Access Bank Acquires NBK

KCB enters into a binding agreement with Access Bank for the sale of NBK

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the acquisition of National Bank of Kenya by Access Bank PLC and 2023 full-year results from Absa, KCB, Co-op Bank, and Kakuzi.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Whether it's restocking shelves with pharmaceuticals for your chemist, replenishing agricultural supplies for your agrochemical shop, or acquiring tools and equipment for your hardware store, their tailored financing solutions can help you get the cash you need.

KCB Exits NBK at 1.25X Book Value

KCB Sells NBK 4 Years Post Acquisition: KCB Group last week announced that it had entered into a binding agreement with Access Bank PLC on 20th March 2024 for the sale of 100% of the issued ordinary shares of National Bank of Kenya (NBK), a bank it acquired in 2019, to Access Bank PLC. Access Bank is set to acquire NBK at a price of 1.25X of net book value, which translates to an amount in the region of KES 13.3B going by NBK’s KES 10.6B shareholders equity as at the end of December 2023, and the KES 13.3B absolute transaction price could change depending on NBK’s equity at the time the transaction closes. The transaction is set to take 6 to 9 months to close subject to approval by the relevant regulators.

“Between September [2023] to now, the Group Board has been going through an evaluation of the best of the options to resolve NBK. I love this institution. We have demonstrated the clean up that we have made with this institution. It’s turned around very well. We’ve been hit with an exceptional case that then made sure that we were not compliant on capital. It is the duty of the Group Board to resolve those issues. The Group Board evaluated three options, and the Group Board made a decision that to protect the value and efforts we’ve put in NBK over the last 4 years, and given that we know what value it is, the right thing to do and for the good of all stakeholders, particularly our staff, is to accept a binding offer from Access Group. The clean up that we have done in NBK for the last 4 years has given us an opportunity to price NBK at 1.25 multiple of the book. That, I think, demonstrates the value of the institution.”

KCB Group Chief Executive Officer, Paul Russo

Rationale for KCB’s Exit: The decision behind KCB Group's exit from NBK was underpinned by a mix of NBK’s variables/factors that have weighed on the overall Group performance. Notably, NBK was grappling with significant capital shortfalls alongside a substantial stock of Gross Non-Performing Loans (NPLs) and these were compounded by historical issues. NBK's core capital ratio, a key measure of financial strength indicating core capital as a proportion of total risk-weighted assets, stood at 7.5%. This figure was notably below the regulatory threshold of 10.5% by a margin of 3 percentage points (pp), underscoring concerns about its capital adequacy. Additionally, NBK's total capital ratio, reflecting total capital as a share of total risk-weighted assets, was at 12.5%, falling short of the threshold by 2 pp.

Further exacerbating the situation, within the Group's portfolio, as of end 2023, NBK exhibited the highest NPL ratio, standing at 25.3%, 8 pp higher than the Group average of 17.3%. Moreover, NBK was the second-largest contributor to the Group's KES 47.1B year-on-year increase in NPLs, accounting for KES 6.7B or 14.3%. KCB Bank Kenya accounted for the lion's share at KES 37.2B or 79%.

As at the end of December 2023, NBK’s Return on Equity (RoE), plunged to -24.7%, in stark contrast to 8.8% in 2022. This decline was particularly notable when juxtaposed with the Group's RoE, which stood at 17.8% [FY 2022: 22.5%]. The negative RoE was attributed to losses incurred in the year from, notably, the one-off KES 2.2B payout regarding the undervalued disposal of a client’s land at the Court of Appeal as compensation. By Q3 2023, NBK had accrued a substantial net loss of KES 2.95B, a significant deviation from the KES 885.5M net profit recorded in Q3 2022.

NBK stood out as the sole subsidiary within the Group to register a negative growth in operating income by the end of 2023, recording a 2% decline to KES 11.4B. These challenges, when collectively taken, pointed towards NBK's financial instability and the resultant drag within the Group, necessitating the strategic decision to exit the subsidiary to mitigate associated risks.

“As you will recall, in 2019, KCB Group took a bold step and acquired 100% of ordinary shares of National Bank of Kenya Limited. The move essentially put NBK under the ambit of KCB Group where it became a full-fledged subsidiary. Over the past 4 years, we have made progressive investments in the bank. Regrettably, some significant legacy claims have eroded all the gains that we had achieved.”

KCB Group Chairman, Dr. Joseph Kinyua

Find the press release on the acquisition by Access Bank PLC here and KCB Group’s cautionary announcement here.

Absa Bank Kenya FY 2023 Results

Absa Bank Kenya became the third bank to release FY 2023 results last week, with the asset base growing by 8.9% year-on-year to KES 519.8B. Total operating income grew by 18.7% to KES 54.6B. The bank’s after-tax profit amounted to KES 16.4B, up 12.2%, and Per Share Earnings were KES 3.01, up 11.9%. The Board of Directors declared a Dividend Per Share (DPS) of KES 1.55, up 14.8%.

Assets Breach KES 500B Mark: The asset base expanded by 8.9% to cross the KES 500B mark and reach KES 519.8B on the back of 18.4% growth in the loan book to KES 335.7B, to account for 64.6% of the asset base, the highest since 64.9% recorded in FY 2016. On the backdrop of the growth in lending was a 17.5% cut in the stock of government securities on the balance sheet to KES 74.7B, representing 14.3% of assets from 19% in FY 2022.

