👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Bamburi’s competing offers, HF Group’s rights issue, and Kenya’s visit to the IMF.Bamburi’s Competing Offers

Choose One: Bamburi Cement, one of the top cement producers in Kenya, has issued a shareholder circular detailing the two competing offers for the acquisition of its shares, with the board maintaining neutrality by not recommending a preferred bid. Shareholders have a deadline of December 5th, 2024, to decide between the offers from Savannah Clinker and Amsons Group. Shareholders are advised to review these terms carefully, particularly, the potential implications of accepting either offer such as the different outcomes regarding the company’s listing status and the squeeze-out processes.

Proposed Offers: Savanna Clinker has increased its offer to KES 76.55 per share, KES 11.55 higher than its initial offer, and significantly above Amsons Industries' steady KES 65 per share. Savanna’s offer is conditional upon achieving more than 60% acceptance, whereas Amsons has no acceptance threshold. Savanna also allows partial acceptance while Amsons requires shareholders to sell all their holdings. Both offers propose a squeeze-out procedure under the Companies Act if they acquire 90% or more of Bamburi’s shares, with Amsons offering to pay either the prevailing market price or their offer price, whichever is higher. However, Savanna has not received any irrevocable undertakings from shareholders while Amsons has entered into an escrow agreement with Fincen, Kencem, and Absa Bank Kenya, guaranteeing a break fee of 3% if more than 75% of shares are tendered. Additionally, while Savanna does not plan to delist Bamburi from the Nairobi Securities Exchange, Amsons could proceed with delisting if they achieve a 75% threshold.

Advisor’s Thoughts: The Directors appointed SIB as an independent financial advisor to prepare a circular in compliance with the take-over regulations. This circular provides shareholders with the necessary information to make an informed decision on the offers and is available on Bamburi’s website. Based on SIB’s assessment of Bamburi’s value and financial information, they concluded that there is no indication that either of the offers is unfair or unreasonable.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

HF Group Rights Issue

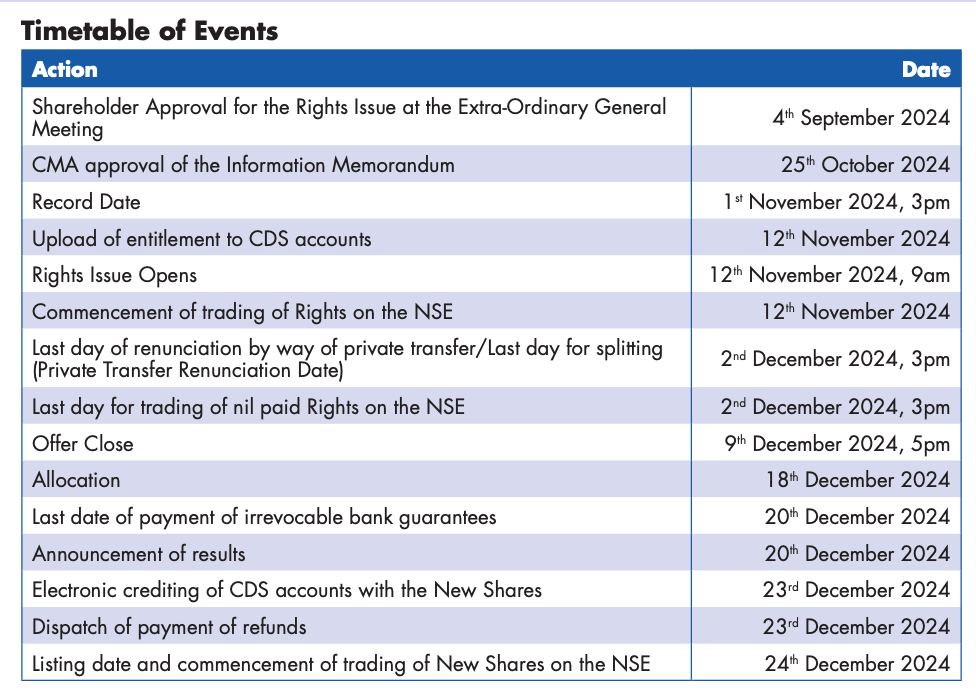

Looking for Money: HF Group Plc has received approval from the Capital Markets Authority (CMA) for a KES 4.6 billion rights issue, offering 1.15 billion new ordinary shares at KES 4.00 each (Last Friday’s closing price was KES 4.52]. Shareholders on the register as of 1st November 2024 will be eligible to participate, with an opportunity to oversubscribe through "Green Shoe Option Shares." HF Group has introduced a Green Shoe option that permits an additional 30% of new shares (up to 346.15m shares) to be issued if there is an oversubscription. The rights will trade on the Nairobi Securities Exchange (NSE) starting 12th November 2024, and the proceeds will be used to support HF Group’s digital transformation strategy and business expansion initiatives. Major shareholders, including Britam and NSSF, have committed to taking up their full rights which can be seen as a vote of confidence that may encourage other shareholders to participate.

