Finance Bill Faces Stiff Protests

Bill proceeds to third reading amid mounting public opposition

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the public opposition against the Finance Bill, 2024, the USD 1.3B surge in forex reserves ahead of the KENINT 2024 eurobond maturity, and Africa Mega Agriculture Centre Limited’s proposed acquisition of 84% of Kenya Orchards Limited.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Finance Bill, 2024, to Third Reading

Mounting Public Opposition: In what is an unprecedented show of social opposition, Kenyan youth were out in the streets this week protesting the tax proposals in the Finance Bill, 2024. Despite the protests, the Finance Bill sailed through its second reading on the floor of the House with 204 yes votes,115 no votes, and 0 abstentions. The Bill will now be presented for a third reading this week in what is bound to be accompanied by another showdown of protests on the streets as legislators deliberate on the bill at the National Assembly.

“Two scenarios at play here tied to 'IF' the Finance Bill 2024 is shot down at the third reading stage next week which is a clause-by-clause vote of the Finance Bill. One, that each clause of the Finance Bill is shot down, including the amendments, and two, the MPs can vote down the contentious as proposed in the initial Finance Bill, and introduce amendments such as the ones proposed by the Finance Committee (and also by other MPs who are non-Finance Committee members).”

“In any event, the former scenario (the one that shoots down the Bill in its entirety) has a low likelihood, and that leaves us with the latter scenario that envisages incorporating amendments from the Finance Committee (and other MPs). That said, the exact costs of the potential tax revenue foregone will only be known next week after the Bill is passed into an Act of Parliament. Coincidentally, the Appropriations Bill 2024 will also be passed around the same time and I don't anticipate that the Appropriations Bill can be adjusted lower in time, to accommodate potential tax revenue foregone. All these tees up the odds of a supplementary budget at the front end of FY 2024/2025 as a corrective measure.”

IC Asset Managers Economist, Churchill Ogutu

KES 200B Shortfall: Amid the discussions during the second reading, The National Treasury sent a letter to parliament warning of extensive cuts to the budgets of various areas including energy, parliament, and CDF should parliament fail to pass the Bill. Failure to pass will result in a KES 200B shortfall that would need to be financed by cutting expenses.

Fitch Ratings: According to Fitch Ratings, the social opposition to the Finance Bill, 2024 could thwart the government’s plans to fund the FY 2024/2025 budget which has been projected at 3.3% of GDP from 5.7% projected in FY 2023/2024. The budget statement read to Parliament earlier this month by the Cabinet Secretary to the National Treasury placed the fiscal deficit at KES 597B with KES 263.2B being funded by domestic borrowing while KES 333.8B being funded by external borrowing.

“Achieving the deficit targets in Kenya’s budget proposal for the fiscal year ending June 2025 (FY25) will be challenging given social opposition. We expect to revise our deficit forecast for FY25 only marginally to 4.3% of GDP, from 4.4% at the time of the last review in February. The difference from the budget target partly reflects our view that revenue will fall short, consistent with Kenya’s record of revenue underperformance (in 9MFY24 revenue fell short of target by 1.7% of forecast FY24 GDP).”

Dropped Proposals: In response to the public opposition to some of the clauses contained in the bill, Parliament’s Committee of Finance and National Planning chaired by Hon. Kuria Kimani dropped some proposals including the proposed 16% Value Added Tax (VAT) on bread and the 2.5% annual tax on motor vehicles.

Despite the removal of the proposed annual tax on motor vehicles, the new proposal is that the Road Maintenance Levy (RML) be raised by KES 7 from KES 18 to KES 25 per litre, and this is bound to lead to increases in fuel prices. In this regard, the Ministry of Roads & Transport has invited public comments and participation on the proposed increase in the RML and the meetings will be held on 8th July 2024, at various regional offices Whether other clauses of the Finance Bill, 2024, will be dropped as the Bill sails through Parliament or as a result of the public opposition and protests is yet to be seen.

