👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover more Q3 2022 bank earnings and the debt markets.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

Equity Q3 2022 Results

Total Assets up 15%: In the nine months to September 2022, the asset base grew 15.2% year-on-year to KES 1.4T [2021: KES 1.2T]. The loan book grew 20.6% to reach KES 673.9B while investment securities increased by 1.4% to KES 366.5B. Customer deposits grew 15.1% [2021: 26.6%, 2021: 44.5%] to KES 1T, equivalent to 73.9% of the balance sheet.

Revenue Decomposition: Interest income from loans and advances grew 19.9% to KES 53.7B while that from government securities edged 43.1% higher to reach KES 29.6B. The total interest income rose 25.6% to KES 84.2B.

Bottom Line: Net Interest Income was up 23.4% to KES 59.8B while Non-Interest Income expanded 32% to KES 42.2B, bringing the contribution to gross operating income to 59:41 [2021: 60:40]. Profit Before Taxes increased 21% to KES 44.3B while the net profit for the year rose 27.9% to KES 34.4B.

No Dividend: The bank did not announce an interim dividend.

Regional Performance: Across its operations in the region, Equity Bank South Sudan saw its cost-to-income ratio drop by the largest margin to 21.9% [2021: 93.5%]. All subsidiaries registered a drop in this metric except the Kenyan and Ugandan banking units which recorded ratios of 41.2% and 58.1%, respectively [2021: 39.8%, 51.1%]. At the group level, the ratio stood at 56.6% [2021: 54.5%].

Spire Bank Transaction: In September, Equity Bank entered into an Assets and Liabilities Purchase Agreement with Spire Bank for the purchase of specific Assets and Liabilities. The transaction has since faced legal headwinds including resignations by Spire Bank’s Board as well as a freeze on the acquisition process by the High Court following a suit by Spire’s employees. The matter is pending determination.

Find our analysis of the results here.

I&M Q3 2022 Results

Assets up 7.4%: Total assets increased 7.4% year-on-year to KES 428.7B [2021: KES 399.1B]. Loans and advances grew 11.4% to KES 231.2B representing 53.9% of the balance sheet [2021: 52%]. Investment securities fell 3.4% to KES 98.8B [2021: KES 102.2B] to account for 23.1% of the balance sheet [2021: 25.6%].

Net NPLs Down: Loan loss provisions fell 5.9% to KES 3.6B and were down by 52.6% from 2020. Gross Non-Performing Loans (NPLs) rose 4.2% to KES 23.7B to account for 10.2% of the loan book [2021: 10.9%]. Net NPLs fell 12.9% to KES 5.8B, to represent 2.5% of the loan book [2021: 3.2%].

Operating Income: Net Interest Income and Non-Interest Income grew 15.6% and 1.2% to KES 16.2B and KES 8.8B respectively, bringing the contribution to gross operating income to 65:35 [2021: 69:31]. Total operating income grew 23.9% to KES 25B.

Net Income Grows 25%: Profit Before Taxes was up 31.9% to KES 10.1B and the Net Income increased by 25.1% to KES 7.2B. The bank did not announce an interim dividend.

Find our analysis of the results here.

StanChart Q3 2022 Results

Balance Sheet Grows 10.7%: The asset base expanded by 10.7% to reach KES 366.1B. Net loans rose 3.3% to reach KES 136.1B, representing 37.2% of the balance sheet [2021: 39.8%]. Government securities grew 18.5% to KES 111.4B, accounting for 30.4% of the balance sheet [2021: 28.4%].

Lacklustre Lending: The loan-to-deposit ratio stood at 47.6% [2021: 50.9%], extending a downward trend that has been registered over the past few years. The highest ratio posted recently was in 2015 when the metric stood at 72.5%.

Interest Income Mapping: Interest Income from loans and advances edged higher by 9.5% to reach KES 9.1B while that from investment securities rose 4.1% to KES 7.6B. Gross interest income for the period was up 7.3% to KES 18.2B.

