loss for the period amounted to KES 172M, up 19X from H1 2022.

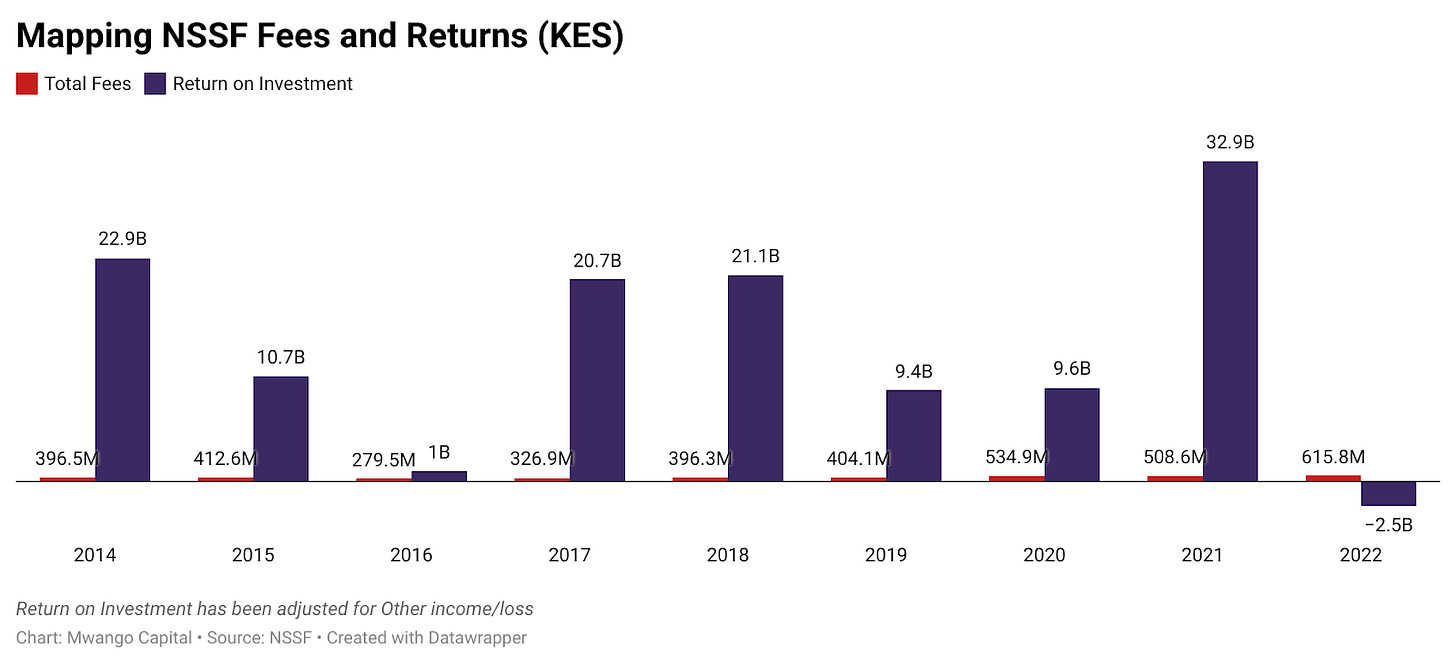

NSSF’s Negative RoI: For the year ended 30th June 2022, net assets grew by a marginal 0.4% to reach KES 285.7B. Member contributions edged higher by 10% to KES 15.92B, while benefits payable totalled KES 5.4B, down 7.9% to KES 5.4B. Operating costs were up 4.3% to KES 6.9B, and the net Return on Investment (RoI), when adjusted for other income, was a KES 2.5B loss [2021: KES 32.7B profit] on account of KES 29B losses incurred from changes in the market value of investments.

SASRA Deficit Widens: The SACCO Societies Regulatory Authority (SASRA) released its financial results for the fiscal year 2021/2022 this week. Total assets grew by 28.3% to KES 564.7M with cash and cash equivalents increasing by 25.4% to KES 294.9M. On the P & L, gross revenue increased by 22.8% to KES 538M while total expenses increased by 24.1% to KES 571M. As a result, the regulator’s deficit widened by 49.4%(KES 10.9M) to KES 32.8M.

