Family Bank Targets NSE Listing

The bank plans to list on the Nairobi Securities Exchange in 2026

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Family Bank’s NSE listing plans, Q1 2025 credit officer survey, and StanChart’s Q1 2025 earnings.Family Bank Targets NSE Listing in 2026

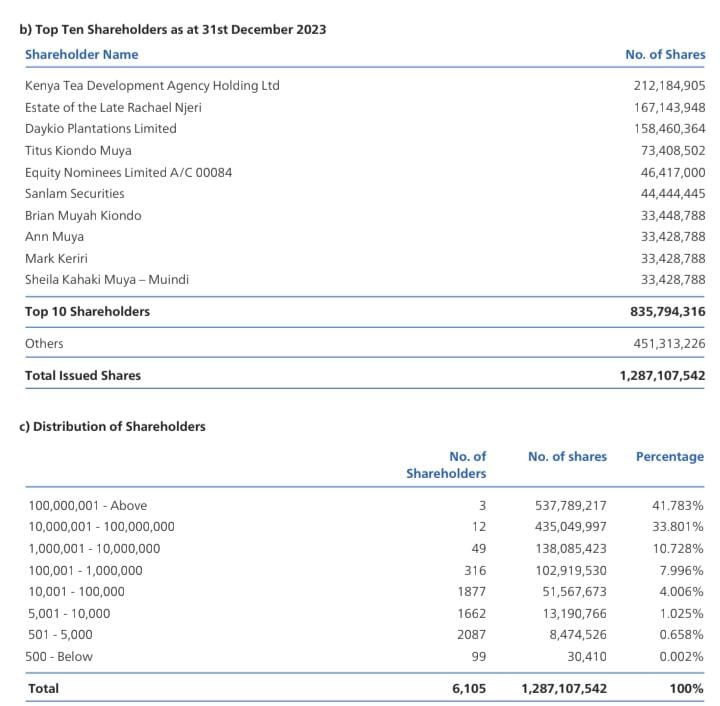

Family Bank plans to list on the Nairobi Securities Exchange in 2026, preferably through a listing by introduction if it secures institutional capital on favorable terms. If this capital is not secured, the bank will pursue a formal IPO supported by anchor shareholders, including the founding Muya family.

The bank has approved a non-operating holding company structure to support regional expansion across East Africa. It is also upgrading its core banking system and advancing sustainability initiatives through the Family Bank Foundation.

Q1 2025 Performance: Net interest income grew 32.6% year-on-year to KES 3.2B, while profit after tax increased 15.4% to KES 1.05B. Earnings per share rose 14% to 0.81. Total assets expanded 19.2% to KES 174B, and the loan book grew 10% to KES 96.2B. Provisions increased 59.6% to KES 333.8M, reflecting a cautious credit outlook.

Gross non-performing loans rose 7% to KES 14.9B, but the NPL ratio of 14.1% remains below the industry average of 17.2%. Reported NPL coverage stands at 58.6%, with adjusted coverage at 80%.

Shareholder funds rose 37% year-on-year to KES 24.4B, supported by retained earnings. Return on equity improved to 15.4% from 13.7% in Q1 2024. Capital adequacy remains strong at 15.8%, well above regulatory requirements. The bank ranks among Kenya’s top 10 for net interest margin, maintaining levels above 8% due to efficient fund deployment and lower deposit costs.

Book value per share increased to KES 18.7 in Q1 2025, up from KES 13.9 in Q1 2024. Operating expenses rose 40%, mainly due to a one-off consulting fee linked to strategic plan implementation. Family Bank continues to meet the Central Bank’s KES 10B minimum capital requirement, positioning it well for potential mergers and acquisitions.

Find our analysis of the results here.

Standard Chartered Q1 2025 Results

Profit Down 13.5%: StanChart Kenya’s Profit After Tax declined to KES 4.86B in Q1 2025, marking a 13.5% year-on-year drop as both interest and non-interest income came under pressure. Net interest income dipped slightly by 0.8% year-on-year to KES 8.2B, reflecting a 12.6% decline in interest income from loans to KES 5.0B and a 52.0% drop in income from deposits and placements with banking institutions to KES 846M, down from KES 1.7B.

