👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Q3 2023 banking sector results from Kenya’s listed banks.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Any plan that involves food is now sweeter especially when you pay with CO-OP Bank Visa Card. Spend KES 1000 and above at selected Creamy Inn, Vasilis, Chicken Inn, Pizza Inn, and Galitos outlets and get a KES 300 voucher!

Equity Group, Standard Chartered Kenya, KCB Group, NCBA Group, I&M Group, Absa Bank Kenya, and Stanbic Bank Kenya all released their Q3 2023 earnings during the week. Some of the general trends we observed from the results included increased cost of funds, increased provisioning, cuts in government securities holdings, and regional subsidiaries outperforming the Kenyan units.

KCB Group Assets Reach KES 2T

Kenya’s Largest: After breaching KES 1T in assets in 2021, KCB Group’s asset base was up 65% year-on-year to cross the KES 2T mark and reach KES 2.1T. This is attributable to 43% organic growth and 22% owing to the TMB consolidation. This was the highest growth in assets across the reporting banks followed by I&M Group which was up 26.9% to KES 544.1B. Standard Chartered Kenya recorded the lowest growth at 1% to KES 369.7B.

For the Kenyan banking units, KCB Kenya recorded the highest growth in assets at 49.7% while StanChart Kenya recorded the lowest growth at 1.0%. KCB Kenya was the market leader at KES 1.4T in assets, with Equity Bank Kenya Limited (EBKL) following at KES 973.2B - a gap of KES 433.7B [Q3 2022: KES 61.8B].

Loan Books vs Govt Securities

Pivot Towards Lending: KCB Group’s loan book was up 38.1% to KES 1T to account for 49.91% of the balance sheet [Q3 2022: 59.46%]. The growth was driven by KES 214B in organic growth and KES 75B from the TMB integration. For Equity Group, loans grew by 26% to KES 845.9B, accounting for 50.0% of assets [Q3 2022: 49.4%]. StanChart and Stanbic recorded the lowest growth in their loan books, up 5.5% and 5.9% to KES 143.6B and KES 250.9B, respectively. Absa had the highest loan-to-deposit ratio at 93.4% [Q3 2022: 102.9%] while StanChart had the lowest at 48.0% [Q3 2022: 47.6%].

G-Secs Holdings: Only Equity Group, I&M Group, and KCB Group increased their stocks of government securities, up 4.1%, 14.6%, and 33.4% to KES 242.8B, KES 73.9B, and KES 325.6B, respectively. StanChart led in cutting aggregate government securities holdings, reducing them by 46.3% to KES 103.6B. This was followed by Absa at 23.8%, Stanbic at 17.1%, and NCBA Group at 2.9%. For StanChart Kenya, there was a notable 51.9% decline in Kenya government securities held at fair value through Other Comprehensive Income (OCI) to KES 53.6B.

