👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Moody's upgrade of Kenya's credit outlook, CBK's infrastructure bond, and TransCentury's return to profitability.Moody’s Upgrades Kenya’s Outlook to Positive

Moody's Boost: Moody’s has revised Kenya’s credit outlook to positive from negative while affirming its Caa1 rating for both local and foreign currency debt. The change reflects easing liquidity risks and improving debt affordability, driven by lower domestic borrowing costs and strong investor demand. Since mid-2024, Treasury yields have dropped significantly following monetary easing and a stable exchange rate, reducing refinancing pressures on the government.

“The change in outlook to positive is driven by the increasing likelihood of Kenya's liquidity risks easing and debt affordability improving over time. Domestic financing costs have started to decline amid monetary easing and could continue to do so if the government sustains its more effective management of social demand and fiscal consolidation. Such a track record would also boost Kenya's access to both concessional and commercial external funding. Revenue collection efforts, if successful, present potential for further improvements in debt affordability.”

Moody’s

“The positive outlook is undoubtedly a welcome development. However, it is anchored on promising developments that are fraught with significant downside risks. On one side, we have a population justifiably opposed to tax increases—a sentiment that cannot be dismissed. On the other, the government seems steadfast in its belief that fiscal consolidation can only be achieved through tax hikes, all while failing to tackle excessive spending and the persistent mismanagement of public funds. This stark dichotomy raises serious concerns about the sustainability of the country’s fiscal trajectory. According to Treasury projections, the government anticipates an additional KES 325 billion in revenues in the next fiscal year. Yet, in reality, we see little evidence of the government meeting its current targets. Simultaneously, there appear to be no plans to curb the automatic rise in spending—a clear sign that tax increases will persist in the future. In my view, this does not paint a picture of a truly positive outlook for the fiscal space, the business environment, or investor sentiment.”

Standard Investment Bank Senior Associate Research, Stellar Swakei

Fiscal Reforms Gain Momentum: Kenya’s push for revenue-led fiscal consolidation has played a key role in the outlook upgrade. Recent tax reforms, aimed at boosting revenue by 1% of GDP, signal a commitment to narrowing the deficit and stabilizing debt at around 66% of GDP. However, the government’s track record of missing revenue targets remains a risk, and sustained fiscal discipline will be critical for long-term debt sustainability.

“The passage of tax legislation underscores a proactive stance toward fiscal consolidation and commitment to enhancing revenue collection. This revenue led strategy has the potential to produce a more durable reduction in Kenya's fiscal deficit as opposed to deficit reduction driven mainly by cuts to discretionary spending.”

Moody’s

“Moody's outlook revision from negative to positive reflects the improving fiscal position characterized by lower refinancing risks and high liquidity more so in the domestic market. Technically, a positive upgrade portends a rating upgrade within the next 24 months, which suggests that Moody's will be on the lookout for upside risks. Furthermore, the Moody's outlook revision comes hot in the heels of other rating agency announcements in the coming weeks; Fitch Ratings and S&P on 31st Jan and 21st Feb, respectively. Notably, Moody's rating is currently a notch lower on a comparable basis to Fitch Ratings and S&P (both have stable ratings), and at the very least we should expect some revision in outlook to positive from the two credit rating agencies For investors, we expect some agnostic attitude. For one, local investors care less about the ratings on their investment decisions; both debt exposure and zero consideration for equity exposure. For the offshore market, Kenya's ratings by the major agencies are all 'junk' rated, so there is that blanket consideration. I think the notable adjustment is when Kenya makes the leap from 'junk' status to 'investment grade' and that's where the tide can change in a meaningful manner”

IC Asset Managers Economist, Churchill Ogutu

Credit Risks Still Loom: Despite the improved outlook, Kenya faces elevated credit risks, including weak debt affordability and large external financing needs. The country must refinance USD 2.5B –USD 3B annually over the next five years, including Eurobond repayments. Access to concessional financing and external markets will be crucial in managing these obligations. If fiscal consolidation stays on track and financing conditions continue to improve, an upgrade from Caa1 could follow.

