Safaricom Upbeat About Ethiopia

Safaricom Ethiopia is taking steps to bolster its data capabilities

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Safaricom’s second Investor Day in 2024, Kenya Power's and Longhorn Publisherss half-year 2023/2024 results, and the Q2 FY 2023/2024 Quarterly Economic and Budgetary Review.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Get access to proper healthcare and prioritize your family's well-being through Co-op Bancassurance Intermediary.

Takeaways from Safaricom’s Investor Day

Last week, Safaricom PLC convened its second investor day of the year in Addis Ababa, Ethiopia, (the first was held in Nairobi, Kenya) on the back of a series of meetings held by the Board of Directors in the country. Among the key outcomes of these meetings was the declaration of an interim dividend for FY 2024. Safaricom PLC also provided updates on its progress in the current financial year, which concludes on 31st March 2024, as well as insights into its operations in Ethiopia launched in 2022.

Interim Dividend Slashed: The Board of Directors of Safaricom PLC has declared an interim dividend of KES 0.55 per share for the financial year ending 31st March 2024, 5.2% lower than that declared in the year ending 31st March 2023. In aggregate, the interim dividend totals KES 23.03B as compared to KES 23.24B in the previous year.

“We continue to reinforce that our dividend policy is to pay 80% of distributable profits for that year, and that we are committed to going forward. So, interim dividends should be seen in the context of full year dividends. We are also keeping to the guidance that we gave to our investors at half-year. We are not changing that. We continue to see strong performance in Kenya, we are making progress in terms of commercial execution in Ethiopia but we will of course announce the full results sometime in May [2024].”

Safaricom PLC Chief Executive Officer, Peter Ndegwa

Upbeat about Ethiopia: As at December 2023, which marked 18 months in the market, Safaricom Ethiopia had a total of 2,242 active sites. The customer base exceeded 4M and the population coverage stood at 33%. Mobile data continues to be the biggest play in the market with H1 FY 2023/2024 data revenues totaling KES 2.5B [52% of total revenue]. In this regard, Safaricom Ethiopia is taking more steps to bolster its data capabilities given the scale of the opportunity in mobile data in the market, and here is what Safaricom executives had to say on mobile data and the opportunity in Ethiopia.

“So far, we’ve established the fastest data network in Ethiopia, offering our customers superior customer service. We have made initial steps in establishing inclusive digital financial services for the people of Ethiopia by launching a robust, inclusive, and secure M-PESA network in Ethiopia. Admittedly, the market hasn’t unfolded as anticipated, there have been various challenges, security challenges, importation but this is the last remaining market in the world practically with only a single mobile operator, now 2 operators. We know that we will be successful. We take pride in our achievements having launched 2,200 sites so far on the air in 23 cities, acquired over 4M customers, and attained 33% population coverage within 15 months of our commercial launch. This is significant, compared to Kenya’s 6,300 sites built over 20 years.”

Safaricom Ethiopia Board Chairman, Michael Joseph

“Mobile data has been a huge success in Ethiopia. In September, the Ethiopia team had a big milestone where they overtook, from a usage perspective, the Kenya average mobile data usage per customer at 4.3GB vs 3.7GB in Kenya. Ethiopia is critical to Safaricom’s future, Ethiopia is full of opportunities. Our view and outlook continue to be reaffirmed by the growth of our customer numbers and also usage from our customers especially on mobile data. The huge population, 120M people, the second largest country in Africa, youthful population coupled with low mobile penetration and a rapid economic growth drives our confidence to invest in the future of this country. Although there will be some near-term challenges, we believe in the future of this country.”

Safaricom PLC Chief Executive Officer, Peter Ndegwa

“We are also currently doing tests on 5G. We are testing 5G in Addis Ababa where we have 25 - 30 sites now that are live. 18 months in since the launch in August 2022, we have 2,242 sites live, working, running as at the end of December 2023. Over an 18-month period, we were building an average of 125 sites every month. Just to give you an idea, 3M Ethiopians turn 18 years old every year. 2M people live in Lesotho, one of Vodacom countries. So every year, we are adding 1.5X Lesotho as an addressable market in Ethiopia. That’s what this means - 3M young adults in Ethiopia turn 18 every year. We have to be there. We have to be their aspirational brand because they need data.”

