Analyst Perspectives on Kenya

Significant external inflows improved confidence in the local currency

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover analyst perspectives on Kenya, Liberty, Bamburi and Nation Media Group FY 2023 earnings, and Kenya Power price cuts.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay to any Paybill & Till with MCo-opCash and stand a chance to be among the 100 daily winners of Ksh 1,000.

Analyst Perspectives on Kenya

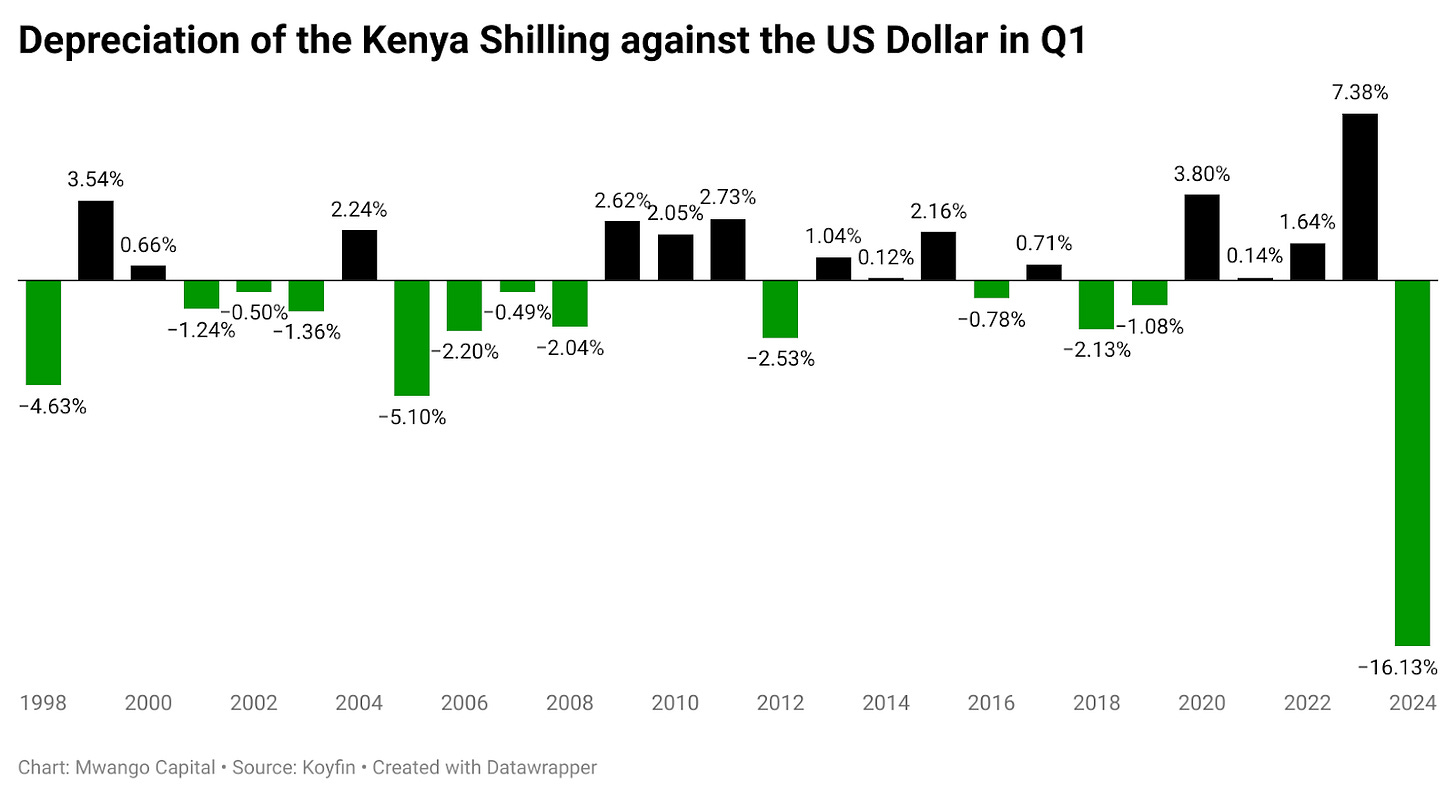

External Balance: According to Goldman Sachs’ analysts, Bojos Morule and Andrew Matheny, three main aspects underpinned Kenya’s external balance in Q1 2024, including the KENINT 2031 Eurobond issuance, and the simultaneous buyback of the KENINT 2024 Eurobond, rising participation of foreign investors in the domestic market, and the appreciation of the Kenyan shilling against the US dollar. The significant external inflows improved the confidence in the local currency, and as a result, the shilling recovered ground against the US dollar.