Operating Income Grows by 18.7%: Interest Income from loans and advances rose by 44.2% to KES 44.3B, while that from government securities fell by 2.6% to KES 9.2B in line with changes in asset allocation in the operating period. Net Interest Income (NII) grew by 23.9% to KES 40B, while Non-Funded Income (NFI) edged higher by a marginal 6.3% to KES 14.5B and in total, operating revenue crossed the KES 50B mark to KES 54.6B representing a growth of 18.7%. The contribution matrix of NII and NFI to operating income was 73:27 [FY 2022: 70:30].

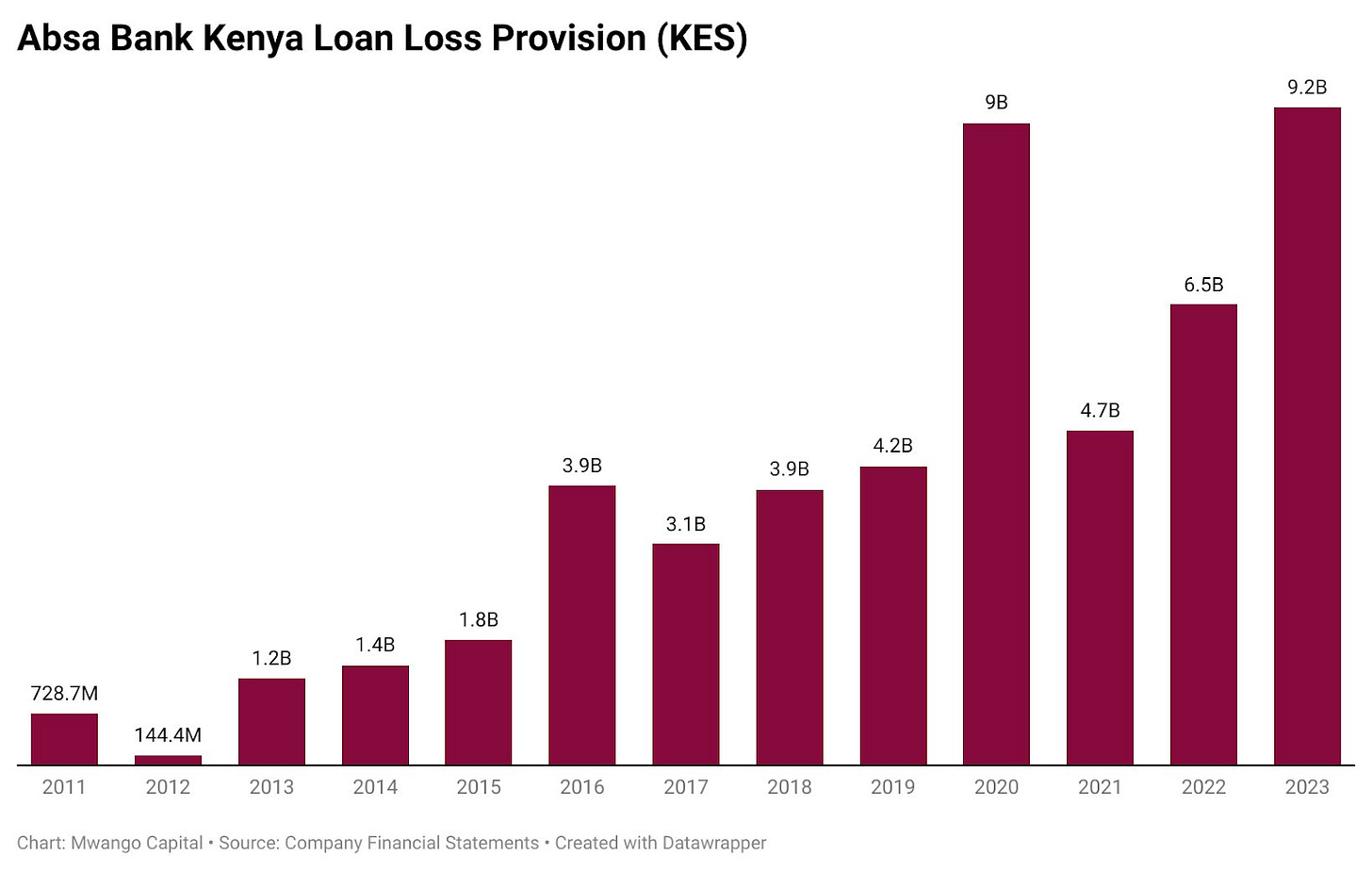

NPLs and Provisioning: The stock of gross NPLs closed the year at KES 35.2B, up 56.6% to account for 10.5% of the loan book, marking the first time this has been in double-digits. On a net basis, the NPLs were KES 12B, up a whopping 175.1% to represent 3.6% of loans - the highest in data going back to 2012. The bank ramped up provisions in the operating period by 42.7% relative to 2022 to KES 9.2B, equivalent to 30% of operating expenses from 25.8% in 2022.

“You see the impairment numbers picking up year-on-year, 43% growth rate. And really here you can be able to attribute it to about four, four key areas. Number one, of course the book has picked up. That lending that I have mentioned, KES 53B in lending, 18% growth in lending, automatically if you are looking at IFRS 9, it means your impairment numbers will definitely pick up. The other one is what we call the macroeconomic environment overlays that we are putting. With what we’ve seen in the macroeconomic environment from an IFRS [perspective], it means we need to take forward looking provisions. And in here you can be able to see a figure there of about 0.9 a share of a bill of shillings.”

