Kenya Cancels Adani Deals

President William Ruto has cancelled two high-profile deals with the Adani Group

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenyan banks Q3 2024 results, cancellation of the Adani deals, and I&M Group’s proposed issuance of 86.5M shares.Kenya Cancels Adani Deals

Cancelled: President William Ruto has cancelled two high-profile deals with the Adani Group following mounting public outcry and fresh allegations of bribery and fraud against the conglomerate’s founder, Gautam Adani. The President directed the Ministry of Transport to revoke a proposed 30-year lease of Jomo Kenyatta International Airport (JKIA) and instructed the Energy Ministry to annul a USD 700M agreement with Adani Energy Solutions for power transmission infrastructure. These moves, driven by corruption claims and constitutional principles of transparency and accountability, come amidst ongoing court battles and new U.S. charges implicating the Adani Group in a multibillion-dollar bribery scheme.

“I have stated in the past, and I reiterate today, that in the face of undisputed evidence or credible information on corruption, I will not hesitate to take decisive action. Accordingly, I now direct - in furtherance of the principles enshrined in Article 10 of the Constitution on transparency and accountability, and based on new information provided by our investigative agencies and partner nations - that the procuring agencies within the Ministry of Transport and the Ministry of Energy and Petroleum immediately cancel the ongoing procurement process for the JKIA Expansion Public Private Partnership transaction, as well as the recently concluded KETRACO transmission line Public Private Partnership contract, and immediately commence the process of onboarding alternative partners”

President William Ruto

Bribery, Fraud, and Market Fallout: The Adani Group faces an escalating crisis as U.S. prosecutors charged founder, Gautam Adani, and seven others with bribery, securities fraud, and obstruction of justice. Allegations include paying ₹2,029 crore (~USD 265M) in bribes to Indian officials and misleading investors to secure over USD 3B in loans and securities. The fallout has been catastrophic: Adani Enterprises shares plummeted 23%, Adani Green Energy dropped 19%, and Adani Ports & SEZ slid 14%, wiping out nearly USD 27B in market value. The conglomerate also scrapped a USD 600M bond sale, raising questions about its financial stability.

"....In furtherance of the Bribery Scheme, the co-conspirators, through Gautam S. Adani, Sagar R. Adani, Vneet S. Jaain, and others, offered and promised Indian government officials approximately ₹2,029 crore (~ $265M) in bribes”

Ripple Effects: One deal that remains unaffected is Adani's involvement in developing Kenya's Universal Health Coverage (UHC) system. While not cancelled, the agreement raises broader concerns, particularly for Safaricom, a publicly listed company holding a 22.56% stake in the UHC contract. The partnership also includes Apeiro Ltd (59.55%) and Konvergenz Network Solutions (17.89%). Apeiro’s ties to the Adani Group, through its parent company Sirius International Holding, have come under scrutiny. Critics argue that the government’s failure to conduct thorough due diligence on Adani has left Kenya vulnerable to potential legal and financial risks, with the full implications yet to be determined.

"...we call upon the government to make public all the costs and losses incurred and ensure that appropriate measures are undertaken to ensure minimization of losses to the country.”