Operating Income Up 10%: Net Interest Income grew 16.1% to KES 15.8B [2021: KES 14.7B], while Non-Interest Income was up 10.3% to reach KES 8.8B [2021: 7.6B]. The contribution to gross operating income - which grew 10.3% to KES 24.6B - was 64:36 [2021: 66:34], respectively.

Interim Dividend: Profit Before Tax was up 37.1% to reach KES 12.3B [2021: KES 8.9B] while Net Income stood at KES 8.7B, a 37.1% increase. The bank has recommended an interim Dividend Per Share amounting to KES 6, bringing the Payout Ratio to 26.5%.

Find our analysis of the results here.

NCBA Q3 2022 Results

Assets Up 5.8%: Total assets were up 5.8% to KES 595.4B. Loans and advances rose 11.7% to KES 266.1B, equivalent to 44.7% of the balance sheet [2021: 42.3%]. Investment securities were up 10.4% to KES 232.6B, accounting for 39.1% of the asset base [2021: 37.4%].

Interest Income Grows 13.3%: Interest income from loans and advances edged 4.9% higher to KES 20B, while income from securities reached KES 18.2B, up 4.8X the pace of growth in interest income from loans. The total interest income stood at KES 38.8B, a 13.3% increase.

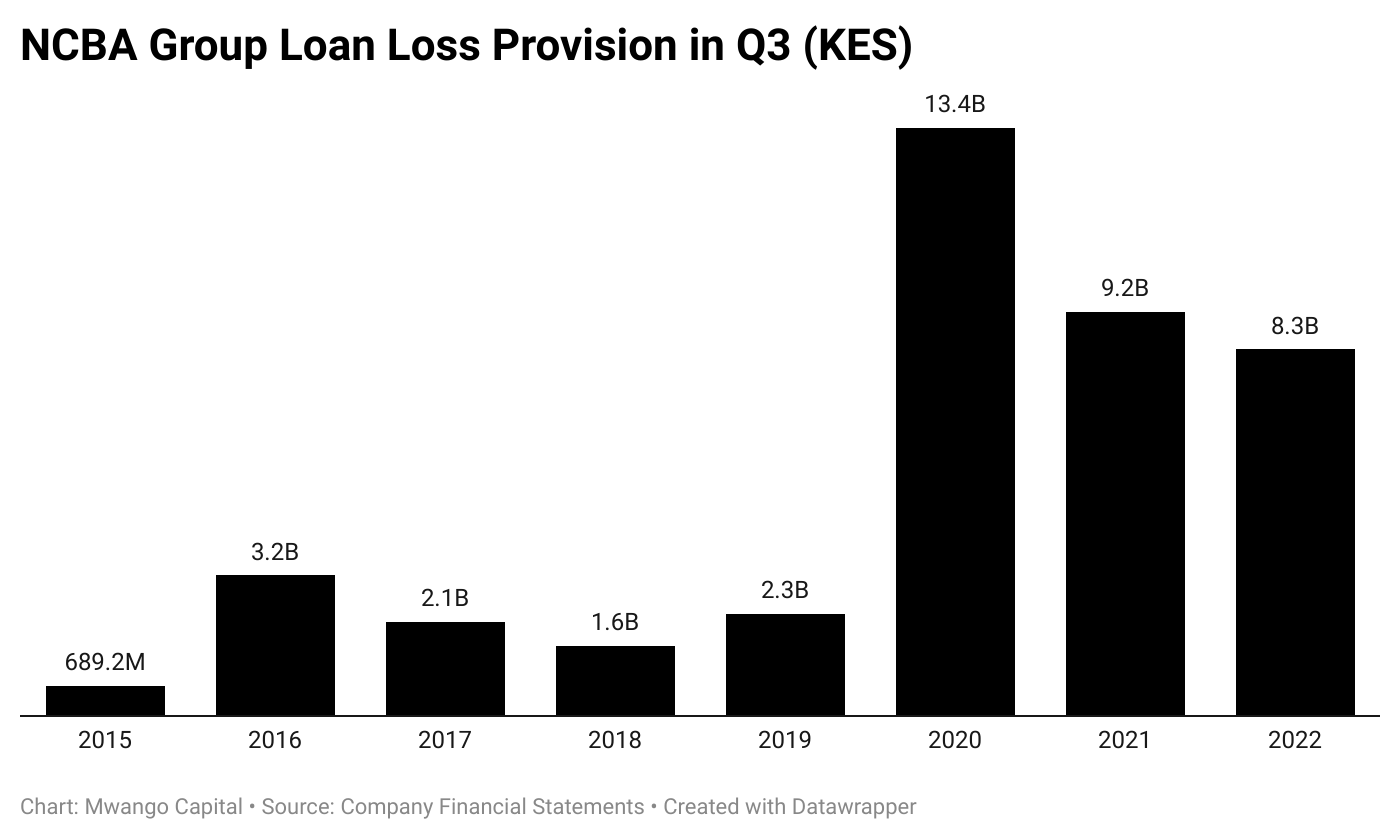

Provisions Fall 9.2%: Loan loss provisions through the income statement fell 9.2% to reach KES 8.3B, equivalent to 18.2% of total operating income. Net Interest Income and Non-Interest Income grew by 15.1% and 40.1% to reach KES 23.2B and KES 22.5B, respectively, bringing the contribution to gross operating income to 51:49 [2021: 56:44].

FX Trading Income Buoys Earnings: Foreign Exchange (FX) trading income grew 162.9% to KES 9.2B [2021: 3.5B], to account for 40.9% of Non-Interest Income [2021: 21.8%]. Gross operating income for the period was up 26.2% to reach KES 45.8B. To highlight the impact of FX trading revenue, total operating income excluding FX trading income was KES 36.6B [2021: KES 32.8B], an 11.6% increase.