The Structure: HF Group’s rights issue is structured to offer two new shares for every share held. This means the share base will triple if all rights are fully taken up. Existing shareholders who do not participate in the rights issue will see their ownership significantly diluted by approximately 66.7% as the total share count triples. With the share base tripling, the EPS will be diluted by approximately 66.7%. This means that unless the capital raised is effectively deployed to increase earnings, each share’s claim on earnings will diminish substantially. For investors, this is a critical risk factor, as the actual returns will depend on HF Group’s ability to grow earnings in line with the increased share count.

Share Price Reaction: HF opened the week’s trading session as the leading loser, down 7.5% to close at KES 4.18. The stock is however up 20.1% YTD.

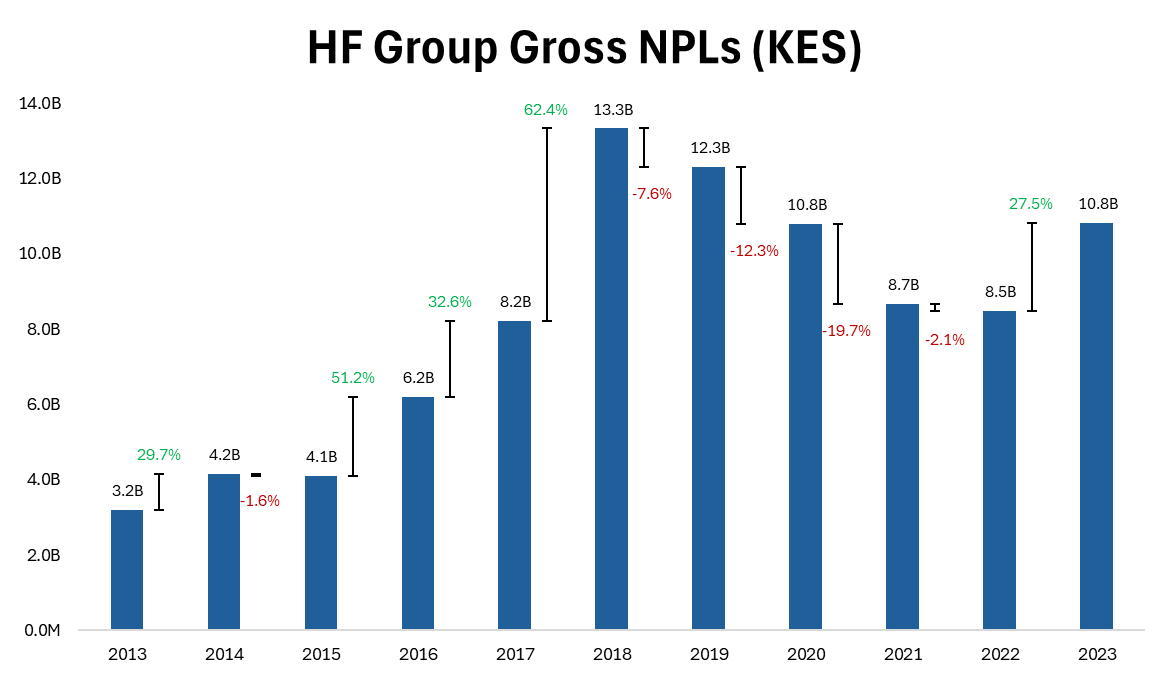

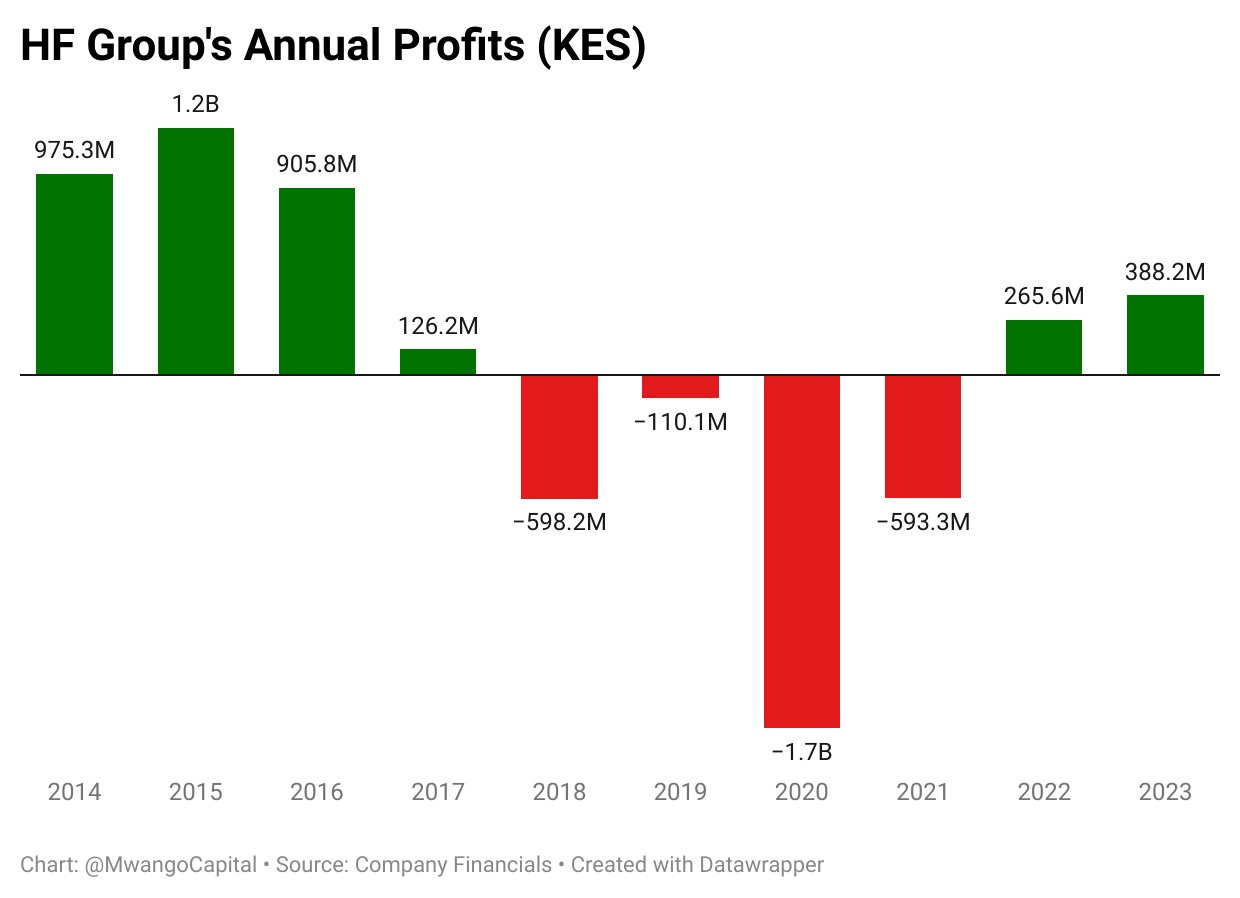

Below, we analyse HF Group’s last 10 years in asset allocation, funding, margins, asset quality, and capital adequacy.

Kenya’s IMF Review Date Confirmed

7th and 8th Review: According to a newly released calendar, the International Monetary Fund (IMF) executive board is scheduled to decide on fresh funding for Kenya this week on Wednesday, October 30th, 2024. Kenya expects to receive KES 113B in the next tranche of loans following a breakthrough in discussions that had stalled funding due to the rejection of new tax measures in the Finance Bill, 2024, in June. The IMF plans to complete the seventh and eighth reviews under the extended credit facility and the extended fund facility (ECF/EFF), alongside the second review of the resilience and sustainability facility (RSF).

“The expected IMF disbursement will be proof that the Fund does not always demand the tightest austerity. It can be flexible”

FIM Partners Head of Macro-Strategy, Charlie Robertson

“Everyone seems to be expecting a US$1.3 billion disbursement [from the IMF]. My math puts it at US$873.0M. We already have sight of where the new fiscal deficit target is - 4.3% of GDP”

Business Journalist, Julians Amboko

Kenya-IMF Meetings: Kenya's high-level delegation, led by Treasury CS John Mbadi and Central Bank Governor Dr. Kamau Thugge, attended the 2024 IMF/World Bank meetings in Washington, D.C., focusing on global economic challenges and securing financing for its economic agenda. Treasury PS Chris Kiptoo met with JICA's Hara Shohei to discuss a $500 million Samurai bond, insured by Japan’s NEXI, aimed at funding decarbonization efforts and infrastructure projects like the Dongo Kundu SEZ.

