👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenyan banks’ market capitalization, Safaricom’s acquisition of M-PESA, and the recently announced 6.5-year infrastructure bond.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Are you in the process of purchasing or constructing a home? Cooperative Bank has a range of loan options starting from KES 500,000 to KES 8M.

Benefit from up to 90% financing when building and a full 100% financing for pre-constructed homes.

KCB’s Tanking Market Capitalization

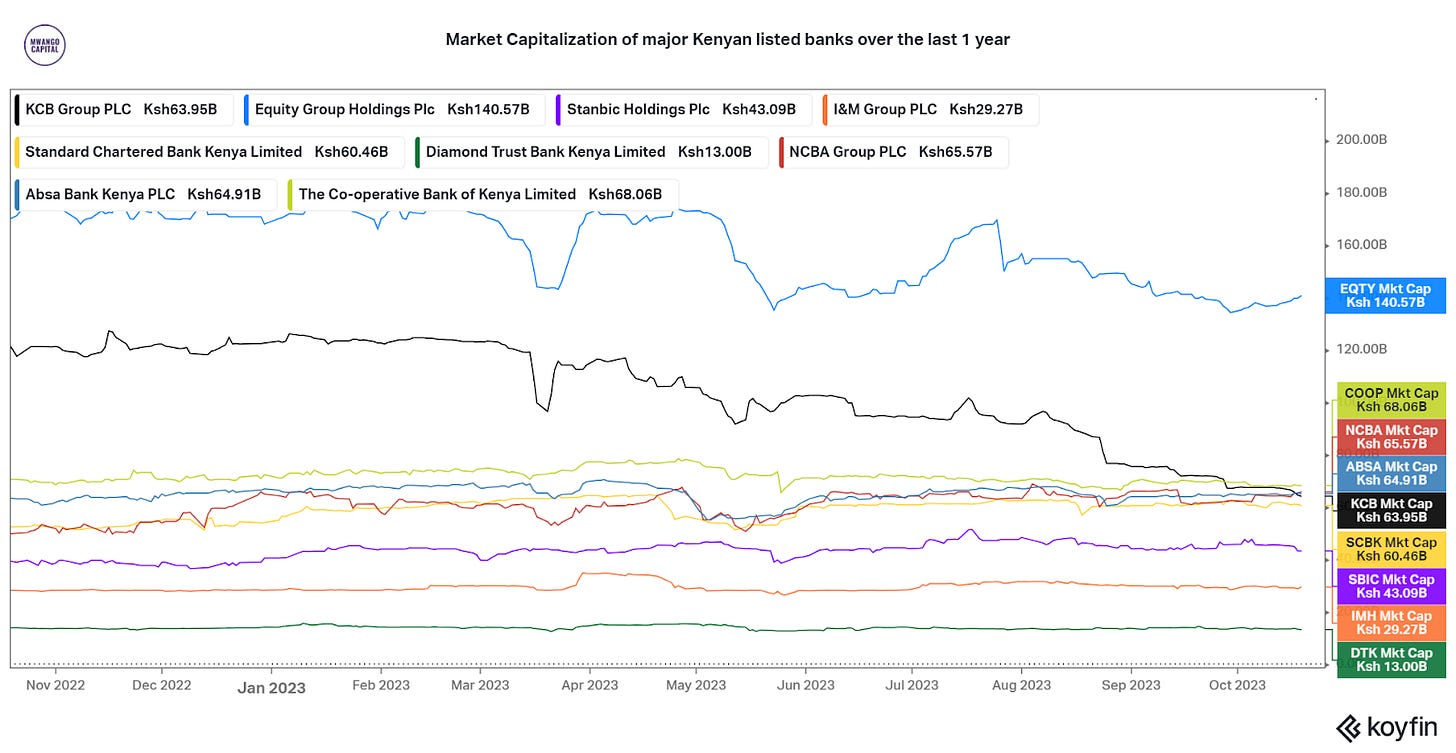

KCB Down 47.2%: The lender’s share price closed the week ended October 19, 2023, at KES 19.90 - a 79-month low. Market capitalization has almost halved from KES 121.9B a year ago to KES 64.4B at the close of last week. The stock has been on a downtrend, which could be a result of investor and market sentiment on some of the group’s fundamentals including its stock of non-performing loans (NPLs) and the Kenyan subsidiary’s thin capital ratios.