Net Income Grows 96.2%: Profit Before Tax rose 56.7% to reach KES 18.2B, while the net result for the year was up 1.9X to reach KES 12.8B [2021: KES 6.5B], accounting for 27.9% of gross operating income [2021: 17.9%]. The bank did not announce an interim dividend.

Find our analysis of the results here.

Stanbic Q3 2022 Results

Assets Increase 25.9%: Gross assets rose 25.9% to KES 371B [2021: KES 295B], shooting past the KES 300B mark to KES 371B after the slump witnessed in Q3 2021. Loans and advances rose 34% to KES 236.9B [2021: KES 176.6B], accounting for 63.8% of the balance sheet, while investment securities rose 39.1% to KES 63.5B [2021: KES 45.7B], representing 17.1% of the asset base [2021: 15.5%].

Profit and Loss Analysis: Interest Income from lending activities was up 24% to reach KES 13.4B, while that from government securities fell 2% to reach KES 3.5B. Total interest income was up 19% to reach KES 17.6B. Net Interest Income was up 27% to KES 12.7B and Non-Interest Income was up 38% to KES 10.3B, bringing the contribution to total operating income to 55:45 [2021: 57:43].

Provisions Up 89%: Loan loss provisions through the income statement rose 88.7% to reach KES 2.9B [2021: KES 1.5B]. The provisions accounted for 21.5% [2021:14.5%] of Total Operating Expenses (OPEX) and 12.4% of gross operating income [2021: 8.7%]. Up 27.2% to KES 13.3B [2021: KES 10.5B], provisions were the key driver in the surge as OPEX excluding provisions grew 16.7% to KES 10.4B [2021: KES 8.9B].

