👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover quotes from the CBK Governor on the economy, KRA's legal notice to raise excise duties, and NSSF and the call for increased savings.First off, enjoy our weekly business news in memes brought to you by Mwango Capital:

CBK Governor on a Roll

Governor Lets Loose: The Central Bank of Kenya Governor, Dr Patrick Njoroge, has been on a roll this week giving a presentation during the induction for Members of the 13th National Assembly and interviews with CNN and Bloomberg. Here are some quotable quotes we picked from him including some bombshell revelations on the forex shortages we have been having:

"If you remember what was happening with Goldenberg, this is what some of the people were pushing towards. I don't want to get into the details because they will ask me where is the proof and I will say I don't have proof. I'm not the DCI. The hype, the pressures had nothing to do with what was happening in the markets. What was happening is that we did have some of the rogue traders, in particular, banks, and they were working to do their thing, so we went after those and dealt with some of them. You cannot kill every mosquito in the room...we were in a particular kipindi, everything was politics...sanity has resumed."

On Debt Levels:

"Economic consequences of high debt are adverse and it’s the duty of Legislators to not only ensure that we repay the debts, but also avoid accumulating more debts as a country"

On Rising Interest Rates in Developed Markets:

"The policies being adopted in advanced economies such as rate hikes are freezing us out of the financial markets meaning it may be tougher to borrow even as inflation bites. We need support from advanced economies, to make sure emerging markets are not left on their own.”

On Subsidies:

“Any subsidy is a cost. It’s a subsidy but at the same time, it’s a cost in the sense that somebody needs to be taxed somewhere to cover that subsidy. So that balance is one that needs to be struck, and I think also there is another side of it which is when the subsidy is removed, prices will rise. It has happened with Super Petrol and therefore that will be reflected in inflation and there will be knock-on effects. The bottom line is subsidies are generally temporary.”

On Regulating Digital Credit Providers:

“We have done what we should have done this year and yesterday on the 17th of September that was Saturday we actually began, we finished that process of the first batch of let’s say approving, licensing the Digital Credit Providers and today we issued a press release which you can see on your phone indicating that we have now started this to be able. To be honest there were 288 of these people that came to us. 288. Just imagine the mess that those people are creating. We approved 10.”

On Investing in Africa:

"Take a long-term bet on Africa, on Kenya. The three-year horizon is killing us."

Though he did not give a timeline, it seems like Kenya will be back in the Eurobond market soon. We are looking forward to the Monetary Policy Committee (MPC) press briefing to hear more from the Governor.

Spotlight on NSSF

Save More!: The clarion call from the new President has been for increasing savings rates. This past weekend he had this to say:

"We want every Kenyan to save. Those who are employed, their employers should also match their savings &those who are not employed, the government...will give them money equivalent to a percentage of their saving...this is how we can stop being slaves to our lenders”

President of Kenya, William Samoei Ruto

The savings will most likely be going to the National Social Security Fund (NSSF), an institution that a majority of Kenyans that participated in our Twitter poll do not trust.

Null & Void: Meanwhile, the High Court halted a bid to increase members' monthly contributions to KES 2,068, ruling that the law supporting the increments was unconstitutional. The move is a blow to the current government's social security plan that mostly anchors on the NSSF contributions.

FY 2021 Results: NSSF reported its 2021 results with the fund’s contributions receivable from members marginally down by 2% to KES 14.4B. Its net return on investments was up 237% to KES 32.7B mostly driven by a KES 21.6B increase in the market value of investments. Total expenses grew 21.5% to KES 6.6B, equivalent to a substantial 45.4% of members' contributions.

Portfolio Rebalancing: NSSF has been actively reorganizing its investment portfolio over the last few years. Investments in government securities have doubled within a five-year period to KES 170.9B in FY 2021 [2017: KES 83.2B]. In quoted securities, the fund acquired an additional 11M KCB Group shares worth KES 440.5M in May 2022 and an additional 3.33M shares in August 2022, bringing its shareholding in KCB Group to 8.65%. The fund dropped Britam Asset Managers (Britam) as its contracted Investments manager earlier this year.

