👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s Umeme’s surprise dividend, Ethiopia’s banking sector Oopening, and Centum’s profit warningKRA has extended working hours this weekend to help you beat the 30th June 2025 tax return deadline. Service and contact centers open Sat & Sun, 9am–6pm, and Mon 30th, 7am–midnight.

Surprise Dividend

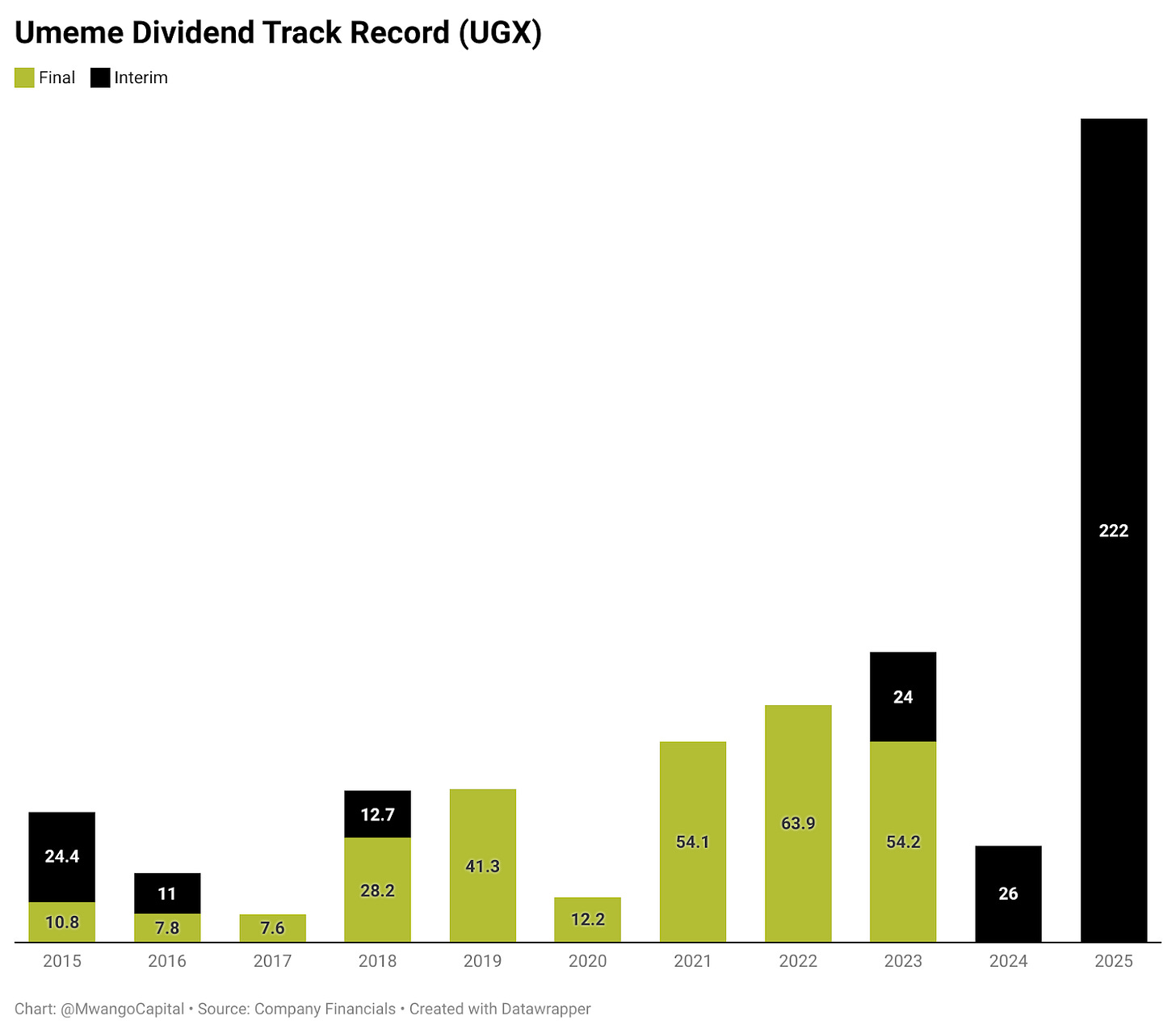

Last week, Umeme declared an interim dividend of UGX 222 per share (KES 7.96), payable on or before July 31, 2025, to shareholders on record as of July 14. The announcement came as a surprise, as the company had already released its FY2024 results without declaring any payout.