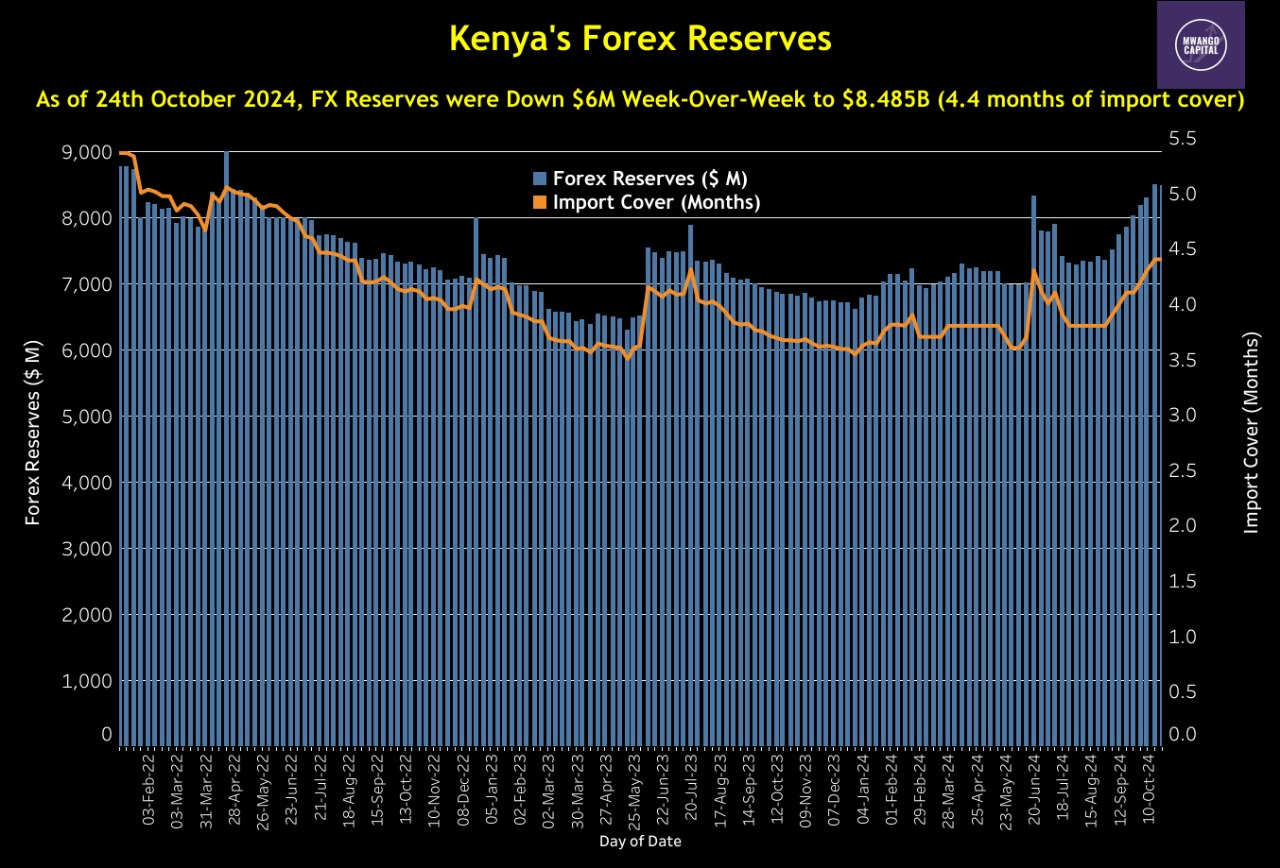

KES at Appropriate Levels: During the trip to Washington Central Bank of Kenya Governor Kamau Thugge was quoted by Bloomberg stating that the Kenyan shilling has reached appropriate levels after substantial gains this year, making it the best performer among global currencies. The shilling, which now trades at 129 per US dollar, has gained 21% this year. He assured that the CBK is ready to utilize the country's record foreign reserves to continue defending the currency’s stability. A reminder that earlier this year he was talking about an overvaluation of the same shilling at levels of 155+. The reserves have risen by ~$1.2B over the past 8 weeks.

Markets Wrap

NSE: In Week 43 of 2024, Bamburi led the week’s top gainers rising 17.4% to close at KES 69.00, while EA Portland was the worst performer, dropping 18.5% closing at KES 22.00. The NSE 20 went down by 0.4% to 1,853.8 points, the NSE 25 declined by 0.3% to 3,131.7 points, and the NASI index advanced by 0.8% to 115.5 points, while the NSE 10 dropped by 0.8% to 1,215.0 points. Equity turnover increased by 45.9% to KES 1.17B, while bond turnover went down to KES 19.24B from KES 34.44B the previous week.

