👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover J.P.Morgan entry into Kenya, Ethio Telecom's share sale, and CBK's upgraded payment system.J.P. Morgan in Kenya

Rep Office: The Central Bank of Kenya has authorised J.P. Morgan Chase Bank to establish a representative office in Kenya. Sailepu Montet will head the representative office in Nairobi as the Country Manager for Kenya and will focus on commercial and investment banking, treasury services, and limited wealth management.

“The Central Bank of Kenya (CBK) announces the granting of authority to JPMorgan Chase Bank N.A. of the United States of America (USA) to establish a Representative Office in Kenya by the name of JPMorgan Chase Bank N.A. Representative Office Kenya. This authority is granted pursuant to Section 43 of the Banking Act and follows the fulfilment, by JPMorgan Chase Bank N.A., of the stipulated authorisation requirements.”

“Under the Banking Act, Representative Offices of foreign banks in Kenya serve as marketing and liaison offices for their parent banks and affiliates and are not permitted to undertake banking business. The JPMorgan Chase Bank N.A. Representative Office Kenya will operate in line with this requirement”.

Central Bank of Kenya

Africa Tour: J.P. Morgan CEO Jamie Dimon visited Nigeria this week as part of the bank’s plans to explore business opportunities in Kenya and the wider Africa region. He also landed in Kenya during the week and is expected to meet with central bank officials and other major industry stakeholders in addition to the US Ambassador.

“Capital goes to where it's taken care of, you know, where people think they can make some money and have a return on capital in the long run. And very often, the countries, I'm not talking about Nigeria, you know if they have very inconsistent policies, companies don’t want to go there. And the real capital is going to come from companies.”

J.P. Morgan CEO, Jamie Dimon

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Ethio Telecom Launches Share Sale

Debut IPO: The first public share sale in Ethiopia’s capital markets will see the sale of a 10.0% ownership stake of Ethio Telecom to Ethiopians.

In the first round of the public sale 100 million ordinary shares of Ethio telecom, each valued at 300 birr, are on offer for sale through the telebirr SuperApp with a minimum investment of 9,900 birr (33 shares) and a maximum of 999,900 birr (3,333 shares). The sale period runs from October 16, 2024, to January 3, 2025.

Ethiopian Securities Exchange: The establishment of the country’s exchange as well as the privatisation of state-owned enterprises have been part of reforms to open up the country to greater investment. Business Redefined host in March 2024 sat down with Dr Brook Taye, Director General Ethiopia Capital Markets Authority to discuss the build-up to the formal launch of the exchange.

Markets Wrap

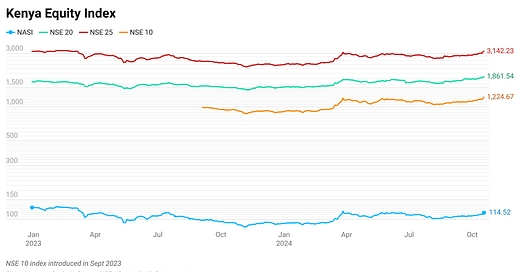

NSE: In Week 42 of 2024, Kenya Orchards led the week’s top gainers rising 58.9% to close at KES 70.00, while EA Portland was the worst performer, dropping 40.6% closing at KES 27.00. The NSE 20 went up by 3.0% to 1,861.5 points, the NSE 25 gained 4.7% to 3,142.2 points, and the NASI index advanced by 4.0% to 114.5 points, while the NSE 10 edged up by 4.8% to 1,224.7 points - its highest points since the inception of the index. Equity turnover decreased by 10.2% to KES 804.28M, while bond turnover increased to KES 34.4B from KES 15.4B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed for the third consecutive week recording an overall subscription rate of 337.22% from 304.3% the prior week. A total of KES 34.6B was accepted, translating to an acceptance rate of 42.7% similar to the previous week. Yields across the 90-day, 180-day, and 364-day tenors dropped by 22.4 bps, 45.9 bps, and 42.6 bps closing at 14.766%, 15.636%, and 15.912% respectively.