In Nairobi, Umeme shares doubled to UGX 700 (KES 25.09), a record high. In Uganda, where the stock is primarily listed, the price remained flat at UGX 415. Some investors tried to transfer shares to Nairobi to take advantage of the rally but the inter-depository transfer system remains unreliable and was previously suspended.

“Dividend policy previously was based on profitability, but as we indicate in the prospectus, Umeme was running a 20-year concession. Now that shift will be based on free cash flows available to the company.“

Umeme Ltd MD, Selestino Babungi

The End of the Concession: Umeme’s 20-year electricity distribution concession officially ended on March 31, 2025, after the government opted not to renew it in 2022. Operational control has since shifted to the Uganda Electricity Transmission Company Limited (UETCL), but Umeme says the legal transfer of assets remains incomplete, pending full settlement of the buyout amount.

The company is claiming USD 410M from the government for unrecovered investments and regulatory income. So far, only USD 118M has been paid, leaving a disputed balance of USD 292M. After failed negotiations in May, Umeme initiated international arbitration in London, seeking full compensation under its support agreement.

Buyout Wrangles and Valuation: At the heart of the dispute is how the buyout amount is calculated. Umeme includes unrecovered tariff-regulated revenue components, while the government and Auditor General apply a narrower view, focused solely on core capital investments. CFO Andrew Oyie noted that the company booked a USD 95M provision in FY 2024 in line with IFRS, reflecting expected credit losses on the unpaid balance.

“The government’s view is based on investments, a narrower subset of what we define as modifications, which also include unrecovered regulatory income through the tariff. At the end of the concession, we reconciled the amounts we hadn’t recovered, and they became due under the buyout. That’s why our valuation is significantly higher.”

Umeme Ltd Chief Corporate and Regulatory Officer, Blessing Nshaho

Interest on the outstanding USD 292M continues to accrue daily. Umeme remains confident that the arbitration award will be enforceable, citing Uganda’s waiver of sovereign immunity under the support agreement. Management sees the buyout recovery as the company’s key value driver in the post-concession phase.

"The USD 292M will keep changing daily. Interest accrues from the end of the concession until payment, starting at 5%, then 10%, 15%, and up to 20%. The amount stated excludes interest, which continues to run."

Umeme Ltd MD, Selestino Babungi

FY 2024 Results: For the year ended December 2024, Umeme delivered a strong operational performance despite preparing to exit the concession. Electricity sales rose 11 percent to 4,674 GWh, the highest in the company’s history. The customer base grew by 220,000 to nearly 2.2 million, while system losses improved slightly to 16 percent from 16.2 percent. Revenue came in at USD 613M, with gross margin up 9.1 percent to USD 218M.

However, one-off costs related to network audits, staff redeployment, and legal and advisory services weighed on the bottom line, resulting in a pre-tax loss driven by large provisions tied to the end of the concession.

What Happens Next: With operations concluded, Umeme’s immediate focus is the recovery of the USD 292M it claims remains due. Arbitration is in motion, but the timeline remains uncertain.

“Ideally, we look at a period of anywhere from one to three years, depending on how quickly the tribunal moves. We are pushing for an early hearing and decision, but several factors are beyond our control. It’s difficult to give a firm timeline at this stage.”

Noah Mwesigwa (SM&Co. Advocates).

Despite the uncertainty, Umeme has signaled interest in future opportunities. Management pointed to potential electricity distribution concessions in Ghana, Sierra Leone, and Zanzibar, as well as opportunities to provide technical advisory services in Uganda and other markets. The company is also exploring construction services, including power network development. However, any expansion will depend on how the buyout process unfolds.