Across Telcos

M-PESA, Airtel Money Limits Up: Safaricom PLC and Airtel Money in the week received approval from the Central Bank of Kenya to increase the daily transaction limit to KES 500K from KES 300K. However, each transaction is still subject to a limit of KES 150K, and mobile money users from the two telcos can transact multiple times up to the KES 500K daily limit.

Vodacom Tanzania Acquisition: Vodacom Tanzania PLC announced that it has concluded the terms of the 100% acquisition of the issued share capital of Smile Communications Tanzania Limited. The acquisition is subject to approval from the Tanzania Fair Competition Commission (FCC), the Tanzania Communications Regulatory Authority (TCRA) and the Capital Markets and Securities Authority (CMSA).

“If all conditions are fulfilled or waived timeously, the Acquisition will become unconditional and be implemented, which is anticipated to be early in the last quarter of 2023. If the Acquisition becomes unconditional and is implemented, it will provide Vodacom with control of Smile Tanzania (“take over”).

M-PESA Goes Live in Ethiopia: M-PESA went live in Ethiopia 3 months after Safaricom Ethiopia received the Payment Instrument Issuer License from the National Bank of Ethiopia. The M-PESA application is available in 5 languages for Android devices on Google’s PlayStore, and an iOS version is set to be released in the coming weeks.

Ethiopia Telecoms Sector Liberalisation: Ethiopian authorities are set to grant the second telecoms licence by the end of 2023. With the Request for Qualifications (RFQ) submission deadline set for 15th September 2023, the subsequent proposal phase could lead to the third licence being granted in November or December 2023.