Treasury Bills and Bonds: Treasury Bills were oversubscribed for the fourth consecutive week, with an overall subscription rate of 357.33%, up from 337.22% the previous week. Investors placed bids worth KES 85.8B, out of which KES 41.8B was accepted, resulting in an acceptance rate of 48.7%, slightly higher than the previous week’s 42.7%. Yields on the three Treasury Bill tenors saw a decline, dropping by 32.8 basis points, 48.9 basis points, and 44.3 basis points, closing at 14.432% for the 91-day, 15.147% for the 182-day, and 15.469% for the 364-day bills.

Reopenings: The Central Bank of Kenya is seeking to raise KES 45B through the issuance of reopened 10 and 15-year Treasury bonds, FXD1/2023/10 (8.3 years), FXD1/2022/15 (12.5 years), and FXD1/2024/10 (9.4 years). The period of sale for the FXD1/2023/10 and FXD1/2022/15 bonds is from October 25, 2024, to November 6, 2024, while the sale period for the FXD1/2024/10 bond runs from October 25th, 2024, to November 13th, 2024.

Eurobonds: During the week, yields increased across all six outstanding bonds. KENINT 2028 saw the biggest rise, up by 20.2 basis points to 8.85%, followed by KENINT 2032, which rose by 19.5 basis points to 9.72%. The smallest increase was recorded by KENINT 2027, which went up by 7.6 basis points to 7.65%. On average, the week-on-week change in yields was 16.2 basis points.

Market Gleanings

🚌| BasiGo Secures USD 42M Funding | Kenyan electric vehicle assembler BasiGo has secured USD 42M to deliver 1,000 electric buses over the next three years. This funding includes USD 24M in Series A equity, led by Africa50, and USD 17.5M in debt from the British International Investment (BII) and the U.S. Development Finance Corporation (DFC). This follows a USD 3M funding from CFAO Group earlier this year.

📱| New Rules for Mobile Devices | The Communications Authority of Kenya (CA) has introduced new tax compliance rules for mobile devices, effective January 1, 2025. Local assemblers must upload IMEI numbers to a KRA portal, importers must disclose IMEIs in their KRA documents, and retailers must verify device compliance before selling. Mobile network operators will be required to connect only compliant devices via a whitelist provided by the authority.

💸| Acorn Settles Bond Balance | Acorn Holdings has successfully repaid the remaining KES 2.7B of its five-year, KES 5.7B green bond issued in 2019, ahead of its maturity. The bond-financed sustainable student housing projects across Nairobi provide over 7,000 beds. The bond, issued through Acorn Student Accommodation (ASA), offered investors a return of 12.5%.

🏥| From NHIF to SHIF | This will be the first month under the Social Health Insurance Fund where salaried Kenyans will have 2.75% of their gross salary deducted for healthcare coverage. The Social Health Authority has clarified that employers are, however, not obligated to match these contributions and that contributors are encouraged to consult with KRA for insurance-related tax relief.

🏦| NSE Launches Options Trading | The Nairobi Securities Exchange (NSE) will introduce options derivatives trading on NEXT, its derivatives market, after approval from the Capital Markets Authority, in response to growing investor demand. This allows investors to trade options on existing futures contracts for single stocks and indices.

🔺| Adani-Ketraco Deal on Ice | The High Court in Nairobi has issued conservatory orders suspending a KES 95.6B project agreement between KETRACO & Adani Energy Solutions. The court cited concerns over secrecy, public participation, and constitutional compliance. The next hearing is set for 11th November 2024.

🇹🇿| Tanzania‘s First QR Payment System | NMB Bank, in partnership with Mastercard, has launched Tanzania’s first QR Pay by Link (QR PBL) payment solution. This will enable small and medium-sized enterprises (SMEs) to accept digital payments via QR codes or secure links without the need for traditional point-of-sale terminals. The solution aims to reduce transaction costs and streamline payment processes.

🇷🇼| IMF and Rwanda | IMF staff and Rwandan authorities have reached a staff-level agreement on the necessary policies to complete the fourth reviews of Rwanda’s Policy Coordination Instrument (PCI) and the Resilience and Sustainability Facility (RSF), as well as the second review of the Stand-by Credit Facility (SCF) arrangement. If approved, Rwanda will access USD 95.9M under the RSF and USD 89.0M under the SCF.