“And then the third one really is the high delinquency, especially on the side of we’ve seen manufacturing side, trade, and this one you will be able to say because of FX picking up, you’ve seen taxes, we’ve seen some strain with some of our customers, so that has brought the risk to that number. That’s what we’re calling the portfolio quality. And then of course on the side of personal household and SMEs also showing some delinquency, and there we’ve been able to pick some impairment. The last one, which is a fourth reason why you’re seeing there is because of FX. So, that component, the 30% exposure of lending in foreign currency, the minute you have a weakness in the local currency, automatically it means then the impairment is peaking, both on the side of the balance sheet and also on the side of the income statement. So that basically what explains the impairment number that we have there.”

Absa Bank Kenya Chief Finance Officer, Yusuf Omari

Profitability and Dividends: Pre-tax profits edged higher by 13.6% to reach KES 23.7B, and after-tax profits totaled KES 16.4B, up 12.2% from FY 2022. The Board of Directors declared a DPS of KES 1.35, which when added to the KES 0.2 interim DPS, brings the total DPS for the year to KES 1.55, up 14.8% from FY 2022.

Find the results, our analysis, an X thread with key charts and an X Space where we hosted Absa Bank Kenya’s Chief Finance Officer (CFO) Yusuf Omari.

KCB Group FY 2023 Results

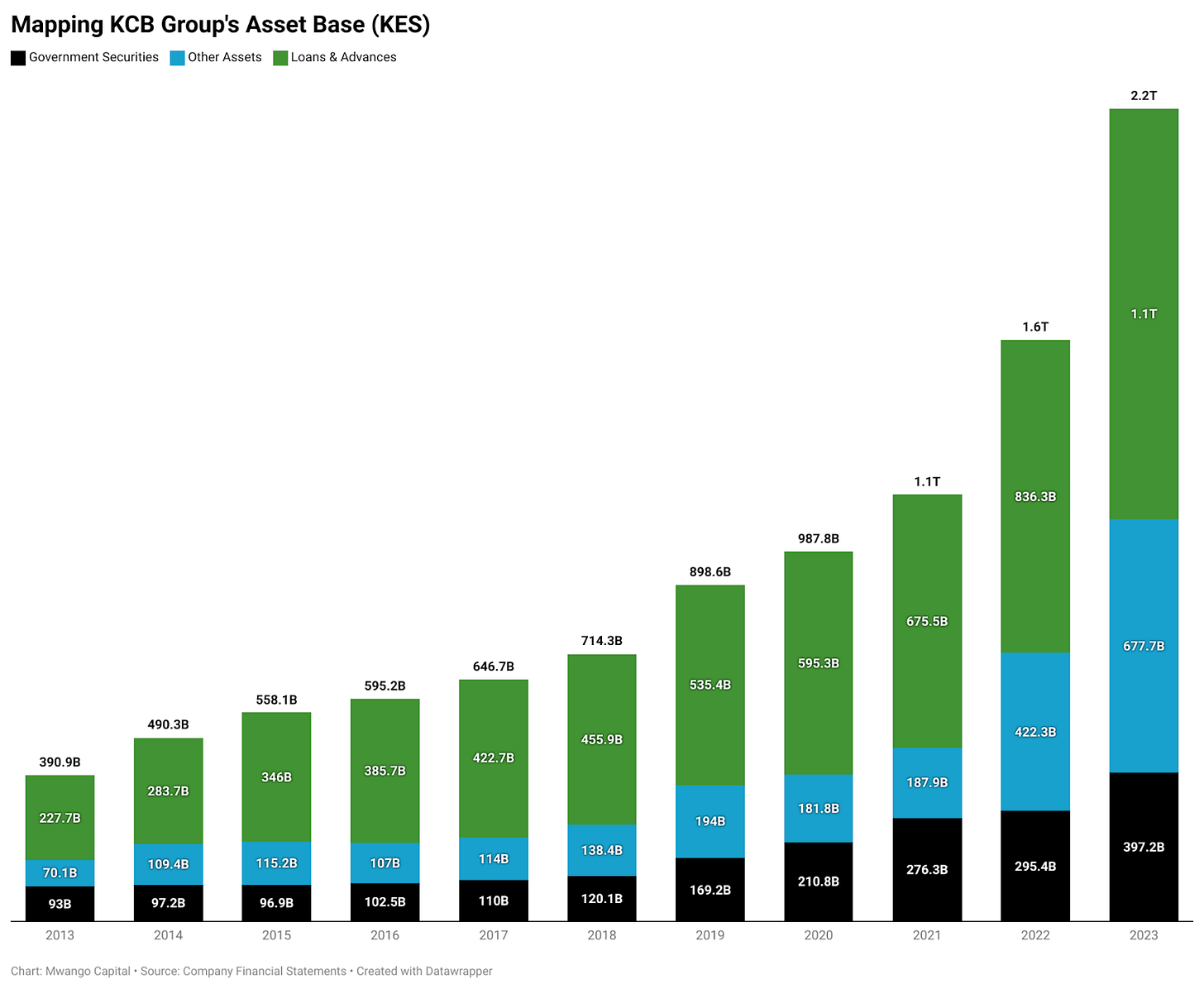

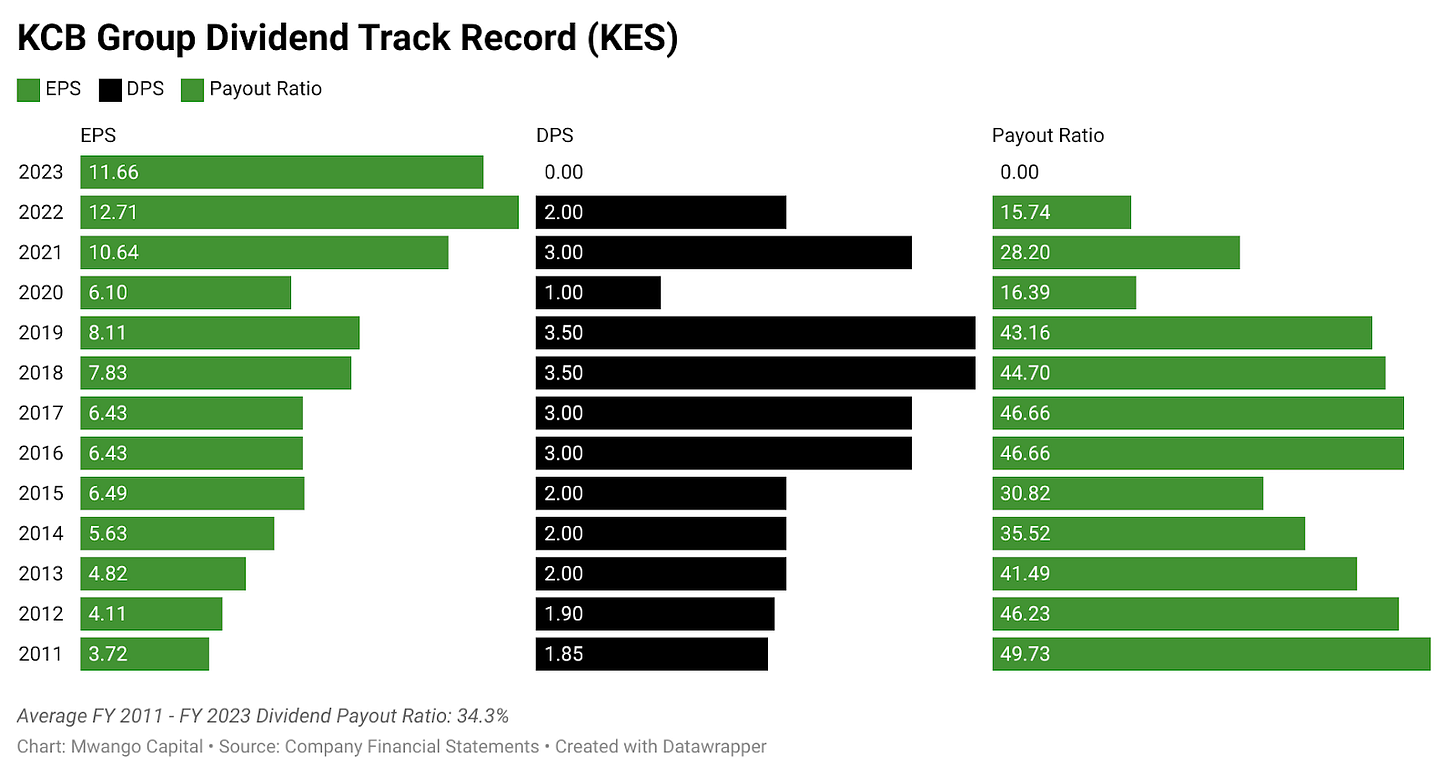

