Upcoming KENINT 2024 Maturity

The $2B Eurobond, issued in June 2014, has less than a year to maturity

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the upcoming KENINT 2024 maturity and Airtel Kenya's 5G plans.First off, enjoy a dose of our weekly business news in memes.

This week’s newsletter is brought to you by:

Co-operative Bank of Kenya. Co-operative Bank of Kenya is providing reduced-interest mortgages of 9.9% on a reducing-balance basis, enabling you to borrow up to Kes 8 million to buy or build a home in any part of Kenya.

KENINT 2024 Upcoming Maturity

9 Years Since Issue: The $2B Eurobond was issued on 24th June 2014 at a coupon rate of 6.875% and a price of 103.207. With less than one year to maturity, the yield as of the market close last week was 12.053% at a price of 95.291. The National Treasury has indicated that it has received at least 300 proposals on how to approach the redemption of the debut Eurobond, including one that involves a buyback to take advantage of the depressed prices. At the New Global Financing Pact in Paris, Kenya’s President William Ruto pointed out that Kenya was set to repurchase at least half of the Eurobond before the end of this year.

“The people who are looking to make a kill from this, they think they can scare us and create a narrative around it. I want to promise them that we are going to redeem half of it before the end of the year and we will square it out before time lapses next year. We are in a good space.”

Kenya’s President, William Samoei Ruto

BuyBack Mechanism: The financing for the redemption is set to come from at least $1B from the World Bank, together with finances from a syndicated loan and funds from development banks and the IMF. As of market close in the week, KENINT 2024 price stood at 95.291 down 7.7% since inception, while the yield stood at 12.053%, nearly double the 6.875% coupon rate for the bond at inception. The price depreciation underpins the current strategy around repurchasing it.

FY 2023/24 Budget: Kenya’s Treasury has projected KES 241.8B towards redemption of the maturing Eurobond. This amount is equivalent to 50.8% of projected external debt redemption costs which stand at KES 475.6B.

Impact of Shilling Depreciation: The Kenya Shilling, which traded at 87.50 against the dollar at the inception of KENINT 2024, breached the 140 mark to close at 140.3 - an all-time low. According to data on the vote heads of the Consolidated Fund, the projection of external debt redemption for KENINT 2024 in June 2024 has been put at an aggregate outlay of KES 301.5B, translating to an exchange rate ballparking KES 150 to the US Dollar, painting a rough picture of the trajectory of the shilling over the next 1 year.

Past Eurobond BuyBacks: On 31st March 2022, Russia completed the buyback of 72.4% of its dollar-denominated 2022 Eurobonds at an aggregate purchase price of 124.4B roubles ($1.58B) including $1.45B in nominal value of the bonds plus accumulated coupon payouts totalling $130M. In the corporate world, Informa PLC, a digital services provider, repurchased €200M of its Eurobonds in September 2022 in what was a broader plan to buy back part of its €650M Eurobonds set to mature in July 2023.