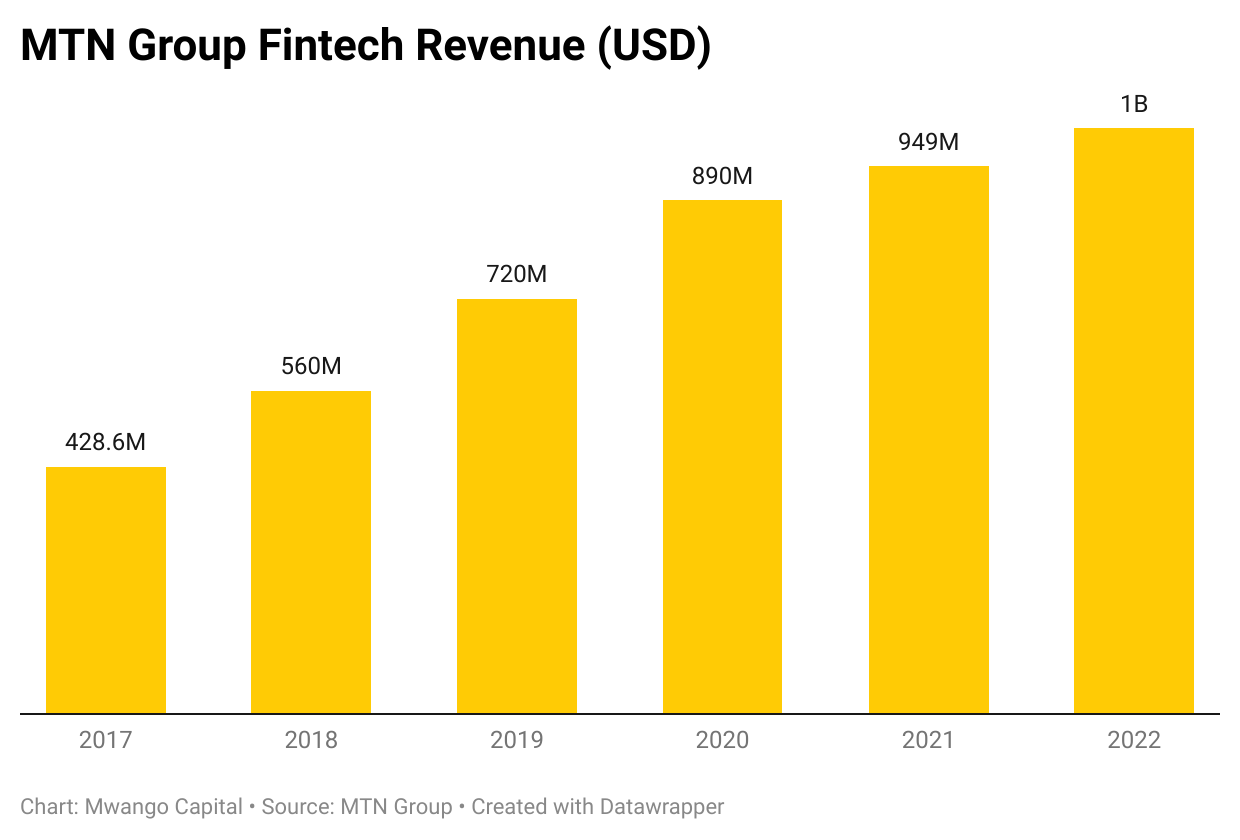

Mastercard eyes MTN Fintech Stake: MTN Group in the week disclosed it had signed a Memorandum of Understanding with Mastercard that paves the way for Mastercard's minority investment in MTN’s fintech arm with USD 5.2B in total enterprise value. A final investment agreement is imminent, and as part of the agreement, MTN will leverage Mastercard’s technology to expand its payments and remittance services across Africa.

Markets Wrap

NSE: In Week 33 of 2023, Car & General was the top-performing stock, up 18.0% to KES 40.0. Olympia was the worst-performing stock, down 23.3% to KES 3.25. The NSE 20, NSE 25, and NASI indices were all down 3.9%, 3.3%, and 2.5% respectively. Equity turnover rose 35.6% to KES 1.7B while bonds turnover fell by 8.1% to KES 13.1B.

