👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Standard Chartered Absa, and Co-operative Banks' FY24 results.Standard Chartered Bank Kenya FY 2024 Results

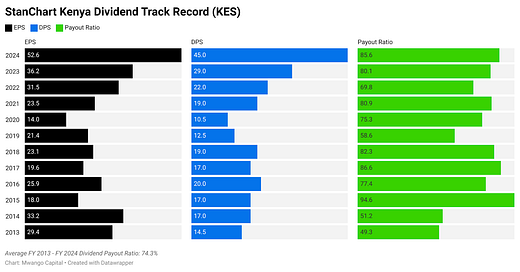

Payout Ratio at 84.8%: Standard Chartered Bank Kenya delivered strong FY24 results, driven by growth in both interest and non-interest income. Net interest income rose 13.4% YoY to KES 33.3B, supported by higher loan yields, increased investments in money markets, and improved margins.

Non-funded income surged 40.4% YoY to KES 17.4B, with transaction services and securities income driving the gains. Loan loss provisions declined 29.6% YoY to KES 2.4B, while operating expenses increased 7.5% YoY, supporting a 45% growth in profit after tax to KES 20.1B.

Earnings per share rose 45% YoY to KES 53.09, while the total dividend payout, including the KES 8.00 interim dividend paid in October 2024, reached KES 45.00 per share, translating to an 85.6% payout ratio.

Deposits Down 14%: Customer deposits declined 13.8% YoY to KES 295.7B, largely due to the appreciation of the shilling against the dollar, which impacted foreign currency deposits, and a shift by clients toward alternative wealth investments. Despite this, the bank maintained a high current and savings account ratio of 97%, supporting its low-cost funding structure.

Interest income from loans grew 25.9% YoY to KES 22.8B, driven by higher lending rates. The local currency loan book expanded 2% YoY to KES 115B, while the foreign currency loan book shrank 28% YoY to KES 36.4B, reflecting lower utilization and the impact of currency appreciation. Income from government securities rose 18% YoY to KES 9.8B, with exposure to CBK and government securities increasing 17% YoY to KES 127.0B.

ROE at 27.9%: Standard Chartered’s return on equity improved to 27.9% from 22.5%, driven by strong earnings growth and improved operational efficiency. The cost-to-income ratio declined to 39.6%, supported by revenue expansion and disciplined cost management. The non-performing loan ratio improved by 230 basis points to 7.4%, with non-performing assets reducing by 29% to KES 12B.

Assets under management grew 27% to KES 235.3B, reflecting increased client investments. SC Shilingi, the bank’s fastest-growing wealth management solution, recorded a 238% YoY increase in assets under management to KES 17.6B.

Share Price Reaction: Following the record FY 2024 dividend announcement, Standard Chartered Bank Kenya surged 12.9% on 19th March, closing at KES 305.50.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Absa Bank Kenya FY 24 Results

PAT UP 27.5%: Absa Bank Kenya Plc posted a solid performance in FY24, with the earnings per share rising 27.6% YoY to KES 3.84 and profit after tax increasing 27.5% YoY to KES 20.8B.

Net interest income grew 15.4% YoY to KES 46.2B, driven by higher loan yields, while non-interest revenue rose 10.8% YoY to KES 16.1B. However, interest expenses surged 30.1% YoY to KES 18B. The board proposed a final dividend of KES 1.55 per share, bringing the total payout to KES 1.75 (+12.9% YoY), with the dividend payout ratio easing to 46%.

"We made significant progress in 2023, and we’re focused on maintaining strong returns and sustainable growth in 2024. We are cautious about expecting double-digit growth in balance sheet growth.We are focused on delivering returns above the cost of equity to our shareholders, ensuring we continue to meet expectations for profitability."

Absa Bank Kenya CFO, Yusuf Omari

Stronger Shilling Impacts Balance Sheet: Absa’s loan book contracted 7.9% YoY to KES 309.1B, impacted by a stronger shilling, stricter credit risk controls, and reduced long-term lending. However, short-term lending and digital disbursements remained strong, with Timiza loans growing 21% YoY to KES 25.1B.

Customer deposits edged up 1.2% to KES 367.1B. Interest income from loans and advances surged 20.6% YoY to KES 53.4B, helping offset flat returns from government securities, which rose just 2.4% to KES 9.4B.

