EABL H1 2024 Earnings

KES' depreciation leads to an increase in forex losses and net finance costs

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover East African Breweries' results for the half-year ended 31st December 2023 and Safaricom Ethiopia Q3 FY 24 updates.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Get ready for the YEA account movie magic giveaway by opening a YEA account.

EABL H1 2024 Earnings

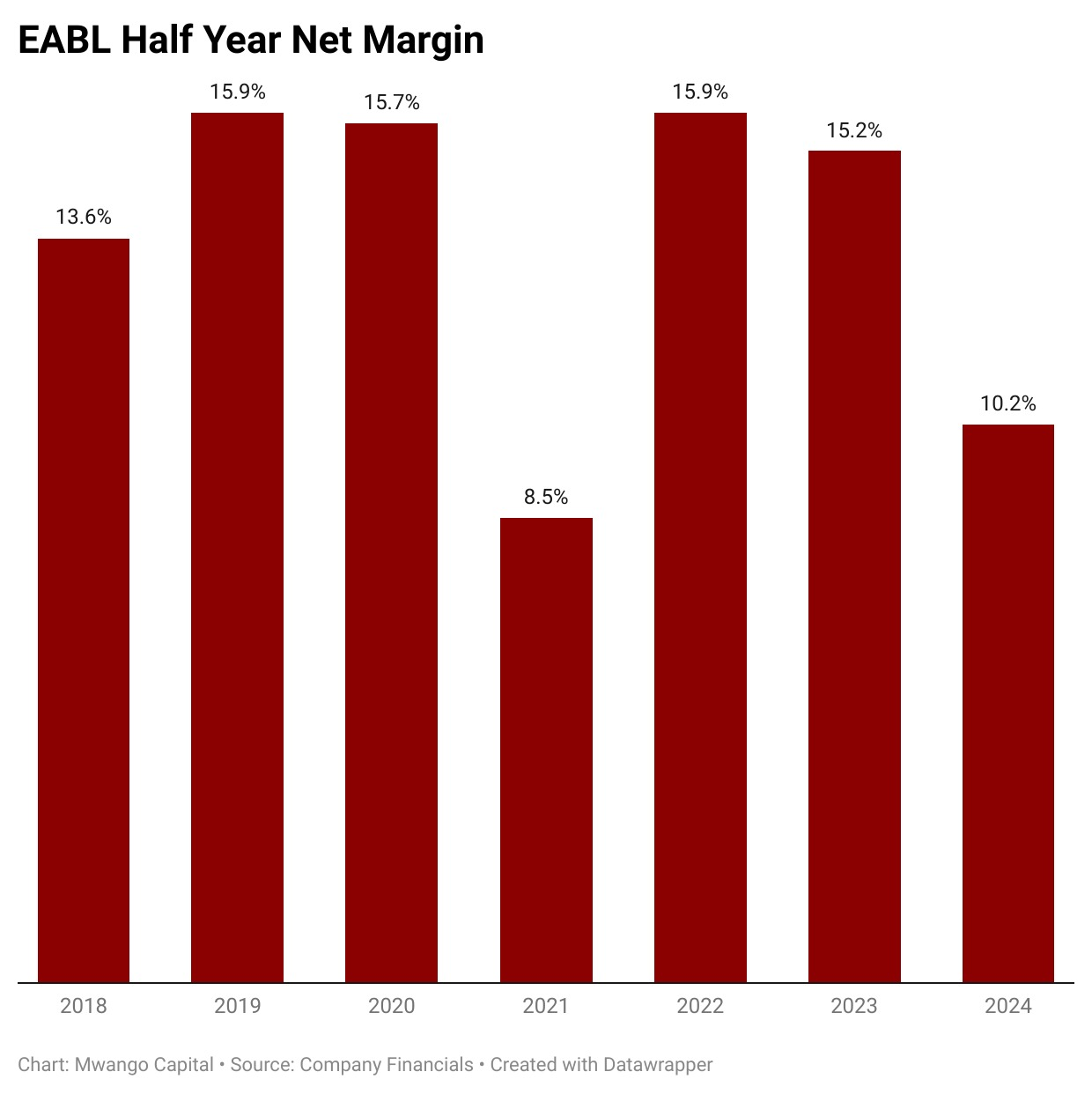

During the week, East African Breweries Limited PLC (EABL) reported half-year earnings for the 6 months ended 31st December 2023. Gross revenue totaled KES 119.1B, up 13.8% year-on-year, while net revenue grew by 16.2% to reach KES 66.5B. Profit after tax declined for the second consecutive time closing the half year at KES 6.8B, down 22.1%, to bring the net margin to 10.2%

.

