👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover HF Group’s rights issue results, Bamburi Cement's takeover by Amsons, and amendments to PAYE by KRA.HF Group's Rights Issue Oversubscribed

HF Group has successfully concluded its rights issue, achieving a subscription rate of 138.32%, significantly surpassing the targeted KES 4.6B. The capital raise attracted applications worth KES 6.38B, reflecting strong investor confidence. The issue was priced at KES 4.00 per share, aimed at raising KES 5.99B through the issuance of 1.5B new ordinary shares. The rights issue was structured to offer two new shares for everyone held, with the uptake further bolstered by a greenshoe option allowing for an additional 384M shares.

“The outcome of the rights issue has been an overwhelming success. We went to our shareholders asking for additional investment of KES 4.6B. Upon conclusion of the process, we have received applications of KES 6.38B. We are now firmly on the path to powering our next phase of business growth.”

HF Group CEO, Robert Kibaara

Strengthening Capital Position: The proceeds from HF Group's rights issue will strengthen its capital base, support the bank's expansion in personal, business, and commercial banking, and enhance its tech infrastructure and digital assets. CEO Robert Kibaara highlighted that the capital raise will enable the bank to grow its customer base and scale operations significantly. The Group is also on course to fully comply with the new capital regulations, which require banks to grow their capital base to KES 10B by 2028.

"These funds will go towards expanding the growth of our business. 85% will go towards this while 15% will go towards technology and digitization of the business to increase efficiency and customer experience. With this successful rights issue, we have positioned ourselves well to meet upcoming regulatory requirements, including the mandate to raise our capital to KES 10B by 2028. This capital injection puts us ahead of the curve in terms of compliance, while also providing a solid foundation for the bank’s future growth. We are confident that, with sufficient capital, we can continue to expand our business and offer even greater returns to our shareholders in the coming years.”

HF Group CEO, Robert Kibaara

Subscription Performance: The total number of shares accepted under entitlement amounted to 474,201,310, with a take-up percentage of 61.65%. The oversubscription rate of 38.32% highlights the strong demand for HF Group’s shares. Shareholders applied for a total of 1.596B shares, surpassing the original offer of 1.153B shares. Due to this high demand, HF Group exercised its greenshoe option, which allowed the company to raise an additional KES 399,981,020, bringing the total gross proceeds to KES 5,999,981,020. This additional funding will play a crucial role in bolstering HF Group's capital position as it prepares for upcoming regulatory changes.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

