Kenya’s Deals at the IMF Spring Meetings

The USD 750M World Bank loan is expected by early June 2025

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya's highlights at the IMF Spring Meetings, President Ruto's visit to China, and the government's consideration to diversify reserves with gold.Kenya’s Deals at the IMF Spring Meetings

IMF Cuts Global Growth Projections: At this year's IMF and World Bank Spring Meetings, the IMF downgraded its global growth forecast to 2.8% for 2025, citing rising trade tensions and uncertainty fueled by U.S. tariff policies. Chief Economist Pierre-Olivier Gourinchas warned that the global economic system is undergoing a major reset, with escalating trade barriers threatening to further slow down global trade and growth. Alongside the global revisions, the IMF also trimmed Kenya’s GDP growth outlook, now projecting the economy to expand by 4.8% in 2025, slightly lower than the 5.0% growth forecast issued in October 2024.

Kenya Set to Receive USD 750M World Bank Loan: Kenya expects to receive the full USD 750M World Bank loan by early June 2025 after addressing key conditions tied to governance reforms. Treasury Cabinet Secretary John Mbadi said progress on the Conflict of Interest Bill 2025, which was recently sent back to Parliament for strengthening, helped clear the way for disbursement. Central Bank Governor Kamau Thugge confirmed that macroeconomic and policy requirements had been met, with the World Bank board expected to approve the funding in May.

Kenya Signs EUR 60M Deal with OPEC Fund: Kenya has signed a EUR 60M agreement with the OPEC Fund to support a series of infrastructure and energy projects. Treasury Cabinet Secretary John Mbadi and OPEC Fund President Dr. Abdulhamid Alkhalifa signed the deal on the sidelines of the IMF and World Bank Spring Meetings in Washington, D.C. The funding will go towards projects including the Kenyatta National Hospital Burns and Paediatrics Centre, rural electrification in five regions, expansion of the Bura Irrigation Scheme, Kenya Electricity Expansion, and urban roads development in Wajir.

Kenya Rules Out Exceptional Access in New IMF Talks: On the sidelines of the World Bank Spring Meetings, Central Bank of Kenya Governor Kamau Thugge said Kenya is not seeking exceptional access in its talks with the IMF for a successor programme. He noted that the government is comfortable within the Fund’s normal access limits and expects repayments of about USD 1.05B between 2025 and 2027 to create room for further borrowing under the 600% of quota ceiling. The new programme could start with a modest disbursement but may be scaled up as repayments unlock additional space.

This week’s newsletter is brought to you by Arvocap Asset Managers.

𝐅𝐮𝐧𝐝𝐬 𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 | 𝟑𝐫𝐝 𝐉𝐮𝐧𝐞 𝟐𝟎𝟐𝟒 - 𝟑𝟏𝐬𝐭 𝐌𝐚𝐫𝐜𝐡 𝟐𝟎𝟐5

📊 10 months. Multiple funds. One mission—growing your wealth with purpose.

At Arvocap, our funds are more than investment vehicles—they're designed to align with your vision, your pace, and your dreams.

Here’s a glimpse into how our nest of funds has performed over the last 10 months:

💰 Almasi Fixed Income Accumulation Fund

For the steady builder who values consistency and compounding.

📈 Thamani Equity Fund

For bold investors ready to tap into the growth of Kenya’s stock market.

🌍 Africa Equity Special Fund

For those betting on Africa’s giants and long-term continental prosperity.

🎯 Ngao Income Fund

Decide how and when your income comes to you—flexible, efficient, and tailored to your lifestyle.

💼 Arvocap Money Market Fund

Your premier cash management tool—secure, accessible, and smart.

And that’s just the beginning.

🚀 We offer a broader range of expertly managed funds, each crafted to meet unique investment needs and goals.

🔗 Visit www.arvocap.com or call us today to explore the full list and find the fund that’s right for you.

President Ruto’s Visit to China

Last week, President William Ruto made his inaugural State Visit to China, where he held discussions with Chinese President Xi Jinping. The bilateral talks focused on enhancing cooperation in areas such as trade, infrastructure, and sustainable development.