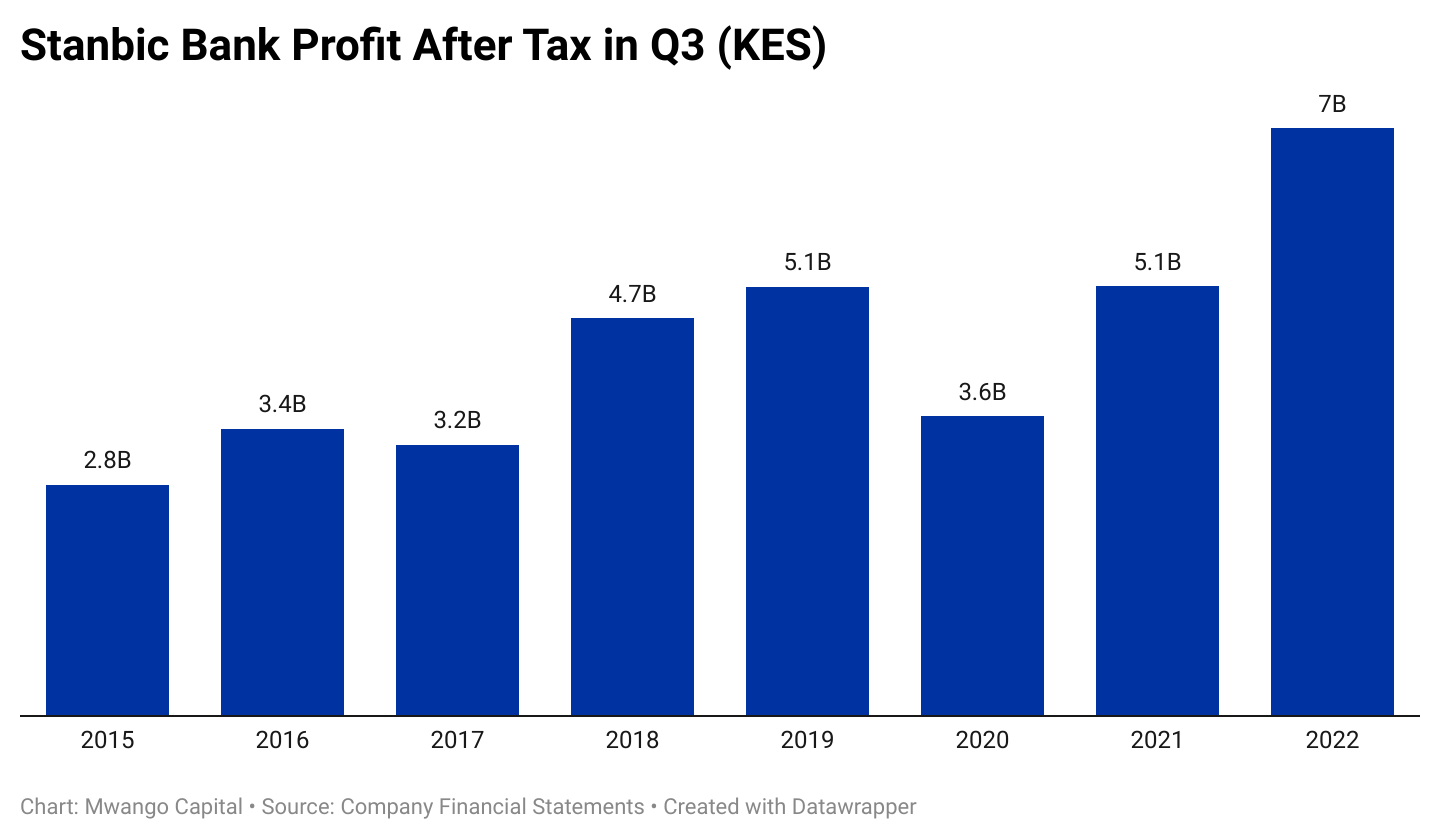

Pre-Tax Profit Nears KES 10B: Profit before tax edged 37.7% higher to KES 9.7B [2021: KES 7B], bringing the Net Profit to KES 6.9B [2021: KES 5.1B], a 36.8% increase. Net profit as a percentage of total operating income stood at 30.4% in Q3 2022 [2021: 29.2%]. The bank did not announce an interim dividend.