“You can’t go out looking for all these business opportunities when you have around USD 292M of shareholder value at stake,”

Umeme Ltd MD, Selestino Babungi

Find a link to Umeme’s FY 2024 results conference call transcript here.

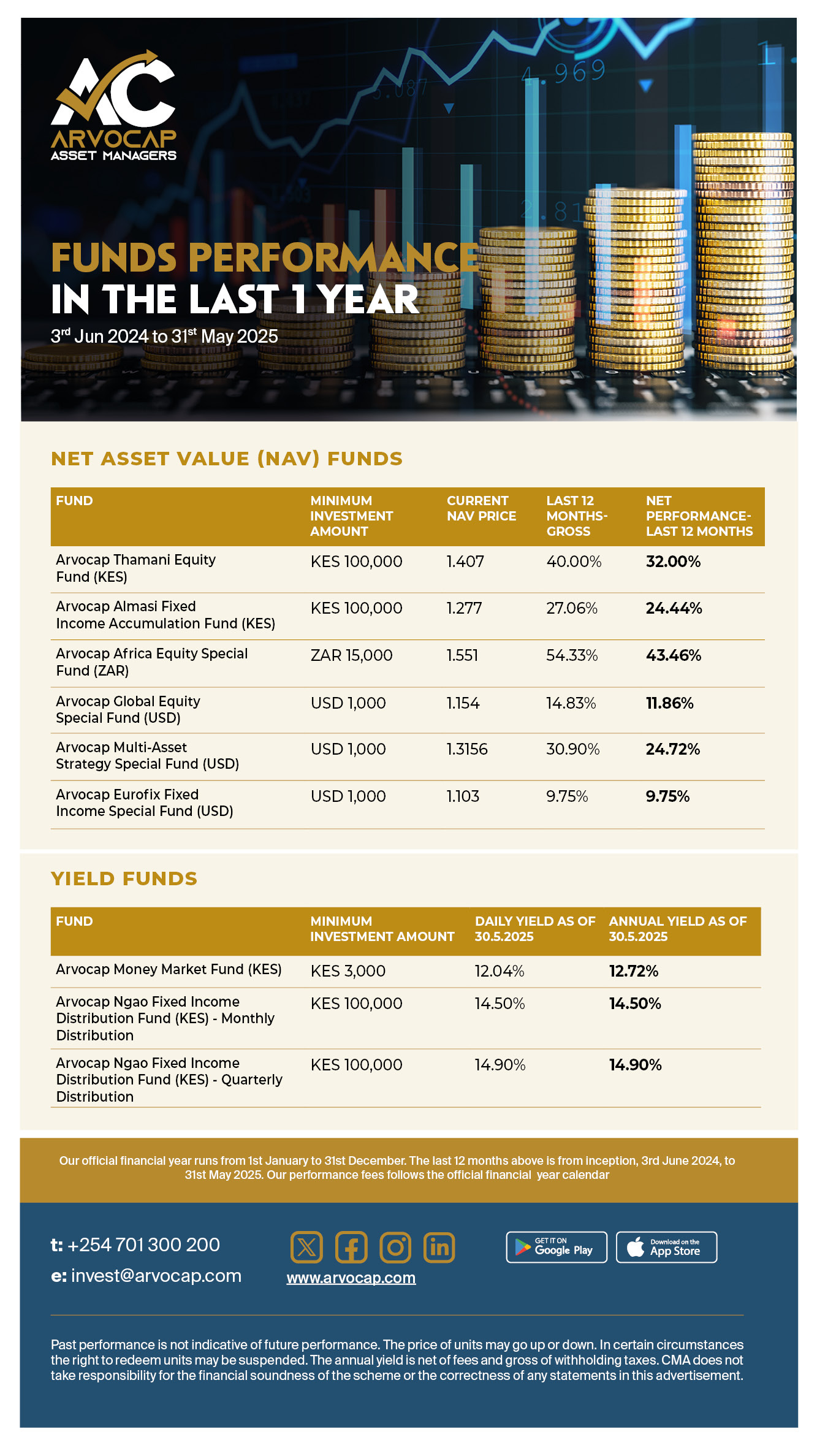

This week's newsletter is brought to you by Arvocap Asset Managers, a licensed and trusted investment partner committed to your financial growth. The Almasi Fixed Income Accumulation Fund has recorded a 27.06% cumulative return since inception, driven by strategic investments in government and corporate fixed-income securities. Learn more at www.arvocap.com.