“Kenya faced external liquidity pressures from early 2022 given the lack of access to international capital markets as well as low domestic interest rates. These factors resulted in a large cumulative currency depreciation and declining FX reserves until 2024, calling into question the sustainability of the country’s external balances. These dynamics have recently reversed, however, as Kenya regained market access on the back of improving external conditions, causing the Shilling to rebound considerably.”

Goldman Sachs analyst Bojos Morule and Andrew Matheny

“Kenya has seen one of the most remarkable turnarounds of any frontier market this year, after a partial buyback of its June 2024 Eurobond and offshore inflows to an infrastructure bond issue were timed to coincide with seasonally elevated horticulture exports around Valentine’s day. The improvement in confidence and functioning of its FX market since, and sharp KES appreciation, have seen fears over Kenya’s ability to meet external debt payments recede.”

Standard Chartered Bank Head of Research, Africa and Middle East, Razia Khan

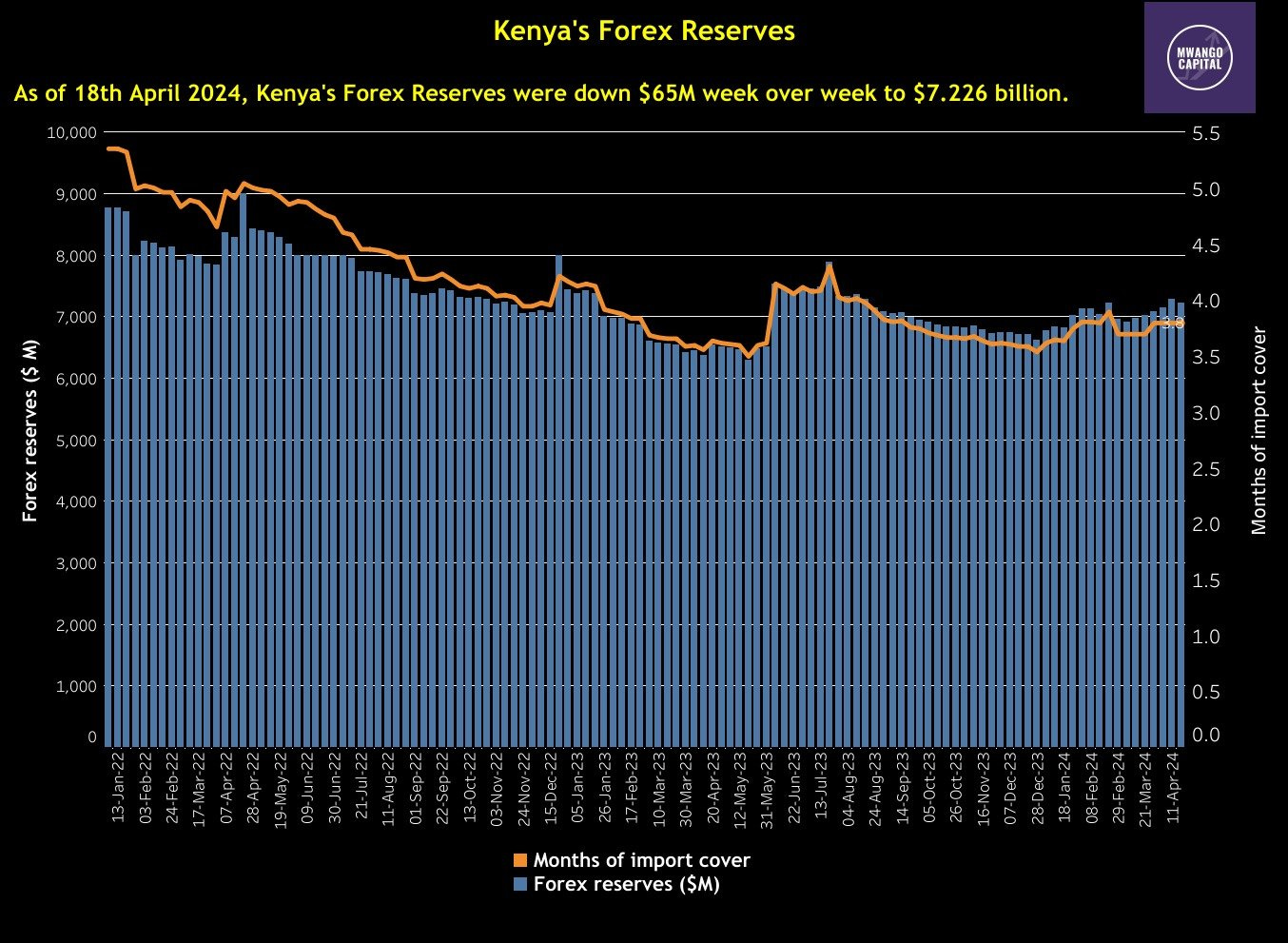

USD 9B FX Reserves: Further, the analysts project that Kenya’s reserves are expected to rise to USD 8.9B as at the end of 2024 and reach USD 10B over the medium term on the back of the KENINT 2031 Eurobond issued in February 2024, the expected USD 1.2B Development Policy Operation (DPO) loan disbursement in May 2024, the unwinding of the current account deficit as a result of appreciation of the shilling, and the projected USD 1B foreign investor inflows into the domestic market in 2024.

“While external financing needs are comparatively large in the coming years, continued access to foreign inflows — dependent on external market conditions and domestic factors (in particular, follow-through on fiscal consolidation) — should in our view enable Kenya to keep FX reserves relatively stable at adequate import cover levels.”