Find our analysis of the results here.

DTB Q3 2022 Results

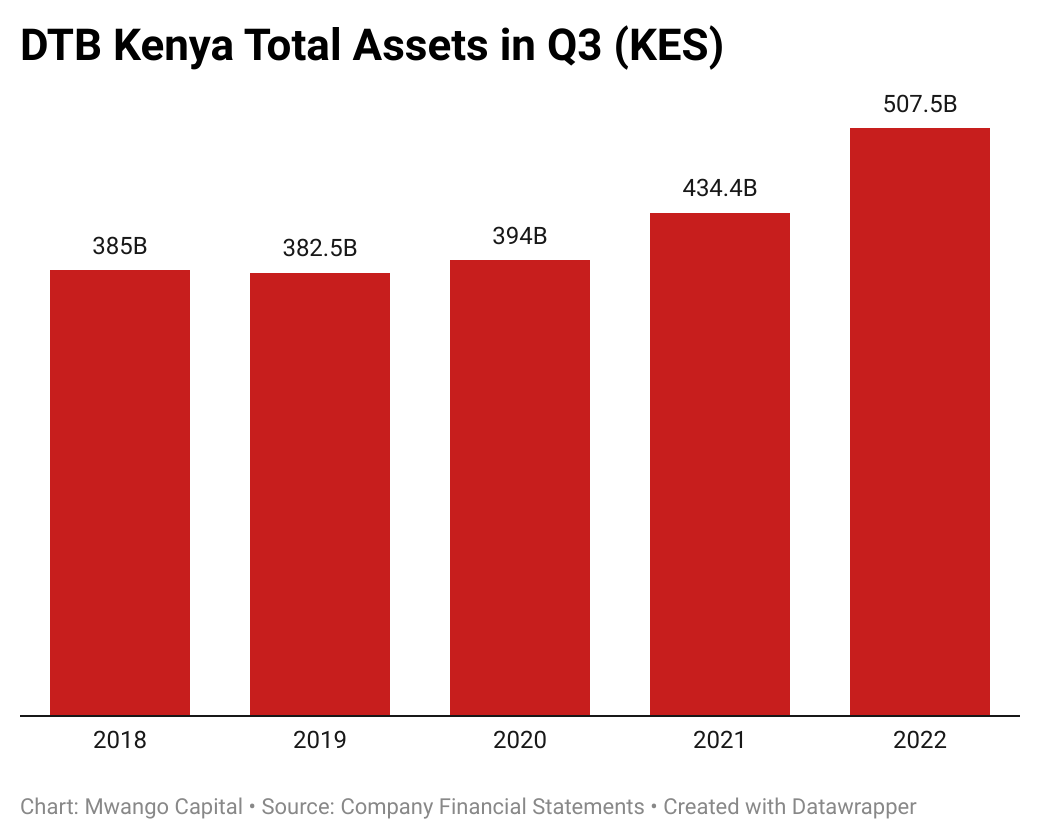

Assets Surpass 500B: The asset base expanded 16.8% surpassing the half-a-trillion mark to reach KES 507.5B [2021: KES 434.4B]. Loans and advances grew 18.3% to reach KES 243.7B [2021: KES 206.6B], representing 48% of the balance sheet [2021: 47.5%], while holdings of investment securities were up 14.5% to KES 179.9B [2021:KES 157.3B], accounting for 35.5% of total assets [2021: 36.2%].

Income Overview: Interest Income from loans rose 9.4% to KES 15.2B [2021: KES 13.9B], while that from investment securities, at 23.4%, rose 2.5X the pace of interest income growth to reach KES 13.6B [2021: KES 11B]. Total Interest Income edged 15.4% higher to KES 28.9B [2021: KES 25.1B].