On a positive note, interest income from government securities increased by 69.4% to KES 3.4B, benefiting from higher yields. Total interest expenses fell by 13.1% to KES 1.1B, while loan loss provisions dropped by 24.7% to KES 412.5M.

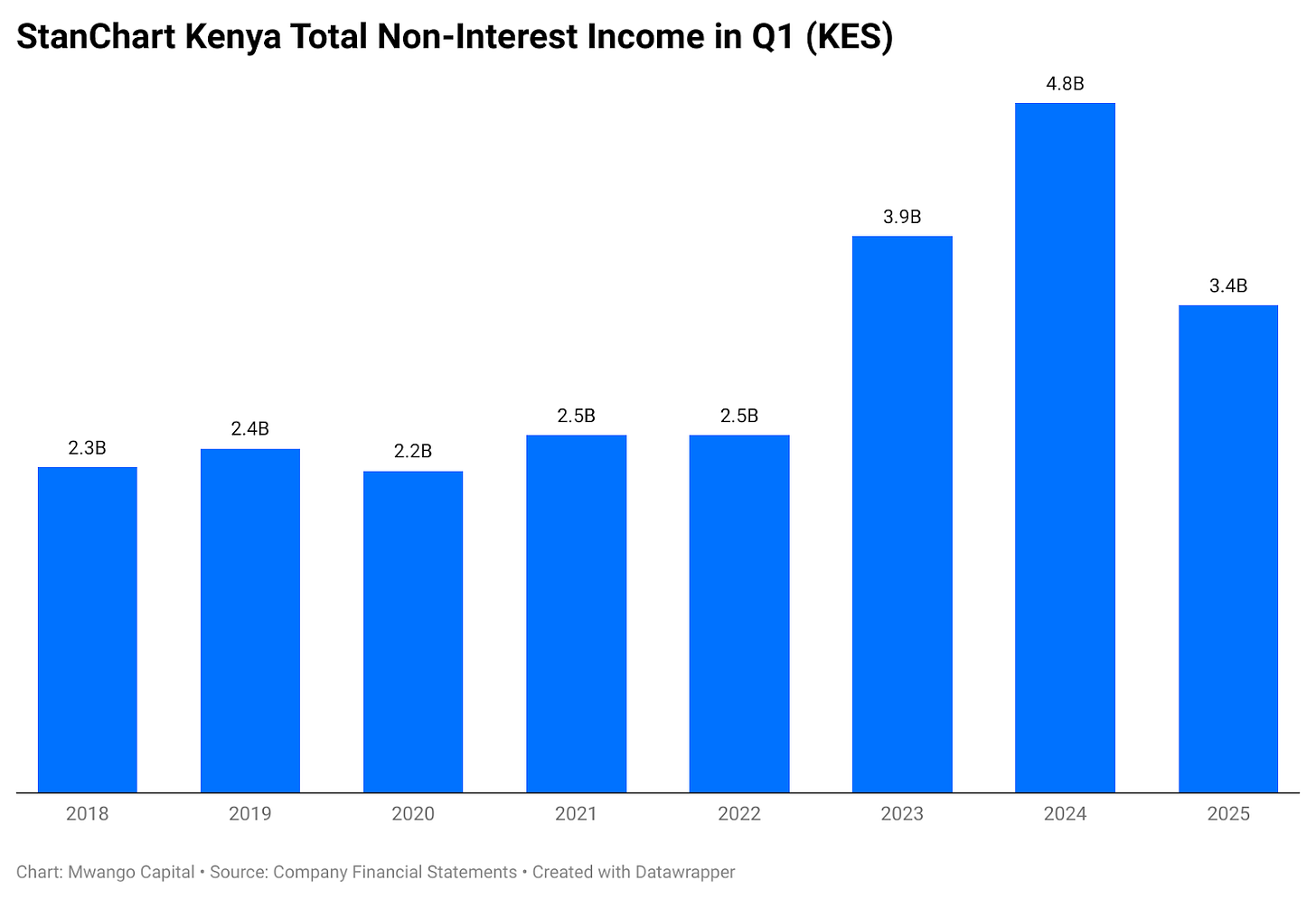

Non-Interest Income Falls 29%: The bank’s non-funded income declined by 29.3% year-on-year to KES 3.4B in Q1 2025, mainly driven by a 59.1% drop in FX trading income to KES 1.03B amid lower market volatility. Fees and commissions eased slightly to KES 1.7B, while other income rose by 26.2% to KES 696.1M, supported by gains from bond trading and dividend income from subsidiaries. Overall, the contribution of non-interest income to total operating income fell to 29.2%, down from 36.7% in Q1 2024.