Rising Costs: Half-year indirect taxes crossed the KES 50B mark, growing by 10.8% to KES 52.5B, equivalent to 44.1% of gross sales [H1 23: 45.3%, H1 22: 43.3%]. The cost of sales was KES 37B, up 20.6%, outpacing net sales and gross sales growth. Further, the cost of sales as a share of gross sales and net sales was 31.1% and 55.7%, up from 29.3% and 53.6% in H1 23, respectively.

On the supply side, there were excise tax increases on key raw materials, glass at 10%, sugar at 5%, and excise adjustments as a result of inflation at 16%. Fuel and electricity costs edged higher by 39% and 16%, compounding the elevated operating costs. Further, changes occasioned by the Finance Act 2023 requiring tax remittance after 24 hours from monthly previously have affected cash flows and revenues, and increased the complexity of tax accounting. In an interview with Julians Amboko on Business Redefined, here is what EABL’s CFO, Risper Ohaga had to say:

“It is extremely problematic. Administratively, it means you are reconciling your accounts daily. When we had it monthly, you close your books, you reconcile your numbers, you are sure you have done the right number, the right submission, you can reconcile it to your general ledger and you are correct. Now you pay the excise which is a consumption tax you are now paying it the minute you remove it from the store. You don’t know whether you’ve sold it or not.”

“The intent was to deal with the illicit. I don’t think it has had any impact on them. And It has actually punished the compliant tax-payers even more.”

