👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenya Banks' H1 2022 results, KQ's reduced losses, and the reopened 10-year and 15-year treasury bonds.First off, enjoy our weekly business news in memes brought to you by Mwango Capital:

Kenya Banks’ H1 2022 Results

Equity’s Deposits Near KES 1T: The balance sheet edged 19.1% to reach KES 1.3T, driven by a 28.9% increase in loans and advances to KES 650.6B. The bank aims to triple the balance sheet by 2025, having doubled it in the last 2 years.

Net profit rose by 35% to KES 24.4B, bringing the net profit margin to 37.2%, with a cost-to-income ratio of 52.9%. The bank also recorded a loss in its bond portfolio amounting to KES 38.9B. For I & M Bank, the loss amounted to KES 5.6B in H1 2021, surpassing its net profit of KES 4.93B.

Across its subsidiaries, Equity BCDC, the DRC subsidiary, registered the highest cost-to-income ratio at 64.3%, a decrease from 75.8% in H1 2021. The Group has a 60% target for Equity BCDC. At KES 3B, Equity BCDC recorded the highest Profit After Tax across its regional subsidiaries. This was an increase of 89% year-over-year.

KCB’s NPLs in Sharp Focus: The bank’s Gross Non-Performing Loans rose 81% to KES 173.4B with NPLs up by 155.5% to reach KES 93.9B. Despite this, the loan loss provisions through the P&L fell 34.4% year-over-year to KES 4.3B. The Group CFO commented on this divergence between the fall in provisions vis-a-vis the increase in the NPLs.

“What was downgraded this year was already sitting in Stage 3 in prior years.”

KCB Chief Financial Officer, Kimathi Kambi

Net Income rose by 28.4% to KES 19.6B bringing the Net Profit Margin to 32.8% and the cost-to-income ratio to 52.9%.

KCB recorded a loss of KES 2.9B from fair-value changes in assets marked to market, bringing the total comprehensive income for the year to KES 20.3B, a 47.9% increase.

Regionally, KCB expects to conclude the acquisition of TMB bank in DRC by the end of Q4 2022. TMB has $1.5B in assets and 109 branches countrywide. Rwanda recorded 213% year-over-year growth in total assets, followed by Tanzania and Burundi at 38% and 27%, respectively.

Absa and NCBA interim dividends: These are the only 2 listed banks paying dividends, having declared dividends of KES 2 and KES 0.2, respectively.

NCBA: Its total assets were up 11.4% year-over-year to KES 604.3B, pushing past Cooperative’s KES 603.2B and effectively becoming Kenya’s third largest bank by asset size. The Group reduced its provisions through the P&L by 6.1% to KES 6.1B, with overall operating expenses falling 4.6% to KES 17.1B. Its net income was up 66.9% to KES 7.8B.

Absa: Provisions through the P&L rose by 52.2% to KES 2.96B - the highest across all listed banks that have announced results. At a cost-to-income ratio of 56.4%, the bank booked a net profit of KES 6.3B, an increase of 12.9% year-over-year. The bank has announced an interim dividend of KES 0.2 per share.

NFI Boosts Coop’s Bottom-line: The bank’s Non-Funded Income grew by 28.8% year-over-year to KES 13.3B, while interest income grew 11.8% to KES 21.1B boosting the growth in the bottom line. The bank recorded significant increases in its bottom line with pretax and aftertax income rising 46.1% and 55.7% to KES 15.28B and KES 11.47B, respectively. More on the bank’s H1 earnings here.

DTB’s KES 485B Assets: DTB’s asset base rose by 12.9% to reach KES 485B. Gross NPLs reached KES 31.8B, an increase of 43%, constituting 13.6% of the loan book. Provisions rose by 5.2% to KES 2.4B while total operating expenses were up 13.4% to KES 9.4B. Net Profit increased by 25.6% to KES 3.96B, representing a 5.7% ROE. The bank will not pay an interim dividend.

Other Banking News:

KES 500B Gross NPLs: A CBK report showed that the Gross Non-Performing Loans of the banking sector in Kenya for H1 2022 rose by 18.2% year-over-year to reach KES 514.4B, to account for 14.7% of gross loans compared to 13.9% in Jun 2021.

Rising Fixed Deposits Rates: Latest data from the CBK shows interest rates on fixed deposits in banks rose to a 22-month high to reach 6.62% in June 2022 compared to 6.64% registered in Aug 2020. The savings rate has halved over the same period to reach 2.5% in Jun 2022 compared to 4.11% in Aug 2020.

Small Businesses Pay Higher Rates: Compared to individual borrowers and corporates, small businesses are being charged 0.2% - 0.8% more in interest on bank loans because of the high-risk profile attached to such businesses compared to individuals and corporates.

More: For more of our analyses on banks, check out these links for Equity, KCB, DTB, NCBA, Coop Bank, and Absa.