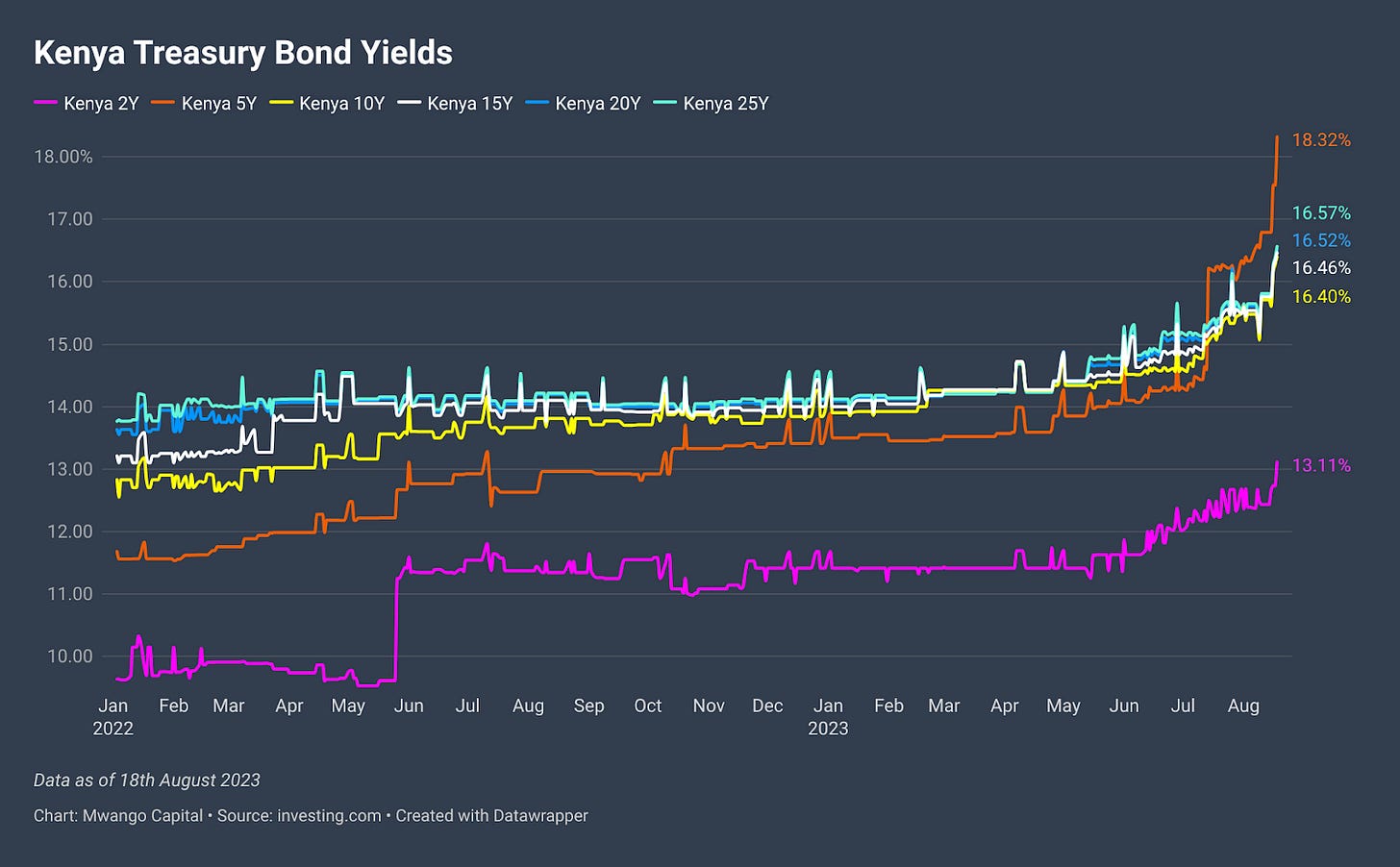

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day closed at 13.4754%, 13.2758%, and 13.7459% respectively. The total amount on offer was KES 24B with the CBK accepting KES 43.6B of the KES 44.7B bids received, to bring the aggregate performance rate to 186.16%. The 91-day and 364-day instruments recorded 955.74% and 25.92% performance rates, respectively.

Treasury Bonds: The new 2-Year FXD1/2023/02 and the re-opened 5-Year FXD1/2023/05 recorded performance rates of 95.75% and 36.76% attracting bids worth KES 38.3B and KES 14.7B, respectively, against a cumulative KES 40B sought. The CBK accepted KES 11.7B and KES 7.5B, and the market weighted average rates were 17.6% and 18.2%, respectively. In aggregate, the performance rate was 132.52%, with KES 19.1B of KES 53B accepted. The entire accepted amount has been earmarked for new borrowing or net repayment.

