👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover EABL's half-year results, C&G's FY 2022 results, and approval of the Equity-Spire Bank transaction.First off, enjoy a dose of our weekly business news in memes brought to you by the Mwango Capital:

EABL Half-Year Results

Sales and Profitability: Sales growth was impacted by rising taxes, and as such net revenues were up only 4.4% higher to KES 57.3B [H1 2021: +23.5% to 54.9B]. Gross profit was marginally up by only 0.3% to KES 26.6B while net income for the period fell 0.4% to KES 8.7B. Overall, the company will retain the level of interim dividend it paid in 2021 of KES 3.75 per share.

Impact of Taxes: The company was clear that the rising excise taxes are impacting sales. In an interview with NTV’s Julians Amboko, the EABL CFO called for the government to consistency in tax policy to encourage long-term investment:

“I think we are reaching the point where continuous exercise increases damage volume to where you know it becomes a difficult position to be in with the kind of Investments that we have so I think it's really critical time to have the policy conversations be it the finance bill or the national tax policy they need to give us the confidence to invest in this country knowing that there'll be consistent policy that will enable us to grow and contribute positively to the economy”

Access to FX: Seems like things are improving in the FX markets for EABL as per the CFO:

“We did feel the impact of limited access to FX and also the rates just you know where they're sitting right now. In December we felt some relief we were able to get better access to FX we also are consistently watching it…So it's not off the radar we do feel a bit more comfortable over the last few months but it's still top of the mind for us”

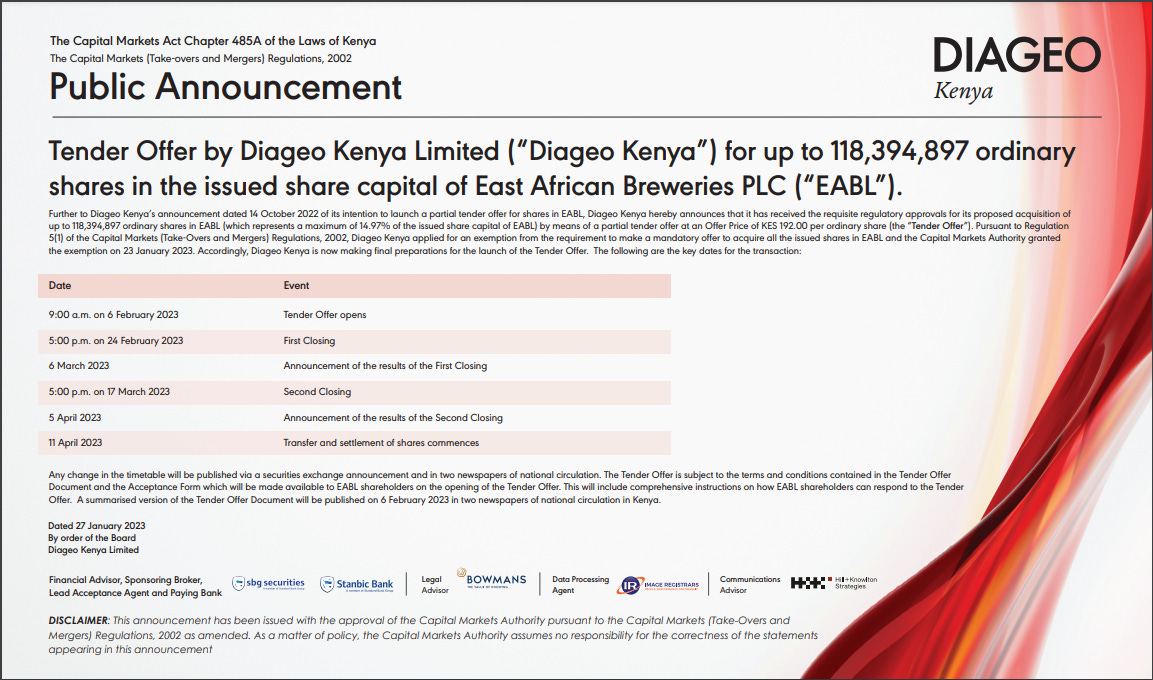

Diageo Tender Offer: In October 2022, Doageo proposed to acquire up to 118.4M ordinary shares of EABL. As of the date of the announcement, Diageo Kenya held 395.6M shares or 50.03% of EABL's issued share capital. Last week, the CMA granted regulatory approval for the transaction, and the tender offer is set to open on February 6, 2023.

KBL’s New MD: Mark Ocitti is set to join EABL subsidiary, Kenya Breweries Limited (KBL), as its Managing Director effective March 1, 2023. He replaces John Musunga who joined Guinness Nigeria, a Diageo subsidiary in West Africa.