Safaricom Ethiopia Chief Executive Officer, Wim Vanhelleputte

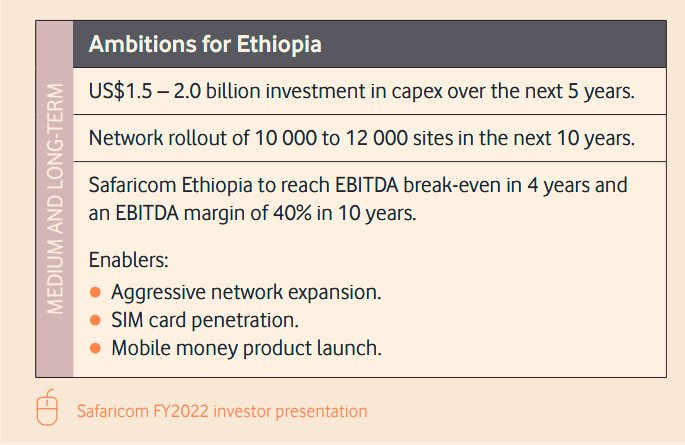

Scaling Ethiopia Operations: Safaricom Ethiopia is embarking on its scaling phase, aiming to bolster its sites to over 4,000 and expand its customer base to 15M - 20M. With Ethiopia’s Average Revenue Per User (ARPU) standing at 30% lower compared to other countries, the company foresees market share growth through increased subscriber volume rather than elevated pricing strategies. To reach an ARPU target of USD 1.5 - USD 2, crucial for achieving EBITDA break-even, Safaricom Ethiopia is leveraging a potential regulatory shift, the declaration of dominance for Ethio telecom (Ethiotel), which currently holds 90% market share, which could allow for potential market share gains on account of reduced off-net Mobile Termination Rates (MTRs) which currently stand at 0.21 for Ethiotel and 0.31 for Safaricom Ethiopia.

Additionally, in a bid to expand its customer base and bolster APRU, the company plans to diversify its service offerings, exploring fixed, wholesale, and enterprise sectors and further engagement in extensive marketing campaigns, particularly targeting the youth and emphasizing data services. Despite the predominantly cash-based economy in Ethiopia, efforts to promote M-PESA mobile money services are underway and the company is offering incentives such as free M-PESA entry bundles and limited calls, zero charges for person-to-business M-PESA transactions as well as M-PESA person-to-person transactions below USD 2.

“Ethiopia has been scaling - scaling the network. Building the foundations for success, you need a network, you need people, you need distribution, you need the M-PESA platform. So all those building blocks, the foundation of our success have now been put in place. So what we are looking at now is scaling those for future success. So the building phase is almost over, the foundations have been built, now we are gonna start building the house and show how successful we can be here.”

Safaricom Ethiopia Chief Executive Officer, Wim VanhellePutte

Safaricom Share Price Trend: As at market close last week, Safaricom’s share price at the Nairobi Securities Exchange (NSE) was KES 13.40, down 1.5% month-to-date, down 3.6% year-to-date, and down 42.7% over the last one year and down 70% from its peak in August/September 2021. Market capitalization closed at KES 535.73B, accounting for 36.9% of total market capitalization at the NSE, as compared to 47.5% at the same time last year.

IFC - MPESA Partnership: The International Finance Corporation (IFC) and M-PESA Mozambique in the week announced a new cooperation agreement to boost financial inclusion in the country. The agreement will focus on strengthening M-PESA’s agent network, merchant strategy, and rural outreach, as well as exploring new products such as insurance for farmers. This builds on the previous collaboration between IFC and M-PESA that saw the number of active mobile money users grow from 1.9M to 6M in 4 years.

