Kenya’s Energy Pulse: 2024 Update

Performance of Kenya’s energy sector for the first half of FY 2024/25

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover trends in Kenya's energy sector in H1 2024/25, NMG's widening losses, and CBK's lifting of the moratorium on new commercial bank licenses.Kenya’s Energy Sector

EPRA has published its latest update on the performance of Kenya’s energy sector for the first half of FY 2024/25, covering the period from July to December 2024. The report offers a snapshot of trends across electricity, petroleum, and renewable energy. Below are the key highlights.

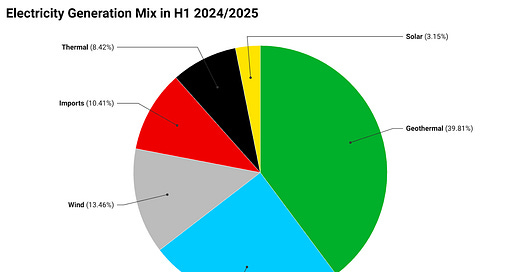

Electricity Generation: Electricity generation rose 6.1% to 7,222 GWh. Geothermal remained the top source (39.8%), though its share declined from last year due to the shutdown of the Olkaria I plant and increased imports. Imports jumped 79% to 752 GWh (10.4% of supply), largely driven by full operations of the Ethiopia interconnector and the commissioning of the Kenya–Tanzania line in December 2024.

Peak Demand: Peak demand refers to the highest load on the electricity grid over the year, typically occurring between 19:30 and 20:30 hours nationwide. During the review period, peak demand reached 2,288.35 MW on 29th October 2024—an increase of 117.79 MW from 2,170.56 MW recorded in the same period the previous year. Throughout the period, demand consistently remained above 2,200 MW. This growth is driven by organic load increases and more new connections.

Own-Source Power Generation: Kenya’s captive power capacity continued to grow in 2024, with an additional 125.1 MW licensed. This pushed the total installed capacity for own-use generation—mainly by companies and households—to 574.6 MW, more than double the 280.76 MW recorded in 2022. Captive power, which is not fed into the national grid, now accounts for 15.04% of the country’s total installed capacity of 3,811.6 MW. The growth is largely driven by the use of solar PV systems, which contribute 271.3 MW, or nearly half of the total captive capacity.

Electricity Access: Between July and December 2024, a total of 194,654 new customers were connected to the electricity grid, bringing the cumulative number of grid-connected customers to 9,852,423. This marked a decline in new connections compared to the same period in the previous financial year, which saw 260,257 new connections.

System Losses: System losses consist of technical losses, caused by energy dissipation in transmission and distribution systems, and commercial losses, which result from unbilled electricity due to issues like theft or metering errors. In the period under review, 24.2% of the total energy purchased by the national utility was lost, marking a one-percentage-point increase from the 23.2% recorded during the same period in the previous financial year. This was 6.7% above the 17.5% threshold allowed by EPRA for the financial year 2024/2025 in the approved tariff.

Petroleum Demand and Consumption: Domestic demand for petroleum products rose by 7.12% to 2,911,214.12 m³ compared to the same period in the previous financial year. Consumption remained steady throughout the review period, with the highest demand recorded in October, driven by increased use of Automotive Gas Oil (AGO). The peak demand for Premium Motor Spirit (PMS) occurred in December, likely due to increased travel during the festive season.

Electric Mobility: During the review period, electricity consumption under the electric mobility tariff rose to 1.80 GWh, a 480.65% increase compared to the same period in the previous financial year. As of December 2024, the number of registered electric vehicles—including two-wheelers, three-wheelers, and four-wheelers—stood at 5,294, up 41.06% from 3,753 in 2023.

Market Share: There were 144 registered Oil-Marketing Companies (OMCs) as of December 2024. These companies market AGO, IK, PMS, JET A1, lubricants, and LPG.

April/May Pump Prices: EPRA announced a reduction in pump prices for the April–May cycle. The price of Super Petrol has decreased by KES 1.95 to KES 174.63, Diesel by KES 2.20 to KES 164.86, and Kerosene by KES 2.40 to KES 148.99.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Earnings Wrap

NMG Posts Wider Loss in FY 24: Nation Media Group (NMG) posted a net loss of KES 254.4M for the year ended Dec 31, 2024, up from KES 205.7M in 2023—its second straight annual loss and the first time in over a decade. Turnover fell 12.5% to KES 6.23B, driven by weak consumer spending and rising living costs. Gross profit declined 9.08% to KES 4.3B. Cost of sales dropped 18.9%, while operating costs fell 17.2% due to cost containment and increased digitization.