Goldman Sachs analyst Bojos Morule and Andrew Matheny

Further, other supporting variables underpinning the reserves projection include the approved augmentation of Kenya’s current programme with the IMF and a USD 3.0B 3-year programme announced by Afreximbank. In the current financial year, other external inflows include those from the Trade Development Bank, which exceed USD 395M so far. In the Monetary Policy Committee (MPC) meeting held earlier this month, the CBK Governor projected reserves ballparking USD 8.1B at year-end, equivalent to about 4.1 months of import cover.

“Near-term, we expect FX reserve gains on USD 1.2B of World Bank receipts and c. USD 940M from the IMF after its 7th review.”

Standard Chartered Bank Head of Research, Africa and Middle East, Razia Khan

“In terms of the usable foreign exchange reserves, we have seen a fairly steady increase from the end of 2023 where we had reserves worth USD 6.5B. As of 2nd April [2024], that had risen to USD 7.1B, and as I’ve indicated from the balance of payments, we expect this figure to rise by another USD 1B so that by the end of December of 2024, we should have USD 8.1B of usable foreign exchange reserves and that will be equivalent to about 4.1 months of import cover.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Fiscal Update: In March 2024, tax revenue collections were up 2.5% year-on-year to KES 160.04B, while from July 2023 to March 2024, the tax revenue collections were up 10.2% to KES 1.54T. With non-tax revenue for July 2023 - March 2024 at KES 52B, the total tax and non-tax revenue stands at KES 1.587T. Domestic borrowing and external borrowing for March 2024 stood at KES 58.18B and KES 32.77B while for July 2023 to March 2024, the totals were KES 603.8B and KES 506.9B, respectively. Separately, on fiscal matters, the government has published the draft Affordable Housing Regulations, 2024, and the public has up to 29th April 2024 to submit comments.