Higher Excise Duties

What Happened? On 1st Sep 2022, Kenya Revenue Authority’s Commissioner General published a draft legal notice with proposed excise duty inflationary adjustments. This is targeted at particular items that are charged excise duty at a specific rate per unit under the Excise Duty Act, 2015 and other goods subject to fees or levies at a specific rate under the Miscellaneous Fees and Levies Act, 2016. The specific rates will be adjusted using the average inflation rate for the financial year 2021/2022 of 6.3%, as determined by the Kenya National Bureau of Statistics, and will be effective from 1st Oct 2022.

Why So? Legally, the KRA Commissioner General is empowered under the Excise Duty Act, 2015 and Miscellaneous Fees and Levies Act, 2016 to adjust, annually, the specific rates of excise duty and export levy to consider the rate of inflation.

What is Excise Duty? Excise duty in Kenya is imposed on the locally manufactured goods, importation, or local supply of certain commodities and services. Excisable commodities include bottled water, soft drinks, cigarettes, alcohol, fuels, and motor vehicles. Excisable services include telephone and Internet data services, fees charged for money transfer services, and other fees charged by financial institutions.

Affected Items: Some of the products that will be affected include fuel prices with the price of petrol likely to increase by ~KES 1.5 and that of diesel by ~KES 1.46. Beers, spirits, and wines will also rise. Goods whose excise duty is charged as a percentage of their price will be exempt from the adjustment since the tax naturally rises with price changes.

Looking Ahead: The introduction of the excise duty is likely to further hurt the manufacturing sectors that contributed 7% to the GDP in 2021 against the target of 15%. Tax policies that make locally made excisable goods a lot more expensive than imports open up room for illicit trade to thrive. The inflation adjustments will result in numerous tax obligations which are likely to affect the viability of future investments in the excisable goods segment of manufacturing. Kenyan manufacturing is a capital-deficient sector that mostly relies on foreign investments.

Last Week on Mwango

In this new section, we highlight the most important analysis and discussions that we did on Mwango Capital:

A thread on NSSF Kenya Vs NSSF Uganda

#MwangoSpaces on the subsidy program and the Kenyan economy

#MwangoSpaces on unique insights from Kenya’s business history

Debt Markets

T-Bills Market: In the gilts market, in what is a buck in the trend recently witnessed, the acceptance rate was highest in the 182-day paper compared to the 91-day paper. The acceptance rate across the 91-day, 182-day and 364-day paper came in at 93%, 53% and 10.4% while the market-weighted average interest was 8.951%, 9.625% and 9.909%, respectively.

CBK Targets KES 60B: In its prospectus for re-opened 10-year FXD1/2017/10, 15-year FXD1/2020/15 and new 20-year fixed coupon FXD1/2022/25 treasury bonds, the Central Bank of Kenya is seeking KES 40B and KES 20B from the two instruments, respectively. The auction for the reopened instruments is October 5, 2022, and that for the new instrument is October 19, 2022.

Eurobond Market: In the Eurobond market last week, yields for the paper due 2024 were up by 126 basis points to close at 13.373%. KENINT 2024 last traded at these levels back in June this year. While the yields of all Eurobond instruments were up - yields on KENINT 2024 rose the highest and those for the paper due 2048 rose the least by 31 basis points.

What Else Happened This Week

🪓 Splitting Safaricom: When asked by MPs about splitting Safaricom by separating its telecom and mobile money operations, The CBK Governor had this to say:

"I would want you to ask me that question in January next year. So if you just be patient, ask the question next time I see you before the end of the year, but definitely by January."

CBK Governor, Dr Patrick Njoroge

⚖️ Afrasia Bank vs SBM Bank: In a statutory demand, Afrasia Bank has given SBM Bank Kenya 3 weeks to settle a claim of $7.5M (+$16.645K interest) it had deposited in collapsed Chase Bank 6 years ago. In response, SBM Bank has issued a demand letter to Afrasia Bank to publish a notice of retraction and instructed its lawyers to make an application to the courts to strike out Afrasia's statutory demand.