LSK President, Faith Odhiambo

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenya Banks Q3 2024 Results

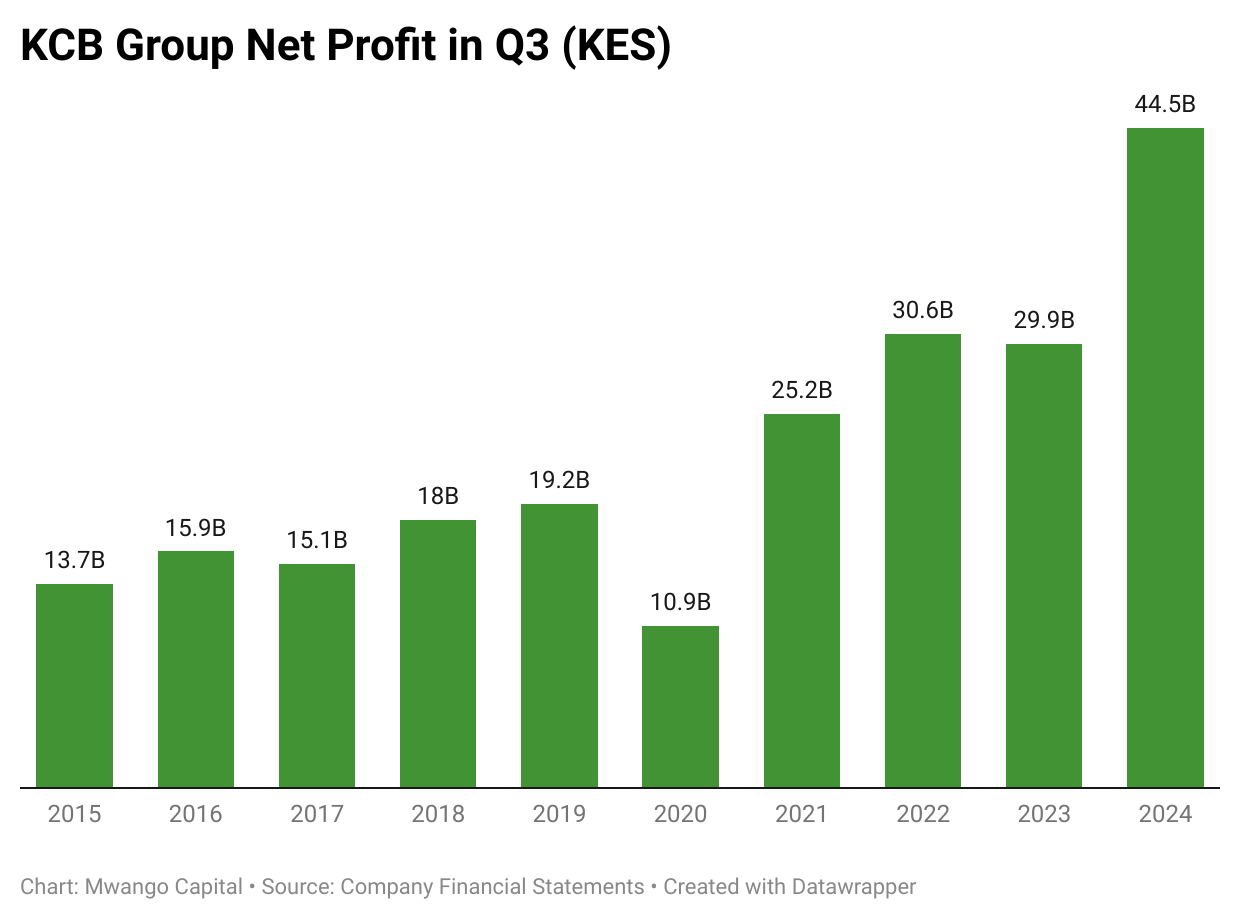

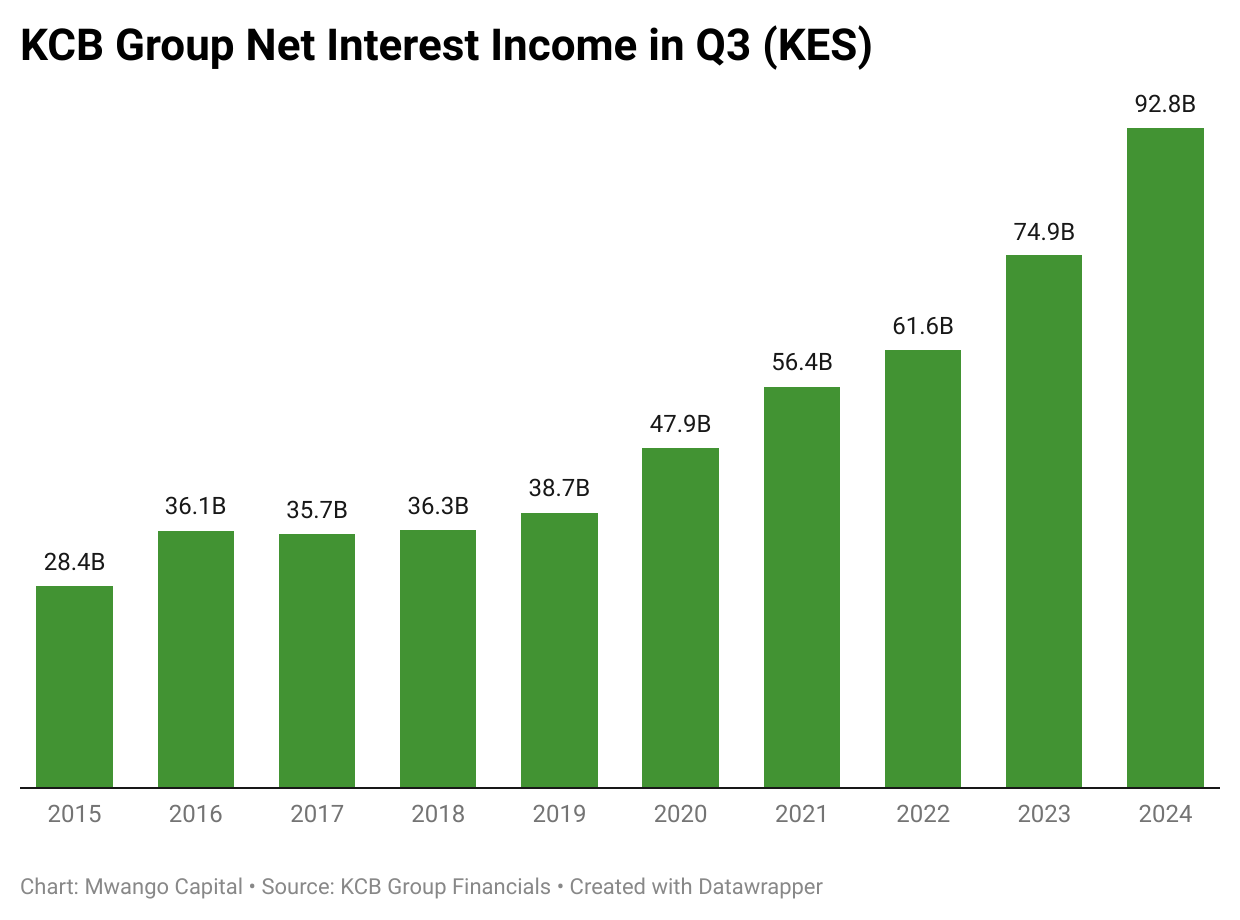

KCB’s Impressive Profit Growth: KCB Group Plc delivered an impressive 48.7% year-on-year increase in Profit After Tax (PAT) to KES 44.5B in Q3 2024, driven by strong interest income and non-interest revenue (NIR). The earnings per share (EPS) increased to KES 13.85, fueled by a significant 30.8% surge in total interest income to KES 149.0B. KCB Kenya played a pivotal role, recording a 36.5% growth in interest income to KES 102.0B due to higher loan yields and revenues from government securities. The total operating income grew by 21.9% to KES 143.0B

Banking Income: The Group's net interest income rose 23.9% to KES 92.8B. The increase in interest income from loans and advances, which rose 27.1% to KES 104B, was a key contributor, alongside a 27.0% rise in interest income from government securities to KES 37.9B. Non-interest income showed resilience, growing 18.3% to KES 50.2B, supported by a 68.0% surge in foreign exchange trading income to KES 13.8B. However, interest expenses on customer deposits increased by 46.8% to KES 40.7B.

Concerning Asset Quality: Despite impressive revenue growth, non-performing loans remain a concern. Gross non-performing loans (NPLs) increased 15.1% to KES 215.3B raising the overall group NPL ratio to 18.5% from 16.4% in Q3 2023. KCB Kenya's NPLs grew by 12.8% to KES 166.7B while National Bank of Kenya's NPLs surged by 36.2% to KES 30.2B. In response, the bank increased its loan loss provisions by 12.2% to KES 17.8B.