HY 2023/2024 Results Wrap

Kenya Power Back to Profit: Kenya Power revenues recorded the highest year-on-year growth in more than a decade at 31% to KES 113.6B on the back of increased electricity sales and growth in unit sales. The cost of sales was muted, rising by 19% to KES 83B, bringing the gross profit to KES 30.5B, up a whopping 81% to bring the gross margin to 26.9% [2022: 19.5%]. Operating profit was up 2.6X to KES 14.5B, and a notable item was the 103% surge in finance costs to KES 15B on account of the depreciation of the Kenya Shilling in the operating period. The firm returned to profitability in the period at KES 319M from a KES 1.1B net loss in 2022.

Longhorn Widens Loss: In H1 2023/2024, Longhorn Publishers recorded KES 525.9M in revenue, up 3.7% year-on-year. Gross profit fell by 12.3% to KES 81.7M, translating to a gross margin of 15.5% [2022: 31.3%]. The net loss widened by KES 74.3M to KES 193.3M. In its commentary, management noted a 70% increase in printing costs due to currency depreciation coupled with increased cost of business led to gross margin compression. In its H2 outlook, the firm anticipates a stronger half with government contracts expected to rake in KES 550M and opportunities for gaining more market share as significant updates to the Competency-Based Curriculum (CBC) effectuate.

QBER Q2 FY 2023/2024

The National Treasury's latest Quarterly Economic and Budgetary Review, covering the period ending December 31, 2023, is out. Here are some of the key takeaways from the report:

Economic Growth: The Kenyan economy expanded by 5.9% in Q3 2023 compared to a growth of 4.3% in Q3 2022 primarily due to a strong performance in agricultural activities. The Accommodation and Restaurant sector recorded the highest growth at 26%, with the Mining and Quarrying sector growing the least at 1.1%.

Balance of Payments: The current account deficit improved to USD 4.2B equivalent to 4.4% of GDP in December 2023 [December 2022: USD 5.7B or 5.3% of GDP]. The capital account, which tracks net investment flows into the country, recorded a USD 14.3M decline to register a USD 127.5M surplus.

Revenue and Expenditure: Total revenue collection as of 31st December 2023 was KES 1.3T up 14.5%. Ordinary revenue was KES 1.08T accounting for 82.9% of total revenue. The aggregate expenditure and lending was KES 1.7T out of which KES 1.26T or 74.4% was recurrent expenditure [Q3 2022/2023: 74.6%].

Pending Bills: As of 31st December 2023, the gross outstanding national government pending bills were KES 539.9B. State corporations accounted for the bulk at 83.1% or KES 448.4B, while Ministries, Departments and Agencies (MDAs) accounted for KES 91.5B or 16.9%. In aggregate, the pending bills were equivalent to 3.3% of GDP.

Public Debt: Domestic debt grew by 27.6% to KES 5.05T, while external debt edged higher by 7.4% to KES 6.08T or 57% of gross debt [2022: 49.8%, 2021: 52%]. In sum, gross public debt amounted to KES 10.7T, up 5% or KES 505.2B in absolute terms.

Debt Service: During the quarter ending December 2023, the national government paid KES 6.9B guaranteed debt on behalf of Kenya Airways. The payments are composed of KES 5.5B as principal payment and KES 1.4B as interest. The aggregate external debt service payments to external lenders amounted to KES 239.6B, out of which 56.2% or KES 134.6B was principal and KES 105B or 43.8% in interest. 43.7% of the total external debt service was to bilateral creditors [commercial: 35.6%, multilateral: 20.7%].

You can access the entire document here.