Earnings Wrap

Kapchorua Tea FY 2025 Results: Kapchorua Tea’s FY2025 results tell a story of resilience under pressure as revenue edged up 1.1% to KES 2.22B, but net profit sank 54.6% to KES 181.2M, hit by weaker global tea prices, oversupply in export markets, and the impact of a stronger shilling on forex earnings.

The sharp decline in earnings per share—from KES 51.04 to KES 23.16—was well telegraphed via a prior profit warning, yet the board opted to hold the dividend steady at KES 25.00 per share, a signal of confidence or an attempt to preserve investor loyalty. The payout ratio surged to 108%, translating to an 11.5% dividend yield at the current share price of KES 217.50, suggesting the dividend is being sustained through retained earnings. Operating cash flow dropped 24.3% to KES 302.2M, pointing to tighter liquidity and reduced internal funding capacity.

The stock closed the week at KES 221, up 1.6%, as investors responded positively to the maintained dividend despite the steep profit decline.

Williamson Tea Kenya FY 2025 Results: It was a tough year for Williamson tea as the tea producer swung to a net loss of KES 166.4M from a profit of KES 526.9M the previous year, dragged down by a 2% drop in revenue to KES 4.11B and a sharp decline in both finance income and associate contributions.

Earnings per share fell into negative territory at KES (8.76), down from KES 28.41. Despite a weak bottom line and negative total comprehensive income, the board proposed a KES 10.00 dividend, down from KES 25.00 in 2024. Interestingly, operating cash flow improved sharply, up 80.6% to KES 555.6M, and cash and equivalents rose 14.2% to KES 818M.

The stock closed the week at KES 200, down 4% week-on-week and 11.7% year-to-date, as investors reacted to the weaker earnings and reduced dividend payout.

Bonus Issuance: Both Kapchorua Tea and Williamson Tea have proposed bonus share issues alongside their FY2025 results. Kapchorua plans a 1-for-2 bonus issue, while Williamson is offering a 1-for-1. The moves are likely aimed at improving share liquidity and optimising capital structure, rather than reflecting underlying earnings strength.

Finance and Appropriations Acts Signed into Law

Finance Bill 2025 Summary: Signed into law by President Ruto last week, the Finance Act 2025 introduces sweeping tax reforms aimed at expanding Kenya’s tax base and stimulating key sectors. It reduces Capital Gains Tax from 15% to 5% for investments above KES 3B, replaces the Digital Asset Tax with a 5% excise duty on transaction fees, and introduces a 5% excise on betting and gaming deposits.

It also mandates employers to apply tax reliefs automatically, raises the tax-exempt daily subsistence allowance from KES 2,000 to KES 10,000, exempts VAT on mosquito repellent inputs and local tea, and supports telco investment with spectrum deductions. New licensing and enforcement provisions were added to tighten compliance across imports and tax administration.

Appropriations Bill 2025 Summary: Also signed into law, the Appropriations Act 2025 authorizes KES 1.88 trillion in Consolidated Fund spending and KES 672 billion in Appropriations-in-Aid for FY 2025/26. Recurrent expenditure accounts for KES 1.81T while KES 744.5B is set for development. The agriculture sector receives KES 47.6B, including KES 10.2B for value chain development and KES 8B for fertilizer subsidies. The health sector gets KES 133.4B, with KES 17.3B allocated to the Global Fund and KES 13.1B to primary care. Education commands the largest share at KES 658.4B, including KES 387.8B for teacher resource management. Infrastructure projects receive KES 217.3B for roads, KES 62.8B for power, and KES 38.6B for transport logistics, reinforcing the Bottom-Up Economic Transformation Agenda.