East African Breweries PLC CFO, Risper Ohaga

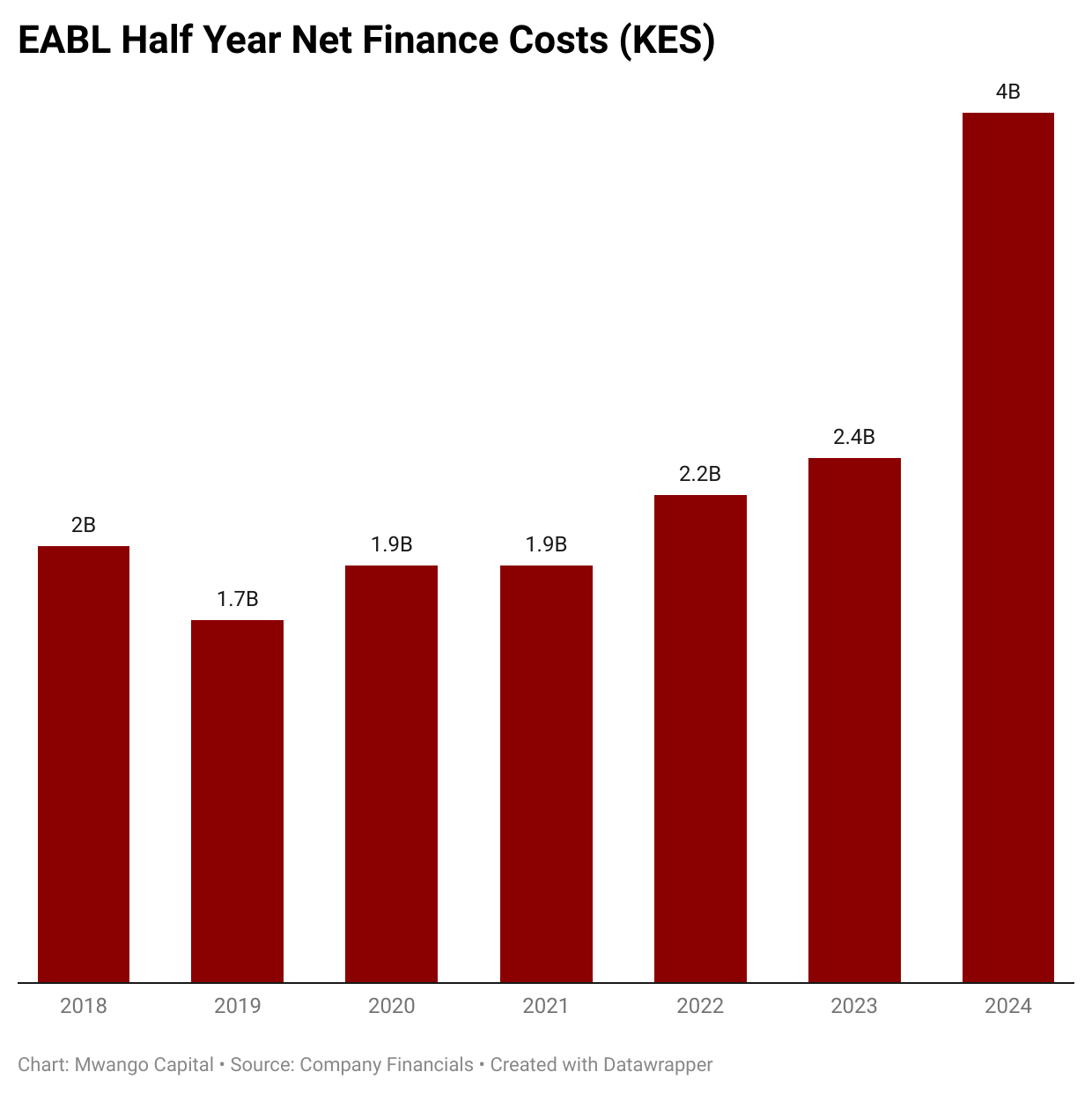

Macros Weigh on Earnings: As a result of the depreciation of the Kenyan shilling in the operating period, foreign exchange losses grew by 11X to reach KES 2.3B - equivalent to 14.1% of operating profit [H1 23: 1.4%]. Higher interest rates in the operating environment contributed to net finance costs growing by 65.7% to reach KES 3.9B, impacting profitability.

“We do see the impact of the macros - the combined effect of currency depreciation and finance costs brings our profit after tax -22% compared to the previous year. And if you look at the depreciation of the currency against the pound we are nearly 37% year-on-year, against the dollar we are 27% depreciation year-on-year. You are seeing that in the numbers as well as the 182-day T-bill is 600 bps up so you are seeing that in the net finance costs as well.”

East African Breweries PLC Chief Finance Officer, Risper Ohaga

Interim Dividend Slashed: The Board of Directors declared an interim Dividend Per Share (DPS) of KES 1.00, down 73% from the KES 3.75 DPS declared in H1 2022/23.

Market reaction: Following the half-year results announcement, EABL closed as the week’s top loser, down 11.4% to KES 104.50.

Here are links to the presentation, results, our analysis, and a thread with key charts.

Safaricom Ethiopia Q3 FY 24 Update

Operational Highlights: Safaricom PLC last week held a quarterly update on Safaricom Ethiopia and released insights on the Ethiopian market, where it launched operations in October 2022. The operator’s 90-day and 1-month active total customers closed Q3 FY 24 at 4.34M and 2.78M, up 5.3% and 7.8% quarter-on-quarter, respectively, with the respective average revenue per user numbers standing at KES 113.89 and KES 170.13, up 4.5% and 10.5%.