“We have listened to the view of Kenyans and we are all in agreement that there are 2 things that we must do. One of them is that we need to protect Kenyans from increased cost of living and therefore the proposed 16% VAT on bread has been dropped. To support reducing the cost of living, we are doing something about vegetable oil so that we do not make it expensive for Kenyans. Transfer of mobile services is a key concern to many Kenyans and therefore again we have proposed that we do not have any increase in taxation on mobile phone transfer.”

“We have seen in the recent past the proposals that we’ve made on statutory deductions on SHIF and housing levy has added along, especially on salaried Kenyans and therefore we have proposed that those statutory deductions now be allowable.”

Chairman of the Finance and National Planning Committee, Hon. Kuria Kimani

“Since the budget presentation, the government has already backtracked on some revenue-raising measures proposed in the Finance Bill for FY25 that were included in the budget’s estimates, such as the repeal of tax exemptions on some financial services and a 2.5% motor vehicle tax, which supports our view. Faced with significant public opposition, the government's capacity to increase tax rates or introduce new taxes is constrained, leaving it to focus primarily on enhancing tax revenue through administrative tax efficiency measures.”

FX Reserves Surge

USD 1.3B: Kenya's foreign exchange reserves recorded a notable surge of USD 1.3B last week, raising the total FX reserve cover to USD 8.321B. The reserves provide approximately 4.3 months of import cover, a level not seen since 12th May 2022, when the reserves stood at USD 8.372B, covering about 4.98 months of imports.