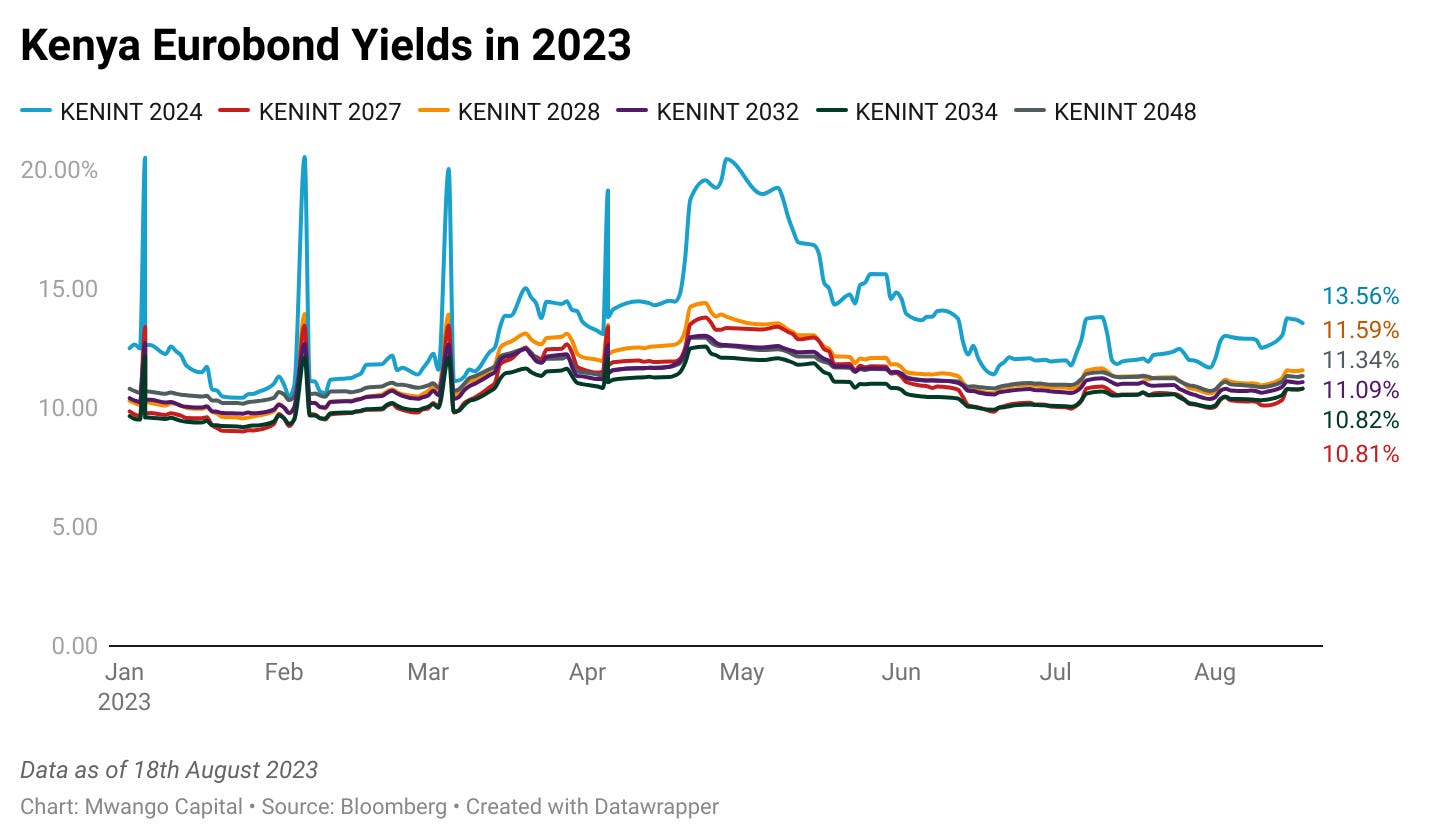

Eurobonds: In the week, the yields rose across the 6 outstanding papers this week.

KENINT 2024 rose the most, up by 96.9 basis points to 13.562%, while KENINT 2032 rose the least, appreciating by 40.6bps to 11.087%. The average week-on-week change stood at 59.85 bps.

All yields rose on a Year-To-Date (YTD) basis. KENINT 2028 led gains at 127.8 bps to 11.59%, while KENINT 2048 recorded the lowest gains at 51.8 bps to 11.342%.

All prices fell week-on-week, with KENINT 2048 falling the most at 3.8% to 77.503. KENINT 2024 fell the least at 0.7% to 94.836. YTD, only KENINT 2024 appreciated, by 2.5%, while other papers recorded losses. KENINT 2034 led losses at 6.9% to 72.171 while KENINT 2027 fell the least at 1.7% to 88.468. The average price change week-on-week and YTD was -2.8% and -2.4%, respectively.

Market Gleanings

⛽ | Aug/Sep 2023 Pump Prices | The Energy and Petroleum Regulatory Authority has kept pump prices unchanged from August 15 to September 14 despite an average 6.2% increase in landed costs. The government opted to cushion consumers by compensating Oil Marketing Companies (OMCs) from the Petroleum Development Levy Fund. Prices for Super Petrol, Diesel, and Kerosene will remain at KES 194.68, KES 179.67and KES 169.48 with the intervention covering KES 7.33, KES 3.59 and KES 5.74, per litre, respectively.

⚡ | Ormat - Kenya Power | In Q2 2023 Kenya Power accounted for 14.4% of Ormat Technologies' revenue, as compared to 15.5% in 2022. The total amount overdue from Kenya Power as of 30th June 2023 was USD 42.7M out of which USD 7.8M or 18.3% was paid in July 2023.

👨💼 | Appointments | In the week, President William Ruto nominated Andrew Mukite Musangi to be the next Chairperson of the Board of the Central Bank of Kenya. Separately, Eng. Peter Waweru Njenga has been appointed to be the next Managing Director and CEO of KenGen, taking over from Abraham Serem who has been in acting capacity. KenGen's share price closed the week at KES 2.32, down 38.5% over the last 1 year and down 28% YTD. Across the region, NSSF Uganda has a new CEO in Patrick Ayota.

🗜️ | NCE Resumes Operations | The Nairobi Coffee Exchange resumed operations on August 15th, but with only 2,705 bags, a fraction of its usual capacity of 7,000 to 10,000 bags. Major millers and marketers opted not to participate in the auction due to confusion over the implementation of new coffee regulations. Coffee estates also withheld their produce as the millers they contracted are not licensed by county governments.