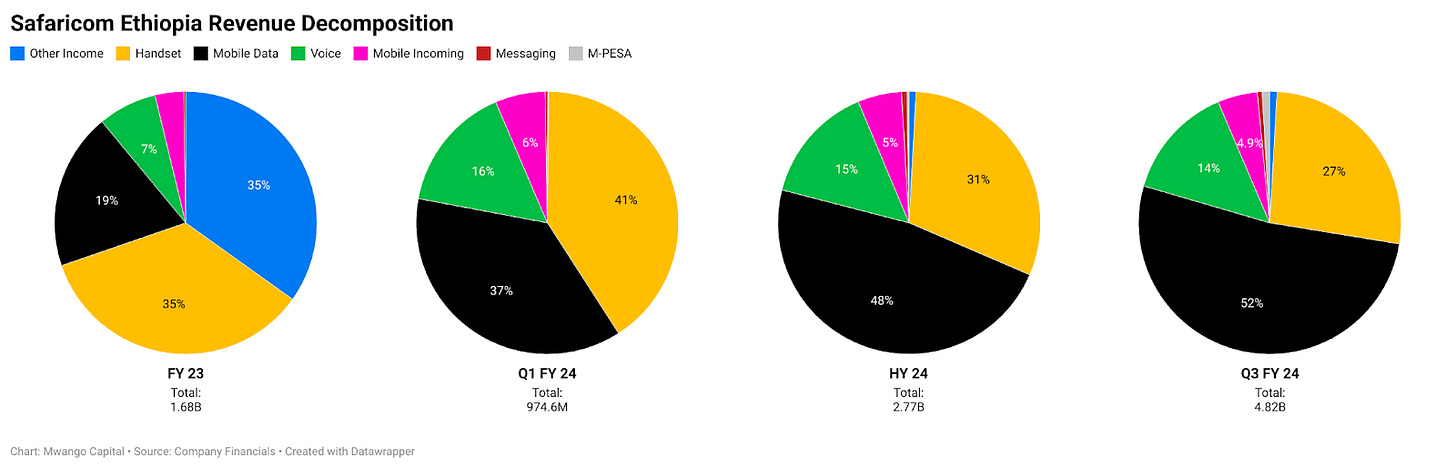

Data Anchors Revenue: Mobile data revenue was KES 2.5B, up 74%, to account for 52% of total revenue. Voice revenue closed the period at KES 678M, up 66.8% to be the second largest service revenue item. Total service revenue was KES 3.5B, up 84%, while handset (hardware) revenue closed at KES 1.3B, up 51%.

M-PESA Ethiopia Update: As at the end of December 2023, M-PESA had 3.1M registered customers, 26.2K agents, and 43.1K merchants. M-PESA customers have surpassed the previously set target of 2M customers by March 2024. Further, in the operating period, M-PESA pulled in KES 44.9M in revenue, 6.2X that in H1 FY 24. Here is what Safaricom PLC’s Chief Finance Officer (CFO) had to say on M-PESA in Ethiopia at the call:

“We are in the build phase, signing merchants, building agents. This business is still under its build phase. You cannot copy-paste Kenya. Rely on us to keep scaling this business.”

Safaricom PLC CFO, Dilip Pal

On Funding and FX Access: As at the end of Q3 FY 24, the aggregate funding of Safaricom Ethiopia by the Global Partnership for Ethiopia (GPE) partners, the IFC, and through debt amounted to USD 1.6B. In terms of the debt structure, the firm’s obligations as at the end of Q3 FY 24 included USD 600M in foreign debt and local debt totaling KES 69.87B- out of which KES 18.87 is local and KES 51B in deferred vendor payments. Here is what Dilip Pal had to say on leverage, funding, and US dollar access in Ethiopia:

“Yes, we need more debt funding and the quantum will be determined by Capital Expenditure.”

“We are sourcing all our hard currency or US Dollars through equity shareholders. The IFC - bringing in USD 100M debt. So far, foreign currency has been coming from equity and the IFC. We are still not on the priority list [for US Dollars in Ethiopia].”

3rd MNO License: Last year, Ethiopia failed to attract any bids for a third wireless telecommunications licence on account of conflicts in parts of the country, and subsequently, the Ethiopian Communications Authority cancelled the Request for Qualification. The overarching factor in getting a 3rd operator licence has been the instability in parts of the country and a lacklustre macro environment.

“Clearly, the timing has not been right.”

