Kenya Eyes $1.5B UAE Bond Deal

The private bond placement is part of the strategy to diversify sovereign bond issues

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s USD 1.5B UAE private bond, QBER Q2 FY2024/25 highlights, and CBK hitting its KES 50B bond buyback target.Kenya to Secure USD 1.5B Bond Deal from UAE

Kenya is set to raise USD 1.5B through a private bond placement in the United Arab Emirates this week. The issuance, initially planned for staggered disbursement, will now be received in full, providing immediate liquidity relief and supporting foreign reserves. This move aligns with Kenya’s strategy to diversify its sovereign bond markets beyond the traditional London Eurobond market, mitigating refinancing risks following the challenges faced with the Eurobond 2024.

The UAE has been expanding its economic influence in Africa, signing a trade and investment pact with Kenya in January and committing USD 35B to Egypt last year.

Meanwhile, Kenya is broadening its funding sources, with Panda (RMB) and Samurai (Yen) bond issuances also in the pipeline. The International Monetary Fund has previously advised Kenya to evaluate the impact of its debt strategy on fiscal sustainability, especially after the country revised its fiscal deficit projection for FY 2024/2025 from 4.3% to 4.9% of GDP.

“It is a private bond placement in the UAE, part of our strategy to diversify sovereign bond issues from London Eurobond market to mitigate the refinancing risk we suffered with Eurobond 2024. Also in pipeline Panda(RMB) and Samurai(Yen) issues.”

President's Council of Economic Advisors Chairperson, Dr. David Ndii

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Quarterly Economic and Budgetary Review

The National Treasury has released its latest Quarterly Economic and Budgetary Review for the period ending December 31, 2024 (Q2 FY2024/25). Here are the key highlights from the report:

Economic Growth: In Q3 2024, the economy grew by 4.0%, marking a slowdown from the 6.0% growth recorded in the same period in 2023. The growth was primarily driven by strong performances in Agriculture, Forestry & Fishing. The Accommodation and Restaurant sector recorded the highest expansion at 13%, while the Mining and Quarrying sector experienced the steepest contraction, shrinking by 11.1%.

Balance of Payments: In December 2024, the current account deficit stood at USD 4.5B (3.6% of GDP), compared to USD 4.2B (4.4% of GDP) in December 2023. Meanwhile, the capital account, which tracks net investment flows into the country, recorded a USD 48.9M increase, bringing the surplus to USD 176.5M.

Revenue and Expenditure: By December 2024, total revenue collection, including A-I-A, reached KES 1.37T, falling KES 62.8B short of the KES 1.43T target. Revenue and grants stood at 7.6% of GDP, down from 8.2% in the same period of FY 2023/24. Total expenditure and net lending amounted to KES 1.89T, exceeding the KES 1.80T target and growing 11.1% year-over-year, with KES 1.40T allocated to recurrent spending.

Pending Bills: As of December 31, 2024, the National Government’s pending bills totaled KES 539.9B. State Corporations accounted for KES 426.3B (81.3%), while Ministries, State Departments, and other government entities owed KES 97.8B (16.7%). Development-related pending bills made up 51.0% of the total, with recurrent bills comprising 49.0%.