Key Infrastructure Projects: During the visit, both sides committed to advancing major infrastructure projects. Key developments include the extension of the Standard Gauge Railway (SGR) from Naivasha to Malaba, the expansion and dualing of the Nairobi-Nakuru-Mau Summit highway, and upgrades to the Eldoret Bypass, the Kiambu-Northern Bypass, and the construction of Nithi Bridge. Kenya and China also agreed to implement the Intelligent Transport System and Junction Improvement Project in Nairobi, aimed at easing traffic congestion and modernising urban mobility.

New Trade Agreements: Kenya and China signed a Framework Agreement on Economic Partnership, which will focus on improving market access for Kenyan exports like tea, coffee, and macadamia. This agreement is expected to increase trade and strengthen economic ties between the two nations. Separately, during a Kenya-China Private Sector Roundtable, President Ruto oversaw the signing of investment agreements worth USD 1.06B.

Earnings Wrap

BOC Posts Higher Profit: BOC Kenya reported a 6.9% increase in profit after tax to KES 211.6M for FY 2024, supported by lower taxes and improved margins. Revenue fell 21.8% to KES 1.2B, mainly due to the completion of donor-funded medical infrastructure projects in 2023. Operating profit declined 17.5% to KES 222.5M, while total assets rose 4.3% to KES 2.3B. The board declared a final dividend of KES 8.65 per share, up from KES 6.05 in 2023. BOC plans to install additional donor-funded oxygen plants by mid-2025 to expand access to remote health facilities.

Jubilee Life Profit Jumps on Investment Gains: Jubilee Life Insurance reported a turnaround in FY 2024, posting a profit after tax of KES 2.1B, up from just KES 19.4M in 2023. The surge was driven by an 87.4% increase in investment returns to KES 17.1B. Insurance revenue fell 8.1% to KES 4.8B, but the overall net financial result swung to a KES 3.3B surplus from a KES 1.2B loss the year before. Earnings per share jumped to KES 83.19 from KES 0.78. Jubilee Life, is a fully owned subsidiary of Jubilee Holdings.

WPP ScanGroup Swings to Losses on Forex Hit: WPP ScanGroup posted a loss after tax of KES 506.7M for FY 2024, compared to a profit of KES 130.1M in the previous year. Revenue declined 23.6% to KES 2.4B, while cash generated from operations fell by KES 442.5M. Total assets were down 10.7% to KES 7.2B, and earnings per share dropped to negative KES 1.17 from positive KES 0.31 in 2023. The company attributed the performance mainly to foreign exchange losses of KES 249M, reversing a gain of KES 288M the year before, as the strengthening Kenyan Shilling impacted dollar-denominated transactions across its operations in 39 African markets.