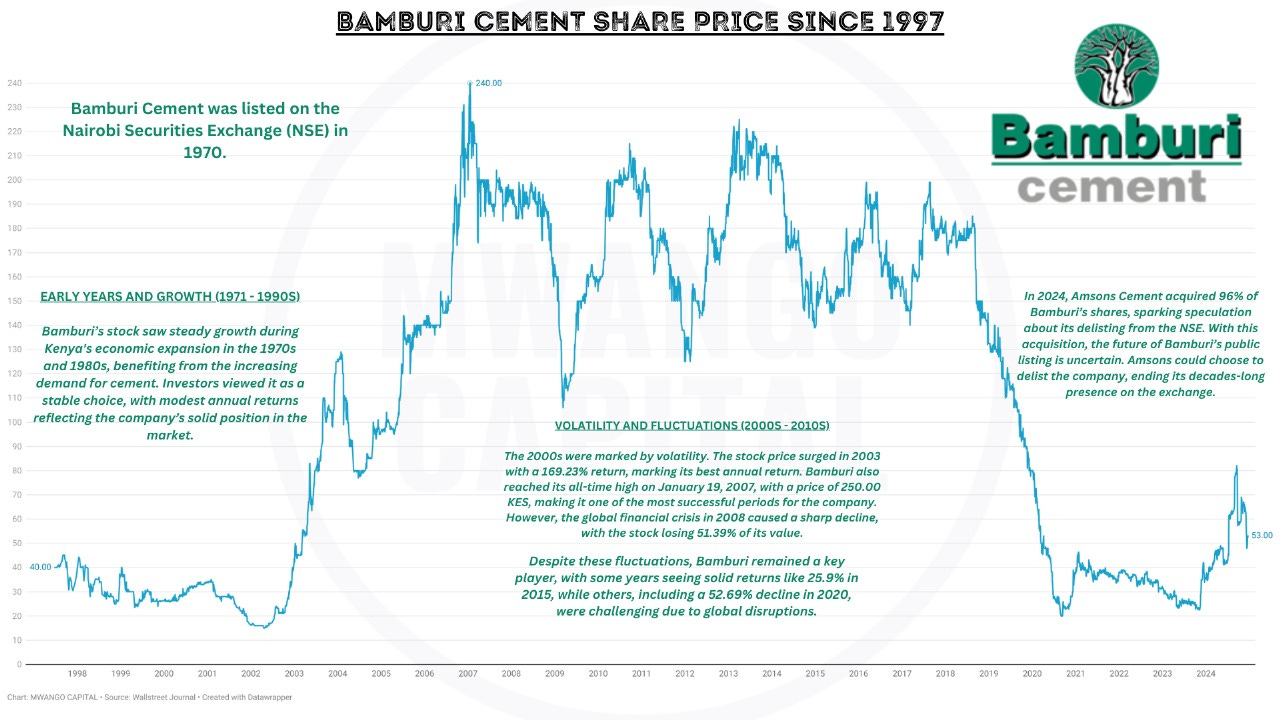

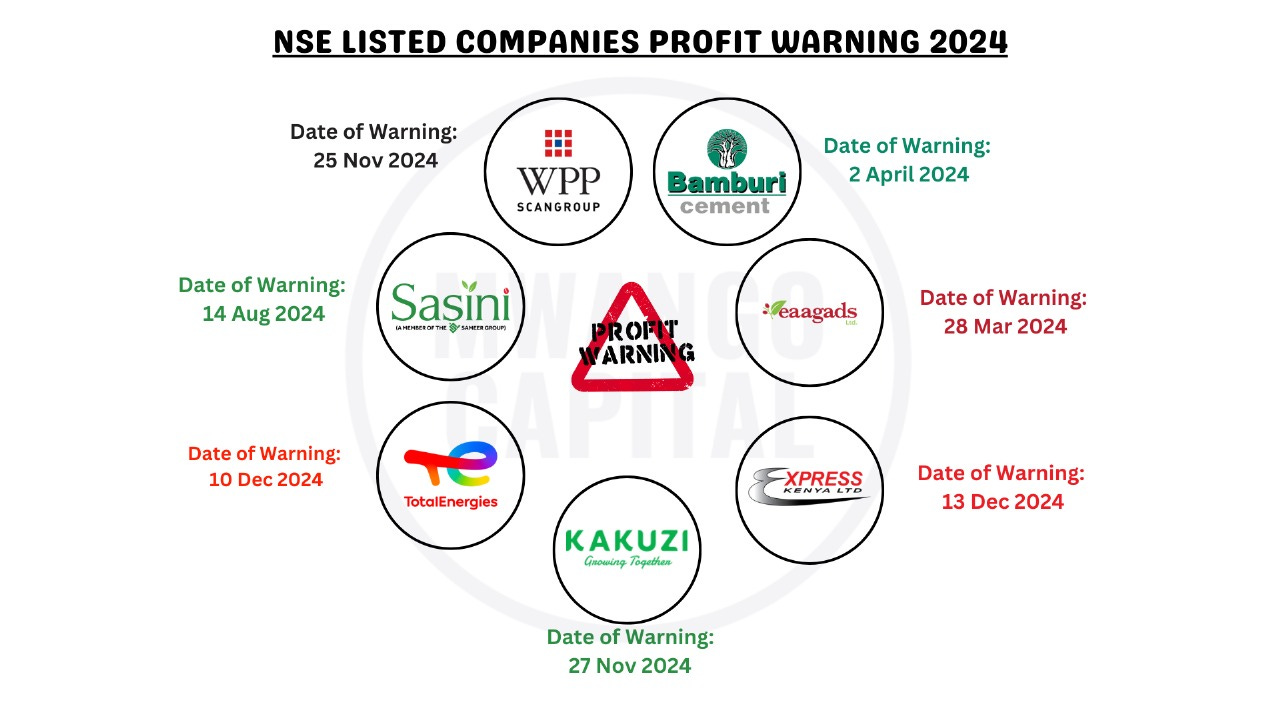

Amsons Acquires Stake in Bamburi

Amsons Gets its Stake: Amsons Industries (K) Ltd has acquired 350.4M shares of Bamburi Cement, representing 96.54% of the company’s total shareholding, in a $180M (KES 22.8B) deal following the closure of its takeover offer. The bid, which aimed for 100% ownership of Bamburi’s KES 5.00 par value shares, left minority shareholders with 12.6M shares (3.46%). Amsons Group, a Tanzania-based conglomerate with an annual turnover exceeding $1B, expands its East African footprint through this acquisition. Holcim, the previous majority stakeholder, divested its 58.6% stake in Bamburi Cement to Amsons for over $100M, signaling its exit from Kenya as part of a global portfolio realignment.

“This acquisition aligns with our strategy to expand into specialized cement manufacturing and complements our broader growth objectives. With Bamburi Cement now part of the Amsons family, we anticipate creating significant mutual benefits through this integration.”

Amsons Group Managing Director, Edha Nahdi

Set for Delisting? According to its offer document, Amsons Industries committed to transferring shares from Bamburi shareholders who accepted its bid within 14 days of the offer becoming unconditional, with payments completed within the same period. With over 90% acceptance, Amsons now holds the right to invoke a squeeze-out for the remaining shares held by non-participating shareholders. Additionally, surpassing the 75% ownership threshold positions the conglomerate to delist Bamburi Cement from the Nairobi Securities Exchange (NSE). The takeover process saw Amsons emerge as the sole bidder after Savannah Clinker withdrew its bid following the arrest and indictment of its chairman and main shareholder, Benson Ndeta, on charges including defrauding ABSA Bank of $35M. This development led the financier of Savannah’s bid to demand additional due diligence, and the Capital Markets Authority (CMA) declined a request to extend the offer period by 60 days.

