👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the Draft 2023 Budget Policy Statement, 2022 private capital markets highlights, and the debt markets.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

The Draft 2023 Budget Policy Statement

Last week, the government released the draft Budget Policy Statement for 2023. Here are a few key takeaways:

Kenya Kwanza Maiden BPS: In the 2023 Budget Policy Statement (BPS), the first to be prepared under the Kenya Kwanza Government, the total budget for the FY 2023/24 is projected at KES 3.64T, and the allocation across the National Government, Consolidated Fund Services and County Governments stands at KES 2.2T, KES 909B and KES 375B, respectively.

Economic Expansion: The Gross Domestic Product (GDP) is projected to expand by 5.5% in 2022 from 7.5% in 2021. Projections indicate that the economy will grow by 6.1% in 2023 spurred by the government’s development agenda.

Revenue and Expenditure: Ordinary revenue is projected to increase by 17.1% to KES 2.6T or 15.8% of GDP in FY 2023/24 [FY 2022/23: KES 2.2T]. Gross expenditure is projected to rise by 7.4% to KES 3.64T [FY 2022/23: KES 3.4T].

Fiscal Deficit: The fiscal deficit is projected to reduce by 18.1% from KES 849.2B [5.8% of GDP] in FY 2022/23 to KES 695.2B [4.3% of GDP] in FY 2023/24. The deficit is projected to soften further to KES 832.6B [3.6% of GDP] in FY 2026/27.

KES 3T Target: In order to realise KES 3T in FY 2023/24 and KES 4T over the medium term in tax revenue, below are some of the notable revenue collection measures the government sets to undertake:

Reduce the Value Added Tax gap from 38.9% to 19.8% of the potential by fully rolling out the electronic Tax Invoice Management System (TIMS).

Reduce Corporate Income Tax (CIT) gap from 32.2% to 30.0% of the potential.

Integration of the KRA tax system with the Telecommunication companies.

Pending Bills: As of December 21, 2022, county governments had cleared KES 22.9B of the KES 48.1B eligible bills verified as of June 30, 2022. The gross amount of pending bills rendered ineligible due to lack of documentation stood at KES 108.1B as of June 30, 2022.

Public Debt: In FY 2023/2024, internal and external debt redemption is projected at KES 953.4B, which brings the aggregate fiscal requirement for the financial year 2023/24 to KES 4.6T. In Davos, Switzerland, for the World Economic Forum Annual Meeting 2023; here is what the CBK governor Patrick Njoroge said about Kenya's borrowing:

"Kenya's borrowing will need to be measured. We will be borrowing some more to ensure we can sustain whatever prepayments going forward. As markets open, we'll need to top up our external borrowing."

CBK Governor, Patrick Njoroge

Separately, this is what Prime Cabinet Secretary Musalia Mudavadi had to say about Kenya's relationship with the IMF in an interview with NTV:

“When you lose the IMF, you are in trouble, because it is sending a message to the world that this economy is a rogue economy, it is in trouble and it will need to go to the intensive care unit for it to come out. So you must look at the IMF not as an enemy but as a partner. This is the lesson that Kenyans ought to appreciate.”

Prime Cabinet Secretary, Musalia Mudavadi

Find the Draft 2023 Budget Policy Statement here.

2022 E. Africa Private Capital Markets

Below are the key private capital markets highlights from I&M Burbidge Capital’s Annual East Africa Financial Review 2022.

Transactions up 30.3%: A total of 129 transactions were recorded in 2022 [2021: 99]. The gross disclosed value of 86 deals that had a disclosed deal value was USD 1.8B, a 94.8% increase from $900.8M for those that had a disclosed deal value in 2021. The overall median deal value increased by 21.3% to $9.1M [2020: 7.5M].

Venture Capital: Venture Capital (VC) investments accounted for 51% of all private transactions, double those recorded in 2021. The total disclosed value rose by 1167% to $713.1M to account for 40% of the total disclosed deal value in private capital markets. The median deal value for VC transactions rose 117% to $5M.

Private Equity: Traditional Private Equity deals fell by 31.6% to 26 [ 2021: 38, 2020:41]. The median deal value however increased by 14% to $26.1M [2021: $22.9M]. The market recorded a 60% increase in PE exits to 8 [2021: 5], with at least 3 undisclosed additional exits in the year.