In FY 2023, KCB Group’s total assets were up 39.7% year-on-year to reach KES 2.2T. Total interest income edged higher by 42.8% to KES 168.2B. Profit before tax and after-tax profit declined by 15.5% and 8.3% to KES 48.5B and KES 37.5B, respectively, and the Board of Directors did not declare a dividend in the year as compared to KES 2.00 in FY 2022.

Balance Sheet Mix: Loans grew by KES 259.7B or at 27%, unchanged from the 27.8% growth recorded in FY 2022, to reach KES 1.1T accounting for 50.5% of the balance sheet [FY 2022: 53.8%]. Investments in government securities were up 34.5% to KES 397.2B, equivalent to 18.30% of the asset base from 19.01% in 2022. In terms of the funding of the balance sheet, the deposit base grew by 48.92% to reach KES 1.7T, equivalent to 77.9% of the balance sheet [FY 2022: 73.1%].

NPLs Surpass KES 200B Mark: The stock of gross NPLs edged higher by 29.2% to breach the KES 200B mark to settle at KES 208.3B, equivalent to 19.0% of the loan book [FY 2022: 19.3%]. Net NPLs recorded a marginal uptick of 1.8% to KES 78.1B, but represented a lower share of the loan book, 7.1%, as compared to 9.2% in FY 2022. A notable point was that the impacts of FX changes contributed to KES 55.9B or 48% of the growth in gross NPLs in the operating period.

“NPL continues to be one of the areas we are focusing a lot. In the year under review, we had a flat NPL ratio at 17.3%. The bad news is the value of non-performing loans did go up and close at about KES 208.3B. Of that growth, which is about KES 47B from KES 161B [in 2022] to KES 208.3B [in 2023], there was a big element that came out of the weakening of the Kenya Shilling - about KES 23B was driven from just that translation with the shilling losing about 28-30% last year. If you take a like-for-like for stock using constant exchange rate, the year-on-year growth drops from 28% to 15%.”