Expensive Deposits

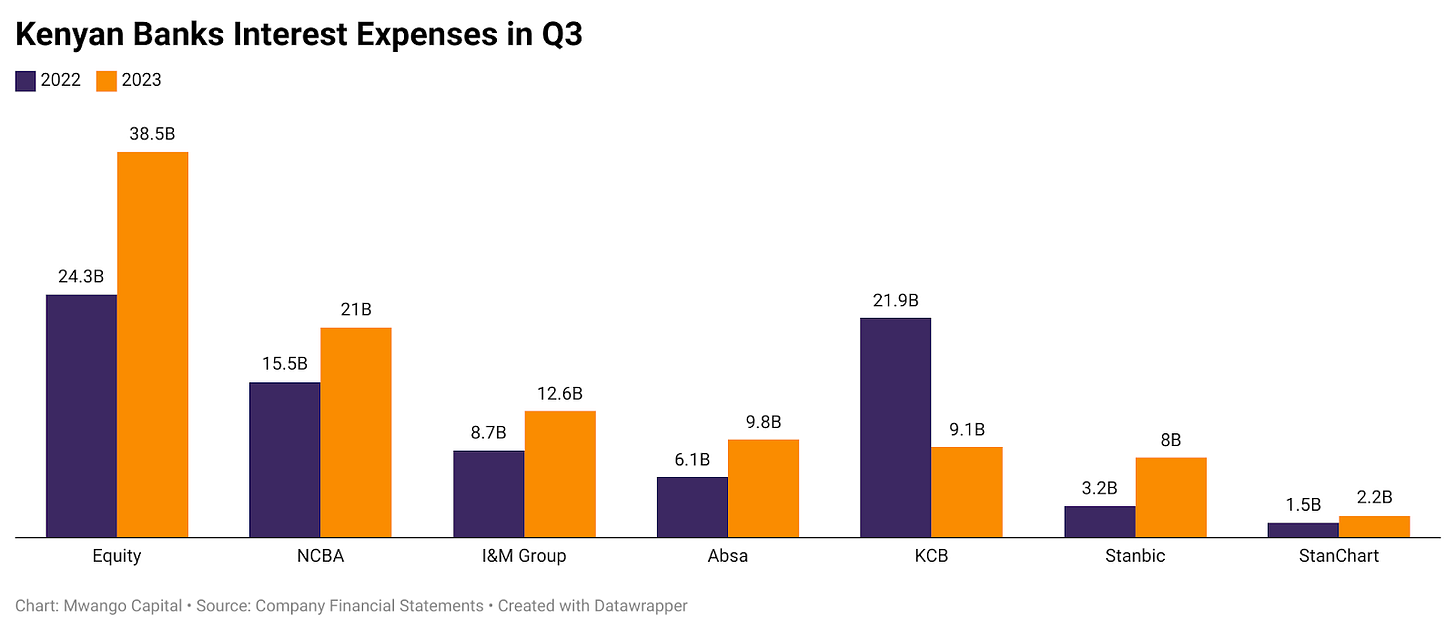

Increased Interest Expenses: Stanbic Bank recorded the highest growth in interest expenses, up 152.1% to KES 8B, growing 3.2X the pace of interest income growth. Equity Group’s total Interest expenses edged higher by 58.4% at the Group level to reach KES 38.5B, growing at nearly twice the 32.1% recorded for total interest income in the period. NCBA Group recorded the lowest growth in interest expenses at 35.3% to KES 21B.

Concerning Asset Quality

Increased Provisioning: Equity’s gross NPLs grew the highest, up 83.5% to KES 124.4B, while Net NPLs were KES 58.1B, up 130.9%. As a result, provisions grew by 96.6% to KES 18.9B, making up 22.5% of operating expenses [Q3 2022: 16.7%]. KCB Group had the largest absolute gross NPLs at KES 187B, up 25.3%, on account of KES 10B, 20B, and 44B accruing from the TMB impact, FX losses, and downgrades, respectively. KES 21B in recoveries and KES 15B in write-offs offset the growth. Provisions grew by 118.1% to KES 15.8B. Despite a 2% drop in gross NPLs to KES 23.6B, StanChart had the highest growth in provisions at 193.4% to KES 1.8B.

Subsidiaries Outperforming Kenyan Units

Subsidiaries Anchor Earnings: Among the banks that have reported, Stanbic Bank Kenya, Absa Bank Kenya and Standard Chartered Bank are the only banks that recorded profit growth for their Kenyan banking units. Other banks saw their PAT decline, only for subsidiaries to bolster the aggregates and return a profit at the Group level.

KCB Group: Excluding KCB Kenya, other subsidiaries accounted for 33.4% of Group assets [Q3 2022: 26.4%], with TMB accounting for 13.3% of the asset base. KCB Uganda recorded the highest year-on-year growth in asset size at 70% to KES 51B. Total assets in subsidiaries outside Kenya were KES 548B, up 5%, while net earnings grew by 3X to KES 12B driven by growth in Tanzania, Uganda, South Sudan, and TMB integration.

Equity Group: EBKL PAT fell by 20% to KES 19.3B, weighed down by challenging macroeconomic conditions. However, at the Group level, PAT rose by 5.3% to KES 26.2B. The decline in EBKL PAT was offset by the robust earnings from the subsidiaries. In terms of contribution to Profit Before Tax (PBT), Equity BCDC pulled in KES 15.6B, up 157% year-on-year, compared to a 26% drop in EBKL’s PBT to KES 22.7B, out of an aggregate of KES 45.9B in PBT.

"We are aware of the macroeconomic challenges, the significant rise of interest rates as a result of higher inflation in the earlier part of the year, and the significant depreciation of the local currencies against the US Dollar. While the risks have concentrated in Kenya, we have seen the offset from the other subsidiaries. We have seen a strong benefit coming from geographic diversification as the other subsidiaries in the other countries offset the stress in Kenya."