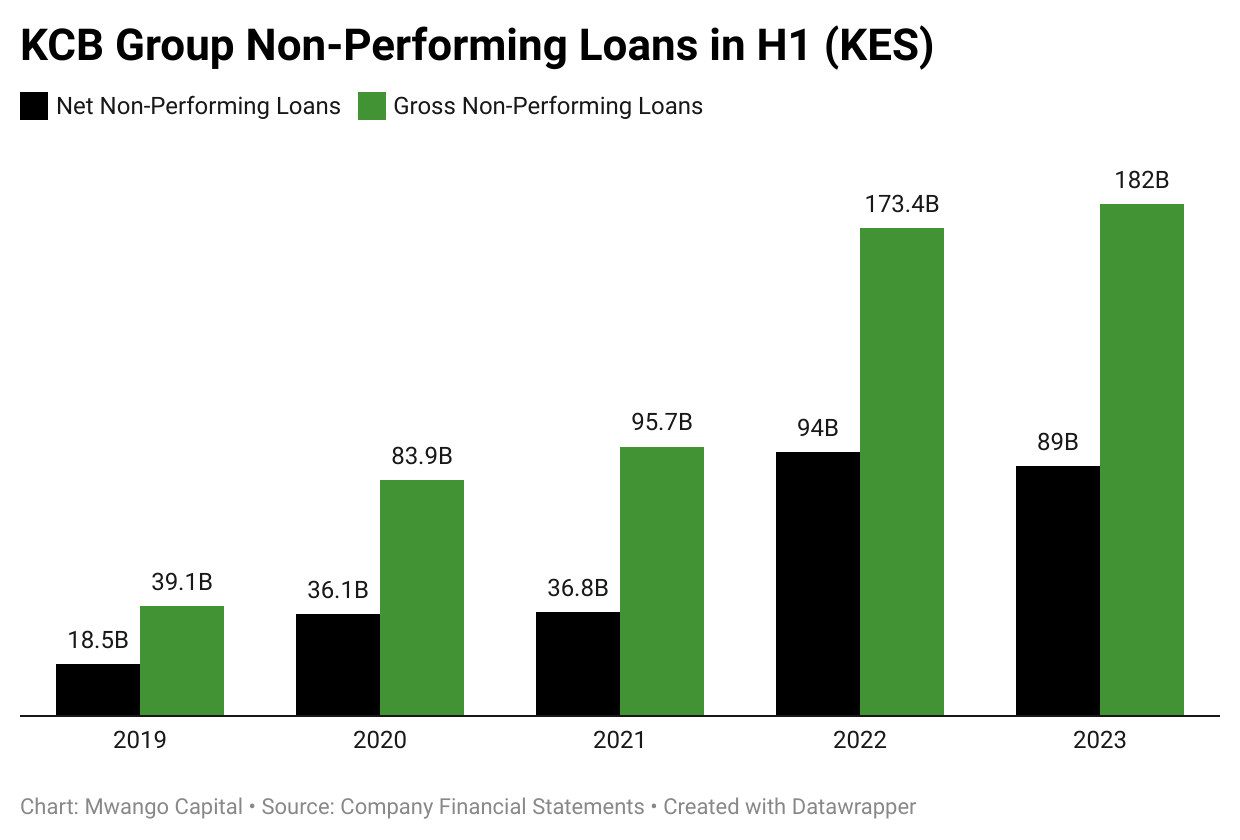

Deteriorating Asset Quality: In H1 2023, KCB Group’s stock of NPLs grew by 34.8% year-on-year to reach KES 182B, equivalent to 18.9% of the loan book [H1 2022: 23.7%]. The Kenyan banking unit closed H1 2023 with KES 141.5B in gross NPLs, equivalent to just over 21.2% of the loan book. The sticky NPLs are among the factors that keep investors worrying about the impact on the quality of earnings, and part of this is transmitting through to the market and the continued depreciation of the stock.