FY 2023 Results Wrap

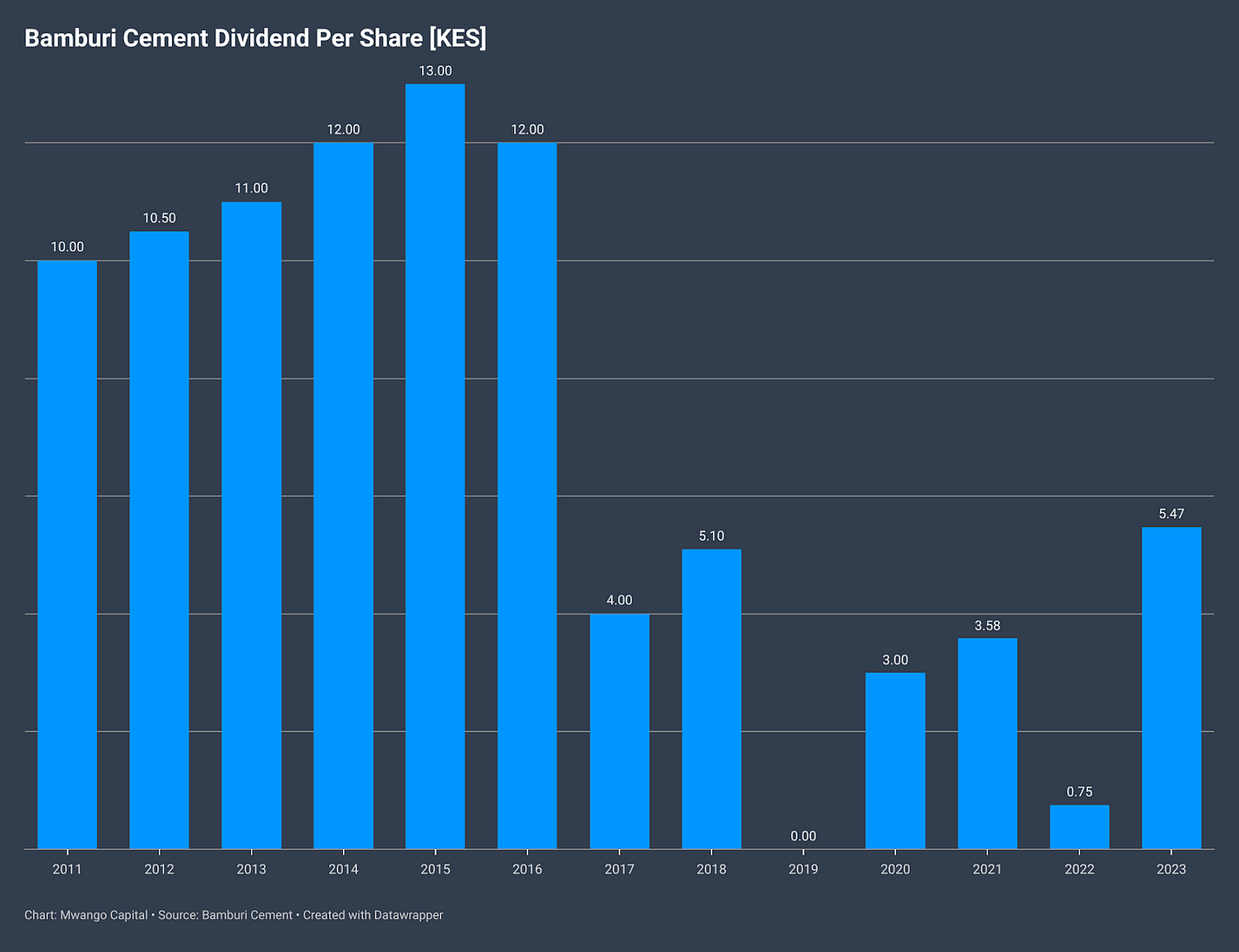

Bamburi Dividend Up 7X: In FY 2023, Bamburi’s turnover was up 6.3% to reach KES 22B, while operating costs rose by 3.9% to KES 20.8B to bring the operating profit to KES 1.02B, representing a growth of 48.3%. The net profit from continuing operations edged higher by 159.7% to reach KES 670M. The Board of Directors has recommended a KES 5.47 first and final dividend [FY 2022: KES 0.75], or KES 1.985B on aggregate as compared to KES 0.75 in FY 2022 [KES 272M]. The set of results was buoyed by the profitable exit in its Ugandan subsidiary, Hima Cement.

Liberty Holdings Results: For the year ended December 2023, the asset base expanded by 9.1% year-on-year to reach KES 43.8B. Insurance revenue totaled KES 13.8B, up 12.5%, with insurance service expense growing by 27.14% to reach KES 12.5B to bring the net insurance service result to KES 1.3B. Profit After Tax was up 2.5X to KES 671.9M, and per-share earnings grew by 190.5% to KES 1.22. The Board of Directors recommended a first and final dividend per share of KES 0.373 [2022: Nil]. Worth noting is the current set of results reflects the entering into force of IFRS 17 which saw FY 2022 results restated to align with the regulatory changes.

NMG’s Losses: In FY 2023, Nation Media Group revenues fell by 2.5% year-on-year to KES 7.1B, with the cost of sales growing 8.4X the pace of revenues to reach KES 1.7B. The firm attributed the declining revenue and surging cost of sales to the macroeconomic environment, specifically falling disposable income, inflation, high interest rates, and the shilling’s depreciation against the US Dollar. Against this backdrop, the firm recorded a net loss of KES 205.7M after taking into account KES 226.1M in income tax credit. Earnings per share were KES -1.1 [FY 2022: KES 1.7], and the Board of Directors did not declare a dividend for the year. The firm also issued an update on its second share buyback programme that started on 3rd July 2023, noting that 14.3M shares of the 19.03M targeted shares have been purchased, and the programme is set to close on 2nd July 2024 or at the attainment of the target.