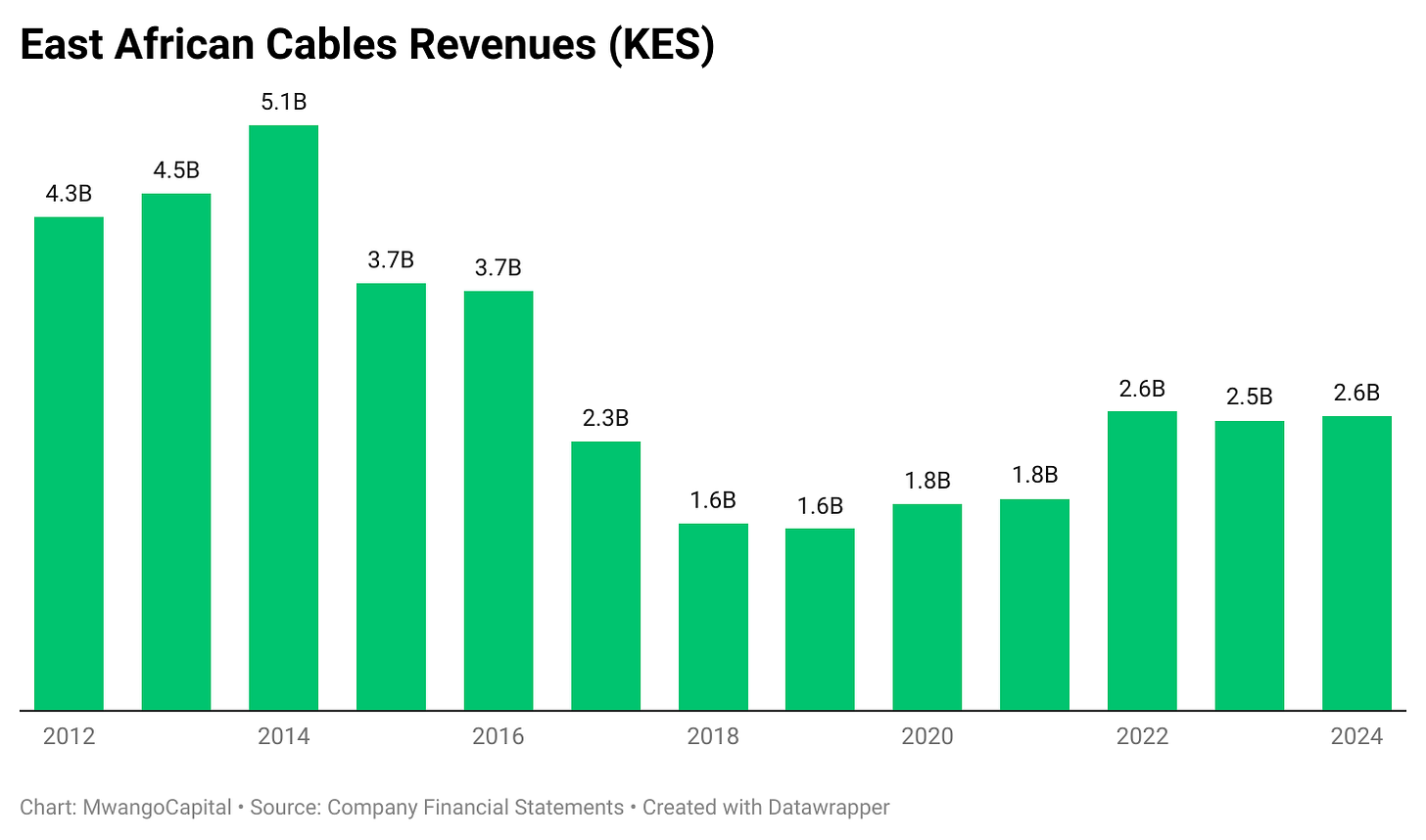

East African Cables Losses Widen: East African Cables saw a 1.7% increase in revenue to KES 2.6B for FY 2024, driven by new products and market channels. Gross profit grew 12.8% to KES 755.9M, while EBITDA improved significantly to KES 179M, up from a loss in the prior year. However, the company reported a wider loss after tax of KES 358.8M, compared to KES 301.9M in 2023, due to higher finance costs. Total assets dropped 11.5% to KES 4.8B. The company is focusing on regional expansion and managing debt issues, with no dividend declared for the year.

Markets Wrap

NSE Weekly Recap: Week 17 (18–25 Apr 2025)

Markets edged higher amid strong domestic trading despite foreign exits.

NASI: +0.38% | NSE 20: +0.02% | Mkt Cap: KES 1.97T (+0.37%)

Top Gainer: Absa New Gold +12.5% to KES 4,000

Top Loser: Sanlam -12.2% to KES 8.96

Equity turnover surged +138% to KES 2.28B

Foreign net outflows: KES 110.4M (15.3% of mkt)