🌾 Subsidized Fertilizer: The National Treasury made available KES 3.6B to subsidize 71,000 MT of fertilizer. The Treasury has said the provision will support 1.4M acres of land. The subsidized fertilizer will be distributed via the National Cereals and Produce Board (NCPB) depots and sub-depots from Sep 19. Individual farmers will receive a maximum of 100 50kg bags.

🛑 Suspended Oil Brands: 10 edible oil and cooking fat brands suffered a temporary suspension by the Kenya Bureau of Standards (KEBS) after samples failed to meet minimum health requirements. The suspended brands include Bahari Fry, Fresh Fri, Fresh Fri with Garlic Oil, Fry Mate, Gold n Pure Olive Gold, Postman, Rina, Salit, Tilly, and Top Fry.

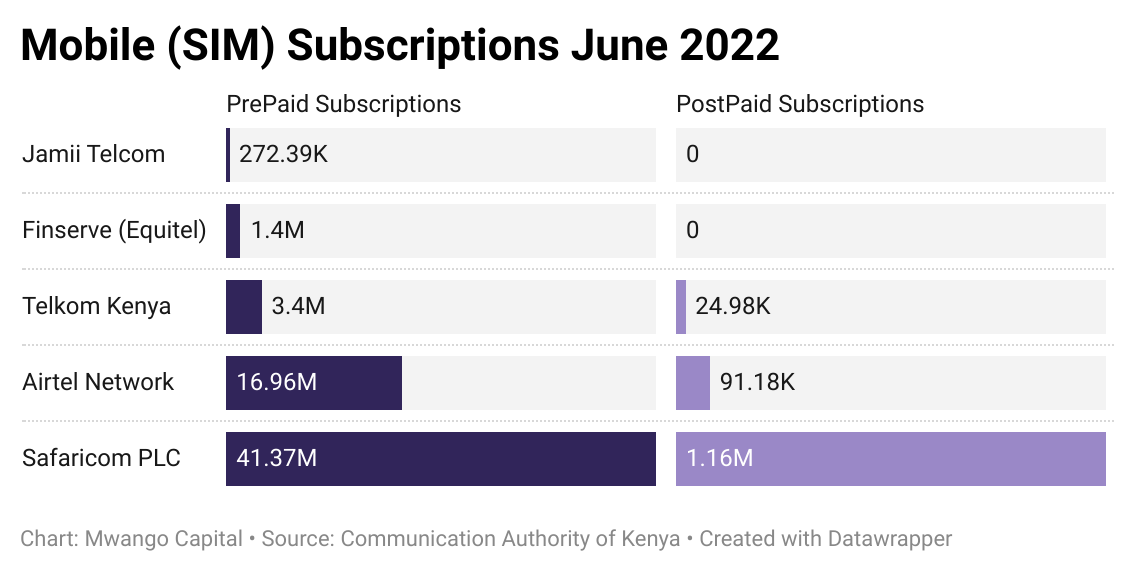

❌ Deactivated SIM Cards: The number of active mobile subscribers dropped from 64.9M in Q3 2021 to 64.7M in Q4 2021 resulting in a SIM Card penetration rate of 130.9% for mobile devices. This is after telecommunication firms deactivated SIM cards registered with incorrect identifying information.

🚩 Ghana's Debt Restructuring: Ghana is set to start talks with domestic bondholders on the restructuring of its $19B local-currency debt pile. This is part of a debt-sustainability plan to secure a $3B loan from the International Monetary Fund (IMF). Interest on domestic debt accounts for ~75% of total interest costs leading to Ghana’s Eurobonds seeing extended declines.

Interest Rate Watch

🇿🇦 South Africa: The MPC of the South African Reserve Bank (SARB) hiked its repurchase rate by 75 basis points to 6.25%. The rate hike delivered by the SARB MPC is equivalent to what was delivered by the US Federal Reserve.

🧾 The Week Ahead: We await the interest-rate decisions by Angola on Monday, Nigeria, and Lesotho on Tuesday, Mauritius on Wednesday, Kenya on Thursday, and Mozambique on Friday. Kenya's second-quarter GDP & inflation data for September for Kenya and Uganda come in on Friday.