"Businesses have been cautious with their investments due to high rates, opting not to acquire expensive machinery in such a volatile environment.On the consumer side, there has been a rise in digital and payday loans."Yusuf Omari, CFO Absa Bank Kenya.

Asset Quality Risks: Gross non-performing loans (NPLs) rose 20.5% YoY to KES 42.5B, with trade, real estate, and personal lending segments facing significant strain. In response, Absa restructured KES 3.4B in loans and tightened risk controls to mitigate further deterioration. While rising deposit costs remain a concern, the bank improved efficiency, with its cost-to-income ratio dropping 200bps YoY to 37.7%.

"Our non-performing loan (NPL) ratio ticked up, mainly due to the high interest rates, which have affected both businesses and consumers. However, our credit quality remains one of the best in the industry." Yusuf Omari, CFO Absa Bank Kenya.

Co-operative Bank FY 24 Results

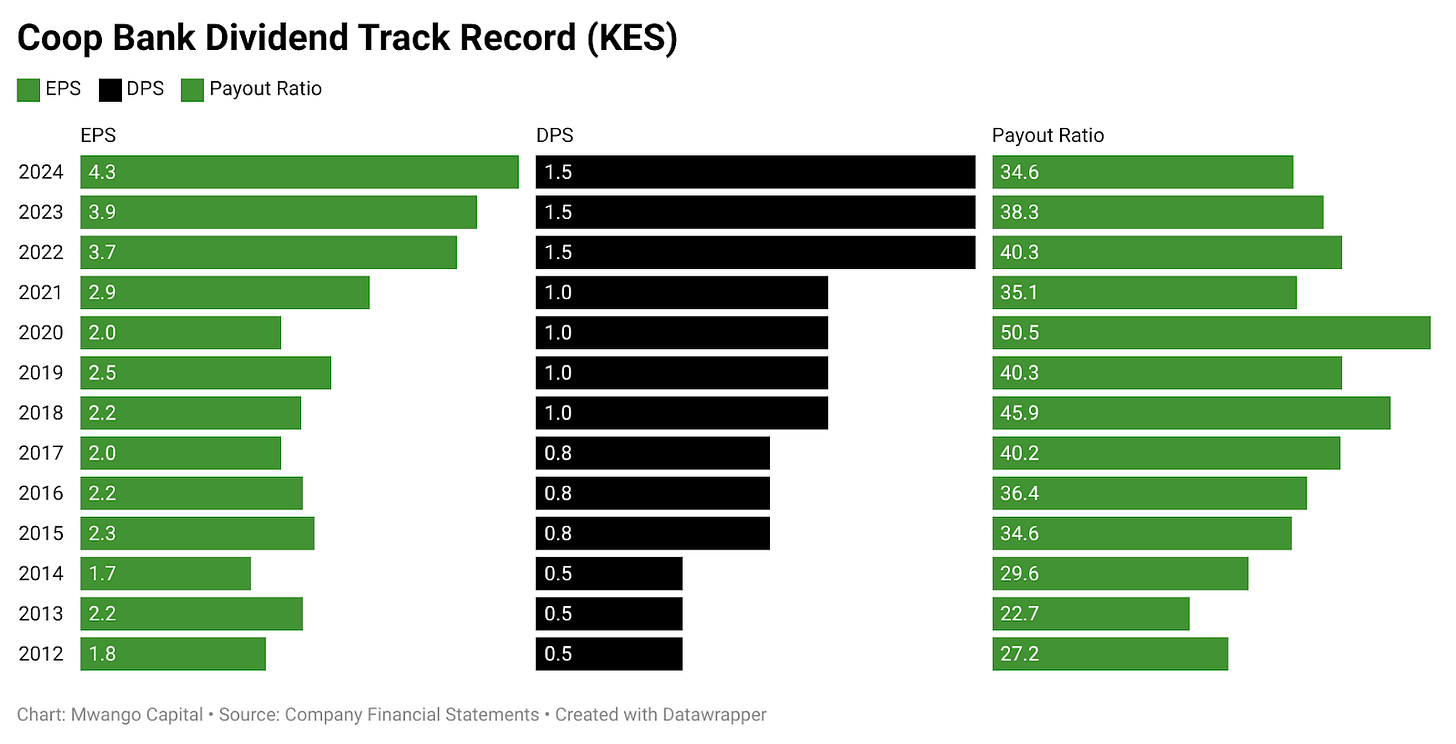

Co-operative Bank of Kenya recorded a 9.8% YoY increase in profit after tax, reaching KES 25.46B in FY 2024, supported by a 12.5% rise in total operating income to KES 80.6B.