Round-up of Other Banks’ Results

StanChart’s Expensive Deposits: Standard Chartered Bank Kenya reported an impressive 62.7% year-on-year growth in net profit to KES 15.8B for Q3 2024. This performance was driven by a 17.0% increase in net interest income to KES 24.8B and a significant 73.5% rise in non-funded income (NFI) to KES 14.2B. The bank benefited from higher loan yields with net interest income supported by a 34.5% surge in interest from loans and advances, which reached KES 17.3B. Despite a sharp 91.7% increase in interest expenses to KES 4.2B driven by the rising cost of customer deposits (up 80.9% to KES 3.2B), the net interest margin improved to 9.5%. Loan loss provisions rose marginally by 7.4% to KES 1.9B, while asset quality showed improvement, with gross non-performing loans (NPLs) declining by 48.5% year-on-year to KES 12.1B.

I&M’s Interim Dividend: I&M Group reported a 21.3% year-on-year growth in net earnings to KES 9.95B for the first nine months of 2024. This performance was driven by a 37.4% rise in net interest income to KES 26.3B with the net interest margin expanding to 7.0% This reflected higher yields on loans, which increased by 43.7% to KES 34.9B, and on government securities, which rose by 18.1% year-on-year to KES 10.2B. Non-funded income declined by 11.5%, primarily due to a 52.7% drop in forex trading income to KES 2.8B, but overall operating income grew by 19.8% to KES 35.8B. Asset quality remained stable, with gross non-performing loans (NPLs) declining by 130 basis points to KES 35.7B. Customer deposits rose by 2.8% to KES 413.8B, though loans contracted slightly, declining by 2.1% to KES 281.3B. The board recommended an interim dividend of KES 1.30 per share.

Stanbic Cuts Provisions: Stanbic Bank's Q3 2024 results showed a 9.3% year-on-year growth in net profit to KES 10.1B driven by a 4.8% increase in net interest income to KES 18.9B. Despite a 17.8% decline in non-interest revenue to KES 10.4B, operating income decreased by only 4.5% to KES 29.3B, supported by a 40.2% reduction in loan loss provisions to KES 2.7B. Total interest income surged 48.6% to KES 38.8B, primarily from loans and advances, although the loan book contracted by 12.8% to KES 218.7B. Total Interest expenses rose sharply by 147.4% to KES 19.6B, driven by interest expenses from deposits (up 172% to KES 16.6B). Asset quality showed signs of stress, with gross non-performing loans (NPLs) increasing by 3.2% to KES 24.8B.

Absa’s Worrying Asset Quality: Absa Bank reported a solid 19.8% year-on-year growth in net earnings to KES 14.7B for Q3 2024. Net interest income rose 17.7% to KES 34.53B driven by a 28.4% increase in interest income from loans. Gross non-performing loans (NPLs) rose by 23.5% to KES 42.67B, increasing the NPL ratio to 12.6%. To address this, the bank raised its loan loss provisions by 18.7% to KES 8.03B. Customer deposits declined slightly by 0.7% to KES 351.80B, while the loan book contracted by 5.9% to KES 311.46B.

Markets Wrap

NSE This Week: In Week 47 of 2024, Eaagads led the top gainers, rising by 10.0% to close at KES 13.25, while Sanlam was the worst performer, dropping 16.7% to close at KES 5.00. All indices were red, with the NSE 20, NSE 25, NSE 10, and NASI falling by 2.0%, 2.4%, 2.9%, and 2.0% to close at 1,891.2, 3,118.3, 1,201.6, and 112.7 points respectively. Equity turnover rose by 83.5% totaling KES 1.3B, while bond turnover increased to KES 31.85B from KES 23.42B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed in the week with an overall subscription rate of 321.8%, down from 398.1% the previous week. Investors placed bids worth KES 77.2B, out of which KES 46.4B was accepted, resulting in an acceptance rate of 60.1%. Yields on the three treasury bill tenors continued to decline, dropping by 75.7 basis points, 84.9 basis points, and 60.4 basis points, closing at 12.03%,12.21%, and 13.29% for the 91-day, 182-day, 364-day bills.