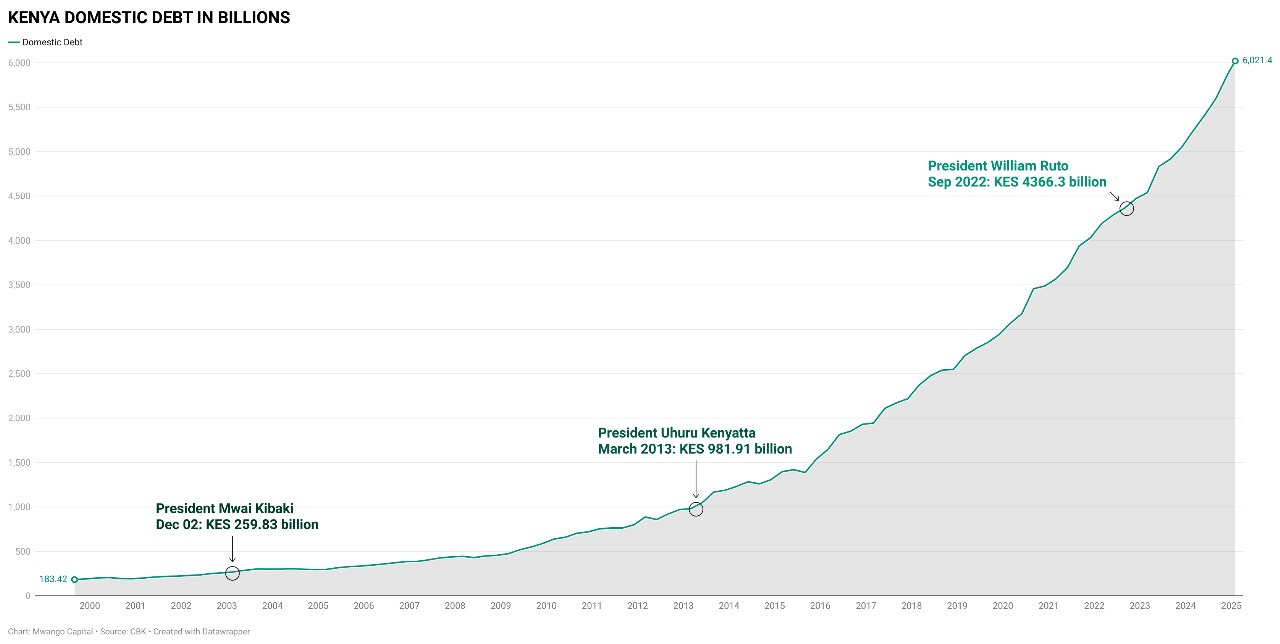

Public Debt: By December 31, 2024, public and publicly guaranteed debt stood at KES 10.93T, down KES 213.9B from KES 11.14T in December 2023, driven by the appreciation of the Kenya Shilling against major currencies. External debt accounted for KES 5.06T (46.3%), while domestic debt stood at KES 5.87T (53.7%). Net public debt was KES 10.36T.

Debt Service: As of December 2024, the National Government had not serviced any guaranteed debt on behalf of parastatals. Total external debt service payments amounted to KES 231.3B, with KES 129.6B (56.0%) allocated to principal repayment and KES 101.7B (44.0%) to interest. Payments to bilateral creditors accounted for 44.0%, commercial creditors 33.4%, and multilateral creditors 22.6% of the total.

Access the entire report here.

