KQ Breaks 10-Year Loss Streak

The airline reported a KES 513M profit after tax, up from a KES 21.7B loss in H1 2023

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, Kenya Airways' first profit in a decade, H1 2024 banking results from I&M, NCBA, and Standard Chartered, and the National Treasury on the Finance Bill, 2024.Kenya Airways Posts First Profit in a Decade

A Decade-Long Turnaround: Kenya Airways (KQ) has delivered an unexpected financial turnaround in the first half of 2024, reporting a profit after tax of KES 513M, marking its first profitable period in over a decade. This sharp contrast to the KES 21.7B loss recorded in H1 2023 highlights the airline’s strategic realignment, which has begun to bear fruit. The 22% year-on-year increase in revenue to KES 91.5B, driven by robust passenger demand and a resurgence in cargo operations, underscores the carrier’s ability to capitalize on post-pandemic recovery trends in global aviation. However, this profitability is not merely a function of revenue growth; it also reflects the airline’s intensified focus on cost management and operational efficiency.

“This is a milestone in our journey to recovery...if you remember last year, we had communicated how the…unfavorable exchange rates between the Kenyan shilling and the dollar had significantly cut us. We have seen a reversal of that situation where we see the Kenyan shilling has significantly strengthened against the US dollar by about 19%. So obviously that has helped us to reduce the forex losses. But more importantly, you've also seen the increase in our revenue numbers by 22%.”

Kenya Airways Chief Executive Officer, Allan Kilavuka

Debt Restructuring and FX Risk Mitigation: Underlying this financial recovery is a more sophisticated approach to debt management, particularly in mitigating foreign exchange risks that have historically plagued Kenya Airways. The conversion of a significant portion of its dollar-denominated debt into Kenyan shilling loans has been pivotal, reducing the volatility in its financial statements caused by currency fluctuations. This strategic debt restructuring has not only reduced total liabilities from KES 312B to KES 297B but also provided a much-needed cushion against the turbulent foreign exchange markets.

“The conversion of our major debt into Kenyan shilling loans has reduced our exposure to currency fluctuations, significantly improving our financial stability. This strategic move has allowed us to better manage our liabilities and enhance cash flow.”

Kenya Airways Chief Finance Officer, Hellen Mathuka

Fleet Management and Capital Challenges: Despite these gains, Kenya Airways faces significant hurdles that could impede its long-term recovery. The airline’s fleet management strategy is under strain, with difficulties in acquiring larger aircraft to replace its aging Embraer fleet, which is critical for optimizing its route network and improving operational efficiency. Additionally, while Project Kifaru 2.0, the airline’s strategic transformation plan, aims to secure a strategic equity partner by the end of 2024, the success of this initiative is uncertain. The capital injection from this partnership is essential for reducing debt and fueling the airline’s growth ambitions in an increasingly competitive market.

“We are reasonably confident that we're on course to break even by the end of the year,” Kilavuka said, though this confidence is tempered by the recognition that external factors such as global oil prices, geopolitical tensions, and the availability of suitable aircraft could easily derail these efforts. The airline’s path to sustained profitability, while clearer now than in years past, remains fraught with both opportunities and risks.

“We are reasonably confident that we're on course to break even by the end of the year. However, we remain vigilant as external factors like oil prices and aircraft availability could impact our performance….The Embraer was a very good aircraft for us when we were developing routes. However, for mature routes, you need a bigger-sized aircraft. Unfortunately, we are finding it very difficult to find suitable replacements in the market. This is a significant challenge for our fleet management strategy…We are a very low-margin business, and any escalation in costs, particularly related to fleet operations, could easily tilt us into a loss position. The difficulty in acquiring larger aircraft to replace the Embraer fleet adds to these cost pressures, making it crucial for us to carefully manage our expenditures.”

Kenya Airways Chief Executive Officer, Allan Kilavuka

Here are the links to our analysis, the presentation, and the results.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

KCB Resumes Dividend Payment

NPLs Grow by 5%: The gross stock of Non-Performing Loans (NPLs) grew by 16.5% to reach KES 212.1B, equivalent to 20.6% of gross loans [H1 2023: 18.9%]. The Group’s NPL ratio consequently closed at 18.5% which was mainly driven by Kenya (26.7%), DRC (11.1%), and Uganda (9.1%) in terms of subsidiaries. Across segments, the SME & Micro sector drove the growth in the NPL by registering a 550 bps growth relative to H1 2023, followed by Mortgage at 180 bps, Checkoff at 70 bps, and Corporate at 30 bps. The Corporate segment however closed the period with the highest NPL ratio at 32.7%, followed by Mortgage at 21.9%, SME & Micro at 16.6% and Checkoff at 4.0%.