Non-Interest Income Up 43%: Net Interest Income grew 14.1% to KES 16.8B [2021: KES 14.7B], while Non-Interest Income increased 43.5% to reach KES 6.9B [2021: KES 4.8B], bringing the contribution to gross operating income to 71:39 [2021: 76:34]. Up 80.6% to reach KES 3.3B [2021: KES 1.8B], foreign exchange trading income accounted for 47.5% of Non-Interest Income [2021: 37.8%].

Net Income Up 21%: Total operating income grew 21.3% to KES 23.7B [2021: KES 19.5B]. Profit Before Taxes was up 20.2% to reach KES 8.9B, and the bank registered KES 6.3B in Net Profit [2021: KES 5.2B], an increase of 21.1%. The bank did not announce an interim dividend.

Find our analysis of the results here.

More Q3 2022 Bank Earnings

Family Bank's Assets Up: The asset base expanded by 19.9% to reach KES 128.6B [2021: KES 107.4B]. Loans grew 22.7% to KES 79.9B representing 62.1% of the balance sheet. Gross NPLs increased by 6% to KES 12.1B. Net interest income was up 9.8% to KES 6.3B while Non-Interest Income rose 22.4% to KES 2.8B. Gross operating income edged 13.4% higher to reach KES 9B, bringing the Net Profit to KES 2.5B.

Kingdom Bank Net Profit Up 47%: Kingdom Bank, a subsidiary of Co-operative Bank Kenya, posted a 71.6% increase in total assets to KES 33.2B. The loan book expanded by 18% to KES 5B while investments in securities rose 5.2% to KES 24.5B, accounting for 73.9% of gross assets. Total operating income fell 13.5% to KES 2.1B [2021: KES 2.5B], while Net Income for the period rose 47.5% to reach KES 609.2M [2021: KES 413.1M].

Debt Markets

Treasury Bills Market: In the short-term debt markets, yields for the 91-Days, 182-Days and 364-Days instruments were 9.237%, 9.733%, and 10.219%, compared to 9.191%, 9.721%, and 10.181%, respectively, in the previous auction - an increase of 9.6 basis points (bps) overall. On aggregate, the acceptance rate stood at 89.2%, a decline compared to the 125.4% recorded in the previous auction.

IFB1/2022/14 Tap Sale Results: Out of a KES 5B advertised amount, the Central Bank of Kenya (CBK) received KES 19.136B in bids at face value, and accepted KES 19.132B at cost, bringing the performance and acceptance rates to 382.7% in both instances. The adjusted average price was KES 100.52 per kes 100 at a coupon rate of 13.938%.

Re-Opened Treasury Bonds: The CBK is in the market seeking KES 40B through re-opened twenty-year and twenty-five-year FXD1/2008/20 and FXD1/2022/25 fixed coupon treasury bonds. The bonds have coupon rates of 13.75% and 14.188% and the period of sale is expected to run through December 6. Investors should expect the results of the operation on December 8.

IFB Bond Prospectus: The CBK last week issued a prospectus for a 6-year amortized Infrastructure Bond IFB1/2022/6 via switch auction. The bond has a total value of KES 87.8B, and the CBK has outlined various source securities comprising 3 Treasury Bills and 1 Treasury Bond with gross maturity sizes of KES 31.96B and KES 55.85B, respectively, set to be rolled over in the operation. The bids closure and auction results dates have been slated for November 30 and December 1, respectively.

Eurobond Market: Yields fell across all outstanding instruments, with KENINT 2028 leading the decline by 24.6 bps week-on-week, followed by KENINT 2032, KENINT 2034 and KENINT 2048 at 23.1 bps, 21.3 bps and 18.2 bps, respectively. The decline was modest on KENINT 2027 and KENINT 2024 which fell 12.4 bps and 7.2 bps, respectively, bringing the aggregate decline to 106.8 bps or 17.8 bps on average.