The Central Bank of Kenya (CBK) has issued a prospectus for re-opened fixed-coupon Treasury bonds: FXD1/2023/10 with a 14.151% coupon and FXD1/2018/20 with a 13.2% coupon, targeting a combined KES 25B, alongside FXD1/2024/10 with a 13% coupon targeting KES 20B.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds declined across the board, with the KENINT 2028 recording the sharpest drop of 28.4 basis points to 8.78%, followed by the KENINT 2031, which fell 11.6 basis points to 9.89%. The average week-on-week yield decrease was 11.6 basis points.

Market Gleanings

💷| I&M to Issue 86.5M Shares | I&M Group Plc has issued a circular on its plan to issue 86.5 million new shares at KES 48.42, an 81% premium, increasing total shares from 1,653.6 million to 1,740.1 million. The issuance, expected to raise between KES 1.69B and 4.19B, will dilute existing shareholders' stakes by 4.97% while increasing EAGH’s shareholding from 10.7% to 15.1%. Proceeds will fund the iMara 3.0 strategy, focusing on regional expansion, infrastructure, and sustainability, with short-term investments projected to boost net interest income by KES 428M.

🏦| CBK Unveils Updated Banknotes | The Central Bank of Kenya (CBK) has introduced updated banknotes for the KES 50, KES 100, Ksh 200, and KES 500 denominations. The new currency features updated signatures, with the signature of CBK Governor Kamau Thugge replacing the previous one, and that of Treasury Principal Secretary Dr. Chris Kiptoo. All existing notes remain legal tender.

In other news, the CBK is inviting comments on three key draft guidelines aimed at strengthening the banking sector's resilience. These are the Liquidity Coverage Ratio (LCR) Guideline, Net Stable Funding Ratio (NSFR) Guideline and the Leverage Ratio Guideline.

💰| Kenya’s UAE Loan | Bloomberg reported this week that Kenya plans to draw down on a USD 1.5B loan from the UAE in tranches to stay within IMF borrowing limits. ~USD 700M could be accessed in early 2025, with the rest disbursed later. A question was put to the IMF on their reservations about this loan and this was their response:

“With respect to the more specific questions, on the question on the UAE loan, we're not going to comment on the specific discussions that the authorities are having with their bilateral creditors. What I can say is that given that Kenya does have... that we assess Kenya to have a high risk of debt distress, any new borrowing should be considered within the context of a comprehensive fiscal strategy to reduce debt vulnerabilities while also addressing the recent and emerging fiscal challenges. And with respect to next steps, I don't have any update at the moment, but we will keep you posted once we have more to share.”

IMF Director of the Communications Department, Julie Kozack

📉| More Rate Cuts | Equity Bank Kenya has announced a reduction in its loan interest rates, lowering the Equity Bank Reference Rate (EBRR) from 17.83% to 17.39%, following the Central Bank of Kenya's CBR reduction to 12.0%. Effective November 18, 2024, the new rates apply to all new and existing KES-denominated loans.

M-Oriental Bank also announced a reduction in its base lending rate from 17% to 16.5% per annum, effective November 20, 2024, while the Development Bank of Kenya has also announced a reduction in its Base Lending Rate from 15.1% to 14.9% per annum, effective November 5, 2024. This follows the Central Bank of Kenya's CBR cut to 12% on October 8, 2024, and applies to all KES-denominated credit facilities, both existing and new.

📉| Scangroup Expects Lower Profits | The marketing and communications group issued a profit warning citing FX losses driven by the appreciation of the Kenyan Shilling as the main driver for expected earnings dropping by at least 25.0% for the year ended 31 December 2024.

💼| Key Appointments |

CBK: Kenya's Treasury Cabinet Secretary has appointed four new members to the Monetary Policy Committee for a three-year term starting August 24, 2024. The appointees are Isis Nyong’o, Dr. Kemboi Kipruto, Dr. Freshia Mugo, and Jared Osoro.

Stanchart: Standard Chartered Bank announced the resignation of Peter Gitau as Chief Technology & Operations Officer, effective November 25, 2024. Gitau also stepped down from the Board of Directors. In his place, the bank appointed Jane Mwai as the new Chief Technology & Operations Officer, subject to approval by the Central Bank of Kenya.