C&G FY 2022 Results

Revenue Grows 13%: Car & general’s total sales for the year ended September 30, 2022, were up 13.2% to KES 19.4B. Gross Income fell 1.5% to KES 3B bringing the gross margin to 15.5% [2021: 17.8%]. While group-level sales increased 13% and sales outside Kenya grew 48%, Kenya sales fell 5% on account of election uncertainty, dollar shortages, exchange rate fluctuations, and logistic challenges that dampened the operating environment in Q3 and Q4.

Operating Segments: The two-wheeler business in Tanzania recorded impressive volume growth and the equipment business increased its market share. Watu Holdings, its credit business, now has a footprint in Uganda, Tanzania, and Sierra Leone in addition to its parent country Kenya. Across investment property, Car & General recorded a valuation gain of KES 112M with the firm attributing the footfall growth at Nairobi Mega to the completion of the Nairobi Expressway and the full opening of Uhuru Highway.

Net Income Down 23%: Operating profit fell by 33.3% to KES 735.7M while the net income for the year was down 23.4% to KES 679.5M. EPS fell 23.7% to KES 8.55. The full-year dividend was down 62.5% to KES 0.6 [2021: 1.6], equivalent to KES 64.2M, bringing the dividend payout ratio to 7% [2021: 14.3%].

FX Impacts Profitability: Earnings for the year were significantly impacted by forex losses in Kenya totalling KES 301M and demurrage costs of KES 139M in the Trading businesses. Lower sales in Kenya coupled with supply chain issues in both Kenya and Tanzania led to higher levels of paid-up stock amounting to KES 1.9B, equivalent to 11.6% of the Cost of Goods Sold in the year.

You can find the results here.

Mergers & Acquisitions

Equity-Spire Transaction: The National Treasury and Planning on January 24 approved the acquisition of certain assets and liabilities of Spire Bank by Equity Bank Kenya with the acquisition taking effect on January 31. As per the Assets and Liabilities Purchase Agreement, Equity Bank Kenya will take up all of Spire’s existing 20K customers with over KES 1.3B in deposits and 3.7K customers with a KES 945M net loan book.

CIB Egypt takes up Mayfair Stake: Egypt’s Commercial International Bank (CIB) has acquired an additional 49% stake in Mayfair CIB Bank, bringing CIB’s stake in Mayfair to 100%. This comes after CIB acquired a 51% stake in Mayfair in 2020. The acquisition is set to take effect on January 31.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.538%, 9.954%, and 10.504% respectively. The total amount on offer was KES 24B with the CBK accepting all the KES 34.3B received bids. The performance and acceptance rates were 142.91% and 133.7%, respectively.