Growth and Expansion: The Group has maintained a strategic presence in Ethiopia through its representative office for the past decade, signaling its strong interest in the market. Recent macroeconomic reforms introduced by the Ethiopian government have caught the attention of investors, who are closely evaluating the potential investment implications. During the latest investor briefing, the Group CEO provided insights on the company's outlook in light of these developments.

“In terms of Ethiopia, we are positive. The latest that we are getting from the engagements is that September is the outlook. We are watching. I think we've seen positive signals from the market from the changes that have happened. We are ready as KCB should that happen. We've worked with the Board, we know exactly what entry model we will use but we can only make that final call when you know the decision is made.”

KCB Group Chief Executive Officer, Paul Russo

Separately, the Group further issued an update on the acquisition of the National Bank of Kenya (NBK) by Access Bank PLC, pointing out that the transaction had progressed further and is on track to close by the end of this year.

Dividend Resumption: Following a hiatus in FY 2023 due to internal recapitalization requirements at KCB Bank Kenya, the Group reinstated its dividend policy in H1 2024, with the Board of Directors declaring an interim dividend of KES 1.50 per share. This resumption underscores the recovery of the Kenyan banking unit’s capital position, which had previously constrained the Group's ability to distribute dividends in FY 2023 marking the first such suspension in nearly two decades.

Here are links to our analysis, the results, the investor briefing, and the presentation.

I&M Group H1 2024 Results

High-level Highlights: The asset base expanded by 12.1% year-on-year to reach KES 564.4B, with the loan book growing by 5.3% to KES 284.2B, accounting for 50.4% of the balance sheet as compared to 53.4% in H1 2023. After cutting the stock of government securities in the last two consecutive quarters, the Group modestly ramped up its holdings by 32.1% to KES 143.1B, equivalent to 25.4% of the asset base [H1 2023: 21.9%].