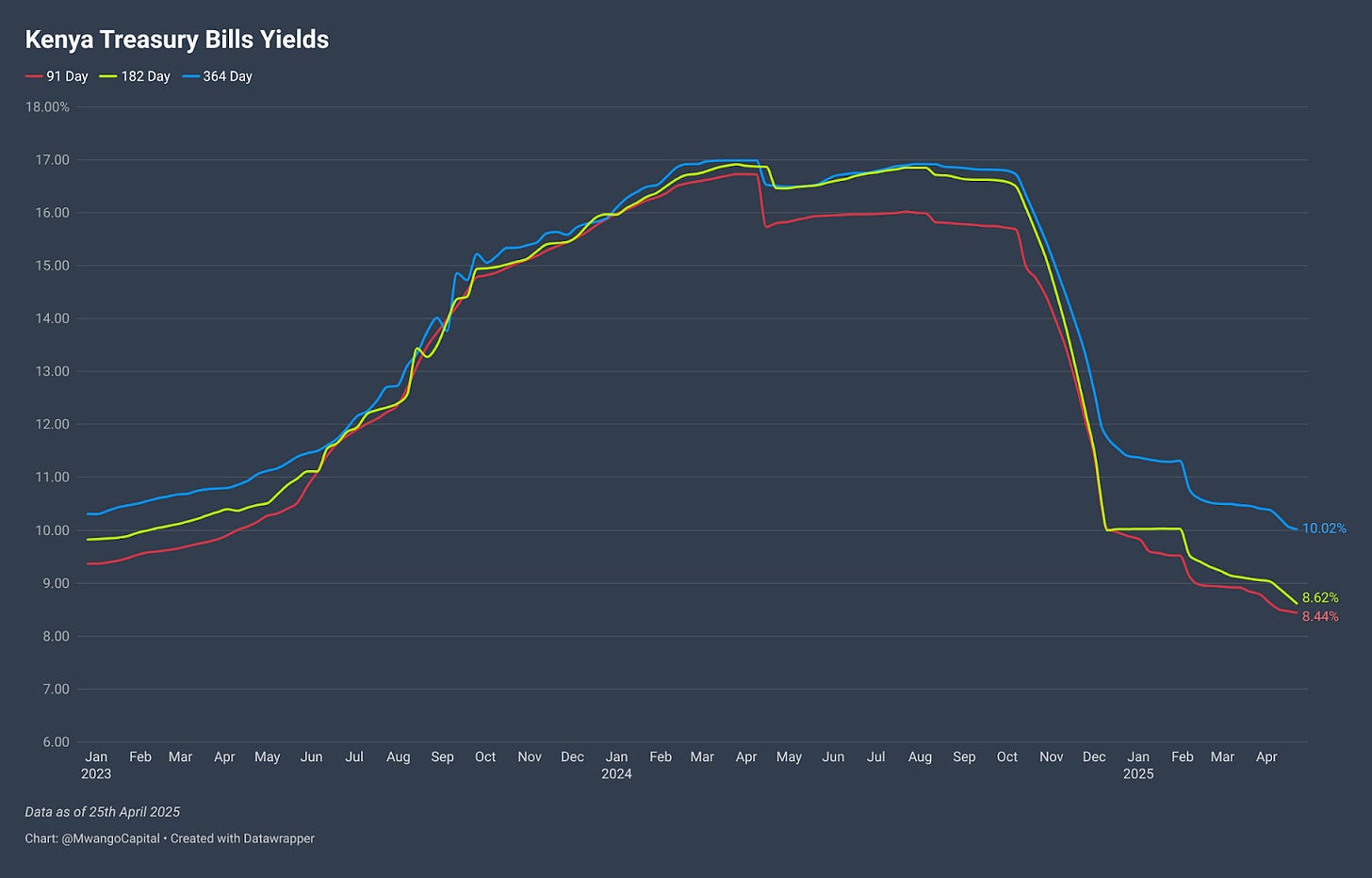

91D T-Bill: -2.7bps to 8.44% | 182D: -14bps to 8.62%

Eurobond yields eased slightly across the curve

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 178.53%, up from 160.08% the previous week. Investors placed bids totaling KES 42.84B, with the Central Bank of Kenya (CBK) accepting KES 42.76B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 2.65, 13.95, and 5.04 basis points to 8.4434%, 8.619%, and 10.0208%, respectively.