Markets Wrap

NSE This Week

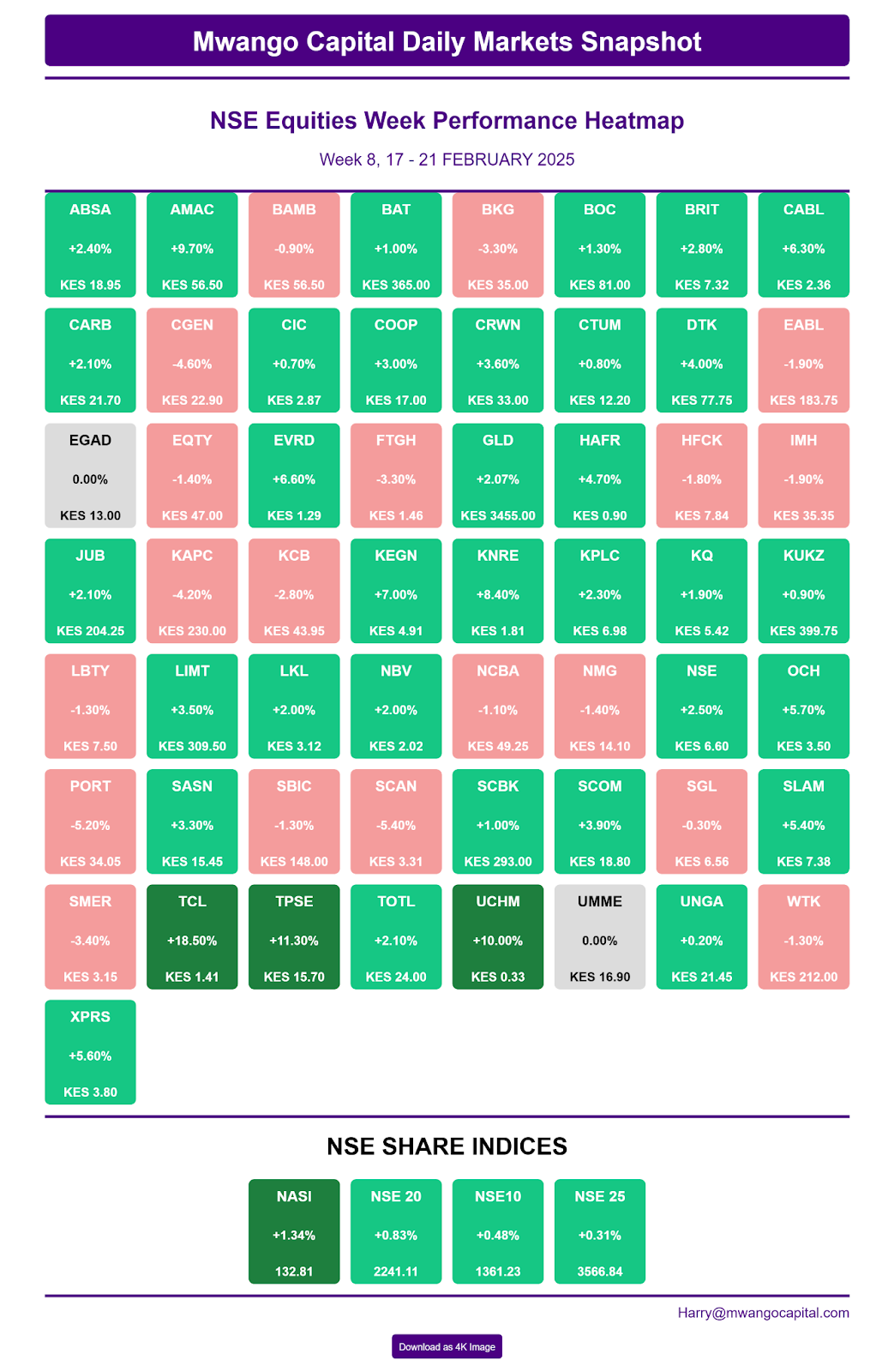

TransCentury Ltd soared to KES 1.41 (+18.5%) while ScanGroup dropped to KES 3.31(-5.4%), leading gains and losses.

Markets inched higher—NASI at 132.8 (+1.34%), NSE 20 at 2,241.1 (+0.83%), NSE 10 at 1,354.7 (+1.28%), and NSE 25 at 3,566.2 (+0.31%).

Equity turnover rose 5.4% to KES 2.07B while bond turnover surged 307.7% to KES 127.43B.

Foreign investors recorded net inflows of KES 86.7M, accounting for 29.73% of total turnover.

Eyes are on EABL’s interim dividend on March 3 and KCB’s FY results on March 12.

Uganda and Dar es Salaam Securities Exchange

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 137.3%, down from 184.4% the previous week. Investors placed bids totaling KES 32.94B, out of which KES 32.9B was accepted, reflecting a 99.8% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 2.2, 9.8, and 6.8 basis points to 8.948%, 9.312%, and 10.526%, respectively.