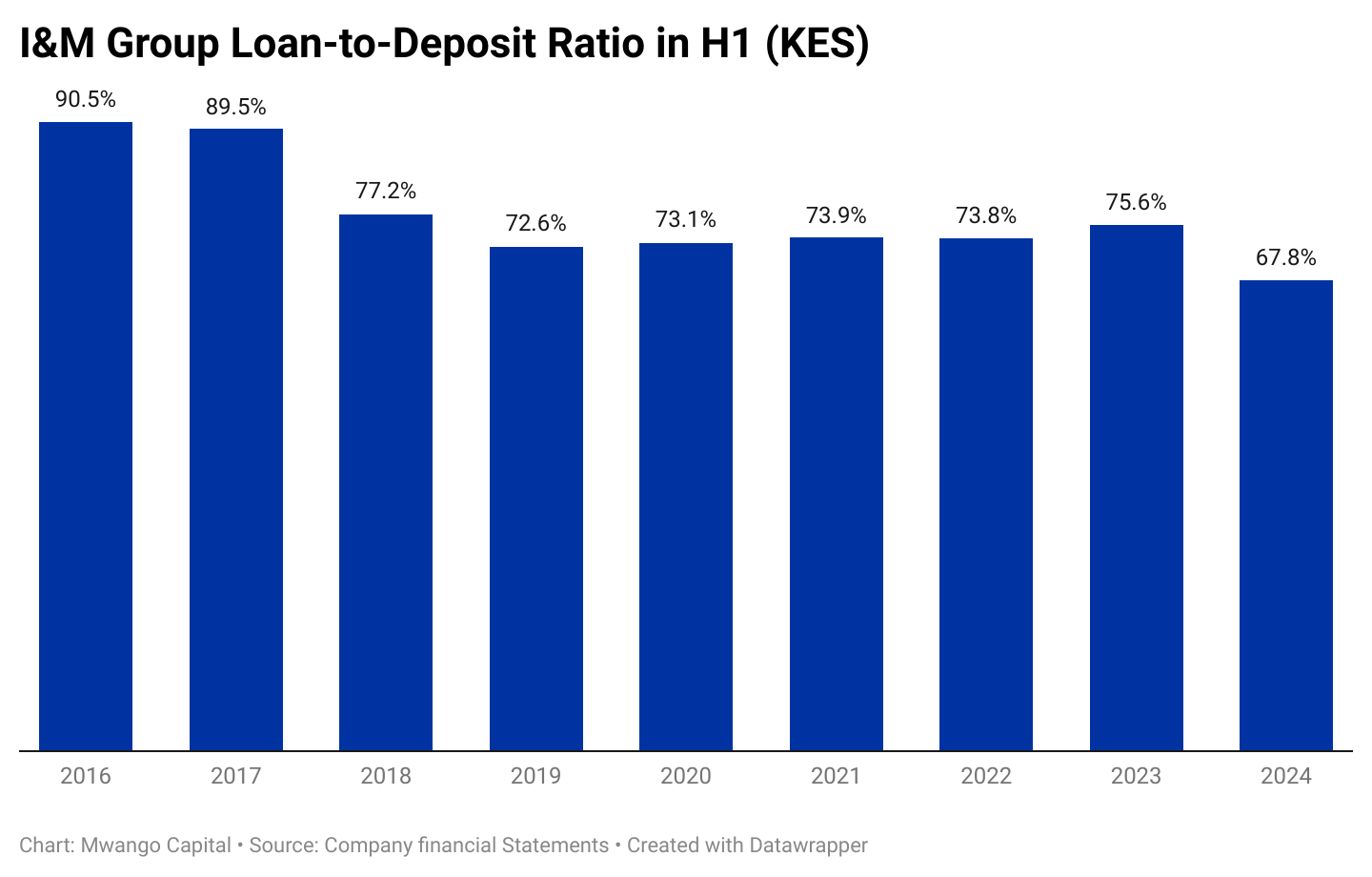

The balance sheet was 74.3% funded by customer deposits totaling KES 419.4B up from 70.9% in H1 2023 or a total of KES 356.8B. When the deposits are juxtaposed to net lending to customers, the Group’s loan-to-deposit ratio closed the operating period at 67.8%, down from 75.6% in H1 2023.

Mapping the Revenue Lines: Interest income from loans and advances grew by 48.4% to reach KES 22.6B, while that from government securities edged higher by 26.9% to KES 6.9B. In total, interest income amounted to KES 31.1B, representing a 46.1% growth. Total interest expenses were up 1.6X to KES 14.6B, equivalent to 46.9% of total interest income [H1 2023: 42.7%]. As a result, the Group netted KES 16.5B in interest income, up 35.2%.

Across the Non-Funded Income (NFI) basket, all revenue lines were down compared to H1 2023, except for fees and commissions, which in sum rose by 16.2% to KES 3.7B. FX Trading income recorded the largest decline at 37.7% or by KES 623.4M to reach KES 1.8B. In total, NFI shrank by 10.9% to KES 6.2B.

Profitability and Returns: Operating income for the period under review surged by 18.5% to KES 22.7B, with the contribution across net interest income (NII) and NFI standing at 73:37 [H1 2023: 64:36]. Pre-tax profits amounted to KES 8.4B, up 27.3%, and the net income for the period was KES 6.1B, up 21.1%.

Here are the links to our analysis and the results.

StanChart’s KES 8.00 Interim Dividend

Results Highlights: The bank recorded a 2.7% growth in net loans, reaching KES 149.3B alongside a 1.3% increase in government securities to KES 71.6B. Deposits experienced a modest decline of 2.6% to KES 276.4B. The bank’s total non-performing loans decreased significantly by 42.9% to KES 13.6B, and provisions were down 23.3% to KES 1.5B.

Revenue Composition: Net interest income rose by 19.3% to KES 16.5B, reflecting gains from loans and government securities. Non-interest income also surged by 36% to KES 9.6B. These gains boosted profit after tax by 48.8% to reach KES 10.3B.

KES 8.00 Interim Dividend: The Board of Directors recommended the payment of an interim dividend of KES 8.00 for H1 2024 - equivalent to 31.4% of the recorded EPS. Noteworthy, last year’s interim dividend was paid in Q3 and it amounted to KES 6.00, equivalent to 23.6% of EPS.

Here are the links to our analysis and the results.

NCBA’s Interim Dividend Up 29%

Mapping the Digital Business: Digital banking returned KES 2.8B in pre-tax profit, up 77.7% with Kenyan operations accounting for the bulk of the profit at 66.9% or KES 1.9B. Uganda’s Mo-Kash pulled in KES 467M, Rwanda’s Mo-Kash KES 351M, and Tanzania’s M-Pawa KES 125M, representing a growth of 10%, 21% and 135.8%, respectively. In Ghana, the Group recorded a loss of KES 15M, nearly double the KES 8M loss incurred in H1 2023.