Asset Quality: Gross non-performing loans declined by 26.1% year-on-year to KES 12.2B in Q1 2025, reflecting tighter credit risk management. Loans and advances to customers fell by 10.2% to KES 137.9B, while customer deposits dropped by 6.8% to KES 285.2B.

Find our analysis of the results here.

KCB Group Q1 2025 Results

Net Profit Flat: KCB Group posted a 0.4% year-on-year increase in Q1 2025 profit after tax to KES 16.5B, while earnings per share declined 2.4% to KES 20.03. Net interest income rose 8.5% to KES 33.7B, driven by a 2.2% increase in total interest income to KES 50.2B and an 8.6% drop in interest expenses to KES 16.5B. Income from loans and advances rose 5.4% to KES 35.5B, while income from government securities declined 7.9% to KES 12.3B. Loans and advances to customers were flat, up just 0.1% to KES 1.02T. KCB Kenya recorded a 57.3% drop in FX trading income to KES 1.7B.

Customer deposits declined 4.9% to KES 1.43T. Group non-interest income fell 9.8% to KES 15.7B, mainly due to a 34.7% drop in FX trading income to KES 3.1B. Fees and commissions were flat at KES 10.1B, with loan-related fees rising 7.4% to KES 3.0B and other fees falling 2.3% to KES 7.4B. Gross non-performing loans increased 13.6% to KES 233.3B, though loan loss provisions declined 11.3% to KES 5.6B.

Find our analysis of the results here.

NCBA Group Q1 2025 Results

Net Profit Up 3.4%: NCBA Group reported a 3.4% year-on-year increase in Q1 2025 net profit to KES 5.5B. Net interest income rose 20.6% to KES 9.9B, driven by a 35.5% drop in interest expenses to KES 7.2B, despite a 10.1% decline in total interest income to KES 17.2B. Income from loans and advances fell 11.1% to KES 10.3B, reflecting a 10.4% contraction in the loan book to KES 287B. Income from government securities declined 6.2% to KES 6.3B, while income from deposits and placements with banks fell 28.7% to KES 558M. Customer deposits dropped 9.6% to KES 495.7B, with associated interest costs down 35.9% to KES 6.6B.

Non-interest revenue declined 4.5% to KES 7.4B, weighed by a 49.6% drop in FX trading income to KES 1.2B. Fees and commissions fell 2.8% to KES 4.5B, with loan-related fees up 2.1% to KES 3.1B and other fees down 12.1% to KES 1.4B. Loan loss provisions rose 20.3% to KES 1.6B, while gross non-performing loans declined 5.9% to KES 37.8B. Total assets contracted 5.6% to KES 655.9B.

Find our analysis of the results here.

Q1 2025 Credit Officer Survey

The Central Bank of Kenya (CBK) released the Credit Officer Survey report for the quarter ended March 31, 2025. Below are some highlights from the report:

Asset and Loan Growth Remain Modest: Kenya’s banking sector recorded marginal growth in Q1 2025, with total assets edging up 0.4% quarter-on-quarter to KES 7.67T. Gross loans rose 0.6% to KES 4.12T, with lending mainly concentrated in the personal and household, trade, and construction sectors. On the funding side, customer deposits declined slightly by 0.2% to KES 5.73T.

Asset Quality Under Pressure: Gross non-performing loans increased by 6.6% during the quarter to KES 715.9B, raising the NPL ratio to 17.4% from 16.4% in December 2024. This points to continued credit risk strain, even as banks adopt more selective lending practices.

Profitability and ROE Improve: The sector posted a pre-tax profit of KES 73.5B in Q1 2025, up from KES 58.4B a year earlier, driven by a 14.2% drop in expenses to KES 165.9B that outpaced a 5.0% decline in income to KES 239.5B. Return on Equity improved to 23.1% from 22.0%, while capital adequacy and liquidity ratios stood at 20.1% and 58.4%, respectively, well above regulatory thresholds.

Find the report here.