Find a link to the Assented Finance Act 2025 here and the Assented Appropriations Bill 2025 here.

Markets Wrap

Below are some NSE highlights from week 26:

Market Performance: The Nairobi Securities Exchange recorded strong gains in Week 26, with the All Share Index rising 4.65% to close at 152.5. Market capitalization increased to KES 2.40T. Equity turnover declined 32.6% to KES 1.66B, while bond turnover dipped 6.9% to KES 6.37B. Foreign investors traded KES 530.8M (31.9% of turnover), while locals accounted for KES 1.13B (68.1%).

Top Movers: Umeme led the week’s gainers with a 54.4% jump to KES 19.15, hitting a high of KES 24 on Tuesday following the announcement of an interim dividend of UGX 222 for FY25. KenGen extended its rally, crossing the KES 6 mark—last seen in March 2019—and hit a high of KES 6.98 on Friday. Crown Paints was the top loser, falling 18.0% to close at KES 38.05.

Corporate Actions & Announcements: Corporate actions this week include final dividend payments by Equity Group (KES 4.25 per share) and Crown Paints (KES 3.00 per share). Last week, BAT Kenya paid its FY24 final dividend of KES 45.00 on Wednesday, 25 June, while DTB Bank followed with a payment of KES 7.00 on Friday, 27 June. TotalEnergies also closed its books on 27 June for its FY24 final dividend of KES 1.92 per share. Elsewhere, TransCentury cancelled its AGM that was slated for Friday, citing circumstances beyond the control of the company.

Treasury Bills: Treasury bills were undersubscribed last week, with a subscription rate of 60.37%, down from 114.15% the previous week. Investors submitted bids totaling KES 14.5B, and the Central Bank of Kenya (CBK) accepted KES 14.4B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 3.0, 1.48, and 1.67 basis points to 8.1387%, 8.4613%, and 9.7221%, respectively.

FY 2025/26 First Bond: Kenya’s National Treasury is seeking KES 50B in its first bond sale for the 2025/2026 fiscal year, aiming to raise KES 635.5B from the domestic market. The government is reopening two bonds first issued in 2018: 20-year and 25-year papers. The 20-year bond now has 12.8 years to maturity with a 13.2% coupon rate. The 25-year bond has 18 years remaining and a 13.4% coupon

Eurobonds: Yields on six of Kenya’s seven outstanding Eurobonds declined last week, with the KENINT 2048 leading the drop, falling by 26.90 basis points to 10.451%. The KENINT 2028 followed, with its yield down 24.70 basis points to 8.044%, while the KENINT 2027 held steady at 6.979%. On average, Kenya’s Eurobond yields fell by 21.97 basis points week-on-week.

Market Gleanings

🇪🇹| Ethiopia Opens its Banking Sector | The National Bank of Ethiopia has issued Directive No. SBB/94/2025, formally opening the banking sector to foreign participation through subsidiaries, branches, and representative offices, effective June 25, 2025. Subsidiaries and branches must hold a minimum paid-up capital of ETB 5 billion ($38.5 million or KES 5 billion),, higher than Kenya’s KES 3 billion ($23.3 million) and Nigeria’s ₦25 billion (~$16.5 million or KES 2.13 billion), while representative offices must still deposit $100,000 as security. Onboarding costs include a $2,500 investigation fee and a $150,000 licensing fee, with annual renewals.

The operational standards are pretty stringent: vaults must meet size thresholds, disaster recovery sites must be at least 40km from head offices, and customer data must be stored locally, challenging for firms reliant on global cloud infrastructure. Governance rules require one-third of board seats in foreign-owned banks to be held by Ethiopian nationals. Earlier this month, the NBE held talks with KCB Group’s top leadership, who reaffirmed their commitment to entering the Ethiopian market, underscoring growing regional interest in this tightly regulated but newly liberalized sector.