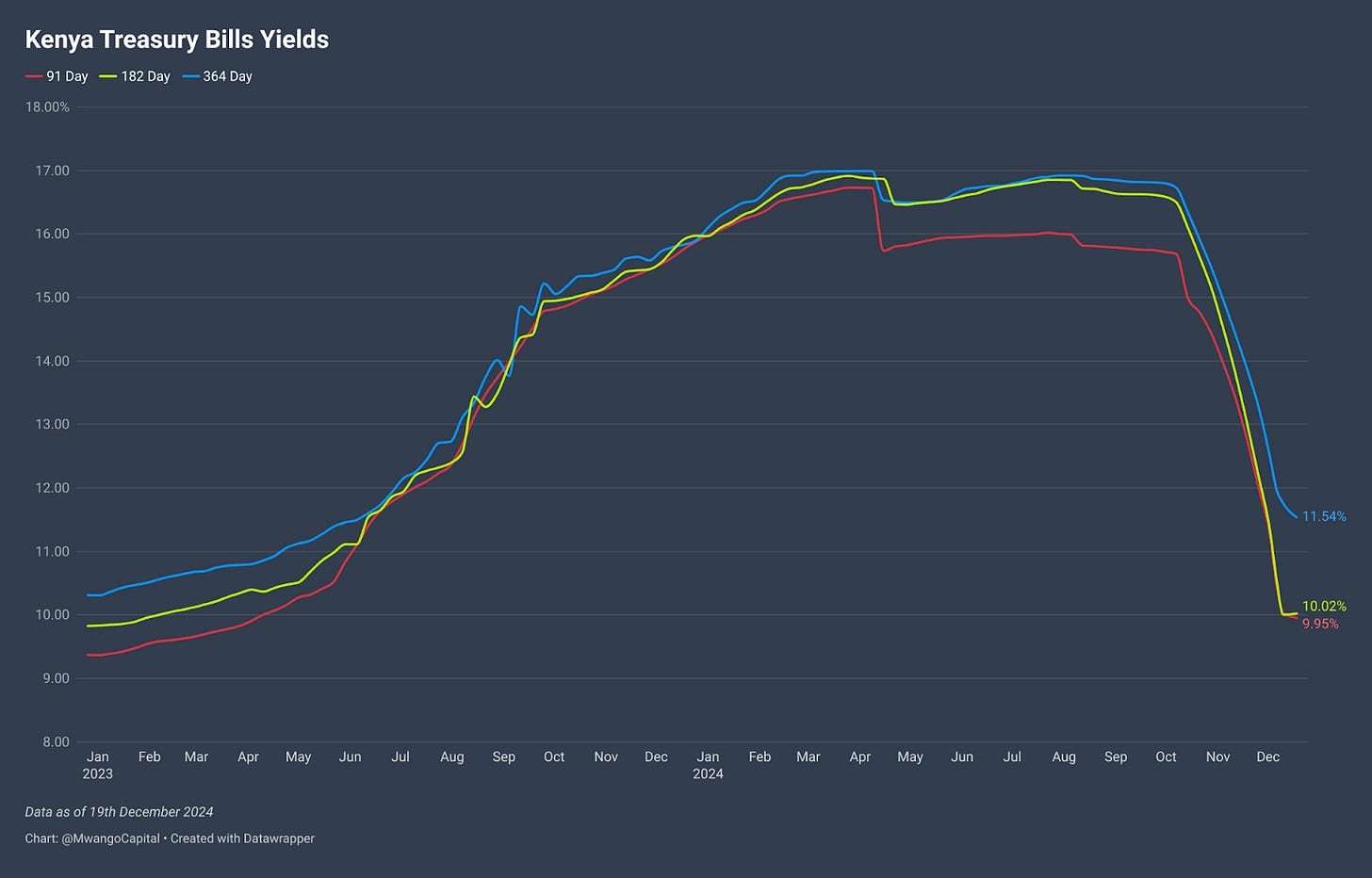

Treasury Yields Touch Single Digits

Falling Rates: Interest rates on Treasury bills have dropped to levels last seen in April 2023, with the 91-day paper falling into single-digit territory at 9.954%. This comes as the Central Bank of Kenya (CBK) continued its monetary easing cycle in December reducing the benchmark rate to 11.25%. The latest auction recorded an undersubscription, with an overall subscription rate of 54.49%, down from 69.17% the previous week. Investors placed bids worth KES 13.07B, out of which KES 13.04B was accepted achieving an acceptance rate of 99.9%. Yields on the 364-day paper declined to 11.537%, while the 182-day bill registered a marginal increase of 2.01 basis points to close at 10.021%.

Reprieve for the Government: The falling rates on Treasury bills offer a significant reprieve to the government by reducing borrowing costs and easing the financing of bond and treasury bill maturities.

Markets Wrap

NSE This Week: In Week 51 of 2024, Carbacid led the top gainers, rising by 17.1% to close at KES 20.85, while Uchumi was the worst performer, dropping 18.2% to close at KES 0.18. The NSE 20 rose by 1.5% to 1,908.5 points, while the NSE 25, NSE 10, and NASI indices gained by 1.5%, 1.3%, and 2.2%, closing at 3,292.2, 1,268.4, and 121.7 points, respectively. Equity turnover rose by 1156.5%, totaling KES 24.9B, while bond turnover rose to KES 39.7B, up from KES 25B the previous week.