“We did see some downgrades, about KES 56B of downgrades but equally we did have about KES 40B of recoveries, upgrades and write-offs. Across subsidiaries, KCB Kenya and NBK Kenya were the key drivers for that growth. We do know there is a substantial amount of pending bills that the government hasn’t paid and that will have an impact on our NPL. We do know the environment was a bit inflationary, there was scarcity of foreign exchange so that has an impact on the working capital of a lot of our traders, so that, you can see it in this sectoral analysis of the NPL, and this is for KCB Kenya.”

KCB Group Chief Finance Officer, Lawrence Kimathi

Dividend Skipped: Profit before tax declined by 15.5% to KES 48.5B, and net income edged lower by 8.3% to reach KES 37.5B. Per Share Earnings declined by 8.3% to KES 11.66, and the Group did not declare a dividend in the year [FY 2022: KES 2.00]. This marked the first time the Group has not declared a dividend in a financial year in more than 2 decades. Here is KCB Group’s CEO on why the Group is skipping a dividend payout in FY 2023:

“With the exception of NBK, all our subsidiaries are compliant on both core capital and total capital, and some of them like BPR having some significant buffers because we believe that there is a lot of room for growth. If you recall, in the same presentation last year, KCB Bank Kenya capital buffers were very low and it was a massive concern for not just the KCB Group, but you know a lot of investors and analysts. We are happy to report that those buffers have improved, both at core capital and total capital we are carrying about 1.3 pp in terms of buffer.”

“However, we still believe that KCB Kenya is not where we would want it to be from a capital point of view and it is for that reason that the Board has decided we shall be holding any dividend payments out of the 2023 results. So this year we want to conserve capital, we want to set up KCB Bank Kenya to be able to deliver very good growth in 2024.”

KCB Group Chief Finance Officer, Lawrence Kimathi

Find the results, our analysis, and an X thread with key charts. We are set to host the KCB Group CFO on Mwango Spaces in the afternoon on 25th March 2024.

Co-operative Bank of Kenya FY 2023 Results

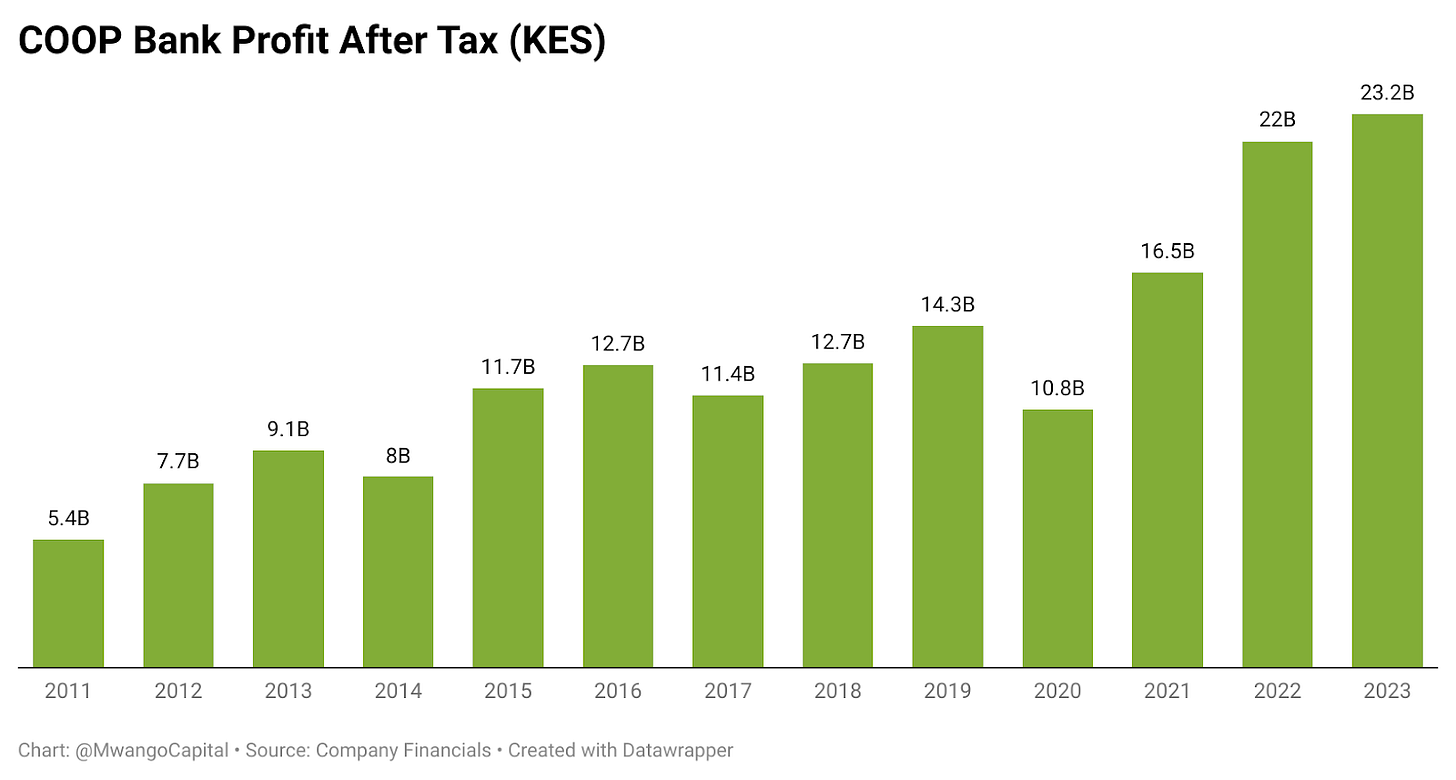

Co-operative Bank of Kenya announced its set of FY 2023 results, with the asset base expanding by 10.5% year-on-year to reach KES 671.1B. Notably, NII fell by 0.6% to KES 45.2B, while NFI was up by 2.8% to KES 26.5B. Net profit for the year was up 5.2% to reach KES 23.2B, and the Board of Directors declared a first and final dividend per share amounting to KES 1.50, unchanged from FY 2022.