DFI Investments: Total Development Finance Investments (DFI) led transactions were up 55.6% to 14 [2021: 9], with a gross disclosed value of $525.9M and a median deal value of $40M.

M&A: Mergers and Acquisitions rose 24% to 22 [2022: 18] with a total disclosed value of $121M, up more than 7X from 2021. The financial services sector had the highest number of M&A deals with 5, followed by Manufacturing and ICT at 4 and 3, respectively.

Notable Transactions: Notable PE & VC transactions in 2022 were Leapfrog’s $70M investment in Sun King, AfricInvest’s acquisition of Actis’ stake in AutoXpress, and Wasoko’s $125M Series B capital raise. On the exits side, notable transactions were Ascent Capital’s exit from International Clinical Laboratories in Ethiopia and Amethis’ exit from Naivas to IBL.

You can access the entire report here.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.474%, 9.891%, and 10.47% respectively. The total amount on offer was KES 24B with the CBK accepting all the KES 29.4B received bids. The acceptance rate was 122.5%.

T-bonds: Across tap sales on FXD1/2020/005 and FXD1/2022/015 bonds, total bids received at cost were KES 13.9B and KES 4.1B. The CBK accepted KES 13.6B and KES 4.1B bringing the weighted average rate of accepted bids to 12.879% and 14.186%, respectively.

Eurobonds: Last week, yields on all outstanding papers were down across all 6 outstanding papers.

KENINT 2024 recorded the largest drop, falling 212.2 basis points Year-To-Date and 130.8 bps week-on-week to 10.481%.

KENINT 2034 fell the least on a Year-To-Date and week-on-week basis; falling by 61.3 bps and by 18.2 bps, respectively, to 9.242%.

KENINT 2048 led price gains Year-To-Date and week-on-week, rising 5.8% and 3.1%, respectively, to 82.361.

What Else Happened This Week

🧾 Excise Tax Adjustment: Cigars, cigarettes, wines and spirits, beverages, beer, cider and cosmetics are among the items whose prices are set to increase if proposed regulations on Excise Stamp effective March 1 2023 sail through.

🗠 Centum Buyback: The CMA has exempted Centum from regulations that limit the purchase of shares to below 25% of the average daily trading volume four weeks preceding the purchase date of the Share Repurchase Scheme. The exemption will allow Centum to purchase more shares considering its low trading volumes of below 100K shares daily against the buyback programme’s requirement of 66.5M shares in 18 months.

🤝🏽 CAK - Unilever Agreement: As part of the settlement agreement reached between the Competition Authority of Kenya and Unilever, Unilever will reduce payment terms for all existing SMEs from 90 days to 60 days and 45 days effective January 1, 2023, and January 1, 2025, respectively, and dedicate an annual budget of KES 75M to undertake supplier development training for its SME suppliers for 3 years.

⚖️ Mobile Bank Charges: Commercial banks have started complying with the court order that suspended bank-to-mobile wallet charges. The High Court had earlier ordered the suspension of the reintroduction of the charges pending the determination of proceedings regarding financial consumer rights.

📉 Weakening Kenya Shilling: The local unit continues its losing trend versus the US Dollar and other major hard currencies, with some commercial banks selling the dollar at a high of KES 134. The CBK is currently quoting the USDKES at 124.1 units to the dollar.