What Else Happened This Week

📉 Remittances Down 1.4%: In October 2022, remittances from Kenyans abroad were $332.6M (KES 40.6B), a decrease of 1.4% year-on-year [October 2021: $337.4M/KES 41.2B]. On a month-on-month basis, the remittances are up 4.6% [September 2022: KES 38.8B].

🕵️ KRA’s Kakuzi Investigation: KRA will soon release its verdict on investigations on Kakuzi over tax evasion linked to Camellia Plc. The firm and its Board are also under investigation by the Capital Markets Authority (CMA) for their roles in the alleged shifting of profits abroad and conflict of interest by Camellia.

💰 Falling FX Reserves: Kenya’s stock of official foreign exchange (FX) reserves is at its lowest level in 7 years, standing at $7.04B as of November 24. The amount is equivalent to 3.95 months of import cover, which is below the statutory requirement of 4 months. Here’s CBK Governor, Dr. Patrick Njoroge's comment from last week’s Monetary Policy Committee (MPC) press briefing.

“We have adequate cover to smooth out any volatilities that would come. We also know, as I said, we are doing our best endeavours to ensure that we get reserves and this is why we are not stressed as it were, and so in terms of the CBK continuing to perform its function in the markets and elsewhere, also the function of payment of government external payments, we have absolutely no problem continuing with that at 100%.”

CBK Governor, Dr. Patrick Njoroge

⚠️ Bamburi’s Profit Warning: The Cement manufacturer last week issued a profit warning announcement on its results for fiscal 2022. The firm projects net earnings for the 2022 financial year will be lower than those in fiscal 2021 by at least 25%. Bamburi closed at KES 33.40 last week, down 12.6% year-to-date.

🛠️ Ghana’s Debt Restructuring: Ghana is likely to undertake some form of debt restructuring in which it will ask holders of its international bonds to accept a 30% haircut and forgo some interest payments. Separately, in a move meant to tackle dwindling FX reserves, Ghana’s government is working on a new policy to buy oil products with gold rather than dollar reserves.

Interest Rate Watch

🇦🇴 Angola: The National Bank of Angola’s MPC maintained its key policy rate at 19.5% after a 50 bps cut in its September meeting. Annual inflation in Africa’s largest crude oil producer eased for the 9th straight month in October to reach 16.68% [September 2022: 18.16%].

🇸🇿 Eswatini: The Monetary Policy Consultative Committee (MPCC) and the Central Bank of Eswatini increaseD the discount rate by 50 bps to 6.5% citing the interplay of the current global, regional, and domestic economic factors. In October 2022, overall annual inflation in the monarchy eased to 5.5% [September 2022: 6.7%].

🇰🇪 Kenya: Last week, the CBK’s MPC hiked the key benchmark rate by 50 bps to 8.75%. The latest action brings the cumulative rate hikes to 3 in 2022 with a total impact of 175 bps. In October 2022, annual inflation stood at 9.6%, an increase of 40 bps from 9.2% in September.

🇳🇬 Nigeria: In its MPC meeting held last week, the MPC of the Central Bank of Nigeria unanimously voted to raise the Monetary Policy Rate by 50 bps to 16.5% citing a continued uptrend in inflation - albeit at a decelerating rate, despite the bank’s 3 consecutive rate hikes in 2022 amounting to 400 bps. Annual October in Africa’s most populous nation reached 21.09% in October 2022 [September 2022: 20.77%].

🇿🇲 Zambia: The MPC of the Bank of Zambia decided to hold the monetary policy rate steady at 9%. The MPC cited projections showing decelerating inflation over the forecast horizon and its return to the target range of 6 - 8% in Q1 2024. Annual inflation in Zambia reached 9.8% in November 2022 from a 4-month low of 9.7% in October.