Markets Wrap

NSE: In Week 16 of 2024, TPS Eastern Africa was the top-performing stock, up 27.7% to close at KES 20.05. Sanlam was the worst-performing stock, down 12.8% to close at KES 6.00. The NSE 20 was down 2.1% to close at 1689.31 points, the NSE 25 was down 3.8% to close at 2821.19 points, and the NASI index decreased by 3.6%, to close at 106.60 points. Equity turnover was up 5.8% to KES 1.6B from KES 1.4B in the prior week while bond turnover closed the week at KES 22.3B compared to the prior week’s KES 16.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.8029%, 16.4667%, and 16.5077% respectively. The total amount on offer was KES 24B with the CBK accepting KES 25.9B of the KES 26B bids received, to bring the aggregate performance rate to 108.7%. The 91-day and 364-day instruments recorded 150.13% and 122.76% performance rates, respectively.

Treasury Bonds: Across the re-opened FXD1/2023/02 bond, the total bids received at cost was KES 47.2B. The CBK accepted KES 34.7B bringing the weighted average rate of accepted bids to 16.9%. The performance and acceptance rates were 117.98% and 73.6%, respectively.

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2027 rose the most, up by 6.50 basis points (bps) to 8.045% while KENINT 2028 was the only paper that depreciated, falling by 2.20 bps to 8.724%. The average week-on-week change stood at 3.27 bps.

All papers except for KENINT 2034 had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 542.80 bps while KENINT 2034 rose by 10.30 bps.

Prices were mixed week-on-week, with KENINT 2032 and KENINT 2034 falling the most by 0.3% to 92.505 and 80.254, respectively. YTD, KENINT 2028 rose the most at 3.7% to 95.252, while KENINT 2034 fell the most at -0.3%.

Market Gleanings

⚡| Kenya Power Cuts Prices | The fuel cost charge and foreign exchange fluctuation adjustment, which are the main variable components of the electricity bill, have seen a substantial decrease of 37.3% between March and April 2024. This has resulted in a drop in the cost of power by up to 13.7% this month.

🏨| Hilton’s Disposal | Hilton International Ltd has expressed interest in selling its 50.425% stake in International Hotels (Kenya) Limited, the company that owns the iconic Hilton Hotel. Interested parties are required to provide evidence of legal registration or incorporation, company profile, track record of similar acquisitions, and demonstrate the financial capacity to acquire the 50.425% of equity.

📉| Faulu’s Further Losses | Faulu Kenya has reported a significant deepening of losses, escalating from KES 301M in 2022 to a staggering KES 1.4B in 2023. This downturn was primarily driven by a 16.7% decline in the microfinance bank’s total income, which fell to KES 3.4B. The FY 23 results further revealed a 9.7% decrease in assets and a 4.5% reduction in customer advances, which now stand at KES 12.4B.

🛫| KQ Seeks Equity Investor | Kenya Airways is on the verge of securing a deal with an equity investor by the end of the year, according to CEO Allan Kilavuka. The airline is optimistic that this capital injection could steer it back to profitability. The Kenyan government could lose its majority stake of 48% if the new investor buys out all the shares offered in the recapitalization deal.

🏦| IMF - WB Spring Meetings | The 2024 IMF-World Bank Spring Meetings addressed critical global challenges, especially economic growth and the looming debt crisis. Despite raising its forecast for Egypt's growth (4.2% for 2024/25), the World Bank expressed concerns about a potential global sovereign debt crisis. Separately the IMF’s review of Kenya’s USD 4.43B funding program will continue in Washington, following a staff mission in the country. This review, focused on fiscal improvements like revenue collection, spending cuts, and reducing government arrears, could unlock over USD 1B in loans for Kenya.

🇳🇬| Nigeria’s Dwindling Reserves | Nigeria is experiencing a rapid depletion of its foreign exchange reserves, the fastest in four years. Liquid reserves have declined 5.6% since March 18, down to USD 31.7B as of April 12, marking the steepest decline since April 2020. Despite a 43% devaluation in January, the naira has recovered most of its losses, following measures by the Central Bank of Nigeria to improve liquidity, attract capital inflows, and allow market determination of the exchange rate.

Charts of the Week