The earnings growth was fueled by a 24.5% increase in interest income from loans to KES 55.9B, a 16.2% rise in interest income from government securities to KES 24.9B, and a 13.9% uplift in net interest income to KES 51.5B. However, loan loss provisions jumped 44.2% to KES 8.7B, highlighting a more challenging credit environment.

Co-op Bank Maintains Dividend: Balance sheet growth remained strong, with total assets increasing 10.7% YoY to KES 743.2B, while customer deposits grew 12.1% YoY to KES 506.1B, strengthening the bank’s funding base. Loans and advances declined slightly by 0.1% YoY to KES 373.7B.

Asset quality remains a concern, as gross non-performing loans (NPLs) rose 6.2% YoY to KES 71.1B, though net NPLs fell 10.6% YoY. The bank maintained its dividend at KES 1.50 per share, resulting in a total payout of KES 8.8B, scheduled for payment on June 10 to shareholders on record as of April 28.

Markets Wrap

NSE Weekly Recap: Week 12 (14 - 21 Mar 2025):

Standard Chartered Bank (+12.3%) jumped to KES 304.00, while Car & General (-10.0%) fell to KES 22.05, topping the gainers and losers.

Markets posted modest gains—NASI (+0.52%) at 130.2, NSE 20 (+0.37%) at 2,245.0, NSE 10 (+0.01%) at 1,335.9, and NSE 25 (+0.15%) at 3,534.9.

Equity turnover rose 14.0% to KES 2.29B, and bond turnover increased 33.4% to KES 76.11B.

Foreign investors offloaded KES 153.5M, accounting for 19.95% of total turnover.

All eyes now turn to a packed week of results, including Equity Group, I&M, KCB, and Jubilee.