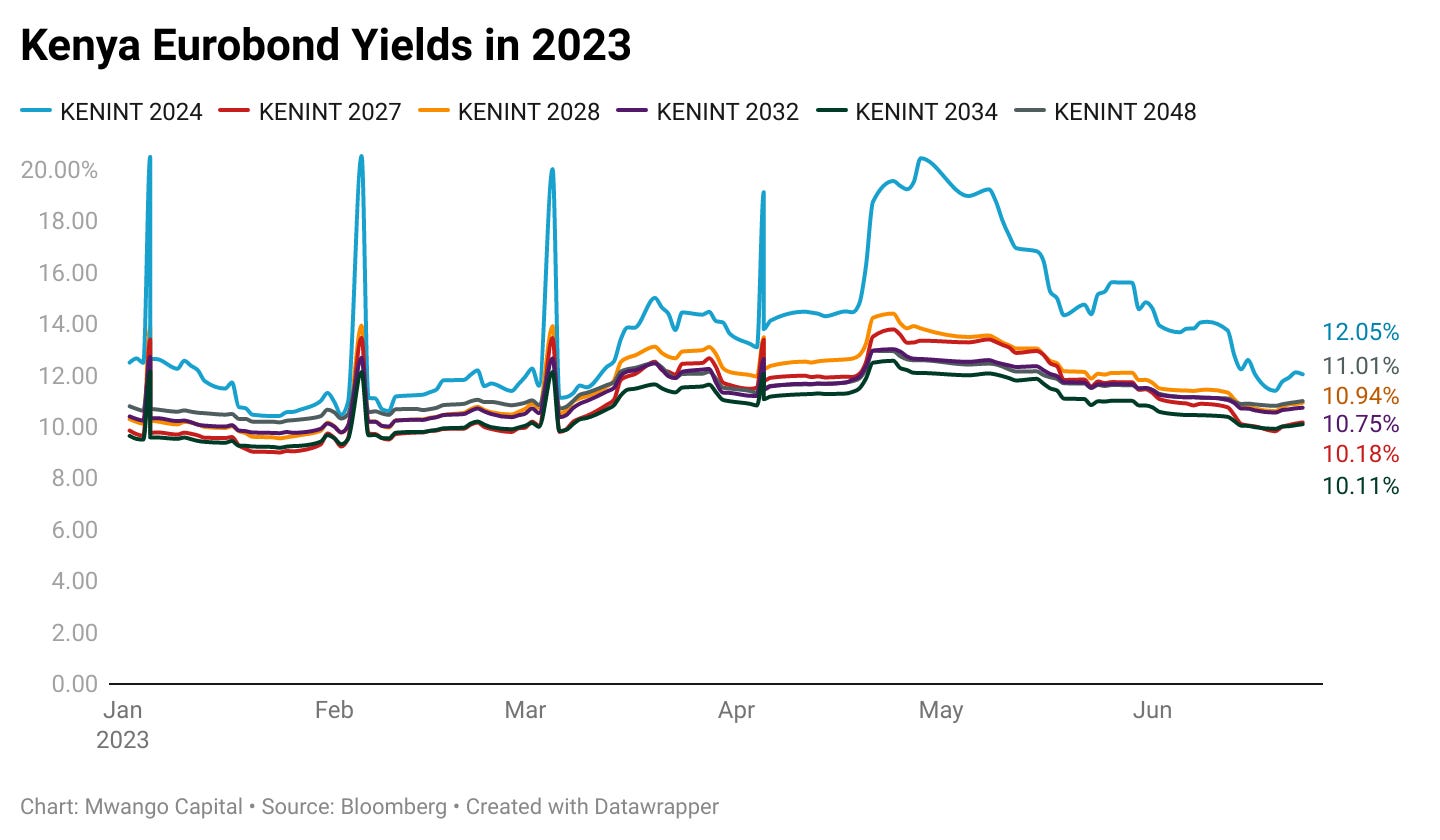

Kenya Eurobonds Performance: In the week, the yields across the 6 outstanding papers registered a mixed performance on a week-on-week basis.

All yields rose with the exception of KENINT 2024, which fell by 0.9% to 12.053%. KENINT 2028 rose the most - by 21.8 basis points to 10.943%. The average week-on-week change stood at 11.75 bps.

All yields were up on a Year-To-Date (YTD) basis, with the exception of KENINT 2024, which fell by 55 bps. KENINT 2028 led gains, appreciating by 63.1 bps, while at the lower end, KENINT 2048 appreciated by 18.7 bps. The average increase was 22.5 bps.

KENINT 2024 led price gains week-on-week, rising by 0.1% to 95.291. All other prices fell, with KENINT 2048 collapsing the most, down 1.1% to 76.68. On a YTD basis, KENINT 2024 price was up 3%. The average price change on a week-on-week and YTD basis was -0.6%.

Energy Wrap

Alten Commissions Solar Plant: Alten Kenya Solafarms commissioned a 44 MW solar facility in Kesses, Uasin Gishu County, with the project having an investment outlay totalling $87M (KES 12.2B). 400 construction jobs, with 15 on permanent terms, are set to be created as a result, and 100% of electricity output from the facility is to be delivered to the national grid via a 20-year take-or-pay Power Purchase Agreement. According to KNBS solar generation in 2022 grew by 129% year-on-year to 383.7GWh on account of Alten Solar Power plant commissioning and full operationalisation of Malindi, Selenkei, and Cedate Solar plants. Solar power imports rose by 4.6% to 316GWh.

Kenya Power Reverses Token Decision: Kenya Power has reversed its decision effective 1st September 2022 to lock out banks from selling electricity tokens for prepaid customers. Equity Bank and KCB have notified their customers to resume buying the tokens through their banking applications or dedicated USSD codes. For the banks that have reactivated the service, the development is set to translate to more contribution to non-funded income in the operating period.