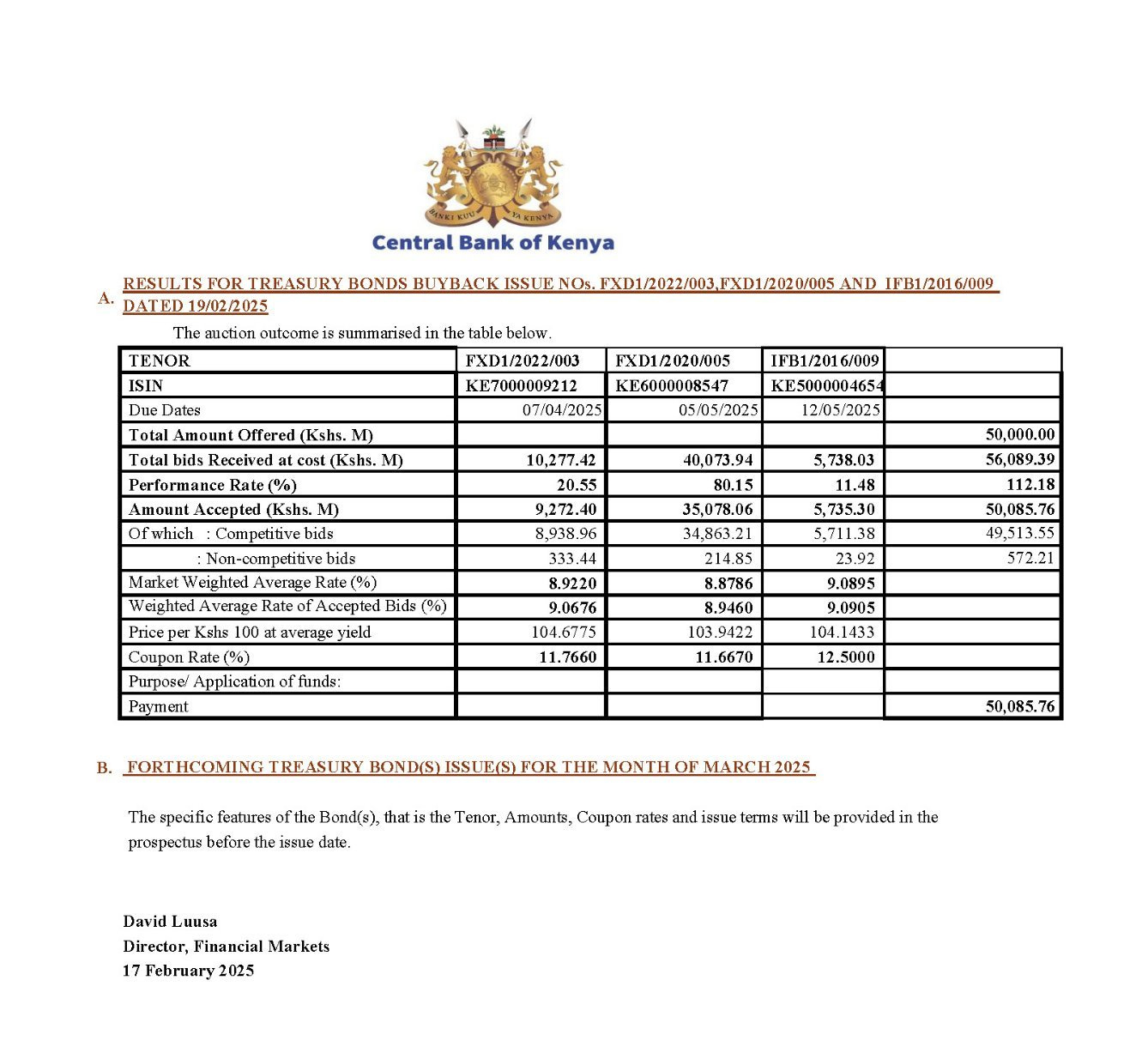

Treasury Bonds: The Central Bank of Kenya (CBK) is inviting bids for the re-opened FXD1/2018/25 Treasury bond with a 13.400% coupon. The bond auction aims to raise KES 25B, with the deadline for bids set for 5th March 2025 at 10:00 AM.

In its bond buyback that closed on February 17, the Central Bank of Kenya (CBK) met its KES 50B target, reducing upcoming maturities from KES 185.05B to KES 135B. Bondholders offered KES 56.1B, with CBK accepting KES 50.09B at face value plus accrued interest. This marks Kenya’s first domestic bond buyback, replacing an earlier KES 204B switch bond program. The move was financed by an oversubscribed KES 130B infrastructure bond sale in February.

Eurobonds: Last week, yields on Kenya’s six outstanding Eurobonds rose, with the KENINT 2031 bond leading the increase, up 10.0 basis points to 9.765%. The KENINT 2028 bond followed, declining by 8.30 basis points to 8.459%. On average, Eurobond yields increased by 6.38 basis points week-on-week.