“We would likely upgrade Kenya's rating if domestic financing conditions improve further and fiscal consolidation measures show signs of success, engendering investor confidence that tangibly lowers liquidity risks, enhances debt affordability and places Kenya's debt burden on a durable downward trajectory.”

Moody’s

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

CBK Targets KES 70B from IFBs

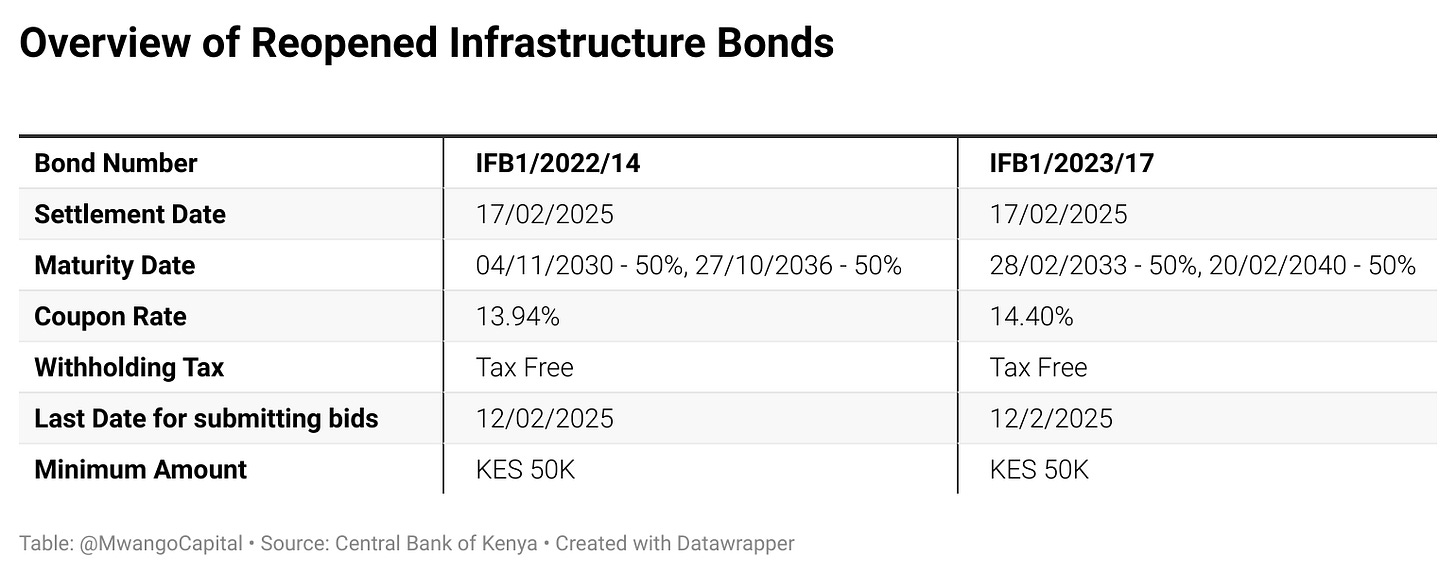

The Central Bank of Kenya (CBK) is looking to raise KES 70B through two reopened infrastructure bonds to support public development projects. The 14-year bond, originally issued in 2022, offers a coupon rate of 13.938% and has 11.8 years left to maturity. The 17-year bond, with a coupon rate of 14.399%, has 15.1 years to maturity. Both bonds will be redeemed in phases, with half of the principal repaid in 2030 and 2033, and the remainder settled upon final maturity.