Markets Wrap

NSE Weekly Recap: Week 21 (16–23 May 2025)

Top Gainer: Nairobi Business Ventures +10.8% to KES 1.95

Top Loser: Home Afrika –17.5% to KES 0.52

NASI: -0.3% to 133.9

Market Capitalisation: KES 2.11T (-0.3%)

Equity Turnover: KES 2.63B (+18.9%)

Bond Turnover: KES 59.6B (+35%)

Foreign Participation: 21.4% of total turnover

Net Foreign Inflow: KES 2.6M

Treasury Bills: Treasury bills were oversubscribed last week, with a subscription rate of 142.44%, down from 179.69% the previous week. Investors submitted bids totaling KES 34.2B, and the Central Bank of Kenya (CBK) accepted KES 29.9B out of the KES 24B on offer. Yields on the 91-day and the 182-day T-bills declined by 4.68, and 0.81 basis points to 8.323% and 8.5750%, respectively. The 364-day T-bills increased by 0.04 basis points to 10.002%.

Treasury Bonds: The CBK’s re-opened 20-year bond FXD1/2012/020 received KES 54.39B in bids against KES 30B offered, with KES 43.52B accepted at an average yield of 13.65%. Proceeds will cover KES 14.23B in redemptions and raise KES 29.29B in new borrowing.