Kenya-Tanzania Electricity Line: Kenya is planning to complete a 98 KM electricity transmission line connecting Isinya to Namanga that will bridge to Tanzania by year-end. The high-voltage line is set to close a gap in a pan-African supply pool that links 19 nations, allowing electricity flow from Ethiopia to Zambia. Separately, KenGen is actively pursuing two contracts for geothermal drilling in Tanzania in a bid to diversify its revenues. If the bid is successful, the contracts will add to similar projects undertaken in Djibouti and Ethiopia.

Kipeto’s Energy Generation Licence: Kipeto Energy, which runs a 100 MW wind power plant in Kajiado, is applying for a new energy generation licence after a change in controlling interest. Ultimately, Meridian infrastructure parallel fund II is set to acquire the entire shareholding of Actis in Kipeto Energy.

Across Telcos

Airtel Kenya 5G Plans: Airtel Kenya is currently doing tests of the network in the country before launching it next month. The product’s target market includes rich neighbourhoods with 5G devices. Safaricom PLC launched its 5G network on 27th October 2022 which currently has a coverage spanning 9 counties with a total population of 13.8M people.

Airtel Kenya NSE Listing: According to media reporting in the week, Airtel Africa could list its Kenyan operations on the NSE should the government retain listing as part of licensing conditions.

“As part of our license obligation, there's a requirement to list in Kenya. For the last couple of months, there’s been discussion around whether that condition is going to be changed or is going to stay. We still have been waiting for clarity from Kenya on whether there’s still an obligation to list. We are working on ways to comply with any lawful requirement of our licence. So, if we are obliged to list, we will list. But once again, there’s been some indication from Kenyan authorities that this may not be a requirement. But whatever requirement there is, we will meet it.”

Airtel Africa Group CEO, Segun Ogunsanya

Safaricom Ethiopia CEO Change: Safaricom Ethiopia CEO Anwar Soussa will be leaving the firm effective 31st July 2023 after serving for two years. During his tenure, Safaricom Ethiopia acquired 4M customers and has attained a network coverage of 25% of the total population, spread across 50 cities. Separately, operational data indicates that Ethiopia's average revenue per user (ARPU) currently stands at $0.8, against that of $6 in Kenya. Safaricom’s ARPU stood at $5.9 in FY 2010 and $5.3 in FY 2011 according to available data.

Markets Wrap

NSE: In Week 25 of 2023, Express PLC was the top-performing stock on the Nairobi Securities Exchange, unchanged from last week, appreciating by 17.6% to KES 4.00. TransCentury PLC was the worst-performing stock, falling 19.1% to KES 0.72. The NSE 20 index rose by 1.1% to 1,582.5 points while the NSE 25 index appreciated by 3.1% to 2,716.9 points. The NSE All Share Index (NASI) appreciated by 6.9% to close at 107.2 points. Equity turnover was down 39.8% to KES 995.9M while bonds turnover increased by 329.5% to KES 16.9B.

Treasury Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 11.785%, 11.863%, and 11.934% respectively. The total amount on offer was KES 24B with the CBK accepting KES 15.3B of the KES 15.3B bids received, to bring the aggregate performance rate to 63.91%. The 91-day and 364-day instruments recorded 275.34% and 23.35% performance rates, respectively.

Treasury Bonds: The third tap sale of FXD1/2023/03 recorded a performance rate of 123.7% attracting bids worth KES 18.56B against KES 15.0B sought, with the Central Bank of Kenya accepting KES 18.55B. Kenya has had 7 tap sales in 2023 - 2 infrastructure bond tap sales and 5 fixed rate bond tap sales.

Business Daily had, last week, reported that the government had issued a 3-year bond of KES 17.5B for 14.22% seeking to pay off part of KES 45.8B debt owed to Oil Marketing Companies (OMCs). The second tranche of the remaining KES 28B bond will be issued in the second week of next month.

County Bond?: The devolved units are engaging the National Treasury with a proposal to float a KES 100B devolution bond that will allow for disbursements to counties which are currently sitting on arrears totalling KES 61.1B for the months of May and June.

We have agreed that the Senate and the Council of Governors engage with the National Treasury to introduce a devolution bond that would enable the Treasury to meet requests for exchequer releases as they fall due.