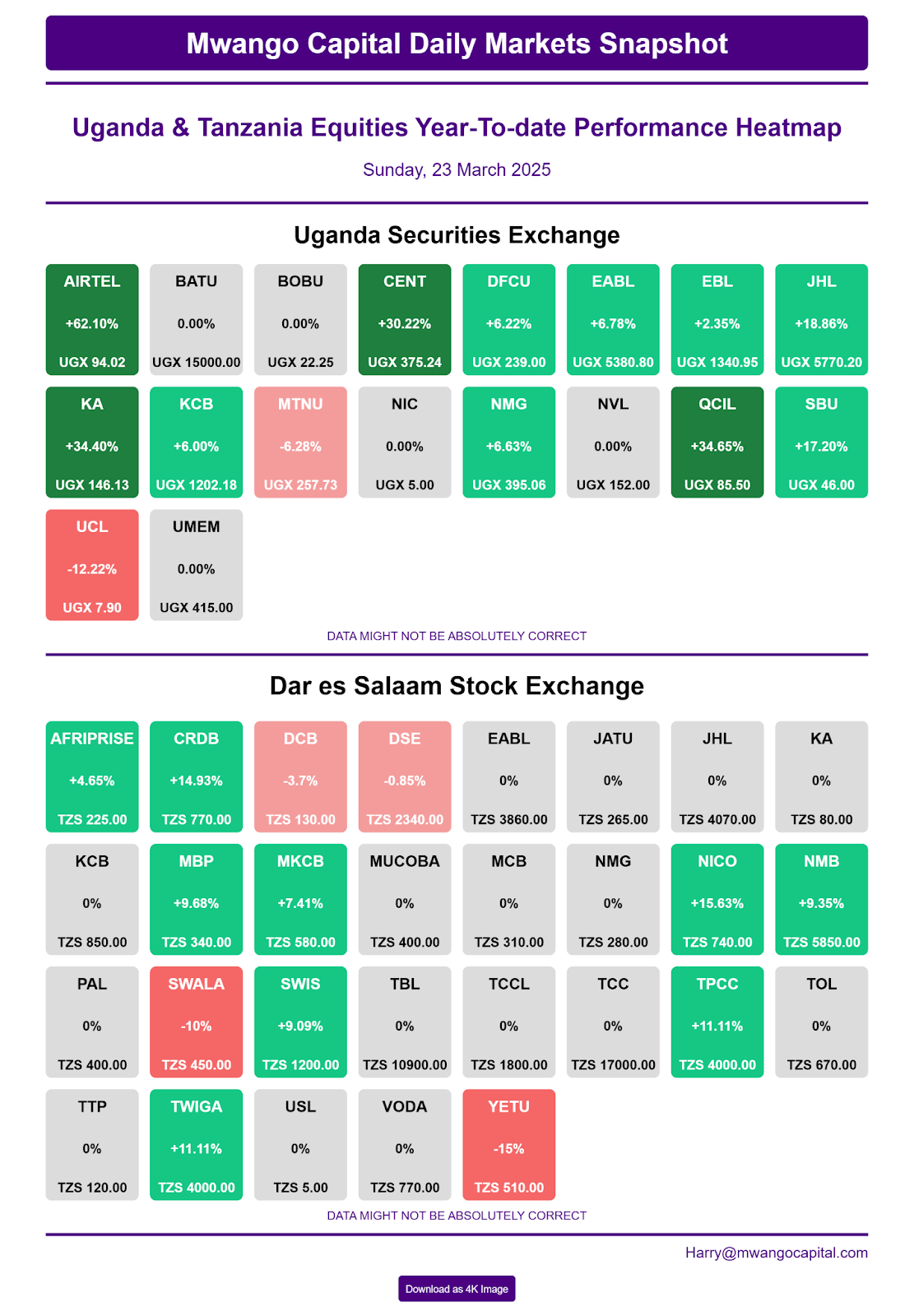

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 128.99%, down from 149.2% the previous week. Investors placed bids totaling KES 30.9B, out of which KES 24.5B was accepted, reflecting a 79% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 7.78, 2.89, and 1.23 basis points to 8.8402%, 9.086%, and 10.4613%, respectively.

Treasury Bonds: The government has reopened its 15-year and 25-year fixed coupon treasury bonds with the bid window running from March 20 to April 2, 2025. Investors can bid on three bond issues—the 15-year FXD1/2020/015 at a coupon rate of 12.75%, the 15-year FXD1/2022/015 at 13.94%, and the 25-year FXD1/2022/025 at 14.88%.

Eurobonds: Last week, yields on six of Kenya’s seven outstanding Eurobonds rose, led by the KENINT 2036 bond, which gained 22.80 basis points to 10.581%. The KENINT 2028 bond followed, climbing 17.0 basis points to 8.522%, while the KENINT 2027 bond was the only decliner, dropping 5.90 basis points to 6.902%. On average, Eurobond yields increased by 10.17 basis points week-on-week.

Market Gleanings

💰| Kenya Seeks New IMF Deal | Kenya and the IMF have agreed to abandon the ninth review of the current USD 3.6B Extended Fund Facility and Extended Credit Facility programme, set to expire next month, and instead negotiate a new deal. By the end of last October, USD 3.12B had already been disbursed under the programme, meaning Kenya could have unlocked an additional USD 490M in the final review. News of the shift sent Kenya’s 2032 and 2048 dollar bonds lower, trading at their lowest levels in six months.

🤝| National Oil Company Partners with Rubis | The National Oil Corporation of Kenya (NOC) has entered into a strategic partnership with RUBiS Energy Kenya following the successful completion of the Specially Permitted Procurement Procedure (SPPP). As a non-equity strategic partner, RUBiS will provide financial support, working capital financing, and technical expertise to help NOC regain profitability, clear legacy debts, and expand its retail network.

🔺| Registrar of Companies Dissolves Bobmil | The Registrar of Companies has dissolved Bobmil Industries Limited and Haleon Limited, officially striking them off the register as per Gazette Notice No. 3388 issued on February 14, 2025. Bobmil Industries was a key player in manufacturing, while Haleon Limited operated across various sectors. The notice, signed by Registrar of Companies Joyce Koech, serves as a formal announcement of their closure.