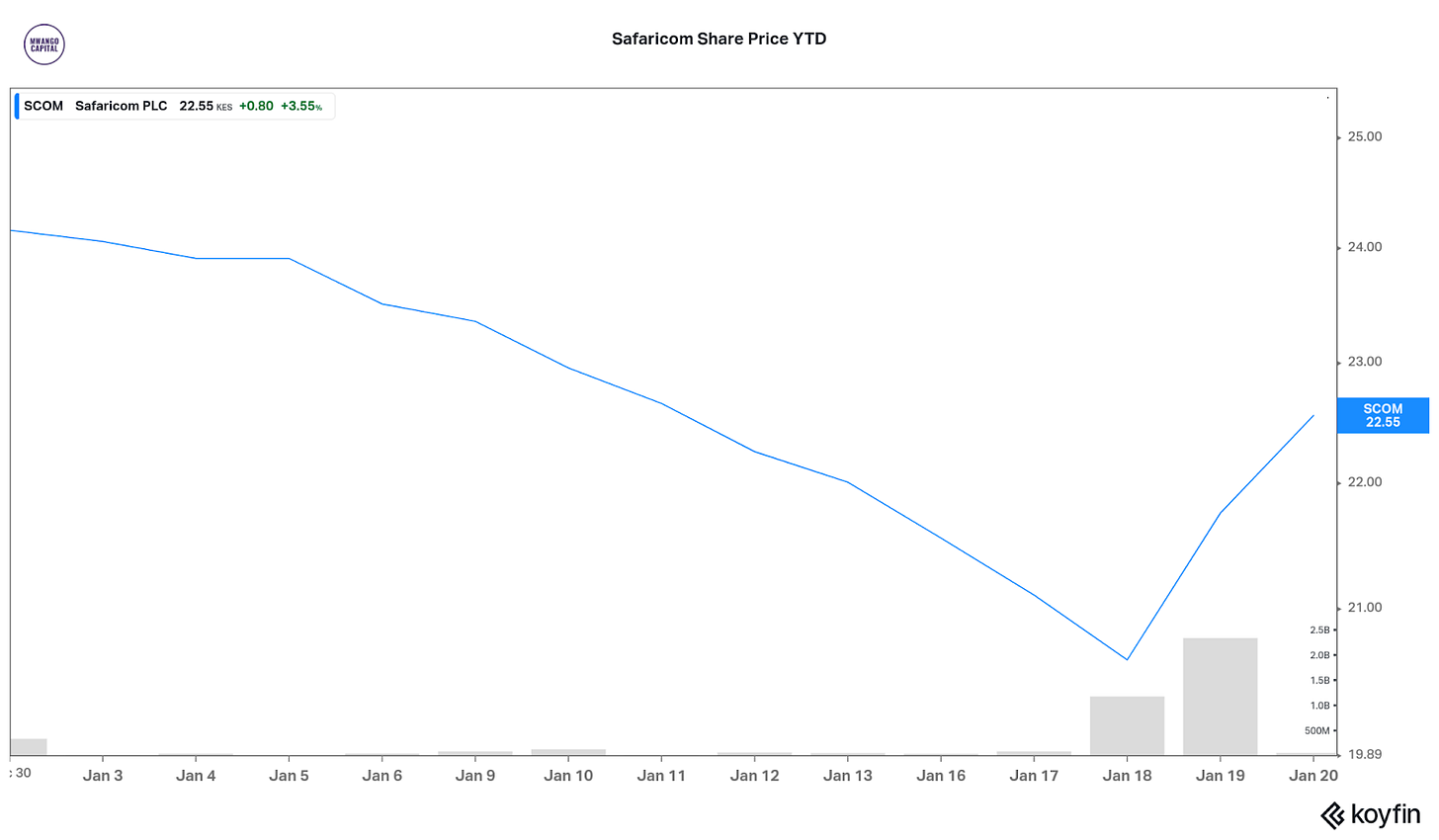

📈 Safaricom’s Record Trading Volume: Safaricom last Thursday recorded the highest trading volume Year-To-Date, with 107.5M shares exchanging hands at the NSE.

💰 Zambia-China Debt Deal: US Treasury Secretary expressed optimism in Dakar, Senegal, that China will be willing to enter into a multilateral debt restructuring deal with Zambia. The comments come as IMF head Kristalina Georgieva is set to visit Zambia - Africa’s first pandemic-era sovereign defaulter; between January 22 and January 26, with the main agenda being the restructuring of Kenya’s debt.

Interest Rate Watch

🇦🇴 Angola: The National Bank of Angola cut its Basic Interest Rate by 150 basis points (bps) to 18% on the back of a reduction in inflation throughout 2022. Inflation in Africa’s second-largest crude oil producer was 13.86% as of December 2022, the lowest in the last 5 years.

🇳🇬 Nigeria: The Monetary Policy Committee of the Central Bank of Nigeria is set to have its MPC meeting on January 23 and 24. In November 2022, the MPC hiked the key rate by 100 bps to 16.5%. Inflation in Africa’s largest crude oil producer currently stood at 21.3% as of December 2022.