Strong Demand: The tax-exempt status of these infrastructure bonds is expected to draw robust investor interest, particularly after Parliament blocked a proposed 5% withholding tax on such instruments. Earlier in 2024, a similar issuance achieved an impressive 412% subscription, raising KES 288.6B against a target of KES 70B. Investors have until February 12, 2025, to bid on the reopened bonds.

Treasury Eyes Direct Control: The Treasury has proposed transferring the role of selling government bonds and treasury bills from the Central Bank of Kenya (CBK) to the Public Debt Management Office (PDMO). This move aims to streamline debt operations and separate fiscal and monetary responsibilities. If implemented, the PDMO will take charge of administering government securities, including setting the borrowing calendar and determining debt pricing, a role currently performed by the CBK as the government’s fiscal agent.

TransCentury Returns to Profitability in H1 2024

Last week, TransCentury released its financial results for H1 2024 and FY 2023, Below are the key highlights from the period:

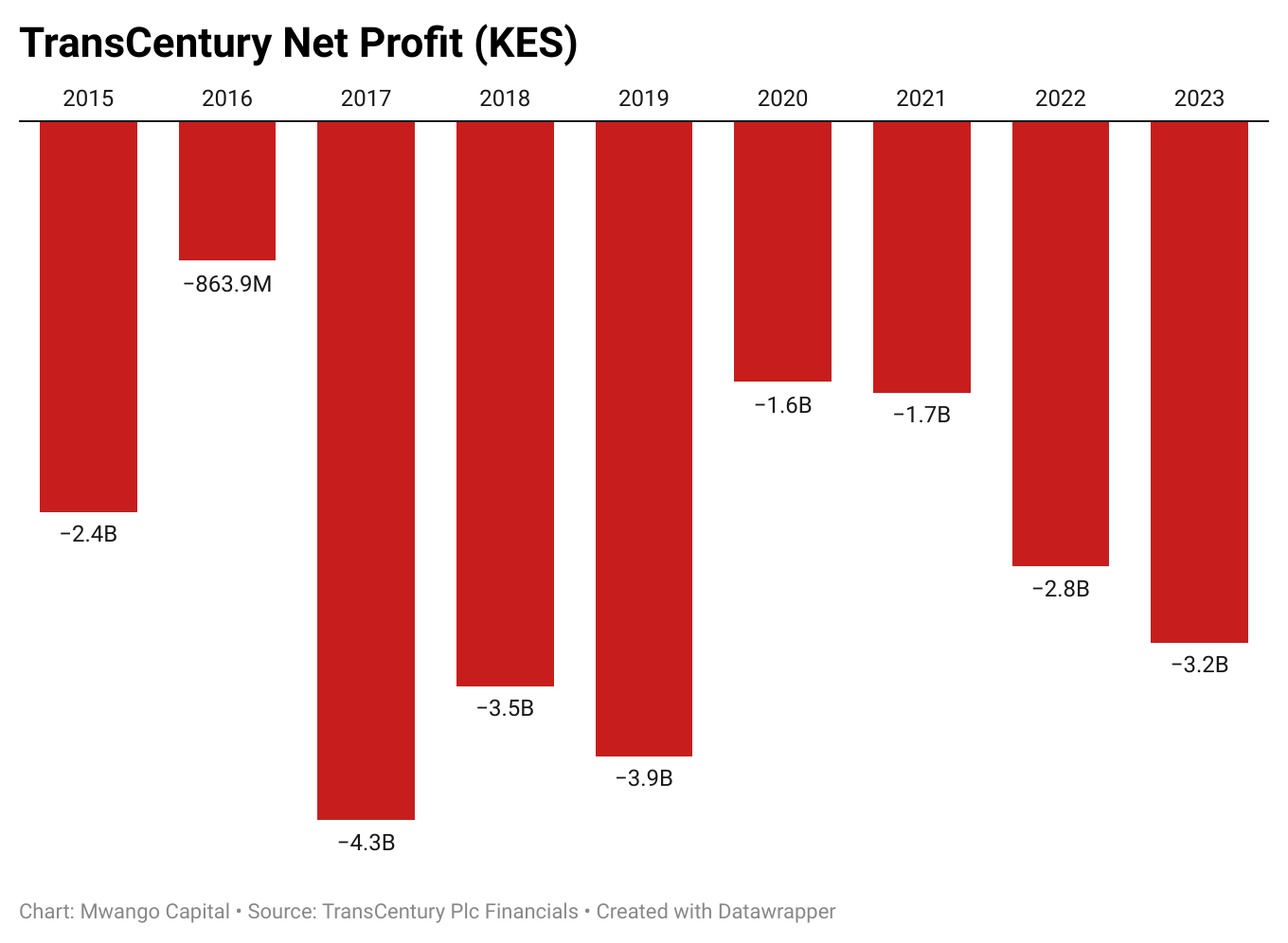

H1 2024 Results: TransCentury Ltd has returned to profitability in H1 2024, posting a net profit of KES 375M compared to a loss of KES 1.67B in the same period last year. The turnaround was driven by a 12% growth in revenue to KES 3.09B and strategic initiatives such as improved efficiencies, innovative offerings, and market development.

Operating profit surged by 1062.1% to KES 172M, supported by gains from non-core asset disposals and the Kenya Shilling’s appreciation, which reversed prior foreign exchange losses. Despite these gains, total assets declined by 19.3% to KES 10.79B, and cash and equivalents fell by 42.9% to KES 181M, reflecting ongoing financial restructuring efforts.

FY 2023 Results: TransCentury PLC recorded a 15% revenue growth for FY 2023, reaching KES 3.09B, driven by strategic efforts to expand and deepen market reach. The Group achieved an operating profit of KES 356M, a remarkable turnaround from a loss of KES 2.77B in the previous year, reflecting improved topline performance and ongoing operational efficiency initiatives.