Earnings Breakdown: All core banking subsidiaries except Uganda recorded a decline in pre-tax profits, with Kenya, Tanzania, and Rwanda recording KES 1.4B, KES 38M, and KES 173M in drops in the pre-tax profits. Across the non-banking subsidiaries, only the investment bank recorded a drop in pre-tax profits of KES 2M, as compared to gains of KES 70M and KES 139M across the insurance agents and leasing vehicles, respectively. The Group’s net result for the operating period was KES 9.8B, up 5%.

Shareholder Returns and Dividends: A key highlight is that shareholder funds across the Group crossed the KES 100B for the first time on account of growth in profitability across the Group that has bolstered retained earnings and ultimately shareholder equity. In terms of dividends, the Board of Directors declared an interim dividend of KES 2.25 per share, up from KES 1.75 declared in H1 2023 to represent a growth of 28.6%.

Here are the links to the results and the investor briefing. We hosted the Group CEO, John Gachora in last week’s edition of MwangoSpaces. Find the recording here.

We expect results from Absa Bank Kenya and DTB Group in the coming week. Small banks that reported in the week include Sidian Bank.

Markets Wrap

NSE: In Week 34 of 2024, I&M Holdings led the market, rising 35% to KES 27.80, while Williamson Tea was the worst performer, dropping 11.0% to KES 208.00. The NSE 20 climbed by 3.4% to 1,699.3 points, the NSE 25 gained 3.1% to 2,825.4 points, and the NASI index advanced by 2.4% to 104.9 points, while the NSE 10 edged up by 1.3% to 1,076.7 points. Equity turnover rose by 52.6% to KES 1.2B, while bond turnover jumped to KES 44.5B from KES 6.9B the previous week.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.80%, 16.66%, and 16.86% respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 17.1B of the KES 19.2B bids received, to bring the aggregate performance rate to 79.87%. The 91-day and 364-day instruments recorded 197.8% and 54.9% performance rates, respectively.

Eurobonds: In the week, yields fell week-on-week across the 5 outstanding papers with KENINT 2028 falling the most, down 33.70 bps to 10.144%, followed by KENINT 2032 at 15.90 bps to 10.210%. KENINT 2048 recorded the least week-on-week decline at 7.30 bps to 10.796%, and the average week-on-week change stood at -16.25 bps.

Tap Sales: The government has announced another Tap Sale of Treasury Bond IFB1/2023/017, offering KES 15B to investors. The sale period is set from 20th to 29th August 2024, or until the targeted amount is reached, with a settlement date of 2nd September 2024. The bond carries an average yield of 17.7279% and a coupon rate of 14.3990%.

Worth Noting: The CBK is set to implement a significant policy shift next month by eliminating commission payments to stockbrokers, custodian banks, and authorised securities dealers who facilitate the sale of Treasury bonds. This decision is poised to remove a substantial revenue stream for these financial intermediaries. The CBK had been paying a 0.15% commission on the value of securities sold, net of a 5% withholding tax. Given the scale of primary Treasury bill and bond auctions, which typically attract tens of billions of shillings from institutional investors, this move will likely have far-reaching implications for market dynamics and the role of intermediaries in the bond market

Market Gleanings

💼| Mbadi on the Finance Bill, 2024 | In a recent interview, the National Treasury Cabinet Secretary John Mbadi outlined several key clauses from the Finance Bill, 2024 set for reintroduction. Among the notable measures, the government plans to increase excise duty on imported sugar from KES 5 to KES 7.5 per kilogram, a tax amnesty to raise KES 30-50B, and pension reforms allowing for the release of pensions without tax deductions.

However, some controversial proposals such as the eco levy, motor vehicle circulation tax, and taxation on essential goods like bread and sanitary pads will not be reintroduced. The revised bill targets raising KES 150B, although the exact figures are still under review.

⚖️| Supreme Court on Finance Act, 2023 | The Supreme Court has suspended The Court of Appeal's decision that nullified the Finance Act, 2023, allowing the government to continue collecting taxes under the extended law. The apex court cited public interest, emphasizing the need to maintain stability in the ongoing budgeting and appropriation process.

🔻| S&P Downgrades Kenya | Following in the footsteps of Moody's and Fitch Ratings, S&P Global Ratings downgraded Kenya's long-term sovereign credit rating to 'B-' from 'B' on 23rd August 2024, citing a deteriorating fiscal and debt outlook following the repeal of the 2024/2025 Finance Bill which will slow fiscal consolidation, potentially increasing debt in the medium term. The repeal of the Finance Bill reduced expected fiscal revenue and widened the budget deficit to 4.3% of GDP in FY 2025. More from the review:

Debt-servicing costs are projected to exceed 30% of government revenue from 2024 to 2027, the highest among all rated sovereigns.