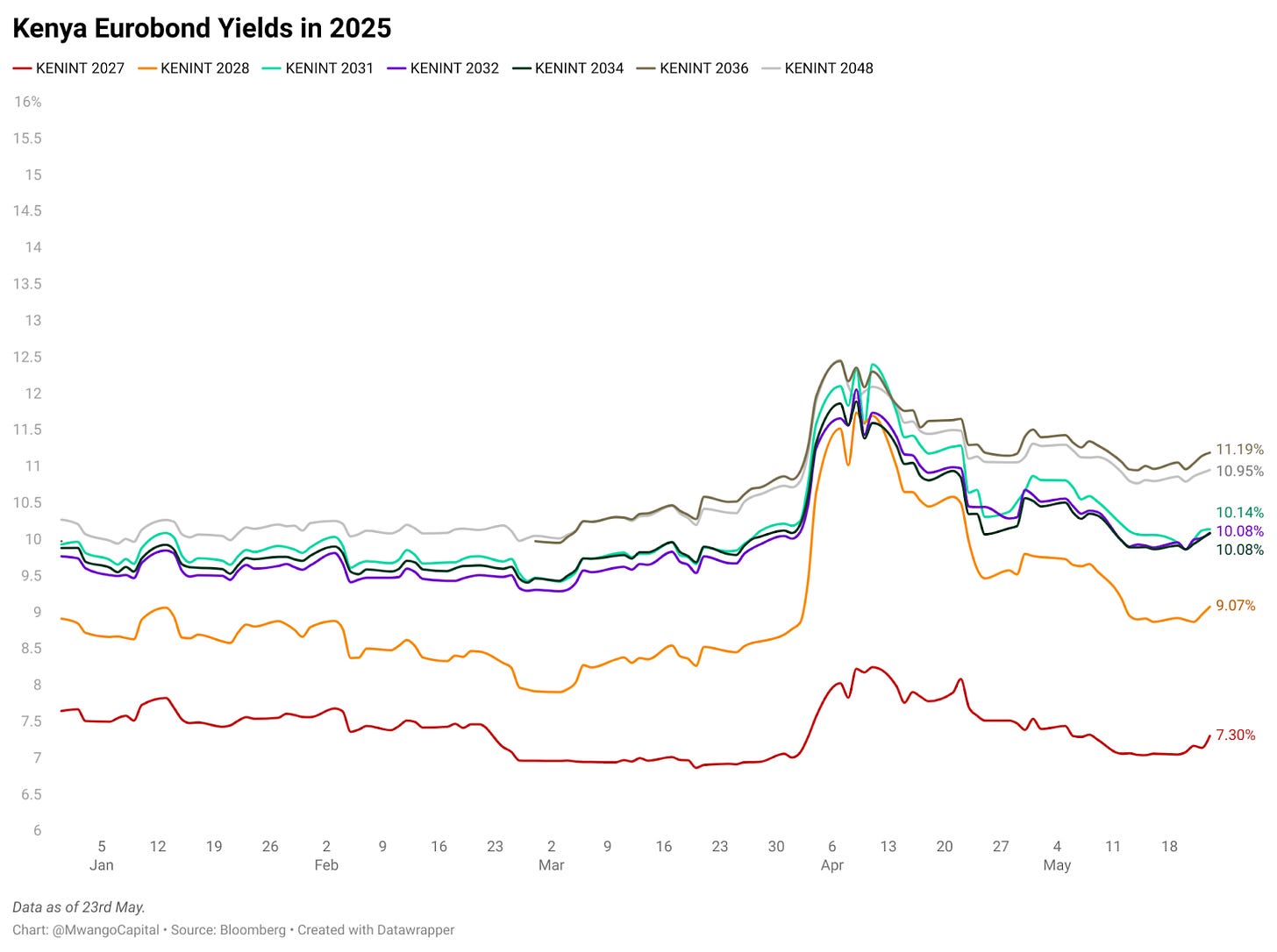

Eurobonds: Last week, yields on Kenya’s seven outstanding Eurobonds rose, led by the KENINT 2027 bond, which increased by 24.40 basis points to 7.30%. The KENINT 2036 bond followed, up 22.30 basis points to 11.186%. On average, Eurobond yields climbed by 18.80 basis points week-on-week.

Market Gleanings

☕| Kapchorua, Williamson Issue Profit Warnings | Kapchorua Tea Kenya and Williamson Tea have issued profit warnings for the financial year ending March 31, 2025, projecting a decline of over 25% in after-tax earnings compared to the previous year. The companies cited depressed global tea prices due to oversupply and flat demand, alongside a stronger Kenyan shilling that has negatively impacted export revenues. Kapchorua Tea reported a net profit of KES 399M in 2024, while Williamson Tea recorded KES 526.9M.

🔴| Bamburi Cement Trading Suspended | Trading of Bamburi Cement Plc shares on the Nairobi Securities Exchange has been suspended effective 21 May 2025, following Amsons Group’s acquisition of 96.54% of the company’s issued ordinary shares. The acquisition triggers a compulsory buyout of the remaining shareholders, and the suspension is meant to facilitate the final share transfer. The suspension will remain in effect for 60 days or as determined by the Capital Markets Authority.

📉| Family Bank Cuts Base Lending Rate | Family Bank has reduced its Base Lending Rate by 100 basis points, from 15.95% to 14.95%. The revised rate, which includes a margin based on individual credit risk, takes effect from 25 May 2025 for new loans and 15 June 2025 for existing loans.

💼| NCBA Appoints James Gossip as MD | NCBA Group has appointed James M. Gossip as Managing Director of NCBA Bank Kenya PLC, effective 12 May 2025. He brings over 30 years of international banking experience, including senior roles at HSBC, most recently as MD for the Belt & Road Initiative in Asia Pacific. John Gachora remains Group MD and CEO of NCBA Group PLC.

✅| CMA Approves Standard Group Rights Issue | The Capital Markets Authority has approved Standard Group’s planned rights issue, through which the company will issue 283.7M new shares at KES 5.29 each, targeting to raise KES 1.5B. The offer is in the ratio of 11 new shares for every 3 held and represents a 16% discount to the current market price of KES 6.30. Proceeds will be used to settle liabilities, fund working capital, support growth, and drive digital transformation. Standard Group's stock is up 25.5% year-to-date, closing at KES 6.30 on May 23, 2025.

💼| CMA Expands Fund Manager Pool | The Capital Markets Authority (CMA) has licensed Meridian Asset Management and Swala Capital, increasing the total number of fund managers to 45. Ndovu Wealth received approval to launch two Kibaba special funds denominated in KES and USD. Assets under management for Collective Investment Schemes now exceed KES 400 billion. Additionally, CMA has licensed three new corporate trustees to support the growing CIS market: MTC Trust & Corporate Services, Standard Chartered Bank Kenya, and NCBA Group.

🤝🏻| EFG Finance Acquires Stake in MaxAB-Wasoko | EFG Finance, a subsidiary of EFG Holdings, has sold its Egypt-based B2B e-marketplace, Fatura, to MaxAB-Wasoko. As part of the transaction, EFG Finance acquired a significant shareholding in MaxAB-Wasoko and secured a board seat. MaxAB-Wasoko merged with Wasoko last year to expand its presence into Kenya, Rwanda, and Tanzania.