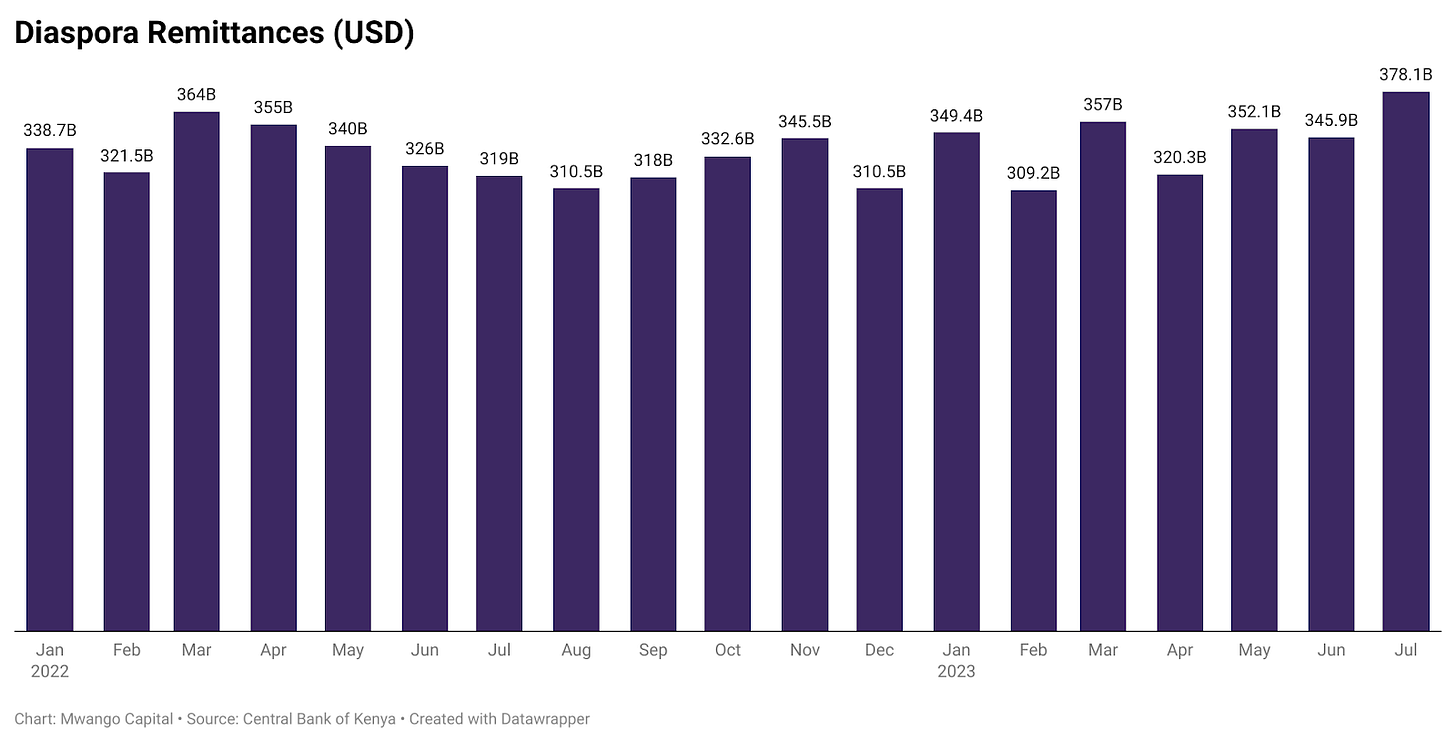

🗳️ | Diaspora Remittances | In July 2023, remittances totalled $378.1M, up 18.4% year-on-year. On a month-on-month basis, the remittances increased by 9.3% with the cumulative 12-month remittances to the month ending July 2023 reaching $4.076B, up 2.0% year-on-year.

💲 | Tanzania Dollar Shortages? | Tanzanian OMCs are struggling to import fuel on account of challenges with US Dollar availability. Monthly requirements for petroleum imports are at USD 250M and the outstanding amount across letters of credit, swaps and post-import loans is in the region of USD 747M. As a result, petroleum product prices have risen significantly, with gasoline and diesel imports falling by 24% from January to August compared to a similar period in 2022.