Total assets declined 8.6% to KES 7.5B, while cash reserves dropped 18% to KES 2.38B. Operating costs included a one-off restructuring charge of KES 157.8M in June 2024. Despite revenue pressure, the digital segment grew 11%, with users rising to 62.4M from 60.2M. No dividend was recommended, citing the economic environment and ongoing investment plans.

Bamburi Cement FY 2024: Bamburi Cement posted a net loss of KES 905M for FY 2024, more than double the KES 399M loss reported in 2023, largely due to a KES 1.43B foreign exchange loss linked to proceeds from the KES 10.88B sale of its stake in Hima Cement. Turnover was relatively flat, easing 0.5% to KES 21.9B, while operating profit declined 31.5% to KES 700M as market demand remained weak amid heavy rains, unrest, and a tough domestic environment.

Despite the widened loss, Bamburi generated strong cash flows, with cash from operations rising 65.8% to KES 4.7B. Although no final dividend was declared, the company paid a special dividend of KES 6.63B (KES 18.25 per share) during the year, funded by the Hima transaction.

Markets Wrap

NSE Weekly Recap: Week 16 (11–17 Apr 2025):

Markets dipped across the board with low activity and sustained foreign exits.

NASI: -1.14% | NSE 20: -0.70% | Mkt Cap: KES 1.97T (-1.14%)

Top Gainer: Sameer +13.2% to KES 3.43

Top Loser: Express -10.1% to KES 3.20

Equity turnover: -40.6% to KES 959M | Bond turnover: -31.4%

Net foreign outflows: KES 226.3M (51.2% of mkt)

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 160.08%, down from 223.9% the previous week. Investors placed bids totaling KES 38.4B, with the Central Bank of Kenya (CBK) accepting KES 36.4B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 3.0, 13.56, and 16.07 basis points to 8.469%, 8.7585%, and 10.071%, respectively.

Bonds: The Central Bank of Kenya is reopening three Treasury bonds—15, 20, and 25-year tenors—with coupon rates of 13.942%, 12.000%, and 14.188%, respectively. A total of KES 80B is on offer to support budgetary needs. Bidding for the 15- and 25-year bonds runs until April 30, while the 20-year bond is open until May 7. Minimum competitive bids are set at KES 2M per tenor via the CSD system. Settlement dates are May 5 and May 12.

Eurobonds: Last week, yields on the seven outstanding Eurobonds rose, led by the KENINT 2028 bond, which gained 105.00 basis points to 11.596%. The KENINT 2031 bond followed, climbing 81.10 basis points to 11.564%. On average, Eurobond yields increased by 54.67 basis points week-on-week.

Market Gleanings

🟢| CBK Lifts Bank Licensing Ban | The Central Bank of Kenya will lift its moratorium on licensing new commercial banks effective July 1, 2025. The moratorium, which has been in place since November 2015, was introduced due to governance and operational challenges in the sector. Its removal follows regulatory reforms, increased consolidation, and entry of new investors in the industry. Under the updated Business Laws (Amendment) Act, 2024, new entrants will be required to meet a higher minimum core capital threshold of KES 10B.

📶| Airtel Gets Two More Years to Expand Network | Airtel Kenya has been granted an extension by the Communications Authority to complete its network rollout in underserved areas by January 2027. The telco had committed to improving coverage in 102 sub-locations as part of its license conditions but had only fully covered 40 by the end of 2024. Twenty-five areas remain without any Airtel signal, while others are only partially covered.

💰| KRA Waives KES 158B in Penalties | The Kenya Revenue Authority has waived KES 158B in interest, fines, and penalties under its ongoing tax amnesty programme, benefiting 2.9 million taxpayers as of 9th April 2025. The amnesty, which runs until June 30, 2025, covers tax debts accrued up to the end of 2023. While taxpayers with no outstanding principal tax automatically qualify, those with unpaid principal must apply through the iTax system and commit to a payment plan. KRA has also collected KES 10.9B in principal tax so far.