Asset Base Grows 10.5%: The balance sheet was up by 10.5% to close the year at KES 671.1B. Loans and advances expanded by 10.3% to KES 451.6B to account for 55.8% of the asset base, unchanged from 55.9% in FY 2022. Investments in government securities edged higher by 8.9% to KES 190.8B to account for 28.4% of the asset base [FY 2022: 28.8%].

Interest Income Mapping: Interest income from loans and advances grew by 11.0% to KES 44.9B, while that from government securities rose by 10.9% to KES 23.1B and on aggregate, interest income was up 11.9% to KES 69.1B. Operating income totaled KES 71.7B, up 0.6%, while operating expenses edged lower by 6.1% to KES 39.7B, bringing pre-tax profits to KES 32.4B, up 10.0%. Net income for the period totaled KES 23.2B, representing a growth of 5.2%.

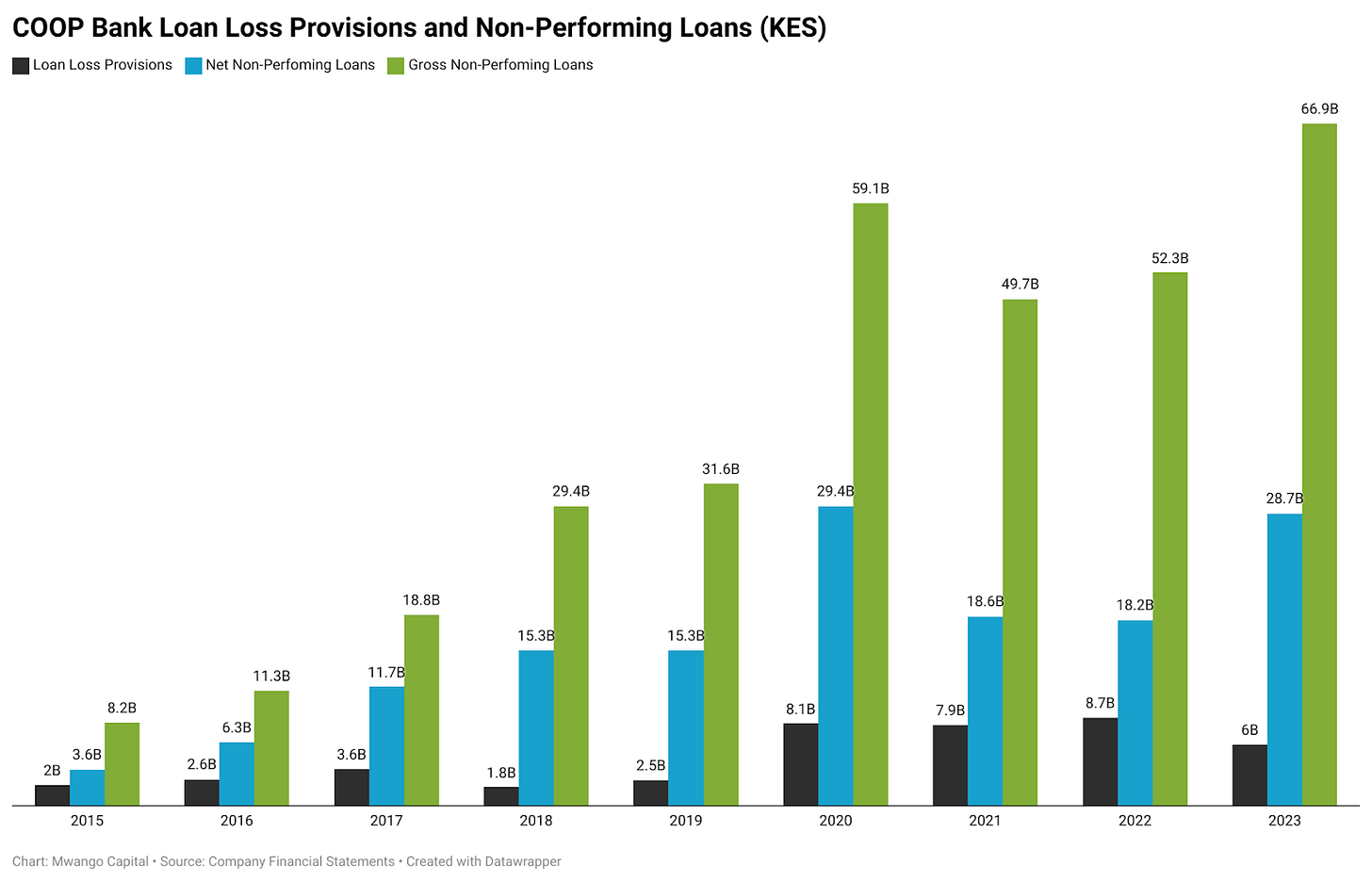

Provisions Fall Despite Rising NPLs: Across the banks that have released their FY 2023 results, Co-operative Bank bucked the trend in provisions by cutting them by 30.8% to KES 6B from KES 8.7B. The bank reduced provisions even as the stock of gross NPLs rose by 27.9% to KES 66.9B, while that of net NPLs edged higher by 57.2% to reach KES 28.7B.