Despite high external debt and financing needs, immediate external liquidity risks have eased.

The stable outlook is based on expectations of strong economic growth and continued access to concessional external financing, which balances the pressures from high-interest costs and slower fiscal consolidation.

The rating could be further downgraded if Kenya faces mounting external or domestic refinancing pressures, or if fiscal consolidation efforts stall, leading to higher interest costs. On the other hand, the rating could be upgraded if Kenya's financing pressures ease or if there is a renewed commitment to public finances and significant progress in fiscal consolidation.

The IMF's 7th review of Kenya's programme, expected to release around USD 600M, is pegged on the outcome of the Supreme Court court ruling regarding the constitutionality of tax measures implemented under the 2023/2024 Finance Bill.

Kenya is unlikely to tap exceptional access to IMF resources under the 7th review, reducing the potential disbursement from the originally expected USD 1B, and has also expressed its intention of signing up for a new IMF programme after the current one expires in March 2025.

Kenya's authorities have expressed intentions to conduct buybacks of portions of its 2028 and 2031 Eurobonds using proceeds from the 2024 Eurobond and IMF disbursements, as part of a strategy to manage external debt pressures.

Although immediate external liquidity pressures have slightly receded, Kenya's structurally large external imbalances remain a key vulnerability, with external debt amortizations projected at about USD 2.0B annually over FY 2025 - FY 2027, including USD 300M in Eurobond repayments each May.

Potential foreign financing options for FY 2025 include sustainability-linked bonds, Samurai, Sukuk, and Panda bond issuances, alongside expected disbursements from the IMF and World Bank.

Kenya's debt trajectory remains sensitive to the outcome of the government's appeal against the repeal of tax measures in the Finance Bill.

Fiscal consolidation in Kenya is challenged by social pressures, with the government focusing on dismantling red tape to support small businesses while benefiting from a vibrant services-led private sector and a growing middle class.

Rising external and fiscal vulnerabilities are tied to higher debt-service repayments and financing constraints, exacerbated by the repeal of the Finance Bill, which has disrupted fiscal plans, leading to increased borrowing and higher interest costs.

Kenya's current account deficit narrowed to 3.7% of GDP as of June 30, 2024, but is expected to widen to 4.8% over 2024-2027 due to high external debt and reliance on external financing.

🟢| Bidcoro Acquires Suntory | The Competition Authority of Kenya has unconditionally approved Bidcoro Africa Limited's acquisition of the entire issued share capital of Suntory Beverage & Food Kenya Limited. Bidcoro, known for its brands like Suntop, Sunquick, and Suncola, will acquire Suntory Kenya, which manufactures and distributes beverages under the Ribena and Lucozade brands.

📄| H1 2024 Earnings Wrap |

Liberty Kenya: Liberty Kenya Holdings has reported a significant increase in its first-half 2024 results, with net profit surging by 170% to KES 424M. This was driven by a strong performance in the insurance services segment, where revenue jumped by 851% to KES 514M.

CIC Insurance: CIC Group reported a slight increase in profit for the first half of 2024, with net profit after tax rising by 0.6% to KES 710M. This was driven by growth in asset management income, which grew by 6% to KES 604M. The company's earnings per share improved to KES 0.30 in 2024.

Kakuzi: Kakuzi Plc's half-year 35% increase in turnover to KES 1.175B and a pre-tax profit of KES 507M reflects both recovery and resilience. The standout growth in avocado profits, up 42% to KES 951M, highlights the firm's ability to capitalize on supply disruptions in key markets like Peru and Mexico.

KMRC: Kenya Mortgage Refinance Company’s (KMRC) H1 2024 net interest income surged by 56.7% to KES 956.2M, while expenses increased by 24.5% to KES 155.6M. The company achieved a 65% rise in profit before tax to KES 800.6M and an 84.4% increase in profit after tax to KES 669M.

⚡| Ormat - Kenya Power | Ormat Technologies has received partial payment from Kenya Power for overdue amounts totaling USD 36.9M as of June 30, 2024. In July and August 2024, Kenya Power paid USD 16.4M, representing 44.4% of the total overdue amount. Kenya Power accounted for 13.1% of Ormat's revenues in the second quarter of 2024, slightly down from 14.4% in the same period last year.