Safaricom PLC CEO, Peter Ndegwa

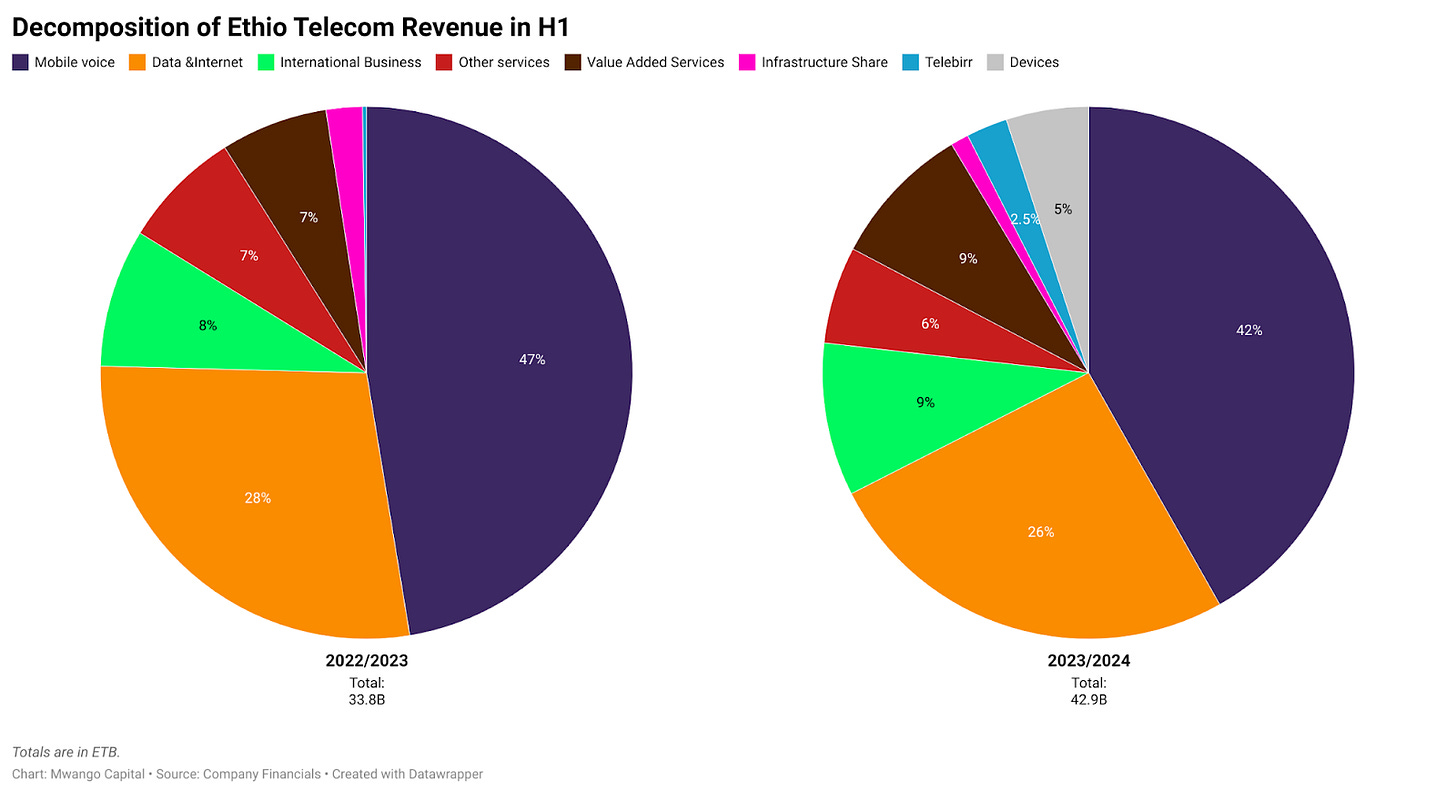

Ethio Telecom H1 2023/24 Results: Total subscribers were 74.6M, up 6.7% year-on-year. Data subscribers grew by 16.3% to 36.4M, outpacing the growth in voice subscribers which stood at 6.1% to 71.7M. Gross revenue totaled ETB 42.9B (USD 632.1M), up 26% in local currency with the bulk of the revenues, being from mobile voice (USD 318.9M), followed by data and internet (USD 196.1M). These two categories accounted for a lion’s share of revenues at 67.5%, 8% lower than what they accounted for in H1 2022/23. Net income for the period was ETB 11B (USD 195.8M), up 14% in local terms.

Find the Safaricom Ethiopia Q3 FY 24 update here and the Ethio Telecom H1 2023/2024 results release here.

Markets Wrap

NSE: In Week 4 of 2024, Car & General was the top-performing stock, up 8.0% to close at KES 27.00. EABL was the worst-performing stock, down 11.4% to close at KES 104.50. All indices were down, with the NSE 20, NSE 25, NSE 10, and NASI falling by 1.2%, 2.4%, 2.7%, and 3.2% to 1,498.0, 2,370.8, 901.2, and 90.4 points, respectively. Equity turnover edged lower by 11.2% to KES 547.99M from KES 616.94M the prior week while bond turnover closed the week at KES 18.64B compared to the prior week’s KES 17.1B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.2903%, 16.3756%, and 16.5225% respectively. The total amount on offer was KES 24B with the CBK accepting KES 21.9B of the KES 24.5B bids received, to bring the aggregate performance rate to 101.97%. The 91-day and 364-day instruments recorded 413.96% and 26.72% performance rates, respectively.