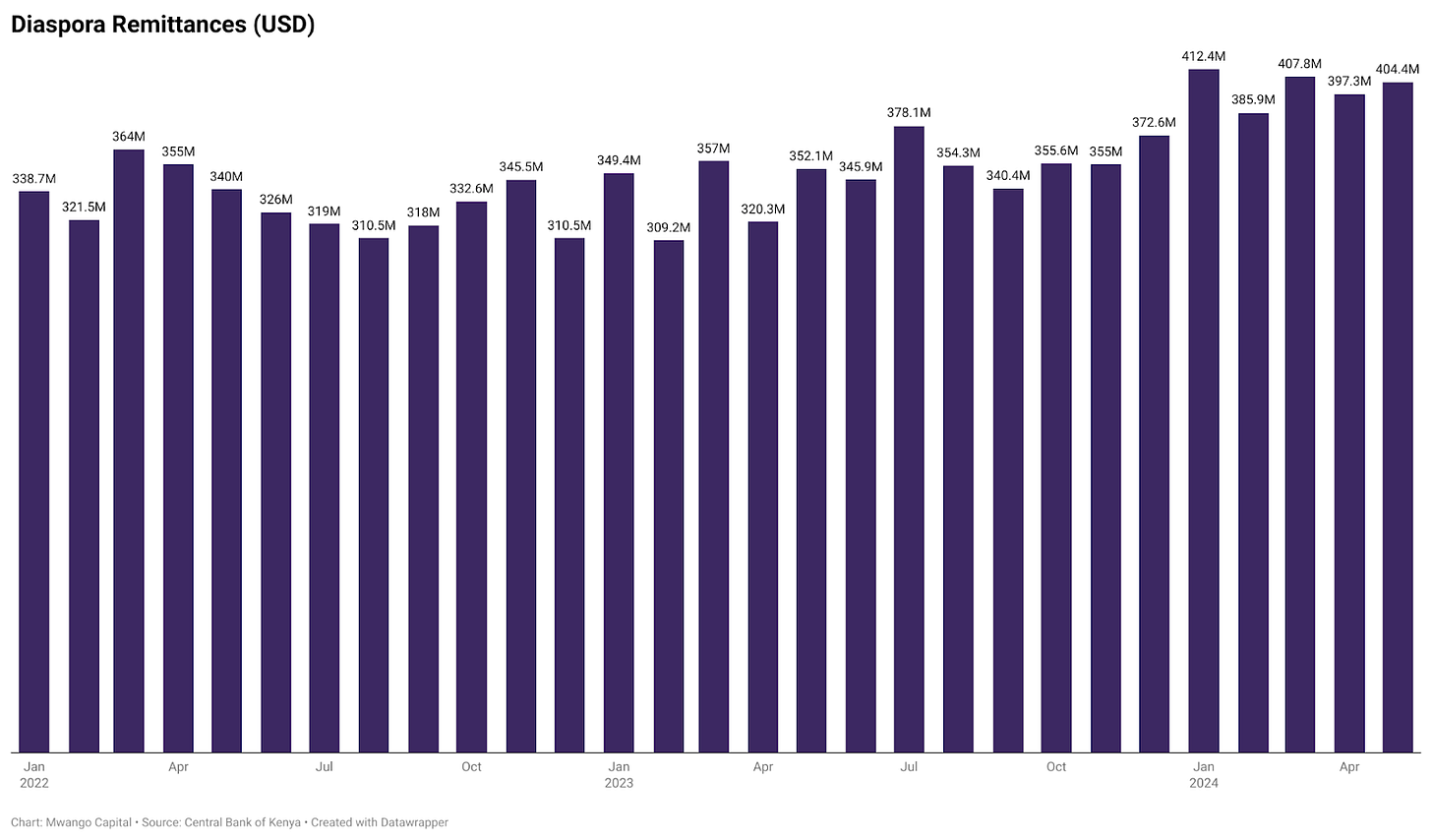

"The increase likely reflects the release of the World Bank DPO loan and will help to maintain Kenya's FX reserves after the final repayment of the 2024 Eurobond. The current account deficit has diminished over the past few years but Kenya remains dependent on financial inflows with debt inflows likely to continue to outsize FDI and equity inflows. Diaspora remittances look poised to exceed USD 5B in 2025 but will be vulnerable to economic downturns in US and European economies despite the higher share coming from the rest of the world."

REDD Intelligence Senior Analyst, Mark Bohlund

KENINT 2024 Maturity: The significant uptick in reserves is primarily attributed to a recent inflow of USD 1.2B from the World Bank's Fiscal Sustainability and Resilient Growth Development Policy Operation, approved on 30th May. However, this boost in reserves may be short-lived as the USD 556.97M outstanding KENINT 2024 USD 2B Eurobond payment is due today, 24th June, and the reserves are likely to fall as the government puts together the requisite sums to offset the outstanding Eurobond debt.

*Edit: The National Treasury has confirmed that the outstanding USD 556.97M KENINT 2024 USD 2B Eurobond payment was settled last Friday, 21st June.

Post-KENINT 2024 maturity, a total of USD 6.6B (KES 848.496B) in Eurobonds will be outstanding, an amount equivalent to 5.6% of Kenya’s KES 15.1T GDP.

“An international bond issue in February 2024 facilitated the buyback of USD 1.44B of a USD 2B Eurobond maturing on 24th June, easing near-term external liquidity pressures. Prospects for additional funding from multilateral lenders should further reduce external financing constraints. The World Bank has authorized USD 1.2B of funding under a Kenya Fiscal Sustainability and Resilient Growth Development Policy Operation, and a Staff-Level Agreement has been reached for the seventh review under the country’s Extended Credit Facility and Extended Fund Facility programmes with the IMF. USD 976M remains to be disbursed under the two programmes.”

May Remittances up 14.9%: Diaspora remittances were USD 404.4M in May 2024, up 1.8% month-on-month from USD 397.3M in April. The remittances were up 14.9% year-on-year from USD 352.1M in May 2023, and for the cumulative 12 months to May 2024, the remittances were USD 4.509B, up 12.8% from the corresponding period in 2023.

Markets Wrap

NSE: In Week 25 of 2024, Kapchorua Tea was the top-performing stock, up 6.1% to close at KES 269.00. Transcentury was the worst-performing stock, down 22.4% to close at KES 0.38. The NSE 20 was down 0.8% to close at 1,730.3 points, the NSE 25 fell by 0.8% to close at 2,924.8 points, while the NASI index declined by 0.8%, to close at 112.8 points. Equity turnover was up 6.3% to close at KES 1.2B from KES 1.1B in the prior week while bond turnover closed the week at KES 23.2B compared to the prior week’s KES 21.7B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9716%, 16.7379%, and 16.7545% respectively. The total amount on offer was KES 24B with the CBK accepting KES 13.4B of the KES 14.4B bids received, to bring the aggregate performance rate to 60%. The 91-day and 364-day instruments recorded 147.96% and 45.53% performance rates, respectively.