Earnings RoundUp

KQs Losses Reduce: While revenue for the period ended Jun 30 2022 increased by 75.9% to KES 48.1B, they booked a loss of KES 9.89B in the period under review compared to that of KES 11.49B registered in 2021. When you factor in losses on hedged exchange differences on borrowings and lease liabilities, the total comprehensive loss for the period reached KES 14.98B, a 54.7% increase:

“The Group saw an increase of 53% in total operating costs. This is mainly driven by the increase in fuel prices and major currency fluctuations witnessed this year, in addition to increased operations for the period. Jet fuel and crude oil prices rose markedly in Q1 2022, putting pressure on already strained airline finances. The elevated jet fuel price adds to the airline’s operating costs.”

Kenya Airways Chairman, Michael Joseph

Bamburi’s Rough Quarter: The company’s net profit for the period was down a massive 87.8% to reach KES 95M for H1 2022. Total sales rose marginally by 2.6% to reach KES 20.1B with operating costs growing at almost twice the pace of sales (6.7%) to reach KES 19.743B, bringing the operating profit margin to 1% compared to 6% in 2021.

Standard Group Widens Loss: While gross sales fell by 14.1% to KES 1.37B, operating costs edged up by 7% in the period to KES 1.71B. The loss for the year increased by 390.5% to KES 300.2M despite the KES 128.7M income tax credit booked. The Board of Directors has not announced an interim dividend.

TPS Eastern Africa Gets Closer to Profitability: Revenue rose by 141.5% to KES 2.6B, narrowing the loss after tax by 95.7% to KES 23.5M. No interim dividend has been announced.

Crown Paints Net Profit Down 15%: Despite a 22.4% increase in sales to KES 6B, pretax profit and net profit fell by 15.3% in both cases to KES 426M and KES 288M, respectively. Earnings Per Share were down 25.2% to KES 2.02.

BOC Announces Dividend: Revenue fell by 27.6% to KES 504M bringing pretax profits 8.8% lower to KES 59.9M. Net profit stood at 39.1M, an increase of 2.1%. The firm has announced a dividend of KES 1.6 compared to KES 1.5 in H1 2021.

Debt Markets

T-bills: Of the KES 24B offered through the various short-term debt securities, the CBK accepted KES 15B, translating to an acceptance rate of 62.5% compared to 82.1% in the previous auction. Yields rose by a total of 14 basis points from the previous auction.

T-bonds: The Central Bank of Kenya (CBK) last week issued a prospectus for reopened 10-year FXD1/2022/10 and 15-year FXD1/2022/015 with a total offer amount of KES 50B. The coupon rates for the two instruments are 13.490% and 13.942%, respectively. The sale will run till Sep 13.

Eurobonds: Yields on the paper maturing in 2024 fell by 61 basis points week-on-week to 14.158%, while on the farthest end, the KENINT 2048, yields were down by 2.4 basis points to 11.880%. Overall, yields on all Eurobond papers were down by an average of 10 basis points.

Mergers, Deals, and Acquisitions

Pwani Oil in Stationery Market: Pwani Oil is set to have exposure to the stationery market through the proposed acquisition of Kartasi Industries Limited by Kartasi Products Limited, which has affiliations with the manufacturer of edible oil. The transaction was approved by the Competition Authority of Kenya.

“The Authority approved the acquisition of the business and assets of Kartasi Industries Limited by Kartasi Products Limited on condition that Kartasi Products Limited retains the target’s 69 permanent employees for at least 1 year from the completion date of the transaction.”

Crowne Plaza Sale Gets Approval: The Competition Authority of Kenya has approved the sale of the Crowne Plaza hotel by Golden Jubilee Limited to Falcon NBO, a pan-African hospitality fund. The transaction met, among other requirements, the KES 1B total assets threshold required across the merging entities and the value of the transaction ballparks KES 4.5B.

What Else Happened This Week

⌛ Risk-Based Lending Pending implementation: Banks continue to get risk-based lending approval, a regime that will see credit priced according to the client’s risk profile. This heralds an increase in the cost of bank loans. However, implementing the policy across some banks is yet to take full effect. Banks have pointed out that the implementation would be distasteful in the current economic environment:

“If I was going to be fair to you, those who have gotten approval, why have they not implemented? That’s what I am asking myself.”

KCB Group CEO, Paul Russo

Other banks have also weighed in:

"Maximum rate we have charged is 13%. The maximum approved so far (under the risk-based pricing model) is 18%. We have restrained ourselves so that we can allow our customers to recover."

Equity Group CEO, James Mwangi

“The reality is that the current environment is very different from when we first applied for risk-based pricing. In an ideal world, we do not want to charge higher interest rates than we need to.”

Absa Bank Kenya CEO, Jeremy Awori

“Customers are coming under a lot of pressure in terms of being able to survive. A reprice of loans in the prevailing environment may not be the best play. We are keeping our interest rates low as we monitor the macroeconomic environment.”

Equity Group Head of Financial and Regulatory Reporting, Mary Nteere

❌ Kenya Out of Debt Relief: Kenya missed out on an Africa-targeted debt relief program due to its middle-income country status. The program is set to help 17 poor states riddled in debt to forego their repayments. Kenya’s external public debt stood at KES 6.83T in Jun 2022 compared to KES 7.06T a year earlier.