Market Gleanings

📊| Shilling Rally Eases Kenya’s Debt Burden | Kenya’s total public debt fell by 2% to KES 10.93T (USD 84.6B) as of December 2024, marking the first decline in at least two decades, according to the National Treasury. The drop was driven by the Kenyan shilling’s 21% surge in 2024, making it the world’s best-performing currency. While domestic debt rose by 16% to KES 5.87T, external debt remained relatively stable, increasing by just 0.49% to USD 39.1B.

📄| Earnings wrap |

Longhorn Publishers H1 2024/25 Results: Longhorn Publishers' revenue declined 46.9% to KES 278.8M, but gross profit increased 68.4% to KES 112.9M. The company reduced its loss after tax to KES 148.6M from KES 207.4M in the previous year. Net cash from operations fell 6.2% to KES 126.3M, and total assets dropped 25.6% to KES 1.8B. Cash reserves shrank 47.6% to KES 32.4M.

BAT Kenya FY 2024: BAT Kenya reported a 1% rise in net revenue to KES 25.7B, but profit after tax dropped 19.5% to KES 4.5B due to higher costs and operating pressures. Operating profit fell 9% to KES 7.3B, while cash from operations surged 23% to KES 10.4B. Earnings per share (EPS) declined 19.5% to KES 44.83, and the company declared a final dividend per share (DPS) of KES 50.00.

✅| CMA Approves Ziidi Shariah MMF | The Capital Markets Authority (CMA) has approved Gulfcap Investment Bank to register the Ziidi Shariah Money Market Fund. The fund will operate independently with its own incorporation documents and target M-PESA users interested in Sharia-compliant investments. With this approval, the number of licensed firms offering Shariah-compliant unit trust funds in Kenya rises to seven.

⚡| Kenya’s Power Demand Hits New Record | Kenya’s electricity demand hit a record 2,316 MW on February 12, 2025, exceeding the previous peak of 2,304 MW recorded on January 15. Data from Kenya Power shows demand has grown by 116 MW since June 2024, averaging 14.5 MW per month. The increase is driven by grid stabilization and the connection of over 198,535 new customers in the last six months. E-mobility consumption has also surged with billed electricity more than tripling in under a year.

🔺| KRA Probes BAT Over Alleged Tax Underpayment | The Kenya Revenue Authority (KRA) has launched an investigation into claims that BAT Kenya underpaid USD 28M in taxes between 2017 and 2018. The allegations stem from a report by the University of Bath’s Tobacco Control Research Group, which suggests discrepancies in the company’s tax declarations and payments. BAT Kenya rejected the claims, stating that the report contains errors in revenue, profit, and tax calculations.

✔️| Eurazeo SE Cleared to Acquire Bioline | The Competition Authority of Kenya (CAK) has approved French investment firm Eurazeo SE’s KES 1.1B acquisition of Bioline Agrosciences and Dudutech Properties. The transaction, executed through Eurazeo’s subsidiary Legendre Holding 114, will merge the two firms under the new owner. CAK stated that the acquisition will not impact competition, as Bioline is a small player in a market led by Syngenta, Bayer, and Corteva.

🔴| Zuku Fined by ODPC for Unsolicited Messages | Wananchi Group Limited, trading as Zuku, has been ordered to pay KES 500,000 to a former customer, for failing to stop sending him promotional messages despite multiple requests. Data Commissioner Immaculate Kassait also recommended prosecuting Zuku’s directors for obstructing an investigation. The ODPC found that Zuku denied access to its records despite a search warrant, making its claims of not receiving deletion requests unverifiable.

✔️| African Leaders Approve Financial Stability Fund | African leaders have agreed to establish the African Financial Stability Mechanism (AFSM) to help prevent debt crises, the African Development Bank (AfDB) announced. The fund will have its own credit rating, allowing it to raise capital internationally. The AfDB estimates the mechanism could save African governments USD 20B in debt servicing costs by 2035. Membership will be voluntary for African Union states, with non-African countries allowed to hold up to 20% of seats.