Treasury Bonds: The Central Bank of Kenya has announced a tap sale of Treasury Bonds, Issue Nos. FXD1/2023/002, FXD1/2024/003, FXD1/2023/005, and FXD1/2023/010, dated June 24, 2024. A gross amount of KES 20B is on offer, with the bonds having coupon rates of 16.9723%, 18.3854%, 16.884%, and 14.151%, respectively. The adjusted average prices for these bonds are KES 105.6489, KES 109.6836, KES 103.733, and KES 94.95 per KES 100, respectively.

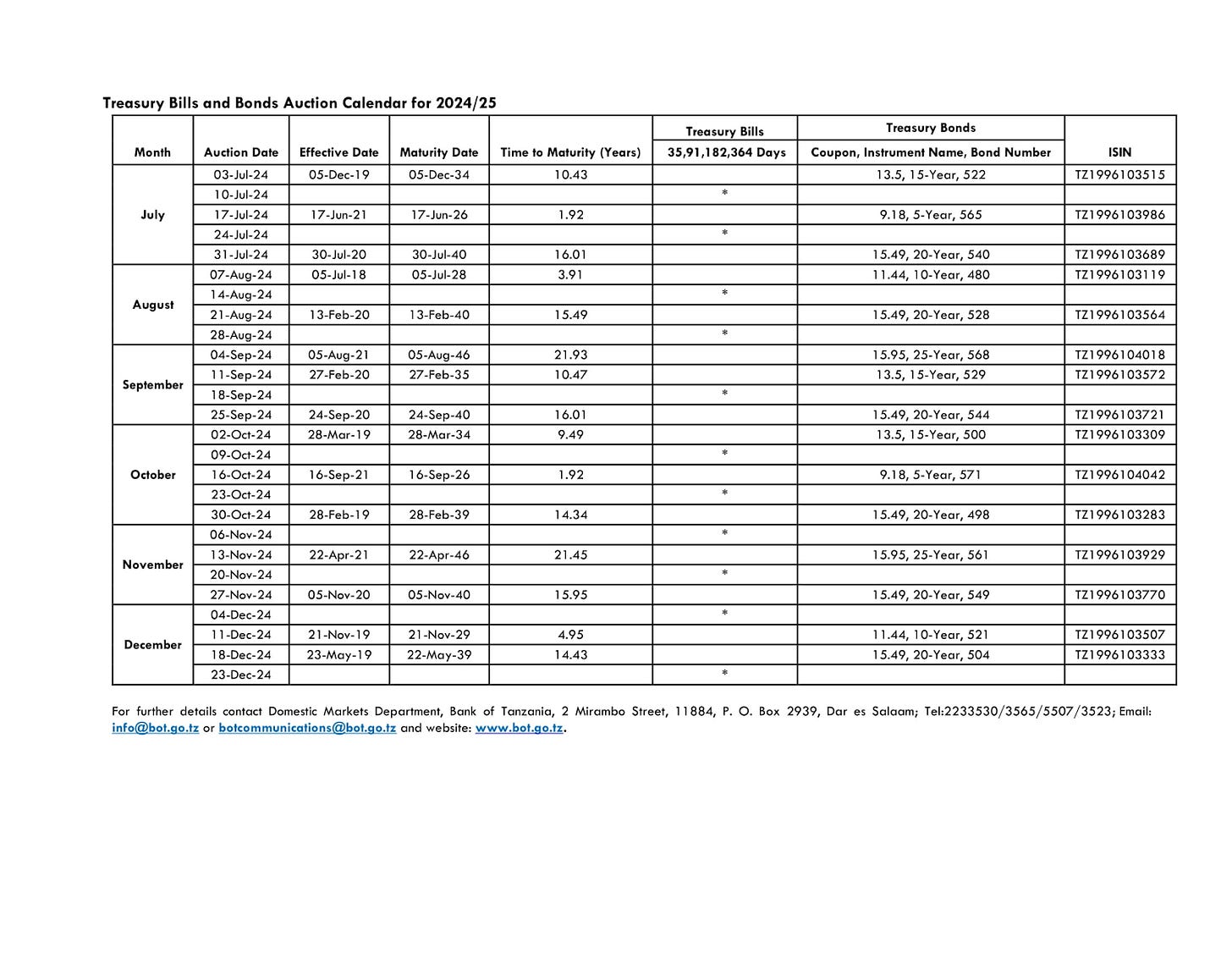

Separately, the Bank of Tanzania has published its calendar for the issuance of government securities for H1 FY 2024/2025. See the details below:

Eurobonds: In the week, apart from KENINT 2024 which was flat, the yields were up across all the other 6 outstanding papers.