Treasury Bonds: The CBK has issued a prospectus for an 8.5-year amortised infrastructure bond issue no. IFB1/2024/8.5. The amount on offer is KES 70B, and the minimum competitive bid amount is KES 2M per CDS account per tenor. The bid closure date is 14th February 2024 at 10:00 AM, and the results of the auction will be announced on 16th February 2024. Find the prospectus here.

Eurobonds: In the week, yields rose across the 6 outstanding papers.

KENINT 2024 rose the most week-on-week, up by 61.00 bps to 13.475% while KENINT 2048 rose the least, appreciating by 19.00 basis points to 10.442%. The average week-on-week change stood at 36.62 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 94.50 bps while KENINT 2048 rose the least at 31.50 bps.

Prices fell across the board week-on-week, with KENINT 2034 falling the most at 1.8% to 78.761. Year-to-date, KENINT 2048 fell the most, depreciating by 2.8% to 80.805, while KENINT 2024 was flat.

Markets Gleanings

🧾| Tax Updates | KRA has raised rates for fringe benefits tax, deemed interest rate, and low-interest benefit for Jan to March 2024 in comparison to October to December 2023 rates. Fringe benefits tax to rise to 15% up from 13%, deemed interest rate to 15% up from 13%, and low-interest benefit to 14% up from 10%. Separately, the Court of Appeal rejected the state's application to stay the Finance Act ruling, meaning that there will be no imposition of the Housing levy until the appeal is conclusively heard.

🤝 | Twiga - Incentro Dispute | Twiga Foods and Incentro Africa have resolved a dispute regarding Google Cloud services in which Incentro had, last year, sought liquidation of Twiga to recover USD 261,879 (KES 42M) for the provision of the services.

📊 | CMA Q4 2023 Bulletin | As of the end of Q3 2023, registered Collective Investment Schemes held a total of KES 206.7B in Assets Under Management (AUM), up 32.8% year-on-year. CIC Unit Trust Scheme had the highest absolute AUM across Collective Investment Schemes at KES 61.2B, up 1% year-on-year. Find the entire bulletin here.

💰 | Diaspora Remittances | In December 2023, diaspora remittances were USD 372.6M, up 5% month-on-month. The cumulative remittances in 2023 reached an all-time high of USD 4.19B, up 4% year-on-year from USD 4.028B in 2022.

🇨🇮 | Cote d’Ivoire’s Eurobond Issuance | Côte d'Ivoire issued 2 series of sustainability bonds to finance sustainable development projects, including USD 1.1B via a sustainable bond maturing in 2033 and USD 1.5B for a conventional bond due in 2037. The sustainable bond maturing in 2033 yielded 7.875% [down from the initial 8.375%], while the conventional offering due in 2037 yielded 8.5% [down from the initial 8.875%]. The sale was oversubscribed by more than 3X, with a combined demand of USD 8B, and will be included in the JPMorgan EMBI Index for emerging-market debt.

“Cote d'Ivoire floated a combined $2.6bn Eurobond issuance becoming the first sub-Saharan African country to tap the international bond markets in 21 months. This brings the Eurobond issues by the sovereign to 12; equally split between USD and EUR issues.”

“With coupon rates of 7.625% and 8.25% for the 2033 sustainable bond and 2037 Eurobond, respectively, this removed the wall of worry that was investors' minds amidst a higher interest rate environment. But with a currency peg to the Euro and a combined balance sheet with 7 other West African countries under WAEMU, Cote d'Ivoire buttressed itself hence its existing papers have been trading at sub-10.0% levels.”

“Liability management operations were at play here with proceeds of the bonds going towards partial redemption of its current 5.125% 2025 and 4.875% 2032 issues. With these targeted issues denominated in EUR, Cote d'Ivoire will have to convert the $2.6b proceeds to EUR (€2.4b equivalent) before conducting the liability management operations. Furtherance, the sovereign is expected to conduct early prepayment of identified €1.8-1.9b loans”

“With Cote d'Ivoire issuing a sustainability bond, this will increasingly become a choice option for sub-Saharan issuers trying to regain market access in my view.”

IC Asset Managers Economist, Churchill Ogutu

💸 | AfDB’s Social Global Benchmark Bond | The African Development Bank has successfully launched and priced a USD 2B 3-year Social Global Benchmark due 25th February 2027. This bond marks the Bank’s first social bond issuance under its new Sustainable Bond Framework introduced in September 2023.