Treasury Bonds: The Central Bank of Kenya has issued a prospectus for the re-opened Fifteen-Year and Twenty-Five-Year Fixed Coupon Treasury Bonds FXD1/2018/15 and FXD1/2022/25 targeting KES 30B. The period of sale is from 13/12/2024 to 15/01/2025.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds increased across the board, with the KENINT 2034 recording the sharpest increase of 52.80 basis points to 9.769%, followed by the KENINT 2031, which rose by 48.80 basis points to 9.918%. The average week-on-week yield increase was 44.13 basis points.

Market Gleanings

📄| KRA Announces PAYE Amendments | The Kenya Revenue Authority (KRA) has announced amendments to PAYE, effective December 27, 2024, following the Tax Laws (Amendment) Act, 2024. New deductions include contributions to the Housing Levy, SHIF, and post-retirement medical funds, capped at KES 15K per month, mortgage interest (up to KES 360K annually), and pension contributions (also up to KES 360K annually). The Act eliminates reliefs for the Housing Levy and post-retirement medical funds. Certain employee benefits, like meals valued under KES 5K per month and benefits under KSh 60K annually, will be tax-exempt. Gratuity payments into pension schemes, up to KES 360K per year, will also be excluded from taxable income.

🌾| Kenya in Talks to Lease Farmland to UAE’s Al Dahra | Kenya is negotiating with Abu Dhabi’s Al Dahra to lease 200,000 acres for irrigation development, with a USD 800M investment. The deal, expected to be signed early next year, is part of a public-private partnership (PPP) that includes a dam project by China Road and Bridges Corp. Kenya seeks to attract private investors for large-scale agricultural projects through long-term leases of 500,000 acres of underutilized state-owned land.

⛽| Cabinet Approves G-to-G Extension | The Cabinet has approved the extension of the Government-to-Government (G-to-G) arrangement for importing refined petroleum products, which has helped stabilize the shilling-dollar exchange rate at KES 129, down from KES 166, and reduced petrol prices from KES 217 to KES 177 per litre. The arrangement, which allows payments in Kenyan shillings, secures petroleum supply and eliminates the need for an estimated USD 500M in monthly dollar payments.

🇪🇹| Ethiopia Opens Banking Sector to Foreign Banks | Ethiopia has ratified the Banking Business Proclamation, allowing foreign banks to operate in the country as part of efforts to attract more overseas investment. This move follows gradual economic liberalization since Prime Minister Abiy Ahmed took office in 2018. The new law permits foreign banks to establish subsidiaries, open branches, and buy shares in local banks, with foreign ownership capped at 40%. The law aims to strengthen local lenders through increased competition.Ethiopia's banking sector is currently dominated by state-owned Commercial Bank of Ethiopia.

🔴| SACCOs Warned Against Loan-Funded Dividends | The Ministry of Co-operatives and MSME Development, led by Cabinet Secretary Wycliffe Oparanya, has issued strict warnings to SACCOs against paying dividends using bank loans, emphasizing the financial risks and legal repercussions of such practices. Oparanya stated that SACCO bosses who resort to borrowing funds to pay dividends will face severe penalties, including jail terms, starting next year. This move comes as part of the government's efforts to protect members' funds and ensure compliance with proper financial management practices. SACCOs are urged to prioritize robust internal controls, adhere to liquidity and capital adequacy standards, and strictly follow the Co-operative Societies Act to safeguard their financial health and member interests.

✅| Kenafric Acquires Economic Industries | The Competition Authority of Kenya (CAK) has unconditionally approved Kenafric Manufacturing Limited's acquisition of Economic Industries Limited. Kenafric, a Kenyan company controlled by Zarrar Holding Limited, manufactures PVC, EVA, rubber footwear, and stationery products such as exercise books and notebooks. The acquisition allows Kenafric to expand its stationery business in Kenya as Economic Industries exits and liquidates its operations.