Profitability and Dividends: Pre-tax profits grew by 10% to KES 32.4B while after-tax profits edged higher by 5.2% to KES 23.2B. Across subsidiaries, Kingdom Bank Limited returned the largest amount of pre-tax profits at KES 1.08B, followed by Co-op Consultancy & Bancassurance Intermediary at KES 877.1M. Operations in South Sudan returned KES 291.3M in pre-tax profits, while Co-op Trust Investment Services contributed KES 226M. The Board of Directors declared a first and final dividend of KES 1.50 per share, unchanged from FY 2022, bringing the payout ratio to 38.3%, down from 40.3% in FY 2022.

Find the results, our analysis, and an X thread with key charts.

Coming Up: We expect results from I&M Group on 25th March 2024, Equity Group on 26th March 2024, NCBA Group and DTB Group on 27th March 2024, and HF Group and BK Group on 28th March 2024.

Kakuzi FY 2023 Results

Highlights: Sales grew by 21.8% year-on-year to reach KES 5.4B, while pre-tax profits fell by 45.6% to KES 663.9B, equivalent to 12.3% of sales as compared to 27.5% in FY 2022. The decline in pre-tax profits was on account of pre-tax losses of KES 354M in the macadamia segment as compared to KES 635M pre-tax profit in FY 2022. The overall pre-tax position was buoyed by the avocado segment which returned KES 1.4B, up 75% from KES 0.8B in FY 2022.

Profit Down by Nearly 50%: In line with the profit warning for FY 2023 issued last year that highlighted FY 2023 net earnings would be ~25% lower than those in FY 2022, the net profit position stood at KES 453.5M to represent a 46.4% decline. Nonetheless, the Board of Directors declared a KES 24.00 Dividend Per Share, unchanged from FY 2022, payable on 15th June 2024.

Inaugural India Avocado Exports: Kakuzi plans to ship out its first ever avocado export to India by the end of March. The firm is looking to diversify its markets and has identified India and Malaysia as high-potential destinations for its avocado sales. The inaugural shipment of 20 Tons of Kakuzi Hass Avocados will arrive at Nhava Sheva Port, India's second-largest container port.

Find the results and our analysis here.