Looking Ahead: In H1 2023, KCB recorded KES 16.1B and KES 13.9B in net income at the Group and Kenya subsidiary levels, down 18.3% and 15.6% year-on-year, respectively. Excluding the impact of COVID-19 in 2020, this was the first time the Group recorded a decline in net income in H1 since 2017 when it fell by 0.2%. KCB Group did not pay a dividend in H1 2023, with earnings per share coming in at KES 9.71 [2022: 12.15], and investors will be looking to see whether the bank will pay out a dividend.

Market Cap Shape-Up: Over the last year, there has been a shake-up in the top 5 most valued banking companies at the NSE. While Equity Group remains the leading stock, it has shed value, losing 17.20% in share price and market capitalization in the period. Among the major listed lenders, KCB Group has lost the most value over the last year.

Banking Sector News Roundup: Here is a roundup of news across the banking sector last week:

KCB - Mastercard Partnership: KCB Bank Kenya has partnered with Mastercard to launch the World Elite Exclusive Credit Card, a premium credit card that offers market-exclusive privileges to high-net-worth individuals. The card will be available in two categories: World Elite KES Credit and World Elite USD Credit.

Absa Kenya Launches Wezesha Stock: Absa Kenya has launched a new digital platform, Wezesha Stock, to boost inventory management and trading for small and medium enterprises (SMEs). Under Wezesha Stock, Absa Bank Kenya will provide automated credit of between KES 100K and KES 10M to businesses dealing in fast-moving consumer goods, agro-processing, oil marketing, and agrochemicals.

Family Bank’s Rights Issue: Family Bank is offering 800 million new shares for sale through a rights issue, following approval from shareholders. This will increase the bank’s issued authorised ordinary shares to 2,300,000,000 ordinary shares. The funds raised will go towards strengthening the bank's capital base, for local and regional growth plans, driving investments in IT infrastructure and new product initiatives, and supporting onward lending activities. The rights issue opens on October 19, 2023 and closes on November 30, 2023. Find the Information Memorandum (IM) here.

Deals, Mergers, and Acquisitions

Safaricom Acquires M-PESA: Last week, Safaricom PLC announced the completion of the acquisition of the entire issued share capital of M-PESA Holding Co. Limited from Vodafone International Holdings BV. M-PESA Holding is the corporate trustee responsible for holding M-PESA customer funds under the M-PESA trust management. Post-completion, M-PESA Holding will continue to act as the corporate trustee of the M-PESA trust funds.

Hilton, Intercon Privatisation: The Privatisation Authority has appointed Standard Investment Bank (SIB) to guide the privatisation of Intercontinental and Hilton hotels. SIB will also offer advice for the privatisation of the Kenya Development Corporation, which holds the government’s stake in Hilton Hotel. The sale is part of the government’s plan to privatise at least 266 state-owned companies. Once the sale is complete the government will cease to have a majority stake in the two hotels.

Acorn’s JKUAT Student Housing: Property developer, Pecan Properties LLP, is proposing to build a KES 676.9M student accommodation at JKUAT. The 362-room residence will be built on a 0.196-acre parcel of land. The project is estimated to cost KES 676.9M of which KES 676,901 is payable to NEMA. Pecanwood Properties LLP is a subsidiary of Acorn, a property developer in Kenya.

Zhende Invests in Tatu City: Zhende Medical, a Chinese company specialising in the production and sale of disposable medical devices, has announced plans to invest USD 180M in Kenya to build production facilities in Tatu City special economic zone. The investment is expected to create 7,000 jobs and generate USD 320M in annual exports. The deal was announced at the Third Belt and Road Forum for International Cooperation in Beijing.

Across Borders: Canadian minerals exploration company Windshear Gold Corp. reached a USD 30M settlement agreement with the United Republic of Tanzania over a dispute regarding the company’s SMP Gold Project. The settlement agreement terminates the arbitration proceedings that were initiated in 2017 after the Tanzanian government revoked the company’s mining licences. The company will announce its plans for the settlement funds in due course.