KENINT 2024 remained flat at 15.15% ahead of its maturity today. KENINT 2031 rose the most, up 57.8 bps to 10.56%, followed by KENINT 2028 at 57.2 bps to 9.97%. KENINT 2027 rose the least, up 19.2 bps to 8.62%. The average week-on-week change stood at 35.8bps

Except for KENINT 2027 which shed 41.3 bps%, yields on the remaining papers rose on a year-to-date (YTD) basis, with KENINT 2024 rising the most by 262.4 bps followed by KENINT 2034 at 100.9 bps to 10.35%.

All prices fell week-on-week, except KENINT 2024, which was flat at 99.854. KENINT 2048 fell the most at 2.80% to 78.28, followed by KENINT 2031 at 2.70% to 96.189. KENINT 2027 fell the least at 0.50% to 95.909. YTD, KENINT 2024 rose the most at 2.5%, followed by KENINT 2027 at 1.80%. KENINT 2048 price fell the most YTD, down 5.90%.

Market Gleanings

📄| AMAC’s Acquisition of KOL Shares | Kenya Orchards Limited (KOL) last week issued a notice of intention from Africa Mega Agriculture Centre Limited (AMAC) regarding the proposed acquisition of 10,863,537 ordinary shares in KOL. This private transaction would constitute approximately 84.423% of KOL’s total issued share capital.

💰| Tala Impact Report | Tala, a digital lending company, has announced that it has disbursed KES 300B to Kenyans since its inception in 2014. According to the 2023 Tala Impact Report, fintech disburses about KES 10B to KES 15B monthly in Kenya, serving 3.5M customers. Globally, Tala serves over 9 million customers with KES 750B already disbursed in the Philippines, Mexico, and India.

🛬| KQ Resumes Maputo Flights | Kenya Airways (KQ) has resumed direct flights between Nairobi and Maputo, with three weekly flights on Wednesdays, Fridays, and Sundays. The relaunch aims to cater to travelers from Kenya and other African cities via Nairobi. The new route complements KQ's existing service to Nampula, Mozambique, marking Maputo as KQ's 45th destination.

💸| TRIFFIC Receives Funding | Vantage Capital, Africa’s largest mezzanine finance fund manager, has provided USD 47.5M in mezzanine funding for the Two Rivers International Finance & Innovation Centre (TRIFIC SEZ) in Nairobi. Vantage’s investment will support the acquisition and renovation of an office tower and the development of two Grade A office towers.

🌳| IHS Kenya Green Housing Project | IHS Kenya, a Southern African private equity fund manager, has introduced a green housing development in Limuru, Kiambu County. The project, known as “Muzi Salama,” consists of 240 two and three-bedroom apartments within the Tilisi Masterplan Development. Spanning 2.5 acres, Muzi Salama is set to be completed in the next 24 months, with prices starting at KES 5.2M.

💼| Ethiopia Opens up Banking Sector | Ethiopia's Council of Ministers last week approved a draft policy allowing overseas banks to acquire up to 30% ownership in domestic lenders and up to 40% of total foreign ownership. This move is part of the government’s broader economic reform, which aims to attract Foreign Direct Investment (FDI) and enhance financial inclusion.

🟢| AIIM Explores Stake Sale | African Infrastructure Investment Managers Ltd. (AIIM) is in discussions with several companies, including BlackRock Inc., regarding the sale of a stake in one of the continent’s largest renewable energy businesses. AIIM has significantly expanded its renewable energy portfolio across Africa, with stakes in projects generating over 2,800 megawatts of power.