Equity Group Chief Risk Officer, Sam Gitwekere

Macro Environment

Currency Depreciation, a Headwind: The macroeconomic fundamentals, especially around the performance of the Kenyan Shilling had a significant impact on operations in the period. Relative to the US Dollar, the exchange rate of the Kenyan shilling stands at 152.89. It has lost 23.9% of its value in 2023, 25% over the last 1 year, and 22.7% between Q3 2022 and Q3 2023.

"If you look at the countries we operate in, the country that has had the biggest impact of the global macro shock is Kenya. It is the country whose currency has had the highest depreciation. That has carried the biggest impact as it has translated to imported inflation at a time the country had to import food, energy. While that required a lot of dollars, it is when the US and the developed world increased rates and they became more attractive than emerging markets. While we needed US dollars for imports, there were massive outflows and that made the situation in Kenya challenging."

Equity Group Chief Executive Officer, Dr. James Mwangi

"The depreciation of the shilling, particularly for Kenya, has caught us. And you will see it in the numbers in many organisations. That comes with challenges, particularly on the credit book - on facilities that are dollar-denominated. And it's not a KCB issue, it is not a one institution issue, it comes with a challenge for banking."

KCB Group Chief Executive Officer, Paul Russo

Consumer Wallets Shrinking: Last month, on the sidelines of the annual meetings of the International Monetary Fund and World Bank in Marrakech, Morocco, Dr. James Mwangi pointed out that the customer was coming under pressure.

“You see disposable income for most of the households shrinking by up to 30%. That means reduced economic activities and that is reflected in the transaction volumes.”

Equity Group Chief Executive Officer, Dr. James Mwangi

In Equity’s set of released results, transaction numbers on EazzyNet, Equitel, and Equity Mobile App fell by 10%, 16%, and 68% to 1.6M, 237.5M, and 161.6M, respectively. In terms of transaction value, only Equitel recorded a decline, with the aggregate transacted value falling by 38% to KES 1.19T. Separately, at their investor briefing, KCB Group executives also highlighted the falling disposable incomes in Kenyan households:

"You can tell the impact of shrinking disposable income from households, that you know the impact of that does show in a lot of our business by way of NPL."

KCB Group Chief Finance Officer, Lawrence Kimathi

"There are obviously fiscal pressures and I think disposable income is shrinking."

KCB Group Chief Executive Officer, Paul Russo

Profitability and Dividends

Just like in H1 2023, Stanbic reported the highest growth in PAT in Q3 2023, up 32.7% to KES 9.3B. Equity reported the largest absolute PAT in the period at KES 36.2B, up 5.3%. KCB Group’s bottom line grew the least relative to Q3 2022, rising by 0.4% to KES 30.7B. StanChart Kenya’s net income edged higher by 11.3% to KES 9.7B, and the bank declared an interim dividend of KES 6.00, unchanged from Q3 2022.

Share Price

Market Performance at the NSE: Last week, NCBA Group gained the most across the reporting banks, up 6.87% week-on-week to KES 38.10. Absa gained 4.98%, Stanbic 4.8%, KCB 2.84%, StanChart 1.28% and Equity 0.79% to KES 11.60, KES 109.25, KES 19.90, KES 158.50, and KES 38.20, respectively. Here is what executives had to say on market performance of some of their banks:

"The last time we were discussing here, our market cap was equal to the size of the next two largest listed banks. If you look at the numbers, we are now almost the size of the three next largest banks."

Equity Group Chief Executive Officer, Dr. James Mwangi

"One, is obviously, when you look at individuals, the disposable income. That is not the major issue. Foreign investors are down on average 42% - 45%. They are getting out. But the other fundamental issues and I want to speak about them, when I speak to investors, they tell me we are worried about your NPL. I said yeah, but we were aggressive. We were the first to make the right call. I am glad as I stand today, everybody is starting to see the direction of travel."

KCB Group Chief Executive Officer, Paul Russo

Banking News Roundup

Access Bank Adjusts Rates: Access Bank Kenya announced last week that it was revising its base lending rate upwards to 16.63% p.a. effective 17th December 2023, applicable to all existing and new Kenya Shilling-denominated credit facilities. The adjustment is in light of higher short-term interest rates in the macroeconomic environment.

Family Bank Rights Issue: Family Bank Kenya’s Board of Directors has extended the Rights Issue Closure date from 16th November 2023 to 30th November 2023. The bank is seeking KES 800M in additional capital via a rights issue. Separately, the bank’s Board of Directors last week appointed Nancy Njau as Managing Director and Chief Executive Officer to replace Rebecca Mbithi who is leaving to pursue personal interests after 5 years at the helm.