In the October 2024 Treasury Bond tap sale of FXD1/2022/010, the Central Bank of Kenya received bids worth KES 16.5B against KES 15.0B offered, translating to a subscription rate of 109.98%. A total of KES 15.1B was accepted at a cost, translating to an acceptance rate of approximately 91.5%. The allocated average rate for accepted bids stood at 16.9516%. The coupon rate for the bond was 13.4900%.

Eurobonds: In the week, yields fell week-on-week across the 6 outstanding papers with KENINT 2027 falling the most, down by 32.9 bps to 7.57%, followed by KENINT 2028, down 29.8 bps to 8.65%. KENINT 2048 recorded the least week-on-week decline at 17.9 bps to 10.04%, and the average week-on-week change stood at -24.6 bps.

Market Gleanings

📄| I&M’s Share Issuance | I&M Group is set to issue up to 86.5 million new ordinary shares to East Africa Growth Holding (EAGH) at KES 48.42 per share, a significant premium over the current market price of KES 25.05. The new shares will represent approximately 4.97% of I&M's total share capital after the transaction.

🏦| CBK Upgrades Payment System | The Central Bank of Kenya (CBK) has transitioned from the Kenya Electronic Payment and Settlement System (KEPSS) to the internationally recognized ISO 20022 Standard. This upgrade aims to improve settlement times, streamline processing, enhance liquidity management for financial institutions, and aid in detecting and preventing fraudulent transaction.

⛽| EPRA Cuts Prices | The Energy and Petroleum Regulatory Authority (EPRA) has announced a reduction in pump prices for the October/November cycle. Super petrol prices will drop by KES 8.18 to KES 180.66, diesel by KES 3.54 to KES 168.06, and kerosene by KES 6.94 to KES 151.39 per litre. The road maintenance levy remains unchanged at KES 25 per litre.

🇪🇹| Ethiopia’s FX Spreads Policy | The National Bank of Ethiopia has implemented a new policy on foreign exchange (FX) spreads and fees, requiring financial institutions to separately display their forex trading spreads in daily posted rates. Banks must now clearly show the differences between buying and selling rates, with adjustments limited to 2% of posted rates based on market conditions. Furthermore, all FX-related fees and commissions must be disclosed, reported, and charged separately to clients, in line with international best practices.

📉| NCBA Revises Rates | Following the recent reduction in the Central Bank of Kenya Rate (CBR), the bank will, effective November 18, 2024, revise its Kenya Shillings Base Lending Rate from 17.50% to 16.91% and its USD Base Lending Rate from 11.75% to 11.09% per annum for variable rate loans. New loan facilities will adopt the revised rates immediately while fixed-rate loans remain unaffected.

💼| Leadership Changes |

African Development Bank: The African Development Bank Group has appointed Dr. Kennedy K. Mbekeani as Director General for the East Africa Regional Development, Integration and Business Delivery Office, as well as Country Manager for Kenya, effective October 16, 2024.

Safaricom PLC: James Maitai has been appointed as the Group Chief Technology and Information Officer (CTIO) at Safaricom PLC, effective November 1, 2024. With over 23 years of experience in the tech sector, Maitai rejoins Safaricom PLC from Safaricom Ethiopia, where he has served as CTIO since January 2023.

💰| IMF Agreements |

Tanzania: Tanzania has reached a staff-level agreement with the IMF for the fourth review of its Extended Credit Facility (ECF) and the first review of the Resilience and Sustainability Facility (RSF), unlocking USD 265.78M in funding pending board approval. This will bring total IMF financial support to USD 758.11M under the ECF and USD 114.07M under the RSF.

Benin: IMF staff and Benin authorities have reached a staff-level agreement on policies to finalize the Fifth Review of Benin’s 42-month blended Extended Fund Facility (EFF)/Extended Credit Facility (ECF) and the Second Review of the Rapid Credit Facility (RSF). Subject to approval by the IMF Executive Board, Benin is set to receive a disbursement of USD 42M under the ECF and EFF arrangements, along with up to USD 53M under the RSF arrangement.