Treasury Bonds: The Central Bank of Kenya is reopening three Treasury bonds—15, 20, and 25-year tenors—with coupon rates of 13.942%, 12.000%, and 14.188%, respectively. A total of KES 80B is on offer to support budgetary needs. Bidding for the 15- and 25-year bonds runs until April 30, while the 20-year bond is open until May 7. Minimum competitive bids are set at KES 2M per tenor via the CSD system. Settlement dates are May 5 and May 12.

Eurobonds: Last week, yields on the seven outstanding Eurobonds declined, led by the KENINT 2028 bond, which dropped by 98.60 basis points to 9.461 percent. The KENINT 2031 bond followed, falling by 87.10 basis points to 10.304 percent. Overall, Eurobond yields declined by an average of 59.29 basis points week-on-week.

Market Gleanings

🏦| Government Considering Diversifying Reserves with Gold | The Central Bank is actively exploring the addition of gold to its foreign-exchange reserves to diversify beyond traditional currencies like the US dollar, according to Governor Kamau Thugge. Speaking during the IMF and World Bank Spring Meetings, Thugge said a team is assessing the feasibility of the move, reflecting a global shift where central banks are boosting gold holdings to hedge against currency risks and geopolitical uncertainties. Current reserves include just 600 ounces of gold, valued at about KES 169M (USD 1.3M).

🚗| MojaEV to Start Local EV Assembly | MojaEV Kenya Ltd., a Chinese-backed electric vehicle distributor, plans to begin local assembly in August at Associated Vehicle Assemblers in Mombasa as a way to reduce the high import taxes that burden the EV sector. The company targets assembling up to 300 vehicles a month and 1,500 units annually, with long-term plans to set up its own factory for battery and solar components. Currently exporting to Tanzania, MojaEV also plans to expand into several other African countries. Local production is expected to lower vehicle prices, which now range between KES 2.5M and KES 7.5M.

✅| Jubilee to Consolidate Uganda Insurance Units | Jubilee Holdings Limited has announced plans to merge its life and health insurance subsidiaries in Uganda as part of efforts to streamline operations and improve efficiency. The two businesses will combine under a new entity, Jubilee Life and Health, while a separate investment arm will remain operational. The merger will not affect operations in Kenya or Tanzania, and existing Ugandan policyholders will not experience changes. Completion of the transaction is subject to approval from the Ugandan regulators.

🤝| China-Kenya Trade Hits Record in Q1 | In the first quarter, trade between China and Kenya reached a record 16.13 billion yuan (about USD 2.24B), marking an 11.9% increase from the previous year. China’s exports to Kenya rose by 11.8%, while Kenya’s exports to China grew by 13.2%. China is Kenya’s largest trading partner, and Kenya is China’s top partner in East Africa.