Find a consolidated document containing results from Equity Group, Standard Chartered Kenya, KCB Group, NCBA Group, I&M Group, Absa Bank Kenya, and Stanbic Bank Kenya here.

Markets Wrap

NSE: In Week 47 of 2023, Standard Group was the top-performing stock, up 25.8% to close at KES 7.50. Olympia was the worst-performing stock, down 13.1% to close at KES 2.65. The NSE 20 index increased by 2.6% to close at 1,510.3 points, the NSE 25 increased by 2.5% to close at 2,416.5 points, and the NASI index increased by 1.9% to close at 92.2 points. Equity turnover increased to KES 519.5M from KES 441.1M the prior week while bond turnover closed the week at KES 13.9T compared to the prior week’s KES 11.8T.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.4426%, 15.4445%, and 15.5828% respectively. The total amount on offer was KES 24B with the CBK accepting KES 26.6B of the KES 27.6B bids received, to bring the aggregate performance rate to 115.11%. The 91-day and 364-day instruments recorded 584.91% and 18.52% performance rates, respectively.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2028 fell the most week-on-week, down by 52.00 bps to 11.581% while KENINT 2048 fell the least, depreciating by 20.10 basis points to 11.307%. The average week-on-week change stood at -32.05 bps.

KENINT 2028 rose the most on a year-to-date (YTD) basis, appreciating by 126.9 bps while KENINT 2024 rose the least at 20.0 bps.

Prices rose across the board week-on-week, with KENINT 2034 rising the most at 2.4% to 73.878. KENINT 2024 appreciated the least at 0.2% to 96.813. Year-to-date, KENINT 2024 was the only price that rose, appreciating by 4.7%. The largest price losses YTD were 4.7% for KENINT 2034 to 73.878. The average price change week-on-week and YTD was -0.03% and 0.02%, respectively.

Market Gleanings

💸| Centum RE Maturing Notes | Centum Real Estate Limited this week announced the repayment of its outstanding Senior Secured Zero Coupon Fixed Rate Notes and Senior Secured Zero Coupon Equity Linked Notes, amounting to KES 2.95B, issued in 2020. The repayment date was Friday, 24th November 2023.m the Fixed Income Market Segment of the Nairobi Securities Exchange.

⚠️ | More Profit Warnings |

Crown Paints Kenya PLC: The Board of Directors announced that, based on a preliminary assessment of the unaudited consolidated accounts, the group’s full-year earnings are expected to decrease by more than 25%. This is attributed to increased raw material costs, higher transport expenses, foreign exchange rate volatility, and a slowdown in economic activities.

WPP Scangroup: The Board of Directors announced that the group’s net earnings for the financial year ending 31st December 2023 are expected to be lower than the previous year. This is due to the continued subdued economic environment which has led to cautious spending by clients and a restructuring program that led to a one-off severance cost of KES 178M.

☎️| Call Rates to Drop | Calling rates are set to drop in Kenya following a review of mobile termination rates (MTRs) and fixed termination rates (FTRs) by the Communications Authority of Kenya (CA). The new MTRs and FTRs have been capped at KES 0.41 per minute, effective from 1st March 2024.

⚡| Ormat - Kenya Power | As of 30th September 2023, the amount outstanding from Kenya Power to Ormat Technologies was USD 50.6M of which USD 0.5M was paid in October 2023. In the 9 months ending 30th September 2023, Kenya Power contributed to 14.0% of Ormat's gross revenues compared to 14.9% in 2022.

💸| World Bank USD 12B Funding | Kenya is set to receive up to USD 12B in financial support from the World Bank over the next three fiscal years (FY24 - FY26), subject to the approval of new operations by the Bank's Executive Directors. This financial package is expected to provide support for Kenya’s ambition to become an upper-middle-income country by 2030.

🤝 | EAC Admits Somalia | Somalia has officially joined the East African Community (EAC) as its eighth member. The country's admission was approved by the region's leaders during the 23rd ordinary summit of the heads of state held in Arusha, Tanzania, on Friday, 24th November, 2023.

🔴 | Ethiopia Cancels 3rd Telecoms Licence | Ethiopia has cancelled its search for an international telecoms licence due to a lack of market interest. The Ethiopian Communications Authority (ECA) launched the bidding process in June. The country is also seeking the sale of a 45% stake in the state-run operator, Ethio Telecom, to an international company.