Markets Wrap

NSE: In Week 42 of 2023, EA Portland was the top-performing stock, up 12.3% to close at KES 8.20. Express Kenya was the worst-performing stock, down 8.8% to close at KES 3.65. The NSE 20 index rose by 0.18% to close at 1,490.10 points, the NSE 25 dropped by 0.07% to close at 2,460.57 points, and the NASI index fell by 0.08% to close at 93.17 points. Equity turnover went down to KES 219.04M from KES 469.02M prior week while bond turnover closed the week at KES 9.8B compared to the prior week’s KES 3.7B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.0458%, 15.0763%, and 15.3405% respectively. The total amount on offer was KES 24B with the CBK accepting KES 27.5B of the KES 29.6B bids received, to bring the aggregate performance rate to 123.39%. The 91-day and 364-day instruments recorded 585.90% and 22.67% performance rates, respectively.

Treasury Bonds: The CBK has issued a prospectus for a 6.5-year amortised infrastructure bond issue no. IFB1/2023/6.5. The amount on offer is KES 50B, and the minimum competitive bid amount has been revised to KES 2M per CDS account per tenor.The bids closure date is 8th November 2023 at 10:00AM, and the results of the auction will be announced on 10th November 2023. Find the prospectus here.

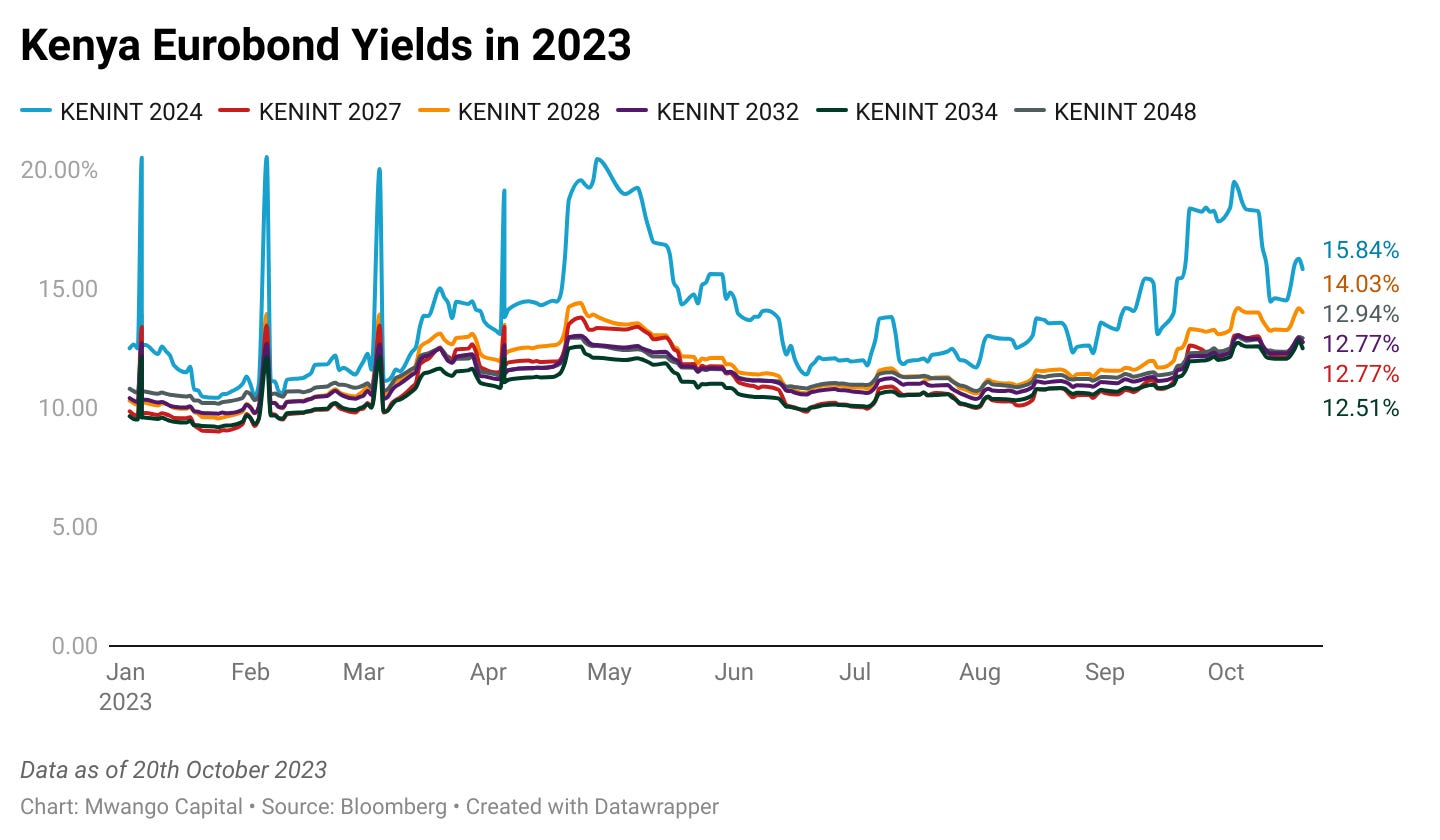

Eurobonds: In the week, yields rose across the 6 outstanding papers.

KENINT 2024 rose the most week-on-week, up by 122.9 bps to 15.841%, while KENINT 2034 rose the least, appreciating by 43.8 basis points to 12.508%. The average week-on-week change stood at 285.9 bps.

KENINT 2028 rose the most on a year-to-date (YTD) basis, appreciating by 371.7 bps to 14.029% while KENINT 2048 rose the least at 211.6 bps.

Prices fell across the board week-on-week, with KENINT 2024 falling the least at 0.6% to 94.501. KENINT 2048 depreciated the most at 4.4% to 65.441. Year-to-date, KENINT 2024 was the only price that rose, appreciating by 2.2%. The largest price losses YTD were 16.6% for KENINT 2034 to 64.660. The average price change week-on-week and YTD was -0.10% and -0.02%, respectively.