📄| Old Mutual FY 2024 Results | Old Mutual Holdings PLC reported a net profit of KES 838M for 2024, rebounding from a KES 114M loss in 2023. Profit before tax surged 84.7 percent to KES 2.59B, while investment income grew 41.6 percent to KES 7.7B. Insurance revenue rose 3.6 percent to KES 33.8B, but the insurance result declined 78.1 percent to KES 361M. Total assets fell 7.5 percent to KES 74.8B, while cash and equivalents dropped 5.4 percent to KES 11.34B.

📶| MTN Group 2024 Results | MTN Group reported a 4.4B rand pre-tax loss for 2024, down from a 12.2B rand profit the previous year, largely due to Nigeria's naira devaluation and economic pressures. MTN Nigeria’s pre-tax loss widened by over 200% to USD 355.7. In Sudan, ongoing conflict impacted operations, leading to 11.7B rand in impairments, but MTN has started restoring service in some areas. While service revenue fell 15% to 177.8B rand, it rose 14% in constant currency terms.

💰| Equity Group and Proparco Partnership | Equity Group and Proparco have signed a EUR 1M technical assistance agreement to support the Climate Resilient Agri-Food Systems (CRAFS) project, aimed at helping smallholder farmers adopt sustainable practices. The initiative, led by Equity Group Foundation (EGF), will provide training, financial access, and knowledge exchange to 15,000 farmers annually, promoting climate-smart agriculture to boost productivity.

✔️| AMAC Acquires 14.21% Stake | Africa Mega AgriCorp PLC (AMAC) has secured approval from the Capital Markets Authority (CMA) for the acquisition of 1,828,460 shares, representing 14.21% of its issued shares, from Hansa Dinesh Chandra Shah to Gulf Africa Innovations Ltd (GAI). This move will enable AMAC, formerly Kenya Orchards Ltd, to leverage GAI’s technology and outsourcing capabilities to enhance its agritech platform.

💰| EIB Global Pledges €1.2M for East Africa’s Cities | The European Investment Bank (EIB Global) has allocated EUR 1.2M (KES 166M) in technical assistance to support climate-resilient urban development in Kenya, Tanzania, and Uganda. Funded through the City Climate Finance Gap Fund, the initiative aims to help cities develop investment-ready climate projects by bridging financial and technical gaps.

🇪🇹| Ethiopia Secures Debt Restructuring Deal | Ethiopia has reached an agreement in principle with its official creditors to restructure USD 8.4B in debt, aiming to reduce USD 3.5B in debt service costs under its IMF program. The deal, co-chaired by France and China, provides USD 2.5B in relief between 2023 and 2028, easing Ethiopia’s external debt burden. Officials anticipate signing a final deal by mid-2025, with implementation through bilateral agreements.

Chart of the Week

Corporate Events This Week

Monday, 24 Mar 2024

📊 Umeme Ltd Full Year 2024 Results

Tuesday, 25 Mar 2024

📊 I&M Holdings Full Year 2024 Results

📊 Kenya Airways Full Year 2024 Results

🧠 Co-operative Bank Investor Briefing

Wednesday, 26 Mar 2024

📊 NCBA Bank Full Year 2024 Results

📊 Kakuzi PLC Full Year 2024 Results

📢 Kakuzi PLC Notice of AGM

Thursday, 27 Mar 2024

📊 Equity Group Full Year 2024 Results

📊 CIC Insurance Full Year 2024 Results

📊 Jubilee Insurance Full Year 2024 Results

📊 HF Group Full Year 2024 Results

🏛️ TransCentury AGM

Friday, 28 Mar 2024

📊 Limuru Tea Full Year 2024 Results

📊 DTB Bank Full Year 2024 Results

📊 Britam Holdings Full Year 2024 Results

📊 NSE PLC Full Year 2024 Results

📊 KMRC Full Year 2024 Results (Dated 30 March)

eTIMS compliance survey

Please assist in filling out this survey conducted by Namiri Technology Limited, proprietors of DigiTax - a leading eTIMS compliance 3rd party integrator. They seek to gather your insights that will inform improvements to streamline tax compliance in Kenya.

Please note that all responses provided will be anonymous