🚩| Centum Issues Profit Warning | Centum Investment Company Plc has issued a profit warning, indicating that its net earnings for the year ended 31 March 2025 (FY2025) will be at least 25% lower than the KES 2.6B profit reported in FY2024. The decline is mainly attributed to lower fair value gains on investment property, with the company noting that while actual transaction prices within its subsidiaries held steady, revaluation gains under IFRS were significantly lower compared to the prior year. Centum clarified that these revaluation movements are non-cash and do not affect operational performance or cash flows.

🔴| TransCentury and East Africa Cables suspended | After a stellar run at the NSE this year, TransCentury and East African Cables have been suspended from trading following their seizure by Equity Bank over a combined unpaid debt of KES 4.7B ($ 36 million). The NSE suspended the two companies after the firms were placed under receivership and administration, locking shareholders out indefinitely. The suspension marks a dramatic reversal for the two stocks, which had posted some of the highest year-to-date returns (187.2% for TransCentury and 58.3% for East African Cables.

💰| T-Bills Hit KES 1T Mark | Kenya’s Treasury Bills reached a record KES 1.003T last month, up 62.8% from KES 615.9B in June 2024. T-bills now make up 16.16% of total domestic debt, highlighting increased demand from unit trusts, pension funds, and government housing funds.

🧂| Tata Magadi Hit by Falling Soda Ash Prices | Tata Chemicals Magadi Limited, which extracts and exports soda ash and salt from Lake Magadi, faced a challenging FY2024, with significant performance declines driven by a 21% YoY drop in soda ash prices, falling to USD 302.6 per metric tonne, and a 15.2% YoY reduction in sales volume, which dropped to 244.8K tons. The weakened demand for soda ash globally, combined with these price and volume declines, severely impacted revenue. Administrative costs surged by 176% to $9.45M due to increased management and operational expenses, further straining profitability. However, the company managed to reduce distribution costs by 40%, largely due to lower transportation expenses, providing some relief.

📈| Kenya Power Rally | Kenya Power has staged a dramatic rally over the past year, ending the week at KES 11.40, up 137% this year alone. One of its most prominent believers is Kiharu MP Ndindi Nyoro, who grew his stake in KPLC from 9.1 million shares in 2021 to a peak of 32.5 million in 2023, before reducing it to 20.08 million by 2024. Nyoro, once the largest individual shareholder, argued in 2022 that the utility was trading at less than 1% of its asset value, with untapped “sleeping capital” that could electrify more homes if reforms were allowed.

⚖️| Court Halts Stanchart Pension Payout | Standard Chartered Bank Kenya has secured a temporary court order halting the execution of a tribunal directive requiring pension recalculations for 629 former employees, potentially worth up to KES 30B. The High Court issued a conservatory order suspending payment and further proceedings pending a full hearing in September. This comes after the bank lost an earlier appeal, with judges dismissing its objections as unmeritorious and affirming the tribunal’s ruling.

🏦| Equity Group to Set Up UAE Office | Shareholders of Equity Group Holdings Plc have approved the establishment of a representative office in the United Arab Emirates, subject to regulatory approvals. The office is expected to support the Group’s regional presence and facilitate business development in the Gulf region. The board has been authorized to take all necessary actions to operationalize the office, including filings, commercial arrangements, and related structures.

✔️| Cabinet Approves State Corporations Reform Bill | Cabinet has approved the Government-Owned Enterprises Bill, 2025, introducing major reforms in the governance of commercial State corporations. The Bill creates a new category of entities called Government Owned Enterprises and seeks to professionalize appointments through a merit-based process overseen by an independent panel. It bars conflicts of interest among board leadership and mandates that the chairperson be elected from independent directors

✔️| A Commendable Effort | Nike CEO John Donahoe opened the company’s Q4 FY25 earnings call with a powerful nod to Faith Kipyegon’s courageous attempt to break the four-minute mile, an effort that, while falling just short at 4:06:42, etched a new personal best and ignited global admiration:

"We're super proud of Faith...and we were all inspired by her effort. The Breaking4 journey will live on as a symbol of courage & ambition. You have to dare to try, and I deeply admire the monumental effort."

Nike CEO, John Donahoe