However, the overall loss widened by 16%, with a net loss of KES 1.67B, primarily due to increased finance costs and currency depreciation in 2023, although a partial reversal occurred in 2024 with the stabilization of the shilling.

Market Reaction: TransCentury emerged as the top gainer on the Nairobi Securities Exchange last week, with its share price surging by 86% to KES 0.93. Meanwhile, its subsidiary, East African Cables, ranked as the second-highest gainer, with its share price climbing 41.96% to close the week at KES 1.59.

Markets Wrap

NSE This Week:

Kenya Airways, last week’s top gainer, plunged 36.9% to KES 5.36, making it the worst performer. TransCentury Ltd soared 86.0% to KES 0.93, leading the gainers.

The NSE 20 rose 1.82% to 2,185.8, NASI gained 1.29% to 132.5, NSE 10 climbed 3.05% to 1,371.49, and NSE 25 advanced 2.86% to 3,569.73.

Equity turnover increased 9.1% to KES 2.00B, while bond turnover rose 4.2% to KES 49.00B.

Foreign investors recorded outflows of KES 27.3M, accounting for 53.87% of turnover.

Investors await EABL’s HY results (30 Jan) and Kenya Power’s KES 0.70 dividend (31 Jan).

Treasury Bills: Treasury bills were oversubscribed with a subscription rate of 136.73%, a notable rise from 78.59% the previous week. Investors placed bids totaling KES 32.81B, of which KES 32.80B was accepted, yielding a 99% acceptance rate. Yields on the 91-day, 182-day, and 364-day bills saw slight declines, dropping by 3.95, 0.2, and 1 basis points, respectively, to 9.5252%, 10.0279%, and 11.2945%.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds increased across the board, with the KENINT 2034 recording the sharpest increase of 11.70 basis points to 9.725%, followed by the KENINT 2028, which rose by 11.10 basis points to 8.8%. The average week-on-week yield increase was 8.95 basis points.