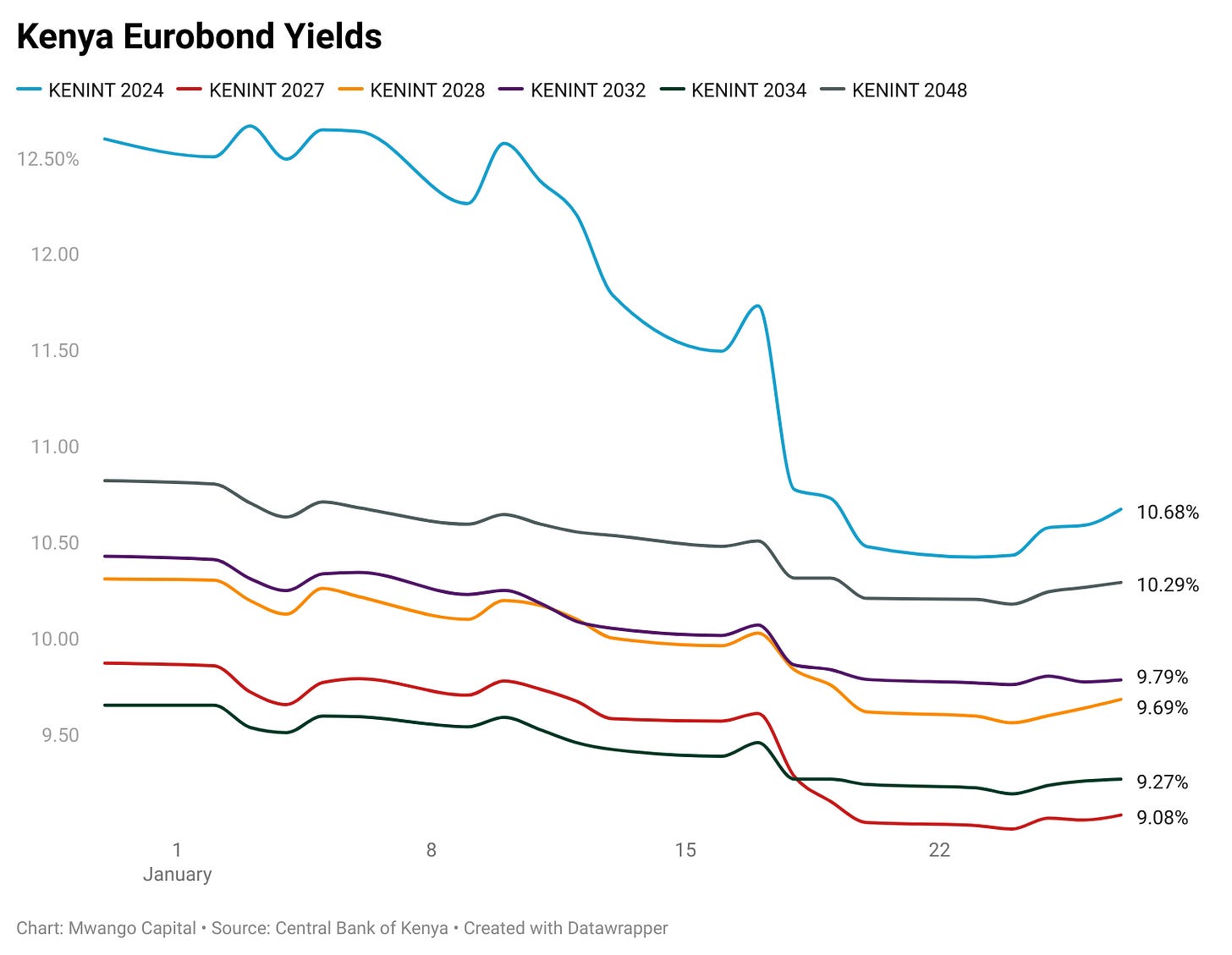

Eurobonds: Last week, the performance of yields was mixed across all 6 outstanding papers.

KENINT 2024 recorded the largest drop year-to-date, falling 192.8 basis points (bps) and rising by 19.4 bps week-on-week to 10.675%.

KENINT 2034 fell the least on a year-to-date basis, falling by 38.5 bps to 9.27%.

KENINT 2048 led price gains year-to-date and week-on-week, rising 5%.

What Else Happened This Week

👨💼 Safaricom’s New Chairman: Adil Khawaja was appointed as the new Safaricom Chairman. Meanwhile, Safaricom CEO, Peter Ndegwa, commented on speculation about his tenure in an interview with Citizen TV.

🎙️ Budget Policy Statement: We had a discussion on the draft 2023 Budget Policy Statement on #MwangoSpaces.

⚠️ More Profit Warnings: Eveready and Kenya Airways issued profit warnings for their latest financial years. While for Eveready the issue is the derecognition of deferred tax assets, for Kenya Airways the issue is Forex losses. Here is an excerpt from the Kenya Airways notice:

“…the net earnings would be constrained by Forex losses. The forex losses were occasioned by the novation of the guaranteed USD loans as Part of the ongoing financial restructuring programme. This means that the exchange rate differences reported below the operating results and previously accumulated in the balance sheet reserves under hedge accounting treatment. will be released to the statement of profit or loss since the hedge instrument no longer exists. This is a one-off expected loss.”

🏦 Tanzania Banks Reporting: NMB’s total assets expanded by 18% to TZS 10.2T. The loan book grew by 29% to TZS 6T, accounting for 58.8% of the asset base. Net Interest Income grew by 16.3% to TZS 214B, bringing the Net Interest Margin to 2.1% (unchanged from 2021). Profit Before Tax was up 49% to TZS 621M and Net Profit grew by 47% to TZS 429B. Return on Equity improved marginally to 6.9% [2021: 6.6%].

⚒️ Ghana Debt Restructuring: Ghana’s government last week reached an agreement with the Ghana Insurers Association that agreement will see insurance companies participate in the Domestic Debt Exchange Programme on similar terms as banks. Separately, the IMF is pushing Africa’s largest gold producer to stop borrowing from its Central Bank, a requirement for the country to secure final approval for a $3B IMF bailout.

Interest Rate Watch

🇳🇬 Nigeria: The Monetary Policy Committee (MPC) Of the Central Bank of Nigeria, in its first sitting of 2023, increased the key benchmark rate by 100 bps to 17.5%, the highest level in 17 years. The MPC cited the need to rein in inflation that reached 21.3% in December 2022 in Africa’s most-populous nation.

🇿🇦 South Africa: The MPC of South Africa’s Reserve Bank increased the key rate by 25 bps to 7.25% citing the aim to anchor inflation expectations firmly around the target band set at 3 - 6%. Inflation in South Africa stood at 7.2% as of December 2022.