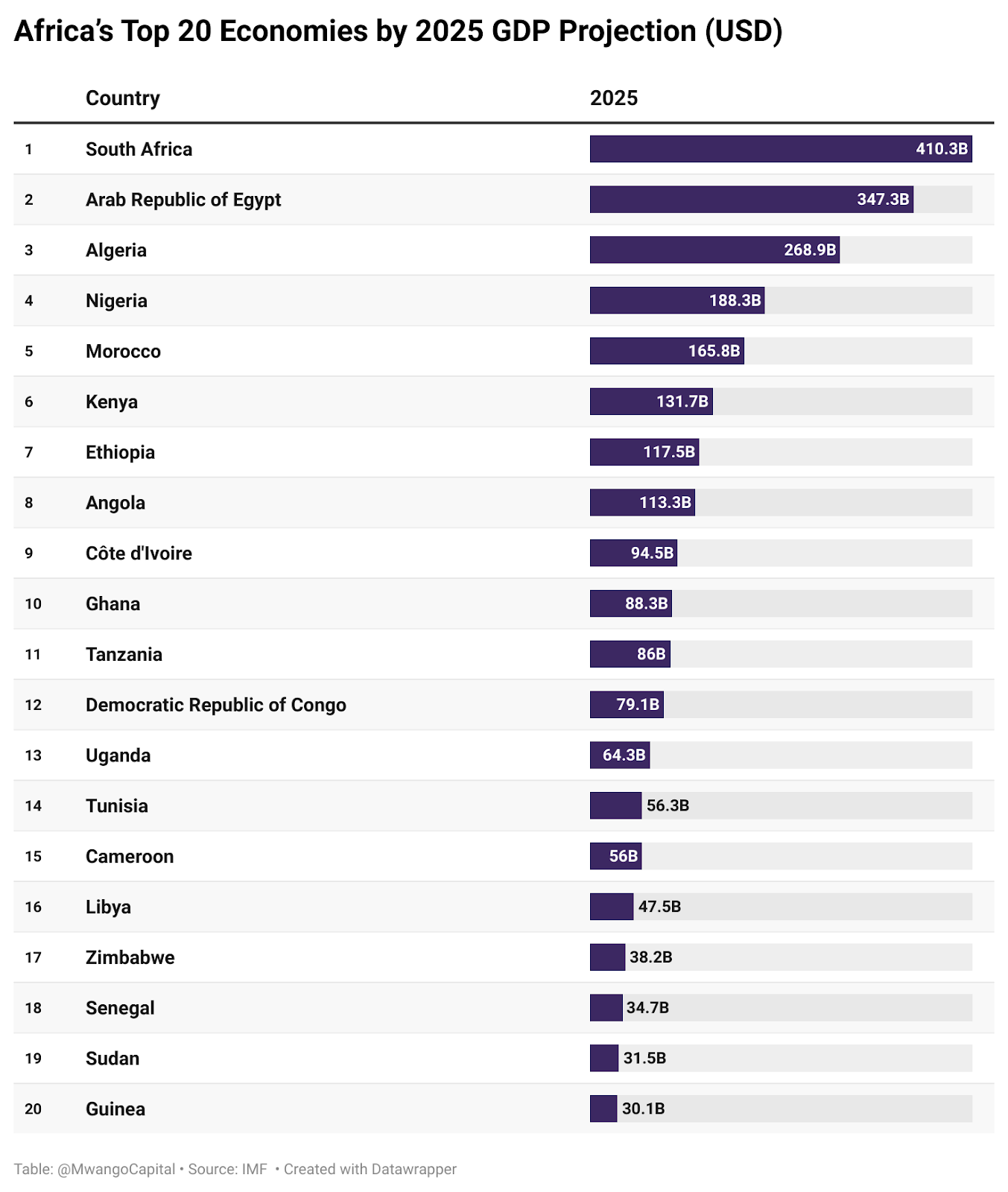

🇪🇹| Ethiopia to Join BRICS New Development Bank | Ethiopia is set to join the BRICS New Development Bank (NDB), becoming the fourth African country to do so. The move follows applications and political backing from all BRICS members. This development further extends the bank's reach in Africa, adding to its existing members, South Africa, Egypt, and Algeria, and reinforces Ethiopia's position in regional and global economic frameworks.

🤝| Kenya, Ethiopia Sign MoU to Boost Border Trade | Kenya and Ethiopia have signed an MoU to enhance cross-border trade at the Moyale border under the AfCFTA framework. The agreement establishes a USD 1,000 trade threshold for goods, simplifying processes for border communities. It allows traders to make up to four trips per month, with specific product lists for both countries. The deal is expected to boost bilateral trade, with Kenya being Ethiopia’s largest export market in the Horn of Africa.

💻| Cyberattacks in Kenya Surge to 2.5B | Cyberattacks in Kenya rose to 2.5 billion in Q1 2025, a 201.85% increase from 840.9 million in Q4 2024, with key sectors such as finance and healthcare being the primary targets. The rise is attributed to weak system safeguards, increased use of AI-driven attacks, and low user awareness. The Communications Authority's Computer Incident Response Team (KE-CIRT) noted that system attacks, which compromise critical infrastructure, saw a 228% spike.