Joint Communique, Council of Governors Chairperson and Senate Speaker

Market Gleanings

👨🏽💼 | New Leadership at the CBK | This week, Dr. Kamau Thugge, the immediate former Senior Advisor to the President and Head of Fiscal and Budget Affairs, assumed office as the 10th CBK Governor, following the exit of Dr. Patrick Njoroge. The new governor has scheduled an MPC meeting today, Monday, 26th June 2023, a week after he officially took over. The next MPC meeting was scheduled for July 2023. Separately, the Kenya Shilling breached the 140 mark against the dollar last week, to close at 140.38. The Shilling is down 13.8% year-to-date, and down 19.2% over the last 1 year.

🤝 | Kenya-EU Trade Deal | Initially an arrangement between EAC countries and the EU, Kenya has broken with the regional block to sign the Economic Partnership Agreement (EPA) on a bilateral basis with the EU as regional partners remain undecided. Data by the EU indicates that EU-Kenya trade totalled €3.3/$3.6B/KES 447B in 2022, up 27% compared to 2018.

“Concluding negotiations for an Agreement with Kenya - the economic hub of East Africa - is a historic moment. It puts us firmly on the path towards a privileged relationship based on trust, rules and opportunity. It will bring our regions closer, and unlock new areas of cooperation and mutual benefit for our workers, businesses and traders.”

Executive Vice-President and Commissioner for Trade, Valdis Dombrovskis

🧾 | Two Rivers Gazetted as an SEZ | Trade Cabinet Secretary Moses Kuria gazetted Two Rivers International Financial Centre (TRIFIC) as a Special Economic Zone. The action unlocks a set of incentives for TRIFIC including 0% corporate tax on foreign-sourced income, 10% corporate tax on domestic-sourced income, 0% withholding tax on dividends, and 0% VAT.

“The total land in Two Rivers is about 106 acres. It's a mixed-user master plan development and, so far, we’ve only developed about 20% of the total approved development. What has been approved for use as a Special Economic Zone for services is 64 acres of the 106 acres. For example, the Mall is not part of the area that has been zoned as a Special Economic Zone, but the North Tower has been zoned as a Special Economic Zone.”

Centum CEO, James Mworia

Here is a link to the Twitter Space where we hosted James Mworia on TRIFIC’s gazettement.

💱 | Central Bank of Tanzania on FX | The Central Bank of Tanzania issued a stern reminder to market players to adhere to its strict forex regulations aimed at dealing with an emerging forex crisis. It warned that all the prices of goods and services in Tanzania should be quoted in Tanzanian shillings.

“All prices of goods and services in Tanzania should be quoted in Tanzanian shillings. These pertain to rent for land, housing and office; fees for education; medical services, equipment and reagents; transport, logistic and port services; electronic equipment and telecommunication services.

💼 | Hela Apparel Secures Funding | Hela Apparel Holdings PLC received $5M/KES 700M from Norfund to strengthen the development of manufacturing operations in East Africa. The proceeds from Norfund’s investment will be utilised to strengthen Helas’s strategic supply chain partnerships in East Africa. Hela has 12 factories worldwide with 2 based in Kenya. Employees exceed 20K with production at 10M Units per month. Listed on Colombo Stock Exchange - Sri Lanka’s main stock exchange, Hela is down 36.11% Year-To-Date and closed at a Market Cap of $26.7M (KES 3.9B) last week.

🛑 | Debt Ceiling Amended | Parliament has approved the conversion of Kenya’s debt ceiling from a hard cap of KES 10T to a maximum of 60% of GDP in present value terms. As of December 2022, Kenya's present value of public debt was at 60% of GDP already [Domestic at 33.2% of GDP and external debt at 26.8% of GDP]. The National Treasury projects this to decline to 53.1% by FY 2025/2026.

"The committee recommends that the threshold for debt shall be a debt anchor of 55% and shall not exceed plus 5% of GDP in present value terms."

⚖️ | TransCentury, EA Cables File Injunctions | After Equity Bank appointed a receiver and administrator for TransCentury and East African Cables, respectively, the two firms this week went to court to secure injunctions.

"[We have] been in active engagement with the lender [Equity] as recently as a day before the notice was published in the local dailies without any reference to the company on the

same. The discussions included a detailed payment plan that was provided to the bank."

💰 | Hustler Fund Update | As of 23rd June 2023, KES 31.6B had been disbursed through the Hustler Fund, with the amount repaid standing at KES 21.1B. The total number of borrowers stood at 20.5M, and repeat borrowers were 7.1M. The aggregate number of transactions done over the platform stood at 44.35M. Across the Hustler Fund groups, the total groups created stood at 229.9K with 15.6K approved groups. The amount disbursed to groups stood at KES 26.8M with KES 166.6K repaid.