⚡| Govt Seeks Private Investors for Power Lines | The government is seeking private investors to build and operate four high-voltage power lines valued at USD 371.58M, months after scrapping a deal with India’s Adani Group. According to the National Treasury, the projects are expected to be completed between 2026 and 2029 and aim to help close a USD 5B infrastructure financing gap. The new projects are part of Kenya’s push toward universal electricity access by 2030.

🛢️| Tullow Oil to Sell Kenyan Assets to Gulf Energy | Tullow Oil has signed an agreement with Gulf Energy Ltd to sell Tullow Kenya BV, which holds the company’s entire stake in Kenya, for at least USD 120M. The deal will be paid in three installments: USD 40M at completion, USD 40M upon Field Development Plan approval or by June 2026, and USD 40M over five years starting in 2028. Tullow will also receive royalty payments under certain conditions and retains a 30% back-in right for future development phases. The sale, aimed at reducing debt, is subject to regulatory approvals.

🇳🇬| KCB Awaits Nigeria’s Nod to Finalize NBK Sale | KCB Group has announced that it has received key regulatory approvals from the Central Bank of Kenya and the National Treasury to proceed with the sale of National Bank of Kenya (NBK) to Nigeria’s Access Bank Plc. The transaction, initiated in March 2024, includes the transfer of select NBK assets and liabilities to KCB Bank Kenya. The deal now awaits final clearance from the Central Bank of Nigeria before completion.

💰| Kenya Eyes Realistic IMF Deal | Kenya is preparing to negotiate a new program with the IMF after exiting a four-year USD 3.6B arrangement last month. Prime Cabinet Secretary, Musalia Mudavadi, said talks with the IMF will begin this spring, with a new deal likely by November. He emphasized the government’s focus on setting realistic targets, following backlash over harsh tax measures that triggered nationwide protests. The cancelled program had about USD 850M in pending disbursements. Mudavadi noted the new deal could span three years and would reflect Kenya’s priorities.

🤝| Twiga Acquires Majority Stake in Three Distributors | Twiga Foods has acquired majority stakes in three regional FMCG distributors—Nairobi-based Jumra, Kisumu’s Sojpar, and Mombasa’s Raisons—as it diversifies beyond fresh farm produce. The move enables Twiga to tap into wider product categories such as personal care, household items, and beverages, while leveraging the distributors' regional networks to deepen its national reach. Twiga said the acquisitions mark a strategic shift toward a tech-powered distribution model, combining its digital infrastructure with the operational strength of the acquired firms.

🇳🇬| Fitch Ratings Upgrades Nigeria to ‘B’ | Fitch Ratings has upgraded Nigeria’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B' from 'B-', citing the government's commitment to policy reforms since June 2023. Key reforms, including exchange rate liberalization, tightening of monetary policy, and subsidy removals, have boosted policy coherence and reduced risks to macroeconomic stability.

💰| IMF Wrap |

Ghana: Ghana has reached a staff-level agreement with the IMF on the 4th review of its USD 3B loan program. Once approved by the IMF Board, the deal will unlock a USD 370M disbursement.. The agreement was part of Ghana’s three-year program under the Extended Credit Facility, approved by the IMF Executive Board in May 2023.

Madagascar: IMF staff and Madagascar have reached a staff-level agreement on the second review of the country’s economic program. Upon IMF Board approval, Madagascar will receive a total of USD 108M—USD 51M under the Extended Credit Facility (ECF) and USD 57M under the Rapid Support Facility (RSF).

Mali: The IMF Executive Board has approved a disbursement of USD 129M under the Rapid Credit Facility (RCF) to address the urgent needs caused by flooding in Mali. This disbursement is accompanied by an 11-month Staff Monitored Program (SMP) aimed at supporting Mali’s economic reforms and re-establishing a track record of implementation.

Gambia: The IMF and Gambia have reached a staff-level agreement that could unlock USD 16.8M in funding, pending board approval. In addition, a separate deal may provide Gambia with USD 65M for climate resilience initiatives, aiding the country in strengthening its environmental and economic sustainability.

Also, would you have a position on the dollar exchange rate to the shilling? It is steadily on 129 since more than 90 days, whereas the Euro has recently been spiking. Is this not some type of easing made by CBK through reserves selling? Why is noone writing about it or is it only me?

Would it be sensible to remark how new power generation investments in Kenya are hampered by Ethiopia selling power at throwaway prices? This is a clear impediment to national generation growth, benefitting the usual suspects that should be highlighted.