Market Gleanings

📜 | Ilam Fahari’s Redemption Results | The redemption offer of up to 36,585,134 units from non-professional investors in ILAM Fahari I-Reit was oversubscribed by 113.08%, with applications for redemption of 41,371,604 units received. The transaction has resulted in the REIT's promoter, ICEA LION Asset Management Limited, increasing its unitholding to 22.74% post redemption.

🏛️| Vivo Fashion Group Joins Ibuka Program | Vivo Fashion Group Limited has joined the Nairobi Securities Exchange (NSE) Ibuka program, a premium incubation and acceleration program for high-growth companies in Kenya. The program will enable Vivo to restructure its business and pursue capital market transactions.

⚡| Kenya Power Board Restructuring | Kenya Power is seeking shareholders' approval to amend its Memorandum and Articles of Association to safeguard the interests of minority shareholders and to comply with good corporate governance practices. In the proposed restructuring of the Board of Directors, the government will appoint five directors while the remaining shareholders will elect four directors. Currently, the government holds 50.09% of the Company’s shares.

💸| KRA’s Amnesty Programme | The Kenya Revenue Authority (KRA) has so far collected KES 3.4B from the ongoing tax amnesty programme. The tax amnesty programme allows taxpayers to apply for a waiver of penalties and interest accrued until December 31, 2022. KRA has identified 2.8 million taxpayers who qualify for the amnesty programme and expects to collect over KES 51B from the debts accrued in that period.

⛽| Uganda-Tanzania Oil Pipeline | The USD 4B Uganda-Tanzania crude oil pipeline is back on track after Tanzania settled a disagreement with some Chinese funders on a separate matter. Standard Bank, which is considering investing USD 100M in the project, is awaiting the completion of an environmental and social impact assessment study. Uganda is also seeking other sources of financing for its portion of the pipeline after the China Export and Credit Insurance Corp failed to announce an investment.