🤝🏿 Fahari to Offer Agricultural Services: Fahari Aviation, a subsidiary of Kenya Airways, has signed a Service Agreement with Kipkebe Ltd., a subsidiary of Sasini, to offer fertilizer application and chemical spraying services on tea farms using drone technology.

🏤 Affordable Housing Plan: The National Housing Corporation is seeking KES 7B through a Public Private Partnership (PPP) to help fund, build and transfer 3,500 low-cost houses in Athi River, Machakos County. The NHC will collect rent and pay the private investors for 15 to 20 years.

Interest Rate Watch

🇧🇼 Botswana: The Monetary Policy Committee (MPC) of the Bank of Botswana increased the Monetary Policy Rate by 50 basis points from 2.15% to 2.65%. The MPC has cited rising inflation in its decision. Annual inflation rose by 160 basis points to 14.3% in July from 12.7% in June.

Chart of the Week

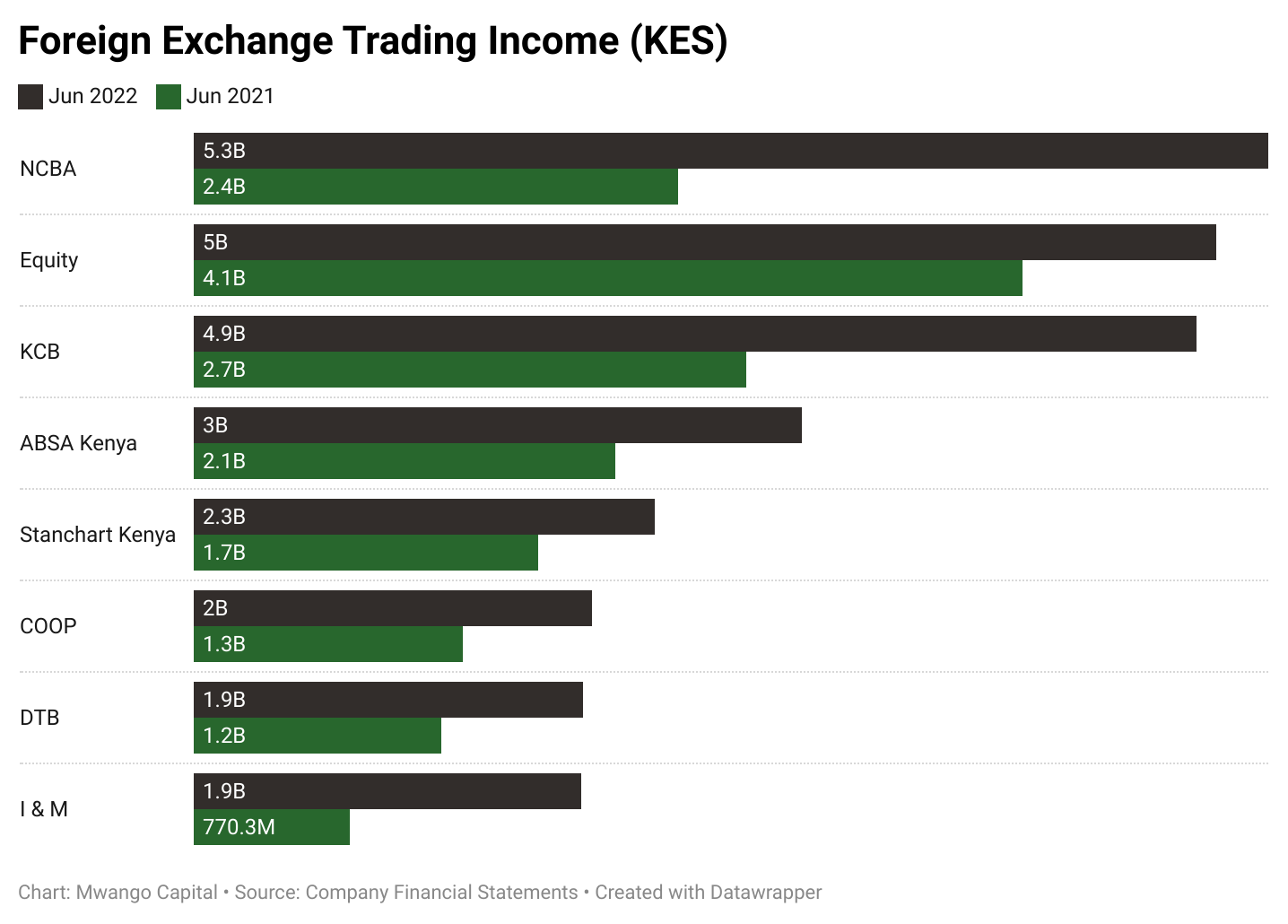

The developments in the currency market have created a windfall for banks in foreign exchange trading income, which has collectively increased by 61.6% to KES 26.8B among the 8 largest listed banks.