Markets Wrap

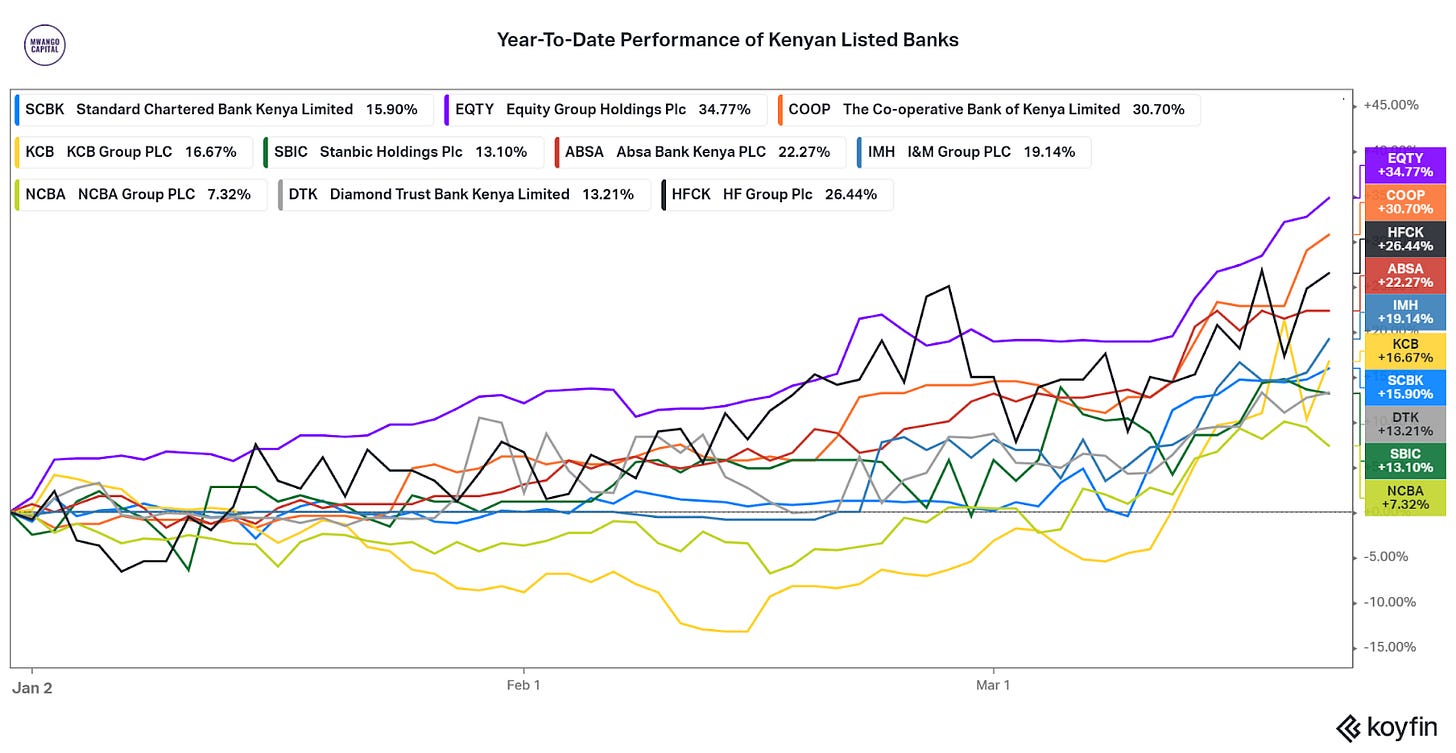

NSE: In Week 11 of 2024, KCB Group was the top-performing stock, up 15.9% to close at KES 24.0. Eveready was the worst-performing stock, down 8.4% to close at KES 1.20. The NSE 20 gained 5.2% to close at 1,637.7 points, the NSE 25 rose by 7.0% to close at 2,702.3 points, and the NASI index edged higher by 7.3%, crossing the 100 points mark to close at 101.8 points. Equity turnover was up 256.1% to KES 2.7B from KES 770.3M in the prior week while bond turnover closed the week at KES 33.7B compared to the prior week’s KES 35.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.7306%, 16.9137%, and 16.9890% respectively. The total amount on offer was KES 24B with the CBK accepting KES 20.6B of the KES 24.7B bids received, to bring the aggregate performance rate to 102.83%. The 91-day and 364-day instruments recorded 291.20% and 89.44% performance rates, respectively.

Treasury Bonds: In the T-bonds market, the total bids received in the reopened sale of FXD1/2023/005 and FXD1/2024/010 treasury bonds were KES 59.7B out of a target amount of KES 40B, bringing the performance rate to 149.33%.The CBK accepted KES 22.6B in bids bringing the acceptance rate to 56% .

Eurobonds: In the week, yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper whose yield rose, up by 0.70 bps to 7.198% while KENINT 2032 fell the most, depreciating by 39.90 basis points to 8.611%. The average week-on-week change stood at -31.10 bps.

All papers had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 533.20 bps while KENINT 2034 fell the least at 16.80 bps.

Prices rose across the board week-on-week, with KENINT 2048 rising the most at 2.9% to 83.949 while KENINT 2024 stayed flat at 99.888. YTD, KENINT 2027 rose the most at 3.6% to 96.929, while KENINT 2034 rose the least at 1.5% to 80.393.

Market Gleanings

🏠| Affordable Housing Bill | President William Ruto this week signed the Affordable Housing Bill into law. Effective from March 19th, 2024, employers are required to deduct 1.5% of gross salary for the Affordable Housing Levy and match it with their own 1.5%. Despite Dr. Magare’s petition, the High Court declined to grant conservatory orders on the Affordable Housing Act. As a result, planned contributions to the fund will proceed as scheduled, with the hearing set for May 16, 2024.

📄| Government Approves New Retirement Benefits Policy | The Kenyan government has approved a new National Retirement Benefits Policy, providing a comprehensive framework for the arrangement, provision, and management of retirement benefits. This policy aims to ensure the development, growth, coordination, and enhanced coverage of workers in Kenya, including Kenyan workers in the diaspora.

⚡| KenGen Awards Upgrade Olkaria Contract | Kenya Electricity Generating Company PLC (KenGen) last week awarded a multibillion contract for the rehabilitation of Kenya's oldest geothermal power plant in Olkaria. This initiative aims to upgrade the plant's capacity from 45MW to 63MW, accelerating the nation's transition to green energy. Led by SEPCOII Electric Power Construction Co., Ltd as the Engineering, Procurement, and Construction contractor, and Toshiba Energy Systems and Solutions Corporation supplying steam turbines and generators, the project is set to revolutionize the plant's operational efficiency and increase electricity output by up to 40%.

🧾| Bandari DT SACCO Results | In the 2023 financial year, Bandari DT SACCO saw strong growth in net interest income, up 17.2% year-on-year to KES 662.2M. While net income fell 12% year-on-year to KES 192.7M, the SACCO offered its members an interest rate on deposits of 12.00%, an increase from 11.5% in FY 2022. Additionally, the dividend rate remained steady at 18%.

💸| mTek Secures Funding | mTek, a digital online insurance platform, has secured a USD 1.25M investment from Verod-Kepple Africa Ventures (VKAV) and Founders Factory Africa (FFA) to expand its footprint across East Africa. This new funding aims to support mTek's rapid growth, enabling it to increase its presence in the Kenyan and East African insurance market while solidifying its position as a leader in Insurtech innovation.

📡| MTN Rwanda FY 2023 Results | MTN Rwanda released its financial results for the year ending 31st December 2023 last week. The company reported a significant growth in total revenue, which increased by 11.2% to Rwf 249.4B, and service revenue, which also rose by 11.2% to Rwf 246.5B. EBITDA saw a growth of 6.8%, reaching Rwf 115.8B. However, net finance costs increased by 15.8% to Rwf 36.5B. The company experienced a downturn in profit before tax (PBT) and profit after tax (PAT), which decreased by 28.5% and 28.9% to Rwf 17.6B and Rwf 11.5B respectively. Earnings per share (EPS) also fell by 28.9% to Rwf 8.5.

🇹🇿| Moody’s Upgrades Tanzania | Moody’s Investors Service has upgraded Tanzania’s long-term issuer ratings to B1 from B2, citing the country’s economic resilience and diversified exports, which have bolstered its capacity to withstand external shocks. The outlook has been revised to stable, reflecting a balanced debt burden and expectations of sustained GDP growth driven by private sector investment. Despite challenges such as weak institutions and reliance on foreign-currency debt, Tanzania shows signs of improvement in its business environment.