🟩| Delisting of Acorn Green Bond | The Nairobi Securities Exchange has announced the delisting of the Acorn Green Bond, effective 4th October 2024, following the early redemption of KES 2.69B under Acorn Project (Two) LLP’s Medium-Term Note Programme.

⚖️| DRC Files Complaints Against Apple | The Democratic Republic of the Congo has filed criminal complaints in France and Belgium against Apple subsidiaries, accusing the company of using minerals pillaged from the DRC and engaging in deceptive supply chain practices. Despite demands in April 2024 for Apple to address these allegations, no substantive response has been provided. The DRC’s legal team calls the complaints a first step toward accountability for exploitation fueling conflict, child labor, and environmental harm.

✈️| Ethiopian Airlines Partners with DRC to Launch Air Congo | Ethiopian Airlines has partnered with the Government of the Democratic Republic of the Congo (DRC) to establish Air Congo, with the DRC government holding a 51% majority stake and Ethiopian Airlines managing the airline with a 49% share. Air Congo has commenced operations with two Boeing 737-800 aircraft, initially serving seven airports within the DRC. Key technical agreements have been signed, including aircraft leases, technical support, and systems assistance. Additionally, Ethiopian Airlines will train Congolese nationals as pilots, cabin crew, sales and service staff, and technicians.

🔴| Air Tanzania Banned from EU Airspace | The European Commission has updated the EU Air Safety List, including Air Tanzania due to safety concerns identified by the European Union Aviation Safety Agency (EASA). As a result, the airline is subject to an operating ban or restrictions within the European Union and has not been granted a Third Country Operator (TCO) authorization. The latest revision includes 129 airlines, with 100 certified in 15 states where aviation oversight is deemed insufficient, and 29 individual airlines with significant safety deficiencies.

📊| Fed Cuts Rates | The Federal Reserve has lowered rates by 25 basis points in December, with Cleveland Fed President Beth M. Hammack dissenting in favor of no change. The latest statement highlights a more explicit consideration of the timing and extent of future rate adjustments, reflecting stronger-than-expected economic growth, labor market performance, and inflation revisions. Additionally, the FOMC has reduced the offering rate of Overnight Reverse Repos (ON RRPs) by 5 basis points to 4.25%, aiming to redirect money market funds into the repo market

🔺| Receiverships |

Milele Beach Resort: Kamal Anantroy Bhatt of Anant Bhatt LLP has been appointed as the Receiver and Manager for Presbyterian Foundation (Milele Beach Hotel) in Mombasa, effective 16th December 2024, by the National Bank of Kenya. Following this appointment, the Receiver will have sole authority over the company’s assets and operations, and the Directors' powers are no longer valid.

Steel Makers Ltd: KVSK Sastry has been appointed as the Receiver and Manager for Steel Makers Ltd, effective 23rd August 2024. As Receiver, Sastry has full authority over the company's assets, and the powers of the directors to manage these assets have been revoked. The directors are required to submit a Statement of the Company’s Affairs within 12 days from the date of the notice.

💰| IMF Roundup |

Tanzania: The IMF Executive Board has completed the fourth review under the Extended Credit Facility arrangement with Tanzania, enabling an immediate disbursement of USD 148.6M. Additionally, the first review of the 23-month arrangement under the Resilience and Sustainability Facility (RSF) has been completed, allowing for an immediate disbursement of USD 55.9M, bringing the total disbursement to USD 204.5M.

Zambia: The IMF Executive Board has completed the fourth review under Zambia's 38-month ECF Arrangement, providing the country with immediate access to about USD 184M. Program performance has been satisfactory, with Zambia meeting all June 2024 quantitative performance criteria and most of the indicative targets for June and September 2024.

Rwanda: The IMF Executive Board has concluded the fourth review under the Policy Coordination Instrument (PCI), the fourth and final review under the Resilience and Sustainability Facility (RSF), and the second and final review under the Standby Credit Facility (SCF). This enables immediate disbursements of about USD 94.23M under the RSF and USD 87.5M under the SCF.