Markets Wrap

NSE: NSE: In Week 8 of 2024, Eveready was the top-performing stock, up 11.3% to close at KES 1.38. BK Group was the worst-performing stock, down 13.1% to close at KES 32.15. The NSE 20 gained 1.0% to close at 1,536.7 points, the NSE 25 rose by 3.1% to close at 2,475.9, and the NASI index increased by 1.9% to close at 92.8 points. Equity turnover rose by 22.8% to KES 1.2B from KES 1B the prior week while bond turnover closed the week at KES 173.1B compared to the prior week’s KES 23.4B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.5895%, 16.7344%, and 16.9194% respectively. The total amount on offer was KES 24B with the CBK accepting KES 23B of the KES 36.9B bids received, to bring the aggregate performance rate to 154.06%. The 91-day and 364-day instruments recorded 247.57% and 196.51% performance rates, respectively. Notably, the 364-day T-bill was oversubscribed for the first time in more than a year.

Treasury Bonds: The NSE last week recorded trading records for bonds, with bond turnover standing at KES 36.3B on Tuesday, KES 41.4B on Wednesday, KES 44B on Thursday - representing an all-time high, and closed the week at KES 39.9B. Across the trades, the IFB1/2024/8.5 bond auctioned earlier this month stood out as the highest-grossing and most actively traded bond in the trading days.

Market Gleanings

👨🏿💼| Changes at the NSE | Frank Mwiti has been appointed as the new Chief Executive Officer of the NSE effective 2nd May as the current CEO, Mr. Geoffrey Odundo, exits on 1st March. David Wainaina who is the current Chief Operating Officer will step in as the Acting CEO until then.

🏦| Equity Revises Rates | Equity Bank announced last week that it will be adjusting its Reference Rate from the current 17.56% to 18.24%, effective from 20th February 2024. This decision comes in response to the CBK Monetary Policy Committee (MPC) increasing the Central Bank Rate (CBR) to 13% in February 2024, up from 10.5% in December 2023.

☀️| Bamburi Solar Power Efforts | Bamburi Cement PLC has signed a Power Purchase Agreement (PPA) with MOMNAI Energy Limited to set up two solar plants near its Mombasa and Nairobi facilities. The project will reduce power costs and carbon emissions by using renewable energy, accounting for 40% of Bamburi’s power supply.

💲| Diaspora Remittances | Kenya received USD 412.4M in diaspora remittances in January 2024, an increase of 18% from the same month last year. The remittances also grew by 10.7% month-on-month from USD 372.6M in December 2023.

💸| Tax Revenue in January 2024 | Kenya’s tax revenue collections for January 2024 rose by 8.8% year-on-year to KES 165.6B, while the cumulative tax revenue collections for July 2023 to January 2024 increased by 10.1% year-on-year to KES 1.22T.

🗎| SACCOs FY 2023 Earnings | Last week more SACCOs reported their FY 2023 results:

Harambee SACCO: The SACCO increased its net interest income by 17.5% to KES 2.8B and its net surplus by 80.9% to KES 804.6M, the highest in the sector. The SACCO also grew its assets by 4.2% to KES 38.6B and its loans and advances to members by 6.9% to KES 29.1B. The SACCO raised its dividend rate to 12% and its interest on member deposits to 8.5%.

Nyati SACCO: The SACCO increased its net interest income by 12.5% to KES 423.8B and its net surplus by 6.5% to KES 200.6M. The SACCO also grew its loans and advances to members by 9.4% to KES 3.71B, while maintaining a high dividend rate of 21.0%. SACCO's assets decreased slightly by 3% to KES 4.94B, mainly due to depreciation and impairment.

⚡| Deals, Mergers, and Acquisitions | Vestas Wind Systems, a wind turbine manufacturer, has sold its 12.5% stake in Lake Turkana Wind Power Limited (LTWP), the largest wind farm in Africa, to the Climate Finance Partnership (CFP), which is managed by BlackRock.

Separately, Kenya Airways (KQ) and Vietnam Airlines have renewed their codeshare partnership following KQ’s resumption of flights to Thailand, which commenced on 21st November 2023.

🔍| FATF Grey lists Kenya | Kenya has been placed on the Financial Action Task Force (FATF) "grey list," indicating increased monitoring to ensure compliance with international Anti-Money Laundering & Counter-Terrorism Financing (AML/CTF) standards. While this is not a sanctions list, it could lead to increased scrutiny from banks and other financial institutions.