Market Gleanings

🔺| CMA Intervenes in Genghis Dispute |The Capital Markets Authority (CMA) has stepped in to address a USD 2.74M debt dispute involving Genghis Capital, following a High Court ruling allowing auctioneers to sell the firm's properties. CMA stated it is working with Genghis to resolve the matter and reassured investors that client assets under the Genghis Money Market Fund and Mali Money Market Fund are secure, as they are held by a custodian and overseen by an independent trustee under the Capital Markets (Collective Investment Schemes) Regulations 2023.

💸| Safaricom Launches Ziidi MMF | Safaricom has officially launched the Ziidi Money Market Fund (MMF) in partnership with Standard Investment Bank and ALA Capital Limited. The fund allows customers to invest directly from their M-PESA wallet, earning daily accrued interest with free deposits and withdrawals. Since its December 2024 rollout, Ziidi MMF has attracted over 450,000 users and KES 2.85B in assets under management.

📊| KNBS to Separate Core Inflation Data | Starting next month, the Kenya National Bureau of Statistics (KNBS) will distinguish fuel, food, and transport price changes from other items in its inflation figures for better clarity on the cost of living. This shift follows the introduction of a report on core and non-core inflation, aimed at addressing discrepancies between KNBS' and the Central Bank of Kenya's (CBK) inflation data. Core inflation, which excludes food and fuel, helps CBK plan long-term monetary policies to ensure price stability.

✔️| Cabinet Approves Restructures | The Cabinet has approved the merger of 42 State Corporations with overlapping mandates into 20 entities to boost efficiency. Nine corporations will be dissolved, with their functions transferred to relevant ministries or other bodies, while 16 corporations with outdated mandates will be divested or dissolved. Six corporations will be restructured to enhance performance, and four public funds will be declassified and returned to ministries. Additionally, all professional bodies classified as State Corporations will be declassified and will no longer receive government funding.

⚖️| Court Rules Against Safaricom on Bonga Points | The High Court of Kenya ruled against Safaricom PLC in a case challenging the expiry of Bonga Points older than three years, declaring the move unconstitutional. The court held that once awarded, Bonga Points become the property of consumers, forming an economic interest protected under Article 46 of the Constitution. Safaricom’s unilateral introduction of expiry dates was deemed a breach of legitimate expectations and consumer rights. The court quashed the notice and prohibited its implementation, reinforcing protections for consumers in loyalty programmes.

⚖️| Leadership Changes |

Bamburi Cement: The Board of Directors of Bamburi Cement Plc has announced changes following the transfer of shareholding from Holcim to Amsons Industries (K) Limited. Non-Executive Directors Claudia Albertini, Grant Earnshaw, and Kaspar Theiler have resigned, effective January 21, 2025. Ms. Albertini, appointed on July 20, 2024, served on the Audit & Risk Committee; Mr. Earnshaw, appointed on February 26, 2024; and Mr. Theiler, appointed on May 7, 2024, served on the Nomination, Remuneration & HR Committee.

DTB: The Board of Directors of Diamond Trust Bank Kenya Limited (DTB) has announced the resignation of Mr. James Loden as Chief Operating Officer, effective January 22, 2025.

I&M Group: The Board of I&M Group PLC has announced the appointment of Ms. Shelia Cheruto Tiren as Group Executive General Manager Human Resources (GEGM HR), effective January 20, 2025. Ms. Tiren has over 20 years of experience in human resources, having served in senior roles at Safaricom Plc, Absa Bank Kenya, Barclays Bank Zambia, and Stanbic Bank.

💰| IMF Roundup |

Ethiopia: The IMF has approved a USD 248M disbursement to Ethiopia under the Extended Credit Facility, bringing total payouts to USD 1.61B to support balance of payments needs.

DRC: The IMF approved a 38-month arrangement for the Democratic Republic of the Congo, with USD 1.73B under the Extended Credit Facility and USD 1.04B under the Resilience and Sustainability Facility, totaling USD 2.77B to support economic reforms.